Key Insights

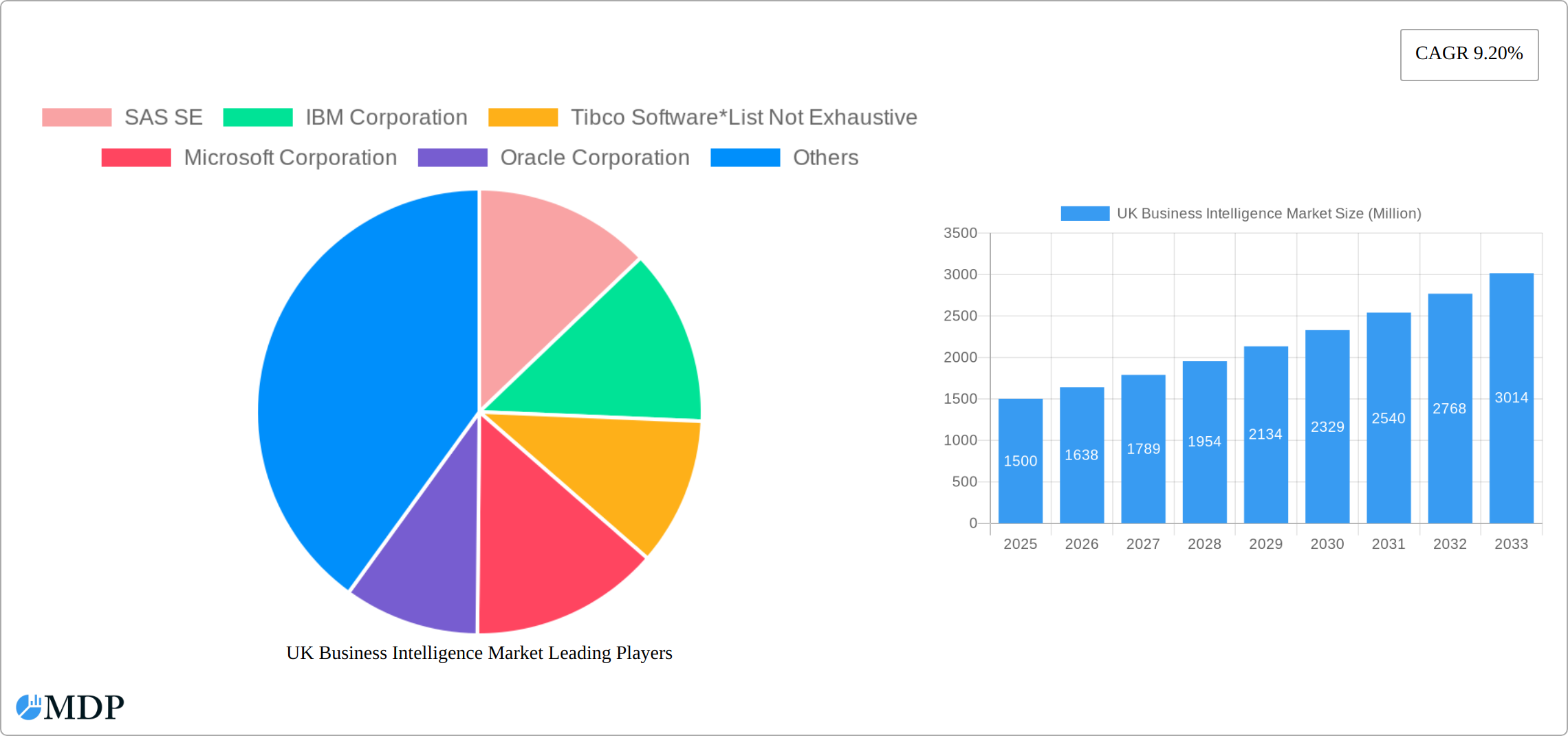

The UK Business Intelligence (BI) market is experiencing robust growth, driven by increasing data volumes, the need for data-driven decision-making across diverse sectors, and the rising adoption of cloud-based BI solutions. The market's Compound Annual Growth Rate (CAGR) of 9.20% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by several key factors. The BFSI (Banking, Financial Services, and Insurance) sector, along with IT & Telecom, are major contributors, demanding sophisticated BI tools for risk management, fraud detection, and customer relationship management. Furthermore, the retail and consumer goods sectors are increasingly leveraging BI for targeted marketing campaigns and supply chain optimization. The growing preference for cloud-based solutions offers scalability, cost-effectiveness, and ease of access, further accelerating market expansion. Large-scale organizations are driving the market's growth due to their higher budgets and more complex data analysis needs. However, the market faces challenges such as data security concerns, the need for skilled professionals to interpret complex data, and the initial investment costs associated with implementing BI systems. Despite these challenges, the projected continued growth highlights the enduring demand for effective data analysis and strategic decision-making in the UK business landscape. The market is expected to show strong performance in the forecast period (2025-2033), propelled by the ongoing digital transformation and the increasing adoption of advanced analytics techniques.

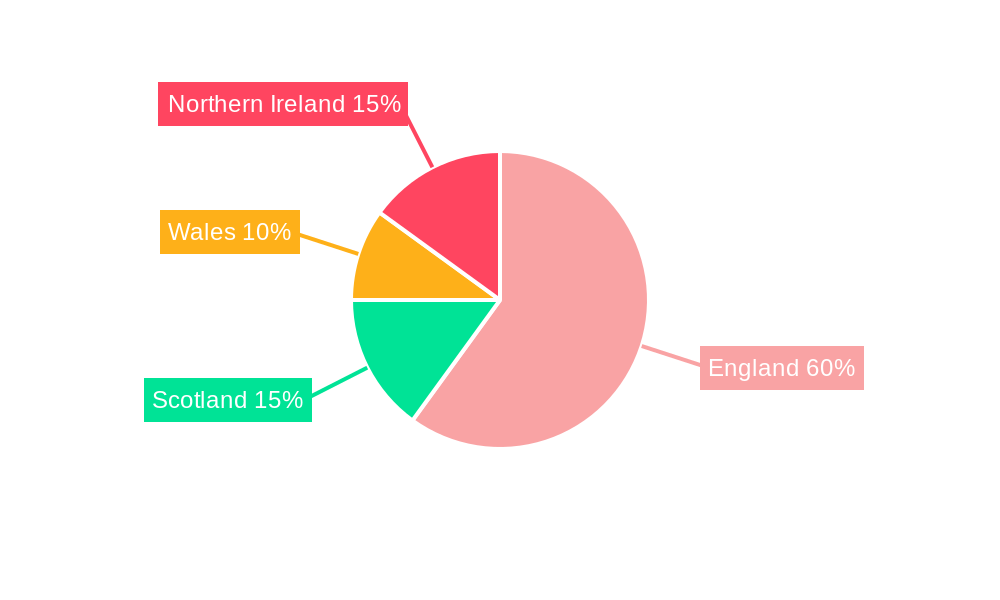

The competitive landscape is dominated by established players such as SAS, IBM, Tibco, Microsoft, Oracle, Tableau, and SAP, each offering a comprehensive suite of BI tools and services. However, the market also presents opportunities for smaller, specialized firms that can cater to niche industry needs or offer innovative solutions. The UK market's regional segmentation reflects the varying levels of digital maturity and technological adoption across England, Wales, Scotland, and Northern Ireland, with London and other major metropolitan areas likely showing faster growth. Future growth will hinge on factors such as technological advancements (e.g., artificial intelligence and machine learning integration in BI), government initiatives promoting data-driven decision-making, and the ability of BI vendors to address data security and privacy concerns effectively. The continued expansion of the UK's digital economy will serve as a significant catalyst for future growth in the BI market.

Unlock Growth Potential: A Deep Dive into the UK Business Intelligence Market (2019-2033)

This comprehensive report provides a detailed analysis of the UK Business Intelligence (BI) market, offering invaluable insights for businesses, investors, and stakeholders seeking to navigate this dynamic landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of current market conditions and future growth trajectories. The UK BI market is projected to reach £xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%.

UK Business Intelligence Market Market Dynamics & Concentration

The UK Business Intelligence market is characterized by a moderate level of concentration, with several major players holding significant market share. However, the market also exhibits a vibrant ecosystem of smaller, specialized firms and innovative startups. Market share is constantly shifting due to mergers and acquisitions (M&A), technological advancements, and evolving customer demands. In 2024, the top five companies held an estimated xx% of the market share. The number of M&A deals in the sector averaged xx per year between 2019 and 2024.

- Innovation Drivers: The increasing adoption of cloud-based BI solutions, the rise of big data analytics, and the growing need for real-time data insights are key innovation drivers.

- Regulatory Frameworks: Data privacy regulations such as GDPR significantly influence market dynamics, driving demand for compliant BI solutions.

- Product Substitutes: While BI solutions are largely unique in their capabilities, organizations may sometimes substitute them with simpler reporting tools or spreadsheets, impacting market penetration.

- End-User Trends: A growing preference for self-service BI tools and the increasing demand for predictive analytics are shaping the market.

- M&A Activity: Consolidation in the market is expected to continue, driven by the need for enhanced capabilities and broader market reach.

UK Business Intelligence Market Industry Trends & Analysis

The UK Business Intelligence (BI) market is experiencing a period of accelerated growth and transformation. This surge is largely propelled by the pervasive digitalization initiatives across a multitude of industries, coupled with the widespread adoption of scalable cloud computing infrastructures. The increasing sophistication of businesses in leveraging advanced analytics, including predictive and prescriptive analytics, is also a significant catalyst. While the BFSI (Banking, Financial Services, and Insurance) and IT & Telecom sectors continue to lead in BI adoption, other verticals are rapidly catching up, driven by the tangible benefits of data-driven strategies. For the projected forecast period (2025-2033), the Compound Annual Growth Rate (CAGR) is anticipated to be robust, estimated at **[Insert Specific CAGR Here]%**. This expansion will be further fueled by the deep integration of Artificial Intelligence (AI) and Machine Learning (ML) into BI platforms, leading to more intelligent insights and automated processes. Advancements in data visualization techniques are making complex data more understandable and actionable for a wider audience. The fundamental need for data-informed decision-making, from C-suite executives to frontline employees, is a constant and growing imperative. Furthermore, the competitive landscape among BI vendors is intensifying, resulting in more accessible, cost-effective, and user-friendly solutions for businesses of all sizes.

Leading Markets & Segments in UK Business Intelligence Market

The UK Business Intelligence market displays significant growth potential across various segments.

By Organization Size:

- Large-Scale Enterprises: This segment dominates the market due to higher budgets and greater need for advanced analytics. Key drivers include investments in digital transformation and a focus on data-driven decision-making.

- Small & Medium-Scale Enterprises (SMEs): This segment is witnessing strong growth, driven by the availability of cost-effective cloud-based solutions and the increasing awareness of the benefits of BI. Challenges remain in terms of technological expertise and budget constraints.

By End-user Vertical:

- BFSI (Banking, Financial Services, and Insurance): This sector is a key driver of market growth, with a high demand for risk management, fraud detection, and customer analytics solutions.

- IT & Telecom: This sector exhibits a high adoption rate of BI tools, leveraging them for network optimization, customer relationship management, and operational efficiency.

- Retail & Consumer Goods: Retailers and consumer goods companies leverage BI for inventory management, customer segmentation, and targeted marketing.

- Manufacturing & Logistics: BI solutions help optimize supply chain management, predictive maintenance, and quality control in the manufacturing sector.

- Public Services: Government bodies and public sector organizations are increasingly adopting BI for improved service delivery, resource allocation, and citizen engagement.

- Other End-user Verticals: Other sectors such as healthcare, education, and energy are also showing increased adoption rates, further boosting market growth.

UK Business Intelligence Market Product Developments

Recent product developments in the UK BI market are characterized by a strong emphasis on innovation and user empowerment. A dominant trend is the proliferation of cloud-native BI solutions, offering enhanced scalability, flexibility, and reduced infrastructure overheads. Embedded analytics is another significant area of advancement, allowing BI capabilities to be seamlessly integrated within existing business applications, providing context-specific insights where users need them most. The integration of AI and Machine Learning is no longer a futuristic concept but a present reality, enabling sophisticated pattern recognition, anomaly detection, and predictive forecasting. This move towards augmented analytics significantly boosts ease of use, democratizes access to powerful analytical tools, and unlocks deeper, more nuanced insights. The market is witnessing a decisive shift towards self-service BI platforms. These user-friendly tools empower business users, regardless of their technical background, to independently access, explore, and analyze data, thereby fostering a culture of data literacy and accelerating decision-making cycles across diverse organizational functions.

Key Drivers of UK Business Intelligence Market Growth

The UK Business Intelligence market's upward trajectory is underpinned by a confluence of powerful factors:

- Technological Advancements: The relentless evolution of AI, ML, and cloud computing technologies is continuously enhancing the power, intelligence, and accessibility of BI solutions. These advancements enable more sophisticated analytics, automation, and real-time insights, driving adoption and maximizing value.

- Economic Resilience and Investment: A generally stable and growing UK economy encourages businesses to invest in strategic technologies like BI. The recognized value of data-driven decision-making in optimizing operations, identifying new opportunities, and mitigating risks fuels this investment.

- Evolving Regulatory Landscape: While data privacy regulations such as GDPR present compliance challenges, they simultaneously act as a significant driver for the development and adoption of robust, secure, and compliant BI solutions. This fosters innovation in data governance and ethical data usage.

- Competitive Pressures and Digital Transformation: Businesses are under increasing pressure to remain competitive in a rapidly evolving digital landscape. BI solutions are crucial for understanding customer behavior, optimizing marketing efforts, streamlining operations, and identifying new market trends, making them an essential component of digital transformation strategies.

Challenges in the UK Business Intelligence Market Market

Despite the positive outlook, challenges exist:

- Data Security and Privacy Concerns: Strict regulations and the sensitive nature of business data pose a significant challenge for BI adoption.

- Integration Complexity: Integrating BI solutions with existing systems can be complex and costly, hindering adoption in some organizations.

- Skills Gap: A shortage of skilled professionals capable of implementing and managing BI solutions may restrain growth. This can be overcome with increased training and education.

Emerging Opportunities in UK Business Intelligence Market

Significant opportunities for growth include:

- Expansion into Emerging Verticals: Sectors such as healthcare and education present untapped potential for BI adoption.

- Development of Specialized Solutions: Tailored BI solutions for specific industry needs can create new market segments and enhance competitive advantage.

- Strategic Partnerships: Collaboration between BI vendors and technology providers can accelerate innovation and expand market reach.

Leading Players in the UK Business Intelligence Market Sector

- SAS SE

- IBM Corporation

- Tibco Software

- Microsoft Corporation

- Oracle Corporation

- Tableau Software

- SAP SE

Key Milestones in UK Business Intelligence Market Industry

- December 2022: Snowflake's expanded availability on Microsoft Azure in the UK marked a significant development. This move substantially broadened its reach and accessibility, providing a powerful cloud-based data warehousing and analytics solution for UK businesses. It directly addresses the growing demand for localized data residency and enhances multi-cloud adoption strategies for BI initiatives across both commercial and public sectors.

- August 2022: Pyramid Analytics' strategic establishment of a dedicated UK Public Sector Practice highlighted the increasing recognition of BI's transformative potential within government operations. This initiative underscores the growing adoption of advanced analytics to improve efficiency, enhance service delivery, and drive data-informed policy-making within public sector organizations.

- [Insert Recent Milestone Here - e.g., Q1 2024]: [Briefly describe a recent significant event, such as a major vendor acquisition, a new product launch with significant market impact, or a key partnership that reshaped a segment of the market.]

Strategic Outlook for UK Business Intelligence Market Market

The outlook for the UK Business Intelligence market remains exceptionally positive, projecting sustained and dynamic expansion. This growth will be propelled by the ongoing wave of technological innovation, the increasing availability and accessibility of diverse data sources, and an ever-growing organizational imperative for data-driven insights to inform strategic and operational decisions. Key strategic opportunities lie in the development and deployment of BI solutions tailored to address specific challenges faced by individual industries, such as optimizing supply chains in retail or enhancing patient outcomes in healthcare. The continued leveraging of AI and ML to automate complex analytical tasks and predict future trends will be paramount. Furthermore, there will be a strategic focus on expanding BI solutions into emerging market segments and catering to the needs of Small and Medium-sized Enterprises (SMEs) who are increasingly recognizing the value of data analytics. Organizations that demonstrate agility in adapting to evolving customer expectations, embrace cutting-edge technologies, and make strategic investments in robust BI capabilities are best positioned to not only thrive but also lead in this highly competitive and rapidly evolving market.

UK Business Intelligence Market Segmentation

-

1. Organization Size

- 1.1. Small & Medium-Scale

- 1.2. Large-Scale

-

2. End-user Vertical

- 2.1. BFSI

- 2.2. IT & Telecom

- 2.3. Retail & Consumer Goods

- 2.4. Manufacturing & Logistics

- 2.5. Public Services

- 2.6. Other End-user verticals

UK Business Intelligence Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Business Intelligence Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing adoption of IoT-enabled technologies and Advanced Analytics tools in the UK; Migration to the cloud has enabled SME's to leverage data to support their decision-making process

- 3.3. Market Restrains

- 3.3.1. ; Lack of Mandatory Regulations for Information Security

- 3.4. Market Trends

- 3.4.1. Growing adoption of IoT-enabled technologies and Advanced Analytics tools in the UK

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Business Intelligence Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. Small & Medium-Scale

- 5.1.2. Large-Scale

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. BFSI

- 5.2.2. IT & Telecom

- 5.2.3. Retail & Consumer Goods

- 5.2.4. Manufacturing & Logistics

- 5.2.5. Public Services

- 5.2.6. Other End-user verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. North America UK Business Intelligence Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Organization Size

- 6.1.1. Small & Medium-Scale

- 6.1.2. Large-Scale

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. BFSI

- 6.2.2. IT & Telecom

- 6.2.3. Retail & Consumer Goods

- 6.2.4. Manufacturing & Logistics

- 6.2.5. Public Services

- 6.2.6. Other End-user verticals

- 6.1. Market Analysis, Insights and Forecast - by Organization Size

- 7. South America UK Business Intelligence Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Organization Size

- 7.1.1. Small & Medium-Scale

- 7.1.2. Large-Scale

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. BFSI

- 7.2.2. IT & Telecom

- 7.2.3. Retail & Consumer Goods

- 7.2.4. Manufacturing & Logistics

- 7.2.5. Public Services

- 7.2.6. Other End-user verticals

- 7.1. Market Analysis, Insights and Forecast - by Organization Size

- 8. Europe UK Business Intelligence Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Organization Size

- 8.1.1. Small & Medium-Scale

- 8.1.2. Large-Scale

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. BFSI

- 8.2.2. IT & Telecom

- 8.2.3. Retail & Consumer Goods

- 8.2.4. Manufacturing & Logistics

- 8.2.5. Public Services

- 8.2.6. Other End-user verticals

- 8.1. Market Analysis, Insights and Forecast - by Organization Size

- 9. Middle East & Africa UK Business Intelligence Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Organization Size

- 9.1.1. Small & Medium-Scale

- 9.1.2. Large-Scale

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. BFSI

- 9.2.2. IT & Telecom

- 9.2.3. Retail & Consumer Goods

- 9.2.4. Manufacturing & Logistics

- 9.2.5. Public Services

- 9.2.6. Other End-user verticals

- 9.1. Market Analysis, Insights and Forecast - by Organization Size

- 10. Asia Pacific UK Business Intelligence Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Organization Size

- 10.1.1. Small & Medium-Scale

- 10.1.2. Large-Scale

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. BFSI

- 10.2.2. IT & Telecom

- 10.2.3. Retail & Consumer Goods

- 10.2.4. Manufacturing & Logistics

- 10.2.5. Public Services

- 10.2.6. Other End-user verticals

- 10.1. Market Analysis, Insights and Forecast - by Organization Size

- 11. England UK Business Intelligence Market Analysis, Insights and Forecast, 2019-2031

- 12. Wales UK Business Intelligence Market Analysis, Insights and Forecast, 2019-2031

- 13. Scotland UK Business Intelligence Market Analysis, Insights and Forecast, 2019-2031

- 14. Northern UK Business Intelligence Market Analysis, Insights and Forecast, 2019-2031

- 15. Ireland UK Business Intelligence Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 SAS SE

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 IBM Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Tibco Software*List Not Exhaustive

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Microsoft Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Oracle Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Tableau Software

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 SAP SE

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.1 SAS SE

List of Figures

- Figure 1: Global UK Business Intelligence Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United kingdom Region UK Business Intelligence Market Revenue (Million), by Country 2024 & 2032

- Figure 3: United kingdom Region UK Business Intelligence Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UK Business Intelligence Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 5: North America UK Business Intelligence Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 6: North America UK Business Intelligence Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 7: North America UK Business Intelligence Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 8: North America UK Business Intelligence Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America UK Business Intelligence Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America UK Business Intelligence Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 11: South America UK Business Intelligence Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 12: South America UK Business Intelligence Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 13: South America UK Business Intelligence Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 14: South America UK Business Intelligence Market Revenue (Million), by Country 2024 & 2032

- Figure 15: South America UK Business Intelligence Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe UK Business Intelligence Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 17: Europe UK Business Intelligence Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 18: Europe UK Business Intelligence Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 19: Europe UK Business Intelligence Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 20: Europe UK Business Intelligence Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe UK Business Intelligence Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa UK Business Intelligence Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 23: Middle East & Africa UK Business Intelligence Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 24: Middle East & Africa UK Business Intelligence Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 25: Middle East & Africa UK Business Intelligence Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 26: Middle East & Africa UK Business Intelligence Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa UK Business Intelligence Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific UK Business Intelligence Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 29: Asia Pacific UK Business Intelligence Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 30: Asia Pacific UK Business Intelligence Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 31: Asia Pacific UK Business Intelligence Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 32: Asia Pacific UK Business Intelligence Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific UK Business Intelligence Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UK Business Intelligence Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UK Business Intelligence Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 3: Global UK Business Intelligence Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Global UK Business Intelligence Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global UK Business Intelligence Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: England UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Wales UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Scotland UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Ireland UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global UK Business Intelligence Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 12: Global UK Business Intelligence Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 13: Global UK Business Intelligence Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global UK Business Intelligence Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 18: Global UK Business Intelligence Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 19: Global UK Business Intelligence Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Argentina UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global UK Business Intelligence Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 24: Global UK Business Intelligence Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 25: Global UK Business Intelligence Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Kingdom UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Germany UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Russia UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Benelux UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Nordics UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global UK Business Intelligence Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 36: Global UK Business Intelligence Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 37: Global UK Business Intelligence Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global UK Business Intelligence Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 45: Global UK Business Intelligence Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 46: Global UK Business Intelligence Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific UK Business Intelligence Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Business Intelligence Market?

The projected CAGR is approximately 9.20%.

2. Which companies are prominent players in the UK Business Intelligence Market?

Key companies in the market include SAS SE, IBM Corporation, Tibco Software*List Not Exhaustive, Microsoft Corporation, Oracle Corporation, Tableau Software, SAP SE.

3. What are the main segments of the UK Business Intelligence Market?

The market segments include Organization Size, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing adoption of IoT-enabled technologies and Advanced Analytics tools in the UK; Migration to the cloud has enabled SME's to leverage data to support their decision-making process.

6. What are the notable trends driving market growth?

Growing adoption of IoT-enabled technologies and Advanced Analytics tools in the UK.

7. Are there any restraints impacting market growth?

; Lack of Mandatory Regulations for Information Security.

8. Can you provide examples of recent developments in the market?

December 2022: Snowflake, a data cloud startup, has announced Snowflake's wide availability on Microsoft Azure in the United Kingdom, owing to increasing customer demand for local data residency in both the commercial and public sectors in the United Kingdom. Snowflake enables organizations in various industries to deploy data and analytical workloads to meet their mission-critical requirements. With actual multi-cloud availability across three major public clouds, businesses may deploy Snowflake's unique data capabilities for workloads, including region-to-region and cross-cloud data replication, across their preferred cloud service providers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Business Intelligence Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Business Intelligence Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Business Intelligence Market?

To stay informed about further developments, trends, and reports in the UK Business Intelligence Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence