Key Insights

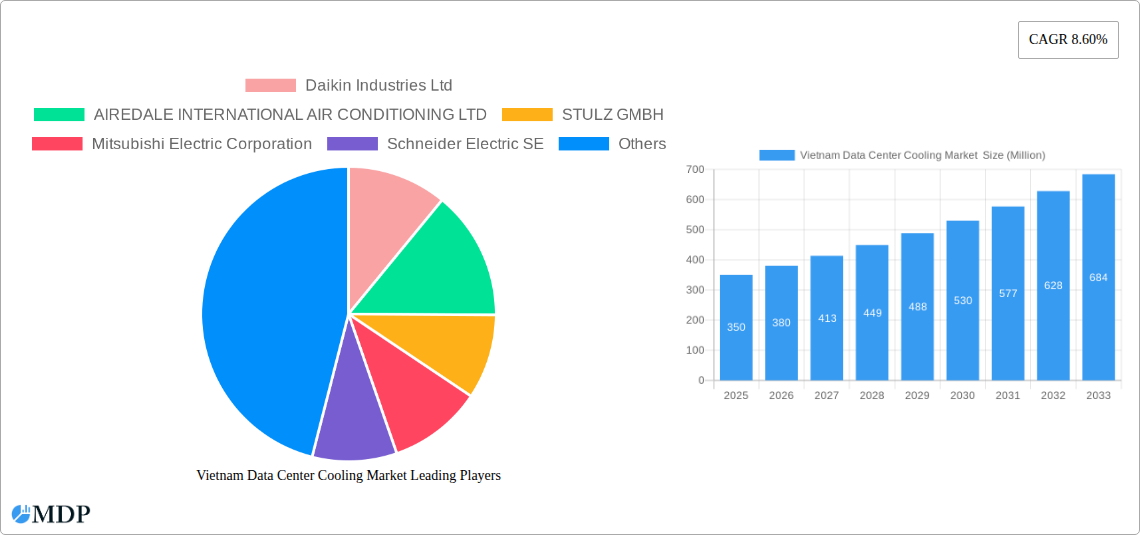

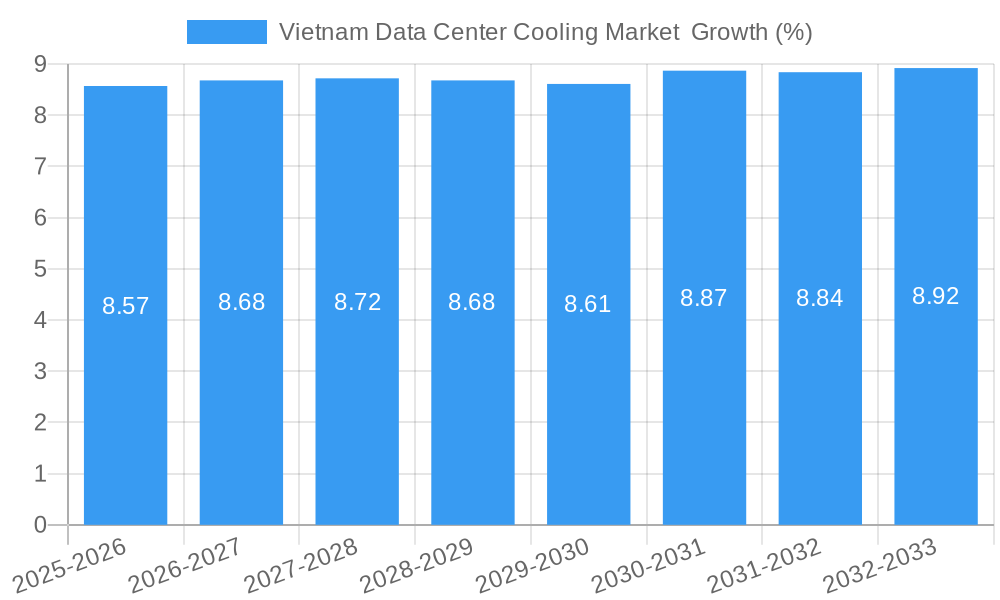

The Vietnam Data Center Cooling Market is poised for significant expansion, driven by the nation's burgeoning digital economy and increasing adoption of advanced technologies. With a projected market size of approximately $350 million in 2025, the market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 8.60% through 2033. This robust growth is fueled by substantial investments in hyperscale and enterprise data centers, necessitated by the rapid increase in data generation from cloud computing, big data analytics, and the Internet of Things (IoT). The IT and Telecom sector, alongside a growing Healthcare industry, are leading the charge in demanding efficient and scalable cooling solutions. Furthermore, government initiatives promoting digital transformation and foreign direct investment in technology infrastructure are creating a fertile ground for market expansion. The increasing demand for high-density computing power within these data centers directly translates to a greater need for sophisticated cooling technologies.

Addressing the escalating heat loads from modern IT equipment, the market is witnessing a pronounced shift towards advanced cooling solutions. While air-based cooling, particularly Chillers and CRAH units, remains a significant segment, liquid-based cooling technologies, including Immersion Cooling and Direct-to-Chip Cooling, are gaining traction due to their superior efficiency in handling high-density racks. These advanced methods are crucial for optimizing energy consumption and reducing operational costs, aligning with Vietnam's sustainability goals. However, the market faces certain restraints, including the initial high capital expenditure for advanced cooling systems and a potential shortage of skilled professionals for installation and maintenance. Nevertheless, the overall outlook remains exceptionally positive, with continuous innovation in cooling technology and the strategic expansion of data center capacity expected to propel the Vietnam Data Center Cooling Market to new heights, reaching an estimated value exceeding $700 million by 2033.

Vietnam Data Center Cooling Market: Insights, Trends, and Growth Projections (2019-2033)

This comprehensive report delves into the dynamic Vietnam Data Center Cooling Market, providing in-depth analysis, strategic insights, and future projections for stakeholders. Explore the critical factors shaping this burgeoning sector, from technological advancements and end-user demands to regulatory landscapes and competitive strategies. The study encompasses a detailed analysis from 2019 to 2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033, building upon historical data from 2019-2024. Understand the market's trajectory and unlock new investment and expansion opportunities.

Vietnam Data Center Cooling Market Dynamics & Concentration

The Vietnam Data Center Cooling Market is characterized by a moderate concentration with a few key players holding significant market share, balanced by the emergence of innovative and agile companies. Innovation drivers are primarily fueled by the escalating demand for high-density computing, the rise of AI and machine learning, and the imperative for energy efficiency and sustainability. Regulatory frameworks are evolving, with government initiatives encouraging foreign investment in digital infrastructure and promoting green technologies, although specific data center cooling standards are still maturing. Product substitutes, while present in basic air cooling solutions, are increasingly challenged by the superior performance and efficiency of advanced liquid cooling technologies. End-user trends are heavily influenced by the rapid digital transformation across various industries, leading to increased adoption of cloud services and the subsequent need for robust data center infrastructure. Mergers and Acquisitions (M&A) activities, while not yet pervasive, are anticipated to increase as larger players seek to consolidate their market position and acquire technological expertise. For instance, the acquisition of smaller cooling solution providers or partnerships to gain access to localized manufacturing capabilities could become more prevalent. The overall market landscape is shifting towards more sophisticated and sustainable cooling solutions to manage the thermal challenges of modern data centers.

Vietnam Data Center Cooling Market Industry Trends & Analysis

The Vietnam Data Center Cooling Market is experiencing robust growth, propelled by a confluence of technological advancements, evolving consumer preferences, and a rapidly expanding digital economy. The CAGR for this market is projected to be in the range of 10-12% over the forecast period, indicating significant expansion. Market penetration is increasing as businesses, particularly in the IT and Telecom, Finance, and E-commerce sectors, recognize the critical need for efficient and reliable data center cooling to support their digital operations. The increasing adoption of high-performance computing (HPC) and the growing density of servers within data centers are driving the demand for more advanced cooling solutions. Traditional air-based cooling, while still prevalent, is facing increasing pressure from the efficiency and performance benefits offered by liquid-based cooling technologies. This shift is a major technological disruption, enabling data centers to handle higher heat loads and operate more sustainably. Consumer preferences are increasingly leaning towards data centers that demonstrate a commitment to energy efficiency and reduced environmental impact, influencing the adoption of eco-friendly cooling solutions like free cooling and liquid immersion. The competitive dynamics within the market are intensifying, with both global leaders and local players vying for market share. Companies are investing heavily in R&D to develop next-generation cooling systems that offer superior performance, lower operational costs, and a smaller carbon footprint. The ongoing digital transformation in Vietnam, coupled with government initiatives to boost digital infrastructure, provides a fertile ground for sustained market growth. The increasing demand for hyperscale and colocation data centers further amplifies the need for scalable and efficient cooling solutions.

Leading Markets & Segments in Vietnam Data Center Cooling Market

The IT and Telecom end-user industry stands as the dominant segment within the Vietnam Data Center Cooling Market, driven by the exponential growth of digital services, cloud computing adoption, and the burgeoning 5G network rollout. This sector's demand for hyperscale data centers, both owned and leased, necessitates highly sophisticated cooling systems to manage immense heat loads.

Cooling Technology:

- Air-based Cooling: Chiller and Economizer systems are currently leading due to their established infrastructure and cost-effectiveness for larger deployments. However, CRAH (Computer Room Air Handler) units remain a vital component for localized cooling within server racks.

- Liquid-based Cooling: Direct-to-Chip Cooling is emerging as a significant growth area, offering precise and efficient heat dissipation for high-density compute nodes essential for AI and HPC applications. Immersion Cooling is also gaining traction for its potential to significantly improve energy efficiency and density.

Type of Data Center:

- Hyperscale (Owned and Leased): This segment is the primary driver of demand due to the massive scale and high-performance computing requirements. The Vietnamese government's focus on developing digital infrastructure, attracting foreign direct investment in large-scale data centers, and the expansion of cloud service providers are key economic policies fueling this dominance.

- Colocation: With the increasing trend of businesses outsourcing their IT infrastructure, colocation data centers are witnessing substantial growth, requiring efficient and scalable cooling solutions.

End-user Industry:

- IT and Telecom: As mentioned, this sector is the prime driver, with continuous investment in network infrastructure, cloud services, and data analytics.

- Retail and Consumer Goods: This segment is increasingly leveraging data analytics and e-commerce platforms, leading to a growing need for robust data center capabilities and, consequently, advanced cooling.

- Healthcare: The digitization of patient records, medical imaging, and the adoption of IoT in healthcare are creating significant data volumes, boosting demand for data center cooling solutions.

The dominance of these segments is underpinned by strong government support for digital transformation, favorable foreign investment policies, and a young, tech-savvy population driving digital consumption. The infrastructure development in key economic zones further supports the expansion of data center facilities.

Vietnam Data Center Cooling Market Product Developments

Product developments in the Vietnam Data Center Cooling Market are largely focused on enhancing energy efficiency, increasing cooling capacity, and enabling higher compute densities. Innovations are driven by the need to address the escalating thermal challenges of modern IT equipment. Direct-to-chip liquid cooling solutions are gaining prominence, offering precise heat removal at the source, which is critical for high-performance computing and AI workloads. Simultaneously, advancements in air-based cooling, such as intelligent CRAH units with variable speed drives and advanced economizers, are optimizing energy consumption. The market is also witnessing increased interest in immersion cooling technologies for their superior thermal performance and potential for significant power savings. These developments provide competitive advantages by enabling data center operators to achieve higher PUE (Power Usage Effectiveness) ratios, reduce operational expenditures, and support the deployment of next-generation, power-hungry hardware.

Key Drivers of Vietnam Data Center Cooling Market Growth

Several key factors are propelling the growth of the Vietnam Data Center Cooling Market. The rapid pace of digital transformation across all industries, including IT and Telecom, E-commerce, and Healthcare, is creating an insatiable demand for data storage and processing, necessitating more robust data center infrastructure. Government initiatives focused on developing Vietnam's digital economy and attracting foreign direct investment in technology sectors are crucial enablers. Furthermore, the increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) technologies, which require high-density computing and generate significant heat, is a major driver for advanced cooling solutions. The rising popularity of cloud computing services, both public and private, further amplifies the need for efficient and scalable data center cooling.

Challenges in the Vietnam Data Center Cooling Market Market

Despite its promising growth, the Vietnam Data Center Cooling Market faces certain challenges. A primary restraint is the evolving regulatory landscape concerning data center operations and environmental standards, which can lead to uncertainty for investors and operators. Supply chain complexities for specialized cooling components and skilled labor shortages for installation and maintenance can impact project timelines and costs. Additionally, the initial high capital expenditure associated with advanced liquid cooling technologies can be a barrier for some enterprises, especially smaller businesses. Competitive pressures from established global players and emerging local vendors can also influence pricing and market accessibility.

Emerging Opportunities in Vietnam Data Center Cooling Market

The Vietnam Data Center Cooling Market presents numerous emerging opportunities for growth. The increasing demand for sustainable and energy-efficient cooling solutions offers a significant avenue for companies specializing in green technologies, such as those employing renewable energy sources for cooling or utilizing advanced liquid cooling for reduced energy consumption. Strategic partnerships between cooling technology providers and data center developers can accelerate market penetration and facilitate the deployment of cutting-edge solutions. The expansion of the edge computing landscape in Vietnam also presents opportunities for smaller, modular cooling solutions tailored for distributed data processing. Furthermore, as Vietnam continues to attract foreign investment in manufacturing and technology, the demand for localized production and servicing of data center cooling equipment is expected to rise, creating opportunities for local players and joint ventures.

Leading Players in the Vietnam Data Center Cooling Market Sector

- Daikin Industries Ltd

- AIREDALE INTERNATIONAL AIR CONDITIONING LTD

- STULZ GMBH

- Mitsubishi Electric Corporation

- Schneider Electric SE

- OVH SAS

- Johnson Controls International PLC (York International)

- Huawei Technologies Co Ltd

- Munters Group AB

- Rittal GMBH & Co KG

Key Milestones in Vietnam Data Center Cooling Market Industry

- August 2023: Cooling module maker Asia Vital Components (AVC) planned to expand its production site in Vietnam to meet growing demand from its US customers. AVC Vietnam, the company's Vietnam subsidiary, operates a USD 50 million production plant covering 10 hectares at the Dong Van 3 Industrial Park in Ha Nam province near Hanoi.

- December 2022: OVHcloud launched a revolutionary hybrid liquid cooling technique for cooling its data centers. This will help businesses save money, manage data responsibly, and help them reduce their carbon footprint. OVHcloud's hybrid immersion liquid cooling technology uses both liquid and immersion cooling. It comprises two cooling systems: a direct-to-chip water cooling system and a passive natural single-phase immersion cooling system.

Strategic Outlook for Vietnam Data Center Cooling Market Market

The strategic outlook for the Vietnam Data Center Cooling Market is exceptionally positive, driven by the nation's commitment to digital transformation and its emergence as a regional technology hub. Growth accelerators will be centered on the adoption of highly efficient and sustainable cooling technologies, such as advanced liquid cooling solutions, to support the increasing density and power requirements of modern data centers. Strategic opportunities lie in fostering collaborations between international cooling solution providers and local infrastructure developers to ensure tailored and cost-effective deployments. Furthermore, capitalizing on the growing demand for green data centers by offering eco-friendly cooling options will be pivotal for market leaders. The continuous evolution of regulatory frameworks, coupled with anticipated investments in hyperscale and colocation facilities, will create a dynamic and expanding market for innovative cooling solutions.

Vietnam Data Center Cooling Market Segmentation

-

1. Cooling Technology

-

1.1. Air-based Cooling

- 1.1.1. Chiller and Economizer

- 1.1.2. CRAH

- 1.1.3. Cooling

- 1.1.4. Other Air-based Cooling Technologies

-

1.2. Liquid-based Cooling

- 1.2.1. Immersion Cooling

- 1.2.2. Direct-to-Chip Cooling

- 1.2.3. Rear-Door Heat Exchanger

-

1.1. Air-based Cooling

-

2. Type of Data Center

- 2.1. Hyperscale (Owned and Leased)

- 2.2. Enterprise (On-premise)

- 2.3. Colocation

-

3. End-user Industry

- 3.1. IT and Telecom

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. Media and Entertainment

- 3.5. Federal and Institutional Agencies

- 3.6. Other End-user Industries

Vietnam Data Center Cooling Market Segmentation By Geography

- 1. Vietnam

Vietnam Data Center Cooling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Volume of Digital Data and Fiber Deployment; Emergence of Green Data Centers

- 3.3. Market Restrains

- 3.3.1. Adaptability Requirements and Power Outages

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Data Center Cooling Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 5.1.1. Air-based Cooling

- 5.1.1.1. Chiller and Economizer

- 5.1.1.2. CRAH

- 5.1.1.3. Cooling

- 5.1.1.4. Other Air-based Cooling Technologies

- 5.1.2. Liquid-based Cooling

- 5.1.2.1. Immersion Cooling

- 5.1.2.2. Direct-to-Chip Cooling

- 5.1.2.3. Rear-Door Heat Exchanger

- 5.1.1. Air-based Cooling

- 5.2. Market Analysis, Insights and Forecast - by Type of Data Center

- 5.2.1. Hyperscale (Owned and Leased)

- 5.2.2. Enterprise (On-premise)

- 5.2.3. Colocation

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT and Telecom

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. Media and Entertainment

- 5.3.5. Federal and Institutional Agencies

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Daikin Industries Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AIREDALE INTERNATIONAL AIR CONDITIONING LTD

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 STULZ GMBH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mitsubishi Electric Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Schneider Electric SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 OVH SAS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Johnson Controls International PLC (York International)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huawei Technologies Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Munters Group AB*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rittal GMBH & Co KG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Daikin Industries Ltd

List of Figures

- Figure 1: Vietnam Data Center Cooling Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Data Center Cooling Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 3: Vietnam Data Center Cooling Market Revenue Million Forecast, by Type of Data Center 2019 & 2032

- Table 4: Vietnam Data Center Cooling Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Vietnam Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Vietnam Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Vietnam Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 8: Vietnam Data Center Cooling Market Revenue Million Forecast, by Type of Data Center 2019 & 2032

- Table 9: Vietnam Data Center Cooling Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 10: Vietnam Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Data Center Cooling Market ?

The projected CAGR is approximately 8.60%.

2. Which companies are prominent players in the Vietnam Data Center Cooling Market ?

Key companies in the market include Daikin Industries Ltd, AIREDALE INTERNATIONAL AIR CONDITIONING LTD, STULZ GMBH, Mitsubishi Electric Corporation, Schneider Electric SE, OVH SAS, Johnson Controls International PLC (York International), Huawei Technologies Co Ltd, Munters Group AB*List Not Exhaustive, Rittal GMBH & Co KG.

3. What are the main segments of the Vietnam Data Center Cooling Market ?

The market segments include Cooling Technology, Type of Data Center, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Volume of Digital Data and Fiber Deployment; Emergence of Green Data Centers.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Share.

7. Are there any restraints impacting market growth?

Adaptability Requirements and Power Outages.

8. Can you provide examples of recent developments in the market?

August 2023: Cooling module maker Asia Vital Components (AVC) planned to expand its production site in Vietnam to meet growing demand from its US customers. AVC Vietnam, the company's Vietnam subsidiary, operates a USD 50 million production plant covering 10 hectares at the Dong Van 3 Industrial Park in Ha Nam province near Hanoi.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Data Center Cooling Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Data Center Cooling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Data Center Cooling Market ?

To stay informed about further developments, trends, and reports in the Vietnam Data Center Cooling Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence