Key Insights

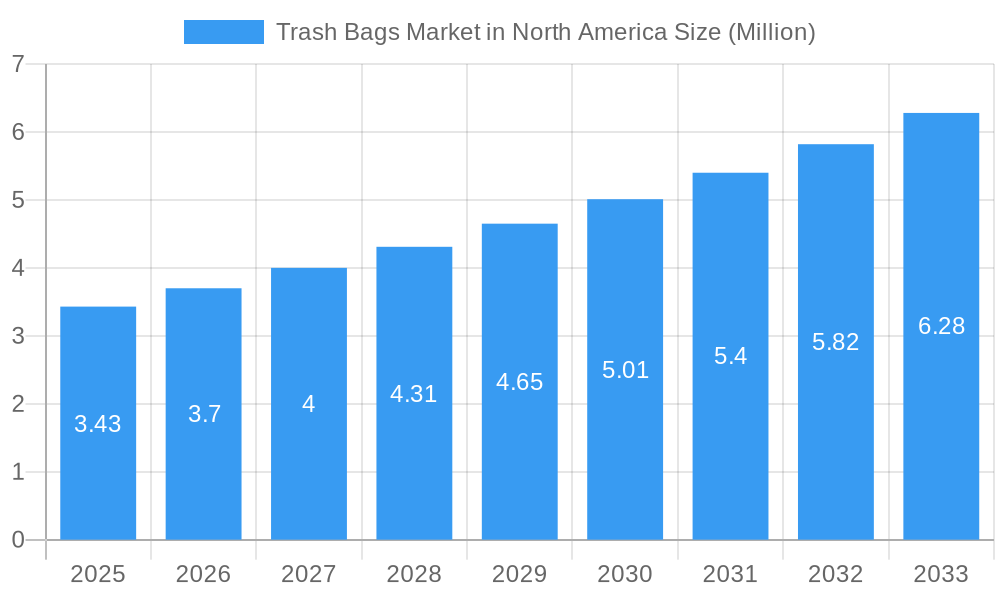

The North American trash bag market is poised for significant expansion, projecting a market size of $3.43 million and a robust CAGR of 7.77% over the forecast period. This growth is primarily fueled by increasing urbanization, a rising consumer focus on hygiene and waste management, and the expanding commercial and industrial sectors across the United States, Canada, and Mexico. The growing awareness of environmental concerns is also driving demand for more sustainable and biodegradable trash bag options, presenting a key trend. Furthermore, regulatory frameworks emphasizing proper waste disposal and recycling initiatives are creating a favorable environment for market players. The residential segment continues to be a dominant force, driven by household disposable income and a persistent need for everyday waste solutions.

Trash Bags Market in North America Market Size (In Million)

However, the market faces certain challenges. Fluctuations in raw material prices, particularly for polyethylene, can impact manufacturing costs and, consequently, profit margins. Intense competition from established players and the emergence of new entrants also contribute to price pressures. Despite these restraints, the inherent necessity of waste management ensures sustained demand. The forecast period is expected to witness innovation in product offerings, including enhanced strength, odor control, and eco-friendly materials, to cater to evolving consumer preferences and regulatory demands. Key companies like The Clorox Company (Glad Products Company), Berry Global Inc., and Novolex Holdings LLC are actively investing in research and development to capture a larger market share.

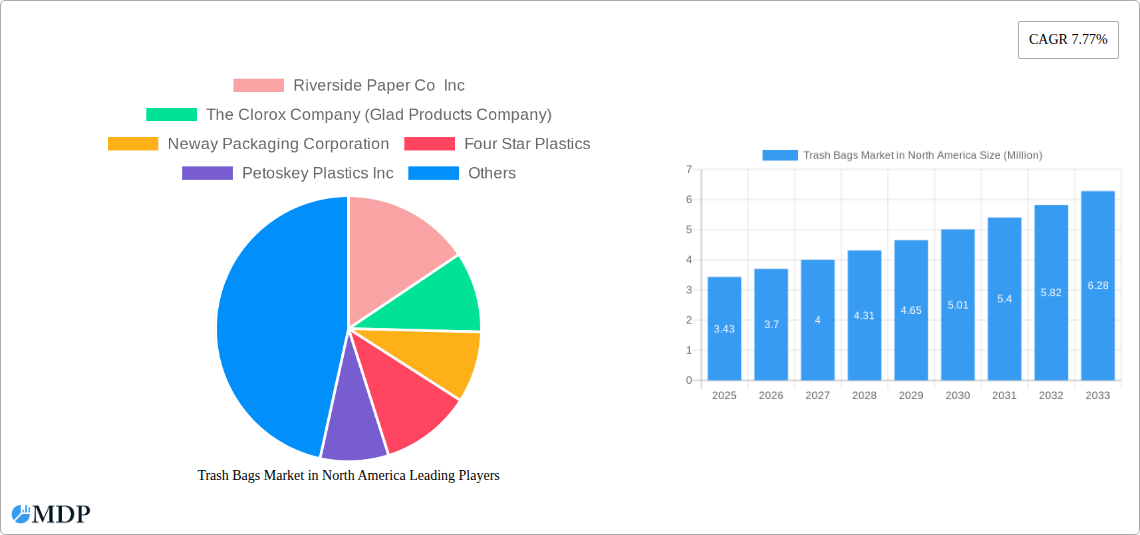

Trash Bags Market in North America Company Market Share

Gain comprehensive insights into the rapidly evolving North America trash bags market with this in-depth report. Covering the study period from 2019–2033, with a base and estimated year of 2025, and a forecast period of 2025–2033, this analysis delves into market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, key players, and strategic outlook. Essential for industry stakeholders, manufacturers, suppliers, and investors seeking to navigate the complexities of the North America trash bag industry, this report provides actionable intelligence to inform strategic decisions and capitalize on market potential. Discover how innovations in sustainable materials, evolving end-user demands for heavy-duty trash bags, and commercial waste management solutions are shaping the future of this vital sector.

Trash Bags Market in North America Market Dynamics & Concentration

The North America trash bags market exhibits a moderate to high concentration, with a few key players holding significant market share. Innovation is largely driven by the increasing demand for sustainable and eco-friendly products, with companies investing in post-consumer recycled (PCR) content and biodegradable alternatives. Regulatory frameworks, particularly concerning waste management and single-use plastics, play a crucial role in shaping product development and market access. The competitive landscape is influenced by the availability of product substitutes, such as reusable bins and advanced waste disposal systems, though their penetration remains limited in many applications. End-user trends are shifting towards convenience, odor control, and enhanced durability, especially within the residential segment. Mergers and acquisitions (M&A) activities, while not intensely frequent, occur strategically to consolidate market position and expand product portfolios. For instance, over the historical period of 2019-2024, there have been approximately 3-5 significant M&A deals annually, with an estimated total transaction value of over $500 Million. Market share distribution sees leading companies like The Clorox Company (Glad Products Company) and Reynolds Consumer Products Inc. (Hefty) commanding substantial portions of the residential market, while industrial and commercial segments are served by specialized manufacturers.

Trash Bags Market in North America Industry Trends & Analysis

The North America trash bags market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033. This robust expansion is fueled by a confluence of factors, including increasing urbanization, rising per capita waste generation, and a growing awareness of hygiene and sanitation. Technological disruptions are primarily focused on material innovation, with a strong emphasis on developing trash bags with enhanced tensile strength, puncture resistance, and leak-proof properties. The integration of recycled materials, such as post-industrial and post-consumer recycled plastics, is a dominant trend, driven by both regulatory pressures and consumer demand for sustainable solutions.

Consumer preferences are evolving, with a growing demand for specialty trash bags tailored to specific needs. This includes preferences for odor-controlling bags, extra-thick bags for heavy-duty applications, and compostable options for organic waste. The commercial sector, encompassing businesses, institutions, and healthcare facilities, represents a substantial segment, driven by the need for efficient and compliant waste management solutions. The industrial segment, while smaller, contributes to market growth through specialized bags for hazardous waste and manufacturing by-products. Competitive dynamics are characterized by a blend of large, established players and smaller, niche manufacturers. Companies are increasingly focusing on differentiating their products through features like drawstrings, tie handles, and specialized packaging. Market penetration is high across North America, with essential product categories enjoying consistent demand. However, the market also sees opportunities in emerging product lines catering to specialized environmental concerns and advanced waste management practices. The overall market size is estimated to reach approximately $12,500 Million by 2025.

Leading Markets & Segments in Trash Bags Market in North America

The North America trash bags market is dominated by the Residential segment, which consistently accounts for the largest share of market revenue, estimated at over 55% of the total market value in 2025. This dominance is driven by the sheer volume of households across the United States and Canada and the everyday necessity of waste disposal. Key drivers for the residential segment include increasing disposable incomes, a rising number of nuclear families, and a growing emphasis on household hygiene and cleanliness. The convenience of disposable trash bags, coupled with innovations in odor control and strength, further solidifies its leading position.

The Commercial segment represents the second-largest contributor, estimated to hold approximately 30% of the market share. This segment encompasses a wide array of end-users, including restaurants, hotels, hospitals, offices, and retail establishments. Growth in this segment is closely tied to the performance of the broader service industry and stringent regulatory requirements for waste management in public and commercial spaces. Economic policies that encourage business growth and infrastructure development directly impact the demand for commercial trash bags.

The Industrial segment, while the smallest, is crucial for specialized applications and holds an estimated 15% market share. This segment includes manufacturing facilities, chemical plants, and other industrial operations that generate specific types of waste requiring specialized containment solutions. Growth drivers here are linked to industrial production output, environmental regulations governing hazardous waste disposal, and the adoption of advanced manufacturing processes that may produce unique waste streams. The demand for industrial trash bags is often characterized by higher performance requirements, such as extreme durability, chemical resistance, and compliance with strict safety standards.

Trash Bags Market in North America Product Developments

Product innovation in the North America trash bags market is centered on enhancing functionality and sustainability. Recent developments include the introduction of trash bags with improved features like stronger drawstrings for easier tying and disposal, enhanced leak-proof designs to prevent messes, and the incorporation of odor-neutralizing technologies. A significant trend is the increasing use of post-consumer recycled (PCR) content, catering to environmentally conscious consumers and meeting regulatory mandates. Companies are also exploring biodegradable and compostable materials to address concerns about plastic waste. These innovations aim to provide superior performance, convenience, and environmental benefits, giving manufacturers a competitive edge and meeting the evolving demands of both residential and commercial users.

Key Drivers of Trash Bags Market in North America Growth

The North America trash bags market is propelled by several key drivers. Increasing urbanization and population growth directly translate to higher waste generation, thus boosting demand for trash bags. Growing consumer awareness regarding hygiene and sanitation drives the preference for convenient and effective waste disposal solutions. Technological advancements in material science have led to the development of stronger, more durable, and eco-friendly trash bags, including those made from recycled materials. Furthermore, stringent government regulations on waste management and environmental protection encourage the adoption of compliant and efficient waste disposal practices, indirectly benefiting the trash bag market. The expansion of the food service industry and healthcare sector also contributes significantly to market growth by increasing the demand for specialized and heavy-duty trash bags.

Challenges in the Trash Bags Market in North America Market

Despite robust growth, the North America trash bags market faces several challenges. Fluctuations in raw material prices, particularly polyethylene, can impact manufacturing costs and profitability. Increasing environmental concerns and regulations regarding plastic waste are pushing for a transition towards more sustainable alternatives, which can be costly to develop and implement at scale. Competition from alternative waste disposal methods and reusable containment systems, while currently limited, poses a potential long-term threat. Supply chain disruptions, as witnessed in recent years, can affect production and distribution efficiency. Additionally, the price sensitivity of a significant portion of the consumer base can make it challenging for manufacturers to pass on the costs associated with premium or eco-friendly products.

Emerging Opportunities in Trash Bags Market in North America

The North America trash bags market presents several emerging opportunities for growth. The increasing demand for sustainable and biodegradable trash bags offers a significant avenue for innovation and market penetration, catering to environmentally conscious consumers and businesses. Expansion into niche markets such as specialized medical waste bags, pet waste bags, and odor-proof kitchen bags can unlock new revenue streams. Strategic partnerships and collaborations between trash bag manufacturers and waste management companies can lead to integrated solutions and expanded distribution networks. Furthermore, technological advancements in smart waste management systems may create opportunities for specialized trash bags that can interact with these systems, such as those with embedded sensors for waste monitoring.

Leading Players in the Trash Bags Market in North America Sector

- Riverside Paper Co Inc

- The Clorox Company (Glad Products Company)

- Neway Packaging Corporation

- Four Star Plastics

- Petoskey Plastics Inc

- Inteplast Group

- Hefty (Reynolds Consumer Products Inc)

- Aluf Plastics

- International Plastics Inc

- Cosmoplast Industrial Company LLC

- Poly-America LP

- Berry Global Inc

- Novolex Holdings LLC

- All American Poly

Key Milestones in Trash Bags Market in North America Industry

- June 2022: Tossits introduced a newly designed trash bag with more vehicle placement options owing to the longer bungee cord feature. Each of these thick bags is made from post-industrial recycled material. These bags are leak-proof and have an adhesive strip that seals off bad odors. This innovation addresses user convenience and sustainability.

- April 2022: The Barry Callebaut Group declared its plans to expand its overall presence in the North American region by building a new specialty chocolate factory in Ontario, Canada. The new state-of-the-art factory is mainly planned to have an initial annual production capacity of more than 50,000 metric tons. This would maximize the overall waste generation process, thereby augmenting the growth of the market significantly by increasing industrial waste.

Strategic Outlook for Trash Bags Market in North America Market

The strategic outlook for the North America trash bags market is positive, driven by a sustained demand for essential waste management solutions and a growing emphasis on sustainability. Key growth accelerators include continued innovation in eco-friendly materials and product functionalities, such as enhanced durability and odor control. Manufacturers that can effectively integrate recycled content and develop compostable alternatives will likely gain a competitive advantage. Expansion into the commercial and industrial segments, through tailored product offerings and partnerships, presents significant untapped potential. The increasing adoption of advanced waste management technologies also creates opportunities for specialized and smart trash bag solutions. Strategic focus on addressing regulatory changes, optimizing supply chains for cost efficiency, and aligning product development with evolving consumer preferences for both convenience and environmental responsibility will be crucial for long-term market success.

Trash Bags Market in North America Segmentation

-

1. End User

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

Trash Bags Market in North America Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

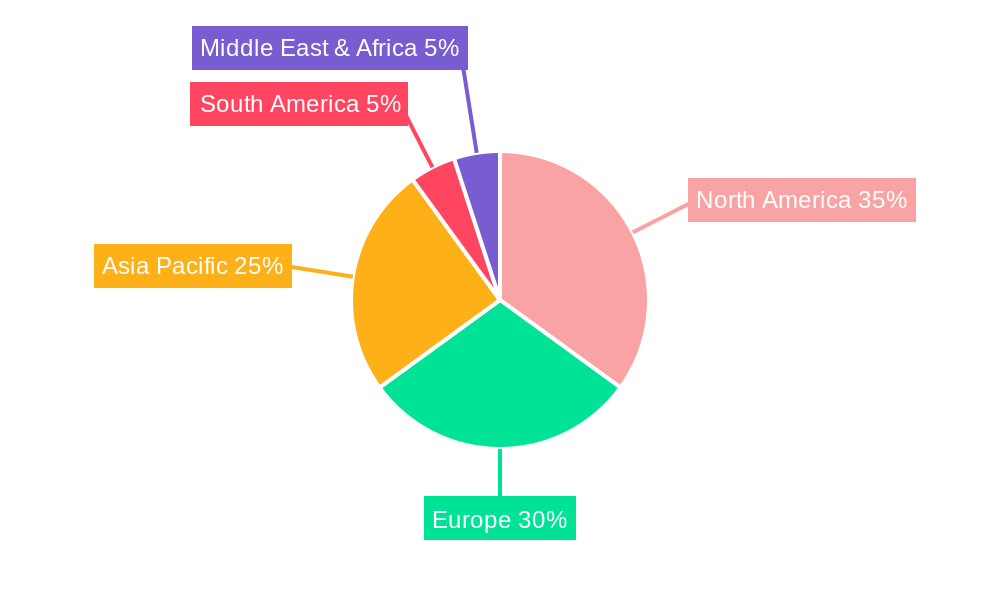

Trash Bags Market in North America Regional Market Share

Geographic Coverage of Trash Bags Market in North America

Trash Bags Market in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. United States Continues to Lead the Market in Terms of Demand and Considering the Various Initiatives Undertaken to Promote Waste Disposal; Growing Demand for Compostable and Oxo-biodegradable Bags

- 3.3. Market Restrains

- 3.3.1. Contamination Due to Poor Packaging or Mishandling

- 3.4. Market Trends

- 3.4.1. Residential Sector Holds Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Trash Bags Market in North America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Trash Bags Market in North America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. South America Trash Bags Market in North America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Europe Trash Bags Market in North America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Middle East & Africa Trash Bags Market in North America Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Asia Pacific Trash Bags Market in North America Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Riverside Paper Co Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Clorox Company (Glad Products Company)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Neway Packaging Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Four Star Plastics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Petoskey Plastics Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Inteplast Group*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hefty (Reynolds Consumer Products Inc )

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aluf Plastics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 International Plastics Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cosmoplast Industrial Company LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Poly-America LP

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Berry Global Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Novolex Holdings LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 All American Poly

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Riverside Paper Co Inc

List of Figures

- Figure 1: Global Trash Bags Market in North America Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Trash Bags Market in North America Revenue (Million), by End User 2025 & 2033

- Figure 3: North America Trash Bags Market in North America Revenue Share (%), by End User 2025 & 2033

- Figure 4: North America Trash Bags Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Trash Bags Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Trash Bags Market in North America Revenue (Million), by End User 2025 & 2033

- Figure 7: South America Trash Bags Market in North America Revenue Share (%), by End User 2025 & 2033

- Figure 8: South America Trash Bags Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Trash Bags Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Trash Bags Market in North America Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Trash Bags Market in North America Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Trash Bags Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Trash Bags Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Trash Bags Market in North America Revenue (Million), by End User 2025 & 2033

- Figure 15: Middle East & Africa Trash Bags Market in North America Revenue Share (%), by End User 2025 & 2033

- Figure 16: Middle East & Africa Trash Bags Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Trash Bags Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Trash Bags Market in North America Revenue (Million), by End User 2025 & 2033

- Figure 19: Asia Pacific Trash Bags Market in North America Revenue Share (%), by End User 2025 & 2033

- Figure 20: Asia Pacific Trash Bags Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Trash Bags Market in North America Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Trash Bags Market in North America Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Global Trash Bags Market in North America Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Trash Bags Market in North America Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Trash Bags Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Trash Bags Market in North America Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global Trash Bags Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Trash Bags Market in North America Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Trash Bags Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Trash Bags Market in North America Revenue Million Forecast, by End User 2020 & 2033

- Table 25: Global Trash Bags Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Trash Bags Market in North America Revenue Million Forecast, by End User 2020 & 2033

- Table 33: Global Trash Bags Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Trash Bags Market in North America?

The projected CAGR is approximately 7.77%.

2. Which companies are prominent players in the Trash Bags Market in North America?

Key companies in the market include Riverside Paper Co Inc, The Clorox Company (Glad Products Company), Neway Packaging Corporation, Four Star Plastics, Petoskey Plastics Inc, Inteplast Group*List Not Exhaustive, Hefty (Reynolds Consumer Products Inc ), Aluf Plastics, International Plastics Inc, Cosmoplast Industrial Company LLC, Poly-America LP, Berry Global Inc, Novolex Holdings LLC, All American Poly.

3. What are the main segments of the Trash Bags Market in North America?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.43 Million as of 2022.

5. What are some drivers contributing to market growth?

United States Continues to Lead the Market in Terms of Demand and Considering the Various Initiatives Undertaken to Promote Waste Disposal; Growing Demand for Compostable and Oxo-biodegradable Bags.

6. What are the notable trends driving market growth?

Residential Sector Holds Major Market Share.

7. Are there any restraints impacting market growth?

Contamination Due to Poor Packaging or Mishandling.

8. Can you provide examples of recent developments in the market?

June 2022: Tossits introduced a newly designed trash bag with more vehicle placement options owing to the longer bungee cord feature. Each of these thick bags is made from post-industrial recycled material. These bags are leak-proof and have an adhesive strip that seals off bad odors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Trash Bags Market in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Trash Bags Market in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Trash Bags Market in North America?

To stay informed about further developments, trends, and reports in the Trash Bags Market in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence