Key Insights

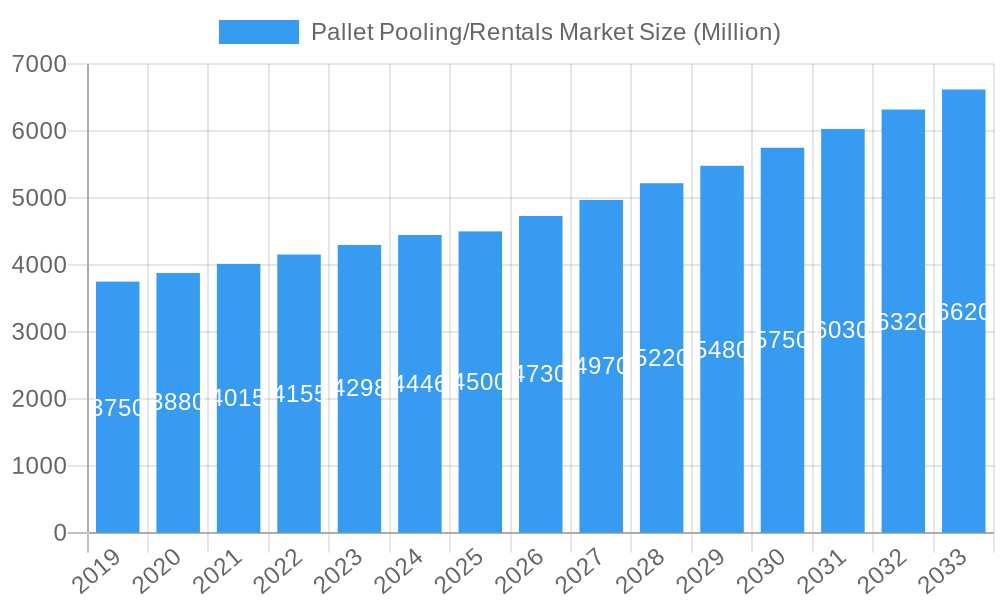

The global Pallet Pooling/Rental Market is projected to reach $6.46 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 5.11% through 2033. This growth is driven by increasing demand for sustainable supply chain solutions, circular economy adoption, and the cost-efficiency and logistical advantages of pallet pooling. Businesses are shifting towards renting pallets due to their economic and environmental benefits. The market is also seeing a rise in standardized pallet designs and advanced tracking technologies, improving operational efficiency and reducing product damage. Furthermore, the focus on waste reduction and lower carbon footprints in logistics strongly supports the pallet pooling model.

Pallet Pooling/Rentals Market Market Size (In Billion)

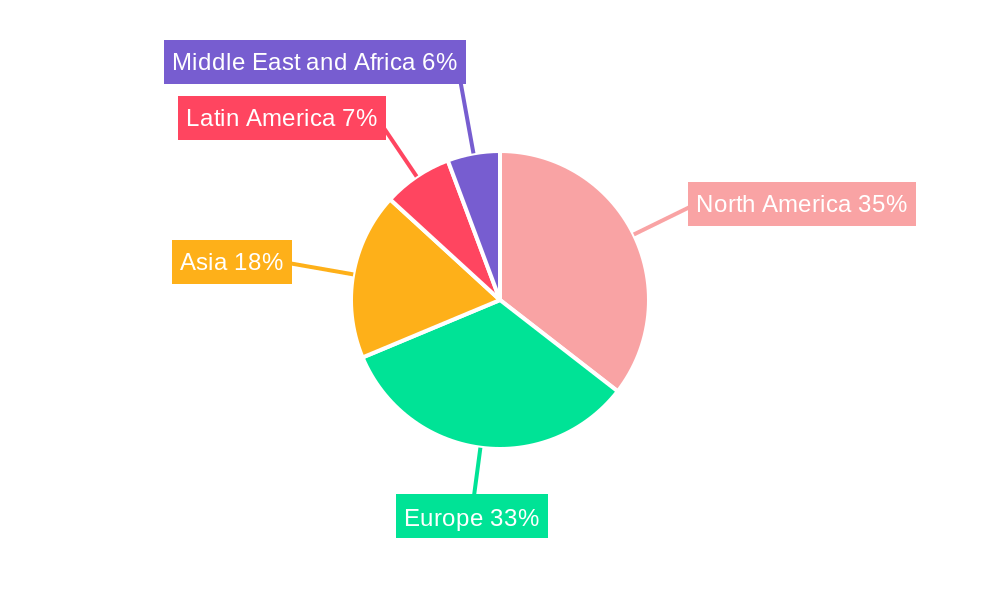

Potential restraints include high initial investment costs for providers and complexities in managing large rental fleets. The competitive availability of inexpensive single-use pallets also poses a challenge in some segments. However, the advantages of reduced handling costs, enhanced inventory management, and improved product integrity continue to drive market expansion. The market is segmented by material type (plastics and wood) and end-user industries, including Transportation & Warehousing, Food & Beverages, Pharmaceuticals, Retail, and Manufacturing. North America and Europe are anticipated to lead, supported by robust logistics infrastructure and sustainability initiatives, while the Asia Pacific region offers significant growth potential.

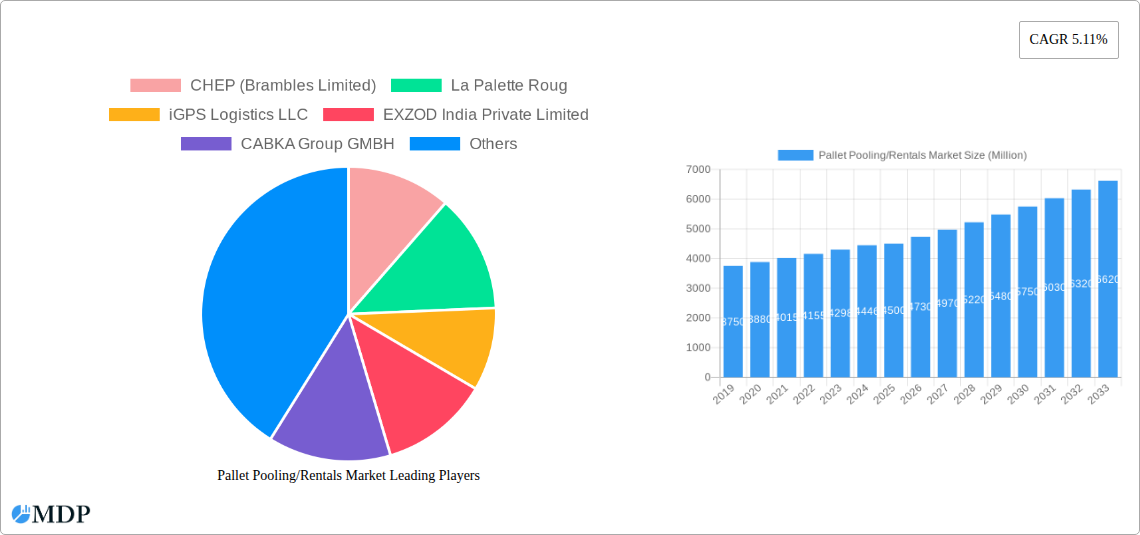

Pallet Pooling/Rentals Market Company Market Share

Pallet Pooling/Rentals Market: Strategic Insights & Growth Forecast (2019–2033)

This comprehensive report provides an in-depth analysis of the global Pallet Pooling/Rentals Market, meticulously examining market dynamics, emerging trends, key growth drivers, and future opportunities. With a study period spanning from 2019 to 2033, and a base and estimated year of 2025, this report offers actionable insights for industry stakeholders, including manufacturers, logistics providers, retailers, and investors. The forecast period from 2025–2033 will illuminate the trajectory of this vital sector. This report is your definitive guide to understanding the current landscape and future potential of the pallet pooling and rentals market, covering material types from plastic to metal and end-user industries from retail to pharmaceuticals.

Pallet Pooling/Rentals Market Market Dynamics & Concentration

The Pallet Pooling/Rentals Market exhibits a moderate to high concentration, with a few dominant global players holding significant market share. CHEP (Brambles Limited) and IFCO Management GmbH are recognized leaders, influencing market trends and pricing strategies. Innovation remains a key driver, with companies continuously developing more durable, sustainable, and efficient pallet solutions. Regulatory frameworks, particularly concerning environmental impact and product safety, are shaping market practices. While traditional wooden pallets remain prevalent, the adoption of plastic and metal alternatives is on the rise due to their longevity and reusability. End-user preferences are shifting towards integrated pooling solutions that offer cost savings, enhanced supply chain visibility, and reduced environmental footprint. Merger and acquisition (M&A) activities, while not rampant, occur strategically to consolidate market positions, expand service offerings, or gain access to new geographical regions. For instance, strategic acquisitions are crucial for companies aiming to achieve a market share of over 25% in key regions. M&A deal counts are expected to average 3-5 significant transactions annually within the forecast period. The market faces challenges from potential product substitutes like single-use packaging, but the inherent sustainability and cost-effectiveness of pooling solutions continue to drive demand.

Pallet Pooling/Rentals Market Industry Trends & Analysis

The Pallet Pooling/Rentals Market is experiencing robust growth, driven by an increasing demand for efficient, sustainable, and cost-effective supply chain solutions. The global market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This growth is fueled by several key factors, including the rising emphasis on circular economy principles, the need to reduce waste in logistics operations, and the inherent benefits of reusable pallets over single-use alternatives. Technological advancements are playing a pivotal role in shaping the industry. The integration of IoT (Internet of Things) devices on pallets allows for real-time tracking, monitoring of condition, and optimized inventory management, leading to enhanced supply chain visibility and reduced loss. Advanced analytics and AI are further optimizing routing, asset utilization, and predictive maintenance, thereby improving operational efficiency for both pooling providers and their clients.

Consumer preferences are evolving towards brands that demonstrate a commitment to sustainability. Pallet pooling solutions significantly contribute to reducing carbon emissions and waste, aligning with corporate social responsibility (CSR) goals. This growing consumer awareness is compelling businesses across various sectors to adopt more environmentally friendly logistics practices. The competitive landscape is characterized by intense competition among established global players and emerging regional providers. Companies are differentiating themselves through service quality, innovation in pallet design, competitive pricing, and the development of integrated solutions that address specific industry needs. The market penetration of reusable pallets in developed economies is steadily increasing, though significant opportunities remain in developing regions. The shift from ownership to rental models provides businesses with greater flexibility and reduced capital expenditure, further stimulating market adoption. The ongoing digital transformation within the logistics sector is also a significant trend, with companies investing heavily in digital platforms and technologies to streamline operations and enhance customer experience.

Leading Markets & Segments in Pallet Pooling/Rentals Market

The Pallet Pooling/Rentals Market is segmented by material type and end-user industries, each exhibiting distinct growth trajectories and dominance.

Material Type Dominance:

Plastic Pallets: These are increasingly dominating the market, particularly in the Food & Beverages and Pharmaceuticals sectors.

- Key Drivers: Superior durability, hygiene properties (easy to clean and sanitize), resistance to moisture and chemicals, and longer lifespan compared to wood. Their nestable design also offers space savings during return journeys.

- Dominance Analysis: Plastic pallets are expected to capture a market share exceeding 35% by 2030, driven by stringent hygiene regulations and a growing demand for automation-compatible solutions. Regions with advanced manufacturing and strict sanitary standards, such as North America and Western Europe, are leading the adoption.

Wood Pallets: While facing competition, wood pallets remain a significant segment, especially in bulk manufacturing and general transportation.

- Key Drivers: Cost-effectiveness, widespread availability, and established recycling infrastructure. They are often favored for their load-bearing capacity in certain applications.

- Dominance Analysis: Despite declining market share, wood pallets will continue to hold a substantial portion, estimated at around 40%, due to their established presence and cost advantages in less sensitive industries. Economic policies encouraging local sourcing and the availability of raw materials will sustain their demand.

Cardboard Pallets: Primarily used for single-use or short-term logistics, especially in retail and e-commerce.

- Key Drivers: Lightweight, cost-effective for specific applications, and easily recyclable.

- Dominance Analysis: This segment is expected to grow moderately, catering to niche applications where return logistics are impractical.

Metals Pallets: Offer extreme durability and heavy load-bearing capacity, used in specialized industrial environments.

- Key Drivers: High strength, resistance to extreme conditions, and suitability for harsh industrial settings.

- Dominance Analysis: This segment will remain a smaller but crucial niche, essential for industries like heavy manufacturing and specialized warehousing.

End-user Industry Dominance:

Transportation & Warehousing: This is the largest and most influential end-user industry.

- Key Drivers: The fundamental reliance on pallets for the movement and storage of goods. Growing e-commerce volumes and the need for efficient logistics networks directly translate to increased demand for pallet pooling services. Infrastructure development and government initiatives to streamline logistics operations are also significant factors.

- Dominance Analysis: Expected to account for over 30% of the market revenue, driven by the sheer volume of goods transported globally and the adoption of advanced warehouse management systems.

Retail: A significant and growing segment due to the demands of modern retail supply chains.

- Key Drivers: Just-in-time inventory management, direct-to-store shipments, and the increasing popularity of omnichannel retail strategies. Retailers are seeking cost-effective and efficient ways to manage product flow.

- Dominance Analysis: Driven by inventory optimization and supply chain visibility, this segment is projected to contribute significantly to market growth.

Food & Beverages: This sector demands high hygiene standards and robust supply chains.

- Key Drivers: Stringent food safety regulations necessitate clean, reusable pallets. The cold chain logistics and the need for efficient product handling from farm to table are critical.

- Dominance Analysis: The demand for hygienic and traceable pallets is high, leading to a substantial market share.

Pharmaceuticals: This industry requires exceptionally high standards of cleanliness, traceability, and security.

- Key Drivers: Strict regulatory compliance, the need to maintain product integrity, and the avoidance of contamination. Reusable pallets offer a controlled and traceable solution for high-value pharmaceuticals.

- Dominance Analysis: Although a smaller volume, the high value and stringent requirements make this a lucrative segment.

Manufacturing: Across various sub-sectors, manufacturing relies on efficient material handling.

- Key Drivers: Automation in manufacturing plants and the need for standardized material handling solutions for raw materials and finished goods.

- Dominance Analysis: This segment’s growth is tied to industrial automation and the overall health of manufacturing output.

Other End-user Industries: Including automotive, chemicals, and industrial goods, which have diverse pallet needs.

Pallet Pooling/Rentals Market Product Developments

Product developments in the Pallet Pooling/Rentals Market are focused on enhancing durability, sustainability, and integration with advanced logistics technologies. Innovations include the introduction of lighter yet stronger plastic pallets with improved load-bearing capacities, designed for automation and robotics. Enhanced features like RFID tagging and GPS integration are becoming standard, offering real-time tracking and inventory management. Companies are also developing specialized pallets for specific industries, such as food-grade or chemical-resistant options, and exploring advanced recycling and material recovery processes. These developments aim to provide superior asset utilization, reduce operational costs, and minimize environmental impact, giving providers a competitive edge in a dynamic market. The trend towards smart pallets with built-in sensors for condition monitoring is also gaining traction, offering unprecedented supply chain visibility.

Key Drivers of Pallet Pooling/Rentals Market Growth

The Pallet Pooling/Rentals Market is propelled by several significant growth drivers. The overarching demand for sustainability and cost-efficiency in supply chains is paramount. Companies are increasingly adopting pallet pooling to reduce their environmental footprint by minimizing waste and emissions associated with single-use pallets. E-commerce growth necessitates efficient and scalable logistics, where pooling offers flexibility and cost savings. Technological advancements, such as IoT integration for tracking and data analytics, enhance supply chain visibility and operational efficiency, making pooling more attractive. Regulatory pressures related to waste management and environmental protection also encourage the adoption of reusable solutions. Furthermore, the high initial investment and ongoing maintenance costs of owning a pallet fleet deter many businesses, making rental and pooling models a more appealing financial alternative.

Challenges in the Pallet Pooling/Rentals Market Market

Despite robust growth, the Pallet Pooling/Rentals Market faces several challenges. Deterioration and loss of pallets due to damage, theft, or misplacement can impact profitability and availability. Complex return logistics and reverse supply chain management require significant operational coordination and can lead to inefficiencies if not optimized. Competition from alternative packaging solutions, including single-use and proprietary systems, poses a constant threat. Fluctuations in raw material costs, particularly for plastic and wood, can affect pricing strategies and margins for pooling providers. Geographical dispersion of operations and the need for a widespread network of collection and redistribution points add to logistical complexities and costs, especially in emerging markets with less developed infrastructure.

Emerging Opportunities in Pallet Pooling/Rentals Market

Emerging opportunities in the Pallet Pooling/Rentals Market are significant and offer catalysts for long-term growth. The increasing demand for sustainable and circular economy solutions is a primary driver, pushing for the development of advanced recycling technologies and bio-based pallet materials. Digitalization and the integration of AI in supply chain management present opportunities for enhanced asset tracking, predictive maintenance, and optimized route planning, leading to greater efficiency and cost savings. Expansion into emerging markets, particularly in Asia and Africa, where the adoption of formal logistics practices is accelerating, offers substantial untapped potential. Strategic partnerships between pooling providers and technology companies, as well as collaborations with large retailers and manufacturers for tailored pooling solutions, will also be crucial for market penetration and customer acquisition. The development of smart pallets with integrated sensors for real-time condition monitoring is another key area for innovation and value creation.

Leading Players in the Pallet Pooling/Rentals Market Sector

- CHEP (Brambles Limited)

- La Palette Rouge

- iGPS Logistics LLC

- EXZOD India Private Limited

- CABKA Group GMBH

- PECO Pallet Inc

- Schoeller Allibert

- LEAP India Private Limited

- NEFAB Group

- IFCO Management GmbH

- Orbis Corporation

Key Milestones in Pallet Pooling/Rentals Market Industry

- April 2024: CHEP, a prominent provider of pallet and container pooling solutions, alerted the public about the unauthorized use and misappropriation of its equipment in circulation. The equipment, ranging from wooden pallets to shipping containers, prominently features the CHEP logo in blue color and phrases like "Property of CHEP" or "Owned by CHEP" for clear identification. This would aid the company in mitigating the potential disruption in the pallet supply chain.

- March 2024: ORBIS Corporation, a global leader in reusable packaging solutions, introduces an extended-life reusable, recyclable 40''×48'' ‘Odyssey’ 3-runner pallet to enhance handling efficiency in automation. Its key features include a reinforced structure and a unique flow-through design, ensuring dimensional consistency and facilitating easy cleaning, thereby maintaining optimal plant and equipment hygiene.

Strategic Outlook for Pallet Pooling/Rentals Market Market

The strategic outlook for the Pallet Pooling/Rentals Market is highly promising, driven by the accelerating global shift towards sustainable and efficient supply chain practices. Key growth accelerators include the continued expansion of e-commerce, demanding more agile and cost-effective logistics solutions, and increasing regulatory impetus for waste reduction and carbon footprint mitigation. Companies that invest in smart pallet technology, enabling real-time tracking and data analytics, will gain a significant competitive advantage by offering enhanced supply chain visibility and operational efficiency. Furthermore, strategic partnerships with manufacturers and retailers to develop customized pooling solutions tailored to specific industry needs will be crucial for market penetration and customer retention. Expansion into underserved emerging markets, supported by investments in localized infrastructure and service networks, presents substantial long-term growth opportunities. The focus on durable, reusable, and recyclable materials will continue to shape product development and operational strategies, ensuring the market's alignment with global sustainability goals.

Pallet Pooling/Rentals Market Segmentation

-

1. Material Type

- 1.1. Plastic

- 1.2. Wood

- 1.3. Cardboard

- 1.4. Metals

-

2. End-user Industries

- 2.1. Transportation & Warehousing

- 2.2. Food & Beverages

- 2.3. Pharmaceuticals

- 2.4. Retail

- 2.5. Manufacturing

- 2.6. Other End-user Industries

Pallet Pooling/Rentals Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. France

- 2.2. Germany

- 2.3. Italy

- 2.4. Spain

- 2.5. United Kingdom

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Egypt

- 5.4. South Africa

Pallet Pooling/Rentals Market Regional Market Share

Geographic Coverage of Pallet Pooling/Rentals Market

Pallet Pooling/Rentals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Innovation in Custom Pallet Design; Rising Demand for Plastic Pallets in Pooling System

- 3.3. Market Restrains

- 3.3.1. ; Challenges in filling highly viscous products into capsules

- 3.4. Market Trends

- 3.4.1. Rising Demand for Plastic Pallets in Pooling Systems

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pallet Pooling/Rentals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.2. Wood

- 5.1.3. Cardboard

- 5.1.4. Metals

- 5.2. Market Analysis, Insights and Forecast - by End-user Industries

- 5.2.1. Transportation & Warehousing

- 5.2.2. Food & Beverages

- 5.2.3. Pharmaceuticals

- 5.2.4. Retail

- 5.2.5. Manufacturing

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Pallet Pooling/Rentals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Plastic

- 6.1.2. Wood

- 6.1.3. Cardboard

- 6.1.4. Metals

- 6.2. Market Analysis, Insights and Forecast - by End-user Industries

- 6.2.1. Transportation & Warehousing

- 6.2.2. Food & Beverages

- 6.2.3. Pharmaceuticals

- 6.2.4. Retail

- 6.2.5. Manufacturing

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Pallet Pooling/Rentals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Plastic

- 7.1.2. Wood

- 7.1.3. Cardboard

- 7.1.4. Metals

- 7.2. Market Analysis, Insights and Forecast - by End-user Industries

- 7.2.1. Transportation & Warehousing

- 7.2.2. Food & Beverages

- 7.2.3. Pharmaceuticals

- 7.2.4. Retail

- 7.2.5. Manufacturing

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Pallet Pooling/Rentals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Plastic

- 8.1.2. Wood

- 8.1.3. Cardboard

- 8.1.4. Metals

- 8.2. Market Analysis, Insights and Forecast - by End-user Industries

- 8.2.1. Transportation & Warehousing

- 8.2.2. Food & Beverages

- 8.2.3. Pharmaceuticals

- 8.2.4. Retail

- 8.2.5. Manufacturing

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Latin America Pallet Pooling/Rentals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Plastic

- 9.1.2. Wood

- 9.1.3. Cardboard

- 9.1.4. Metals

- 9.2. Market Analysis, Insights and Forecast - by End-user Industries

- 9.2.1. Transportation & Warehousing

- 9.2.2. Food & Beverages

- 9.2.3. Pharmaceuticals

- 9.2.4. Retail

- 9.2.5. Manufacturing

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East and Africa Pallet Pooling/Rentals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Plastic

- 10.1.2. Wood

- 10.1.3. Cardboard

- 10.1.4. Metals

- 10.2. Market Analysis, Insights and Forecast - by End-user Industries

- 10.2.1. Transportation & Warehousing

- 10.2.2. Food & Beverages

- 10.2.3. Pharmaceuticals

- 10.2.4. Retail

- 10.2.5. Manufacturing

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CHEP (Brambles Limited)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 La Palette Roug

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 iGPS Logistics LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 EXZOD India Private Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CABKA Group GMBH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PECO Pallet Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Schoeller Allibert

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LEAP India Private Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NEFAB Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 IFCO Management GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Orbis Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 CHEP (Brambles Limited)

List of Figures

- Figure 1: Global Pallet Pooling/Rentals Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Pallet Pooling/Rentals Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Pallet Pooling/Rentals Market Revenue (billion), by Material Type 2025 & 2033

- Figure 4: North America Pallet Pooling/Rentals Market Volume (Billion), by Material Type 2025 & 2033

- Figure 5: North America Pallet Pooling/Rentals Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: North America Pallet Pooling/Rentals Market Volume Share (%), by Material Type 2025 & 2033

- Figure 7: North America Pallet Pooling/Rentals Market Revenue (billion), by End-user Industries 2025 & 2033

- Figure 8: North America Pallet Pooling/Rentals Market Volume (Billion), by End-user Industries 2025 & 2033

- Figure 9: North America Pallet Pooling/Rentals Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 10: North America Pallet Pooling/Rentals Market Volume Share (%), by End-user Industries 2025 & 2033

- Figure 11: North America Pallet Pooling/Rentals Market Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Pallet Pooling/Rentals Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Pallet Pooling/Rentals Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Pallet Pooling/Rentals Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Pallet Pooling/Rentals Market Revenue (billion), by Material Type 2025 & 2033

- Figure 16: Europe Pallet Pooling/Rentals Market Volume (Billion), by Material Type 2025 & 2033

- Figure 17: Europe Pallet Pooling/Rentals Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 18: Europe Pallet Pooling/Rentals Market Volume Share (%), by Material Type 2025 & 2033

- Figure 19: Europe Pallet Pooling/Rentals Market Revenue (billion), by End-user Industries 2025 & 2033

- Figure 20: Europe Pallet Pooling/Rentals Market Volume (Billion), by End-user Industries 2025 & 2033

- Figure 21: Europe Pallet Pooling/Rentals Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 22: Europe Pallet Pooling/Rentals Market Volume Share (%), by End-user Industries 2025 & 2033

- Figure 23: Europe Pallet Pooling/Rentals Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Pallet Pooling/Rentals Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Pallet Pooling/Rentals Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Pallet Pooling/Rentals Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pallet Pooling/Rentals Market Revenue (billion), by Material Type 2025 & 2033

- Figure 28: Asia Pallet Pooling/Rentals Market Volume (Billion), by Material Type 2025 & 2033

- Figure 29: Asia Pallet Pooling/Rentals Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 30: Asia Pallet Pooling/Rentals Market Volume Share (%), by Material Type 2025 & 2033

- Figure 31: Asia Pallet Pooling/Rentals Market Revenue (billion), by End-user Industries 2025 & 2033

- Figure 32: Asia Pallet Pooling/Rentals Market Volume (Billion), by End-user Industries 2025 & 2033

- Figure 33: Asia Pallet Pooling/Rentals Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 34: Asia Pallet Pooling/Rentals Market Volume Share (%), by End-user Industries 2025 & 2033

- Figure 35: Asia Pallet Pooling/Rentals Market Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pallet Pooling/Rentals Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pallet Pooling/Rentals Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pallet Pooling/Rentals Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America Pallet Pooling/Rentals Market Revenue (billion), by Material Type 2025 & 2033

- Figure 40: Latin America Pallet Pooling/Rentals Market Volume (Billion), by Material Type 2025 & 2033

- Figure 41: Latin America Pallet Pooling/Rentals Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 42: Latin America Pallet Pooling/Rentals Market Volume Share (%), by Material Type 2025 & 2033

- Figure 43: Latin America Pallet Pooling/Rentals Market Revenue (billion), by End-user Industries 2025 & 2033

- Figure 44: Latin America Pallet Pooling/Rentals Market Volume (Billion), by End-user Industries 2025 & 2033

- Figure 45: Latin America Pallet Pooling/Rentals Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 46: Latin America Pallet Pooling/Rentals Market Volume Share (%), by End-user Industries 2025 & 2033

- Figure 47: Latin America Pallet Pooling/Rentals Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Latin America Pallet Pooling/Rentals Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Latin America Pallet Pooling/Rentals Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America Pallet Pooling/Rentals Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Pallet Pooling/Rentals Market Revenue (billion), by Material Type 2025 & 2033

- Figure 52: Middle East and Africa Pallet Pooling/Rentals Market Volume (Billion), by Material Type 2025 & 2033

- Figure 53: Middle East and Africa Pallet Pooling/Rentals Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 54: Middle East and Africa Pallet Pooling/Rentals Market Volume Share (%), by Material Type 2025 & 2033

- Figure 55: Middle East and Africa Pallet Pooling/Rentals Market Revenue (billion), by End-user Industries 2025 & 2033

- Figure 56: Middle East and Africa Pallet Pooling/Rentals Market Volume (Billion), by End-user Industries 2025 & 2033

- Figure 57: Middle East and Africa Pallet Pooling/Rentals Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 58: Middle East and Africa Pallet Pooling/Rentals Market Volume Share (%), by End-user Industries 2025 & 2033

- Figure 59: Middle East and Africa Pallet Pooling/Rentals Market Revenue (billion), by Country 2025 & 2033

- Figure 60: Middle East and Africa Pallet Pooling/Rentals Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East and Africa Pallet Pooling/Rentals Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Pallet Pooling/Rentals Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pallet Pooling/Rentals Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Global Pallet Pooling/Rentals Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 3: Global Pallet Pooling/Rentals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 4: Global Pallet Pooling/Rentals Market Volume Billion Forecast, by End-user Industries 2020 & 2033

- Table 5: Global Pallet Pooling/Rentals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Pallet Pooling/Rentals Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Pallet Pooling/Rentals Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 8: Global Pallet Pooling/Rentals Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 9: Global Pallet Pooling/Rentals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 10: Global Pallet Pooling/Rentals Market Volume Billion Forecast, by End-user Industries 2020 & 2033

- Table 11: Global Pallet Pooling/Rentals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Pallet Pooling/Rentals Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States Pallet Pooling/Rentals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Pallet Pooling/Rentals Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Pallet Pooling/Rentals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Pallet Pooling/Rentals Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Global Pallet Pooling/Rentals Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 18: Global Pallet Pooling/Rentals Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 19: Global Pallet Pooling/Rentals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 20: Global Pallet Pooling/Rentals Market Volume Billion Forecast, by End-user Industries 2020 & 2033

- Table 21: Global Pallet Pooling/Rentals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Global Pallet Pooling/Rentals Market Volume Billion Forecast, by Country 2020 & 2033

- Table 23: France Pallet Pooling/Rentals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: France Pallet Pooling/Rentals Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Germany Pallet Pooling/Rentals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Germany Pallet Pooling/Rentals Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Italy Pallet Pooling/Rentals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Italy Pallet Pooling/Rentals Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Spain Pallet Pooling/Rentals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Spain Pallet Pooling/Rentals Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: United Kingdom Pallet Pooling/Rentals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: United Kingdom Pallet Pooling/Rentals Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Global Pallet Pooling/Rentals Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 34: Global Pallet Pooling/Rentals Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 35: Global Pallet Pooling/Rentals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 36: Global Pallet Pooling/Rentals Market Volume Billion Forecast, by End-user Industries 2020 & 2033

- Table 37: Global Pallet Pooling/Rentals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: Global Pallet Pooling/Rentals Market Volume Billion Forecast, by Country 2020 & 2033

- Table 39: China Pallet Pooling/Rentals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: China Pallet Pooling/Rentals Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: India Pallet Pooling/Rentals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: India Pallet Pooling/Rentals Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Japan Pallet Pooling/Rentals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Japan Pallet Pooling/Rentals Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Australia Pallet Pooling/Rentals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Australia Pallet Pooling/Rentals Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Global Pallet Pooling/Rentals Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 48: Global Pallet Pooling/Rentals Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 49: Global Pallet Pooling/Rentals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 50: Global Pallet Pooling/Rentals Market Volume Billion Forecast, by End-user Industries 2020 & 2033

- Table 51: Global Pallet Pooling/Rentals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: Global Pallet Pooling/Rentals Market Volume Billion Forecast, by Country 2020 & 2033

- Table 53: Brazil Pallet Pooling/Rentals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Brazil Pallet Pooling/Rentals Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Mexico Pallet Pooling/Rentals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Mexico Pallet Pooling/Rentals Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Argentina Pallet Pooling/Rentals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Argentina Pallet Pooling/Rentals Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Global Pallet Pooling/Rentals Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 60: Global Pallet Pooling/Rentals Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 61: Global Pallet Pooling/Rentals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 62: Global Pallet Pooling/Rentals Market Volume Billion Forecast, by End-user Industries 2020 & 2033

- Table 63: Global Pallet Pooling/Rentals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 64: Global Pallet Pooling/Rentals Market Volume Billion Forecast, by Country 2020 & 2033

- Table 65: United Arab Emirates Pallet Pooling/Rentals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: United Arab Emirates Pallet Pooling/Rentals Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: Saudi Arabia Pallet Pooling/Rentals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: Saudi Arabia Pallet Pooling/Rentals Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: Egypt Pallet Pooling/Rentals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: Egypt Pallet Pooling/Rentals Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: South Africa Pallet Pooling/Rentals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: South Africa Pallet Pooling/Rentals Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pallet Pooling/Rentals Market?

The projected CAGR is approximately 5.11%.

2. Which companies are prominent players in the Pallet Pooling/Rentals Market?

Key companies in the market include CHEP (Brambles Limited), La Palette Roug, iGPS Logistics LLC, EXZOD India Private Limited, CABKA Group GMBH, PECO Pallet Inc, Schoeller Allibert, LEAP India Private Limited, NEFAB Group, IFCO Management GmbH, Orbis Corporation.

3. What are the main segments of the Pallet Pooling/Rentals Market?

The market segments include Material Type, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.46 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Innovation in Custom Pallet Design; Rising Demand for Plastic Pallets in Pooling System.

6. What are the notable trends driving market growth?

Rising Demand for Plastic Pallets in Pooling Systems.

7. Are there any restraints impacting market growth?

; Challenges in filling highly viscous products into capsules.

8. Can you provide examples of recent developments in the market?

April 2024: CHEP, a prominent provider of pallet and container pooling solutions, alerted the public about the unauthorized use and misappropriation of its equipment in circulation. The equipment, ranging from wooden pallets to shipping containers, prominently features the CHEP logo in blue color and phrases like "Property of CHEP" or "Owned by CHEP" for clear identification. This would aid the company in mitigating the potential disruption in the pallet supply chain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pallet Pooling/Rentals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pallet Pooling/Rentals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pallet Pooling/Rentals Market?

To stay informed about further developments, trends, and reports in the Pallet Pooling/Rentals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence