Key Insights

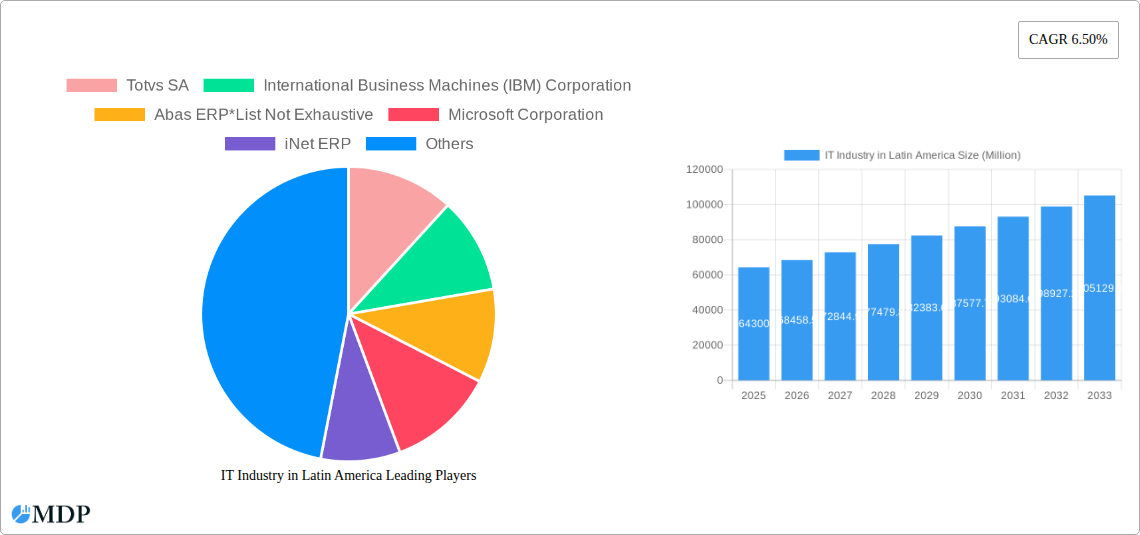

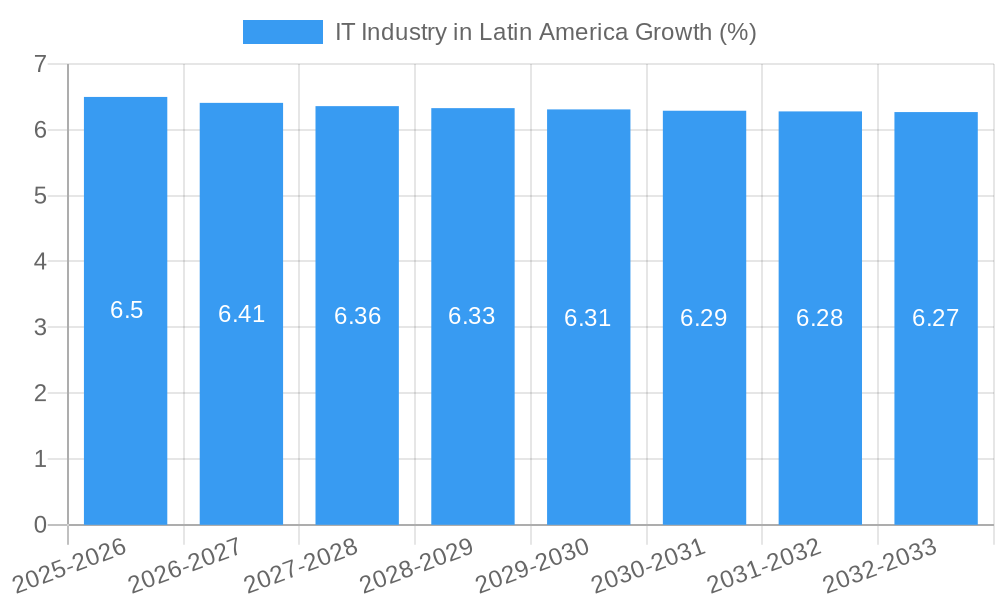

The Latin American IT industry is poised for robust expansion, projected to reach a market size of approximately $64.3 billion by 2025. Fueled by a Compound Annual Growth Rate (CAGR) of 6.50%, this dynamic market is expected to continue its upward trajectory throughout the forecast period, reaching an estimated $87.7 billion by 2033. This significant growth is primarily driven by the accelerating digital transformation initiatives across various end-user industries. Key sectors like Retail, Manufacturing, and BFSI are increasingly adopting advanced IT solutions, including cloud computing, data analytics, and cybersecurity, to enhance operational efficiency, customer engagement, and competitive advantage. The growing adoption of enterprise resource planning (ERP) solutions, particularly by small and medium enterprises (SMEs) seeking to streamline their business processes, is another significant growth catalyst. Furthermore, government initiatives promoting digital infrastructure development and the expansion of IT services in emerging economies within the region are contributing to this positive outlook.

The competitive landscape in the Latin American IT market is characterized by the presence of both global technology giants and specialized local players. Companies such as SAP, Oracle, IBM, and Microsoft are actively expanding their presence and offerings in the region, catering to the diverse needs of large enterprises. Concurrently, agile players like Odoo and Totvs SA are gaining traction by providing tailored ERP and business management solutions, especially to the growing SME segment. Emerging trends such as the increasing demand for artificial intelligence (AI) and machine learning (ML) integrated solutions, the focus on sustainable IT practices, and the growing adoption of Software-as-a-Service (SaaS) models are shaping the market's future. However, certain restraints, including data privacy regulations, the digital skills gap in some areas, and economic volatilities, may pose challenges. Despite these hurdles, the overarching trend towards digitalization and the ongoing investment in technological infrastructure signal a promising future for the IT industry in Latin America.

This in-depth report provides critical insights into the burgeoning IT industry in Latin America, covering the Study Period (2019–2033) with a Base Year of 2025 and an extensive Forecast Period (2025–2033). Dive into the dynamic landscape of cloud computing LATAM, digital transformation Latin America, SaaS Latin America, and ERP Latin America to understand market dynamics, trends, and future opportunities. With over 10 Million USD in potential market value, this report is essential for investors, technology providers, and businesses aiming to capitalize on this high-growth region. We analyze key players like Totvs SA, International Business Machines (IBM) Corporation, Abas ERP, Microsoft Corporation, iNet ERP, SAP, Odoo, Wrike Inc, and Oracle Corporation, and examine the impact of industry developments, including Google's 1.2 Billion USD investment and TOTVS SA's strategic acquisition.

IT Industry in Latin America Market Dynamics & Concentration

The IT industry in Latin America exhibits a moderate to high concentration, with a few dominant players holding significant market share in key segments like enterprise resource planning (ERP) Latin America and software as a service (SaaS) Latin America. Innovation is primarily driven by the increasing demand for digital solutions across various sectors, pushing companies to adopt advanced technologies such as AI, IoT, and cloud infrastructure. Regulatory frameworks are evolving, with governments increasingly promoting digital initiatives and data protection. However, variations exist across countries, influencing market entry and operational strategies. Product substitutes are readily available, particularly in cloud services and generic software solutions, intensifying competition. End-user trends are strongly influenced by the push for efficiency, cost optimization, and enhanced customer experiences, leading to higher adoption rates for integrated IT solutions. Merger and acquisition (M&A) activities have been steadily increasing, with an estimated xx M&A deals in the historical period (2019-2024) as companies seek to expand their market reach and technological capabilities. The market share of key players like SAP and Oracle in the large enterprise segment remains substantial, while emerging players are gaining traction in the SME segment.

IT Industry in Latin America Industry Trends & Analysis

The IT industry in Latin America is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033. This expansion is fueled by a confluence of factors, including the rapid digital transformation initiatives across all end-user industries, increased adoption of cloud-based solutions, and a growing reliance on software-as-a-service (SaaS) models. Technological disruptions are reshaping the market, with the proliferation of artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) enabling businesses to automate processes, gain deeper insights, and offer personalized customer experiences. Consumer preferences are shifting towards user-friendly interfaces, scalable solutions, and integrated platforms that streamline operations and enhance productivity. Competitive dynamics are characterized by intense competition from both established global IT giants and agile local providers. Market penetration for digital services is on an upward trajectory, with an estimated xx% of businesses in the region actively utilizing cloud services by 2025. The demand for cybersecurity solutions is also soaring as data breaches and cyber threats become more sophisticated. Furthermore, the increasing availability of skilled IT talent, though still a challenge in certain specialized areas, is contributing to the industry's growth. The focus on data analytics and business intelligence is enabling organizations to make more informed strategic decisions, driving further investment in IT infrastructure and software. The burgeoning e-commerce sector, coupled with the digitalization of traditional industries like retail and manufacturing, are significant growth drivers. The integration of mobile technologies into business processes is also a key trend, enhancing accessibility and collaboration.

Leading Markets & Segments in IT Industry in Latin America

The IT industry in Latin America is experiencing significant growth across multiple segments. Within Enterprise Size, both Small and Medium Enterprises (SMEs) and Large Enterprises are major contributors to market expansion. SMEs, in particular, are increasingly adopting scalable and cost-effective IT solutions, such as cloud-based ERP and CRM systems, to compete effectively and improve operational efficiency. For instance, the adoption of SaaS Latin America solutions is particularly prevalent among SMEs due to their flexibility and lower upfront investment. Large Enterprises, on the other hand, are investing heavily in sophisticated, integrated IT systems to manage complex operations, drive digital transformation, and enhance their global competitiveness.

Across End-user Industries, the Retail sector is a dominant force, driven by the surge in e-commerce and the need for robust inventory management, customer relationship management, and supply chain optimization solutions. Manufacturing is another significant segment, with companies embracing Industry 4.0 technologies, including IoT, AI, and advanced analytics, to automate production, improve quality control, and optimize resource allocation. The BFSI (Banking, Financial Services, and Insurance) sector is a prime adopter of IT solutions for enhancing customer experience, ensuring regulatory compliance, and bolstering cybersecurity. The IT and Telecom sector itself is a major consumer of advanced IT infrastructure and services, driving innovation and demand for new technologies. The Government sector is also increasingly digitizing its services to improve public administration and citizen engagement.

Key drivers for the dominance of these segments include:

- Economic Policies: Government initiatives promoting digital adoption and investment in technology infrastructure.

- Infrastructure Development: Ongoing improvements in internet connectivity and digital infrastructure across the region.

- Market Demand: Growing consumer and business demand for digital services and seamless online experiences.

- Technological Advancements: Availability of cutting-edge IT solutions that cater to specific industry needs.

IT Industry in Latin America Product Developments

Product innovations in the Latin American IT sector are increasingly focused on AI-driven automation, advanced analytics for business intelligence, and highly secure cloud-based solutions. Companies are developing intuitive ERP and CRM platforms tailored for the region's diverse business needs, emphasizing modularity and integration capabilities. Competitive advantages are being forged through localized language support, region-specific compliance features, and robust cybersecurity measures. The trend towards low-code/no-code platforms is also gaining traction, enabling faster application development and deployment, further enhancing market fit for a wide range of businesses.

Key Drivers of IT Industry in Latin America Growth

Several key factors are propelling the growth of the IT industry in Latin America. Digital transformation initiatives across all sectors are a primary catalyst, as businesses seek to enhance efficiency and competitiveness. The widespread adoption of cloud computing LATAM and SaaS Latin America solutions offers scalability and cost-effectiveness. Government initiatives and investments in digital infrastructure and innovation are fostering a conducive environment. Furthermore, increasing IT spending by businesses, driven by the need for advanced technologies like AI and IoT, is a significant growth accelerator.

Challenges in the IT Industry in Latin America Market

Despite strong growth, the IT industry in Latin America faces several challenges. Regulatory hurdles and data privacy concerns vary significantly across countries, creating compliance complexities. Cybersecurity threats are a persistent concern, requiring substantial investment in protective measures. Talent shortages in specialized IT fields and the need for continuous upskilling of the workforce also present a restraint. Furthermore, infrastructure limitations in some rural areas and the high cost of certain advanced technologies can hinder widespread adoption among smaller businesses.

Emerging Opportunities in IT Industry in Latin America

Emerging opportunities in the Latin American IT market are substantial and varied. The continued expansion of e-commerce and digital payments presents significant avenues for growth in related IT services. Strategic partnerships between global technology providers and local integrators are crucial for market penetration. The increasing adoption of IoT solutions in industries like agriculture, logistics, and smart cities offers immense potential. Furthermore, the burgeoning fintech sector is driving demand for innovative IT solutions in financial services, creating lucrative opportunities for specialized software and service providers.

Leading Players in the IT Industry in Latin America Sector

- Totvs SA

- International Business Machines (IBM) Corporation

- Abas ERP

- Microsoft Corporation

- iNet ERP

- SAP

- Odoo

- Wrike Inc

- Oracle Corporation

Key Milestones in IT Industry in Latin America Industry

- JUN 2022: Alphabet's Google announced plans to invest USD 1.2 billion in Latin America over the next five years to assist economic development and digital change in the area, where it has been operating since 2005. This significant investment signals strong confidence in the region's digital future and is expected to spur innovation and infrastructure development.

- APR 2022: TOTVS SA announced that its subsidiary, TOTVS Tecnologia em Software de Gesto Ltda (TOTVS Tecnologia), entered an Agreement of Sale and Purchase of Shares and Other Covenants. Under this agreement, TOTVS acquired shares representing 100% of the capital stock of GESPLAN SA for BRL 40 million in cash. This strategic acquisition by TOTVS SA, a leading Brazilian software company, enhances its product portfolio and market reach within Latin America's ERP landscape.

Strategic Outlook for IT Industry in Latin America Market

- JUN 2022: Alphabet's Google announced plans to invest USD 1.2 billion in Latin America over the next five years to assist economic development and digital change in the area, where it has been operating since 2005. This significant investment signals strong confidence in the region's digital future and is expected to spur innovation and infrastructure development.

- APR 2022: TOTVS SA announced that its subsidiary, TOTVS Tecnologia em Software de Gesto Ltda (TOTVS Tecnologia), entered an Agreement of Sale and Purchase of Shares and Other Covenants. Under this agreement, TOTVS acquired shares representing 100% of the capital stock of GESPLAN SA for BRL 40 million in cash. This strategic acquisition by TOTVS SA, a leading Brazilian software company, enhances its product portfolio and market reach within Latin America's ERP landscape.

Strategic Outlook for IT Industry in Latin America Market

The strategic outlook for the IT industry in Latin America is exceptionally positive, characterized by sustained growth and expanding opportunities. Key growth accelerators include the ongoing digital transformation across all sectors, the increasing adoption of cloud-native solutions, and the rising demand for AI and data analytics services. Investments in cybersecurity and the development of localized IT solutions will be critical for market success. Strategic partnerships and M&A activities are expected to continue as companies aim to consolidate market positions and expand their technological capabilities, driving further innovation and market penetration.

IT Industry in Latin America Segmentation

-

1. Enterprise Size

- 1.1. Small and Medium Enterprises

- 1.2. Large Enterprises

-

2. End-user Industry

- 2.1. Retail

- 2.2. Manufacturing

- 2.3. BFSI

- 2.4. Government

- 2.5. IT and Telecom

- 2.6. Other End-user Industries

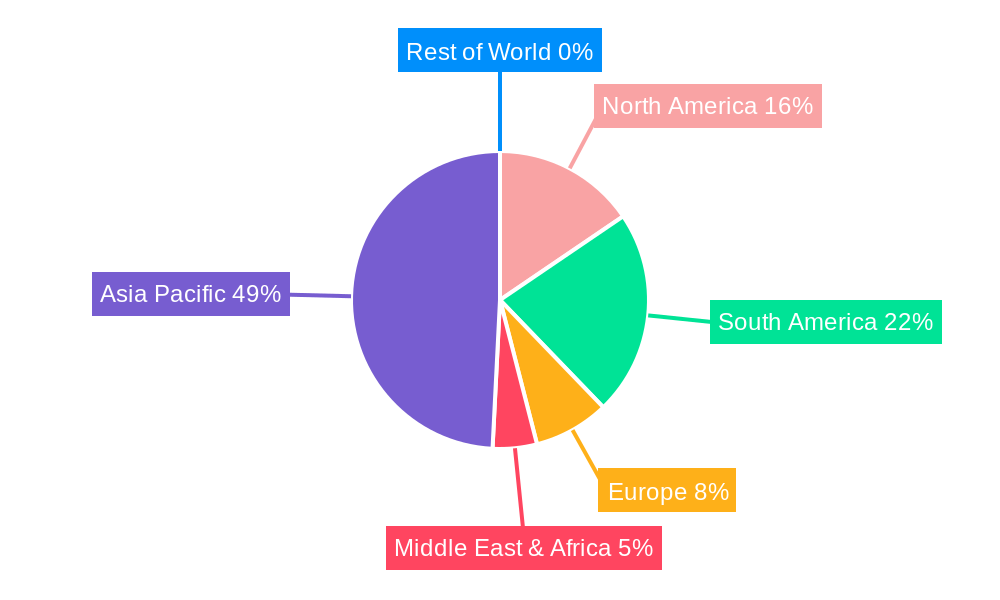

IT Industry in Latin America Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

IT Industry in Latin America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growth of Enterprise Software and the Workplace Automation Industry in the Latin American Market; High Penetration of Manufacturing Companies in Mexico

- 3.2.2 Chile

- 3.2.3 and Peru May Propel the Market's Growth

- 3.3. Market Restrains

- 3.3.1. Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. Growth of Enterprise Software and the Workplace Automation Industry in the Latin American Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global IT Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.1.1. Small and Medium Enterprises

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Manufacturing

- 5.2.3. BFSI

- 5.2.4. Government

- 5.2.5. IT and Telecom

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 6. North America IT Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 6.1.1. Small and Medium Enterprises

- 6.1.2. Large Enterprises

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Retail

- 6.2.2. Manufacturing

- 6.2.3. BFSI

- 6.2.4. Government

- 6.2.5. IT and Telecom

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 7. South America IT Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 7.1.1. Small and Medium Enterprises

- 7.1.2. Large Enterprises

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Retail

- 7.2.2. Manufacturing

- 7.2.3. BFSI

- 7.2.4. Government

- 7.2.5. IT and Telecom

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 8. Europe IT Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 8.1.1. Small and Medium Enterprises

- 8.1.2. Large Enterprises

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Retail

- 8.2.2. Manufacturing

- 8.2.3. BFSI

- 8.2.4. Government

- 8.2.5. IT and Telecom

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 9. Middle East & Africa IT Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 9.1.1. Small and Medium Enterprises

- 9.1.2. Large Enterprises

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Retail

- 9.2.2. Manufacturing

- 9.2.3. BFSI

- 9.2.4. Government

- 9.2.5. IT and Telecom

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 10. Asia Pacific IT Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 10.1.1. Small and Medium Enterprises

- 10.1.2. Large Enterprises

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Retail

- 10.2.2. Manufacturing

- 10.2.3. BFSI

- 10.2.4. Government

- 10.2.5. IT and Telecom

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 11. Brazil IT Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 12. Argentina IT Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 13. Mexico IT Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 14. Peru IT Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 15. Chile IT Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Latin America IT Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Totvs SA

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 International Business Machines (IBM) Corporation

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Abas ERP*List Not Exhaustive

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Microsoft Corporation

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 iNet ERP

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 SAP

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Odoo

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Wrike Inc

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Oracle Corporation

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.1 Totvs SA

List of Figures

- Figure 1: Global IT Industry in Latin America Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Latin America IT Industry in Latin America Revenue (Million), by Country 2024 & 2032

- Figure 3: Latin America IT Industry in Latin America Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America IT Industry in Latin America Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 5: North America IT Industry in Latin America Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 6: North America IT Industry in Latin America Revenue (Million), by End-user Industry 2024 & 2032

- Figure 7: North America IT Industry in Latin America Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 8: North America IT Industry in Latin America Revenue (Million), by Country 2024 & 2032

- Figure 9: North America IT Industry in Latin America Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America IT Industry in Latin America Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 11: South America IT Industry in Latin America Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 12: South America IT Industry in Latin America Revenue (Million), by End-user Industry 2024 & 2032

- Figure 13: South America IT Industry in Latin America Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 14: South America IT Industry in Latin America Revenue (Million), by Country 2024 & 2032

- Figure 15: South America IT Industry in Latin America Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe IT Industry in Latin America Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 17: Europe IT Industry in Latin America Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 18: Europe IT Industry in Latin America Revenue (Million), by End-user Industry 2024 & 2032

- Figure 19: Europe IT Industry in Latin America Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 20: Europe IT Industry in Latin America Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe IT Industry in Latin America Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa IT Industry in Latin America Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 23: Middle East & Africa IT Industry in Latin America Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 24: Middle East & Africa IT Industry in Latin America Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Middle East & Africa IT Industry in Latin America Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Middle East & Africa IT Industry in Latin America Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa IT Industry in Latin America Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific IT Industry in Latin America Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 29: Asia Pacific IT Industry in Latin America Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 30: Asia Pacific IT Industry in Latin America Revenue (Million), by End-user Industry 2024 & 2032

- Figure 31: Asia Pacific IT Industry in Latin America Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 32: Asia Pacific IT Industry in Latin America Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific IT Industry in Latin America Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global IT Industry in Latin America Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global IT Industry in Latin America Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 3: Global IT Industry in Latin America Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global IT Industry in Latin America Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global IT Industry in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global IT Industry in Latin America Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 13: Global IT Industry in Latin America Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: Global IT Industry in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global IT Industry in Latin America Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 19: Global IT Industry in Latin America Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Global IT Industry in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global IT Industry in Latin America Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 25: Global IT Industry in Latin America Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global IT Industry in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 27: United Kingdom IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Germany IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: France IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Italy IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Spain IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Russia IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Benelux IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Nordics IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Rest of Europe IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Global IT Industry in Latin America Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 37: Global IT Industry in Latin America Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 38: Global IT Industry in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 39: Turkey IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Israel IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: GCC IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: North Africa IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: South Africa IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Middle East & Africa IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global IT Industry in Latin America Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 46: Global IT Industry in Latin America Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 47: Global IT Industry in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 48: China IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: India IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Korea IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: ASEAN IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Oceania IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific IT Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IT Industry in Latin America?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the IT Industry in Latin America?

Key companies in the market include Totvs SA, International Business Machines (IBM) Corporation, Abas ERP*List Not Exhaustive, Microsoft Corporation, iNet ERP, SAP, Odoo, Wrike Inc, Oracle Corporation.

3. What are the main segments of the IT Industry in Latin America?

The market segments include Enterprise Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of Enterprise Software and the Workplace Automation Industry in the Latin American Market; High Penetration of Manufacturing Companies in Mexico. Chile. and Peru May Propel the Market's Growth.

6. What are the notable trends driving market growth?

Growth of Enterprise Software and the Workplace Automation Industry in the Latin American Market.

7. Are there any restraints impacting market growth?

Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

JUN 2022 - Alphabet's Google announced plans to invest USD 1.2 billion in Latin America over the next five years to assist economic development and digital change in the area, where it has been operating since 2005.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IT Industry in Latin America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IT Industry in Latin America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IT Industry in Latin America?

To stay informed about further developments, trends, and reports in the IT Industry in Latin America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence