Key Insights

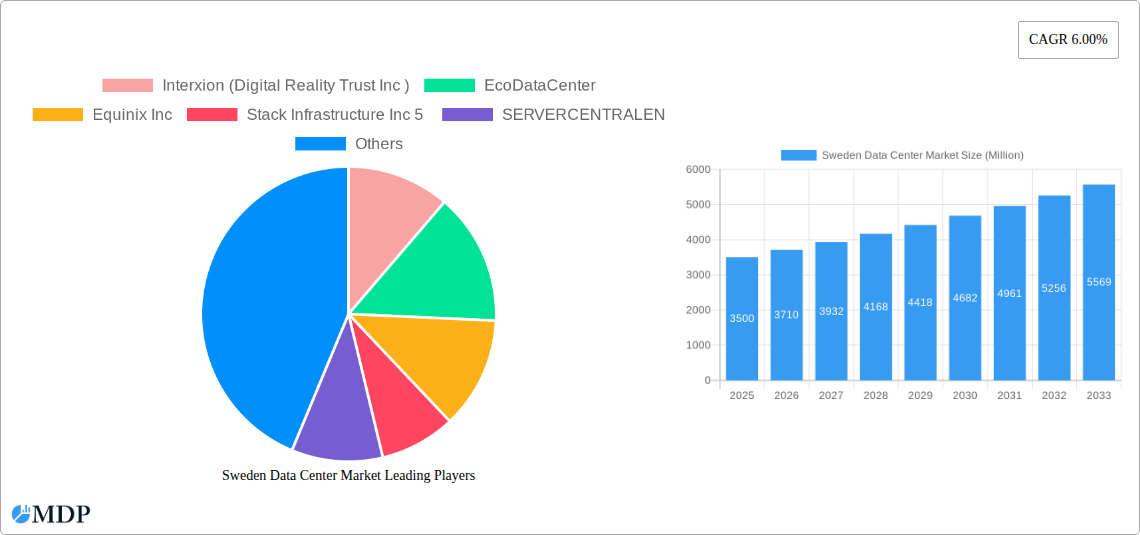

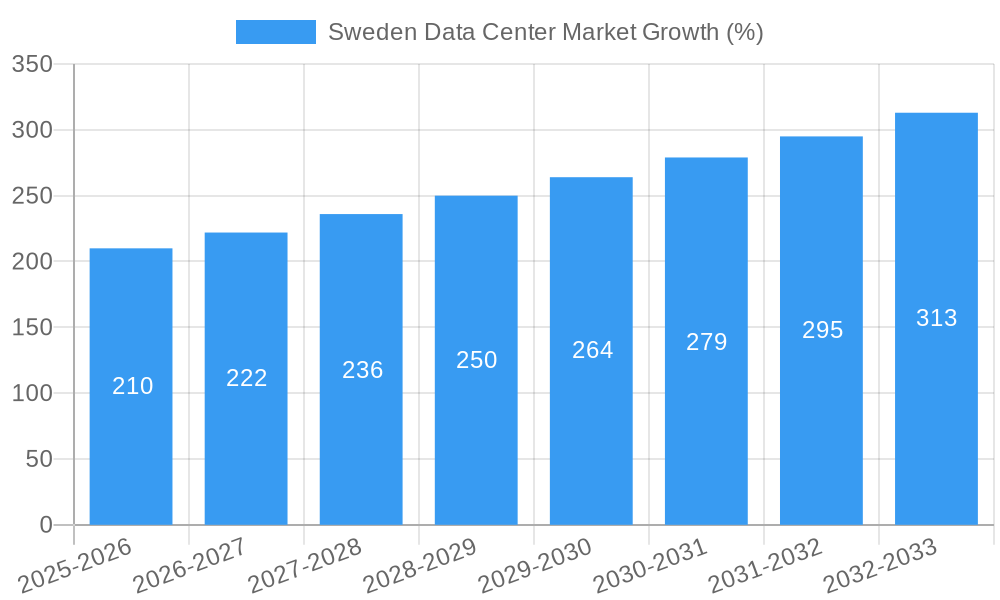

The Swedish data center market is poised for robust expansion, driven by a confluence of escalating digital transformation initiatives and a burgeoning demand for sophisticated IT infrastructure. The market is projected to reach a valuation of approximately USD 3,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of 6.00% expected to propel it to over USD 4,700 million by 2033. This growth is significantly influenced by key drivers such as the increasing adoption of cloud computing services across various industries, the substantial investments in digital infrastructure by hyperscale providers, and the growing need for high-performance computing capabilities to support AI and big data analytics. The Swedish government's commitment to fostering a digital economy and its strategic focus on renewable energy sources also contribute to the market's favorable trajectory, attracting significant foreign investment in data center development. Furthermore, evolving enterprise needs for secure, scalable, and efficient data storage and processing solutions are fueling demand across different data center sizes and tier types.

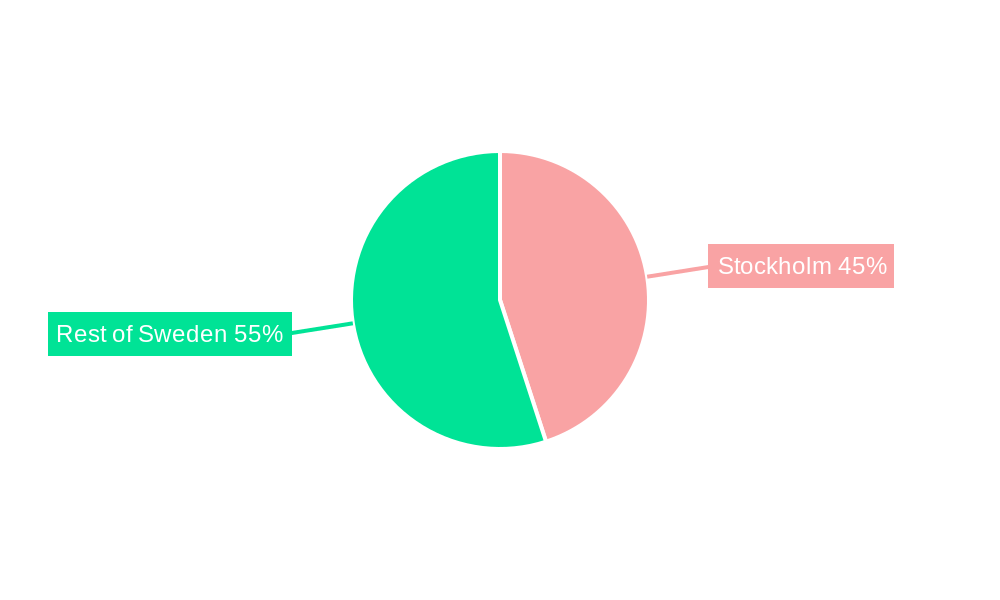

The Swedish data center landscape is characterized by a dynamic segmentation, with Stockholm emerging as a dominant hotspot for data center operations, attracting a significant portion of investments due to its advanced connectivity and skilled workforce. The market is witnessing a pronounced trend towards the development of hyperscale facilities to cater to the demands of cloud providers and large enterprises, while retail and wholesale colocation services continue to serve a diverse range of end-users, including BFSI, e-commerce, media & entertainment, and telecom sectors. Despite the strong growth potential, the market faces certain restraints, including the high upfront capital investment required for building and expanding data center facilities, as well as stringent environmental regulations that necessitate sustainable and energy-efficient operational practices. However, the proactive approach by Swedish data center operators towards adopting green technologies and leveraging renewable energy sources is mitigating these challenges and positioning Sweden as a leader in sustainable data center development.

Sweden Data Center Market Report: Unlocking Growth and Investment Opportunities (2019-2033)

Dive deep into the burgeoning Sweden Data Center Market with this comprehensive report. Analyzing the landscape from 2019 to 2033, with a base year of 2025 and an extended forecast period through 2033, this report offers unparalleled insights into the critical dynamics, emerging trends, and leading players shaping this vital sector. Discover the immense potential for hyperscale, wholesale, and retail colocation within key hubs like Stockholm and the Rest of Sweden. Understand the growth drivers fueled by the booming cloud, BFSI, and e-commerce segments, and gain a competitive edge with actionable intelligence on data center size variations from Small to Massive, Tier 1 & 2 to Tier 4, and non-utilized absorption. This report is an indispensable resource for investors, operators, technology providers, and industry stakeholders seeking to capitalize on Sweden's sustainable and technologically advanced data center ecosystem.

Sweden Data Center Market Market Dynamics & Concentration

The Sweden Data Center Market exhibits a dynamic and evolving concentration landscape, driven by significant investment and a strong emphasis on sustainability. Market concentration is influenced by the presence of major global players and a growing number of specialized local providers. Innovation drivers are primarily centered around renewable energy adoption, energy efficiency, and advanced cooling technologies, positioning Sweden as a leader in green data center development. Regulatory frameworks, while robust, are generally supportive of digital infrastructure growth, focusing on environmental standards and data security. Product substitutes are limited, with cloud services representing the most significant alternative, though dedicated colocation facilities offer superior control and customization for many enterprises. End-user trends reveal a sustained demand from sectors like BFSI, Cloud, and E-Commerce, with an increasing uptake by Manufacturing and Media & Entertainment for their digital transformation initiatives. Mergers and acquisitions (M&A) activities are on the rise, signaling consolidation and strategic expansion by key players. For instance, the market has seen numerous strategic partnerships and acquisitions aimed at expanding capacity and enhancing service offerings. The market share is distributed among a mix of large international operators and niche providers, with significant growth projected in the hyperscale segment.

Sweden Data Center Market Industry Trends & Analysis

The Sweden Data Center Market is experiencing robust growth, propelled by a confluence of technological advancements, burgeoning digital transformation across industries, and a strategic focus on sustainability. The CAGR for the Sweden Data Center Market is projected to be substantial, reflecting the increasing demand for high-density computing power and secure data storage. Market penetration is steadily increasing as more businesses recognize the advantages of outsourcing their IT infrastructure to specialized data center facilities. This trend is particularly evident in the hyperscale segment, driven by the expansion strategies of major cloud providers. The adoption of advanced technologies such as AI, IoT, and big data analytics is further escalating the need for scalable and efficient data center solutions. Furthermore, Sweden's commitment to renewable energy sources provides a unique selling proposition, attracting environmentally conscious organizations and aligning with global ESG (Environmental, Social, and Governance) goals. This focus on green energy not only reduces operational costs but also enhances the attractiveness of Swedish data centers for international clients seeking to minimize their carbon footprint. The competitive dynamics within the market are characterized by a blend of established global players and agile local providers, each vying for market share through innovation, strategic partnerships, and service differentiation. The increasing demand for high-speed connectivity and low latency is also a significant factor driving investment in new data center developments, particularly in strategic locations that can serve a broad geographic area. The ongoing digitalization of Swedish industries, from finance to manufacturing, is creating a sustained demand for reliable and secure data handling capabilities.

Leading Markets & Segments in Sweden Data Center Market

The Sweden Data Center Market is predominantly driven by the Hotspot: Stockholm region, which serves as the primary hub for digital infrastructure development and consumption. This dominance is attributed to its robust connectivity, availability of skilled labor, and proximity to a large concentration of end-users. However, the Rest of Sweden is rapidly gaining traction, fueled by government initiatives promoting regional digital growth and the availability of more affordable land and renewable energy.

Key Dominant Segments:

- Data Center Size: The Massive and Large data center segments are experiencing the highest growth rates, driven by the insatiable demand from hyperscale cloud providers and large enterprises requiring significant computing power and storage.

- Drivers: Expansion of global cloud footprints, increasing data generation from IoT and AI applications, and the need for high-performance computing.

- Tier Type: Tier 3 and Tier 4 data centers are the most sought after due to their high levels of availability, redundancy, and fault tolerance, crucial for critical business operations.

- Drivers: Stringent uptime requirements from BFSI and government sectors, regulatory compliance needs, and the desire for business continuity.

- Colocation Type: Hyperscale colocation is leading the market expansion, followed closely by Wholesale solutions, catering to the needs of major cloud service providers and large enterprises with significant capacity requirements.

- Drivers: Cost-effectiveness of shared infrastructure for hyperscalers, increasing outsourcing of IT infrastructure by enterprises, and the scalability offered by wholesale models.

- End User: The Cloud sector remains the largest consumer of data center services, followed by BFSI and E-Commerce, which are heavily reliant on robust and secure digital infrastructure.

- Drivers: Growing adoption of cloud computing services, the increasing volume of digital transactions, and the need for data-intensive applications in financial services and online retail.

The Absorption: Non-Utilized metric indicates significant available capacity, presenting a prime opportunity for new investments and expansion. Economic policies supporting digital infrastructure development and investments in high-speed fiber optic networks further bolster the growth of these leading segments.

Sweden Data Center Market Product Developments

Product developments in the Sweden Data Center Market are heavily focused on enhancing efficiency, sustainability, and security. Innovations include advanced liquid cooling solutions for high-density compute environments, enabling greater power efficiency and denser rack configurations. The integration of AI and machine learning for predictive maintenance and resource optimization is becoming increasingly prevalent, leading to improved uptime and reduced operational costs. Furthermore, there is a strong emphasis on modular data center designs, allowing for rapid deployment and scalability to meet fluctuating demand. Cybersecurity solutions are continually evolving, with a focus on multi-layered security protocols and advanced threat detection systems to protect sensitive data. These developments are driven by the market's commitment to offering cutting-edge, reliable, and environmentally responsible data center services.

Key Drivers of Sweden Data Center Market Growth

The growth of the Sweden Data Center Market is underpinned by several powerful drivers. A primary catalyst is the accelerating digital transformation across all industries, leading to an exponential increase in data generation and the demand for sophisticated IT infrastructure. Sweden's strong commitment to renewable energy sources, particularly hydropower and wind power, makes it an exceptionally attractive location for data centers aiming for sustainable operations and lower carbon footprints, a key factor for global enterprises. Furthermore, favorable government policies and incentives aimed at attracting foreign investment in digital infrastructure play a crucial role. The country's advanced telecommunications infrastructure, characterized by high-speed fiber optic networks, ensures excellent connectivity, which is vital for data center performance. The increasing adoption of cloud computing, AI, and IoT technologies further amplifies the need for scalable and efficient data center solutions.

Challenges in the Sweden Data Center Market Market

Despite its strong growth trajectory, the Sweden Data Center Market faces several challenges. Securing and expanding access to sufficient electricity, particularly during peak demand periods, can be a constraint, despite the country's renewable energy resources. The high cost of electricity in certain regions, influenced by market fluctuations and grid investments, can impact operational expenses. Regulatory complexities, while generally supportive, can sometimes involve lengthy approval processes for new constructions and expansions. Supply chain disruptions for critical hardware and specialized equipment can lead to project delays. Moreover, the highly competitive landscape necessitates continuous innovation and investment to maintain market share, putting pressure on margins. The growing demand for skilled personnel in areas like data center operations and cybersecurity also presents a talent acquisition challenge.

Emerging Opportunities in Sweden Data Center Market

The Sweden Data Center Market is brimming with emerging opportunities. The ongoing expansion of hyperscale cloud providers into Northern Europe presents a significant avenue for growth, demanding large-scale colocation facilities. The increasing adoption of edge computing, driven by the need for low-latency processing for applications like autonomous vehicles and smart cities, is creating opportunities for smaller, distributed data centers. Sweden's strategic location and robust connectivity also position it as a potential hub for international data transit and peering. Furthermore, the growing emphasis on sustainability and circular economy principles is spurring innovation in green data center design and operation, creating a competitive advantage for companies embracing these trends. Strategic partnerships with local energy providers and technology firms can unlock new avenues for development and service offerings.

Leading Players in the Sweden Data Center Market Sector

- Interxion (Digital Reality Trust Inc)

- EcoDataCenter

- Equinix Inc

- Stack Infrastructure Inc

- SERVERCENTRALEN

- Inleed (Yelles AB)

- Hydro66 Svenska AB (Northern Data AG)

- Bahnhof

- Multigrid Solutions AB

- Conapto AB (Designrepublic se)

- High Sec Hosting HSDC AB

- Ember AB (S BARONS AB GROUP)

Key Milestones in Sweden Data Center Market Industry

- October 2022: Conapto and the real estate firm Fastpartner signed an agreement to construct a 10,000-square-meter data center building in southern Stockholm. This land can accommodate an 8,000 square meter data center and 20 MW of power when fully built, signifying significant capacity expansion in a key market.

- February 2022: EcoDataCenter invested approximately SEK 50 million (USD 4.79 million) in a collaborative initiative with Ellevio and Falu Energi & Vatten to enhance the data center's power supply. This investment, securing access to 80 MW of renewable electricity, enables the facility's growth to its maximum capacity, highlighting a focus on renewable energy integration.

- March 2021: EcoDataCenter announced plans to construct a second data center at its Falun location, involving an investment of SEK 1 billion (USD 102 million) for a new 15MW facility. This marks a substantial expansion for EcoDataCenter and reflects growing demand for green data center solutions in Sweden.

Strategic Outlook for Sweden Data Center Market Market

The strategic outlook for the Sweden Data Center Market is overwhelmingly positive, driven by sustained demand for digital infrastructure and Sweden's unique advantages. Future growth will likely be characterized by continued expansion in the hyperscale and wholesale colocation segments, fueled by global cloud providers. There will be an increasing focus on developing highly efficient and sustainable data centers, leveraging Sweden's abundant renewable energy resources. Investments in edge computing infrastructure are expected to gain momentum, catering to latency-sensitive applications. Strategic partnerships between data center operators, energy companies, and technology providers will be crucial for innovation and market penetration. The market is well-positioned to attract further foreign investment due to its stable regulatory environment and strong commitment to green initiatives.

Sweden Data Center Market Segmentation

-

1. Hotspot

- 1.1. Stockholm

- 1.2. Rest of Sweden

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

Sweden Data Center Market Segmentation By Geography

- 1. Sweden

Sweden Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; High Mobile penetration

- 3.2.2 Low Tariff

- 3.2.3 and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives

- 3.3. Market Restrains

- 3.3.1. ; Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Stockholm

- 5.1.2. Rest of Sweden

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Interxion (Digital Reality Trust Inc )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EcoDataCenter

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Equinix Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stack Infrastructure Inc 5

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SERVERCENTRALEN

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Inleed (Yelles AB)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hydro66 Svenska AB(Northern Data AG)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bahnhof

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Multigrid Solutions AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Conapto AB(Designrepublic se)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 High Sec Hosting HSDC AB

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ember AB(S BARONS AB GROUP)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Interxion (Digital Reality Trust Inc )

List of Figures

- Figure 1: Sweden Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sweden Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Sweden Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sweden Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Sweden Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 4: Sweden Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 5: Sweden Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 6: Sweden Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 7: Sweden Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 8: Sweden Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 9: Sweden Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 10: Sweden Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 11: Sweden Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 12: Sweden Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 13: Sweden Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Sweden Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 15: Sweden Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 16: Sweden Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 17: Sweden Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Sweden Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Sweden Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 20: Sweden Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 21: Sweden Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 22: Sweden Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 23: Sweden Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 24: Sweden Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 25: Sweden Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 26: Sweden Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 27: Sweden Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 28: Sweden Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 29: Sweden Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Sweden Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 31: Sweden Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Sweden Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Data Center Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Sweden Data Center Market?

Key companies in the market include Interxion (Digital Reality Trust Inc ), EcoDataCenter, Equinix Inc, Stack Infrastructure Inc 5 , SERVERCENTRALEN, Inleed (Yelles AB), Hydro66 Svenska AB(Northern Data AG), Bahnhof, Multigrid Solutions AB, Conapto AB(Designrepublic se), High Sec Hosting HSDC AB, Ember AB(S BARONS AB GROUP).

3. What are the main segments of the Sweden Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; High Mobile penetration. Low Tariff. and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

October 2022: Conapto and the real estate firm Fastpartner have signed an agreement to construct a 10,000-square-meter data center building in southern Stockholm. This land can accommodate an 8000 square meter data center and 20 MW of power when fully built.February 2022: To complete the data center's power supply, EcoDataCenter invested about SEK 50 million(4.79 USD million) in a collaborative initiative with Ellevio and Falu Energi & Vatten. The facility's growth to its maximum capacity is made possible by secure access to 80 MW of renewable electricity.March 2021: EcoDataCenter plans to construct a second data center at its location in Falun, Sweden. The Swedish data center company revealed that it would spend SEK 1 billion (USD 102 million) on a new 15MW facility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Data Center Market?

To stay informed about further developments, trends, and reports in the Sweden Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence