Key Insights

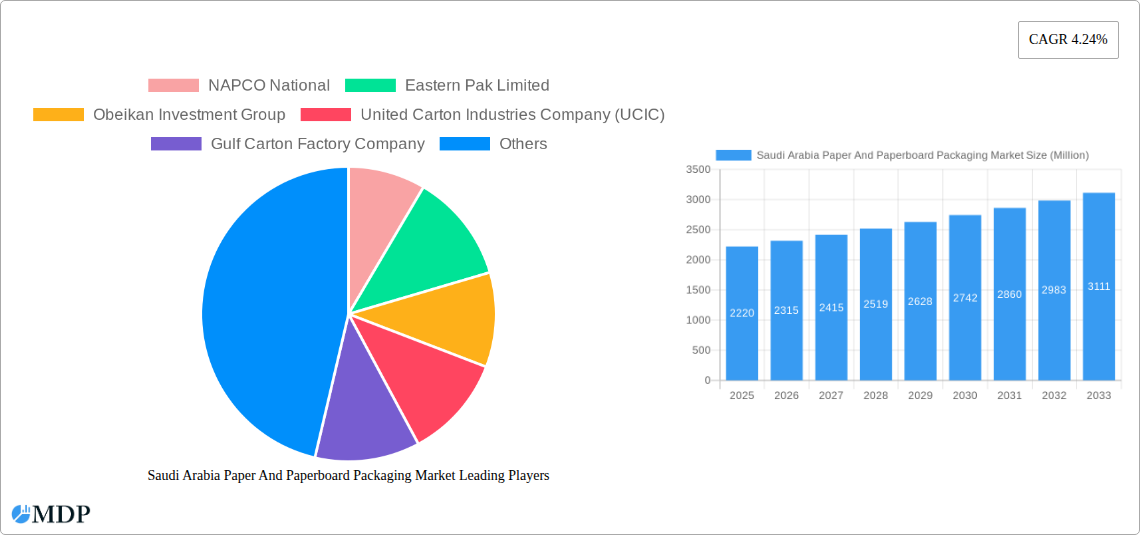

The Saudi Arabia Paper and Paperboard Packaging Market is projected to reach a valuation of USD 1.99 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 3.48% between 2025 and 2033. Key growth drivers include escalating consumer demand in the Food & Beverage, Personal Care & Household, and Healthcare sectors, supported by Saudi Arabia's Vision 2030 economic diversification initiatives. The surge in e-commerce also necessitates advanced packaging solutions. A growing emphasis on environmental sustainability is driving the adoption of recyclable and biodegradable paper packaging, aligning with national and global green objectives.

Saudi Arabia Paper And Paperboard Packaging Market Market Size (In Billion)

While potential fluctuations in raw material costs and intense market competition present challenges, these are expected to be outweighed by strong demand from expanding end-user industries, strategic manufacturing investments, and a preference for eco-friendly packaging. The market is dominated by Folding Cartons and Corrugated Boxes, serving diverse consumer and industrial needs. Increased focus on local manufacturing further bolsters the domestic paper and paperboard packaging industry.

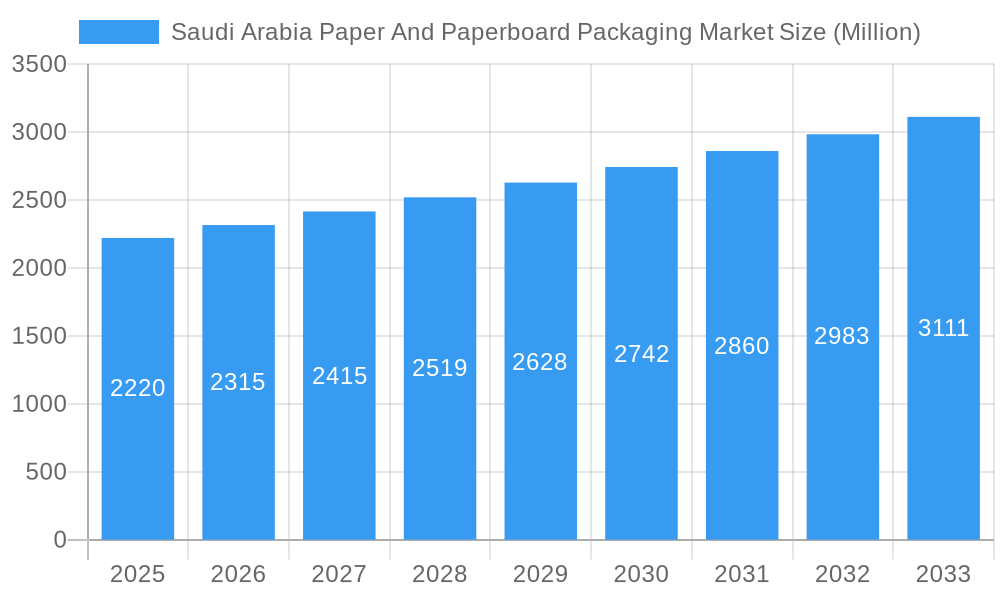

Saudi Arabia Paper And Paperboard Packaging Market Company Market Share

Saudi Arabia Paper and Paperboard Packaging Market: Growth, Trends & Forecast (2025–2033) – Opportunities in a Rapidly Expanding Sector

Gain comprehensive insights into the dynamic Saudi Arabia Paper and Paperboard Packaging Market. This report details market size, growth trajectories, and competitive landscapes, providing essential intelligence for stakeholders to capitalize on the demand for sustainable and innovative packaging. Analysis covers the base year (2025) and an extensive forecast period (2025–2033), offering actionable intelligence on market dynamics, emerging trends, and key drivers.

Saudi Arabia Paper And Paperboard Packaging Market Market Dynamics & Concentration

The Saudi Arabia Paper and Paperboard Packaging Market is characterized by a moderately concentrated landscape, with key players like NAPCO National, Eastern Pak Limited, and Obeikan Investment Group holding significant market share. Innovation drivers are primarily centered around sustainability, with a growing emphasis on recyclable and biodegradable packaging materials, fueled by consumer awareness and evolving environmental regulations. The regulatory framework, while increasingly supportive of local manufacturing and environmental standards, presents both opportunities for compliant businesses and challenges for those slow to adapt. Product substitutes, such as plastics and other flexible packaging materials, pose a continuous competitive threat, necessitating constant innovation in paper-based alternatives. End-user trends are significantly influenced by the Kingdom's Vision 2030, driving growth in sectors like food and beverage, healthcare, and personal care, all demanding advanced packaging solutions. Mergers and acquisitions (M&A) activities are anticipated to increase as larger players seek to consolidate their market position and acquire innovative technologies. While specific M&A deal counts are proprietary, the strategic importance of the sector suggests an active M&A environment in the coming years, driven by market consolidation and expansion strategies. The drive towards localized production and increased domestic content further influences market concentration and investment decisions.

Saudi Arabia Paper And Paperboard Packaging Market Industry Trends & Analysis

The Saudi Arabia Paper and Paperboard Packaging Market is experiencing robust growth, driven by a confluence of economic expansion, shifting consumer preferences, and significant government initiatives aimed at diversifying the economy and promoting domestic manufacturing. The market's Compound Annual Growth Rate (CAGR) is projected to be substantial over the forecast period (2025–2033), reflecting increasing demand across various end-user industries. Technological disruptions are playing a pivotal role, with advancements in paper manufacturing processes leading to stronger, lighter, and more sustainable packaging options. Innovations in printing and finishing techniques are also enhancing the aesthetic appeal and functional properties of paper and paperboard packaging, making them increasingly attractive alternatives to conventional materials. Consumer preferences are increasingly leaning towards eco-friendly and convenient packaging solutions, directly impacting demand for recyclable and biodegradable paper-based products. The surge in e-commerce has further amplified the need for durable and protective packaging, a niche where corrugated boxes excel. Competitive dynamics are intensifying, with both local and international players vying for market share. The market penetration of specialized paper and paperboard packaging solutions is expected to rise as industries recognize their cost-effectiveness and environmental benefits. The ongoing investment in industrial infrastructure and the focus on developing a circular economy within the Kingdom are key facilitators of this growth trajectory. Furthermore, the emphasis on food security and the expansion of the healthcare sector necessitate a continuous supply of high-quality, safe packaging, positioning paper and paperboard as a preferred choice. The development of advanced barrier coatings for paper packaging is also a significant trend, enhancing its suitability for a wider range of products, including those requiring moisture and grease resistance. The competitive landscape is also being shaped by strategic partnerships and collaborations aimed at enhancing supply chain efficiency and developing innovative product offerings that cater to the evolving demands of the Saudi market and the broader GCC region.

Leading Markets & Segments in Saudi Arabia Paper And Paperboard Packaging Market

The Food and Beverage end-user vertical stands as the dominant market segment within the Saudi Arabia Paper and Paperboard Packaging Market. This dominance is driven by several key factors, including the Kingdom's substantial population, a growing appetite for processed and packaged foods, and the expansion of the quick-service restaurant (QSR) sector. Economic policies promoting food security and local agricultural development further bolster demand for food-grade packaging solutions. The Corrugated Boxes type segment is also a significant contributor to market growth, primarily due to its extensive use in the logistics and retail sectors, particularly with the rise of e-commerce. The need for robust and protective secondary and tertiary packaging solutions for a wide array of consumer goods underpins the strong performance of corrugated boxes.

Food and Beverage:

- Key Drivers: Growing population, increasing disposable incomes, expansion of the retail and foodservice industries, government initiatives supporting food production and processing, and a rising demand for convenience and ready-to-eat meals. The shift towards online grocery shopping also significantly boosts demand for packaged food.

- Dominance Analysis: The sector's vast product range, from fresh produce to processed goods and beverages, necessitates diverse packaging formats, with paper and paperboard offering a sustainable and cost-effective solution for many applications. The stringent quality and safety standards for food packaging further favor materials like paperboard.

Corrugated Boxes:

- Key Drivers: Rapid growth of e-commerce and online retail, increasing demand for efficient and protective shipping solutions, and its widespread application in the B2B sector for product transit and storage. Infrastructure development supporting logistics and warehousing also contributes to its dominance.

- Dominance Analysis: The versatility, strength, and cost-effectiveness of corrugated boxes make them indispensable for the transportation and handling of goods across all sectors, from consumer electronics to industrial components. Their recyclability aligns with sustainability goals.

Other End-user Verticals (Healthcare, Personal Care and Household Care, Industrial): These segments, while not as dominant as Food and Beverage, are experiencing significant growth. The healthcare sector demands sterile and tamper-evident packaging. Personal Care and Household Care are witnessing a rise in demand for aesthetically pleasing and functional packaging. The Industrial sector requires robust packaging for machinery and components.

Folding Cartons:

- Key Drivers: Increasing demand for attractive point-of-sale packaging, growth in the consumer electronics, cosmetics, and pharmaceutical industries, and the need for consumer-friendly packaging that enhances brand visibility.

- Dominance Analysis: Folding cartons are crucial for primary packaging, offering excellent printability and structural integrity for smaller consumer goods, contributing to product differentiation on shelves and online.

Saudi Arabia Paper And Paperboard Packaging Market Product Developments

Product developments in the Saudi Arabia Paper and Paperboard Packaging Market are increasingly focused on enhancing sustainability, functionality, and aesthetic appeal. Innovations include the development of advanced paperboard grades with improved barrier properties, enabling them to effectively protect a wider range of products, including those sensitive to moisture and oxygen. The integration of digital printing technologies allows for highly customizable and short-run packaging, catering to niche market demands and promotional campaigns. Biodegradable and compostable coatings are also being introduced, further bolstering the eco-friendly profile of paper packaging. These advancements aim to provide competitive advantages by meeting stringent industry regulations and evolving consumer expectations for environmentally responsible packaging solutions.

Key Drivers of Saudi Arabia Paper And Paperboard Packaging Market Growth

Several key factors are propelling the growth of the Saudi Arabia Paper and Paperboard Packaging Market. The Kingdom's Vision 2030 initiative, with its emphasis on economic diversification and industrial development, is a major catalyst. Increasing consumer demand for sustainable and recyclable products, coupled with growing environmental awareness, is significantly shifting preferences towards paper-based packaging. The rapid expansion of the e-commerce sector necessitates robust and efficient packaging solutions, a role that paper and paperboard excel in fulfilling. Technological advancements in paper manufacturing are leading to improved product quality and a wider range of applications. Furthermore, government support for local manufacturing and investments in infrastructure are creating a favorable ecosystem for the growth of the packaging industry.

Challenges in the Saudi Arabia Paper And Paperboard Packaging Market Market

Despite its promising growth, the Saudi Arabia Paper and Paperboard Packaging Market faces several challenges. Fluctuations in raw material prices, particularly pulp and recycled paper, can impact manufacturing costs and profitability. Intense competition from alternative packaging materials like plastics and flexible films poses a continuous threat. Evolving regulatory landscapes, while generally supportive, can introduce compliance complexities and require significant investment in new technologies. Supply chain disruptions, exacerbated by global events, can affect the availability and timely delivery of raw materials and finished goods. Additionally, the need for significant capital investment in state-of-the-art machinery and sustainable production facilities can be a barrier for smaller players.

Emerging Opportunities in Saudi Arabia Paper And Paperboard Packaging Market

The Saudi Arabia Paper and Paperboard Packaging Market presents numerous emerging opportunities for stakeholders. The growing demand for e-commerce-ready packaging, including specialized solutions for shipping and handling fragile items, offers significant potential. The increasing focus on the circular economy and sustainable packaging solutions creates a favorable environment for manufacturers offering biodegradable, compostable, and highly recyclable paper-based products. Strategic partnerships with international technology providers can unlock access to advanced manufacturing processes and innovative materials. Furthermore, the expansion of the food and beverage, healthcare, and personal care sectors, driven by population growth and lifestyle changes, will continue to fuel demand for sophisticated paper and paperboard packaging. The Kingdom's push for localized production also creates opportunities for domestic players to increase their market share.

Leading Players in the Saudi Arabia Paper And Paperboard Packaging Market Sector

- NAPCO National

- Eastern Pak Limited

- Obeikan Investment Group

- United Carton Industries Company (UCIC)

- Gulf Carton Factory Company

- Middle East Paper Company

- Gulf East Paper & Plastic Industries LLC

- Western Modern Packaging Co Lt

Key Milestones in Saudi Arabia Paper And Paperboard Packaging Market Industry

- January 2024: Bank ABC (Arab Banking Corporation BSC) closed a EUR 24.9 million (USD 26.94 million) sustainability-linked credit facility for the Saudi Paper Manufacturing Company. This funding is designated to support SPM’s expansion plan by facilitating the procurement of state-of-the-art machinery from Toscotec, aiming to enhance efficiencies of scale and scope within SPM’s operations.

- April 2023: Hotpack, a prominent UAE-based manufacturer and supplier of disposable packaging, initiated a specialized food packaging program in Saudi Arabia, marked by a substantial SAR 1 billion (USD 266 million) investment. This initiative is geared towards producing environmentally friendly products, with a dedicated packaging unit focused on manufacturing sustainable and recyclable packaging solutions.

Strategic Outlook for Saudi Arabia Paper And Paperboard Packaging Market Market

The strategic outlook for the Saudi Arabia Paper and Paperboard Packaging Market is exceptionally positive, driven by sustained economic growth, a clear commitment to sustainability under Vision 2030, and evolving consumer behavior. Key growth accelerators include ongoing investments in advanced manufacturing technologies to enhance product performance and recyclability, and the continuous expansion of e-commerce, which demands innovative and durable packaging. Strategic partnerships between raw material suppliers, manufacturers, and end-users will be crucial for developing integrated solutions and optimizing supply chains. Furthermore, exploring opportunities in niche segments such as pharmaceutical and luxury goods packaging, where high-quality aesthetics and protective qualities are paramount, will offer significant growth potential. The focus on developing a circular economy within the Kingdom will further solidify the market's reliance on paper and paperboard packaging as a preferred sustainable choice.

Saudi Arabia Paper And Paperboard Packaging Market Segmentation

-

1. Type

- 1.1. Folding Cartons

- 1.2. Corrugated Boxes

- 1.3. Other Types

-

2. End-user Vertical

- 2.1. Food and Beverage

- 2.2. Healthcare

- 2.3. Personal Care and Household Care

- 2.4. Industrial

- 2.5. Other End-user Verticals

Saudi Arabia Paper And Paperboard Packaging Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Paper And Paperboard Packaging Market Regional Market Share

Geographic Coverage of Saudi Arabia Paper And Paperboard Packaging Market

Saudi Arabia Paper And Paperboard Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Food and Beverage Sector; Regulations on Plastic-based Packaging Products Contributes to Higher Demand; Increasing Demand for Eco-friendly Solutions and Scope for Printing Innovations Propelling the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Reliance on Other Countries for Raw Materials and Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Folding Cartons to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Paper And Paperboard Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Folding Cartons

- 5.1.2. Corrugated Boxes

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Food and Beverage

- 5.2.2. Healthcare

- 5.2.3. Personal Care and Household Care

- 5.2.4. Industrial

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NAPCO National

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Eastern Pak Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Obeikan Investment Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 United Carton Industries Company (UCIC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gulf Carton Factory Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Middle East Paper Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gulf East Paper & Plastic Industries LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Western Modern Packaging Co Lt

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 NAPCO National

List of Figures

- Figure 1: Saudi Arabia Paper And Paperboard Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Paper And Paperboard Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Paper And Paperboard Packaging Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Saudi Arabia Paper And Paperboard Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 3: Saudi Arabia Paper And Paperboard Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Paper And Paperboard Packaging Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Saudi Arabia Paper And Paperboard Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 6: Saudi Arabia Paper And Paperboard Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Paper And Paperboard Packaging Market?

The projected CAGR is approximately 3.48%.

2. Which companies are prominent players in the Saudi Arabia Paper And Paperboard Packaging Market?

Key companies in the market include NAPCO National, Eastern Pak Limited, Obeikan Investment Group, United Carton Industries Company (UCIC), Gulf Carton Factory Company, Middle East Paper Company, Gulf East Paper & Plastic Industries LLC, Western Modern Packaging Co Lt.

3. What are the main segments of the Saudi Arabia Paper And Paperboard Packaging Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.99 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Food and Beverage Sector; Regulations on Plastic-based Packaging Products Contributes to Higher Demand; Increasing Demand for Eco-friendly Solutions and Scope for Printing Innovations Propelling the Growth of the Market.

6. What are the notable trends driving market growth?

Folding Cartons to Witness Major Growth.

7. Are there any restraints impacting market growth?

Reliance on Other Countries for Raw Materials and Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

January 2024 - Bank ABC (Arab Banking Corporation BSC) closed a EUR 24.9 million (USD 26.94 million) sustainability-linked credit facility for the Saudi Paper Manufacturing Company. The loan amount is planned to support SPM’s expansion plan by funding the procurement of state-of-the-art machinery from Toscotec, which will add efficiencies of scale and scope to SPM’s business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Paper And Paperboard Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Paper And Paperboard Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Paper And Paperboard Packaging Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Paper And Paperboard Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence