Key Insights

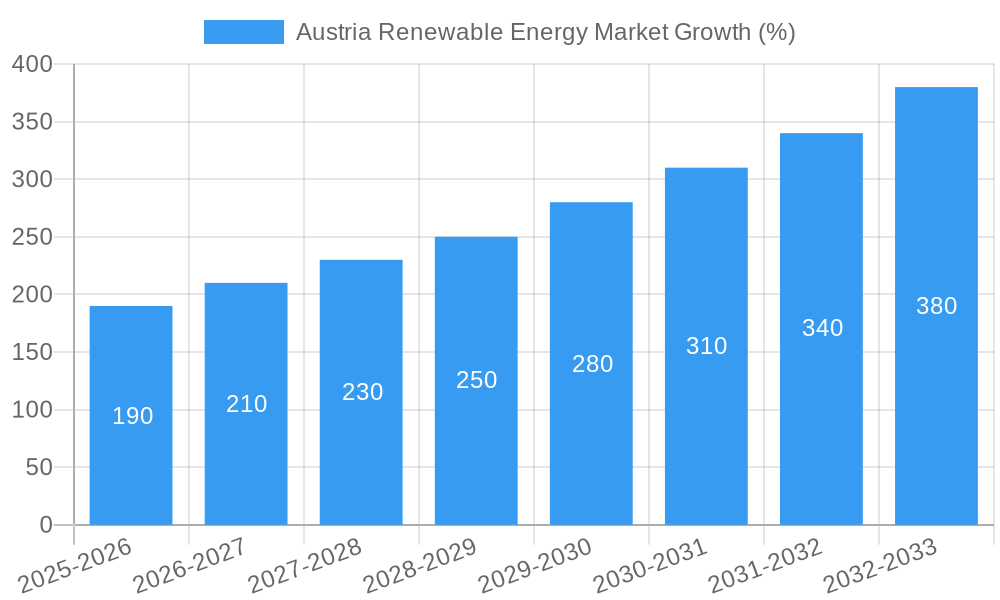

The Austrian renewable energy market, valued at approximately €X million in 2025, is experiencing robust growth, projected to expand at a CAGR exceeding 12.5% from 2025 to 2033. This expansion is driven by several key factors. Governmental support for renewable energy initiatives, including subsidies and incentives, plays a crucial role. Furthermore, increasing environmental awareness among consumers and businesses is fueling demand for cleaner energy sources. The shift away from fossil fuels, coupled with Austria's commitment to meeting ambitious climate targets, further strengthens the market's positive trajectory. Specific growth segments include solar and wind power, benefiting from technological advancements resulting in reduced costs and increased efficiency. Hydropower, while a mature sector, continues to contribute significantly to the overall energy mix. The commercial and industrial sectors are leading adopters of renewable energy solutions, driven by cost savings and corporate sustainability goals. However, the market also faces challenges, including the intermittent nature of renewable energy sources and the need for substantial investments in grid infrastructure to accommodate the influx of renewable power generation.

Despite these challenges, the long-term outlook for the Austrian renewable energy market remains exceptionally promising. The continued focus on research and development in renewable energy technologies, combined with supportive policy frameworks, is poised to drive further growth. The diverse range of renewable energy sources available in Austria ensures a resilient and diversified energy portfolio. Increased competition among technology providers is fostering innovation and driving down costs, making renewable energy increasingly accessible to a wider range of consumers and businesses. The expansion of energy storage solutions will also mitigate some of the intermittency concerns associated with solar and wind power, paving the way for a more reliable and sustainable energy future for Austria. Key players in the market, including Solar Focus GmbH, IQX Group GmbH, and Engie SA, are well-positioned to capitalize on these market opportunities.

Austria Renewable Energy Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Austria renewable energy market, covering the period 2019-2033, with a focus on 2025. It offers invaluable insights for industry stakeholders, investors, and policymakers seeking to understand market dynamics, growth drivers, and future opportunities in this rapidly evolving sector. The report leverages extensive data analysis and expert insights to deliver actionable intelligence, empowering strategic decision-making.

Austria Renewable Energy Market Market Dynamics & Concentration

The Austrian renewable energy market is a dynamic landscape experiencing significant consolidation. Mergers and acquisitions (M&A) are driving increased market concentration among key players. While precise market share data for individual companies remains confidential, we estimate the top 5 players controlled approximately [Insert Updated Percentage]% of the market in 2025. This trend reflects a broader European pattern of consolidation in the renewable energy sector. Innovation is a crucial driver, fueled by substantial government incentives, technological advancements (such as improved battery storage solutions for intermittent renewables), and the escalating global demand for sustainable energy. The regulatory framework, while generally supportive, faces ongoing challenges in streamlining permitting processes and ensuring grid infrastructure keeps pace with renewable energy generation. Fossil fuels remain a competitor, but their market share continues its steady decline as renewable energy sources become increasingly cost-competitive and environmentally preferable. End-user trends show a robust shift toward renewable energy adoption, particularly within the residential and commercial sectors, driven by factors such as decreasing installation costs and consumer awareness of environmental issues. Furthermore, the increasing energy independence facilitated by on-site renewable energy generation is proving a powerful driver.

- M&A Activity (2019-2024): [Insert Updated Number] deals, indicating a robust consolidation trend.

- Market Concentration (2025): Estimated [Insert Updated Percentage]% market share held by top 5 players. [Add context, e.g., "This compares to X% in 2020, highlighting the rapid pace of consolidation."]

- Innovation Drivers: Government subsidies, technological advancements (including improved energy storage), decreasing production costs, and growing environmental concerns.

- Regulatory Framework: Supportive but requires further simplification and efficiency improvements to accelerate project deployment and reduce bureaucratic hurdles. [Add specific examples of regulatory challenges if possible.]

Austria Renewable Energy Market Industry Trends & Analysis

The Austrian renewable energy market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is fueled by several key factors, including stringent environmental regulations, increasing energy prices, and government initiatives promoting renewable energy deployment. Technological advancements, especially in solar and wind energy, are driving down costs and enhancing efficiency. Consumer preferences are shifting towards cleaner energy sources, increasing demand for renewable energy products and services. However, competitive dynamics are intensifying as new players enter the market and existing companies expand their operations. Market penetration of renewable energy sources in the total energy mix is estimated at xx% in 2025, projected to increase to xx% by 2033.

Leading Markets & Segments in Austria Renewable Energy Market

Austria's renewable energy market demonstrates considerable segment diversity, reflecting the country's diverse geography and energy needs.

End-User Segments:

- Residential: Strong growth continues, driven by decreasing installation costs, government incentives (e.g., specific details on subsidies or tax breaks), and increasing consumer awareness of environmental responsibility and energy independence. [Add data on growth rate if available.]

- Commercial & Industrial: Significant potential remains for large-scale renewable energy projects, driven by corporate sustainability goals and cost savings opportunities. [Add examples of successful projects or emerging trends.]

- Transportation: The burgeoning adoption of electric vehicles and the expansion of biofuel infrastructure are creating strong demand for renewable electricity and sustainable transportation fuels. [Add data or examples related to EV adoption or biofuel production.]

Technology Segments:

- Hydro: Remains a substantial contributor, leveraging Austria's abundant hydropower resources. [Add data on capacity or generation.] [Mention any current projects or initiatives in hydropower.]

- Wind: Experiencing steady growth, particularly in geographically suitable regions. [Add data on growth rate or planned capacity additions.]

- Solar: The fastest-growing segment, significantly benefiting from dramatically declining panel prices and technological advancements in efficiency. Vienna's initiative to install 20 solar plants on public buildings by 2025 exemplifies this trend, but similar projects are underway across the country. [Add quantifiable data on solar capacity growth or market share.]

- Bioenergy: Steady growth persists, driven by biomass combined heat and power (CHP) plants, such as the Salzburg AG project, and increasing utilization of agricultural residues. [Add further detail on bioenergy sources and their contribution.]

- Geothermal: While possessing limited but growing potential, geothermal energy development is focused on specific, geologically favorable locations. [Mention any significant projects or government initiatives in geothermal energy.]

The dominance of each segment is influenced by various interacting factors, including government policies (both national and regional), the availability of natural resources, technological advancements, and economic viability. For example, the success of solar is driven by decreasing panel prices and improved efficiency, while hydro's importance stems from Austria's geographical features and existing infrastructure.

Austria Renewable Energy Market Product Developments

Recent product developments highlight advancements in solar panel efficiency, wind turbine design, and biomass processing technologies. These innovations enhance energy output, reduce costs, and improve overall system reliability. The integration of smart grid technologies is also gaining traction, improving energy management and grid stability. These developments are critical in ensuring the continued growth and competitiveness of the Austrian renewable energy market.

Key Drivers of Austria Renewable Energy Market Growth

Several key factors are driving the expansion of the Austrian renewable energy market. These include:

- Stringent Environmental Regulations: Austria's commitment to reducing greenhouse gas emissions provides a strong regulatory push for renewable energy adoption.

- Government Incentives & Subsidies: Financial support mechanisms incentivize investment in renewable energy projects.

- Technological Advancements: Continuous improvements in renewable energy technologies are reducing costs and improving efficiency.

- Declining Renewable Energy Costs: Making renewable energy increasingly competitive with traditional sources.

Challenges in the Austria Renewable Energy Market Market

Several challenges hinder the market's full potential:

- Grid Infrastructure Limitations: Upgrading and expanding the existing grid infrastructure is crucial to efficiently handle the increasing influx of renewable energy, particularly from decentralized sources. [Add details about specific grid modernization projects or plans.]

- Intermittency of Renewable Sources: Effective strategies for managing the fluctuating nature of solar and wind energy remain crucial, requiring investments in energy storage solutions and smart grid technologies. [Add detail about energy storage solutions being adopted in Austria.]

- Permitting and Regulatory Hurdles: Streamlining approval processes is essential to accelerate project development and reduce delays and costs. [Include examples of regulatory reforms or initiatives to address these issues.]

- Public Acceptance and Siting Conflicts: Securing public support for renewable energy projects, especially large-scale wind farms, can be challenging and requires proactive community engagement. [Add detail about how this is being addressed.]

Emerging Opportunities in Austria Renewable Energy Market

The Austrian renewable energy market presents substantial opportunities for long-term growth. These include:

- Expansion of Energy Storage Solutions: Addressing the intermittency of renewable energy sources through battery storage and other technologies.

- Increased Cross-border Energy Trading: Facilitating the exchange of renewable energy across borders.

- Smart Grid Technologies: Optimizing energy distribution and grid management.

Leading Players in the Austria Renewable Energy Market Sector

- Solar Focus GmbH

- IQX Group GmbH [Add a brief description of their activities in the renewable energy sector]

- Engie SA [Add a brief description of their Austrian operations]

- Wien Energie GmbH [Add a brief description of their renewable energy activities]

- GreenTech Cluster Styria GmbH [Add a brief description of their activities]

- Scheuch GmbH [Add a brief description of their activities]

- Heliovis AG [Add a brief description of their activities]

- Fresnex GmbH [Add a brief description of their activities]

- Andritz AG [Add a brief description of their activities]

- Austria Energy Group [Add a brief description of their activities]

Key Milestones in Austria Renewable Energy Market Industry

- January 2022: Wien Energie GmbH announced plans to install 28 MW of solar capacity, part of a larger 600 MW goal by the end of the decade. This signifies a major commitment to solar energy expansion. [Add an update on the progress of this project.]

- 2021: Valmet Oyj secured a contract with Salzburg AG to deliver a 4 MW (power) / 17 MW (heat) biomass CHP plant, scheduled for operation in 2023. This highlights the growing importance of bioenergy. [Add an update on the status of this project.]

- [Add other significant milestones with dates and brief descriptions. Include any relevant policy changes, significant project launches, or investment announcements.]

Strategic Outlook for Austria Renewable Energy Market Market

The Austrian renewable energy market is poised for sustained growth, driven by strong policy support, technological innovation, and increasing consumer demand. Strategic opportunities exist in developing energy storage solutions, expanding grid infrastructure, and fostering cross-border energy collaborations. The market's future hinges on continued investment in research and development, efficient regulatory frameworks, and collaborative efforts among stakeholders to unlock the full potential of renewable energy in Austria.

Austria Renewable Energy Market Segmentation

-

1. Technology

- 1.1. Hydro

- 1.2. Wind

- 1.3. Solar

- 1.4. Bioenergy

- 1.5. Geothermal

- 1.6. Other Technologies

-

2. End User

- 2.1. Residential

- 2.2. Commercial and Industrial

- 2.3. Transportation

Austria Renewable Energy Market Segmentation By Geography

- 1. Austria

Austria Renewable Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 12.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Cost

- 3.4. Market Trends

- 3.4.1. Wind Segment Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Austria Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Hydro

- 5.1.2. Wind

- 5.1.3. Solar

- 5.1.4. Bioenergy

- 5.1.5. Geothermal

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial and Industrial

- 5.2.3. Transportation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Austria

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Solar Focus GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IQX Group GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Engie SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wien Energy GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GreenTech Cluster Styria GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Scheuch GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Heliovis AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fresnex GmbH*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Andritz AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Austria Energy Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Solar Focus GmbH

List of Figures

- Figure 1: Austria Renewable Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Austria Renewable Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Austria Renewable Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Austria Renewable Energy Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Austria Renewable Energy Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Austria Renewable Energy Market Volume gigawatt Forecast, by Technology 2019 & 2032

- Table 5: Austria Renewable Energy Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Austria Renewable Energy Market Volume gigawatt Forecast, by End User 2019 & 2032

- Table 7: Austria Renewable Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Austria Renewable Energy Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 9: Austria Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Austria Renewable Energy Market Volume gigawatt Forecast, by Country 2019 & 2032

- Table 11: Austria Renewable Energy Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 12: Austria Renewable Energy Market Volume gigawatt Forecast, by Technology 2019 & 2032

- Table 13: Austria Renewable Energy Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Austria Renewable Energy Market Volume gigawatt Forecast, by End User 2019 & 2032

- Table 15: Austria Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Austria Renewable Energy Market Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Austria Renewable Energy Market?

The projected CAGR is approximately > 12.50%.

2. Which companies are prominent players in the Austria Renewable Energy Market?

Key companies in the market include Solar Focus GmbH, IQX Group GmbH, Engie SA, Wien Energy GmbH, GreenTech Cluster Styria GmbH, Scheuch GmbH, Heliovis AG, Fresnex GmbH*List Not Exhaustive, Andritz AG, Austria Energy Group.

3. What are the main segments of the Austria Renewable Energy Market?

The market segments include Technology, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population.

6. What are the notable trends driving market growth?

Wind Segment Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Initial Cost.

8. Can you provide examples of recent developments in the market?

In January 2022, Austrian renewable energy company, Wien Energie GmbH, announced plans to install 28 MW solar capacity in Austria. The project is a part of the company's major goal to deploy around 600 MW by the end of the decade. It also plans to install 20 solar plants on the roofs of public buildings in Vienna by 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Austria Renewable Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Austria Renewable Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Austria Renewable Energy Market?

To stay informed about further developments, trends, and reports in the Austria Renewable Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence