Key Insights

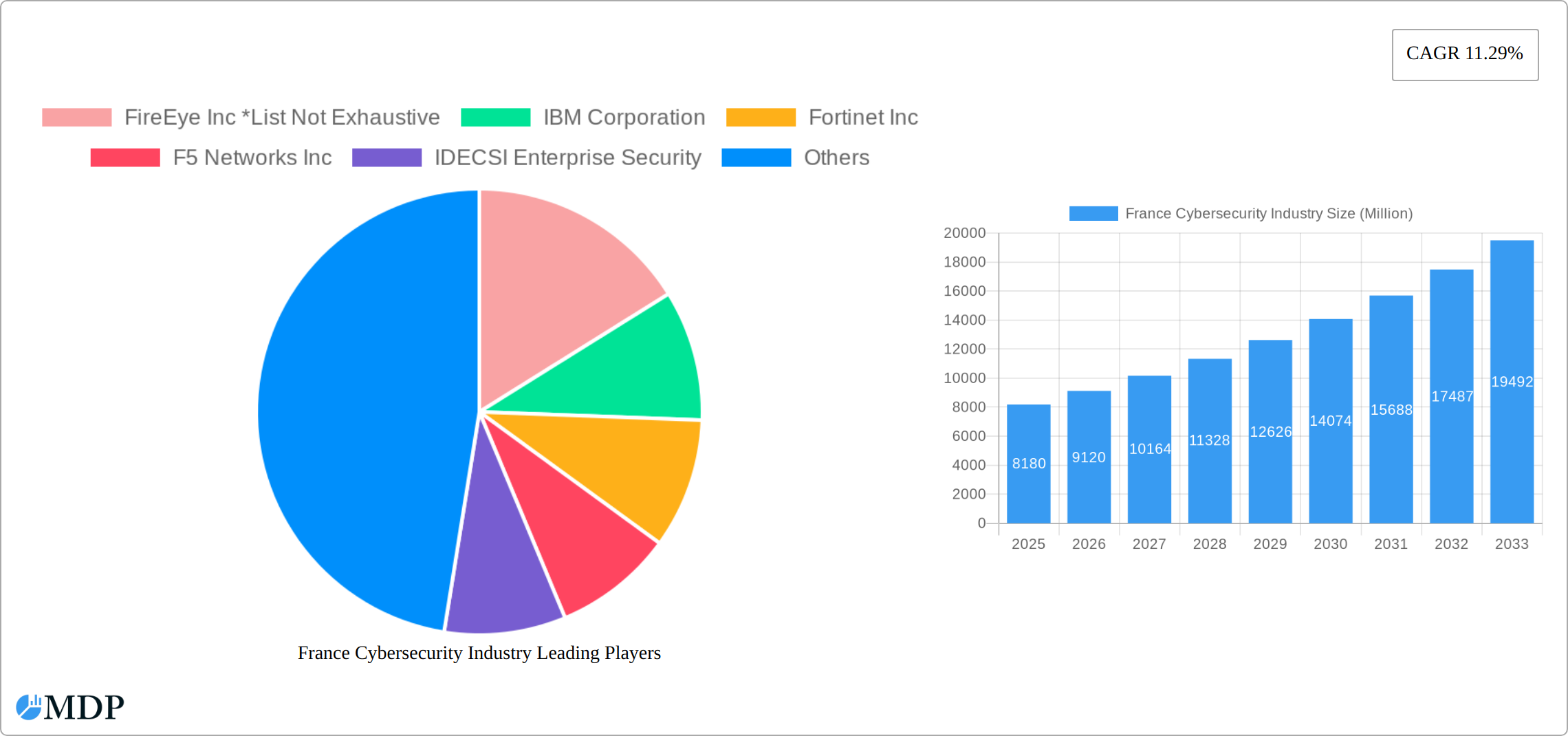

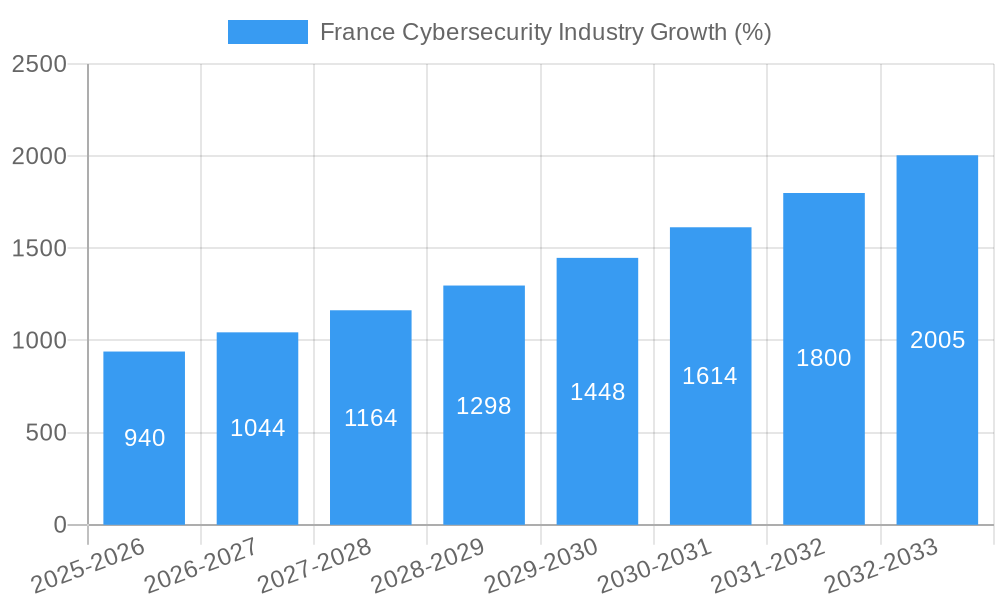

The France cybersecurity market, valued at €8.18 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 11.29% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing digitalization across various sectors, including BFSI (Banking, Financial Services, and Insurance), healthcare, and government & defense, necessitates enhanced cybersecurity measures to protect sensitive data and critical infrastructure from escalating cyber threats. The rising adoption of cloud-based solutions and the increasing sophistication of cyberattacks are further propelling market growth. Furthermore, stringent data privacy regulations, such as GDPR, are compelling organizations to invest heavily in robust cybersecurity frameworks to ensure compliance. The market is segmented by end-user (BFSI, Healthcare, Manufacturing, Government & Defense, IT & Telecommunication, and Others), offering (Security Type and Services), and deployment (Cloud and On-Premise). The competitive landscape includes major players like FireEye, IBM, Fortinet, F5 Networks, and Cisco, amongst others, each vying for market share through innovative product offerings and strategic partnerships.

The substantial growth trajectory is expected to continue throughout the forecast period (2025-2033), driven by ongoing digital transformation initiatives and the evolving threat landscape. However, certain restraints may influence growth rate. These include the high cost of implementation and maintenance of advanced cybersecurity solutions, a potential skills gap in cybersecurity professionals, and the emergence of new and sophisticated cyber threats. Despite these challenges, the market's inherent growth drivers are expected to outweigh the restraints, leading to a significant expansion of the France cybersecurity market over the next decade. The focus will likely remain on developing and implementing effective solutions across various sectors to safeguard digital assets and ensure business continuity in the face of persistent cyber threats. The increasing demand for managed security services and proactive threat intelligence is also anticipated to drive market growth.

Unlocking the Potential: A Comprehensive Analysis of the France Cybersecurity Industry (2019-2033)

This in-depth report provides a comprehensive analysis of the France Cybersecurity Industry, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving market. From market dynamics and leading players to emerging opportunities and future trends, this report unveils the key factors shaping the French cybersecurity landscape. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. The report leverages extensive market research to provide actionable intelligence, forecasting a market size exceeding XX Million by 2033.

France Cybersecurity Industry Market Dynamics & Concentration

The French cybersecurity market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the market is also characterized by a dynamic influx of new entrants and innovative solutions. The market’s growth is propelled by several factors: increasing cyber threats targeting critical infrastructure and businesses, stringent data privacy regulations (e.g., GDPR), and rising government initiatives promoting cybersecurity awareness and investments. Technological advancements, such as AI and machine learning in threat detection, further fuel innovation.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Innovation Drivers: AI-driven threat detection, blockchain security solutions, and improved cloud security protocols are key innovation drivers.

- Regulatory Frameworks: GDPR and other national cybersecurity regulations drive demand for robust security solutions.

- M&A Activity: The historical period (2019-2024) witnessed approximately xx M&A deals, consolidating market share among leading players. The forecast period anticipates a continued rise in M&A activity, driven by a need for enhanced capabilities and broader market reach. The number of M&A deals is expected to reach xx by 2033.

- Product Substitutes: Open-source security tools pose some level of competition, but the demand for managed security services and sophisticated solutions remains high.

- End-User Trends: Increasing adoption of cloud computing and the Internet of Things (IoT) drives demand for comprehensive security solutions across various end-user sectors.

France Cybersecurity Industry Industry Trends & Analysis

The France Cybersecurity Industry is experiencing robust growth, driven by several key trends. The increasing sophistication and frequency of cyberattacks targeting both public and private sector organizations are a primary factor. Furthermore, the rising adoption of cloud computing and IoT devices expands the attack surface, necessitating more robust security measures. Government regulations and initiatives are also significantly impacting market growth, mandating increased security investments across various sectors. Technological advancements like AI and machine learning are revolutionizing threat detection and response capabilities. The market is witnessing a shift towards proactive security measures, with a growing emphasis on threat intelligence and prevention.

The CAGR for the period 2025-2033 is estimated to be xx%. Market penetration in key sectors like BFSI and Government & Defense is expected to increase significantly, driven by regulatory compliance and rising cyber threats. Consumer preference is shifting towards comprehensive security solutions offering integrated threat protection across multiple platforms. Competitive dynamics are characterized by intense innovation, strategic partnerships, and acquisitions.

Leading Markets & Segments in France Cybersecurity Industry

The French cybersecurity market demonstrates strong growth across various segments and end-users. However, some sectors show more significant dominance due to regulatory mandates and high-value assets requiring protection.

By End User:

- Government & Defense: This segment exhibits the highest growth due to significant government investments in cybersecurity infrastructure and the sensitive nature of data handled. Key drivers include stringent regulatory frameworks and the need to protect critical national infrastructure.

- BFSI (Banking, Financial Services, and Insurance): This sector is also a significant contributor to market growth, driven by stringent regulations around data protection and the high value of financial assets. Robust security is paramount to maintaining consumer trust.

- IT and Telecommunication: This sector’s high reliance on digital infrastructure and data transmission necessitates advanced cybersecurity solutions.

By Offering:

- Managed Security Services: This segment is experiencing the fastest growth due to increasing demand for outsourced cybersecurity expertise and the complexity of managing security operations.

By Deployment:

- Cloud: The shift towards cloud-based services drives demand for cloud-based security solutions, making it a rapidly growing segment.

France Cybersecurity Industry Product Developments

Recent product developments highlight a strong trend towards AI-powered security solutions, enabling more effective threat detection and response. The integration of advanced analytics and machine learning algorithms allows for faster identification of malicious activities and improved threat prevention. Furthermore, there's a growing emphasis on automation in security operations, streamlining processes and enhancing efficiency. Products offering integrated security across multiple platforms are gaining significant traction in the market, catering to the growing demand for comprehensive threat protection.

Key Drivers of France Cybersecurity Industry Growth

Several key factors drive the expansion of the French cybersecurity market. The rising prevalence of sophisticated cyberattacks targeting critical infrastructure and businesses necessitates stronger security measures. Stringent data privacy regulations, such as GDPR, mandate organizations to implement robust security controls to protect sensitive data. Government initiatives promoting cybersecurity awareness and investments further fuel market growth. Technological advancements, particularly in AI and machine learning, are enhancing the effectiveness of cybersecurity solutions. Lastly, the increasing adoption of cloud computing and IoT devices expands the attack surface, driving further investment in cybersecurity.

Challenges in the France Cybersecurity Industry Market

Despite the promising growth trajectory, the French cybersecurity market faces several challenges. The skills shortage in cybersecurity professionals hinders the effective implementation and management of security solutions. The complexity of the cybersecurity landscape, with evolving threats and technologies, presents a challenge for organizations seeking to maintain comprehensive protection. The high cost of advanced security solutions can be a barrier for smaller businesses. Furthermore, the integration of different security tools and systems can be complex and time-consuming. Supply chain vulnerabilities also pose a significant risk to the overall security posture of organizations. The potential impact of these challenges includes slower adoption rates of advanced security solutions and increased security breaches.

Emerging Opportunities in France Cybersecurity Industry

The French cybersecurity market presents substantial long-term opportunities. The increasing adoption of IoT devices and connected technologies creates a significant demand for comprehensive security solutions. The growing focus on proactive threat intelligence and predictive analytics offers significant opportunities for innovative companies. Strategic partnerships between cybersecurity vendors and organizations across different sectors can facilitate the adoption of advanced security measures. Government initiatives promoting cybersecurity innovation and collaboration create a supportive environment for market growth. Furthermore, market expansion into new sectors and geographic areas presents further potential.

Leading Players in the France Cybersecurity Industry Sector

- FireEye Inc

- IBM Corporation (https://www.ibm.com/)

- Fortinet Inc (https://www.fortinet.com/)

- F5 Networks Inc (https://www.f5.com/)

- IDECSI Enterprise Security

- Cisco Systems Inc (https://www.cisco.com/)

- AVG Technologies

- Intel Security (Intel Corporation) (https://www.intel.com/)

- Dell Technologies Inc (https://www.dell.com/)

Key Milestones in France Cybersecurity Industry Industry

- 2020-03: Increased focus on ransomware attacks leads to heightened demand for threat detection and response solutions.

- 2021-10: New data privacy regulations are implemented, accelerating the adoption of data security solutions.

- 2022-05: Major cyberattack targeting critical infrastructure prompts increased government investment in national cybersecurity.

- 2023-08: Several significant M&A deals reshape the market landscape. (Specific examples would be inserted here with the data)

Strategic Outlook for France Cybersecurity Industry Market

The French cybersecurity market is poised for sustained growth driven by increasing cyber threats, evolving regulations, and technological advancements. The market's future potential is substantial, especially considering the expanding digital landscape. Strategic opportunities lie in developing innovative solutions leveraging AI, machine learning, and automation. Focusing on proactive threat intelligence and managed security services will be key differentiators for success. Strategic partnerships and mergers will likely continue to shape the market landscape.

France Cybersecurity Industry Segmentation

-

1. Offering

-

1.1. Security Type

- 1.1.1. Cloud Security

- 1.1.2. Data Security

- 1.1.3. Identity Access Management

- 1.1.4. Network Security

- 1.1.5. Consumer Security

- 1.1.6. Infrastructure Protection

- 1.1.7. Other Types

- 1.2. Services

-

1.1. Security Type

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. End User

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Manufacturing

- 3.4. Government & Defense

- 3.5. IT and Telecommunication

- 3.6. Other End Users

France Cybersecurity Industry Segmentation By Geography

- 1. France

France Cybersecurity Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.29% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Digitalization and Scalable IT Infrastructure; Need to tackle risks from various trends such as third-party vendor risks

- 3.2.2 the evolution of MSSPs

- 3.2.3 and adoption of cloud-first strategy

- 3.3. Market Restrains

- 3.3.1. Lack of Cybersecurity Professionals; High Reliance on Traditional Authentication Methods and Low Preparedness

- 3.4. Market Trends

- 3.4.1. Network Security is Expected to Gain Popularity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Security Type

- 5.1.1.1. Cloud Security

- 5.1.1.2. Data Security

- 5.1.1.3. Identity Access Management

- 5.1.1.4. Network Security

- 5.1.1.5. Consumer Security

- 5.1.1.6. Infrastructure Protection

- 5.1.1.7. Other Types

- 5.1.2. Services

- 5.1.1. Security Type

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Manufacturing

- 5.3.4. Government & Defense

- 5.3.5. IT and Telecommunication

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 FireEye Inc *List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fortinet Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 F5 Networks Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IDECSI Enterprise Security

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cisco Systems Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AVG Technologies

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Intel Security (Intel Corporation)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dell Technologies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 FireEye Inc *List Not Exhaustive

List of Figures

- Figure 1: France Cybersecurity Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Cybersecurity Industry Share (%) by Company 2024

List of Tables

- Table 1: France Cybersecurity Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Cybersecurity Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 3: France Cybersecurity Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: France Cybersecurity Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: France Cybersecurity Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: France Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: France Cybersecurity Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 8: France Cybersecurity Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 9: France Cybersecurity Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 10: France Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Cybersecurity Industry?

The projected CAGR is approximately 11.29%.

2. Which companies are prominent players in the France Cybersecurity Industry?

Key companies in the market include FireEye Inc *List Not Exhaustive, IBM Corporation, Fortinet Inc, F5 Networks Inc, IDECSI Enterprise Security, Cisco Systems Inc, AVG Technologies, Intel Security (Intel Corporation), Dell Technologies Inc.

3. What are the main segments of the France Cybersecurity Industry?

The market segments include Offering, Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Digitalization and Scalable IT Infrastructure; Need to tackle risks from various trends such as third-party vendor risks. the evolution of MSSPs. and adoption of cloud-first strategy.

6. What are the notable trends driving market growth?

Network Security is Expected to Gain Popularity.

7. Are there any restraints impacting market growth?

Lack of Cybersecurity Professionals; High Reliance on Traditional Authentication Methods and Low Preparedness.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Cybersecurity Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Cybersecurity Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Cybersecurity Industry?

To stay informed about further developments, trends, and reports in the France Cybersecurity Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence