Key Insights

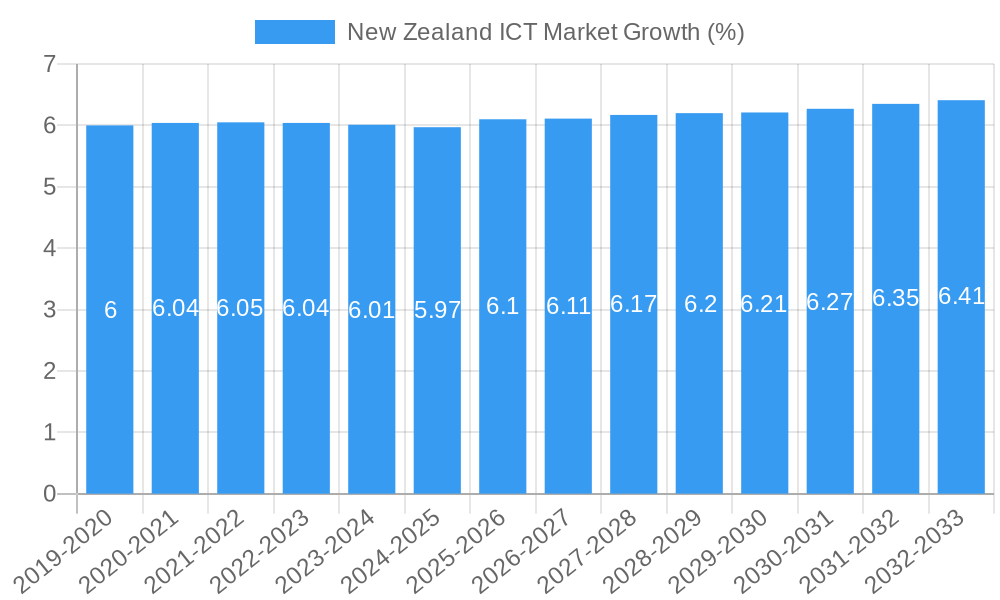

The New Zealand Information and Communications Technology (ICT) market is poised for robust growth, projected to reach an estimated USD 11,500 million by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 7.20% through 2033. This expansion is fueled by significant drivers including the accelerating digital transformation across industries, increasing adoption of cloud computing solutions, and the ongoing expansion of 5G infrastructure. The government's focus on digital innovation and cybersecurity, coupled with a burgeoning demand for advanced IT services and software solutions, further propels market momentum. Small and Medium Enterprises (SMEs) are increasingly investing in ICT to enhance operational efficiency and competitiveness, while large enterprises are leveraging cutting-edge technologies to drive innovation and maintain market leadership. The market is characterized by a dynamic interplay between hardware, software, and a diverse range of IT and telecommunication services, all contributing to a more connected and digitally empowered New Zealand.

Emerging trends like the integration of Artificial Intelligence (AI) and Machine Learning (ML) into business processes, the growing adoption of the Internet of Things (IoT) across various sectors, and the continued demand for robust cybersecurity solutions are shaping the future landscape of the New Zealand ICT market. While the market benefits from these transformative technologies, it also faces certain restraints, such as the shortage of skilled ICT professionals and the initial investment costs associated with adopting new technologies. However, the strong government support for digital initiatives and the increasing digital literacy among businesses and consumers are expected to mitigate these challenges. Key players like Spark New Zealand Limited, Microsoft New Zealand Limited, and Vodafone New Zealand Limited are actively participating in this evolving market, offering innovative solutions and services that cater to the diverse needs of industries such as BFSI, IT and Telecom, Government, and Retail and E-commerce. The continuous innovation and strategic investments by these companies are crucial for sustained market growth and technological advancement.

This in-depth report provides a comprehensive analysis of the New Zealand Information and Communications Technology (ICT) market, forecasting its trajectory from 2019 to 2033, with a base year of 2025. Delving into market dynamics, industry trends, leading segments, and key players, this report offers actionable insights for stakeholders looking to navigate and capitalize on the evolving digital landscape of New Zealand. With a focus on critical segments like Hardware, Software, IT Services, and Telecommunication Services, and across various enterprise sizes and industry verticals, this analysis equips you with the knowledge to make informed strategic decisions.

New Zealand ICT Market Market Dynamics & Concentration

The New Zealand ICT market exhibits a dynamic blend of concentration and fragmentation, influenced by a robust innovation ecosystem and evolving regulatory frameworks. Leading telecommunication providers and global technology giants hold significant market share in specific segments, driving innovation and M&A activities. For instance, the strategic buy-out of Connect 8 Ltd by Spark in January 2022 underscores the consolidation trend within telecommunication infrastructure, crucial for 5G expansion. While specific market share figures are proprietary, industry leaders like Spark New Zealand Limited and Vodafone New Zealand Limited dominate key areas. The market is further shaped by increasing end-user demand for digital transformation, cloud services, and enhanced connectivity, compelling existing players to innovate and adapt. The emergence of new technologies and the push for digital inclusion are also significant innovation drivers. Regulatory frameworks, such as those concerning data privacy and cybersecurity, play a crucial role in shaping market operations and competition. Product substitutes are increasingly prevalent, particularly in software and IT services, necessitating continuous value addition and differentiation. M&A activities, driven by the desire to expand service portfolios and market reach, are expected to continue, consolidating the market further and fostering strategic alliances.

New Zealand ICT Market Industry Trends & Analysis

The New Zealand ICT market is poised for substantial growth, driven by a confluence of factors including accelerating digital transformation initiatives across all industry verticals, increasing adoption of cloud computing solutions, and the burgeoning demand for advanced IT services and telecommunication capabilities. The forecast period of 2025–2033 is expected to witness a Compound Annual Growth Rate (CAGR) of approximately xx%, signifying robust expansion. This growth is further fueled by the government's commitment to digital infrastructure development, including the rollout of high-speed broadband and 5G networks, which enhances market penetration for various ICT solutions. Consumer preferences are shifting towards personalized digital experiences, leading to a greater demand for sophisticated software applications and data analytics. The competitive landscape is characterized by intense rivalry among established players and the emergence of agile startups, fostering innovation and driving down costs. Technological disruptions, such as the widespread adoption of Artificial Intelligence (AI), Internet of Things (IoT), and edge computing, are reshaping service delivery models and creating new market opportunities. The IT services segment, encompassing areas like cloud consulting, cybersecurity, and managed services, is projected to be a significant growth engine, supported by the increasing complexity of business operations and the need for specialized expertise. Similarly, telecommunication services will continue to evolve with the expansion of 5G capabilities, offering higher speeds and lower latency, thus enabling new applications and services across industries like remote work, smart cities, and advanced manufacturing. The BFSI sector is leading in terms of ICT adoption due to the critical need for secure and efficient digital platforms, followed closely by the IT and Telecom, and Government sectors, which are heavily investing in digital modernization. Retail and e-commerce continue to leverage ICT for enhanced customer engagement and operational efficiency, while manufacturing and energy sectors are increasingly adopting IoT and automation for improved productivity and sustainability.

Leading Markets & Segments in New Zealand ICT Market

The New Zealand ICT market demonstrates significant dominance across several key segments, driven by distinct economic policies, infrastructure advancements, and evolving industry demands.

Dominant Segment by Type: IT Services is projected to hold the largest market share, driven by the escalating need for digital transformation, cloud migration, cybersecurity solutions, and managed services across all enterprise sizes. The increasing complexity of technology landscapes and the shortage of in-house IT expertise are compelling organizations to outsource these functions.

- Key Drivers:

- Government initiatives promoting digital adoption.

- Growing demand for cloud consulting and implementation.

- Increased focus on cybersecurity to protect sensitive data.

- The proliferation of remote work models requiring robust IT support.

- Key Drivers:

Dominant Segment by Size of Enterprise: Large Enterprises represent a substantial portion of the ICT market, owing to their larger budgets, complex operational needs, and significant investments in technology for competitive advantage. They are at the forefront of adopting advanced solutions like AI, big data analytics, and enterprise resource planning (ERP) systems.

- Key Drivers:

- Investment in digital transformation for operational efficiency and customer experience.

- Adoption of enterprise-grade software and hardware solutions.

- Significant outsourcing of IT functions to specialized service providers.

- Large-scale cloud adoption for scalability and cost-effectiveness.

- Key Drivers:

Dominant Segment by Industry Vertical: IT and Telecom and BFSI (Banking, Financial Services, and Insurance) are the leading industry verticals in terms of ICT spending. The IT and Telecom sector inherently drives demand for ICT infrastructure and services, while the BFSI sector requires robust, secure, and sophisticated digital solutions for transactions, data management, and customer service.

- Key Drivers for IT and Telecom:

- Continuous investment in network infrastructure and 5G deployment.

- Development and deployment of new software and hardware.

- Demand for cloud services and data center solutions.

- Key Drivers for BFSI:

- Strict regulatory compliance requirements.

- Demand for enhanced cybersecurity and fraud prevention.

- Investment in digital banking and fintech solutions.

- Need for efficient data analytics and customer relationship management.

- Key Drivers for IT and Telecom:

Other significant industry verticals showing robust growth include Government, with its push for e-governance and digital public services, and Retail and E-commerce, which is increasingly relying on ICT for online sales, supply chain optimization, and personalized customer experiences. Manufacturing and Energy and Utilities are also seeing increased adoption of IoT, automation, and data analytics for operational efficiency and sustainability.

New Zealand ICT Market Product Developments

The New Zealand ICT market is characterized by continuous product innovation, driven by advancements in cloud computing, artificial intelligence, and the Internet of Things. Companies are focused on developing integrated software solutions that enhance business processes, improve data analytics capabilities, and deliver personalized customer experiences. Hardware manufacturers are innovating to provide more efficient and connected devices, supporting the growing demand for IoT applications and remote work. The IT services sector is witnessing the development of advanced cybersecurity solutions, managed cloud services, and specialized consulting for digital transformation. Competitive advantages are being carved out through superior product performance, seamless integration, robust security features, and tailored solutions addressing specific industry needs. The recent partnership extension between IBM NZ, MATRIXX Software, and Vodafone NZ to offer enterprise-wide digital commerce exemplifies a significant product development focused on enhancing customer experience and modernizing charging systems.

Key Drivers of New Zealand ICT Market Growth

Several interconnected factors are propelling the growth of the New Zealand ICT market. The increasing adoption of digital technologies across all business sectors, driven by the need for operational efficiency, enhanced customer engagement, and competitive advantage, is a primary driver. Significant government investment in digital infrastructure, including the expansion of broadband and 5G networks, is creating a fertile ground for new ICT services and solutions. Furthermore, the burgeoning startup ecosystem and the influx of foreign direct investment into the technology sector are fostering innovation and competition. The demand for cloud services, cybersecurity solutions, and data analytics is also on the rise as businesses increasingly rely on data-driven decision-making and robust digital protection.

Challenges in the New Zealand ICT Market Market

Despite its growth trajectory, the New Zealand ICT market faces several challenges. A significant hurdle is the shortage of skilled ICT professionals, which can impede the development and implementation of new technologies and services. Regulatory complexities, particularly concerning data privacy and cybersecurity compliance, can also pose challenges for businesses, requiring significant investment in adherence. Furthermore, the geographical dispersion of the New Zealand population can create challenges for widespread, equitable access to advanced ICT services, particularly in rural areas. Global supply chain disruptions can also impact the availability and cost of hardware components.

Emerging Opportunities in New Zealand ICT Market

The New Zealand ICT market is ripe with emerging opportunities, particularly in areas driven by technological breakthroughs and strategic partnerships. The continued expansion of 5G networks presents significant opportunities for the development of innovative IoT applications, smart city solutions, and enhanced telecommunication services. The growing emphasis on sustainability and green technologies is creating a demand for ICT solutions that optimize energy consumption and reduce environmental impact. Furthermore, the increasing adoption of AI and machine learning across various industries, from healthcare to agriculture, offers substantial potential for new service development and market expansion. Strategic partnerships between local and international technology providers, as well as collaborations between industry and academia, are also key catalysts for future growth.

Leading Players in the New Zealand ICT Market Sector

- Spark New Zealand Limited

- TCS (NZ) Ltd

- Crown Infrastructure Partners

- Amazon New Zealand Pty Ltd

- Microsoft New Zealand Limited

- HCL (New Zealand) Limited

- IBM New Zealand Ltd

- Oracle New Zealand

- Google New Zealand

- Two Degrees Mobile Limited

- Vodafone New Zealand Limited

- Vocus Group Limited

- Infosys Technologies Australia Pty Ltd (Australia & New Zealand)

- Tuatahi First Fibre

Key Milestones in New Zealand ICT Market Industry

- April 2022: IBM NZ, MATRIXX Software, and Vodafone NZ declared about extending their partnership to offer enterprise-wide digital commerce to all of its post-pay, pre-pay, wholesale, and IoT customers. By replacing and updating Vodafone's charging system as part of this most recent partnership extension, IBM Consulting and MATRIXX would provide consumers with a new digital experience.

- January 2022: Spark, one of the leading telecommunication companies in New Zealand, unveiled the completion of its strategic buy-out of telecommunication infrastructure contractor Connect 8 Ltd. The agreement is a part of Spark's efforts to boost the rollout of 5G. The financial information about the purchase was kept private.

Strategic Outlook for New Zealand ICT Market Market

The strategic outlook for the New Zealand ICT market is overwhelmingly positive, characterized by sustained growth and increasing sophistication. Future market potential will be unlocked by the continued acceleration of digital transformation initiatives, the widespread deployment of 5G infrastructure, and the growing adoption of AI and IoT. Strategic opportunities lie in developing and delivering specialized cloud solutions, robust cybersecurity services, and data analytics platforms tailored to the unique needs of New Zealand's diverse industry verticals. Collaboration between government, industry, and research institutions will be crucial for fostering innovation and addressing the skills gap. Furthermore, a focus on leveraging ICT for sustainability and driving economic diversification will be key growth accelerators.

New Zealand ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

New Zealand ICT Market Segmentation By Geography

- 1. New Zealand

New Zealand ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Growth of Technology Export; Government Investments in Digital Healthcare

- 3.3. Market Restrains

- 3.3.1. Increasing Hidden Costs of Cloud-based Storage

- 3.4. Market Trends

- 3.4.1. Robust Growth of Technology Export

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. New Zealand ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Spark New Zealand Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TCS (NZ) Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Crown Infrastructure Partners*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amazon New Zealand Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Microsoft New Zealand Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HCL (New Zealand) Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IBM New Zealand Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oracle New Zealand

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Google New Zealand

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Two Degrees Mobile Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Vodafone New Zealand Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Vocus Group Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Infosys Technologies Australia Pty Ltd (Australia & New Zealand)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Tuatahi First Fibre

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Spark New Zealand Limited

List of Figures

- Figure 1: New Zealand ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: New Zealand ICT Market Share (%) by Company 2024

List of Tables

- Table 1: New Zealand ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: New Zealand ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: New Zealand ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 4: New Zealand ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 5: New Zealand ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: New Zealand ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: New Zealand ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: New Zealand ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 9: New Zealand ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 10: New Zealand ICT Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the New Zealand ICT Market?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the New Zealand ICT Market?

Key companies in the market include Spark New Zealand Limited, TCS (NZ) Ltd, Crown Infrastructure Partners*List Not Exhaustive, Amazon New Zealand Pty Ltd, Microsoft New Zealand Limited, HCL (New Zealand) Limited, IBM New Zealand Ltd, Oracle New Zealand, Google New Zealand, Two Degrees Mobile Limited, Vodafone New Zealand Limited, Vocus Group Limited, Infosys Technologies Australia Pty Ltd (Australia & New Zealand), Tuatahi First Fibre.

3. What are the main segments of the New Zealand ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Growth of Technology Export; Government Investments in Digital Healthcare.

6. What are the notable trends driving market growth?

Robust Growth of Technology Export.

7. Are there any restraints impacting market growth?

Increasing Hidden Costs of Cloud-based Storage.

8. Can you provide examples of recent developments in the market?

April 2022: IBM NZ, MATRIXX Software, and Vodafone NZ declared about extending their partnership to offer enterprise-wide digital commerce to all of its post-pay, pre-pay, wholesale, and IoT customers. By replacing and updating Vodafone's charging system as part of this most recent partnership extension, IBM Consulting and MATRIXX would provide consumers with a new digital experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "New Zealand ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the New Zealand ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the New Zealand ICT Market?

To stay informed about further developments, trends, and reports in the New Zealand ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence