Key Insights

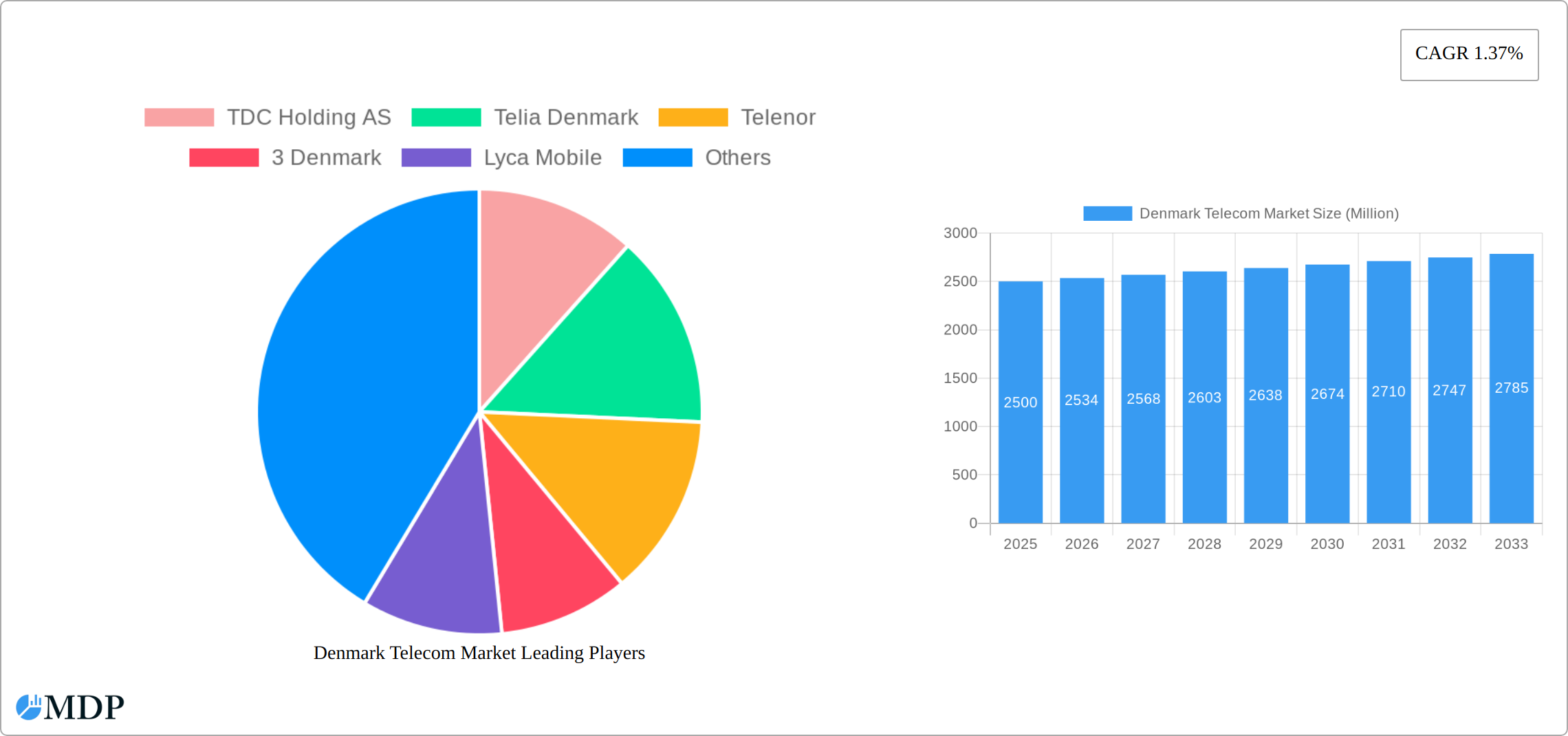

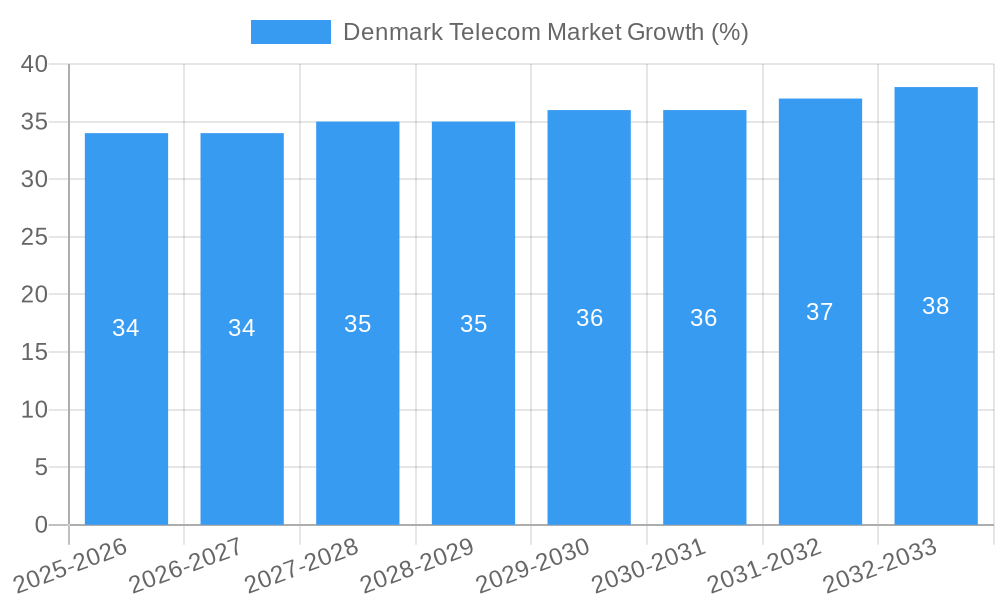

The Denmark Telecom market, valued at approximately €2.5 billion in 2025, is projected to experience steady growth, driven by increasing mobile penetration, the rise of 5G technology adoption, and a growing demand for high-speed internet services. Key players like TDC Holding AS, Telia Denmark, and Telenor dominate the landscape, fiercely competing through innovative offerings and network expansion. The market is segmented by service type (mobile, fixed-line, broadband), technology (4G, 5G, fiber optics), and customer type (residential, business). While the 1.37% CAGR indicates moderate growth, this is expected to accelerate slightly in the coming years due to ongoing investments in infrastructure modernization and the increasing adoption of cloud-based services by businesses. The market faces challenges such as intensifying competition, increasing regulatory scrutiny, and the need to manage rising operational costs. However, strategic partnerships, mergers and acquisitions, and focus on providing value-added services are expected to mitigate these restraints. The forecast period of 2025-2033 shows potential for growth as Denmark continues its digital transformation and businesses adopt advanced communication technologies.

The competitive landscape is characterized by both established players and emerging niche providers. The larger operators are focusing on expanding their 5G networks and offering bundled services to enhance customer loyalty and revenue streams. Smaller players are specializing in specific market niches, such as providing affordable mobile services to the immigrant population or focusing on specific business segments. The industry's future growth hinges on several factors including government policies supporting digital infrastructure development, the rate of 5G adoption among consumers and businesses, and the ongoing evolution of customer preferences for data-centric services. Successful navigation of these factors will be key to achieving projected growth targets.

Denmark Telecom Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Denmark Telecom Market, covering the period 2019-2033, with a focus on market dynamics, industry trends, leading players, and future opportunities. It leverages data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends until 2033. The report is essential for telecom operators, investors, technology providers, and regulatory bodies seeking actionable insights into this dynamic market.

Denmark Telecom Market Market Dynamics & Concentration

The Denmark telecom market exhibits a moderately concentrated structure, with a few major players holding significant market share. TDC Holding AS, Telia Denmark, and Telenor are the dominant players, collectively controlling approximately 75-80% of the market in 2024. However, smaller players like 3 Denmark and Lyca Mobile are making inroads, driven by competitive pricing and niche market strategies, capturing an increasing share of the budget-conscious and specific demographic segments. Market concentration is further influenced by ongoing mergers and acquisitions (M&A) activity, driven by the pursuit of economies of scale and diversification into emerging technologies. Over the historical period (2019-2024), there were approximately 5-7 M&A deals, with a clear focus on consolidation within the core mobile and broadband segments and strategic expansion into new technologies like 5G and the Internet of Things (IoT).

Innovation within the Danish telecom sector is fueled by a dual engine: proactive government initiatives promoting digitalization and fostering a conducive environment for smart city development, alongside the inherent competitive pressure to continuously offer advanced, value-added services. The regulatory framework, while generally supportive of healthy competition and consumer choice, also places a strong emphasis on ensuring robust consumer protection, promoting universal access, and incentivizing significant infrastructure investment, particularly in next-generation networks. Product substitution is primarily driven by the accelerating adoption of fiber optics for fixed broadband and the ongoing, ambitious rollout of 5G networks, which promise substantial improvements in speed, latency, and bandwidth compared to legacy technologies. End-user trends indicate a pronounced and growing demand for integrated bundled services (fixed-mobile convergence), data-centric plans with generous allowances, and sophisticated digital solutions that cater to both personal and professional needs, reflecting a highly digitally engaged populace.

- Market Concentration: Approximately 75-80% of the market share held by the top 3 players in 2024, with smaller players showing growth in specific niches.

- M&A Activity (2019-2024): Approximately 5-7 deals, focused on consolidation and expansion into 5G and IoT.

- Key Innovation Drivers: Government digitalization initiatives, rapid 5G rollout, strong competitive pressures, and increasing demand for IoT solutions.

- Regulatory Framework: Generally supportive of competition, with a strong focus on consumer protection, universal access, and infrastructure investment.

Denmark Telecom Market Industry Trends & Analysis

The Denmark Telecom market is characterized by a steady growth trajectory, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. This growth is fuelled by several factors, including increasing smartphone penetration, rising demand for high-speed internet, and government initiatives supporting digital infrastructure development. Technological disruptions, such as the widespread adoption of 5G and the growing importance of cloud computing, are fundamentally reshaping the industry landscape. Consumer preferences are shifting towards data-intensive applications, personalized services, and seamless connectivity across multiple devices. Competitive dynamics remain intense, with players vying for market share through innovative pricing strategies, service bundles, and strategic partnerships. Market penetration of 5G is expected to reach xx% by 2033, significantly impacting data consumption and service offerings.

Leading Markets & Segments in Denmark Telecom Market

The Danish telecom market demonstrates a relatively uniform geographical distribution of service penetration and adoption, with no single region exhibiting significantly higher uptake or growth rates than others. However, urban centers and densely populated areas tend to experience faster adoption of cutting-edge technologies like 5G and advanced fiber broadband due to their denser populations, existing robust infrastructure, and concentrated business activity. The key drivers for sustained market dominance and widespread adoption across the country include the presence of a world-class digital infrastructure, highly supportive government policies fostering innovation and digital transformation, and a demonstrably high level of digital literacy and adoption among consumers. The consistently strong economic performance and high disposable income within Denmark also contribute significantly to the relatively high demand and capacity for sophisticated telecom services. This homogenous market distribution suggests a broad, evenly spread consumption pattern of telecommunications services across the entire nation, indicating a mature and digitally integrated society.

- Key Drivers for Dominance:

- Ubiquitous and robust digital infrastructure, including extensive fiber optic networks.

- Proactive and supportive government policies promoting digitalization and digital inclusion.

- A highly digitally literate and tech-savvy consumer base.

- Sustained strong economic performance and high purchasing power.

Denmark Telecom Market Product Developments

Recent product developments focus heavily on 5G network enhancements, including improved synchronization capabilities as demonstrated by 3 Denmark's partnership with Net Insight. There's a strong emphasis on cloud-based solutions for enhanced network management and data analytics. These developments aim to improve network efficiency, enhance service reliability, and support the growing demand for high-bandwidth applications. The competitive advantage rests with operators that can effectively manage network capacity, offer competitive pricing, and provide superior customer service.

Key Drivers of Denmark Telecom Market Growth

The continued growth of the Denmark Telecom market is propelled by a confluence of powerful factors. The ever-increasing penetration of smartphones and a diverse array of connected devices, coupled with a soaring demand for high-speed, reliable internet access—fueled by the proliferation of high-definition streaming services, the widespread adoption of remote work models, and the burgeoning gaming sector—are primary growth engines. The ongoing, significant investment in advanced 5G infrastructure deployment is not only enhancing existing services but also creating a platform for new, data-intensive applications. Furthermore, proactive government initiatives aimed at enhancing national digital infrastructure, promoting digital inclusion, and fostering a connected society play a pivotal role in driving market expansion. The inherent economic stability and prosperity within Denmark also serve as a crucial supporting factor, ensuring a strong and consistent purchasing power for advanced telecom services among its population.

Challenges in the Denmark Telecom Market

The Danish telecom market, while robust, is not without its challenges. The significant upfront capital investment required for the comprehensive deployment and ongoing upgrade of 5G infrastructure presents a considerable financial hurdle. Potential global supply chain disruptions can impact the timely availability and cost of critical network equipment, leading to project delays and increased expenses. Moreover, the intense competitive landscape necessitates continuous efforts to offer highly competitive pricing structures, which can exert pressure on profit margins and necessitate innovative service bundling and cost management strategies. Effectively navigating these challenges while maintaining service quality and driving innovation will be crucial for sustained success.

Emerging Opportunities in Denmark Telecom Market

Long-term growth is fueled by the potential of innovative technologies like the Internet of Things (IoT), the expansion of 5G networks into previously underserved areas, and the increasing adoption of cloud-based services. Strategic partnerships and collaborations across different sectors (e.g., healthcare, smart city initiatives) offer further opportunities for market expansion and diversification.

Leading Players in the Denmark Telecom Market Sector

- TDC Holding AS

- Telia Denmark

- Telenor

- 3 Denmark

- Lyca Mobile

- MIT Tele (DLG Tele)

- Cibicom

- Net 1 Denmark

- Ericsson

Key Milestones in Denmark Telecom Market Industry

- January 2024: 3 Denmark partnered with Net Insight to enhance its 5G network synchronization, demonstrating a significant technological advancement.

- March 2024: TCS signed a multi-million-dollar deal with Nuuday for a major cloud transformation, highlighting the increasing importance of cloud computing in the telecom sector.

Strategic Outlook for Denmark Telecom Market

The future trajectory of the Denmark Telecom market appears exceptionally promising, underpinned by relentless technological innovation, the expanding geographical coverage and capabilities of 5G networks, and the ever-growing demand for data-intensive services across all sectors. Strategic partnerships between operators, technology providers, and government entities will be instrumental in accelerating infrastructure development and fostering new service ecosystems. Focused, sustained investments in network modernization and expansion, coupled with agile, customer-centric strategies that prioritize user experience and value-added services, will be vital for maintaining a competitive edge in this dynamic and rapidly evolving market. The market holds substantial untapped potential for growth, particularly in the areas of advanced Internet of Things (IoT) applications, the development and deployment of cutting-edge digital services for businesses and consumers, and the integration of telecommunications with emerging technologies like artificial intelligence and edge computing.

Denmark Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and Messaging Services

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Denmark Telecom Market Segmentation By Geography

- 1. Denmark

Denmark Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.37% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for 5G; Growth of IoT Usage in Telecom

- 3.3. Market Restrains

- 3.3.1. Rising Demand for 5G; Growth of IoT Usage in Telecom

- 3.4. Market Trends

- 3.4.1. Rising Demand for 5G

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Telecom Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and Messaging Services

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Denmark

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 TDC Holding AS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Telia Denmark

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Telenor

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 3 Denmark

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lyca Mobile

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MIT Tele (DLG Tele)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cibicom

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Net 1 Denmark

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ericsson*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 TDC Holding AS

List of Figures

- Figure 1: Denmark Telecom Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Denmark Telecom Market Share (%) by Company 2024

List of Tables

- Table 1: Denmark Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Denmark Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 3: Denmark Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Denmark Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 5: Denmark Telecom Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Telecom Market?

The projected CAGR is approximately 1.37%.

2. Which companies are prominent players in the Denmark Telecom Market?

Key companies in the market include TDC Holding AS, Telia Denmark, Telenor, 3 Denmark, Lyca Mobile, MIT Tele (DLG Tele), Cibicom, Net 1 Denmark, Ericsson*List Not Exhaustive.

3. What are the main segments of the Denmark Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for 5G; Growth of IoT Usage in Telecom.

6. What are the notable trends driving market growth?

Rising Demand for 5G.

7. Are there any restraints impacting market growth?

Rising Demand for 5G; Growth of IoT Usage in Telecom.

8. Can you provide examples of recent developments in the market?

March 2024: Tata Consultancy Services (TCS) signed a significant deal with Nuuday, Denmark's digital connectivity and communications provider. The agreement entails a substantial cloud transformation initiative. Valued in the multi-million-dollar range, TCS will oversee the complete overhaul of Nuuday's IT infrastructure. This overhaul includes migrating Nuuday's systems to TCS's hybrid cloud, setting the stage for further digital evolutions.January 2024: 3 Denmark selected Net Insight to enhance its 5G network's synchronization capabilities. By integrating Net Insight’s state-of-the-art Zyntai nodes, 3 Denmark is pioneering the adoption of this advanced synchronization solution. Collaborating closely, the two firms have been strategizing the deployment to cut synchronization costs and achieve GPS/GNSS independence. This procurement not only underlines a pivotal advancement in 3 Denmark's 5G evolution but also paves the way for a seamless network expansion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Telecom Market?

To stay informed about further developments, trends, and reports in the Denmark Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence