Key Insights

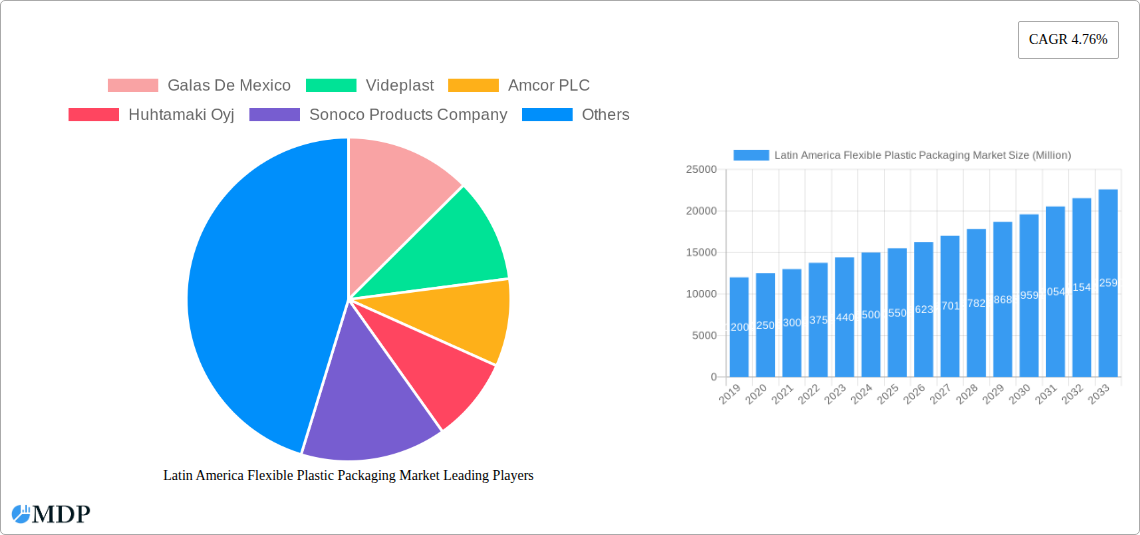

The Latin America Flexible Plastic Packaging Market is projected to reach $15,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of 4.76% from 2025 to 2033. Growth is propelled by rising demand for convenient and sustainable packaging across key sectors. The food and beverage industry leads, focusing on solutions that extend shelf-life and support on-the-go consumption. The personal care, household care, and critical medical and pharmaceutical sectors also contribute significantly, requiring sterile and safe packaging. Polyethylene (PE) and Bi-oriented Polypropylene (BOPP) are anticipated to dominate due to their versatility, cost-effectiveness, and protective barrier properties.

Latin America Flexible Plastic Packaging Market Market Size (In Million)

Market dynamics are influenced by trends such as advanced printing for branding and the increasing adoption of recyclable and biodegradable packaging to address environmental concerns. Challenges include fluctuating polymer raw material prices and evolving regulations on plastic usage and waste management. However, strategic investments in R&D by major players like Amcor PLC, Huhtamaki Oyj, and Sealed Air Corporation in innovative and sustainable packaging structures are expected to mitigate these obstacles. Mexico and Brazil remain pivotal markets, driven by large consumer bases and established manufacturing sectors within the flexible plastic packaging ecosystem.

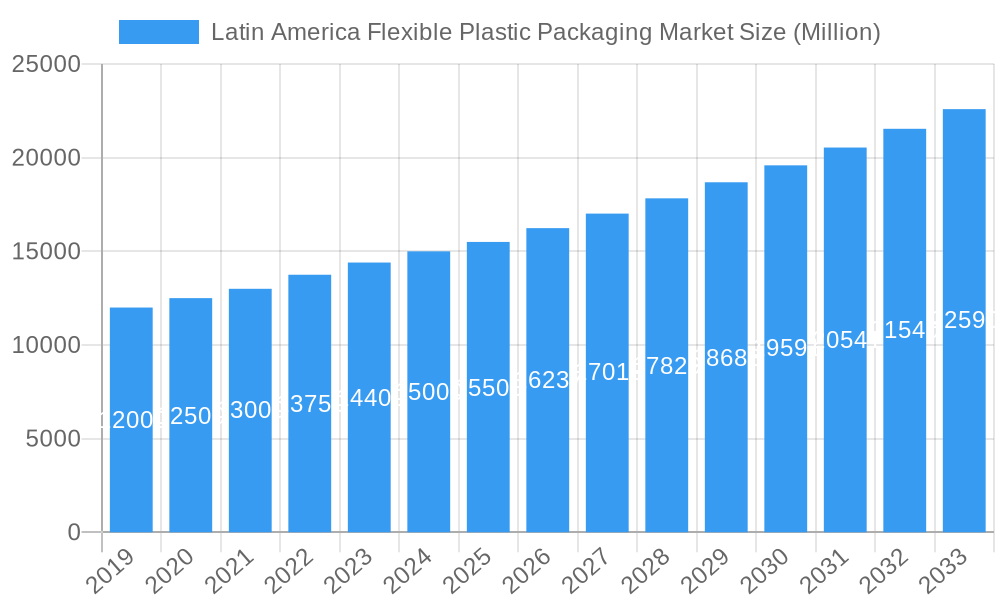

Latin America Flexible Plastic Packaging Market Company Market Share

Gain comprehensive intelligence on the Latin America flexible plastic packaging market. This report offers an in-depth analysis of market dynamics, industry trends, key segments, product developments, and strategic outlooks for the period 2019–2033. With a base year of 2025 and a forecast period from 2025–2033, discover critical growth drivers, emerging opportunities, and challenges for stakeholders in flexible packaging solutions, plastic film manufacturing, and end-use industry supply chains across the region.

Essential for food and beverage packaging companies, personal care and pharmaceutical packaging suppliers, and all participants in the Latin American packaging industry. This report provides actionable insights into market concentration, innovation drivers, regulatory environments, and competitive strategies, including detailed segment analysis by material type (Polyethylene (PE), BOPP, CPP, PVC, EVOH), product type (Pouches, Bags, Films and Wraps), and end-use industries (Food, Beverage, Personal Care, Medical).

Latin America Flexible Plastic Packaging Market Market Dynamics & Concentration

The Latin America flexible plastic packaging market is characterized by moderate to high concentration, with a few major global players and numerous regional and local manufacturers vying for market share. The market share distribution is influenced by technological capabilities, raw material sourcing, and established distribution networks. Innovation drivers are primarily focused on sustainability, such as the development of recyclable flexible packaging, biodegradable plastic films, and packaging with reduced material usage. Regulatory frameworks, while evolving, are increasingly focusing on waste management and the reduction of single-use plastics, impacting material choices and product design. Product substitutes, including rigid packaging and paper-based alternatives, present a competitive pressure, though flexible packaging often offers superior product protection and cost-effectiveness. End-user trends lean towards convenience, extended shelf life, and enhanced consumer appeal, driving demand for advanced features like resealability and barrier properties. Mergers and acquisition (M&A) activities are a significant factor in market consolidation and expansion, with deal counts indicating a strategic push for market penetration and portfolio diversification. For instance, the acquisition of Dow Inc.'s flexible packaging business by Arkema in May 2024 highlights the ongoing consolidation and strategic realignments within the industry. These M&A activities are crucial for gaining economies of scale, acquiring new technologies, and expanding geographical reach within the competitive Latin American landscape.

Latin America Flexible Plastic Packaging Market Industry Trends & Analysis

The Latin America flexible plastic packaging market is poised for robust growth, driven by a confluence of accelerating economic development, expanding middle-class populations, and evolving consumer lifestyles across key economies like Brazil, Mexico, Argentina, and Colombia. The CAGR for the forecast period is projected to be in the range of XX%, reflecting sustained demand. A primary growth catalyst is the burgeoning food and beverage sector, which represents a significant portion of the market penetration due to the increasing demand for convenient, ready-to-eat meals, packaged snacks, and a wider variety of beverages requiring effective and cost-efficient packaging solutions. Technological disruptions are continuously reshaping the industry, with advancements in material science leading to the development of high-performance multilayer flexible films offering superior barrier properties against oxygen, moisture, and light, thereby extending product shelf life. The adoption of advanced printing technologies like rotogravure and flexography is enhancing packaging aesthetics and brand visibility. Consumer preferences are increasingly shifting towards sustainable packaging options, prompting manufacturers to invest in eco-friendly flexible packaging solutions, including those made from recycled content and those designed for recyclability. This demand for sustainability is not merely a trend but a fundamental shift influencing product design and material selection. The competitive dynamics are intensifying, with both global giants and nimble local players competing on innovation, price, and service. The expansion of e-commerce also fuels demand for durable yet lightweight flexible packaging for shipping and handling. Furthermore, the medical and pharmaceutical industries are contributing to market expansion through their need for sterile, tamper-evident, and high-barrier flexible packaging to ensure product integrity and safety. The personal care and household care segments are also experiencing growth, driven by product innovation and consumer demand for aesthetically pleasing and functional packaging.

Leading Markets & Segments in Latin America Flexible Plastic Packaging Market

The Latin America flexible plastic packaging market exhibits distinct leadership across various segments, driven by specific economic, demographic, and industrial factors. Brazil consistently emerges as the dominant market within the region, fueled by its large population, robust industrial base, and significant agricultural output, which directly impacts the food and beverage packaging demand. Mexico follows closely, benefiting from its manufacturing prowess and strong export ties.

Material Type Dominance:

- Polyethylene (PE) holds the largest market share, owing to its versatility, cost-effectiveness, and excellent sealing properties, making it ideal for a wide range of applications, particularly in food packaging and household goods.

- Bi-oriented Polypropylene (BOPP) is a significant contributor, favored for its clarity, stiffness, and excellent printability, making it a popular choice for snack bags, confectionery wrappers, and fresh produce packaging.

- Cast Polypropylene (CPP) is gaining traction due to its high gloss and good barrier properties, particularly in applications requiring steam sterilization.

- Ethylene Vinyl Alcohol (EVOH) is crucial for its superior gas barrier properties, essential for extending the shelf life of sensitive products like meat, poultry, and seafood, and certain dairy products.

Product Type Dominance:

- Pouches (including stand-up pouches, flat pouches, and spouted pouches) represent a dominant product type, driven by their convenience, resealability, and excellent marketing display capabilities, catering to ready-to-eat meals, pet food, and liquid detergents.

- Films and Wraps remain a foundational segment, essential for primary packaging of goods like frozen food, candy & confectionery, and personal care items, as well as for secondary packaging and pallet stabilization.

- Bags are critical for dry goods, grains, and retail applications.

End-use Industry Dominance:

- The Food industry is the undisputed leader, accounting for the largest share of the flexible plastic packaging market. This dominance is propelled by the vast consumption of packaged foods, including frozen foods, dry foods, meat, poultry, and seafood, candy & confectionery, pet food, fresh produce, and dairy products. The growing demand for convenience, longer shelf life, and food safety standards directly translates into increased consumption of flexible packaging.

- The Beverage sector is a significant and growing segment, with flexible packaging used for juices, milk, and other liquid refreshments.

- Personal Care and Household Care industries are also key contributors, with flexible packaging essential for products like detergents, soaps, shampoos, and cosmetics, driven by product innovation and consumer appeal.

- The Medical and Pharmaceutical segment, while smaller, is characterized by high-value, stringent requirements for sterile and tamper-evident packaging, representing a niche for advanced flexible solutions.

Latin America Flexible Plastic Packaging Market Product Developments

Recent product developments in the Latin America flexible plastic packaging market are heavily influenced by the drive for sustainability, enhanced functionality, and improved shelf-life. Innovations include the introduction of mono-material flexible packaging structures designed for easier recycling, and the increasing use of bio-based and compostable plastics to meet growing environmental concerns. Advanced barrier technologies are being integrated into films to reduce food waste and extend the freshness of perishable goods, particularly for meat, poultry, and seafood, and fresh produce. Furthermore, manufacturers are focusing on smart packaging features, such as indicators that signal product freshness or temperature excursions, enhancing consumer trust and safety. The competitive advantage is being gained through customized solutions that cater to specific end-user needs, offering superior protection, extended shelf-life, and improved visual appeal.

Key Drivers of Latin America Flexible Plastic Packaging Market Growth

Several key factors are propelling the growth of the Latin America flexible plastic packaging market. The expanding middle-class population across countries like Brazil, Mexico, and Colombia is driving increased consumption of packaged goods, particularly in the food, beverage, and personal care sectors. Economic recovery and industrial development are boosting manufacturing activities, leading to a higher demand for efficient and cost-effective packaging solutions. Technological advancements in material science and processing technologies are enabling the creation of innovative, sustainable, and high-performance flexible packaging. Furthermore, growing consumer awareness regarding food safety and hygiene is creating a demand for packaging that offers enhanced protection and extended shelf life. Supportive government initiatives promoting domestic manufacturing and foreign investment also contribute to the market's positive trajectory.

Challenges in the Latin America Flexible Plastic Packaging Market Market

Despite its growth prospects, the Latin America flexible plastic packaging market faces several significant challenges. Volatile raw material prices, particularly for oil and natural gas derivatives, can impact production costs and profitability. The evolving regulatory landscape concerning plastic waste and environmental sustainability, while driving innovation, can also pose compliance challenges for manufacturers. Infrastructure limitations in certain regions can hinder efficient supply chain management and distribution networks. Furthermore, intense competition from both global and local players, coupled with the availability of alternative packaging materials, exerts constant price pressure. The need for significant capital investment in advanced recycling technologies and sustainable material research also presents a barrier for smaller players.

Emerging Opportunities in Latin America Flexible Plastic Packaging Market

The Latin America flexible plastic packaging market is ripe with emerging opportunities. The growing demand for sustainable packaging solutions presents a significant avenue for companies investing in recyclable, biodegradable, and compostable flexible packaging. The expansion of e-commerce logistics is creating a need for lightweight, durable, and tamper-evident flexible packaging for online retail. Increasing consumer focus on health and wellness is driving demand for flexible packaging for medical and pharmaceutical products, as well as for organic and specialty food items. Furthermore, the development of advanced barrier films and high-performance packaging technologies for extended shelf life offers substantial growth potential, particularly for perishable food items. Strategic partnerships and collaborations between raw material suppliers, packaging manufacturers, and end-users can unlock new markets and drive innovation.

Leading Players in the Latin America Flexible Plastic Packaging Market Sector

- Galas De Mexico

- Videplast

- Amcor PLC

- Huhtamaki Oyj

- Sonoco Products Company

- Sealed Air Corporation

- Berry Global Inc

- Pack Efficient Sapi DE CV Mexico

- ALPLA Group

- Zubex

Key Milestones in Latin America Flexible Plastic Packaging Market Industry

- May 2024: Arkema, a France-based company, acquired the flexible packaging business of Dow Inc., a US firm, significantly broadening Arkema's offerings in the flexible packaging industry.

- September 2023: SS Polymer and Films, an Indian player, announced its expansion into the Latin American and Middle Eastern markets, marking a substantial leap in its global footprint and poised to attract a broader clientele.

Strategic Outlook for Latin America Flexible Plastic Packaging Market Market

The strategic outlook for the Latin America flexible plastic packaging market is one of continued innovation and sustainable growth. The focus will remain on developing and implementing advanced, eco-friendly packaging solutions to meet stringent environmental regulations and evolving consumer preferences. Companies that invest in research and development for recyclable flexible packaging, mono-material structures, and bio-based alternatives will gain a competitive edge. Expanding production capacity and optimizing supply chains to serve growing markets like Brazil and Mexico will be crucial. Strategic acquisitions and partnerships will continue to play a vital role in consolidating market share, acquiring new technologies, and diversifying product portfolios. The increasing demand from the food, beverage, and pharmaceutical sectors, coupled with the rise of e-commerce, will provide sustained impetus for growth.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Latin America Flexible Plastic Packaging Market Segmentation

-

1. Material Type

- 1.1. Polyethylene (PE)

- 1.2. Bi-oriented Polypropylene (BOPP)

- 1.3. Cast Polypropylene (CPP)

- 1.4. Polyvinyl Chloride (PVC)

- 1.5. Ethylene Vinyl Alcohol (EVOH)

- 1.6. Other Ma

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types

-

3. End-use Industries

-

3.1. Food

- 3.1.1. Frozen Food

- 3.1.2. Dry Food

- 3.1.3. Meat, Poultry, and Sea Food

- 3.1.4. Candy & Confectionery

- 3.1.5. Pet Food

- 3.1.6. Fresh Produce

- 3.1.7. Dairy Products

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Personal Care and Household Care

- 3.4. Medical and Pharmaceutical

- 3.5. Other En

-

3.1. Food

Latin America Flexible Plastic Packaging Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Flexible Plastic Packaging Market Regional Market Share

Geographic Coverage of Latin America Flexible Plastic Packaging Market

Latin America Flexible Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Food and Beverage Sector to Propel Demand for Flexible Plastic Packaging Solutions Packaging; Boost in the Pharmaceutical Industry in Latin American Countries to Drive the Demand for Flexible Plastic Packaging Solutions

- 3.3. Market Restrains

- 3.3.1. Growing Food and Beverage Sector to Propel Demand for Flexible Plastic Packaging Solutions Packaging; Boost in the Pharmaceutical Industry in Latin American Countries to Drive the Demand for Flexible Plastic Packaging Solutions

- 3.4. Market Trends

- 3.4.1. The Food End-Use Industry to Account for Highest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Flexible Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Polyethylene (PE)

- 5.1.2. Bi-oriented Polypropylene (BOPP)

- 5.1.3. Cast Polypropylene (CPP)

- 5.1.4. Polyvinyl Chloride (PVC)

- 5.1.5. Ethylene Vinyl Alcohol (EVOH)

- 5.1.6. Other Ma

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-use Industries

- 5.3.1. Food

- 5.3.1.1. Frozen Food

- 5.3.1.2. Dry Food

- 5.3.1.3. Meat, Poultry, and Sea Food

- 5.3.1.4. Candy & Confectionery

- 5.3.1.5. Pet Food

- 5.3.1.6. Fresh Produce

- 5.3.1.7. Dairy Products

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Personal Care and Household Care

- 5.3.4. Medical and Pharmaceutical

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Galas De Mexico

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Videplast

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amcor PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Huhtamaki Oyj

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonoco Products Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sealed Air Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Berry Global Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pack Efficient Sapi DE CV Mexico

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ALPLA Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zubex*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Galas De Mexico

List of Figures

- Figure 1: Latin America Flexible Plastic Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Latin America Flexible Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Flexible Plastic Packaging Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 2: Latin America Flexible Plastic Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Latin America Flexible Plastic Packaging Market Revenue million Forecast, by End-use Industries 2020 & 2033

- Table 4: Latin America Flexible Plastic Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Latin America Flexible Plastic Packaging Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 6: Latin America Flexible Plastic Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Latin America Flexible Plastic Packaging Market Revenue million Forecast, by End-use Industries 2020 & 2033

- Table 8: Latin America Flexible Plastic Packaging Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: Brazil Latin America Flexible Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Argentina Latin America Flexible Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Chile Latin America Flexible Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Colombia Latin America Flexible Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Latin America Flexible Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Peru Latin America Flexible Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Venezuela Latin America Flexible Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Ecuador Latin America Flexible Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Bolivia Latin America Flexible Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Paraguay Latin America Flexible Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Flexible Plastic Packaging Market?

The projected CAGR is approximately 4.76%.

2. Which companies are prominent players in the Latin America Flexible Plastic Packaging Market?

Key companies in the market include Galas De Mexico, Videplast, Amcor PLC, Huhtamaki Oyj, Sonoco Products Company, Sealed Air Corporation, Berry Global Inc, Pack Efficient Sapi DE CV Mexico, ALPLA Group, Zubex*List Not Exhaustive.

3. What are the main segments of the Latin America Flexible Plastic Packaging Market?

The market segments include Material Type, Product Type, End-use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.2 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Food and Beverage Sector to Propel Demand for Flexible Plastic Packaging Solutions Packaging; Boost in the Pharmaceutical Industry in Latin American Countries to Drive the Demand for Flexible Plastic Packaging Solutions.

6. What are the notable trends driving market growth?

The Food End-Use Industry to Account for Highest Market Share.

7. Are there any restraints impacting market growth?

Growing Food and Beverage Sector to Propel Demand for Flexible Plastic Packaging Solutions Packaging; Boost in the Pharmaceutical Industry in Latin American Countries to Drive the Demand for Flexible Plastic Packaging Solutions.

8. Can you provide examples of recent developments in the market?

May 2024: The France-based company Arkema made headlines by acquiring the flexible packaging business of Dow Inc., a US firm. This strategic move is set to significantly broaden Arkema's offerings in the flexible packaging industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Flexible Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Flexible Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Flexible Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Latin America Flexible Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence