Key Insights

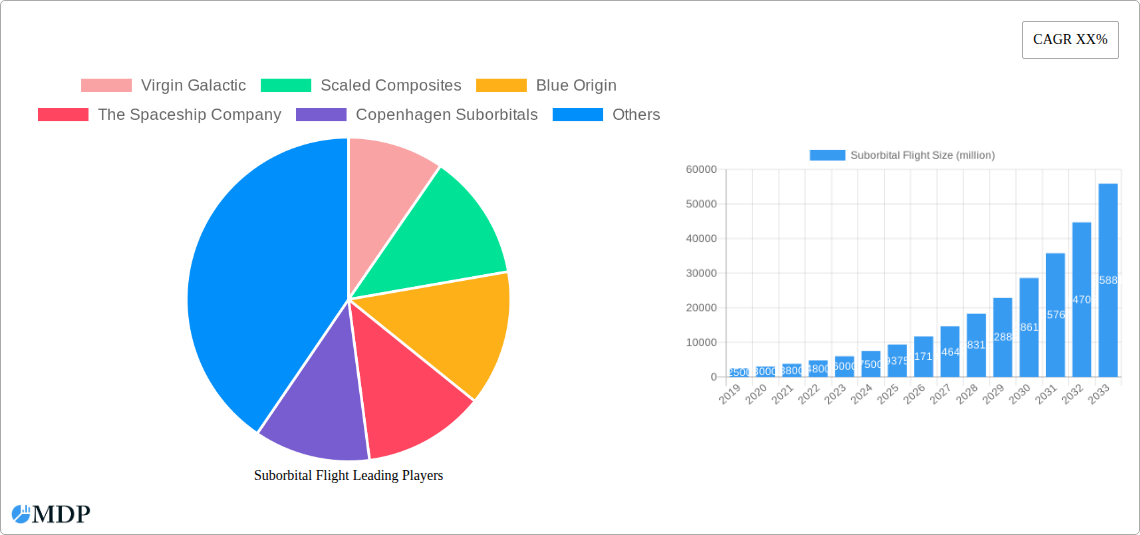

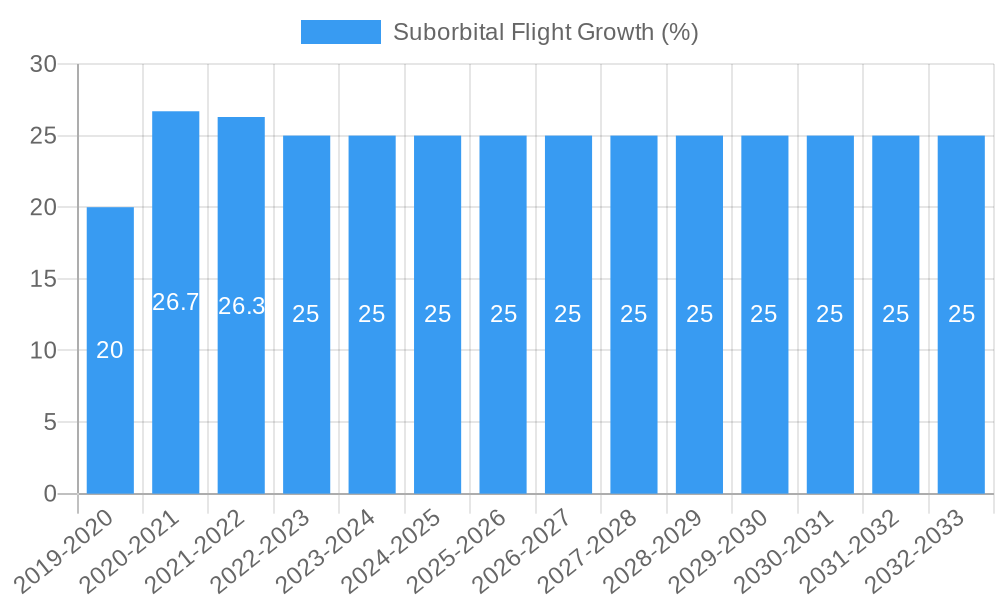

The suborbital flight market is poised for significant expansion, projected to reach a substantial market size of approximately USD 15,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 25% anticipated through 2033. This remarkable growth is primarily propelled by surging demand for unique and accessible space tourism experiences, coupled with increasing investments from private entities and a growing interest from government agencies for research and development purposes. Key drivers include technological advancements in reusable rocket technology, leading to reduced operational costs and increased flight frequency. Furthermore, the burgeoning middle class in emerging economies, particularly in the Asia Pacific region, signifies a new demographic poised to participate in these once-exclusive experiences. The market is segmenting rapidly, with "Business" applications gaining traction for corporate retreats and employee incentives, alongside the established "Government" sector for scientific payloads and testing. The "Six People" and "Eight People" capacity vehicles are expected to dominate as companies focus on economies of scale and broader accessibility.

Despite the optimistic outlook, the suborbital flight market faces certain restraints. High initial capital investment for spacecraft development and launch infrastructure remains a significant barrier to entry for smaller players. Stringent regulatory frameworks surrounding space travel, while essential for safety, can also introduce delays and compliance costs. Public perception and safety concerns, though diminishing with successful missions, continue to be a factor. Geopolitical uncertainties and global economic downturns could also temporarily impact discretionary spending on luxury space experiences. However, the ongoing innovation by leading companies like Virgin Galactic and Blue Origin, focused on enhancing safety, reducing costs, and expanding flight capabilities, is expected to mitigate these challenges. Emerging trends such as the development of specialized scientific payloads for suborbital platforms and the potential integration of suborbital flights into broader aerospace tourism packages will further shape the market landscape. The focus on sustainability in space operations is also likely to influence future technological developments and investment strategies.

This comprehensive report offers an in-depth analysis of the suborbital flight market, a rapidly evolving sector poised for significant expansion. The market exhibits a moderate concentration, with key players like Virgin Galactic, Blue Origin, and Scaled Composites holding substantial market share. Innovation drivers are primarily centered on advancements in propulsion systems, reusable vehicle technology, and enhanced passenger safety features. The regulatory framework is still maturing, with ongoing efforts by international aviation authorities to establish clear guidelines for suborbital tourism and research flights. Product substitutes are currently limited, with high-altitude balloons and conventional aircraft offering alternative but distinct experiences. End-user trends indicate a growing demand for unique adventure tourism, scientific research opportunities, and rapid point-to-point transportation. Mergers and acquisitions (M&A) activities are beginning to shape the landscape, with an estimated xx deal counts during the historical period (2019-2024), reflecting consolidation and strategic partnerships aimed at accelerating market penetration and technological development. The market share distribution is dynamic, with Virgin Galactic and Blue Origin leading in terms of announced missions and passenger capacity, while companies like The Spaceship Company contribute significantly through their proprietary technology development. Copenhagen Suborbitals and PD AeroSpace represent niche players focusing on research and development, and World View targets a unique segment of stratospheric exploration.

Suborbital Flight Industry Trends & Analysis (Approx. 600 words)

The suborbital flight industry is experiencing robust growth, projected to reach a market size of $xx billion by 2033, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This upward trajectory is fueled by a confluence of factors, including rapid technological advancements, increasing consumer appetite for novel experiences, and a growing recognition of suborbital flight's potential for scientific research and business applications. Technological disruptions are at the forefront, with continuous improvements in reusable rocket technology, advanced materials, and autonomous flight systems significantly reducing operational costs and enhancing mission reliability. The development of more efficient and sustainable propulsion systems is a key focus, promising to further democratize access to space. Consumer preferences are increasingly shifting towards experiential travel, with suborbital flights offering a unique blend of adventure, breathtaking views of Earth, and the thrill of experiencing microgravity. This demand is being met by operators offering varying capacities, from one person private excursions to six people and eight people group experiences, catering to a diverse clientele. The competitive dynamics are intensifying as new entrants emerge and established aerospace giants invest heavily in suborbital capabilities. Market penetration is currently in its nascent stages for commercial tourism, with significant scope for expansion as infrastructure develops and operational costs decrease. The industry is moving beyond purely space tourism to encompass a broader range of applications, including microgravity research for pharmaceuticals, materials science, and biotechnology, as well as potential for ultra-fast terrestrial transportation in the long term. The foundational technologies developed for suborbital flight are also paving the way for more ambitious orbital and deep space missions.

Leading Markets & Segments in Suborbital Flight (Approx. 600 words)

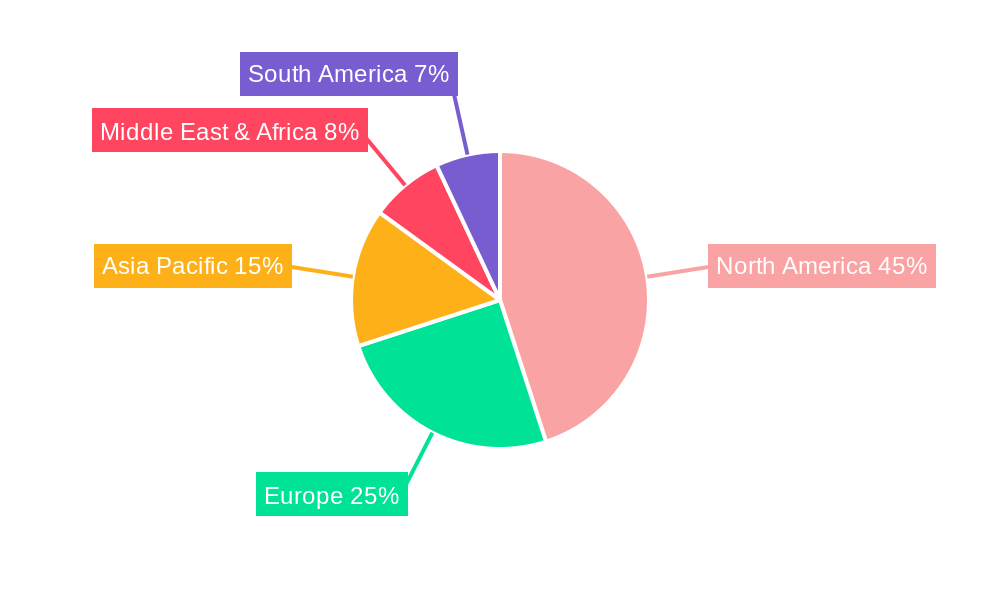

The North American region is currently dominating the suborbital flight market, driven by a robust aerospace industry, significant private investment, and a strong consumer base with a high disposable income. Within North America, the United States stands out as the leading country, home to key players like Virgin Galactic and Blue Origin and a hub for technological innovation in space exploration. The Business application segment is emerging as a significant growth driver, encompassing corporate research and development, payload delivery for scientific experiments, and high-net-worth individuals seeking exclusive travel experiences. The economic policies and government support for the commercial space sector in the US have been instrumental in fostering this growth.

Key Drivers of Dominance in North America & Business Segment:

- Technological Hub: Proximity to leading aerospace companies and research institutions facilitates rapid innovation and adoption of new technologies.

- Investment Ecosystem: A well-established venture capital and private equity landscape actively funds space ventures, including suborbital flight.

- Consumer Demand: A demographic segment with a strong interest in space tourism and unique luxury experiences.

- Government Initiatives: Supportive regulatory frameworks and contracts for scientific payloads from agencies like NASA.

The Six People and Eight People vehicle types are poised to become dominant in the commercial tourism segment. These capacities offer a more economical per-seat cost compared to single-occupancy vehicles, making suborbital experiences more accessible to a wider audience. Companies are focusing on optimizing these cabin configurations to maximize passenger comfort and safety while ensuring efficient operations. The Government application segment, while currently smaller in terms of commercial passenger flights, holds immense potential for scientific research missions, defense applications, and testing of new technologies. Funding from government agencies for space-based research and development will continue to be a crucial, albeit cyclical, driver. The Others application, encompassing space debris monitoring, atmospheric research, and unique filming opportunities, also presents a growing niche.

Suborbital Flight Product Developments (Approx. 100-150 words)

Product development in the suborbital flight sector is characterized by rapid advancements in reusable vehicle designs, enhanced safety systems, and improved passenger amenities. Companies are focusing on creating reliable and cost-effective launch platforms that can accommodate diverse payloads, from human passengers to scientific instruments. Key innovations include advanced composite materials for lighter and stronger airframes, sophisticated propulsion systems for efficient ascent and descent, and state-of-the-art life support and escape systems to ensure passenger well-being. The competitive advantage lies in offering a safe, exhilarating, and unique experience that meets evolving market demands, whether for tourism, research, or specialized applications.

Key Drivers of Suborbital Flight Growth (Approx. 150 words)

The suborbital flight market is propelled by several key drivers. Technologically, advancements in reusable rocket technology and sophisticated life support systems are making flights more feasible and cost-effective. Economically, increasing disposable incomes, a growing appetite for experiential tourism, and significant private investment are fueling demand. Regulatory bodies are also beginning to establish clearer frameworks, which, while still evolving, provide a degree of predictability for market participants. Furthermore, the potential for rapid scientific research and discovery in microgravity environments offers a compelling use case for government and research institutions, further stimulating market expansion.

Challenges in the Suborbital Flight Market (Approx. 150 words)

Despite its promise, the suborbital flight market faces several significant challenges. Regulatory hurdles remain a considerable barrier, with the need for standardized safety protocols and airspace management across different jurisdictions. Supply chain issues, particularly for specialized components and raw materials, can lead to production delays and increased costs, impacting the $xx billion market’s scalability. Intense competitive pressures among a growing number of operators necessitate constant innovation and cost optimization. Furthermore, the high upfront capital investment required for vehicle development and infrastructure poses a significant financial risk, potentially limiting the number of successful market entrants.

Emerging Opportunities in Suborbital Flight (Approx. 150 words)

Emerging opportunities in the suborbital flight market are diverse and promising. Technological breakthroughs in areas like hybrid propulsion systems and advanced autonomous navigation promise to reduce costs and increase flight frequencies, unlocking new market segments. Strategic partnerships between established aerospace companies and emerging startups can accelerate innovation and market penetration. Market expansion beyond traditional tourism into areas like space-based manufacturing, in-orbit servicing simulation, and high-speed point-to-point terrestrial transport presents lucrative long-term prospects. The growing interest in space-based research for medical advancements and material science will also continue to drive demand for suborbital platforms.

Leading Players in the Suborbital Flight Sector

- Virgin Galactic

- Scaled Composites

- Blue Origin

- The Spaceship Company

- Copenhagen Suborbitals

- PD AeroSpace

- World View

Key Milestones in Suborbital Flight Industry

- 2019: Virgin Galactic conducts its first commercial suborbital spaceflight for a private customer.

- 2020: Blue Origin successfully completes its 13th New Shepard mission, carrying scientific payloads.

- 2021: Scaled Composites, in collaboration with Virgin Galactic, continues to refine its SpaceShipTwo system.

- 2022: The Spaceship Company announces advancements in reusable vehicle manufacturing processes.

- 2023: Copenhagen Suborbitals showcases progress on its advanced suborbital rocket designs.

- 2024: PD AeroSpace demonstrates key technologies for its future suborbital vehicle.

- 2024: World View achieves significant milestones in its high-altitude stratospheric balloon operations.

Strategic Outlook for Suborbital Flight Market (Approx. 150 words)

- 2019: Virgin Galactic conducts its first commercial suborbital spaceflight for a private customer.

- 2020: Blue Origin successfully completes its 13th New Shepard mission, carrying scientific payloads.

- 2021: Scaled Composites, in collaboration with Virgin Galactic, continues to refine its SpaceShipTwo system.

- 2022: The Spaceship Company announces advancements in reusable vehicle manufacturing processes.

- 2023: Copenhagen Suborbitals showcases progress on its advanced suborbital rocket designs.

- 2024: PD AeroSpace demonstrates key technologies for its future suborbital vehicle.

- 2024: World View achieves significant milestones in its high-altitude stratospheric balloon operations.

Strategic Outlook for Suborbital Flight Market (Approx. 150 words)

The strategic outlook for the suborbital flight market is exceptionally positive, driven by a clear trajectory towards increased accessibility and expanded applications. Growth accelerators include continued investment in reusable vehicle technology, leading to reduced operational costs and more frequent flights. The diversification of applications beyond tourism, such as scientific research and microgravity experimentation, will create stable demand streams. Governments and private entities are increasingly recognizing the strategic value of suborbital capabilities for research, development, and potential future transportation networks. Companies that can effectively navigate regulatory landscapes, optimize operational efficiencies, and foster strong customer relationships are poised for significant long-term growth in this dynamic sector.

Suborbital Flight Segmentation

-

1. Application

- 1.1. Government

- 1.2. Business

- 1.3. Others

-

2. Types

- 2.1. One Person

- 2.2. Six People

- 2.3. Eight People

- 2.4. Others

Suborbital Flight Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Suborbital Flight REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Suborbital Flight Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Government

- 5.1.2. Business

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. One Person

- 5.2.2. Six People

- 5.2.3. Eight People

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Suborbital Flight Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Government

- 6.1.2. Business

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. One Person

- 6.2.2. Six People

- 6.2.3. Eight People

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Suborbital Flight Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Government

- 7.1.2. Business

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. One Person

- 7.2.2. Six People

- 7.2.3. Eight People

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Suborbital Flight Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Government

- 8.1.2. Business

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. One Person

- 8.2.2. Six People

- 8.2.3. Eight People

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Suborbital Flight Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Government

- 9.1.2. Business

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. One Person

- 9.2.2. Six People

- 9.2.3. Eight People

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Suborbital Flight Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Government

- 10.1.2. Business

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. One Person

- 10.2.2. Six People

- 10.2.3. Eight People

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Virgin Galactic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Scaled Composites

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Blue Origin

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Spaceship Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Copenhagen Suborbitals

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PD AeroSpace

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 World View

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Virgin Galactic

List of Figures

- Figure 1: Global Suborbital Flight Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Suborbital Flight Revenue (million), by Application 2024 & 2032

- Figure 3: North America Suborbital Flight Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Suborbital Flight Revenue (million), by Types 2024 & 2032

- Figure 5: North America Suborbital Flight Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Suborbital Flight Revenue (million), by Country 2024 & 2032

- Figure 7: North America Suborbital Flight Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Suborbital Flight Revenue (million), by Application 2024 & 2032

- Figure 9: South America Suborbital Flight Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Suborbital Flight Revenue (million), by Types 2024 & 2032

- Figure 11: South America Suborbital Flight Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Suborbital Flight Revenue (million), by Country 2024 & 2032

- Figure 13: South America Suborbital Flight Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Suborbital Flight Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Suborbital Flight Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Suborbital Flight Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Suborbital Flight Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Suborbital Flight Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Suborbital Flight Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Suborbital Flight Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Suborbital Flight Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Suborbital Flight Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Suborbital Flight Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Suborbital Flight Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Suborbital Flight Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Suborbital Flight Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Suborbital Flight Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Suborbital Flight Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Suborbital Flight Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Suborbital Flight Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Suborbital Flight Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Suborbital Flight Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Suborbital Flight Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Suborbital Flight Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Suborbital Flight Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Suborbital Flight Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Suborbital Flight Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Suborbital Flight Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Suborbital Flight Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Suborbital Flight Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Suborbital Flight Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Suborbital Flight Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Suborbital Flight Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Suborbital Flight Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Suborbital Flight Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Suborbital Flight Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Suborbital Flight Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Suborbital Flight Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Suborbital Flight Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Suborbital Flight Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Suborbital Flight Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Suborbital Flight?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Suborbital Flight?

Key companies in the market include Virgin Galactic, Scaled Composites, Blue Origin, The Spaceship Company, Copenhagen Suborbitals, PD AeroSpace, World View.

3. What are the main segments of the Suborbital Flight?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Suborbital Flight," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Suborbital Flight report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Suborbital Flight?

To stay informed about further developments, trends, and reports in the Suborbital Flight, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence