Key Insights

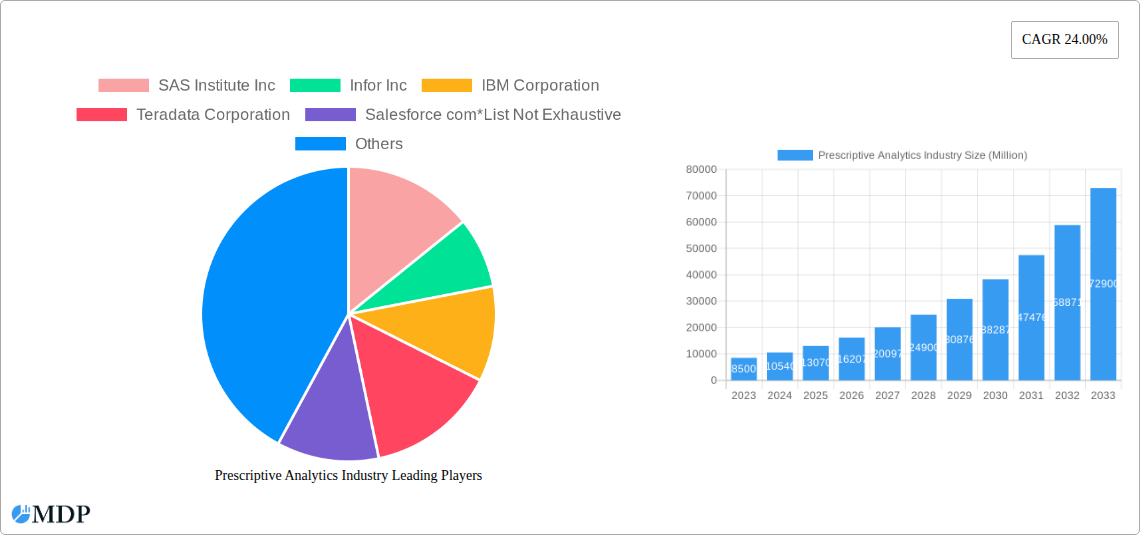

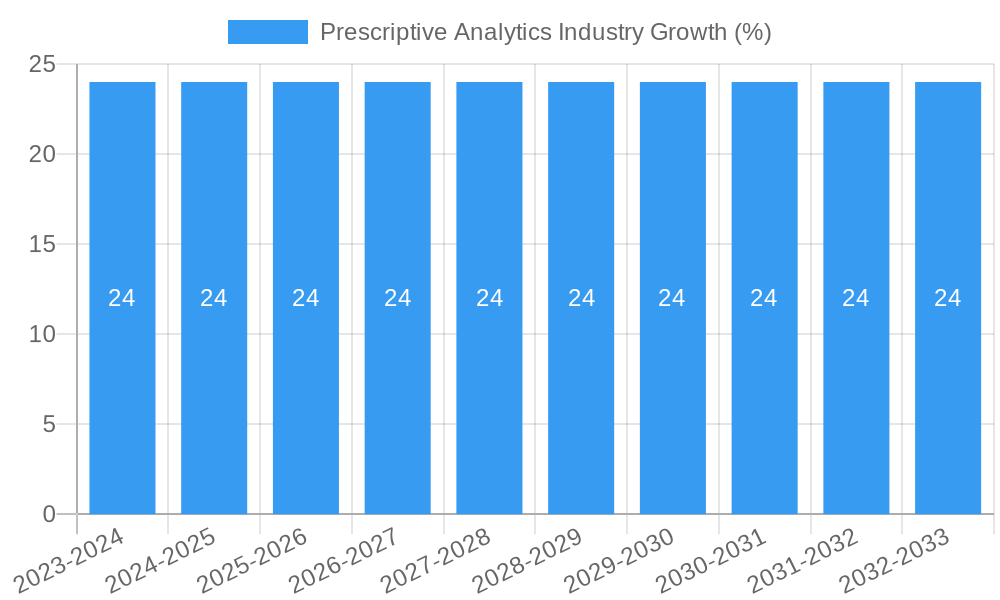

The Prescriptive Analytics Industry is poised for exceptional growth, projected to reach a substantial market size by 2033. Driven by the increasing demand for sophisticated decision-making tools across diverse sectors, the industry is experiencing a remarkable Compound Annual Growth Rate (CAGR) of 24.00%. This rapid expansion is fueled by businesses actively seeking to move beyond understanding past events (descriptive analytics) and predicting future outcomes (predictive analytics) to actively influencing those outcomes through actionable recommendations. Key industries like BFSI, Healthcare, and Retail are at the forefront of adopting prescriptive solutions, leveraging them for optimized resource allocation, enhanced customer experiences, and proactive risk management. The proliferation of big data, coupled with advancements in artificial intelligence and machine learning algorithms, provides the foundational technology enabling these powerful insights.

The market's trajectory is further bolstered by emerging trends such as the integration of prescriptive analytics into cloud-based platforms, making advanced capabilities more accessible and scalable. The growing emphasis on automation and the desire to reduce operational costs are also significant drivers, as prescriptive models can identify the most efficient pathways for complex business processes. While the potential is immense, certain restraints, such as the initial investment costs for implementation and the need for specialized talent, could temper the pace of adoption in some segments. However, the clear return on investment and the competitive advantage offered by prescriptive analytics are compelling enough to overcome these challenges, ensuring sustained and robust market expansion over the forecast period. Leading companies like SAS Institute Inc., IBM Corporation, and Salesforce.com are at the vanguard of this innovation, continuously developing and refining their offerings to meet the evolving needs of the global market.

Prescriptive Analytics Industry Market: Actionable Insights and Future Projections (2019-2033)

Unlock the future of intelligent decision-making with this comprehensive Prescriptive Analytics Industry report. This in-depth analysis provides essential insights into the rapidly evolving prescriptive analytics market, covering key trends, market dynamics, leading players, and strategic opportunities. From the BFSI sector to healthcare and beyond, understand how prescriptive analytics is revolutionizing business operations and driving unprecedented growth. This report, meticulously researched and structured, offers actionable intelligence for industry stakeholders, investors, and decision-makers navigating the complexities of AI-driven insights. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, building upon historical data from 2019 to 2024.

Prescriptive Analytics Industry Market Dynamics & Concentration

The prescriptive analytics market is characterized by a dynamic interplay of technological innovation, evolving end-user demands, and strategic consolidation. Market concentration is moderately fragmented, with key players like SAS Institute Inc., Infor Inc., IBM Corporation, Teradata Corporation, and Salesforce.com commanding significant influence. The drive towards data-driven decision-making, fueled by the proliferation of big data and advanced AI capabilities, acts as a primary innovation driver. Regulatory frameworks, particularly concerning data privacy and security (e.g., GDPR, CCPA), are increasingly shaping the adoption and implementation of prescriptive analytics solutions, adding a layer of complexity and compliance requirements. While direct product substitutes are limited, the effectiveness of traditional business intelligence tools and the potential for in-house development pose indirect competitive pressures. End-user trends show a growing demand for automated and intelligent decision support across all industries, pushing vendors to develop more sophisticated and user-friendly platforms. Mergers and acquisitions (M&A) activity is on the rise as larger enterprises seek to bolster their prescriptive analytics portfolios and expand their market reach. For instance, the acquisition of Databand by IBM Corporation in July 2022 underscores this trend, aiming to enhance data observability and AI capabilities. M&A deal counts are projected to increase as the market matures, with an estimated xx deals expected in the forecast period. Market share within the leading companies is estimated to be around xx% for the top 5 players combined, with significant growth potential for emerging disruptors.

Prescriptive Analytics Industry Industry Trends & Analysis

The prescriptive analytics industry is poised for remarkable growth, driven by an insatiable demand for actionable insights and predictive capabilities. The market is witnessing a significant CAGR of xx% over the forecast period, reflecting the transformative impact of these advanced analytical tools. Market penetration is rapidly increasing across diverse sectors as businesses recognize the strategic advantage of not just understanding "what happened" or "why it happened," but also "what should be done." Technological disruptions are at the forefront, with advancements in machine learning, deep learning, and natural language processing enabling more sophisticated model building and real-time decision automation. The development of self-service analytics platforms and data marketplaces, as highlighted by SAP SE's August 2022 announcement, is democratizing access to these powerful tools, allowing a broader range of users to leverage data for informed actions. Consumer preferences are shifting towards hyper-personalization and proactive service delivery, areas where prescriptive analytics excels by predicting future behaviors and needs. Competitive dynamics are intensifying, with established software giants and agile startups alike vying for market dominance. Companies are investing heavily in R&D to enhance their algorithms, improve integration capabilities with existing enterprise systems, and offer industry-specific solutions. The move towards autonomous analytics, where systems can independently recommend and execute optimal actions, represents a significant future trend, promising increased efficiency and reduced human error. The global market size for prescriptive analytics is projected to reach $xx Million by 2033, a substantial increase from $xx Million in the base year of 2025.

Leading Markets & Segments in Prescriptive Analytics Industry

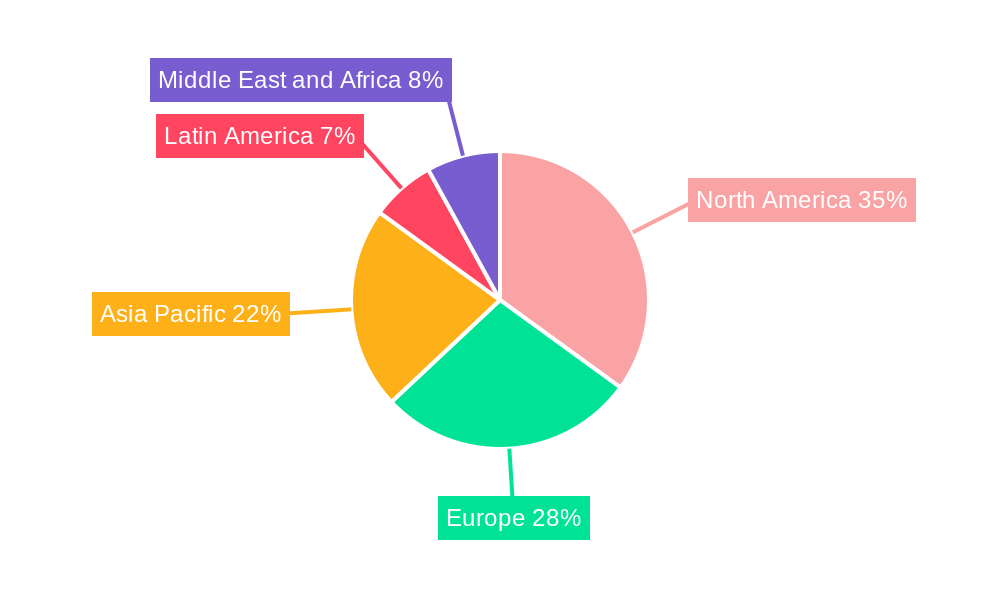

The global prescriptive analytics market exhibits strong regional variations and significant segment dominance, driven by distinct economic policies, infrastructure development, and industry-specific needs.

- Dominant Region: North America currently leads the prescriptive analytics market, driven by a mature technological landscape, a high concentration of innovative companies, and significant investment in AI and big data solutions. The United States, in particular, accounts for a substantial share of the market.

- Key Drivers: Robust R&D spending, a strong startup ecosystem, and the early adoption of advanced technologies by major enterprises. The presence of leading technology firms and venture capital funding further accelerates market growth.

- Dominant End-User Industry: The BFSI (Banking, Financial Services, and Insurance) sector is a primary consumer of prescriptive analytics, leveraging its capabilities for fraud detection, risk management, personalized customer offerings, and optimizing trading strategies.

- Key Drivers: The high volume of sensitive data, the need for real-time decision-making to mitigate financial risks, and the competitive pressure to offer personalized financial products and services. Regulatory compliance also plays a crucial role, demanding sophisticated analytical tools for adherence.

- Other Key Segments and Their Dominance:

- Healthcare: Rapidly growing due to the need for personalized treatment plans, optimizing hospital operations, predicting disease outbreaks, and improving patient outcomes.

- Retail: Essential for inventory management, demand forecasting, personalized marketing campaigns, dynamic pricing, and optimizing supply chain logistics.

- IT and Telecom: Crucial for network optimization, predictive maintenance of infrastructure, customer churn prediction, and personalized service recommendations.

- Industry: Applicable in manufacturing for predictive maintenance of machinery, optimizing production processes, and improving supply chain efficiency.

- Government and Defense: Used for resource allocation, predictive policing, strategic planning, and threat assessment.

The BFSI segment is expected to continue its dominance, with an estimated market share of xx% in 2025, while the Healthcare segment is projected to experience the highest growth rate. The increasing adoption across all these sectors signifies the pervasive utility of prescriptive analytics in driving operational efficiency and strategic advantage.

Prescriptive Analytics Industry Product Developments

Product developments in the prescriptive analytics industry are focused on enhancing the intelligence, accessibility, and integration of analytical solutions. Innovations include the development of more sophisticated machine learning algorithms capable of handling complex, unstructured data, and the integration of real-time data processing capabilities for immediate decision-making. The rise of self-service analytics platforms and data marketplaces empowers business users with intuitive interfaces, reducing reliance on IT departments. Companies are emphasizing the creation of predictive models that not only forecast outcomes but also recommend optimal actions, leading to increased operational efficiency and competitive advantage. Key competitive advantages lie in the ability of solutions to seamlessly integrate with existing enterprise systems, offer industry-specific functionalities, and provide robust data governance and security features. The shift towards autonomous analytics, where systems can learn and adapt independently, is a significant trend shaping the future product landscape.

Key Drivers of Prescriptive Analytics Industry Growth

Several key factors are propelling the growth of the prescriptive analytics industry:

- Technological Advancements: Continuous innovation in AI, machine learning, and big data processing technologies enables more accurate predictions and actionable recommendations.

- Increasing Data Volumes: The exponential growth of data generated across all sectors provides the raw material for powerful prescriptive analytics models.

- Demand for Operational Efficiency: Businesses are actively seeking ways to optimize processes, reduce costs, and improve decision-making through intelligent insights.

- Competitive Pressures: Companies leveraging prescriptive analytics gain a significant competitive edge through better resource allocation, personalized customer experiences, and proactive risk management.

- Regulatory Compliance: Increasingly complex regulations necessitate advanced analytical tools for adherence and risk mitigation.

- Cloud Computing Adoption: The scalability and accessibility offered by cloud platforms facilitate the deployment and use of sophisticated prescriptive analytics solutions.

Challenges in the Prescriptive Analytics Industry Market

Despite its promising growth, the prescriptive analytics industry faces several challenges:

- Data Quality and Integration: Inaccurate or siloed data can severely hamper the effectiveness of prescriptive models, leading to flawed recommendations.

- Talent Shortage: A lack of skilled data scientists and analysts capable of developing, deploying, and interpreting complex prescriptive models remains a significant hurdle.

- Implementation Complexity: Integrating prescriptive analytics solutions with existing IT infrastructure can be challenging and time-consuming.

- Cost of Implementation: The initial investment in technology, talent, and training can be substantial, particularly for small and medium-sized enterprises.

- Ethical Concerns and Bias: Ensuring fairness, transparency, and avoiding bias in AI-driven recommendations is a critical ethical consideration.

- Resistance to Change: Overcoming organizational inertia and gaining user adoption for AI-driven decision-making can be difficult.

Emerging Opportunities in Prescriptive Analytics Industry

The prescriptive analytics industry is ripe with emerging opportunities that will shape its long-term trajectory:

- AI-Powered Automation: The continued development of autonomous systems that can independently make and execute decisions based on data insights will unlock new levels of efficiency.

- Industry-Specific Solutions: Tailored prescriptive analytics solutions for niche industries, such as agriculture, energy, and logistics, will create significant market demand.

- Hyper-Personalization at Scale: Leveraging prescriptive analytics to deliver highly personalized experiences across customer touchpoints, from marketing to product recommendations, will drive customer loyalty.

- Integration with IoT Data: Combining insights from the Internet of Things (IoT) with prescriptive analytics will enable real-time optimization of physical assets and processes.

- Democratization of Analytics: The development of low-code/no-code platforms and intuitive user interfaces will make prescriptive analytics accessible to a wider range of business users.

- Strategic Partnerships: Collaborations between technology providers, domain experts, and industry leaders will accelerate the development and adoption of advanced prescriptive solutions.

Leading Players in the Prescriptive Analytics Industry Sector

- SAS Institute Inc.

- Infor Inc.

- IBM Corporation

- Teradata Corporation

- Salesforce.com

- River Logic Inc.

- Microsoft Corporation

- Altair Engineering Inc.

- Oracle Corporation

- SAP SE

Key Milestones in Prescriptive Analytics Industry Industry

- August 2022: SAP SE announced its strategic shift towards the future of analytics, emphasizing the utilization of new databases, machine learning algorithms, real-time data processing, and the development of self-service analytics and data marketplaces. This move aims to empower customers with intelligent, data-driven insights, signaling the evolution of analytics towards autonomy.

- July 2022: IBM Corporation announced the acquisition of Databand, a leading provider of data observability software. This acquisition significantly enhances IBM's software offerings across data, AI, and automation, ensuring reliable data delivery and improving the overall spectrum of data observability for businesses.

Strategic Outlook for Prescriptive Analytics Industry Market

The strategic outlook for the prescriptive analytics industry is exceptionally robust, fueled by continuous technological advancements and an ever-increasing reliance on data-driven decision-making. The market is set to be characterized by deeper integration of AI and machine learning into core business processes, leading to enhanced automation and predictive capabilities. Key growth accelerators include the expansion of cloud-based prescriptive analytics platforms, making these powerful tools more accessible and scalable. Furthermore, the development of industry-specific solutions and the focus on hyper-personalization will unlock new revenue streams and customer engagement opportunities. Strategic partnerships between technology vendors and enterprises will be crucial for fostering innovation and driving widespread adoption. The future market potential lies in the ability of prescriptive analytics to move beyond mere recommendations to autonomous decision-making, thereby revolutionizing operational efficiency and strategic planning across all sectors.

Prescriptive Analytics Industry Segmentation

-

1. End-user Industry

- 1.1. BFSI

- 1.2. Healthcare

- 1.3. Retail

- 1.4. IT and Telecom

- 1.5. Industri

- 1.6. Government and Defense

- 1.7. Other End-user Industries

Prescriptive Analytics Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Prescriptive Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Importance of Big Data with Large Volumes of Data Generated

- 3.2.2 both in Structured and Unstructured Form; Increasing Adoption of Business Analytics and Business Intelligence

- 3.3. Market Restrains

- 3.3.1. Data Privacy and Security Concerns

- 3.4. Market Trends

- 3.4.1. BFSI is Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. BFSI

- 5.1.2. Healthcare

- 5.1.3. Retail

- 5.1.4. IT and Telecom

- 5.1.5. Industri

- 5.1.6. Government and Defense

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. BFSI

- 6.1.2. Healthcare

- 6.1.3. Retail

- 6.1.4. IT and Telecom

- 6.1.5. Industri

- 6.1.6. Government and Defense

- 6.1.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. BFSI

- 7.1.2. Healthcare

- 7.1.3. Retail

- 7.1.4. IT and Telecom

- 7.1.5. Industri

- 7.1.6. Government and Defense

- 7.1.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Pacific Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. BFSI

- 8.1.2. Healthcare

- 8.1.3. Retail

- 8.1.4. IT and Telecom

- 8.1.5. Industri

- 8.1.6. Government and Defense

- 8.1.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Latin America Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. BFSI

- 9.1.2. Healthcare

- 9.1.3. Retail

- 9.1.4. IT and Telecom

- 9.1.5. Industri

- 9.1.6. Government and Defense

- 9.1.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. BFSI

- 10.1.2. Healthcare

- 10.1.3. Retail

- 10.1.4. IT and Telecom

- 10.1.5. Industri

- 10.1.6. Government and Defense

- 10.1.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. North America Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Prescriptive Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 SAS Institute Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Infor Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 IBM Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Teradata Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Salesforce com*List Not Exhaustive

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 River Logic Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Microsoft Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Altair Engineering Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Oracle Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 SAP SE

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global Prescriptive Analytics Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Prescriptive Analytics Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 13: North America Prescriptive Analytics Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 14: North America Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Prescriptive Analytics Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: Europe Prescriptive Analytics Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: Europe Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Prescriptive Analytics Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Asia Pacific Prescriptive Analytics Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Asia Pacific Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America Prescriptive Analytics Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Latin America Prescriptive Analytics Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Latin America Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East and Africa Prescriptive Analytics Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 29: Middle East and Africa Prescriptive Analytics Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 30: Middle East and Africa Prescriptive Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Prescriptive Analytics Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Prescriptive Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Prescriptive Analytics Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 3: Global Prescriptive Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Prescriptive Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Prescriptive Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Prescriptive Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Prescriptive Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Prescriptive Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Prescriptive Analytics Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Prescriptive Analytics Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Prescriptive Analytics Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 19: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Prescriptive Analytics Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Prescriptive Analytics Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Prescriptive Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Prescriptive Analytics Industry?

The projected CAGR is approximately 24.00%.

2. Which companies are prominent players in the Prescriptive Analytics Industry?

Key companies in the market include SAS Institute Inc, Infor Inc, IBM Corporation, Teradata Corporation, Salesforce com*List Not Exhaustive, River Logic Inc, Microsoft Corporation, Altair Engineering Inc, Oracle Corporation, SAP SE.

3. What are the main segments of the Prescriptive Analytics Industry?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Importance of Big Data with Large Volumes of Data Generated. both in Structured and Unstructured Form; Increasing Adoption of Business Analytics and Business Intelligence.

6. What are the notable trends driving market growth?

BFSI is Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Data Privacy and Security Concerns.

8. Can you provide examples of recent developments in the market?

August 2022 - SAP SE announced it by utilizing new types of databases, machine learning algorithms, real-time data processing capabilities, the development of self-service analytics and data marketplaces, and the company shift from the current state of analytics to the future. We can help customers base decisions on intelligent data-driven insights. As a result, we see the end of analytics as autonomous.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Prescriptive Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Prescriptive Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Prescriptive Analytics Industry?

To stay informed about further developments, trends, and reports in the Prescriptive Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence