Key Insights

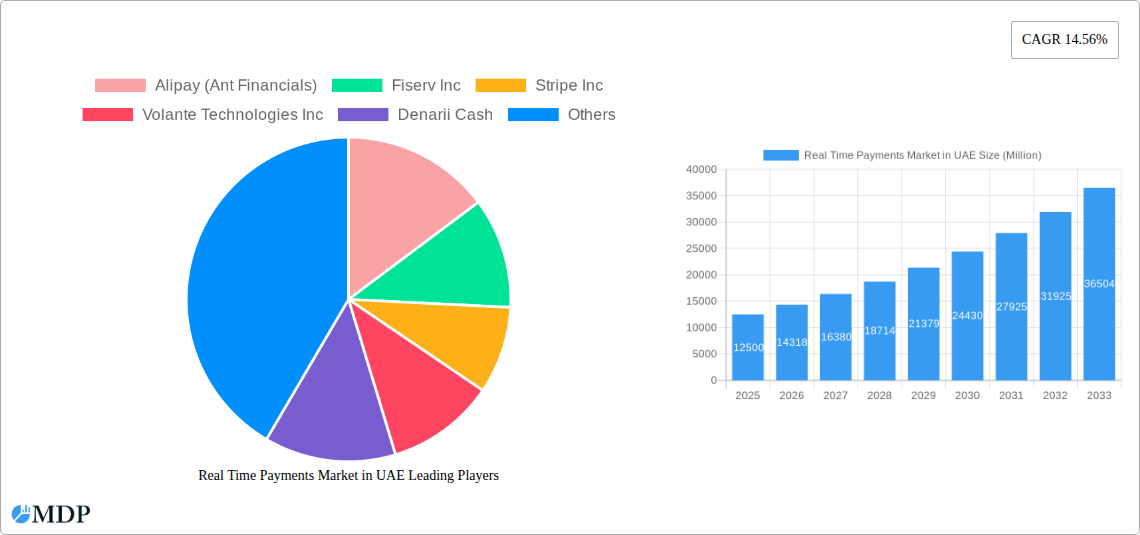

The United Arab Emirates (UAE) Real-Time Payments (RTP) market is experiencing robust expansion, propelled by government-led digital transformation initiatives and a thriving e-commerce sector. With an estimated market size of USD 8.2 billion in the base year of 2024, the market is projected to achieve a Compound Annual Growth Rate (CAGR) of 14.9% by 2033. This growth is fueled by increasing adoption of RTP solutions by consumers and businesses, supported by major industry players. The demand for immediate, secure, and cost-efficient payment methods is rising due to consumer preference for seamless digital experiences and the need for businesses to optimize financial operations. The UAE's strategic positioning and ambition to be a global financial hub further enhance the potential for RTP services. Emerging trends such as the integration of RTP with open banking and the growth of peer-to-peer (P2P) and business-to-business (P2B) payment flows are anticipated to shape market dynamics.

Real Time Payments Market in UAE Market Size (In Billion)

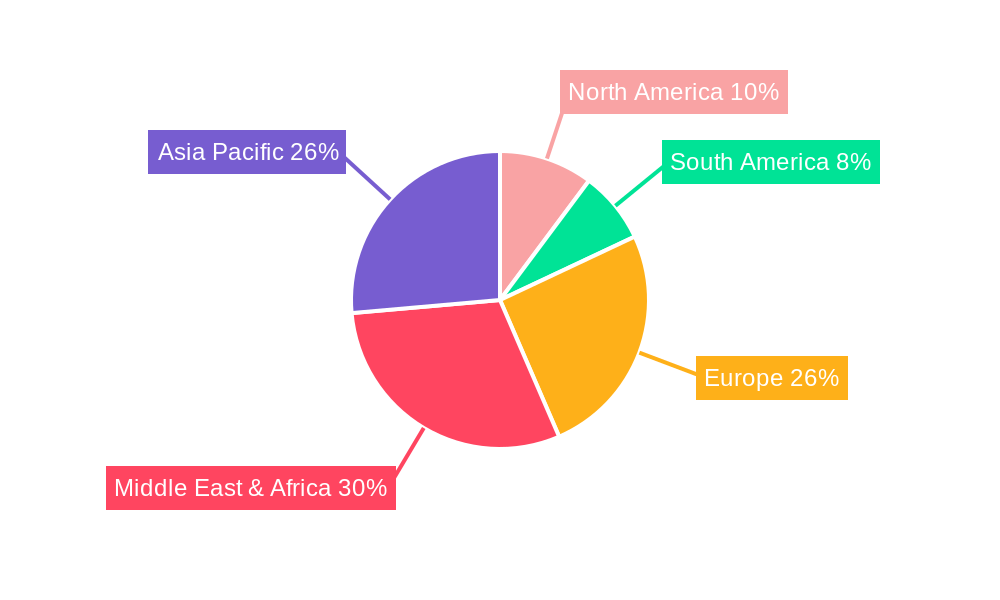

While the UAE RTP market presents significant opportunities, challenges such as initial technology implementation costs and evolving regulatory frameworks require careful management. Nevertheless, the inherent advantages of real-time transactions, including improved liquidity management, reduced operational risks, and enhanced customer experience, are expected to overcome these hurdles. The market is segmented into P2P and P2B, with both segments anticipated to grow substantially. The Middle East & Africa region, particularly the GCC, is poised to lead this growth, reflecting the UAE's progressive approach. Leading companies are actively contributing through innovative RTP solutions catering to diverse market needs. The anticipated increase in transaction volumes and the continuous advancement of payment technologies will be key indicators of the market's vitality and its contribution to the UAE's digital economy.

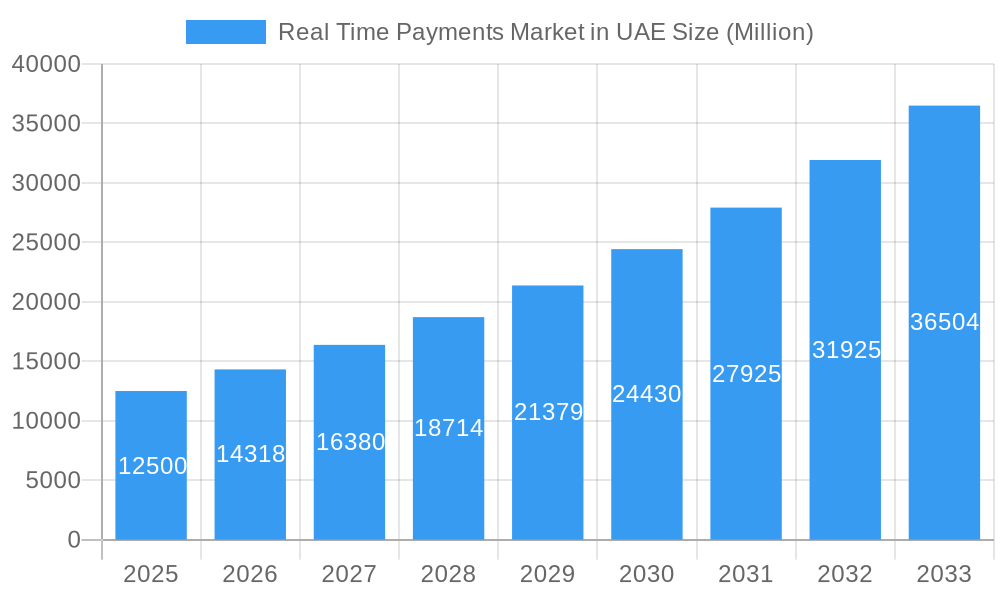

Real Time Payments Market in UAE Company Market Share

Gain comprehensive insights into the dynamic UAE Real-Time Payments market. This report provides an in-depth analysis covering the period up to 2033, with a focus on the forecast period starting from 2024. Understand key drivers such as instant payment solutions in UAE and digital payment trends in Dubai, along with the impact of the UAE Instant Payments Platform (IPP). Essential for financial institutions, technology providers, and policymakers, this analysis offers actionable intelligence for navigating and capitalizing on the rapidly evolving GCC payment ecosystem. Explore market-defining real-time payment innovations, analyze the competitive landscape featuring key players like Mastercard, Stripe, and Alipay, and forecast future growth for UAE fintech.

Real Time Payments Market in UAE Market Dynamics & Concentration

The UAE Real Time Payments market exhibits a dynamic and evolving concentration landscape. Innovation drivers are primarily fueled by the CBUAE's strategic vision for a cashless economy, fostering adoption of instant payment solutions. The regulatory framework, spearheaded by initiatives like the UAE Instant Payments Platform (IPP), mandates participation and encourages interoperability, reducing barriers to entry and promoting competition. Product substitutes, while present in traditional payment methods, are rapidly losing ground to the speed and convenience of real-time transactions. End-user trends indicate a strong preference for seamless, mobile-first payment experiences, driving demand for P2P and P2B instant payment gateways. Mergers and acquisitions (M&A) activities are on the rise as established players seek to expand their reach and acquire innovative technologies. The market saw xx M&A deals in the historical period. Market share analysis shows a gradual shift towards players offering robust real-time payment infrastructure, with major entities like Mastercard and ACI Worldwide holding significant influence. The CBUAE's proactive approach to modernizing the financial infrastructure is a key factor in shaping this concentrated yet competitive market.

- Market Concentration: Moderately concentrated, with increasing competition driven by regulatory support and technological advancements.

- Innovation Drivers: CBUAE's digitalization goals, demand for instant transactions, and growing e-commerce penetration.

- Regulatory Frameworks: Supportive and progressive, with the UAE Instant Payments Platform (IPP) as a cornerstone.

- Product Substitutes: Declining relevance of traditional payment methods against real-time alternatives.

- End-User Trends: Growing demand for speed, convenience, and mobile-enabled P2P and P2B payments.

- M&A Activities: Increasing, signaling consolidation and strategic expansion by key market participants.

Real Time Payments Market in UAE Industry Trends & Analysis

The Real Time Payments market in UAE is experiencing an unprecedented surge, driven by a confluence of factors that are fundamentally reshaping the nation's financial services landscape. The overarching trend is the accelerated digital transformation of payment methods, moving away from traditional, slower processing times towards instant, seamless transactions. This shift is largely propelled by the Central Bank of UAE (CBUAE), which has been instrumental in creating a conducive environment for real-time payments. The introduction of the UAE Instant Payments Platform (IPP), slated for mandatory participation by all financial organizations, is a monumental development that will standardize and accelerate interbank transfers. This platform acts as a catalyst, fostering innovation and competition among service providers.

Technological disruptions are at the forefront of this evolution. Advancements in mobile payment technologies, including QR code scanning, NFC, and biometric authentication, are making real-time payments more accessible and user-friendly than ever before. The proliferation of smartphones and the increasing internet penetration across the UAE have laid the groundwork for widespread adoption. Consumer preferences are rapidly aligning with these technological advancements; users now expect their payments to be instantaneous, secure, and readily available across multiple platforms. This demand is evident in the growing popularity of P2P payment solutions for individual transfers and P2B payment solutions for business transactions, streamlining supply chains and enhancing operational efficiency.

The competitive dynamics within the market are intensifying. While traditional banks are enhancing their real-time capabilities, fintech companies are emerging as significant disruptors, offering agile and innovative solutions. Companies like Stripe Inc. and Alipay (Ant Financials) are expanding their presence, catering to the growing e-commerce sector and cross-border transactions. Mastercard Inc. and ACI Worldwide Inc. are crucial in providing the underlying infrastructure and software solutions that power these real-time networks. The market penetration of real-time payments is projected to reach xx% by 2025, indicating a significant shift in transaction volumes. The Compound Annual Growth Rate (CAGR) for the UAE Real Time Payments market is estimated to be around xx% during the forecast period, signifying robust and sustained growth. This growth is further bolstered by government initiatives aimed at promoting financial inclusion and digital economy growth. The focus on enhancing the speed, security, and accessibility of payments is creating a fertile ground for continued expansion and innovation, solidifying the UAE's position as a leader in digital finance within the GCC.

Leading Markets & Segments in Real Time Payments Market in UAE

The Real Time Payments Market in UAE is characterized by the dominance of specific segments driven by evolving economic policies and robust infrastructure development. While the entire GCC region is seeing significant traction in real-time payments, the United Arab Emirates, particularly Dubai and Abu Dhabi, stands out as the leading market. This leadership is underpinned by a forward-thinking regulatory environment and substantial investments in digital infrastructure, making it a prime hub for digital payment trends in Dubai and the broader UAE.

Within the market, the P2B (Person-to-Business) segment is emerging as a significant growth engine, though the P2P (Person-to-Person) segment continues to hold a substantial share. The P2B segment's growth is intrinsically linked to the burgeoning e-commerce sector and the increasing adoption of digital payment solutions by small and medium-sized enterprises (SMEs) and large corporations alike. Businesses are leveraging real-time payments to improve cash flow management, reduce transaction costs, and enhance customer payment experiences. This is particularly evident in sectors like retail, hospitality, and logistics, where swift and efficient payment processing is critical for operational efficiency.

The P2P segment, meanwhile, benefits from the widespread adoption of smartphones and the convenience of instant money transfers between individuals. This segment is driven by peer-to-peer transactions, remittances, and the growing popularity of digital wallets. The convenience of sending money instantly to friends, family, or even split bills contributes to its sustained demand. The UAE Instant Payments Platform (IPP) plays a crucial role in bolstering both segments by providing a unified and secure infrastructure that supports instant transfers between all participating financial institutions.

- Dominant Region: United Arab Emirates, driven by government support and technological adoption.

- Key Drivers for UAE Dominance:

- Proactive regulatory framework by CBUAE promoting digital payments.

- Significant investment in digital infrastructure and smart city initiatives.

- High smartphone penetration and internet connectivity.

- Strong presence of international financial institutions and fintech hubs.

- Key Drivers for UAE Dominance:

- Dominant Segment: While P2P is established, P2B is showing exceptional growth.

- P2B Growth Drivers:

- Booming e-commerce and online retail sector.

- Need for efficient business-to-business (B2B) transactions and supply chain finance.

- Adoption of digital payment solutions by SMEs.

- Reduced operational costs and improved cash flow for businesses.

- P2P Sustaining Factors:

- Convenience of instant transfers between individuals.

- Widespread use of digital wallets and mobile banking apps.

- Growth in remittances and cross-border P2P transactions.

- Increasing social acceptance of digital peer-to-peer payments.

- P2B Growth Drivers:

Real Time Payments Market in UAE Product Developments

Product development in the UAE Real Time Payments market is characterized by a focus on speed, security, and user experience. Innovations are centered around enhancing existing payment rails and creating new, seamless transaction pathways. Key developments include the integration of AI and machine learning for fraud detection and risk management, ensuring the integrity of instant transactions. Furthermore, the emphasis is on creating interoperable solutions that can seamlessly connect various banking systems and payment providers, exemplified by the foundational work for the UAE Instant Payments Platform (IPP). Mobile-first applications are gaining prominence, offering intuitive interfaces for P2P and P2B transactions. Competitive advantages are being built on low transaction fees, enhanced security features like multi-factor authentication, and robust API integrations for businesses seeking to embed real-time payment capabilities into their platforms.

Key Drivers of Real Time Payments Market in UAE Growth

The growth of the Real Time Payments market in UAE is propelled by a synergistic blend of technological advancements, supportive economic policies, and a clear regulatory vision. The CBUAE's commitment to modernizing the financial ecosystem is paramount, with the development of the UAE Instant Payments Platform (IPP) acting as a significant catalyst. This initiative mandates participation, thereby driving widespread adoption of instant transfer capabilities across all financial institutions. Technologically, the ubiquitous presence of smartphones, coupled with high internet penetration, provides the essential infrastructure for widespread mobile payment adoption. Furthermore, the UAE's strategic focus on becoming a global hub for digital innovation and its ambitious vision for a cashless economy create a fertile ground for the expansion of real-time payment solutions. The increasing demand from both consumers and businesses for faster, more efficient, and secure payment methods further fuels this growth trajectory.

Challenges in the Real Time Payments Market in UAE Market

Despite the rapid growth, the Real Time Payments market in UAE faces certain challenges. Ensuring robust cybersecurity and mitigating the risk of fraud remain critical concerns, as the speed of transactions can potentially amplify the impact of breaches. Regulatory compliance, while generally supportive, requires continuous adaptation to evolving global standards and the integration of new technologies. The initial investment required for upgrading legacy systems and integrating new real-time payment infrastructure can be a barrier for some smaller financial institutions. Furthermore, fostering universal consumer trust and widespread adoption across all demographics, particularly among those less digitally inclined, requires ongoing education and simplified user interfaces. Competitive pressures, while healthy, can also lead to price wars, potentially impacting profitability for service providers.

Emerging Opportunities in Real Time Payments Market in UAE

The Real Time Payments Market in UAE is brimming with emerging opportunities. The ongoing expansion of e-commerce and the growing adoption of online shopping present a significant avenue for P2B real-time payment solutions, enabling faster checkout processes and improved supply chain efficiency. The UAE Instant Payments Platform (IPP) is a foundational opportunity for fintech companies to build innovative overlay services and value-added applications that leverage instant payment capabilities. Cross-border real-time payments represent another vast, largely untapped opportunity, facilitating seamless international remittances and trade finance. Furthermore, the increasing integration of IoT devices and the potential for machine-to-machine payments offer a glimpse into the future of instant transactions. Strategic partnerships between established banks, fintech innovators, and technology providers will be crucial in capitalizing on these evolving market dynamics.

Leading Players in the Real Time Payments Market in UAE Sector

- Alipay (Ant Financials)

- Fiserv Inc

- Stripe Inc

- Volante Technologies Inc

- Denarii Cash

- Finastra

- Mastercard Inc

- ACI Worldwide Inc

- Mashreqbank PSC

- Paypal Holdings Inc

Key Milestones in Real Time Payments Market in UAE Industry

- February 2022: An association of companies led by Accenture was selected by the Central Bank of UAE (CBUAE) to build and operate instant payments platform for the country over the next five years. The new platform lays the groundwork for transforming the financial services ecosystem in the UAE.

- January 2022: ACI Worldwide, a global provider of real-time payment software, announced that the company is working with national banks to help connect to the United Arab Emirates' real-time payments scheme set to launch in October 2022. The UAE Instant Payments Platform (IPP) will enable instant transfers between bank accounts, with participation mandatory for all financial organizations in the country.

Strategic Outlook for Real Time Payments Market in UAE Market

The strategic outlook for the Real Time Payments Market in UAE is exceptionally positive, driven by a clear roadmap towards a fully digitized financial ecosystem. The successful implementation and widespread adoption of the UAE Instant Payments Platform (IPP) will be a critical growth accelerator, fostering innovation and competition. Future growth will likely be characterized by deeper integration of real-time payments into various aspects of daily life and business operations, from e-commerce checkouts to supply chain management and cross-border remittances. Strategic opportunities lie in developing niche solutions for specific industries, enhancing cross-border payment capabilities, and leveraging emerging technologies like blockchain for added security and efficiency. Continuous collaboration between regulators, financial institutions, and technology providers will be paramount to unlocking the full potential of this dynamic market and solidifying the UAE's position as a global leader in real-time payments.

Real Time Payments Market in UAE Segmentation

-

1. Type

- 1.1. P2P

- 1.2. P2B

Real Time Payments Market in UAE Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Real Time Payments Market in UAE Regional Market Share

Geographic Coverage of Real Time Payments Market in UAE

Real Time Payments Market in UAE REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Smartphone Penetration; Falling Reliance on Traditional Banking; Ease of Convenience

- 3.3. Market Restrains

- 3.3.1. Operational Challenges Involving Cross-border Payments

- 3.4. Market Trends

- 3.4.1. Significant Growth in Real Time Payment is Expected due to Digitalization

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Real Time Payments Market in UAE Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. P2P

- 5.1.2. P2B

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Real Time Payments Market in UAE Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. P2P

- 6.1.2. P2B

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Real Time Payments Market in UAE Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. P2P

- 7.1.2. P2B

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Real Time Payments Market in UAE Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. P2P

- 8.1.2. P2B

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Real Time Payments Market in UAE Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. P2P

- 9.1.2. P2B

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Real Time Payments Market in UAE Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. P2P

- 10.1.2. P2B

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Alipay (Ant Financials)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fiserv Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Stripe Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Volante Technologies Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Denarii Cash

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Finastra

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mastercard Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ACI Worldwide Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mashreqbank PSC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Paypal Holdings Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Alipay (Ant Financials)

List of Figures

- Figure 1: Global Real Time Payments Market in UAE Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Real Time Payments Market in UAE Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Real Time Payments Market in UAE Revenue (billion), by Type 2025 & 2033

- Figure 4: North America Real Time Payments Market in UAE Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Real Time Payments Market in UAE Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Real Time Payments Market in UAE Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Real Time Payments Market in UAE Revenue (billion), by Country 2025 & 2033

- Figure 8: North America Real Time Payments Market in UAE Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Real Time Payments Market in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Real Time Payments Market in UAE Volume Share (%), by Country 2025 & 2033

- Figure 11: South America Real Time Payments Market in UAE Revenue (billion), by Type 2025 & 2033

- Figure 12: South America Real Time Payments Market in UAE Volume (K Unit), by Type 2025 & 2033

- Figure 13: South America Real Time Payments Market in UAE Revenue Share (%), by Type 2025 & 2033

- Figure 14: South America Real Time Payments Market in UAE Volume Share (%), by Type 2025 & 2033

- Figure 15: South America Real Time Payments Market in UAE Revenue (billion), by Country 2025 & 2033

- Figure 16: South America Real Time Payments Market in UAE Volume (K Unit), by Country 2025 & 2033

- Figure 17: South America Real Time Payments Market in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Real Time Payments Market in UAE Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Real Time Payments Market in UAE Revenue (billion), by Type 2025 & 2033

- Figure 20: Europe Real Time Payments Market in UAE Volume (K Unit), by Type 2025 & 2033

- Figure 21: Europe Real Time Payments Market in UAE Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Real Time Payments Market in UAE Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Real Time Payments Market in UAE Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Real Time Payments Market in UAE Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Real Time Payments Market in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Real Time Payments Market in UAE Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East & Africa Real Time Payments Market in UAE Revenue (billion), by Type 2025 & 2033

- Figure 28: Middle East & Africa Real Time Payments Market in UAE Volume (K Unit), by Type 2025 & 2033

- Figure 29: Middle East & Africa Real Time Payments Market in UAE Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East & Africa Real Time Payments Market in UAE Volume Share (%), by Type 2025 & 2033

- Figure 31: Middle East & Africa Real Time Payments Market in UAE Revenue (billion), by Country 2025 & 2033

- Figure 32: Middle East & Africa Real Time Payments Market in UAE Volume (K Unit), by Country 2025 & 2033

- Figure 33: Middle East & Africa Real Time Payments Market in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East & Africa Real Time Payments Market in UAE Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Real Time Payments Market in UAE Revenue (billion), by Type 2025 & 2033

- Figure 36: Asia Pacific Real Time Payments Market in UAE Volume (K Unit), by Type 2025 & 2033

- Figure 37: Asia Pacific Real Time Payments Market in UAE Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific Real Time Payments Market in UAE Volume Share (%), by Type 2025 & 2033

- Figure 39: Asia Pacific Real Time Payments Market in UAE Revenue (billion), by Country 2025 & 2033

- Figure 40: Asia Pacific Real Time Payments Market in UAE Volume (K Unit), by Country 2025 & 2033

- Figure 41: Asia Pacific Real Time Payments Market in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Real Time Payments Market in UAE Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Real Time Payments Market in UAE Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Real Time Payments Market in UAE Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Real Time Payments Market in UAE Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Real Time Payments Market in UAE Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Real Time Payments Market in UAE Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Real Time Payments Market in UAE Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: Global Real Time Payments Market in UAE Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Global Real Time Payments Market in UAE Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United States Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United States Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Canada Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Mexico Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Mexico Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Global Real Time Payments Market in UAE Revenue billion Forecast, by Type 2020 & 2033

- Table 16: Global Real Time Payments Market in UAE Volume K Unit Forecast, by Type 2020 & 2033

- Table 17: Global Real Time Payments Market in UAE Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Global Real Time Payments Market in UAE Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Brazil Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Brazil Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Argentina Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Argentina Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Rest of South America Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Global Real Time Payments Market in UAE Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Global Real Time Payments Market in UAE Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global Real Time Payments Market in UAE Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Global Real Time Payments Market in UAE Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: United Kingdom Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Germany Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: France Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: France Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Italy Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Italy Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Spain Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Spain Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Russia Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Russia Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Benelux Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Benelux Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Nordics Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Nordics Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Global Real Time Payments Market in UAE Revenue billion Forecast, by Type 2020 & 2033

- Table 48: Global Real Time Payments Market in UAE Volume K Unit Forecast, by Type 2020 & 2033

- Table 49: Global Real Time Payments Market in UAE Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Global Real Time Payments Market in UAE Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Turkey Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Turkey Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Israel Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Israel Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: GCC Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: GCC Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: North Africa Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: North Africa Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Africa Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: South Africa Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East & Africa Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Real Time Payments Market in UAE Revenue billion Forecast, by Type 2020 & 2033

- Table 64: Global Real Time Payments Market in UAE Volume K Unit Forecast, by Type 2020 & 2033

- Table 65: Global Real Time Payments Market in UAE Revenue billion Forecast, by Country 2020 & 2033

- Table 66: Global Real Time Payments Market in UAE Volume K Unit Forecast, by Country 2020 & 2033

- Table 67: China Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: China Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: India Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: India Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Japan Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Japan Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Korea Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: South Korea Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: ASEAN Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: ASEAN Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Oceania Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Oceania Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: Rest of Asia Pacific Real Time Payments Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: Rest of Asia Pacific Real Time Payments Market in UAE Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Real Time Payments Market in UAE?

The projected CAGR is approximately 14.9%.

2. Which companies are prominent players in the Real Time Payments Market in UAE?

Key companies in the market include Alipay (Ant Financials), Fiserv Inc, Stripe Inc, Volante Technologies Inc, Denarii Cash, Finastra, Mastercard Inc, ACI Worldwide Inc, Mashreqbank PSC, Paypal Holdings Inc.

3. What are the main segments of the Real Time Payments Market in UAE?

The market segments include Type .

4. Can you provide details about the market size?

The market size is estimated to be USD 8.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Smartphone Penetration; Falling Reliance on Traditional Banking; Ease of Convenience.

6. What are the notable trends driving market growth?

Significant Growth in Real Time Payment is Expected due to Digitalization.

7. Are there any restraints impacting market growth?

Operational Challenges Involving Cross-border Payments.

8. Can you provide examples of recent developments in the market?

February 2022 - An association of companies led by Accenture was selected by the Central Bank of UAE (CBUAE) to build and operate instant payments platform for the country over the next five years. The new platform lays the groundwork for transforming the financial services ecosystem in the UAE.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Real Time Payments Market in UAE," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Real Time Payments Market in UAE report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Real Time Payments Market in UAE?

To stay informed about further developments, trends, and reports in the Real Time Payments Market in UAE, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence