Key Insights

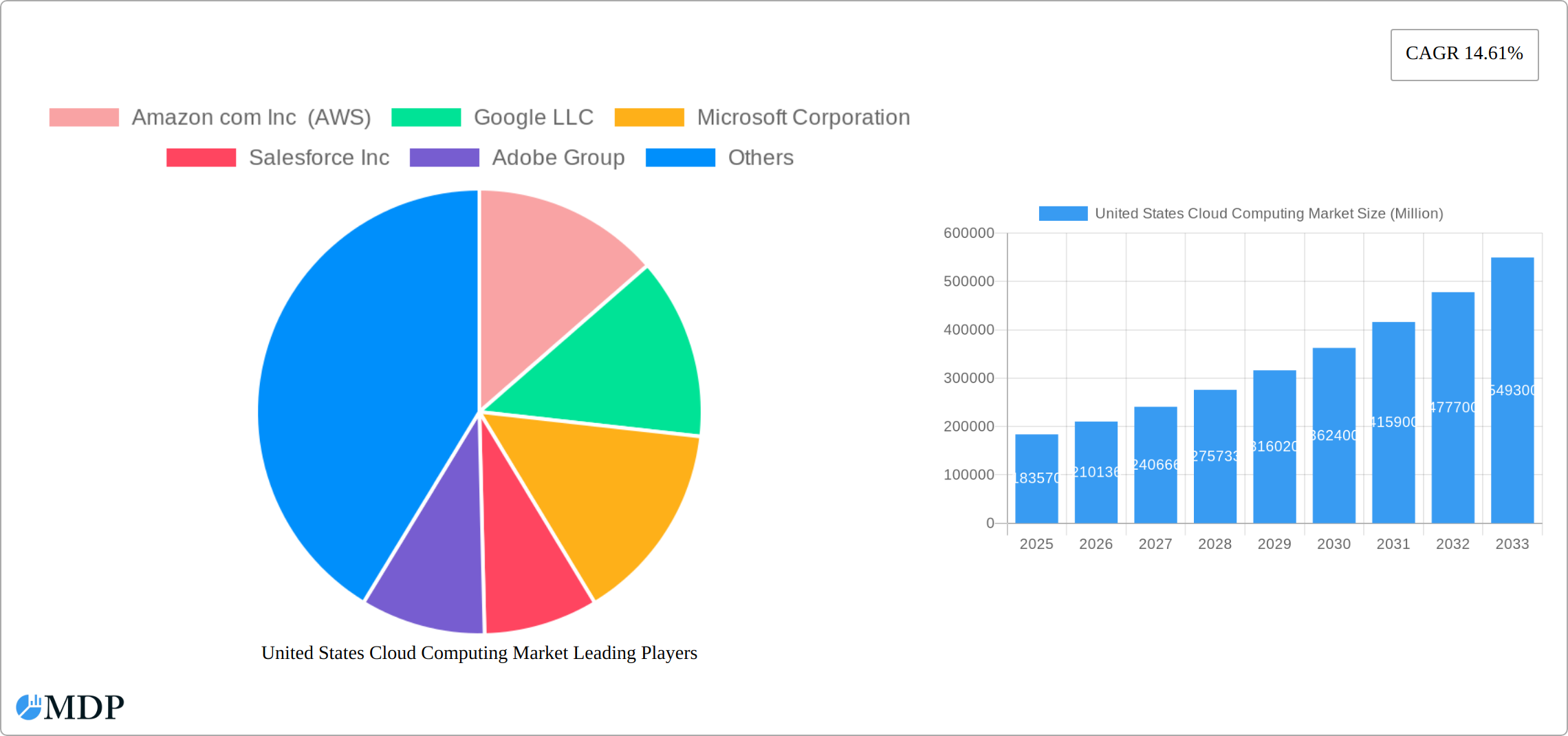

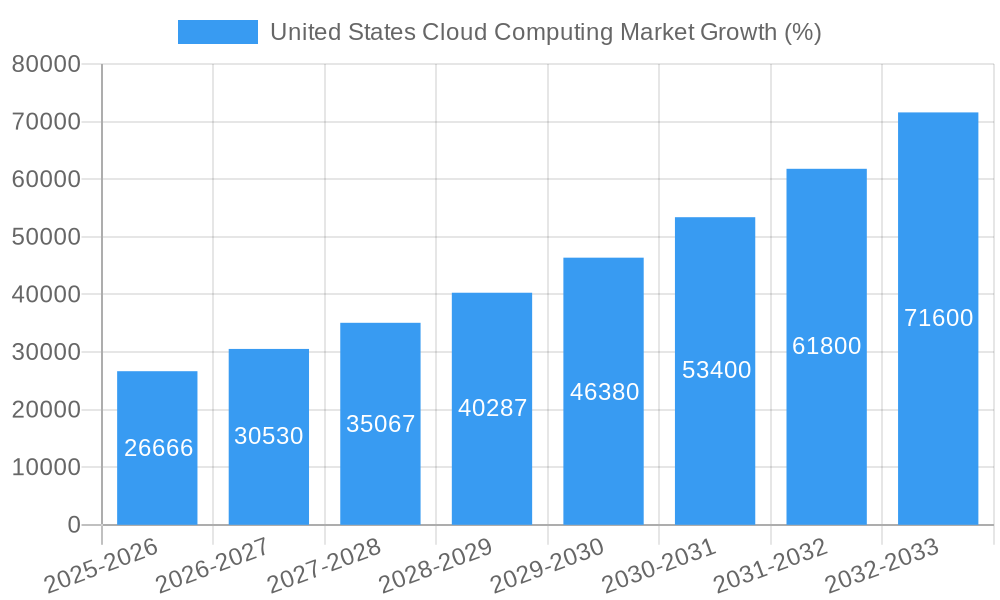

The United States cloud computing market is experiencing robust growth, projected to reach a substantial size, driven by several key factors. The market's Compound Annual Growth Rate (CAGR) of 14.61% from 2019 to 2033 indicates a significant expansion. This growth is fueled by increasing digital transformation initiatives across various industries, the rising adoption of cloud-based solutions for enhanced scalability and cost efficiency, and the growing demand for improved data security and disaster recovery capabilities. Businesses are increasingly migrating their applications and data to the cloud to leverage advanced analytics, AI/ML capabilities, and improved operational efficiency. The market is segmented by service model (IaaS, PaaS, SaaS), deployment model (public, private, hybrid), and industry vertical (BFSI, healthcare, retail, etc.). While precise segment breakdowns are unavailable, it's reasonable to assume that SaaS, leveraging its ease of access and subscription model, currently holds a significant market share, with IaaS and PaaS also demonstrating considerable growth.

Major players like Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), and Salesforce are actively competing to capture market share, leading to innovative service offerings and price optimizations. However, challenges remain including data security concerns, vendor lock-in risks, and the need for robust regulatory compliance frameworks. Despite these constraints, the market is expected to continue its upward trajectory, driven by the ongoing technological advancements and the increasing reliance on cloud computing for business operations across sectors. The forecast period of 2025-2033 anticipates continued strong growth, building upon the robust expansion observed in the historical period (2019-2024) and the established market size in 2025. This growth will likely be driven by sustained adoption within established industry verticals and expansion into new sectors.

United States Cloud Computing Market Report: 2019-2033

Dive into the comprehensive analysis of the booming United States Cloud Computing Market, projecting a value of XX Million by 2033. This in-depth report offers invaluable insights for investors, businesses, and stakeholders seeking to navigate this rapidly evolving landscape. Covering the period from 2019 to 2033, with a base year of 2025, this report provides a detailed overview of market dynamics, industry trends, leading players, and future opportunities. Maximize your understanding and gain a competitive edge with this essential market intelligence.

United States Cloud Computing Market Dynamics & Concentration

The United States cloud computing market exhibits a high degree of concentration, with a handful of major players, including Amazon com Inc (AWS), Google LLC, Microsoft Corporation, Salesforce Inc, Adobe Group, Oracle Corporation, IBM Corporation, DXC Group, SAS Institute Inc, and SAP S, holding significant market share. The market is driven by increasing digital transformation initiatives across industries, the growing adoption of Software as a Service (SaaS), Infrastructure as a Service (IaaS), and Platform as a Service (PaaS) models, and the expansion of 5G networks. Regulatory frameworks, such as data privacy regulations (e.g., CCPA, GDPR), influence market activities. The market also witnesses continuous innovation, with the emergence of serverless computing, edge computing, and AI-powered cloud solutions, pushing the boundaries of what's possible.

Product substitutes, such as on-premise data centers, are gradually losing relevance due to the cost-effectiveness and scalability offered by cloud solutions. Mergers and acquisitions (M&A) play a crucial role in shaping the market landscape, with an estimated XX M&A deals recorded between 2019 and 2024. The average market share of the top 5 players during this period was approximately XX%, indicating a consolidated market structure. End-user trends point towards an increasing preference for hybrid cloud models, combining public and private cloud solutions to optimize cost and security.

- Market Concentration: High, dominated by a few major players.

- Innovation Drivers: Serverless computing, edge computing, AI-powered solutions.

- Regulatory Frameworks: CCPA, GDPR, and other data privacy regulations.

- Product Substitutes: On-premise data centers (declining).

- End-User Trends: Growing adoption of hybrid cloud models.

- M&A Activity: Approximately XX deals between 2019-2024.

United States Cloud Computing Market Industry Trends & Analysis

The United States cloud computing market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of XX% projected from 2025 to 2033. This growth is fueled by several key factors, including the widespread adoption of cloud-based applications across various industries (e.g., healthcare, finance, retail), increasing government initiatives to promote digital transformation, and the growing need for scalable and flexible IT infrastructure. Technological disruptions, such as the rise of artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), are further accelerating market expansion. Consumer preferences are shifting towards cloud-based services due to their accessibility, convenience, and cost-effectiveness. Competitive dynamics are intense, with major players constantly innovating and expanding their service offerings to gain a competitive edge. Market penetration is expected to reach XX% by 2033, indicating significant growth potential. The market is witnessing significant investment in research and development, leading to the evolution of sophisticated cloud technologies. The increasing demand for data analytics and security solutions also significantly contributes to market expansion.

Leading Markets & Segments in United States Cloud Computing Market

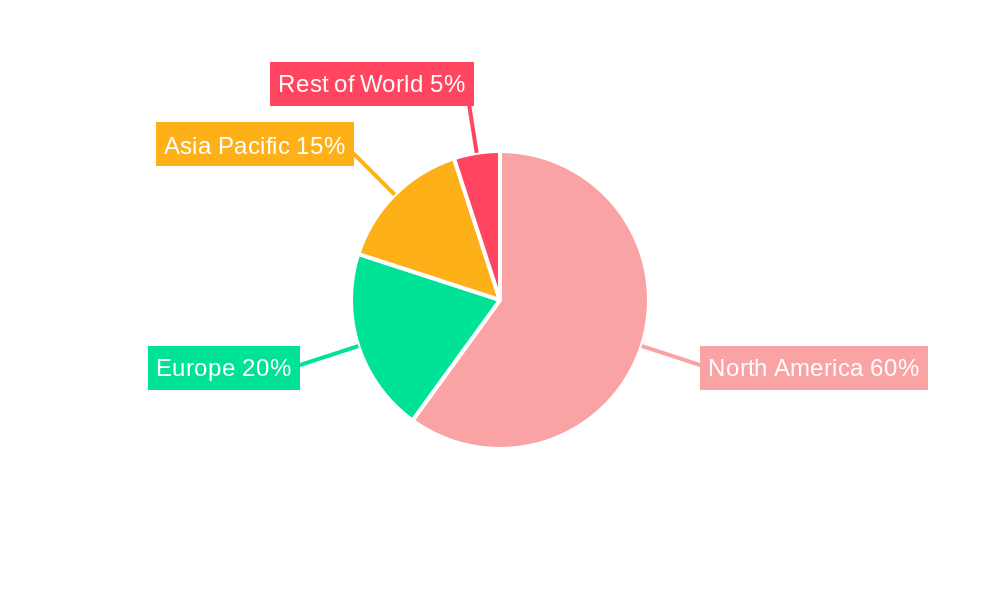

The United States cloud computing market is segmented by service model (IaaS, PaaS, SaaS), deployment model (public, private, hybrid), and industry vertical. While precise regional dominance data is not available, the analysis suggests that the largest market segments are likely to be those focused on IaaS and SaaS, driven by high demand for scalable infrastructure and readily-available software applications across diverse sectors. California, New York, and Texas are likely leading states in cloud computing adoption due to high concentrations of tech companies and strong infrastructure.

- Key Drivers of Dominance:

- Strong Technological Infrastructure: Extensive high-speed internet connectivity and advanced data centers.

- High Concentration of Tech Companies: A large pool of skilled labor and technology expertise.

- Government Initiatives: Government support for digital transformation initiatives.

- Favorable Economic Climate: Robust economic growth and high levels of investment in technology.

Detailed Dominance Analysis: The specific region and segment dominance will be detailed within the full report. This will include a detailed breakdown of market size, growth rates, and key drivers for each segment and region.

United States Cloud Computing Market Product Developments

Recent product developments focus on enhancing security, scalability, and AI/ML integration within cloud platforms. Innovations include advancements in serverless computing, edge computing, and the development of more sophisticated AI/ML-powered tools and services. These advancements provide improved performance, efficiency, and cost optimization for users. The competitive advantage lies in providing robust security features, ease of use, and seamless integration with other IT systems. Companies are focusing on offering customized solutions tailored to specific industry needs.

Key Drivers of United States Cloud Computing Market Growth

Several factors are driving the growth of the United States cloud computing market. Technological advancements, including the development of AI and machine learning capabilities, are enabling businesses to leverage data-driven insights and improve decision-making. The increasing need for scalability and flexibility in IT infrastructure, coupled with the cost-effectiveness of cloud services, is also driving market growth. Government initiatives supporting digital transformation and favorable regulatory frameworks further bolster market expansion.

Challenges in the United States Cloud Computing Market Market

The market faces several challenges, including concerns about data security and privacy, the complexity of migrating to the cloud, and the high costs associated with implementation and maintenance. Regulatory hurdles, such as compliance with data privacy regulations (e.g., CCPA, GDPR), add complexity and increase costs. Supply chain disruptions can impact the availability of hardware and software components, affecting the overall market. Intense competition amongst major players also creates challenges for smaller companies. These challenges represent a potential constraint on the overall market growth rate, projected to be approximately XX% annually during the forecast period.

Emerging Opportunities in United States Cloud Computing Market

The United States cloud computing market presents several significant long-term growth opportunities. The rise of edge computing, serverless computing, and AI-powered cloud solutions creates new avenues for innovation and market expansion. Strategic partnerships between cloud providers and other technology companies will drive the development of integrated solutions tailored to specific industry needs. Increased adoption of cloud services in underpenetrated industries and expansion into new geographic areas also present lucrative opportunities. The overall market outlook remains positive, driven by the continuous advancements in cloud technology and the increasing demand for digital services.

Leading Players in the United States Cloud Computing Market Sector

- Amazon com Inc (AWS)

- Google LLC

- Microsoft Corporation

- Salesforce Inc

- Adobe Group

- Oracle Corporation

- IBM Corporation

- DXC Group

- SAS Institute Inc

- SAP S

Key Milestones in United States Cloud Computing Market Industry

- March 2024: Cognizant and Google Cloud announced an expanded partnership to improve software development lifecycles and developer productivity using Google Cloud's Gemini. This partnership significantly impacts market dynamics by accelerating the adoption of AI-powered development tools.

- April 2024: Broadcom Inc. and Google Cloud partnered to optimize Broadcom's VMware workloads for Google Cloud, enhancing interoperability and expanding the Google Cloud Marketplace offerings. This collaboration strengthens Google Cloud's position in the enterprise market.

Strategic Outlook for United States Cloud Computing Market Market

The future of the United States cloud computing market is bright, with significant growth potential driven by continuous technological innovation, increasing digital transformation across industries, and favorable regulatory environments. Strategic opportunities include focusing on niche market segments, developing innovative cloud-based solutions, and forging strategic partnerships to expand market reach. Companies that embrace agility, adaptability, and a customer-centric approach are best positioned to capitalize on the market's growth potential. The market is expected to continue its strong growth trajectory over the forecast period, driven by ongoing digital transformation and the emergence of new cloud technologies.

United States Cloud Computing Market Segmentation

-

1. Type

-

1.1. Public Cloud

- 1.1.1. IaaS

- 1.1.2. PaaS

- 1.1.3. SaaS

- 1.2. Private Cloud

- 1.3. Hybrid Cloud

-

1.1. Public Cloud

-

2. Organization Size

- 2.1. SMEs

- 2.2. Large Enterprises

-

3. End-user Verticals

- 3.1. Manufacturing

- 3.2. Education

- 3.3. Retail

- 3.4. Transportation and Logistics

- 3.5. Healthcare

- 3.6. BFSI

- 3.7. Telecom and IT

- 3.8. Government and Public Sector

- 3.9. Other En

United States Cloud Computing Market Segmentation By Geography

- 1. United States

United States Cloud Computing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Shift Toward Digital Transformation Across the United States; Advancement of AI and Big Data Analytics

- 3.3. Market Restrains

- 3.3.1. Robust Shift Toward Digital Transformation Across the United States; Advancement of AI and Big Data Analytics

- 3.4. Market Trends

- 3.4.1. Robust Shift Toward Digital Transformation Across North America

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Cloud Computing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Public Cloud

- 5.1.1.1. IaaS

- 5.1.1.2. PaaS

- 5.1.1.3. SaaS

- 5.1.2. Private Cloud

- 5.1.3. Hybrid Cloud

- 5.1.1. Public Cloud

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. SMEs

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.3.1. Manufacturing

- 5.3.2. Education

- 5.3.3. Retail

- 5.3.4. Transportation and Logistics

- 5.3.5. Healthcare

- 5.3.6. BFSI

- 5.3.7. Telecom and IT

- 5.3.8. Government and Public Sector

- 5.3.9. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Amazon com Inc (AWS)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Google LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Microsoft Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Salesforce Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Adobe Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oracle Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IBM Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DXC Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SAS Institute Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SAP S

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amazon com Inc (AWS)

List of Figures

- Figure 1: United States Cloud Computing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Cloud Computing Market Share (%) by Company 2024

List of Tables

- Table 1: United States Cloud Computing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Cloud Computing Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United States Cloud Computing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: United States Cloud Computing Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: United States Cloud Computing Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 6: United States Cloud Computing Market Volume Billion Forecast, by Organization Size 2019 & 2032

- Table 7: United States Cloud Computing Market Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 8: United States Cloud Computing Market Volume Billion Forecast, by End-user Verticals 2019 & 2032

- Table 9: United States Cloud Computing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United States Cloud Computing Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: United States Cloud Computing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: United States Cloud Computing Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: United States Cloud Computing Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 14: United States Cloud Computing Market Volume Billion Forecast, by Organization Size 2019 & 2032

- Table 15: United States Cloud Computing Market Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 16: United States Cloud Computing Market Volume Billion Forecast, by End-user Verticals 2019 & 2032

- Table 17: United States Cloud Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Cloud Computing Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Cloud Computing Market?

The projected CAGR is approximately 14.61%.

2. Which companies are prominent players in the United States Cloud Computing Market?

Key companies in the market include Amazon com Inc (AWS), Google LLC, Microsoft Corporation, Salesforce Inc, Adobe Group, Oracle Corporation, IBM Corporation, DXC Group, SAS Institute Inc, SAP S.

3. What are the main segments of the United States Cloud Computing Market?

The market segments include Type, Organization Size, End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 183.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Shift Toward Digital Transformation Across the United States; Advancement of AI and Big Data Analytics.

6. What are the notable trends driving market growth?

Robust Shift Toward Digital Transformation Across North America.

7. Are there any restraints impacting market growth?

Robust Shift Toward Digital Transformation Across the United States; Advancement of AI and Big Data Analytics.

8. Can you provide examples of recent developments in the market?

March 2024: Cognizant and Google Cloud unveiled an expanded partnership aimed at streamlining the software delivery lifecycle and boosting developer productivity. Cognizant is set to leverage Gemini for Google Cloud in two primary ways. Firstly, Cognizant will train its associates to utilize Gemini for software development support. Secondly, the company will embed Gemini's sophisticated features into its internal operations and platforms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Cloud Computing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Cloud Computing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Cloud Computing Market?

To stay informed about further developments, trends, and reports in the United States Cloud Computing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence