Key Insights

Vietnam's rigid plastic packaging market is projected for substantial expansion, propelled by a growing consumer goods sector, particularly in food & beverage, personal care, and pharmaceuticals. A projected Compound Annual Growth Rate (CAGR) of 2.37% from 2025 to 2032 indicates sustained demand for efficient and cost-effective packaging. This growth is underpinned by increasing disposable incomes, urbanization, and a rise in convenient, ready-to-consume products. Key market trends include the adoption of lightweighting techniques for cost and environmental benefits, a growing preference for sustainable and recyclable plastics, and the emergence of innovative packaging designs to enhance product appeal and shelf life. The market is segmented by packaging type (bottles, containers, films), material type (PET, HDPE, PP), and end-use industry. The estimated market size for 2025 is $11.93 billion. Leading players such as Taiwan Hon Chaun Group, ALPLA, and Bericap, alongside domestic Vietnamese enterprises, shape a competitive landscape characterized by established firms leveraging economies of scale and emerging players targeting niche markets. Potential market constraints include volatile raw material prices, plastic waste management concerns, and regulatory oversight on plastic utilization.

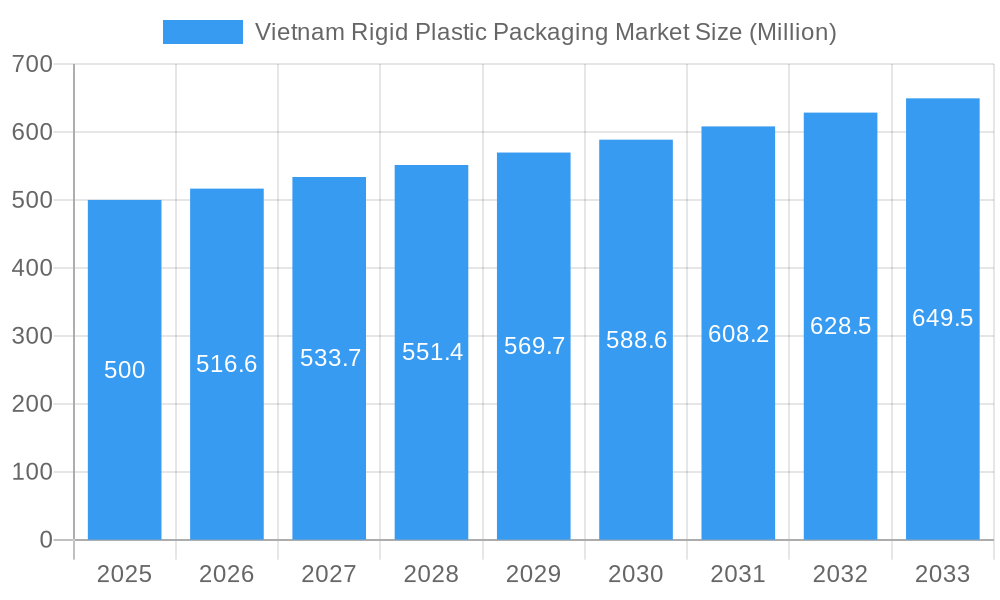

Vietnam Rigid Plastic Packaging Market Market Size (In Billion)

The future trajectory of Vietnam's rigid plastic packaging market is intrinsically linked to its adaptability to evolving consumer demands and environmental considerations. Embracing sustainable packaging practices, including enhanced recyclability and the incorporation of recycled content, will be critical for sustained growth. Innovations in packaging technology, such as lighter designs and improved barrier properties, will further bolster market competitiveness. Effective plastic waste management systems and supportive government policies for the manufacturing sector are also anticipated to fuel expansion within this dynamic market segment. Deeper research into specific sub-segments will provide enhanced clarity on future market dynamics.

Vietnam Rigid Plastic Packaging Market Company Market Share

Vietnam Rigid Plastic Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Vietnam Rigid Plastic Packaging Market, offering crucial insights for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages rigorous research to deliver actionable intelligence. Expect detailed market sizing, competitive landscapes, and future projections, all presented in a clear and accessible format. Maximize your understanding of this dynamic market and make informed strategic decisions.

Vietnam Rigid Plastic Packaging Market Market Dynamics & Concentration

The Vietnam rigid plastic packaging market exhibits a moderately concentrated landscape, with both established multinational corporations and domestic players vying for market share. The market's size in 2025 is estimated at xx Million USD, projected to reach xx Million USD by 2033, demonstrating a robust CAGR of xx%. Market concentration is influenced by factors like technological advancements, regulatory changes, and the increasing demand for sustainable packaging solutions. Major players such as Taiwan Hon Chaun Group, ALPLA Werke Alwin Lehner GmbH & Co KG, and Greif Inc. hold significant market share, while several smaller, agile companies contribute to a competitive ecosystem.

- Innovation Drivers: The market is driven by continuous innovation in materials, manufacturing processes, and design. Lightweighting initiatives and the rising demand for eco-friendly packaging are key factors.

- Regulatory Framework: Government regulations concerning material recyclability and waste management significantly impact market dynamics. Compliance requirements and evolving environmental standards influence packaging choices.

- Product Substitutes: While rigid plastic packaging dominates, alternative materials like paperboard and biodegradable plastics present competitive challenges. The market's responsiveness to these alternatives is a critical factor.

- End-User Trends: The booming food and beverage, consumer goods, and industrial sectors fuel demand for rigid plastic packaging. Changing consumer preferences for convenience and sustainability influence packaging choices.

- M&A Activities: The number of M&A deals in the period 2019-2024 was estimated at xx, reflecting consolidation and expansion efforts by major players. These activities reshape the market structure and intensify competition. Market share consolidation is expected to increase further in the forecast period.

Vietnam Rigid Plastic Packaging Market Industry Trends & Analysis

The Vietnam rigid plastic packaging market demonstrates significant growth potential, driven by a combination of factors. The market is experiencing a growth trajectory fueled by rapid economic expansion, increasing industrialization, and a rising consumer base. Technological advancements in materials science and manufacturing processes are improving efficiency and sustainability. Consumer preferences toward convenience and product protection are also driving demand. However, challenges such as fluctuating raw material prices and environmental concerns necessitate innovative and sustainable solutions.

The CAGR for the period 2025-2033 is projected at xx%, reflecting robust market expansion. Market penetration of new materials and technologies is expected to increase steadily, with a focus on lightweighting, recyclability, and enhanced barrier properties. The competitive landscape features a mix of established international players and local manufacturers, leading to dynamic interactions and innovations. The market is also witnessing an increased emphasis on customization and value-added services to cater to diverse end-user needs.

Leading Markets & Segments in Vietnam Rigid Plastic Packaging Market

The Southern region of Vietnam dominates the rigid plastic packaging market due to its concentration of manufacturing, export-oriented industries, and higher consumer spending. Key drivers for this dominance include robust industrial growth, a strong export market, and well-established infrastructure.

- Key Drivers in Southern Vietnam:

- Concentrated industrial zones

- Strong export-oriented economy

- Developed logistics and transportation networks

- Higher per capita income and consumer spending

The food and beverage sector emerges as the leading segment, driven by the demand for protective and attractive packaging for diverse food and beverage products. This is followed by the consumer goods and industrial goods sectors. The dominance of these segments reflects the high volume of products requiring rigid plastic packaging for protection and marketing.

Vietnam Rigid Plastic Packaging Market Product Developments

Recent product innovations focus on sustainable and recyclable materials, such as PET and other bio-based polymers. Lightweight designs are gaining traction to minimize material use and transportation costs. Improved barrier properties ensure longer shelf life and enhanced product protection. These innovations enhance the market fit by catering to the growing demand for environmentally conscious and cost-effective solutions. The integration of smart packaging technologies, including QR codes and RFID, is also emerging as a key development trend.

Key Drivers of Vietnam Rigid Plastic Packaging Market Growth

Several key factors drive the growth of the Vietnam rigid plastic packaging market. Rapid economic growth and industrialization create high demand for packaging solutions across various sectors. The increasing urbanization and growing middle class lead to higher consumer spending and packaging consumption. Technological advancements, particularly in materials science and manufacturing, enhance product quality and efficiency. Supportive government policies towards industrial development and infrastructure also contribute to the market's expansion.

Challenges in the Vietnam Rigid Plastic Packaging Market Market

The market faces challenges such as fluctuating raw material prices, which impact production costs and profitability. Environmental regulations and sustainability concerns necessitate investment in eco-friendly solutions. Intense competition from both domestic and international players pressures pricing and margins. The reliance on imported raw materials can lead to supply chain vulnerabilities.

Emerging Opportunities in Vietnam Rigid Plastic Packaging Market

The rising adoption of sustainable and eco-friendly packaging presents substantial opportunities for market growth. Technological breakthroughs, such as advancements in bio-plastics and recyclable materials, open new avenues for innovation. Strategic partnerships and collaborations among market players can foster innovation and market penetration. Expansion into emerging market segments, such as e-commerce and specialized packaging solutions, offers additional growth avenues.

Leading Players in the Vietnam Rigid Plastic Packaging Market Sector

- Taiwan Hon Chaun Group

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Bericap Holding GmbH

- Duy Tan Plastics Corporation

- IML Containers (Groupe Lacroix)

- Inplas Vietnam JSC

- Indorama Ventures Vietnam

- Greif Inc

Key Milestones in Vietnam Rigid Plastic Packaging Market Industry

- May 2024: ALPLA Werke Alwin Lehner GmbH & Co. KG launched a recyclable PET wine bottle, aiming for 1 Million units by 2025. This highlights the market's shift toward sustainable packaging.

- May 2024: Greif Inc. showcased innovative plastic packaging solutions at ProPak Asia 2024, emphasizing the company's commitment to the regional market. This reflects the ongoing innovation and competition in the sector.

Strategic Outlook for Vietnam Rigid Plastic Packaging Market Market

The Vietnam rigid plastic packaging market shows promising long-term growth potential, driven by continued economic expansion, increasing consumer demand, and ongoing innovations in sustainable packaging solutions. Strategic partnerships and investments in research and development will be crucial for companies to maintain a competitive edge. Focus on sustainable materials, lightweight designs, and efficient manufacturing processes will be key to capturing market share and meeting evolving consumer preferences. The market offers significant opportunities for companies that can adapt to the changing regulatory landscape and consumer demands.

Vietnam Rigid Plastic Packaging Market Segmentation

-

1. Product Type

- 1.1. Bottles and Jars

- 1.2. Trays and Containers

- 1.3. Caps and Closures

- 1.4. Intermediate Bulk Containers (IBCs)

- 1.5. Drums

- 1.6. Pallets

- 1.7. Other Product Types

-

2. Material

-

2.1. Polyethylene (PE)

- 2.1.1. LDPE & LLDPE

- 2.1.2. HDPE

- 2.2. Polyethylene Terephthalate (PET)

- 2.3. Polypropylene (PP)

- 2.4. Polystyrene (PS) and Expanded Polystyrene (EPS)

- 2.5. Polyvinyl Chloride (PVC)

- 2.6. Other Rigid Plastic Packaging Materials

-

2.1. Polyethylene (PE)

-

3. End-Use Industries

-

3.1. Food**

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Food Products

-

3.2. Foodservice**

- 3.2.1. Quick Service Restaurants (QSRs)

- 3.2.2. Full-Service Restaurants (FSRs)

- 3.2.3. Coffee and Snack Outlets

- 3.2.4. Retail Establishments

- 3.2.5. Institutional

- 3.2.6. Hospitality

- 3.2.7. Other Foodservice End-Uses

- 3.3. Beverage

- 3.4. Healthcare

- 3.5. Cosmetics and Personal Care

- 3.6. Industrial

- 3.7. Building and Construction

- 3.8. Automotive

- 3.9. Other En

-

3.1. Food**

Vietnam Rigid Plastic Packaging Market Segmentation By Geography

- 1. Vietnam

Vietnam Rigid Plastic Packaging Market Regional Market Share

Geographic Coverage of Vietnam Rigid Plastic Packaging Market

Vietnam Rigid Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism to Boost Food and Beverage Industry; Availability of Variety of Plastic Packaging Products in Vietnam

- 3.3. Market Restrains

- 3.3.1. Growing Tourism to Boost Food and Beverage Industry; Availability of Variety of Plastic Packaging Products in Vietnam

- 3.4. Market Trends

- 3.4.1. Polyethylene (PE) Segment is Estimated to Have the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bottles and Jars

- 5.1.2. Trays and Containers

- 5.1.3. Caps and Closures

- 5.1.4. Intermediate Bulk Containers (IBCs)

- 5.1.5. Drums

- 5.1.6. Pallets

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyethylene (PE)

- 5.2.1.1. LDPE & LLDPE

- 5.2.1.2. HDPE

- 5.2.2. Polyethylene Terephthalate (PET)

- 5.2.3. Polypropylene (PP)

- 5.2.4. Polystyrene (PS) and Expanded Polystyrene (EPS)

- 5.2.5. Polyvinyl Chloride (PVC)

- 5.2.6. Other Rigid Plastic Packaging Materials

- 5.2.1. Polyethylene (PE)

- 5.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 5.3.1. Food**

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Food Products

- 5.3.2. Foodservice**

- 5.3.2.1. Quick Service Restaurants (QSRs)

- 5.3.2.2. Full-Service Restaurants (FSRs)

- 5.3.2.3. Coffee and Snack Outlets

- 5.3.2.4. Retail Establishments

- 5.3.2.5. Institutional

- 5.3.2.6. Hospitality

- 5.3.2.7. Other Foodservice End-Uses

- 5.3.3. Beverage

- 5.3.4. Healthcare

- 5.3.5. Cosmetics and Personal Care

- 5.3.6. Industrial

- 5.3.7. Building and Construction

- 5.3.8. Automotive

- 5.3.9. Other En

- 5.3.1. Food**

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Taiwan Hon Chaun Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ALPLA Werke Alwin Lehner GmbH & Co KG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bericap Holding GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Duy Tan Plastics Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IML Containers (Groupe Lacroix)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Inplas Vietnam JSC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indorama Ventures Vietnam

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Greif Inc 8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Taiwan Hon Chaun Group

List of Figures

- Figure 1: Vietnam Rigid Plastic Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Vietnam Rigid Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Vietnam Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 3: Vietnam Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 4: Vietnam Rigid Plastic Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Vietnam Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Vietnam Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: Vietnam Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 8: Vietnam Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Rigid Plastic Packaging Market?

The projected CAGR is approximately 2.37%.

2. Which companies are prominent players in the Vietnam Rigid Plastic Packaging Market?

Key companies in the market include Taiwan Hon Chaun Group, ALPLA Werke Alwin Lehner GmbH & Co KG, Bericap Holding GmbH, Duy Tan Plastics Corporation, IML Containers (Groupe Lacroix), Inplas Vietnam JSC, Indorama Ventures Vietnam, Greif Inc 8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the Vietnam Rigid Plastic Packaging Market?

The market segments include Product Type, Material, End-Use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.93 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism to Boost Food and Beverage Industry; Availability of Variety of Plastic Packaging Products in Vietnam.

6. What are the notable trends driving market growth?

Polyethylene (PE) Segment is Estimated to Have the Largest Market Share.

7. Are there any restraints impacting market growth?

Growing Tourism to Boost Food and Beverage Industry; Availability of Variety of Plastic Packaging Products in Vietnam.

8. Can you provide examples of recent developments in the market?

May 2024: ALPLA Werke Alwin Lehner GmbH & Co. KG, an Austria-based company with operations in Vietnam, unveiled a recyclable wine bottle crafted from Polyethylene Terephthalate (PET). This new bottle is approximately eight times lighter than its glass counterpart. Looking ahead, the company aims to produce a million units of this bottle by 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Rigid Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Rigid Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Rigid Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Vietnam Rigid Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence