Key Insights

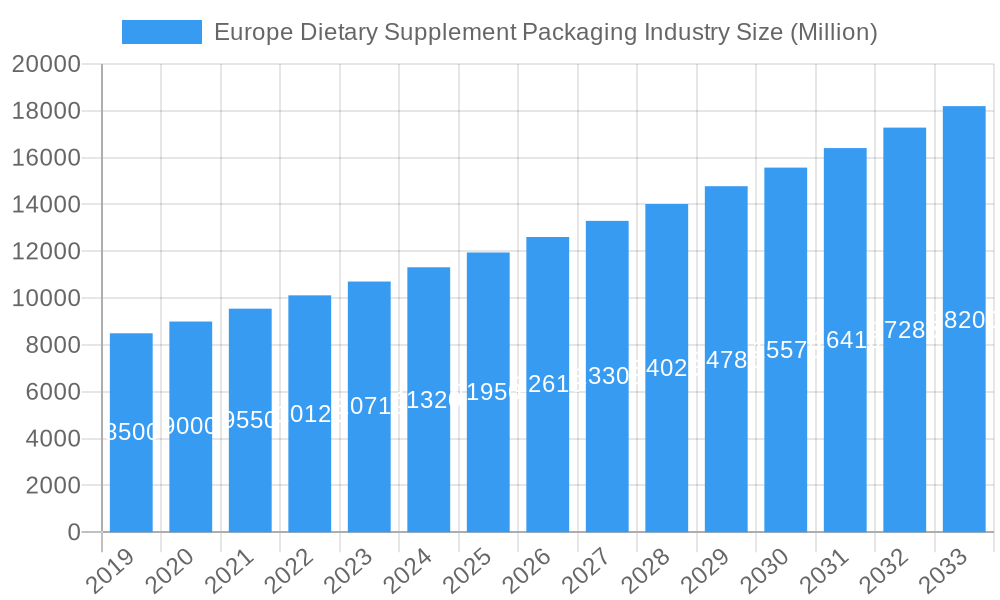

The European dietary supplement packaging market is poised for significant growth, projected to reach approximately USD 11,250 million by 2025, driven by a robust CAGR of 6.70%. This expansion is fueled by several key factors, including the escalating consumer demand for health and wellness products across the continent, a growing awareness of preventative healthcare, and the increasing prevalence of chronic diseases. The market's robust growth trajectory is further supported by the continuous innovation in packaging materials and product designs, aimed at enhancing product shelf-life, consumer convenience, and product differentiation. Notably, the rising disposable incomes in key European nations and a greater emphasis on active lifestyles are contributing to a sustained surge in supplement consumption, consequently boosting the demand for specialized packaging solutions. The market's inherent dynamism is also shaped by evolving regulatory landscapes and a growing preference for sustainable and eco-friendly packaging alternatives, pushing manufacturers towards innovative material choices and design strategies.

Europe Dietary Supplement Packaging Industry Market Size (In Billion)

The market is segmented across various material types, product forms, and formulations, indicating a diverse and sophisticated demand landscape. Plastic, particularly Polypropylene (PP) and Polyethylene Terephthalate (PET), dominates the material segment due to its versatility, cost-effectiveness, and protective properties. However, a noticeable shift towards glass, metal, and paperboard packaging is observed, driven by sustainability concerns and premium branding aspirations. In terms of product type, plastic bottles remain the leading format, but pouches and paperboard boxes are gaining traction for their convenience and eco-friendliness. The formulation segment, encompassing tablets, capsules, powders, and liquids, necessitates specialized packaging to ensure product integrity and safety. Leading companies like Novio Packaging B.V., OPM (labels and packaging) Group Ltd, and Gerresheimer AG are actively investing in research and development to cater to these diverse needs, focusing on smart packaging solutions, child-resistant features, and improved barrier properties to safeguard sensitive supplement formulations and meet stringent European standards.

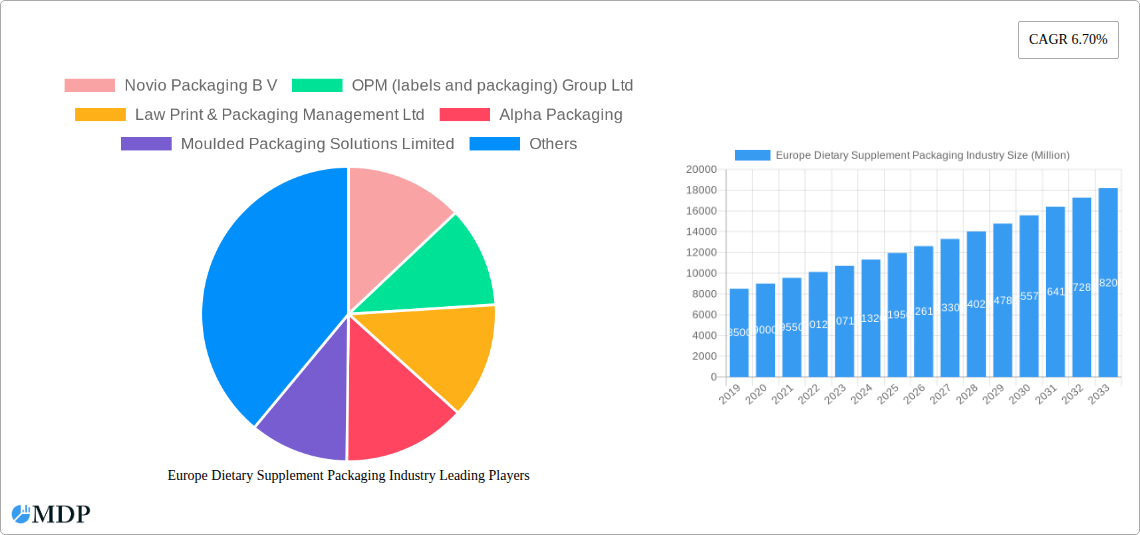

Europe Dietary Supplement Packaging Industry Company Market Share

This comprehensive report, "Europe Dietary Supplement Packaging Industry Market Dynamics, Trends, and Opportunities 2025-2033," offers an in-depth analysis of the burgeoning European dietary supplement packaging market. With a study period spanning from 2019 to 2033, including a detailed base year of 2025 and an extensive forecast period, this report is your definitive guide to understanding the forces shaping this dynamic sector. Navigate through key industry developments, leading market segments, and strategic outlooks, providing actionable insights for manufacturers, suppliers, and investors alike.

Europe Dietary Supplement Packaging Industry Market Dynamics & Concentration

The European dietary supplement packaging market exhibits a moderate to high concentration, with a few dominant players holding significant market share, estimated to be around 65% by major manufacturers in the base year 2025. Innovation is a key driver, fueled by increasing consumer demand for sustainable and user-friendly packaging solutions. Regulatory frameworks, such as those pertaining to food contact materials and recycling directives, are continuously evolving, influencing material choices and design. Product substitutes, primarily in the form of alternative delivery systems for supplements (e.g., ready-to-drink formats), pose a nascent challenge. End-user trends highlight a growing preference for premium, aesthetically pleasing, and convenient packaging, particularly among younger demographics. Mergers and acquisitions (M&A) activity has been steady, with an estimated 12 significant M&A deals recorded in the historical period (2019-2024), indicating a consolidation trend and strategic expansion.

Europe Dietary Supplement Packaging Industry Industry Trends & Analysis

The European dietary supplement packaging market is poised for robust growth, driven by a confluence of factors. A projected Compound Annual Growth Rate (CAGR) of approximately 6.8% from 2025 to 2033 underscores the sector's expansion. This growth is significantly fueled by the increasing health consciousness among European consumers and the rising prevalence of chronic diseases, leading to a higher demand for dietary supplements. Technological disruptions, particularly in material science and printing, are revolutionizing packaging capabilities. The advent of advanced barrier properties in plastic films, the development of biodegradable and compostable materials, and the integration of smart packaging technologies are transforming product preservation and consumer engagement. Consumer preferences are shifting towards personalized nutrition and specialized supplements, creating a demand for flexible and varied packaging formats. The competitive landscape is characterized by intense innovation, with companies striving to differentiate through eco-friendly solutions, enhanced functionality, and compelling branding. Market penetration of sustainable packaging options is anticipated to reach over 70% by 2033, driven by both consumer pressure and legislative mandates. The increasing adoption of e-commerce for supplement sales also necessitates packaging that ensures product integrity during transit and offers an appealing unboxing experience. Furthermore, the trend towards smaller, single-serving or trial-sized packaging for niche supplements is gaining traction, catering to trial and travel needs. The demand for tamper-evident seals and child-resistant closures remains a critical consideration, reflecting ongoing concerns for safety and regulatory compliance.

Leading Markets & Segments in Europe Dietary Supplement Packaging Industry

Within the European dietary supplement packaging industry, Plastic materials dominate, accounting for an estimated 58% of the market share in 2025. This dominance is primarily attributed to the versatility, cost-effectiveness, and advanced barrier properties offered by various plastic types.

Material:

- Plastic: This segment is further segmented into:

- Polypropylene (PP): Highly favored for its chemical resistance and heat stability, commonly used for caps, closures, and some rigid containers.

- Polyethylene Terephthalate (PET): Widely used for its clarity and strength, ideal for clear bottles and containers, especially for powders and capsules.

- Polyethylene (PE): Includes HDPE and LDPE, offering flexibility and durability, utilized in a range of bottles, pouches, and films.

- Other Types of Materials: Encompasses specialized plastics and blends offering enhanced barrier properties or sustainability features.

- Glass: Holds a significant, albeit smaller, share (around 25%), valued for its inertness, premium feel, and recyclability. It is particularly popular for liquids and sensitive formulations.

- Metal: Occupies a niche (approximately 10%), often used for specialty supplements or where an ultra-premium perception is desired, such as aluminum cans or tins.

- Paper & Paperboard: Represents a growing segment (around 7%), driven by sustainability initiatives, used for outer boxes, cartons, and blister card backing.

- Plastic: This segment is further segmented into:

Product Type:

- Plastic Bottles: The leading product type, constituting an estimated 45% of the market, benefiting from the widespread use of plastic materials.

- Glass Bottles: A substantial segment (around 20%), preferred for its premium appeal and inertness.

- Pouches: Experiencing rapid growth (estimated 15%) due to their lightweight, flexibility, and cost-effectiveness, especially for powders and single servings.

- Blisters: A crucial format (around 10%) for tablets and capsules, offering convenience and unit-dose packaging.

- Paperboard Boxes: Primarily used as secondary packaging, contributing to branding and product protection.

- Other Product Types: Includes tubs, sachets, and innovative dispensing systems.

Formulation:

- Tablets: Represent the largest formulation category (around 35%), driving demand for blister packs and bottles.

- Capsules: A close second (around 30%), also heavily reliant on blister packaging and bottles.

- Powder: A significant segment (around 25%), often packaged in pouches, tubs, and bottles.

- Liquids: A smaller but important category (around 10%), typically requiring glass or high-barrier plastic bottles.

Germany, the United Kingdom, France, and Italy are identified as the leading markets, collectively accounting for over 60% of the European dietary supplement packaging market. This dominance is driven by strong consumer spending power, a well-established health and wellness sector, and proactive regulatory environments that encourage innovation and sustainability. The growth of e-commerce across these regions further bolsters the demand for diverse and robust packaging solutions.

Europe Dietary Supplement Packaging Industry Product Developments

Product innovation in Europe's dietary supplement packaging is characterized by a strong focus on sustainability, functionality, and enhanced consumer experience. Developments include the increased use of recycled plastics (rPET, rPP) and biodegradable materials like PLA, addressing environmental concerns. Advancements in barrier technology for flexible packaging are extending shelf life and protecting sensitive formulations. Smart packaging solutions, incorporating QR codes for product authentication and traceability or NFC tags for enhanced consumer engagement, are emerging. Furthermore, innovative dispensing mechanisms for powders and liquids are improving user convenience and accuracy, catering to the growing demand for personalized and convenient supplement consumption.

Key Drivers of Europe Dietary Supplement Packaging Industry Growth

The growth of the European dietary supplement packaging industry is propelled by several key drivers. The escalating health and wellness trend among European consumers, leading to increased supplement consumption, is a primary catalyst. Technological advancements in packaging materials and manufacturing processes enable the creation of more sustainable, functional, and appealing packaging. Evolving regulatory landscapes, while sometimes challenging, also drive innovation towards compliance and eco-friendly alternatives. The expansion of e-commerce channels necessitates robust and attractive packaging to ensure product integrity and enhance the online customer experience.

Challenges in the Europe Dietary Supplement Packaging Industry Market

Despite its growth, the market faces several challenges. Stringent and evolving regulatory requirements concerning food contact materials, recyclability, and labeling can increase compliance costs and necessitate product reformulation. Supply chain disruptions, volatile raw material prices, and logistical complexities can impact production efficiency and profitability. Intense competition among packaging providers leads to price pressures and necessitates continuous investment in innovation. The growing demand for complex, multi-component packaging can also present manufacturing and cost challenges.

Emerging Opportunities in Europe Dietary Supplement Packaging Industry

Emerging opportunities lie in the increasing consumer demand for sustainable and eco-friendly packaging solutions, driving innovation in biodegradable, compostable, and recycled materials. The growth of personalized nutrition and specialized supplements creates a demand for flexible, customizable, and smaller-batch packaging formats. Technological breakthroughs in smart packaging, offering traceability, authenticity verification, and direct consumer engagement, present significant growth avenues. Strategic partnerships between packaging manufacturers and supplement brands can foster co-creation and tailored solutions, tapping into niche market demands.

Leading Players in the Europe Dietary Supplement Packaging Industry Sector

- Novio Packaging B V

- OPM (labels and packaging) Group Ltd

- Law Print & Packaging Management Ltd

- Alpha Packaging

- Moulded Packaging Solutions Limited

- Graham Packaging Company

- Gerresheimer AG

Key Milestones in Europe Dietary Supplement Packaging Industry Industry

- August 2022: ePac Flexible Packaging expands its global operations, including the establishment of a second manufacturing site in the UK, signaling increased capacity and service offerings for the European market.

- Q4 2022: ePac Flexible Packaging initiates expansion plans, including the opening of a second site in Poland and another in France, further strengthening its presence and catering to localized demand.

- Q4 2022: ePac Flexible Packaging inaugurates a new operational facility in Austria, enhancing its distribution and service network across Central Europe.

- Ongoing (2022-2023): ePac Flexible Packaging extends its operational reach to serve markets in the Netherlands and Scandinavia, indicating a strategic focus on broader European market penetration.

Strategic Outlook for Europe Dietary Supplement Packaging Industry Market

The strategic outlook for the Europe Dietary Supplement Packaging Industry is one of sustained growth and innovation. Key accelerators include the continued focus on sustainable packaging solutions, driven by both consumer demand and regulatory pressures, leading to increased adoption of recycled and bio-based materials. The expansion of e-commerce will further drive demand for efficient, protective, and visually appealing packaging. Investing in smart packaging technologies for enhanced traceability and consumer engagement represents a significant opportunity for differentiation. Collaborations between packaging suppliers and supplement brands to develop customized, functional, and aesthetically superior packaging will be crucial for capturing market share and meeting evolving consumer needs.

Europe Dietary Supplement Packaging Industry Segmentation

-

1. Material

-

1.1. Plastic

- 1.1.1. Polypropylene (PP)

- 1.1.2. Polyethylene Terephthalate (PET)

- 1.1.3. Polyethylene (PE)

- 1.1.4. Other Types of Materials

- 1.2. Glass

- 1.3. Metal

- 1.4. Paper & Paperboard

-

1.1. Plastic

-

2. Product Type

- 2.1. Plastic Bottles

- 2.2. Glass Bottles

- 2.3. Pouches

- 2.4. Blisters

- 2.5. Paperboard Boxes

- 2.6. Other Product Types

-

3. Formulation

- 3.1. Tablets

- 3.2. Capsules

- 3.3. Powder

- 3.4. Liquids

- 3.5. Others

Europe Dietary Supplement Packaging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

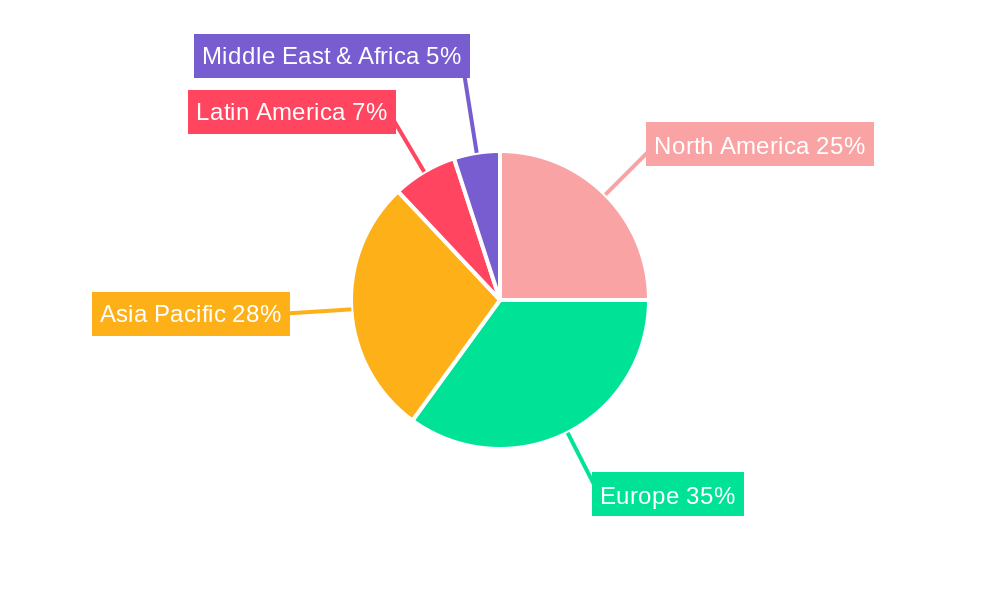

Europe Dietary Supplement Packaging Industry Regional Market Share

Geographic Coverage of Europe Dietary Supplement Packaging Industry

Europe Dietary Supplement Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 High Prevalence of Diseases like Diabetes

- 3.2.2 Cardiovascular disease

- 3.2.3 and other Chronic diseases; Increasing Adoption of Lightweight Packaging Methods

- 3.3. Market Restrains

- 3.3.1. Lower Shelf Life of Active Ingredients and the Higher Manufacturing Cost

- 3.4. Market Trends

- 3.4.1. Glass Material to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Dietary Supplement Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.1.1. Polypropylene (PP)

- 5.1.1.2. Polyethylene Terephthalate (PET)

- 5.1.1.3. Polyethylene (PE)

- 5.1.1.4. Other Types of Materials

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Paper & Paperboard

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Plastic Bottles

- 5.2.2. Glass Bottles

- 5.2.3. Pouches

- 5.2.4. Blisters

- 5.2.5. Paperboard Boxes

- 5.2.6. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Formulation

- 5.3.1. Tablets

- 5.3.2. Capsules

- 5.3.3. Powder

- 5.3.4. Liquids

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Novio Packaging B V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OPM (labels and packaging) Group Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Law Print & Packaging Management Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alpha Packaging

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Moulded Packaging Solutions Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Graham Packaging Company*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gerresheimer AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Novio Packaging B V

List of Figures

- Figure 1: Europe Dietary Supplement Packaging Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Dietary Supplement Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Dietary Supplement Packaging Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 2: Europe Dietary Supplement Packaging Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 3: Europe Dietary Supplement Packaging Industry Revenue undefined Forecast, by Formulation 2020 & 2033

- Table 4: Europe Dietary Supplement Packaging Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Europe Dietary Supplement Packaging Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 6: Europe Dietary Supplement Packaging Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: Europe Dietary Supplement Packaging Industry Revenue undefined Forecast, by Formulation 2020 & 2033

- Table 8: Europe Dietary Supplement Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: France Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Dietary Supplement Packaging Industry?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Europe Dietary Supplement Packaging Industry?

Key companies in the market include Novio Packaging B V, OPM (labels and packaging) Group Ltd, Law Print & Packaging Management Ltd, Alpha Packaging, Moulded Packaging Solutions Limited, Graham Packaging Company*List Not Exhaustive, Gerresheimer AG.

3. What are the main segments of the Europe Dietary Supplement Packaging Industry?

The market segments include Material, Product Type, Formulation.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

High Prevalence of Diseases like Diabetes. Cardiovascular disease. and other Chronic diseases; Increasing Adoption of Lightweight Packaging Methods.

6. What are the notable trends driving market growth?

Glass Material to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Lower Shelf Life of Active Ingredients and the Higher Manufacturing Cost.

8. Can you provide examples of recent developments in the market?

August 2022 - ePac Flexible Packaging expands its operations worldwide, including a second site in the UK. The expansion plans include second sites in Poland and France, while a new operation in Austria is set to open in Q4 2022. Additionally, other sites to serve are the Netherlands and Scandinavia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Dietary Supplement Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Dietary Supplement Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Dietary Supplement Packaging Industry?

To stay informed about further developments, trends, and reports in the Europe Dietary Supplement Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence