Key Insights

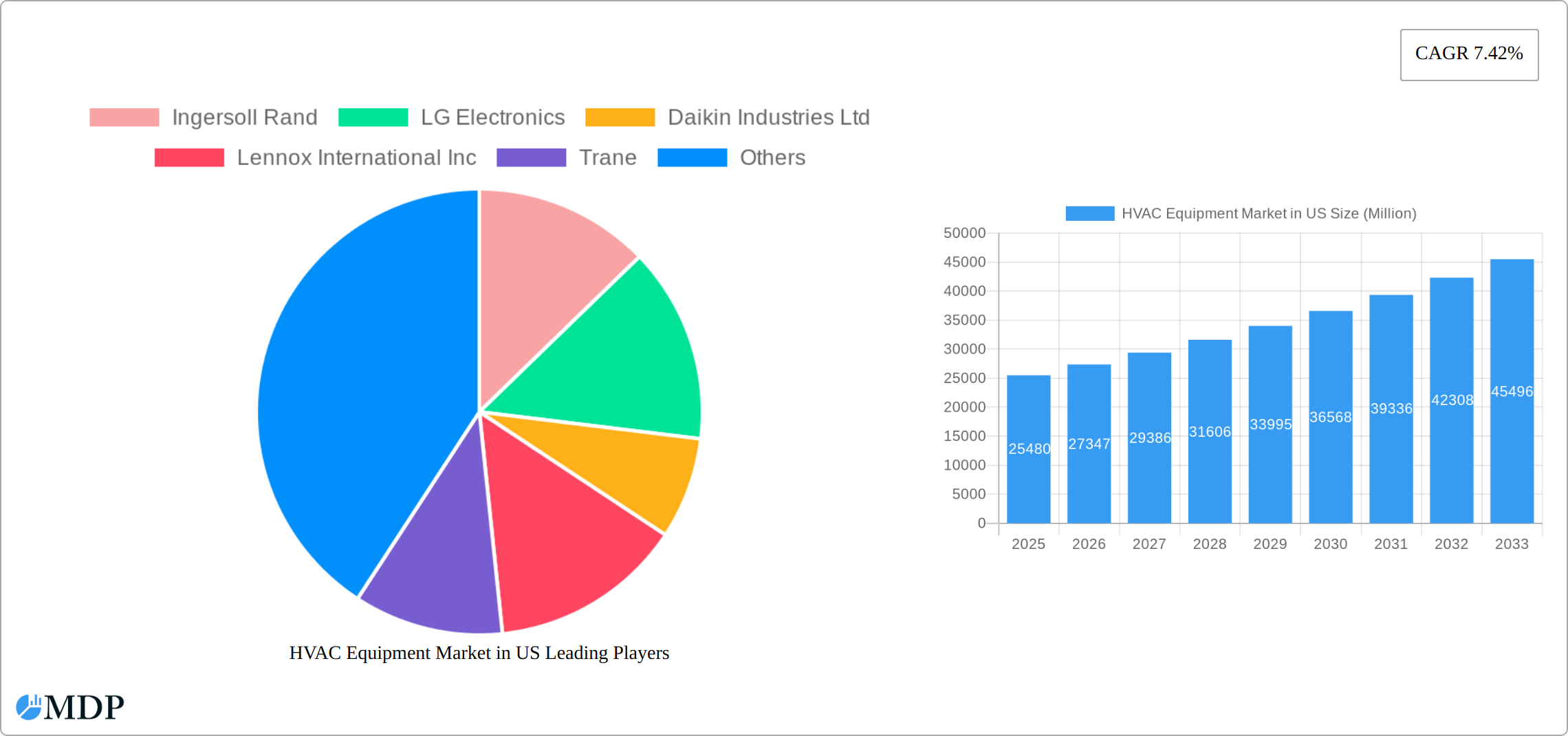

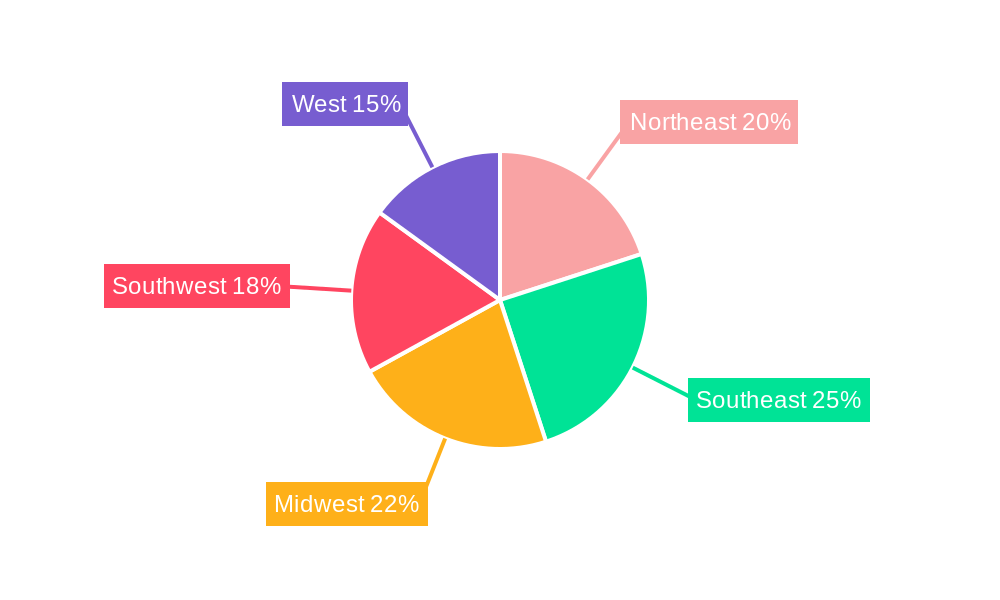

The US HVAC equipment market, valued at $25.48 billion in 2025, is projected to experience robust growth, driven by several key factors. Increasing urbanization and construction activity, coupled with rising disposable incomes and a growing preference for energy-efficient building solutions, are significantly boosting demand. Stringent government regulations aimed at improving energy efficiency and reducing carbon emissions are further accelerating market expansion. The residential segment is a major contributor, fueled by new home construction and renovations focused on enhanced comfort and energy savings. Commercial and industrial sectors also contribute substantially, driven by the need for efficient climate control in offices, retail spaces, and manufacturing facilities. Technological advancements, including smart HVAC systems with improved energy management capabilities and increased connectivity, are shaping market trends, offering consumers and businesses enhanced control and cost savings. Competition among major players like Ingersoll Rand, Daikin, and Carrier is intensifying, leading to product innovation and competitive pricing, benefiting consumers. While rising raw material costs and supply chain disruptions present some challenges, the overall market outlook remains positive, with a projected Compound Annual Growth Rate (CAGR) of 7.42% from 2025 to 2033. The market segmentation by equipment type—air conditioning, chillers, heating, and ventilation—reflects diverse consumer and business needs, contributing to the market's overall dynamism and resilience. Regional variations within the US, influenced by factors like climate and building codes, further contribute to the market's complexity and growth opportunities.

The forecast period of 2025-2033 anticipates continued growth, propelled by ongoing investments in sustainable building practices and increasing awareness of energy conservation. The Northeast and West regions are likely to witness strong growth due to higher adoption rates of energy-efficient technologies. Continued innovation in HVAC technology, particularly in areas such as smart home integration and improved energy efficiency, will remain crucial in driving market expansion. However, potential economic fluctuations and evolving government policies may influence market growth trajectories. Manufacturers are expected to focus on enhancing their product portfolios, exploring sustainable materials and manufacturing processes, and strategically expanding their market presence to capitalize on the projected growth. The market's success hinges on effectively addressing customer needs, navigating regulatory landscapes, and mitigating potential supply chain challenges.

HVAC Equipment Market in US: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the HVAC equipment market in the US, offering crucial insights for stakeholders across the industry value chain. From market dynamics and concentration to leading players and future opportunities, this report covers all essential aspects of this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence for informed decision-making. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

HVAC Equipment Market in US Market Dynamics & Concentration

The US HVAC equipment market exhibits a moderately consolidated structure, characterized by the significant market share held by several key industry leaders. This concentration is shaped by factors including the pursuit of economies of scale, rapid technological advancements, and the cultivation of strong brand recognition. Innovation serves as a critical catalyst, propelling the development of highly energy-efficient solutions and sophisticated smart technologies. Stringent regulatory frameworks, particularly those mandating energy efficiency standards (such as the EPA's ENERGY STAR program), exert a substantial influence on market dynamics. The emergence of alternative technologies, like geothermal heating and cooling systems, presents ongoing competitive challenges. Shifting end-user preferences, increasingly driven by a heightened awareness of indoor air quality and growing sustainability concerns, are actively reshaping demand patterns. Furthermore, mergers and acquisitions (M&A) are actively contributing to the evolving market structure, with a discernible uptick in deal activity observed in recent years. The estimated market size for 2025 is projected to reach [Insert Value] Million. Key metrics that define this market include:

- Market Share: The top 5 dominant players collectively command approximately [Insert Percentage]% of the total market share.

- M&A Deal Counts: An average of [Insert Number] M&A deals were successfully completed annually between the years 2019 and 2024.

- Innovation Drivers: Key drivers fueling innovation include government incentives promoting energy-efficient HVAC systems and the burgeoning consumer demand for integrated smart home technology.

- Regulatory Frameworks: Prominent regulatory influences encompass the EPA’s Significant New Alternatives Policy (SNAP) program and a growing number of state-level building codes that prioritize energy performance and environmental impact.

HVAC Equipment Market in US Industry Trends & Analysis

The US HVAC equipment market is currently experiencing a robust growth trajectory, propelled by a confluence of significant industry trends. A rising trend in disposable incomes, coupled with a heightened consumer desire for enhanced indoor comfort, is stimulating demand, particularly within the residential sector. Technological advancements are actively revolutionizing the industry, notably through the seamless integration of smart home functionalities, expansive IoT connectivity, and intelligent AI-powered control systems. Consumer preferences are undergoing a palpable shift towards energy-efficient and environmentally responsible solutions, thereby creating substantial opportunities for manufacturers that champion sustainable HVAC systems. The market is characterized by intense competition, a dynamic interplay between established players and agile emerging companies, which is effectively driving both innovation and competitive pricing strategies. A notable trend within the commercial building segment is the increasing adoption of Variable Refrigerant Flow (VRF) systems. The overall market expansion is significantly influenced by pivotal factors such as new construction projects, comprehensive building renovations, and essential replacement cycles for existing equipment. These drivers collectively contribute to a resilient and expanding market landscape for HVAC equipment. The projected Compound Annual Growth Rate (CAGR) for the upcoming period is estimated at [Insert Percentage]%, signaling substantial and sustained growth. The penetration of energy-efficient solutions within the market is experiencing a steady and encouraging increase, further fueled by supportive government incentives and a growing collective environmental consciousness.

Leading Markets & Segments in HVAC Equipment Market in US

The commercial segment dominates the US HVAC equipment market, driven by the high density of commercial buildings and ongoing construction activities across various sectors. Within the end-user categories, the residential segment displays significant growth potential due to increasing urbanization and rising disposable incomes. The industrial segment showcases steady growth, fueled by the expanding manufacturing sector and the need for efficient climate control in industrial settings. Among equipment types, air conditioning systems maintain the largest market share, followed by heating and ventilation equipment. The market for chillers is witnessing strong growth, particularly in large commercial and industrial settings. Water heaters, both electric and gas, constitute a significant portion of the market, driven by widespread residential and commercial needs.

- Key Drivers for Commercial Segment:

- Strong construction activity in commercial real estate.

- Growing demand for energy-efficient HVAC systems in office buildings and retail spaces.

- Increasing adoption of smart building technologies.

- Key Drivers for Residential Segment:

- Rising disposable incomes leading to increased spending on home improvement.

- Growing awareness of indoor air quality and energy efficiency.

- Increasing adoption of smart home technologies.

HVAC Equipment Market in US Product Developments

Recent product innovations within the US HVAC equipment market are predominantly centered on enhancing energy efficiency, integrating advanced smart features, and significantly improving indoor air quality. Manufacturers are proactively incorporating cutting-edge technologies, such as inverter compressors, variable-speed motors, and intelligent smart thermostats, to elevate system performance and minimize energy consumption. The integration of the Internet of Things (IoT) and cloud-based platforms is facilitating real-time remote monitoring, proactive diagnostics, and streamlined control, thereby optimizing system efficiency and reducing overall maintenance expenditures. These progressive advancements are directly addressing and capitalizing on the burgeoning consumer demand for convenient, user-friendly, and environmentally conscious HVAC solutions, consequently strengthening their market appeal and adoption rates.

Key Drivers of HVAC Equipment Market in US Growth

The US HVAC equipment market's growth is propelled by several factors. Government regulations promoting energy efficiency incentivize the adoption of advanced HVAC technologies. Economic growth and rising disposable incomes drive demand, particularly in the residential sector. Technological advancements, such as the integration of smart home technology, IoT, and AI, further enhance market expansion. The increasing focus on sustainable solutions and reducing carbon emissions also plays a significant role.

Challenges in the HVAC Equipment Market in US Market

Several challenges impede the market's growth. Stringent regulatory compliance costs and supply chain disruptions can impact profitability. Intense competition, especially from international players, exerts pressure on pricing and margins. Fluctuations in raw material prices, particularly metals and refrigerants, affect manufacturing costs. The overall impact of these challenges is estimated to reduce the annual market growth by approximately xx%.

Emerging Opportunities in HVAC Equipment Market in US

Significant long-term growth opportunities exist in the US HVAC market. Technological breakthroughs, such as the development of more efficient and sustainable refrigerants and advanced heat pump technologies, offer significant potential. Strategic partnerships between HVAC manufacturers and smart home technology providers create new avenues for market expansion. The rising adoption of building automation systems opens opportunities for integrated HVAC solutions.

Leading Players in the HVAC Equipment Market in US Sector

- Ingersoll Rand

- LG Electronics

- Daikin Industries Ltd

- Lennox International Inc

- Trane

- Nortek Air Solutions LLC

- Mitsubishi Electric

- Carrier Global

- Rheem Manufacturing Company

Key Milestones in HVAC Equipment Market in US Industry

- September 2021: Carrier Transicold introduced two new Citimax unit lines, expanding its presence in the heavy-duty refrigerated trucking market.

- January 2022: Daikin Applied launched SiteLine Building Controls, a cloud-based platform for managing HVAC units and building systems, enhancing building efficiency and optimizing operations.

- February 2022: Carrier Global Corporation acquired Toshiba Corporation's stake in Toshiba Carrier Corporation (TCC), strengthening its position in the VRF segment and adding a leading brand to its portfolio.

Strategic Outlook for HVAC Equipment Market in US Market

The future trajectory of the US HVAC equipment market appears exceptionally promising, underpinned by a sustained and escalating demand for both energy-efficient and sustainable solutions. Strategic opportunities abound, particularly in making significant investments in research and development (R&D) for advanced technologies, cultivating strategic partnerships to broaden market reach and influence, and dedicating efforts towards the development of highly tailored solutions designed to meet the specific needs of diverse market segments. The market is poised for substantial expansion, driven by a powerful convergence of technological breakthroughs, stringent regulatory mandates, and evolving consumer preferences. Consequently, strategic investments in sustainability initiatives and the integration of smart technologies will prove indispensable for companies seeking to maintain and enhance their competitive advantage in this dynamic landscape.

HVAC Equipment Market in US Segmentation

-

1. Type of Equipment

-

1.1. Air Conditioning Equipment

- 1.1.1. Unitary Air Conditioners

- 1.1.2. Room Air Conditioners

- 1.1.3. Packaged Terminal Air Conditioners

- 1.1.4. Chillers

-

1.2. Heating Equipment

- 1.2.1. Warm Air Furnace (Gas and Oil)

- 1.2.2. Boilers

- 1.2.3. Room and Zone Heating Equipment

- 1.2.4. Heat Pumps (Air-sourced and Geo-thermal)

-

1.3. Ventilation Equipment

- 1.3.1. Air Handling Units

- 1.3.2. Fan Coil Units

- 1.3.3. Building Humidifiers and Dehumidifiers

-

1.1. Air Conditioning Equipment

-

2. End User

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

HVAC Equipment Market in US Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

HVAC Equipment Market in US REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.42% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Replacement of Existing Equipment with Better Performing Onces; Supportive Government Regulations including Incentives for Saving Energy Through Tax Credit Programs.

- 3.3. Market Restrains

- 3.3.1. Rising Competition among key vendors to limit margins

- 3.4. Market Trends

- 3.4.1. Flourishing Energy and Construction Sectors Bodes well for the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. HVAC Equipment Market in US Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Equipment

- 5.1.1. Air Conditioning Equipment

- 5.1.1.1. Unitary Air Conditioners

- 5.1.1.2. Room Air Conditioners

- 5.1.1.3. Packaged Terminal Air Conditioners

- 5.1.1.4. Chillers

- 5.1.2. Heating Equipment

- 5.1.2.1. Warm Air Furnace (Gas and Oil)

- 5.1.2.2. Boilers

- 5.1.2.3. Room and Zone Heating Equipment

- 5.1.2.4. Heat Pumps (Air-sourced and Geo-thermal)

- 5.1.3. Ventilation Equipment

- 5.1.3.1. Air Handling Units

- 5.1.3.2. Fan Coil Units

- 5.1.3.3. Building Humidifiers and Dehumidifiers

- 5.1.1. Air Conditioning Equipment

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type of Equipment

- 6. Northeast HVAC Equipment Market in US Analysis, Insights and Forecast, 2019-2031

- 7. Southeast HVAC Equipment Market in US Analysis, Insights and Forecast, 2019-2031

- 8. Midwest HVAC Equipment Market in US Analysis, Insights and Forecast, 2019-2031

- 9. Southwest HVAC Equipment Market in US Analysis, Insights and Forecast, 2019-2031

- 10. West HVAC Equipment Market in US Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ingersoll Rand

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LG Electronics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Daikin Industries Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lennox International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Trane

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nortek Air Solutions LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mitsubishi Electric

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Carrier Global

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rheem Manufacturing Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Ingersoll Rand

List of Figures

- Figure 1: HVAC Equipment Market in US Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: HVAC Equipment Market in US Share (%) by Company 2024

List of Tables

- Table 1: HVAC Equipment Market in US Revenue Million Forecast, by Region 2019 & 2032

- Table 2: HVAC Equipment Market in US Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: HVAC Equipment Market in US Revenue Million Forecast, by Type of Equipment 2019 & 2032

- Table 4: HVAC Equipment Market in US Volume K Unit Forecast, by Type of Equipment 2019 & 2032

- Table 5: HVAC Equipment Market in US Revenue Million Forecast, by End User 2019 & 2032

- Table 6: HVAC Equipment Market in US Volume K Unit Forecast, by End User 2019 & 2032

- Table 7: HVAC Equipment Market in US Revenue Million Forecast, by Region 2019 & 2032

- Table 8: HVAC Equipment Market in US Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: HVAC Equipment Market in US Revenue Million Forecast, by Country 2019 & 2032

- Table 10: HVAC Equipment Market in US Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Northeast HVAC Equipment Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Northeast HVAC Equipment Market in US Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Southeast HVAC Equipment Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Southeast HVAC Equipment Market in US Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Midwest HVAC Equipment Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Midwest HVAC Equipment Market in US Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Southwest HVAC Equipment Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Southwest HVAC Equipment Market in US Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: West HVAC Equipment Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: West HVAC Equipment Market in US Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: HVAC Equipment Market in US Revenue Million Forecast, by Type of Equipment 2019 & 2032

- Table 22: HVAC Equipment Market in US Volume K Unit Forecast, by Type of Equipment 2019 & 2032

- Table 23: HVAC Equipment Market in US Revenue Million Forecast, by End User 2019 & 2032

- Table 24: HVAC Equipment Market in US Volume K Unit Forecast, by End User 2019 & 2032

- Table 25: HVAC Equipment Market in US Revenue Million Forecast, by Country 2019 & 2032

- Table 26: HVAC Equipment Market in US Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: United States HVAC Equipment Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: United States HVAC Equipment Market in US Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Canada HVAC Equipment Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada HVAC Equipment Market in US Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Mexico HVAC Equipment Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Mexico HVAC Equipment Market in US Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the HVAC Equipment Market in US?

The projected CAGR is approximately 7.42%.

2. Which companies are prominent players in the HVAC Equipment Market in US?

Key companies in the market include Ingersoll Rand, LG Electronics, Daikin Industries Ltd, Lennox International Inc, Trane, Nortek Air Solutions LLC, Mitsubishi Electric, Carrier Global, Rheem Manufacturing Company.

3. What are the main segments of the HVAC Equipment Market in US?

The market segments include Type of Equipment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.48 Million as of 2022.

5. What are some drivers contributing to market growth?

Replacement of Existing Equipment with Better Performing Onces; Supportive Government Regulations including Incentives for Saving Energy Through Tax Credit Programs..

6. What are the notable trends driving market growth?

Flourishing Energy and Construction Sectors Bodes well for the Market.

7. Are there any restraints impacting market growth?

Rising Competition among key vendors to limit margins.

8. Can you provide examples of recent developments in the market?

February 2022 - Carrier Global Corporation signed a binding agreement to acquire Toshiba Corporation's ownership stake in Toshiba Carrier Corporation (TCC), a joint venture with Carrier in variable refrigerant flow (VRF) and light commercial HVAC. Carrier's planned acquisition will strengthen its position in one of the fastest-growing HVAC segments, scale its global VRF product platform with leading and differentiated technology, and add a well-known brand to its portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "HVAC Equipment Market in US," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the HVAC Equipment Market in US report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the HVAC Equipment Market in US?

To stay informed about further developments, trends, and reports in the HVAC Equipment Market in US, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence