Key Insights

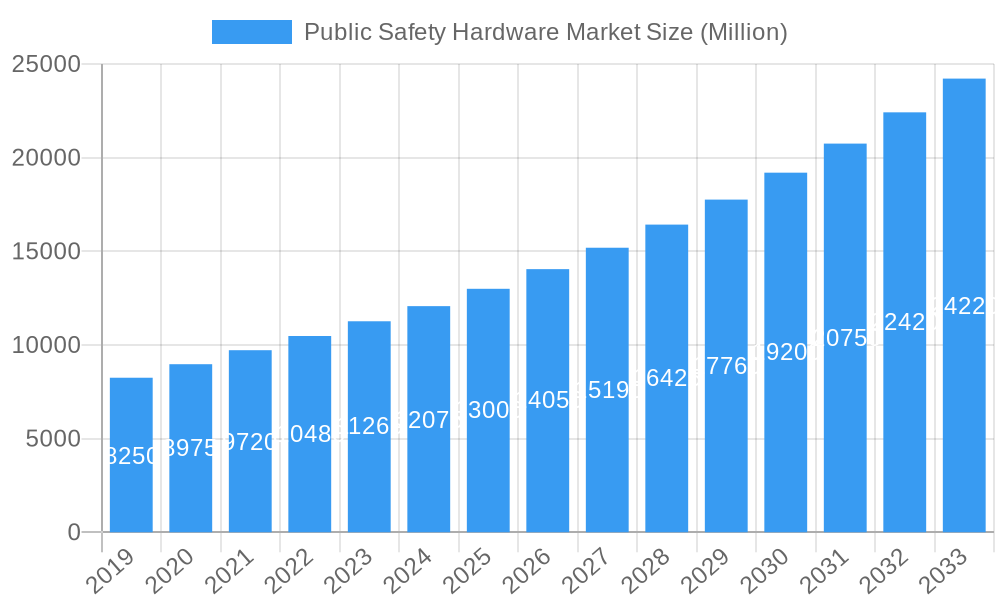

The Public Safety Hardware Market is projected to experience substantial growth, reaching an estimated $19.62 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 10.5% through 2033. This expansion is driven by escalating global security needs and the increasing demand for advanced solutions in law enforcement, emergency response, and disaster management. Key growth catalysts include ongoing innovation in rugged tablets, wearable technology, and sophisticated security and dashboard cameras designed for demanding field operations. Heightened awareness of infrastructure vulnerability to both man-made and natural threats further accelerates the adoption of specialized hardware. A significant market trend is the integration of systems for real-time data analysis and communication, equipping first responders with critical insights for effective decision-making.

Public Safety Hardware Market Market Size (In Billion)

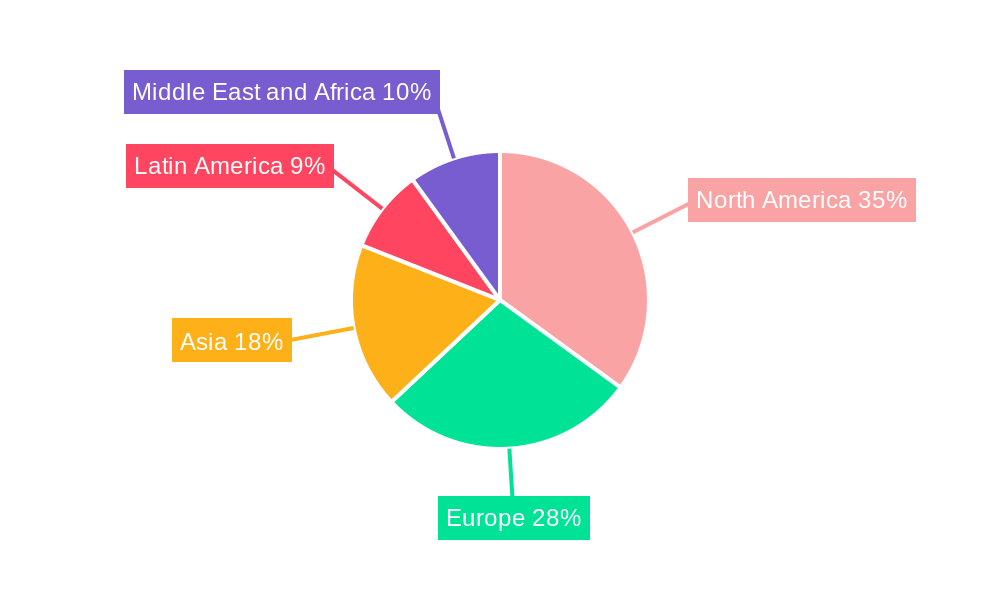

Challenges such as high initial investment for advanced public safety hardware and complex integration with existing systems are present. However, these are being addressed through strategic government funding and a recognized long-term value proposition of improved response times and operational efficiency. The market is segmented by hardware type, with Security and Dashboard Cameras, alongside Rugged Tablets and Wearable Devices, anticipated to lead due to their direct utility in field operations. Geographically, North America is expected to maintain market leadership, supported by significant public safety infrastructure investments, followed by Europe. Asia's emerging economies present considerable growth potential as they prioritize modernization of their safety and security infrastructure.

Public Safety Hardware Market Company Market Share

This comprehensive report delivers a robust analysis of the Public Safety Hardware Market, providing critical intelligence for stakeholders. Covering the period from 2019 to 2033, with a base year of 2024, the report examines market dynamics, industry trends, leading segments, product advancements, growth drivers, challenges, opportunities, key players, and strategic outlook. This essential resource aids in navigating the evolving public safety technology landscape and achieving a competitive advantage.

Public Safety Hardware Market Market Dynamics & Concentration

The Public Safety Hardware Market is characterized by moderate concentration, with a handful of key players holding significant market share, estimated to be around 65% for the top five companies. Innovation is a primary driver, fueled by the continuous need for enhanced situational awareness, improved officer safety, and more efficient emergency response. Regulatory frameworks, such as data privacy laws and interoperability standards, play a crucial role in shaping product development and market access. Product substitutes are emerging, particularly in the software and cloud-based solutions space, though robust hardware remains indispensable for many public safety applications. End-user trends indicate a growing demand for integrated and connected solutions, with a preference for user-friendly interfaces and enhanced data analytics capabilities. Mergers and acquisitions (M&A) activities have been moderately active, with an estimated 15-20 significant deals in the historical period (2019-2024) as companies seek to expand their portfolios and market reach.

- Key Dynamics:

- Technological advancements in AI, IoT, and connectivity.

- Increasing government spending on national security and emergency preparedness.

- Demand for interoperable communication systems.

- Growing adoption of wearable and mobile devices.

- Concentration Metrics:

- Top 5 Company Market Share: Approximately 65%

- M&A Deal Count (2019-2024): 15-20 significant transactions.

Public Safety Hardware Market Industry Trends & Analysis

The Public Safety Hardware Market is experiencing robust growth, driven by escalating global security concerns and the imperative to equip law enforcement, emergency services, and military personnel with advanced tools. The compound annual growth rate (CAGR) for the forecast period (2025–2033) is projected to be approximately 8.5%, signifying substantial expansion. Technological disruptions are at the forefront, with the integration of artificial intelligence (AI) into surveillance cameras for threat detection, the proliferation of ruggedized tablets for field data management, and the increasing adoption of body-worn cameras for transparency and evidence collection. Consumer preferences are shifting towards solutions that offer enhanced data security, real-time communication capabilities, and seamless integration with existing command and control systems. Competitive dynamics are intensifying, with established players investing heavily in R&D and new entrants focusing on niche markets and disruptive technologies. Market penetration for advanced public safety hardware is steadily increasing, particularly in developed nations, as budgets are allocated towards modernization efforts. The demand for robust and reliable hardware that can withstand extreme conditions and operate effectively in diverse environments remains paramount. Furthermore, the increasing focus on citizen safety and effective disaster management is fueling the adoption of sophisticated public safety hardware across various governmental and non-governmental organizations.

Leading Markets & Segments in Public Safety Hardware Market

North America currently dominates the Public Safety Hardware Market, with the United States leading in terms of adoption and expenditure due to significant government investment in defense, law enforcement, and emergency services. The "Law Enforcement" application segment is the largest, driven by the widespread deployment of body cameras, advanced communication systems, and surveillance technologies.

- Dominant Region: North America (USA leading)

- Dominant Application Segment: Law Enforcement

Key Segment Drivers:

- Type: Security and Dashboard Cameras:

- Drivers: Rising crime rates, increased focus on traffic safety, demand for evidence collection, advancements in AI-powered video analytics.

- Dominance Analysis: These cameras are fundamental for monitoring public spaces, aiding investigations, and ensuring road safety. Their continuous improvement in resolution, low-light performance, and intelligent detection features solidifies their leading position.

- Type: Rugged Tablets and Wearable Devices:

- Drivers: Need for mobile data access in the field, enhanced officer efficiency, real-time situational awareness, ruggedization for harsh environments.

- Dominance Analysis: These devices empower field personnel with immediate access to critical information, enabling faster decision-making and improved operational effectiveness. Their durability and connectivity are key to their widespread adoption.

- Application: Law Enforcement:

- Drivers: Need for enhanced surveillance, evidence gathering, officer safety, faster response times, community policing initiatives.

- Dominance Analysis: Law enforcement agencies are the primary adopters of a wide array of public safety hardware, including communication devices, surveillance equipment, and protective gear, due to their daily operational demands.

- Application: Emergency Services:

- Drivers: Critical need for reliable communication during emergencies, patient monitoring, real-time incident management, disaster response coordination.

- Dominance Analysis: Fire departments, ambulance services, and other emergency responders rely heavily on specialized hardware for communication, navigation, and patient care, making this a significant application area.

Public Safety Hardware Market Product Developments

Product innovation in the Public Safety Hardware Market is focused on enhancing connectivity, intelligence, and user experience. Companies are developing advanced body-worn cameras with improved battery life and encrypted data storage, rugged tablets with integrated biometric scanners for secure access, and infrastructure safety devices leveraging IoT for real-time monitoring of critical assets. The integration of AI for predictive analytics and automated threat detection is a key trend, providing end-users with preemptive capabilities. These developments aim to offer competitive advantages by improving officer safety, streamlining operations, and enhancing data accuracy for faster response and decision-making.

Key Drivers of Public Safety Hardware Market Growth

The Public Safety Hardware Market's growth is primarily propelled by increasing global security threats, necessitating advanced technological solutions for law enforcement, emergency services, and defense. Government initiatives and increased defense spending, particularly in regions facing geopolitical instability, significantly boost demand. The continuous evolution of technology, including AI, IoT, and 5G connectivity, enables the development of more sophisticated and integrated public safety systems. Furthermore, a growing emphasis on officer safety and transparency is driving the adoption of body-worn cameras and other accountability tools. The need for efficient disaster management and response capabilities, highlighted by recent global events, also fuels market expansion.

Challenges in the Public Safety Hardware Market Market

Despite robust growth, the Public Safety Hardware Market faces several challenges. High initial investment costs for advanced hardware can be a barrier for smaller agencies or those with limited budgets. The complex and evolving regulatory landscape, including data privacy and interoperability standards, can slow down product development and market entry. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of critical components. Intense competition, both from established players and emerging technology firms, creates pressure on pricing and necessitates continuous innovation. Furthermore, the need for extensive training and ongoing maintenance for complex systems can pose logistical hurdles for end-users.

Emerging Opportunities in Public Safety Hardware Market

Emerging opportunities in the Public Safety Hardware Market lie in the increasing integration of AI and machine learning for predictive policing and real-time threat assessment. The expansion of 5G networks offers unprecedented opportunities for high-bandwidth, low-latency communication, enabling advanced video streaming and remote operations. Strategic partnerships between hardware manufacturers, software providers, and cloud service companies are creating comprehensive, end-to-end solutions that address complex public safety needs. Market expansion into developing economies, as they prioritize public safety infrastructure, presents significant long-term growth potential. The growing demand for interoperable systems that can seamlessly connect disparate agencies and platforms also offers a substantial opportunity.

Leading Players in the Public Safety Hardware Market Sector

- Icom America

- Teledyne FLIR LLC

- IP Access

- L3Harris

- Motorola Solutions

- Honeywell International Inc

- Purvis

- RadioMobile

- Westnet

- Zetron

Key Milestones in Public Safety Hardware Market Industry

- January 2024: Axon launched its Axon Body Workforce line of body cameras, extending its proven technology to retail and healthcare sectors, demonstrating a commitment to broader enterprise safety solutions.

- April 2024: Crossbeats unveiled Roadeye 2.0, an advanced dashcam featuring a 3-inch LCD display and Timelapse Video functionality, enhancing driving safety and user convenience.

Strategic Outlook for Public Safety Hardware Market Market

The strategic outlook for the Public Safety Hardware Market remains highly positive, driven by an ongoing commitment to enhancing public safety and security worldwide. Future growth accelerators include the continued adoption of AI-powered analytics for proactive threat identification, the deployment of next-generation communication systems leveraging 5G technology for real-time data exchange, and the development of integrated platform solutions that connect various public safety domains. Strategic alliances and collaborations will be crucial for addressing complex challenges and offering holistic security solutions. Investment in cybersecurity for public safety hardware will also be paramount, ensuring the integrity and confidentiality of sensitive data. The market is poised for sustained innovation and expansion as governments and agencies continue to prioritize the safety and well-being of their citizens.

Public Safety Hardware Market Segmentation

-

1. Type

- 1.1. Security and Dashboard Cameras

- 1.2. Rugged Tablets and wearable devices

- 1.3. Infrastructure Safety devices

- 1.4. Others

-

2. Application

- 2.1. Law Enforcement

- 2.2. Emergency Services

- 2.3. Military

- 2.4. Infrastructure Security

- 2.5. Disaster Management

- 2.6. Others

Public Safety Hardware Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

Public Safety Hardware Market Regional Market Share

Geographic Coverage of Public Safety Hardware Market

Public Safety Hardware Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing use of technologies such as AI

- 3.2.2 Analytics in law enforcement; Growing investments on public safety related projects

- 3.3. Market Restrains

- 3.3.1 Increasing use of technologies such as AI

- 3.3.2 Analytics in law enforcement; Growing investments on public safety related projects

- 3.4. Market Trends

- 3.4.1. Investments in Public Safety-related Projects Are Increasing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Public Safety Hardware Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Security and Dashboard Cameras

- 5.1.2. Rugged Tablets and wearable devices

- 5.1.3. Infrastructure Safety devices

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Law Enforcement

- 5.2.2. Emergency Services

- 5.2.3. Military

- 5.2.4. Infrastructure Security

- 5.2.5. Disaster Management

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Public Safety Hardware Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Security and Dashboard Cameras

- 6.1.2. Rugged Tablets and wearable devices

- 6.1.3. Infrastructure Safety devices

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Law Enforcement

- 6.2.2. Emergency Services

- 6.2.3. Military

- 6.2.4. Infrastructure Security

- 6.2.5. Disaster Management

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Public Safety Hardware Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Security and Dashboard Cameras

- 7.1.2. Rugged Tablets and wearable devices

- 7.1.3. Infrastructure Safety devices

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Law Enforcement

- 7.2.2. Emergency Services

- 7.2.3. Military

- 7.2.4. Infrastructure Security

- 7.2.5. Disaster Management

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Public Safety Hardware Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Security and Dashboard Cameras

- 8.1.2. Rugged Tablets and wearable devices

- 8.1.3. Infrastructure Safety devices

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Law Enforcement

- 8.2.2. Emergency Services

- 8.2.3. Military

- 8.2.4. Infrastructure Security

- 8.2.5. Disaster Management

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Public Safety Hardware Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Security and Dashboard Cameras

- 9.1.2. Rugged Tablets and wearable devices

- 9.1.3. Infrastructure Safety devices

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Law Enforcement

- 9.2.2. Emergency Services

- 9.2.3. Military

- 9.2.4. Infrastructure Security

- 9.2.5. Disaster Management

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Public Safety Hardware Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Security and Dashboard Cameras

- 10.1.2. Rugged Tablets and wearable devices

- 10.1.3. Infrastructure Safety devices

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Law Enforcement

- 10.2.2. Emergency Services

- 10.2.3. Military

- 10.2.4. Infrastructure Security

- 10.2.5. Disaster Management

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Icom America

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Teledyne FLIR LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IP Access

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 L3Harris

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Motorola Solutions

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Honeywell International Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Purvis

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 RadioMobile

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Westnet

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Zetron*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Icom America

List of Figures

- Figure 1: Global Public Safety Hardware Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Public Safety Hardware Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Public Safety Hardware Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Public Safety Hardware Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Public Safety Hardware Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Public Safety Hardware Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Public Safety Hardware Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Public Safety Hardware Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Public Safety Hardware Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Public Safety Hardware Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Public Safety Hardware Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Public Safety Hardware Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Public Safety Hardware Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Public Safety Hardware Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Public Safety Hardware Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Public Safety Hardware Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Public Safety Hardware Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Public Safety Hardware Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Public Safety Hardware Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Public Safety Hardware Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Public Safety Hardware Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Public Safety Hardware Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Latin America Public Safety Hardware Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Public Safety Hardware Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Public Safety Hardware Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Public Safety Hardware Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Public Safety Hardware Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Public Safety Hardware Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Public Safety Hardware Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Public Safety Hardware Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Public Safety Hardware Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Public Safety Hardware Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Public Safety Hardware Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Public Safety Hardware Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Public Safety Hardware Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Public Safety Hardware Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Public Safety Hardware Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Public Safety Hardware Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Public Safety Hardware Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Public Safety Hardware Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Public Safety Hardware Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Public Safety Hardware Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Public Safety Hardware Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Public Safety Hardware Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Public Safety Hardware Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Public Safety Hardware Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Public Safety Hardware Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Public Safety Hardware Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Public Safety Hardware Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Public Safety Hardware Market?

The projected CAGR is approximately 10.5%.

2. Which companies are prominent players in the Public Safety Hardware Market?

Key companies in the market include Icom America, Teledyne FLIR LLC, IP Access, L3Harris, Motorola Solutions, Honeywell International Inc, Purvis, RadioMobile, Westnet, Zetron*List Not Exhaustive.

3. What are the main segments of the Public Safety Hardware Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.62 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing use of technologies such as AI. Analytics in law enforcement; Growing investments on public safety related projects.

6. What are the notable trends driving market growth?

Investments in Public Safety-related Projects Are Increasing.

7. Are there any restraints impacting market growth?

Increasing use of technologies such as AI. Analytics in law enforcement; Growing investments on public safety related projects.

8. Can you provide examples of recent developments in the market?

January 2024: Axon, one of the prominent global public safety technology players, launched its latest innovation: the Axon Body Workforce. This new line of body cameras, tailored for frontline staff in retail and healthcare, leverages the proven life-saving technology that has earned the trust of over 2,000 law enforcement agencies globally. By extending this technology to enterprise settings, Axon aims to empower organizations to safeguard their most precious assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Public Safety Hardware Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Public Safety Hardware Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Public Safety Hardware Market?

To stay informed about further developments, trends, and reports in the Public Safety Hardware Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence