Key Insights

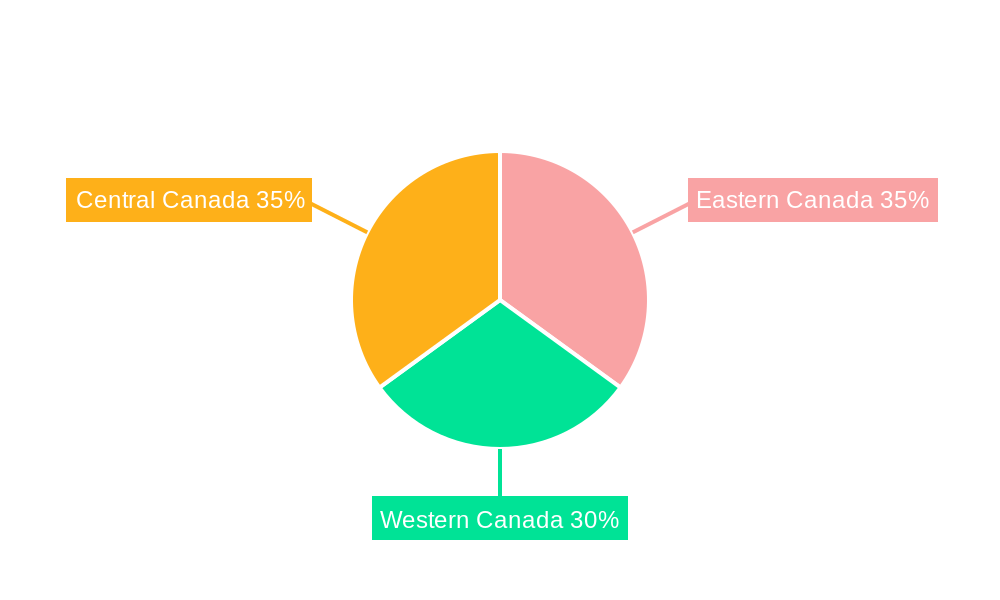

The Canadian e-commerce market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 14.50% from 2025 to 2033. This expansion is fueled by several key factors. Increasing internet and smartphone penetration across all regions of Canada (Eastern, Western, and Central) is driving greater online shopping adoption. Consumers are increasingly comfortable with online transactions and benefit from the convenience and wider selection offered by e-commerce platforms. Furthermore, the ongoing development of robust logistics and delivery infrastructure across the country is facilitating faster and more reliable shipping, contributing to a positive user experience and encouraging further growth. Major players like Amazon, Wayfair, Walmart, Best Buy, Home Depot, Kroger, Costco, Target, and Apple are actively investing in their Canadian e-commerce operations, further stimulating market competition and innovation. This competitive landscape benefits consumers through price competitiveness and a diversified range of products and services.

Despite the optimistic outlook, challenges remain. Competition amongst established players and new entrants requires ongoing adaptation and innovation to maintain market share. Concerns around data privacy and security continue to influence consumer behavior and require addressing through robust security measures. Furthermore, maintaining efficient logistics and supply chains, particularly during peak seasons, is crucial to ensuring a positive customer experience and preventing disruptions. However, given the ongoing trends of digital adoption and investment in infrastructure, the Canadian e-commerce market is well-positioned for sustained, significant growth over the forecast period. Considering a base year market size of $XX million in 2025 (the provided value was missing, and a specific value cannot be created without knowing the specific value from the original source), applying a 14.5% CAGR will substantially increase the market value by 2033.

Canada Ecommerce Industry Report: 2019-2033 - Unlocking Growth in the Canadian Digital Marketplace

This comprehensive report provides an in-depth analysis of the Canada ecommerce industry, covering market dynamics, key players, emerging trends, and future growth prospects from 2019 to 2033. Discover actionable insights to navigate the complexities of this rapidly evolving market, and uncover strategic opportunities for growth. The report utilizes data from 2019-2024 (Historical Period), with the base year set at 2025 and a forecast period extending to 2033 (Forecast Period: 2025-2033). The Estimated Year is 2025.

Canada Ecommerce Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of the Canadian ecommerce market, evaluating market concentration, innovation drivers, regulatory impacts, and key industry trends. We examine the influence of M&A activities, product substitution, and evolving end-user behaviors on market share distribution. Our analysis incorporates data on market share and the number of M&A deals concluded during the study period (2019-2024). The Canadian ecommerce market shows a high level of concentration, with key players like Amazon and Walmart holding significant market share. However, niche players and innovative startups are also emerging, increasing market competition.

- Market Concentration: Amazon and Walmart dominate, holding an estimated xx% and yy% market share respectively in 2025. This is expected to slightly decrease to xx% and yy% by 2033 due to increased competition.

- Innovation Drivers: Technological advancements such as AI-powered personalization, improved logistics, and mobile commerce are driving significant innovation.

- Regulatory Frameworks: Canadian regulations concerning data privacy, consumer protection, and online sales are constantly evolving, shaping industry practices.

- Product Substitutes: The rise of social commerce and the expansion of omnichannel retail strategies create substitute options for online purchases.

- End-User Trends: Increasing internet penetration and a preference for convenience are driving the growth of ecommerce. Younger demographics are particularly driving this increase.

- M&A Activities: The number of M&A deals within the Canadian ecommerce sector averaged xx per year from 2019-2024, indicating a moderately active consolidation phase.

Canada Ecommerce Industry Industry Trends & Analysis

This section provides a detailed analysis of the major trends shaping the Canadian ecommerce landscape. We examine the drivers of market growth, the impact of technological disruptions, evolving consumer preferences, and the competitive dynamics between established players and new entrants. The report will project the Compound Annual Growth Rate (CAGR) and market penetration rates for the forecast period (2025-2033). The Canadian ecommerce market is expected to experience a CAGR of xx% from 2025-2033. Market penetration is predicted to reach xx% of total retail sales by 2033, driven by factors such as rising internet and smartphone usage, increased consumer confidence in online shopping, and the expansion of logistics infrastructure. The growth of mobile commerce, coupled with a growing preference for personalized experiences, is also creating significant opportunities for businesses to engage consumers more effectively.

Leading Markets & Segments in Canada Ecommerce Industry

This section analyzes the dominant regions and segments within the Canadian e-commerce market, identifying key factors driving their success. We explore the influence of economic policies, infrastructure development, consumer behavior, and emerging trends shaping the landscape. The analysis utilizes bullet points for key drivers and paragraphs for deeper insights.

Dominant Segment: While precise market share projections require continuous monitoring, the apparel and footwear segment is currently a strong contender for dominance in the Canadian e-commerce market, fueled by factors detailed below. Further analysis is needed to definitively determine the most dominant segment by 2033 and its precise market share.

Key Drivers:

- Robust Economic Conditions and Consumer Confidence: Strong economic growth and rising disposable incomes, coupled with consumer confidence in online transactions, are significant drivers of e-commerce spending across various sectors. This is particularly evident in the preference for online shopping convenience.

- Improved Digital Infrastructure and Accessibility: Government investment in broadband internet infrastructure, coupled with increased mobile penetration, has significantly expanded the reach and accessibility of e-commerce across Canada, including in previously underserved regions. This improved connectivity is directly translating into higher online sales.

- Favorable Regulatory Environment and Consumer Protection: A relatively supportive regulatory framework, including measures to protect consumer rights and promote fair competition, encourages the growth of e-commerce businesses and fosters consumer trust. The increasing clarity around data privacy regulations also contributes to a more stable and confident online marketplace.

- Evolving Consumer Preferences and Shopping Habits: Canadian consumers are increasingly adopting omnichannel shopping behaviours, blending online and offline experiences. This shift, combined with a preference for convenience and a wider selection of products available online, drives growth within the e-commerce sector.

Canada Ecommerce Industry Product Developments

The Canadian ecommerce industry showcases continuous product innovation, fueled by technological advancements and evolving consumer demands. New product categories emerge regularly, while existing ones are refined to offer enhanced functionality and convenience. This leads to increased competition and a dynamic market landscape. The integration of augmented reality (AR) and virtual reality (VR) technologies for product visualization and personalized experiences is significantly influencing the retail space, leading to a more engaging and interactive online shopping journey. Furthermore, the adoption of sustainable and ethically sourced products is gaining traction as consumers are more mindful of their environmental impact.

Key Drivers of Canada Ecommerce Industry Growth

The growth of the Canadian e-commerce industry is propelled by several interconnected factors. These include the widespread adoption of smartphones and tablets, significantly increased internet penetration rates across all demographics, and the rising popularity of mobile commerce. Government initiatives supporting digital commerce, coupled with technological advancements such as improved payment gateways, sophisticated logistics networks, and enhanced cybersecurity measures, are accelerating this growth. Furthermore, a positive economic outlook and the increasing willingness of consumers to spend online are providing a robust foundation for sustained expansion.

Challenges in the Canada Ecommerce Industry Market

The Canadian ecommerce market faces several challenges. These include maintaining security and trust in online transactions, high logistics costs due to geographical distances and varying infrastructure, and the complexities of handling cross-border transactions. Competition from established players and international entrants also presents a significant hurdle. Furthermore, the evolving regulatory landscape presents ongoing challenges for companies navigating data privacy and consumer protection laws.

Emerging Opportunities in Canada Ecommerce Industry

The Canadian e-commerce market presents substantial long-term growth opportunities. The increasing adoption of mobile commerce and the demand for personalized online shopping experiences are particularly promising areas. Strategic partnerships between businesses and the development of innovative logistics solutions, particularly addressing geographical challenges in a vast country like Canada, are crucial for unlocking further growth. Furthermore, the rising demand for sustainable and ethical e-commerce practices, coupled with the expansion into niche markets catering to specific consumer needs, create opportunities for businesses prioritizing these values. The metaverse and Web3 present entirely new avenues for exploration and revenue generation.

Leading Players in the Canada Ecommerce Industry Sector

- Amazon

- Wayfair

- Zara

- Walmart

- Best Buy

- Home Depot

- Kroger

- Costco

- Target

- Apple

- Shopify (Noteworthy for its contribution to the Canadian e-commerce ecosystem)

Key Milestones in Canada Ecommerce Industry Industry

- April 2022: Amazon opened its most advanced technological supply chain in Canada, with plans to open three more Ontario facilities in 2023. This significantly enhances Amazon's logistics capabilities within the country.

- April 2022: The Home Depot Canada Foundation announced a $125 million investment increase to combat youth homelessness, demonstrating corporate social responsibility and potentially impacting brand perception positively.

- April 2022: Walmart Canada partnered with Stingray Retail Media Network, expanding its advertising capabilities and revenue streams. This highlights the growing importance of retail media networks in the Canadian ecommerce market.

Strategic Outlook for Canada Ecommerce Industry Market

The future of the Canadian e-commerce market remains positive. Continued technological innovation, alongside the increasing consumer preference for online shopping, will drive significant growth. Businesses that prioritize seamless customer experiences, leverage data analytics for effective personalization, and incorporate sustainable business practices will be well-positioned for success. The continued development of robust logistics infrastructure and supportive government policies, alongside adapting to evolving consumer expectations and technological advancements, will contribute to the industry's long-term potential. The ability to adapt to unforeseen challenges and quickly integrate new technologies will be a key factor determining success.

Canada Ecommerce Industry Segmentation

-

1. B2C E-commerce

- 1.1. Market size (GMV) for the period of 2017-2027

-

1.2. Market Segmentation - by Application

- 1.2.1. Beauty & Personal Care

- 1.2.2. Consumer Electronics

- 1.2.3. Fashion & Apparel

- 1.2.4. Food & Beverage

- 1.2.5. Furniture & Home

- 1.2.6. Others (Toys, DIY, Media, etc.)

- 2. Market size (GMV) for the period of 2017-2027

-

3. Application

- 3.1. Beauty & Personal Care

- 3.2. Consumer Electronics

- 3.3. Fashion & Apparel

- 3.4. Food & Beverage

- 3.5. Furniture & Home

- 3.6. Others (Toys, DIY, Media, etc.)

- 4. Beauty & Personal Care

- 5. Consumer Electronics

- 6. Fashion & Apparel

- 7. Food & Beverage

- 8. Furniture & Home

- 9. Others (Toys, DIY, Media, etc.)

-

10. B2B E-commerce

- 10.1. Market size for the period of 2017-2027

Canada Ecommerce Industry Segmentation By Geography

- 1. Canada

Canada Ecommerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Contactless Forms of Payment; Rise in Cross-Border Online Shopping; Penetration of Internet and Smartphone Usage

- 3.3. Market Restrains

- 3.3.1. Operational Compatibility Due to Growing Brand Value

- 3.4. Market Trends

- 3.4.1. Increasing internet users in Canada

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Ecommerce Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 5.1.1. Market size (GMV) for the period of 2017-2027

- 5.1.2. Market Segmentation - by Application

- 5.1.2.1. Beauty & Personal Care

- 5.1.2.2. Consumer Electronics

- 5.1.2.3. Fashion & Apparel

- 5.1.2.4. Food & Beverage

- 5.1.2.5. Furniture & Home

- 5.1.2.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Market size (GMV) for the period of 2017-2027

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Beauty & Personal Care

- 5.3.2. Consumer Electronics

- 5.3.3. Fashion & Apparel

- 5.3.4. Food & Beverage

- 5.3.5. Furniture & Home

- 5.3.6. Others (Toys, DIY, Media, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Beauty & Personal Care

- 5.5. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.6. Market Analysis, Insights and Forecast - by Fashion & Apparel

- 5.7. Market Analysis, Insights and Forecast - by Food & Beverage

- 5.8. Market Analysis, Insights and Forecast - by Furniture & Home

- 5.9. Market Analysis, Insights and Forecast - by Others (Toys, DIY, Media, etc.)

- 5.10. Market Analysis, Insights and Forecast - by B2B E-commerce

- 5.10.1. Market size for the period of 2017-2027

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 6. Eastern Canada Canada Ecommerce Industry Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Ecommerce Industry Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Ecommerce Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Amazon

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Wayfair*List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Zara

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Walmart

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Best Buy

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Home Depot

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Kroger

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Costco

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Target

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Apple

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Amazon

List of Figures

- Figure 1: Canada Ecommerce Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Ecommerce Industry Share (%) by Company 2024

List of Tables

- Table 1: Canada Ecommerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Ecommerce Industry Revenue Million Forecast, by B2C E-commerce 2019 & 2032

- Table 3: Canada Ecommerce Industry Revenue Million Forecast, by Market size (GMV) for the period of 2017-2027 2019 & 2032

- Table 4: Canada Ecommerce Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Canada Ecommerce Industry Revenue Million Forecast, by Beauty & Personal Care 2019 & 2032

- Table 6: Canada Ecommerce Industry Revenue Million Forecast, by Consumer Electronics 2019 & 2032

- Table 7: Canada Ecommerce Industry Revenue Million Forecast, by Fashion & Apparel 2019 & 2032

- Table 8: Canada Ecommerce Industry Revenue Million Forecast, by Food & Beverage 2019 & 2032

- Table 9: Canada Ecommerce Industry Revenue Million Forecast, by Furniture & Home 2019 & 2032

- Table 10: Canada Ecommerce Industry Revenue Million Forecast, by Others (Toys, DIY, Media, etc.) 2019 & 2032

- Table 11: Canada Ecommerce Industry Revenue Million Forecast, by B2B E-commerce 2019 & 2032

- Table 12: Canada Ecommerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 13: Canada Ecommerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Eastern Canada Canada Ecommerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Western Canada Canada Ecommerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Central Canada Canada Ecommerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada Ecommerce Industry Revenue Million Forecast, by B2C E-commerce 2019 & 2032

- Table 18: Canada Ecommerce Industry Revenue Million Forecast, by Market size (GMV) for the period of 2017-2027 2019 & 2032

- Table 19: Canada Ecommerce Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Canada Ecommerce Industry Revenue Million Forecast, by Beauty & Personal Care 2019 & 2032

- Table 21: Canada Ecommerce Industry Revenue Million Forecast, by Consumer Electronics 2019 & 2032

- Table 22: Canada Ecommerce Industry Revenue Million Forecast, by Fashion & Apparel 2019 & 2032

- Table 23: Canada Ecommerce Industry Revenue Million Forecast, by Food & Beverage 2019 & 2032

- Table 24: Canada Ecommerce Industry Revenue Million Forecast, by Furniture & Home 2019 & 2032

- Table 25: Canada Ecommerce Industry Revenue Million Forecast, by Others (Toys, DIY, Media, etc.) 2019 & 2032

- Table 26: Canada Ecommerce Industry Revenue Million Forecast, by B2B E-commerce 2019 & 2032

- Table 27: Canada Ecommerce Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Ecommerce Industry?

The projected CAGR is approximately 14.50%.

2. Which companies are prominent players in the Canada Ecommerce Industry?

Key companies in the market include Amazon, Wayfair*List Not Exhaustive, Zara, Walmart, Best Buy, Home Depot, Kroger, Costco, Target, Apple.

3. What are the main segments of the Canada Ecommerce Industry?

The market segments include B2C E-commerce, Market size (GMV) for the period of 2017-2027, Application, Beauty & Personal Care, Consumer Electronics, Fashion & Apparel, Food & Beverage, Furniture & Home, Others (Toys, DIY, Media, etc.), B2B E-commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Contactless Forms of Payment; Rise in Cross-Border Online Shopping; Penetration of Internet and Smartphone Usage.

6. What are the notable trends driving market growth?

Increasing internet users in Canada.

7. Are there any restraints impacting market growth?

Operational Compatibility Due to Growing Brand Value.

8. Can you provide examples of recent developments in the market?

May 2022- The robotics facility, which Amazon called (new window) its most advanced technological supply chain in Canada, opened in April 2022. In April, the company announced its plans to open three more Ontario facilities in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Ecommerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Ecommerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Ecommerce Industry?

To stay informed about further developments, trends, and reports in the Canada Ecommerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence