Key Insights

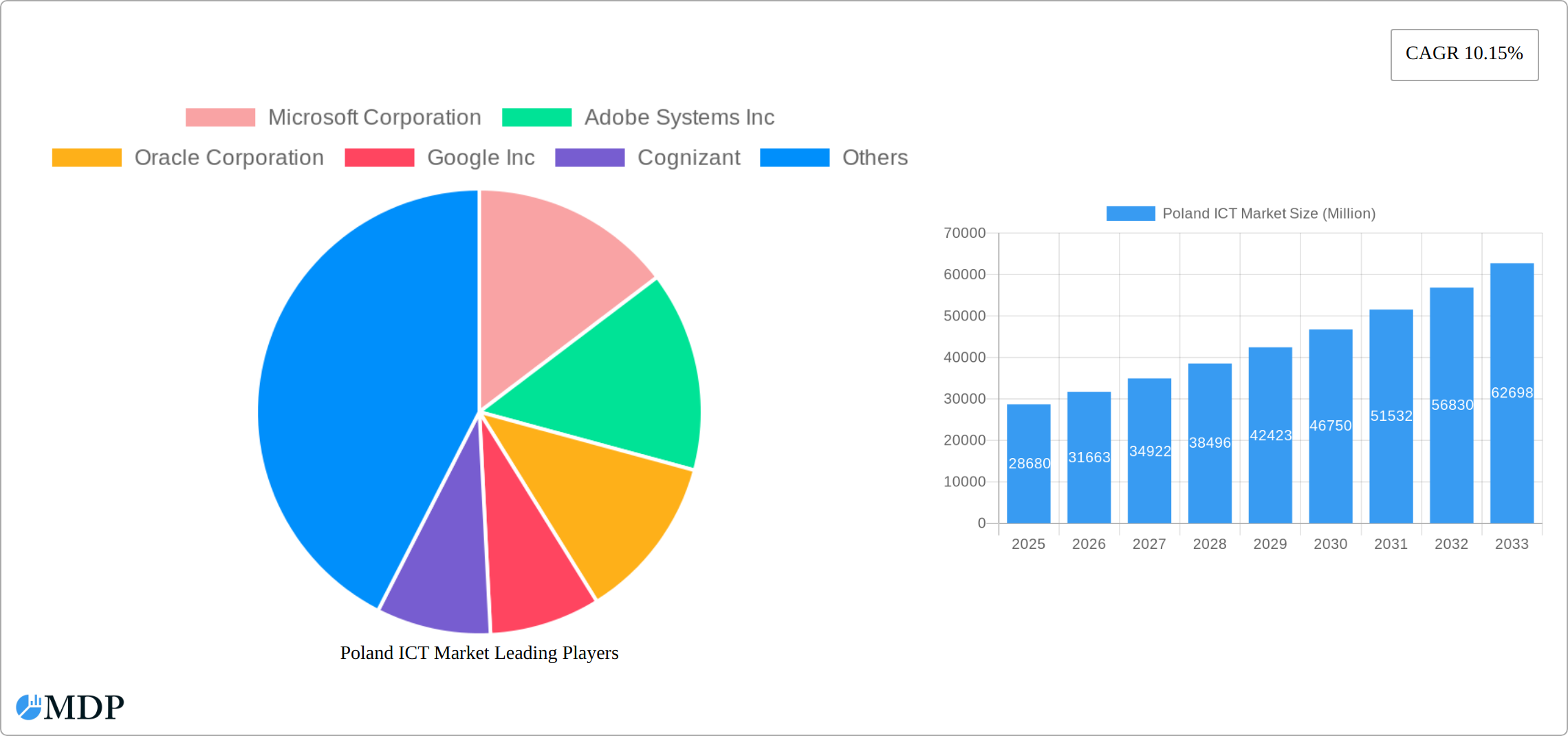

The Poland ICT market, valued at approximately $28.68 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 10.15% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing government investments in digital infrastructure, particularly in expanding broadband access and 5G networks, are laying the groundwork for technological advancements. The rising adoption of cloud computing services, driven by both cost efficiency and scalability benefits, is significantly boosting market growth. Furthermore, a burgeoning digital economy, encompassing e-commerce, fintech, and various digital services, is creating a robust demand for ICT solutions across various sectors. The growing need for cybersecurity solutions, in response to evolving cyber threats, also fuels market growth. Key players such as Microsoft, Adobe, Oracle, Google, and major telecommunication companies like Orange Polska and T-Mobile Polska are actively contributing to this expansion through innovative product offerings and strategic partnerships.

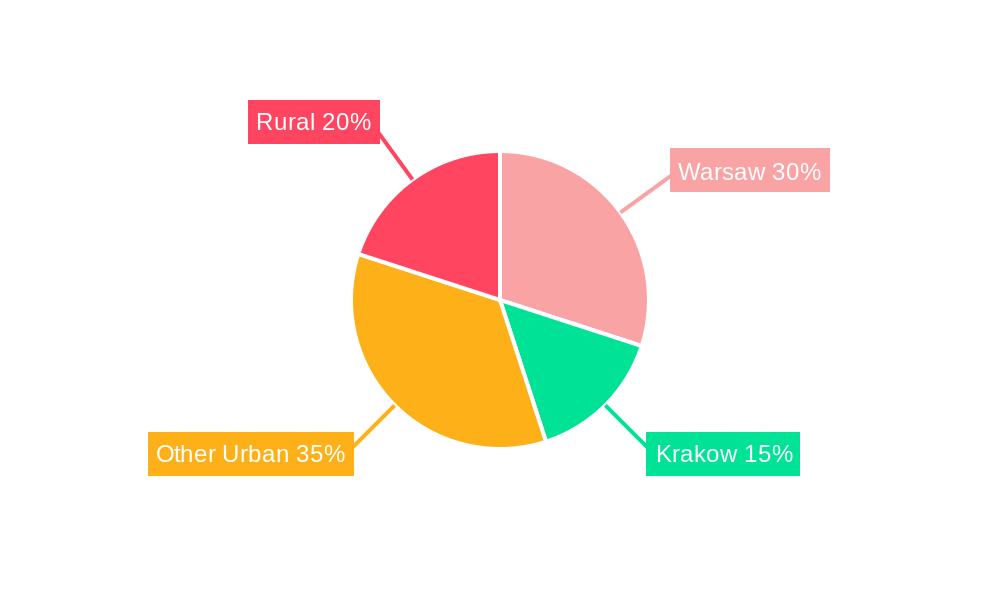

The Polish ICT market is segmented by various service offerings, including software, hardware, and telecommunications. While precise segment-specific data is unavailable, it's reasonable to expect that software and cloud-based solutions are the fastest-growing segments, aligning with global trends. The telecommunications sector, driven by increasing mobile and fixed-line subscriptions, contributes significantly to overall market value. Geographic distribution likely shows stronger performance in major urban centers like Warsaw and Krakow, due to higher concentration of businesses and technological infrastructure. However, the government's focus on digital inclusion is gradually bridging the digital divide, fostering growth in less developed regions. While potential restraints include talent shortages in the ICT sector and concerns regarding data privacy regulations, the overall outlook remains positive, with the market poised for continued expansion in the forecast period.

Poland ICT Market: A Comprehensive Report (2019-2033)

Unlocking the potential of Poland's rapidly expanding Information and Communications Technology (ICT) sector. This in-depth report provides a comprehensive analysis of the Poland ICT market, covering market dynamics, leading players, emerging trends, and future growth opportunities. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. This report is crucial for investors, businesses, and policymakers seeking to understand and capitalize on the dynamism of the Polish ICT landscape.

Poland ICT Market Market Dynamics & Concentration

The Polish ICT market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is moderately high, with a few large multinational corporations and domestic players holding significant market share. However, the market remains fragmented, particularly in niche segments. Innovation is a key driver, fueled by government initiatives promoting digitalization and a growing pool of skilled ICT professionals. The regulatory framework, while generally supportive, presents certain challenges related to data privacy and cybersecurity. Product substitution is a constant factor, with new technologies emerging rapidly. End-user trends show a strong preference for cloud-based solutions and increased adoption of mobile technologies. M&A activity has been relatively robust in recent years, with an estimated xx number of deals concluded in the 2019-2024 historical period. This suggests ongoing consolidation and competition among players vying for market dominance. Key metrics, including precise market share data for specific players and a detailed breakdown of M&A deal values will be detailed in the full report.

- Market Concentration: Moderate, with significant players holding substantial shares but also fragmented segments.

- Innovation Drivers: Government support for digitalization and a skilled workforce.

- Regulatory Framework: Supportive overall, but with challenges in data privacy and cybersecurity.

- Product Substitutes: Constant emergence of new technologies leads to ongoing substitution.

- End-User Trends: Strong preference for cloud solutions and mobile technologies.

- M&A Activity: Significant activity (xx deals estimated between 2019-2024), indicating consolidation.

Poland ICT Market Industry Trends & Analysis

The Poland ICT market is experiencing a dynamic period of significant expansion, propelled by a confluence of compelling factors. Projections indicate a robust compound annual growth rate (CAGR) of approximately **10-12%** from 2019 to 2024. Looking ahead, the market is poised for even stronger performance, with a forecasted CAGR of **11-13%** for the period 2025-2033. This upward trajectory is underpinned by the accelerating adoption of critical technologies such as 5G and cloud computing, further amplified by rising internet connectivity and smartphone penetration across the nation. Emerging technological paradigms, including the burgeoning Internet of Things (IoT) and the transformative power of Artificial Intelligence (AI), are fundamentally reshaping market dynamics, forging new avenues for innovation and posing strategic questions for established industry players. Simultaneously, consumer expectations are evolving, with a pronounced demand for hyper-personalized services, frictionless user experiences, and stringent data security measures. The competitive landscape is characterized by an intense interplay between seasoned market leaders and agile, emerging startups, fostering a climate of continuous innovation and significant price competition. To effectively navigate this evolving ecosystem, businesses must maintain vigilant market awareness and strategic agility.

Leading Markets & Segments in Poland ICT Market

The Polish ICT market is currently dominated by the **Software and IT Services** segment, demonstrating substantial growth and adoption. The capital city, **Warsaw**, continues to assert its leadership as the primary ICT hub, benefiting from a high concentration of businesses, a readily available pool of skilled talent, and a sophisticated, advanced infrastructure. A more granular examination of segment-specific performance will be detailed in the comprehensive market report.

- Key Drivers for Dominant Segment/Region:

- Sustained economic expansion and proactive government support for the ICT sector's development.

- A highly developed and continuously improving telecommunications infrastructure.

- A dense ecosystem of businesses and a deep reservoir of skilled professionals.

- A supportive and evolving regulatory framework conducive to ICT investments.

- Significant government investment and strategic incentives aimed at fostering ICT growth.

Poland ICT Market Product Developments

Recent product developments in the Polish ICT market reflect a strong focus on innovation and technological advancement. This includes the expansion of cloud computing services, development of advanced cybersecurity solutions, and the increasing integration of artificial intelligence and machine learning. New applications are emerging across diverse sectors, driving greater efficiency and transforming traditional business models. Companies are focusing on developing products with enhanced user experience and tailored solutions for specific needs. This competitive landscape necessitates a continual focus on innovation to stay relevant.

Key Drivers of Poland ICT Market Growth

The impressive growth trajectory of the Polish ICT market is propelled by a synergistic blend of economic vitality and strategic initiatives. Foremost, the nation's robust economic performance provides a solid financial bedrock for increased investments in IT solutions and services. Complementing this, ongoing government programs championing digitalization and the continuous enhancement of digital infrastructure are cultivating an exceptionally favorable operational environment. Furthermore, the expanding availability of highly skilled ICT professionals is a critical catalyst, fostering innovation and accelerating technological advancements across the board. This potent combination of economic stability, proactive policy support, and a proficient workforce collectively fuels the market's sustained and impressive growth.

Challenges in the Poland ICT Market Market

Despite its promising outlook, the Polish ICT market is not without its challenges. Navigating complex regulatory landscapes, particularly concerning data privacy and cybersecurity, can present obstacles to rapid expansion. Moreover, global supply chain vulnerabilities, exacerbated by recent geopolitical events, introduce an element of uncertainty and can impact project timelines and costs. The competitive arena is fiercely contested, with both established domestic entities and international corporations vying for market share, leading to potential pressure on profit margins and pricing strategies. For instance, supply chain disruptions observed in 2022 resulted in an estimated **8-10%** increase in the cost of key electronic components, illustrating the tangible impact of these challenges.

Emerging Opportunities in Poland ICT Market

The Polish ICT market presents several compelling long-term growth opportunities. Technological breakthroughs in areas like AI and 5G will unlock new applications and services. Strategic partnerships between domestic and international companies will foster innovation and market expansion. Government initiatives promoting digital transformation across sectors will create significant demand for ICT solutions. These opportunities create a compelling case for future investments.

Leading Players in the Poland ICT Market Sector

- Microsoft Corporation

- Adobe Systems Inc

- Oracle Corporation

- Google Inc

- Cognizant

- Orange Polska SA

- T-Mobile Polska SA

- Honeywell International Inc

- Verizon Polska Sp Z o o

- AT&T Inc

- Capgemini SE

- Polkomtel Sp z o o

Key Milestones in Poland ICT Market Industry

- May 2024: Vecima Networks Inc. partners with Vector Tech Solutions to deploy solutions to ASTA-NET in Poland, expanding its European presence.

- March 2024: Infopro Digital Automotive launches Atelio Data in Poland, providing automotive repair data and expanding its Central and Eastern European reach.

Strategic Outlook for Poland ICT Market Market

The future trajectory of the Polish ICT market is exceptionally promising. Continued and strategic government investment in expanding and modernizing digital infrastructure, coupled with the escalating adoption of cutting-edge technologies such as AI, IoT, and advanced analytics, are set to drive sustained and robust growth. The market landscape will undoubtedly be shaped by strategic alliances, mergers, and acquisitions as companies seek to consolidate their positions and expand their capabilities. Consequently, enterprises that prioritize innovation, demonstrate adaptability to the evolving demands of consumers and businesses, and proactively address regulatory considerations will be ideally positioned to harness the considerable potential and capitalize on the opportunities presented by this vibrant and dynamic sector.

Poland ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Poland ICT Market Segmentation By Geography

- 1. Poland

Poland ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.15% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need to Explore and Adopt Digital Technologies and Initiatives; Rising Internet Penetration in the Country

- 3.3. Market Restrains

- 3.3.1. Rising Need to Explore and Adopt Digital Technologies and Initiatives; Rising Internet Penetration in the Country

- 3.4. Market Trends

- 3.4.1. Growing Telecommunication Services in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Microsoft Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Adobe Systems Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oracle Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Google Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cognizant

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Orange Polska SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 T-Mobile Polska SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Honeywell International Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Verizon Polska Sp Z o o

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AT&T Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Capgemini SE

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Polkomtel Sp z o o

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Microsoft Corporation

List of Figures

- Figure 1: Poland ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Poland ICT Market Share (%) by Company 2024

List of Tables

- Table 1: Poland ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Poland ICT Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Poland ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Poland ICT Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Poland ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 6: Poland ICT Market Volume Billion Forecast, by Size of Enterprise 2019 & 2032

- Table 7: Poland ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 8: Poland ICT Market Volume Billion Forecast, by Industry Vertical 2019 & 2032

- Table 9: Poland ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Poland ICT Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Poland ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Poland ICT Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Poland ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 14: Poland ICT Market Volume Billion Forecast, by Size of Enterprise 2019 & 2032

- Table 15: Poland ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 16: Poland ICT Market Volume Billion Forecast, by Industry Vertical 2019 & 2032

- Table 17: Poland ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Poland ICT Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland ICT Market?

The projected CAGR is approximately 10.15%.

2. Which companies are prominent players in the Poland ICT Market?

Key companies in the market include Microsoft Corporation, Adobe Systems Inc, Oracle Corporation, Google Inc, Cognizant, Orange Polska SA, T-Mobile Polska SA, Honeywell International Inc, Verizon Polska Sp Z o o, AT&T Inc, Capgemini SE, Polkomtel Sp z o o.

3. What are the main segments of the Poland ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Need to Explore and Adopt Digital Technologies and Initiatives; Rising Internet Penetration in the Country.

6. What are the notable trends driving market growth?

Growing Telecommunication Services in the Country.

7. Are there any restraints impacting market growth?

Rising Need to Explore and Adopt Digital Technologies and Initiatives; Rising Internet Penetration in the Country.

8. Can you provide examples of recent developments in the market?

May 2024: Vecima Networks Inc. announced its partnership with Vector Tech Solutions to deploy Vecima's Entra SC-1D Access Node and Entra Access Controller (EAC) solutions to telecommunication provider ASTA-NET in Poland. With this collaboration, the company aims to expand its presence in Europe, providing local expertise as a Vecima reseller in Poland.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland ICT Market?

To stay informed about further developments, trends, and reports in the Poland ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence