Key Insights

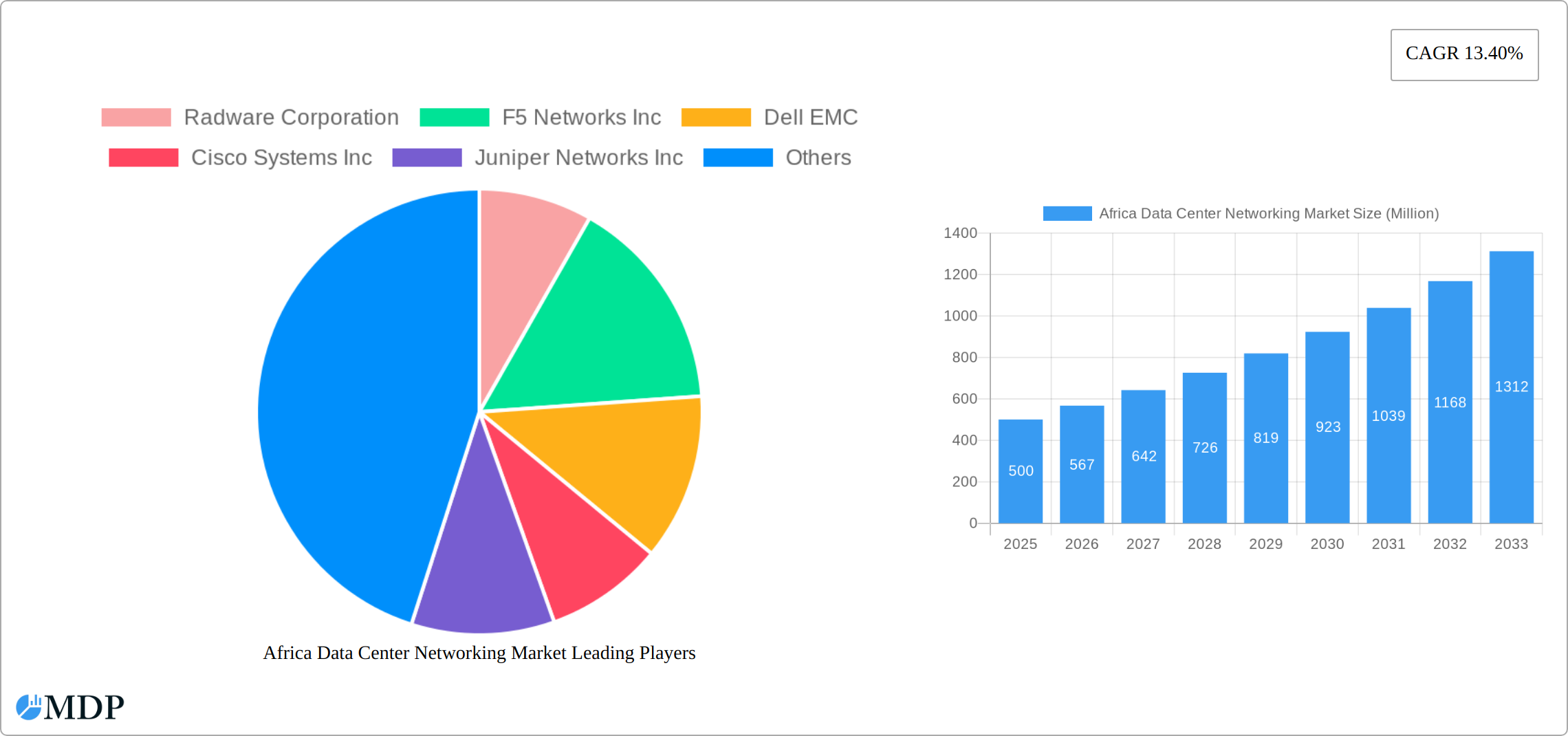

The Africa Data Center Networking market is experiencing robust growth, driven by increasing digital transformation initiatives across various sectors. The expanding adoption of cloud computing, the surge in data traffic generated by the burgeoning mobile user base, and the rising demand for high-speed internet connectivity are key catalysts. A compound annual growth rate (CAGR) of 13.40% from 2019 to 2024 suggests a significant market expansion. While precise market size figures for 2019-2024 aren't provided, we can reasonably estimate the 2024 market size based on the 13.40% CAGR and a projected 2025 value. Assuming a relatively stable growth rate throughout the historical period, and considering the market's current trajectory, the IT & Telecommunication, BFSI (Banking, Financial Services, and Insurance), and Government sectors are primary drivers, representing a significant portion of the end-user segment. The increasing adoption of Software-Defined Networking (SDN) and Network Function Virtualization (NFV) technologies is shaping market trends, offering greater flexibility and scalability for data center operations. However, factors such as limited infrastructure investment in certain African regions and a relative lack of skilled IT professionals pose potential restraints to the market's growth. The market is segmented by end-user (IT & Telecommunication, BFSI, Government, Media & Entertainment, and Other End-Users) and by component (Products, Other Networking Equipment, and Services). Leading vendors include Radware, F5 Networks, Dell EMC, Cisco, Juniper, and others, fiercely competing for market share with a focus on delivering advanced networking solutions tailored to the specific needs of the African data center landscape. The forecast period of 2025-2033 promises continued expansion, with further investments in infrastructure and technology expected to propel market growth.

The projected growth in the Africa Data Center Networking market is largely influenced by ongoing governmental initiatives to promote digital infrastructure development across the continent. Investments in fiber optic networks and improved internet connectivity are laying the foundation for further expansion. This development is particularly noticeable in rapidly growing economies such as Kenya, South Africa, and others across the region. The increasing adoption of cloud-based services and the rising demand for robust data storage solutions further contribute to this market growth. As businesses across all sectors seek to enhance their digital capabilities, the need for reliable and efficient data center networking solutions will become increasingly critical. Competitive pressures from established global players and the emergence of local providers will continue shaping the market landscape. However, the overall outlook remains positive, projecting substantial growth opportunities in the coming years. The focus will likely be on delivering cost-effective, scalable, and resilient solutions that address the unique challenges and opportunities presented by the diverse African market.

Africa Data Center Networking Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic Africa Data Center Networking Market, offering invaluable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report utilizes rigorous data analysis to project market trends and growth opportunities. The report covers key market segments, leading players, and emerging trends, delivering actionable intelligence to guide strategic decision-making. The market size is projected to reach xx Million by 2033, exhibiting a significant CAGR of xx%.

Africa Data Center Networking Market Market Dynamics & Concentration

The Africa Data Center Networking Market is characterized by a dynamic landscape, showcasing a healthy blend of established global providers and a burgeoning ecosystem of innovative regional players. While a few major entities command significant market share, the competitive intensity is steadily increasing, fostering an environment ripe for technological advancement. Market concentration, currently estimated at approximately XX% in 2024, with the top 5 entities collectively holding around XX% of the market share, underscores the opportunities for new entrants and specialized providers. Key growth enablers include the accelerating adoption of cloud services, the widespread rollout of 5G infrastructure, and the burgeoning digital economy across the continent, all of which are fueling an insatiable demand for high-speed, reliable, and scalable networking solutions. Although regulatory frameworks are still maturing in certain areas, there's a discernible trend towards policies that increasingly support technological progress and attract foreign investment. The emergence of Software-Defined Networking (SDN) and other advanced solutions presents both disruptive challenges and significant opportunities for traditional networking vendors to evolve their offerings. End-user behavior is marked by a pronounced shift towards cloud-native solutions and hybrid infrastructure models, with the IT & Telecommunication and Banking, Financial Services, and Insurance (BFSI) sectors leading this transformation. The period between 2019 and 2024 has witnessed moderate merger and acquisition (M&A) activity, with approximately XX deals recorded. These transactions have primarily involved consolidation, with larger entities acquiring smaller companies to bolster their market reach, technological capabilities, and product portfolios.

- Market Concentration (2024): Approximately XX%, with the top 5 players holding about XX% of the market share.

- M&A Deal Count (2019-2024): XX strategic transactions recorded.

- Key Innovation Drivers: Pervasive cloud adoption, rapid 5G network expansion, and a growing imperative for high-capacity, low-latency connectivity.

- Regulatory Landscape: Increasingly conducive to digital transformation, with a growing emphasis on creating supportive environments for technological infrastructure development.

- End-User Trends: A significant migration towards flexible, scalable, and secure cloud-based networking solutions and hybrid architectures.

Africa Data Center Networking Market Industry Trends & Analysis

The Africa Data Center Networking Market is experiencing a period of robust and sustained growth, propelled by a compelling synergy of factors. The pervasive adoption of cloud computing services and the rapid proliferation of new data center facilities across the continent are primary catalysts, driving an unprecedented demand for sophisticated networking solutions that can support increased data volumes and faster processing. Technological advancements, including the transformative impact of 5G network deployments and the adoption of Software-Defined Networking (SDN), are further accelerating market expansion and reshaping network architectures. Consumer expectations are evolving, with a clear demand for enhanced bandwidth, robust security protocols, and unwavering connectivity reliability, directly influencing product development and service innovation by market participants. Competitive dynamics are intensifying, characterized by a strategic race for market share among both established global technology giants and agile, emerging regional vendors. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% over the forecast period (2025-2033), with an anticipated market valuation of XX Million by the end of 2033. Notably, the penetration of advanced networking solutions in Africa remains comparatively lower than in more developed regions, presenting a substantial and largely untapped growth opportunity for market players.

Leading Markets & Segments in Africa Data Center Networking Market

The IT & Telecommunication sector currently dominates the Africa Data Center Networking Market, accounting for xx% of the overall market share in 2024. This is driven by the increasing need for robust network infrastructure to support the expansion of telecom services and digital infrastructure development across the continent. The BFSI sector is also a key segment, with strong demand for secure and reliable networking solutions to support financial transactions and data management. The Government sector is witnessing increasing investment in digital transformation initiatives, further stimulating market growth.

- Dominant End-User Segment: IT & Telecommunication (xx% market share in 2024)

- Key Drivers for IT & Telecommunication Segment: Expanding telecom infrastructure, increasing mobile penetration, and investments in digital transformation projects.

- Key Drivers for BFSI Segment: Growing demand for secure transaction processing, data security, and regulatory compliance.

- Key Drivers for Government Segment: Initiatives focused on e-governance, public cloud adoption, and digital service delivery.

- Dominant Component Segment: Product (xx% market share in 2024)

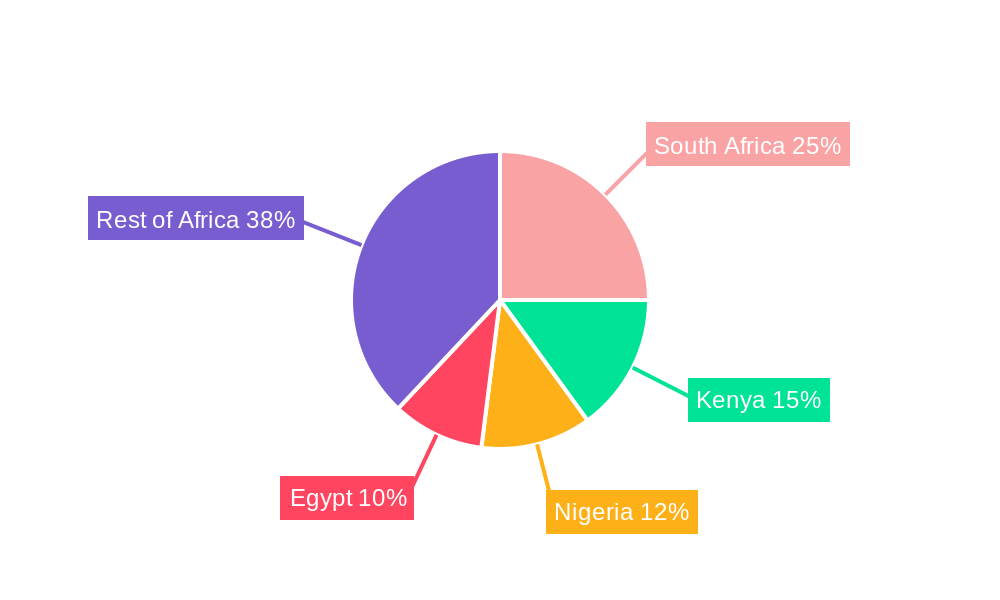

- Geographic Dominance: South Africa, Nigeria, Kenya currently lead the market, driven by higher IT spend, economic growth and digital transformation initiatives.

South Africa is currently the leading market, followed by Nigeria and Kenya, reflecting their relatively advanced IT infrastructure and strong economic growth. These countries are attracting significant investments in data center development, providing a strong foundation for the growth of the networking market.

Africa Data Center Networking Market Product Developments

Recent product innovations are focused on addressing the growing demand for high-bandwidth, low-latency, secure, and scalable networking solutions. This includes advancements in SDN, network virtualization, and cloud-based networking technologies. Manufacturers are also focusing on developing solutions tailored to the specific needs of African markets, considering factors such as power constraints and network infrastructure limitations. The competitive advantage is increasingly determined by the ability to offer innovative, cost-effective, and reliable solutions that cater to the unique challenges of the African landscape.

Key Drivers of Africa Data Center Networking Market Growth

Several factors are driving the growth of the Africa Data Center Networking Market. Rapid urbanization and increasing internet penetration are fueling demand for enhanced connectivity. Government initiatives promoting digitalization and investments in infrastructure are creating favorable conditions for market expansion. Furthermore, the growing adoption of cloud computing and the rise of data-centric businesses are significantly contributing to the market's momentum. Technological advancements, such as the deployment of 5G networks, are further accelerating growth.

Challenges in the Africa Data Center Networking Market Market

Despite its promising growth trajectory, the Africa Data Center Networking Market faces several significant hurdles that could impede its full potential. Pervasive infrastructure limitations, particularly in less developed regions, present substantial barriers to widespread market expansion and the deployment of advanced networking solutions. Unreliable power supply and frequent outages pose a critical challenge, not only disrupting network operations and leading to downtime but also significantly escalating operational costs for data centers. Navigating complex and often inconsistent regulatory frameworks across various African nations can create uncertainty and deter crucial investment. Furthermore, the market grapples with intense competition, where established global players and nimble local vendors are vigorously vying for market share. If these challenges are not effectively mitigated through strategic planning and collaborative efforts, they could potentially temper the market's impressive growth momentum. For instance, the impact of unreliable power on data center service availability is estimated to be as high as XX% annually.

Emerging Opportunities in Africa Data Center Networking Market

Despite the challenges, the Africa Data Center Networking Market presents significant long-term growth opportunities. Strategic partnerships between international vendors and local players can help overcome infrastructure limitations and enhance market penetration. The increasing adoption of mobile money and digital financial services creates strong demand for secure and reliable networking solutions. Furthermore, government initiatives to promote digital literacy and develop digital skills are paving the way for increased technological adoption and market expansion. The potential for growth is considerable, especially with the expected rise in cloud adoption across various sectors.

Leading Players in the Africa Data Center Networking Market Sector

- Radware Corporation

- F5 Networks Inc

- Dell EMC

- Cisco Systems Inc

- Juniper Networks Inc

- Extreme Networks Inc

- NEC Corporation

- A10 Networks Inc

- Huawei Technologies Co Ltd

- TP-Link Corporation Limited

- Array Networks Inc

- Moxa Inc

- H3C Holding Limited

- VMware Inc

Key Milestones in Africa Data Center Networking Market Industry

- July 2023: Moxa bolstered the market's offering of high-performance, versatile networking solutions with the introduction of its MDS-G4020-L3-4XGS series of Ethernet switches. This strategic launch directly addresses the escalating demand for resilient and capable networking within modern data center environments.

- March 2023: F5 Networks Inc. revolutionized multi-cloud networking with the launch of its comprehensive multi-cloud networking (MCN) capabilities. This innovation empowers organizations to seamlessly extend application and security services across diverse cloud environments, thereby simplifying the management of complex, distributed network infrastructures.

Strategic Outlook for Africa Data Center Networking Market Market

The Africa Data Center Networking Market presents a compelling and substantial opportunity for sustained long-term growth and strategic expansion. Continued and targeted investments in critical infrastructure development, complemented by proactive government initiatives aimed at accelerating digitalization across the continent, will collectively foster an increasingly favorable environment for market expansion. The escalating adoption of cloud computing paradigms and the ever-growing demand for secure, reliable, and high-performance networking solutions are poised to be significant drivers of future market growth. To effectively capitalize on the vast potential inherent in this dynamic region, vendors should strategically focus on developing innovative solutions that are precisely tailored to meet the unique needs and address the specific challenges of the African market. A key strategic imperative should be to forge strong partnerships, prioritize localization efforts, and consistently deliver robust, dependable, and cost-effective solutions that acknowledge and overcome the continent's distinct infrastructure limitations.

Africa Data Center Networking Market Segmentation

-

1. Component

-

1.1. By Product

- 1.1.1. Ethernet Switches

- 1.1.2. Router

- 1.1.3. Storage Area Network (SAN)

- 1.1.4. Application Delivery Controller (ADC)

- 1.1.5. Other Networking Equipment

-

1.2. By Services

- 1.2.1. Installation & Integration

- 1.2.2. Training & Consulting

- 1.2.3. Support & Maintenance

-

1.1. By Product

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

Africa Data Center Networking Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Data Center Networking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need of Cloud Storage; Increasing Cyberattacks Among Enterprises

- 3.3. Market Restrains

- 3.3.1. Increasing Network Complexity

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. By Product

- 5.1.1.1. Ethernet Switches

- 5.1.1.2. Router

- 5.1.1.3. Storage Area Network (SAN)

- 5.1.1.4. Application Delivery Controller (ADC)

- 5.1.1.5. Other Networking Equipment

- 5.1.2. By Services

- 5.1.2.1. Installation & Integration

- 5.1.2.2. Training & Consulting

- 5.1.2.3. Support & Maintenance

- 5.1.1. By Product

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. South Africa Africa Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Radware Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 F5 Networks Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Dell EMC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Cisco Systems Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Juniper Networks Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Extreme Networks Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 NEC Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 A10 Networks Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Huawei Technologies Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 TP-Link Corporation Limited

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Array Networks Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Moxa Inc *List Not Exhaustive

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 H3C Holding Limited

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 VMware Inc

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 Radware Corporation

List of Figures

- Figure 1: Africa Data Center Networking Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Data Center Networking Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Data Center Networking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Data Center Networking Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Africa Data Center Networking Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Africa Data Center Networking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Africa Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa Africa Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan Africa Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda Africa Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania Africa Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya Africa Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa Africa Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Africa Data Center Networking Market Revenue Million Forecast, by Component 2019 & 2032

- Table 13: Africa Data Center Networking Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 14: Africa Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Nigeria Africa Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Africa Africa Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Egypt Africa Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kenya Africa Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Ethiopia Africa Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Morocco Africa Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Ghana Africa Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Algeria Africa Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Tanzania Africa Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Ivory Coast Africa Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Data Center Networking Market?

The projected CAGR is approximately 13.40%.

2. Which companies are prominent players in the Africa Data Center Networking Market?

Key companies in the market include Radware Corporation, F5 Networks Inc, Dell EMC, Cisco Systems Inc, Juniper Networks Inc, Extreme Networks Inc, NEC Corporation, A10 Networks Inc, Huawei Technologies Co Ltd, TP-Link Corporation Limited, Array Networks Inc, Moxa Inc *List Not Exhaustive, H3C Holding Limited, VMware Inc.

3. What are the main segments of the Africa Data Center Networking Market?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need of Cloud Storage; Increasing Cyberattacks Among Enterprises.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Share.

7. Are there any restraints impacting market growth?

Increasing Network Complexity.

8. Can you provide examples of recent developments in the market?

July 2023: Moxa introduced its MDS-G4020-L3-4XGS series of Ethernet switches, a highly versatile line of Layer 3 full Gigabit modular managed switches. This series offers support for four 10GbE ports and sixteen Gigabit ports, including four embedded ports. Furthermore, it includes four interface module expansion slots and two power module slots, ensuring the utmost flexibility for a wide range of applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Data Center Networking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Data Center Networking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Data Center Networking Market?

To stay informed about further developments, trends, and reports in the Africa Data Center Networking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence