Key Insights

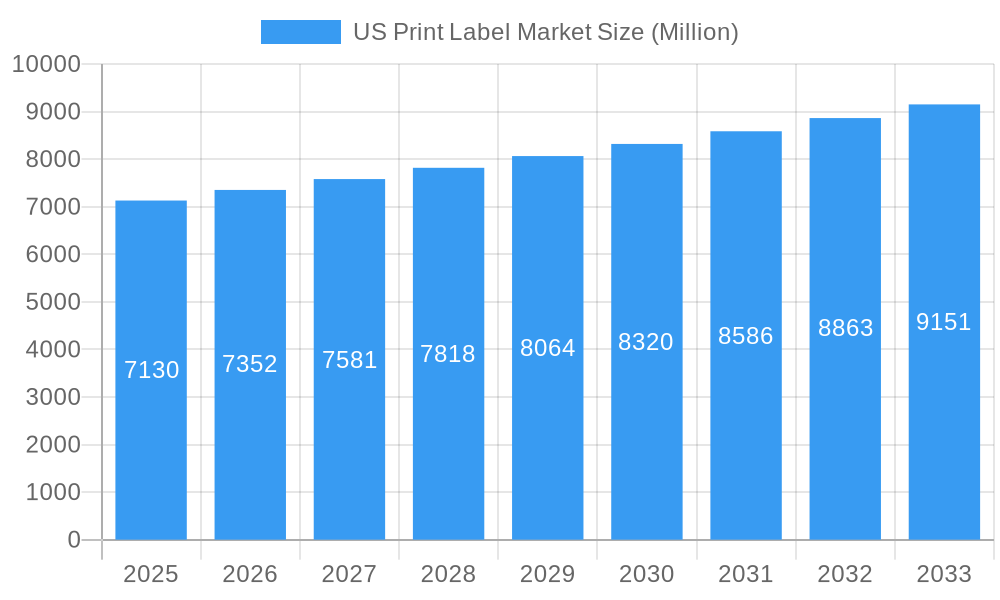

The US print label market is poised for steady expansion, projected to reach approximately $7.13 billion by 2025, with a compound annual growth rate (CAGR) of 3.19% between 2019 and 2033. This growth is propelled by the increasing demand across a diverse range of end-user industries. The Food and Beverage sector remains a dominant force, driven by the constant need for attractive and informative packaging. Similarly, the Healthcare industry's burgeoning demand for pharmaceutical labeling, with its stringent regulatory requirements for safety and authenticity, significantly contributes to market expansion. The Cosmetics and Personal Care segment also plays a crucial role, as brands continuously seek innovative label designs to differentiate themselves in a competitive landscape and enhance consumer appeal. Furthermore, the growth in e-commerce and direct-to-consumer sales models necessitates sophisticated labeling solutions for product tracking, supply chain management, and brand protection, further fueling the market's upward trajectory.

US Print Label Market Market Size (In Billion)

Key drivers shaping the US print label market include technological advancements in printing processes, particularly the increasing adoption of digital printing technologies like Inkjet, which offers greater flexibility, faster turnaround times, and cost-effectiveness for shorter print runs. The evolution of label formats, such as the growing popularity of pressure-sensitive labels and the innovative use of shrink and stretch sleeves for unique packaging shapes, also stimulates market growth. However, challenges such as rising raw material costs, particularly for paper and inks, and increasing environmental regulations regarding waste management and sustainable packaging practices, present potential restraints. Despite these hurdles, the market's inherent resilience, fueled by the continuous innovation in materials, inks, and printing technologies, coupled with the ever-present need for effective product identification and branding, ensures a positive outlook for the US print label sector.

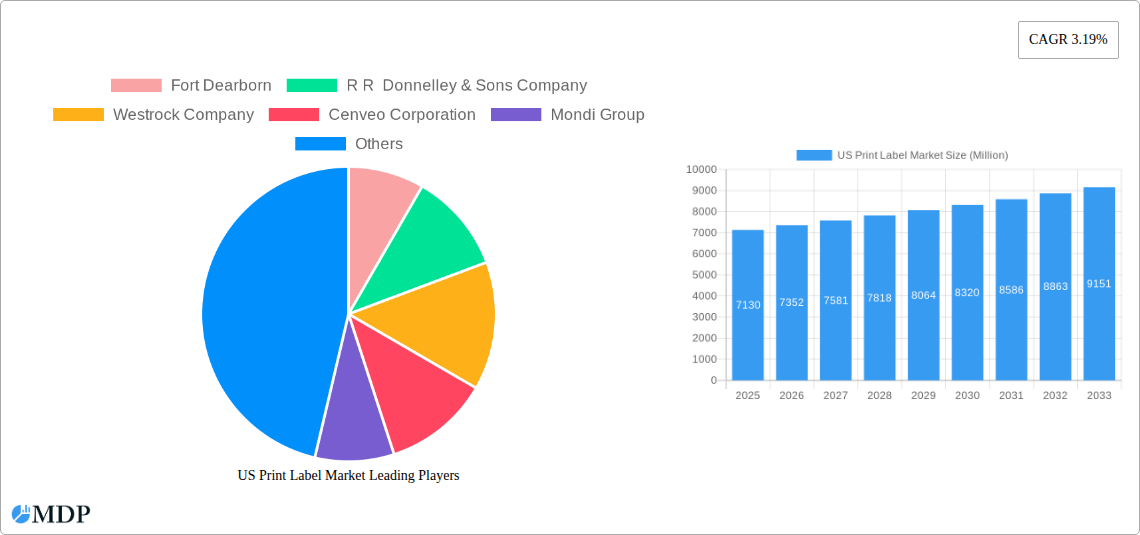

US Print Label Market Company Market Share

Gain unparalleled insights into the dynamic US Print Label Market with this in-depth report. Covering the historical period from 2019-2024 and projecting growth through 2033, with a base and estimated year of 2025, this analysis delves into market segmentation, key industry trends, and strategic imperatives. We dissect the market by print processes like Flexography and Inkjet, label formats including Pressure-sensitive Labels and Shrink and Stretch Sleeves, and critical end-user industries such as Food, Beverage, Healthcare, and Cosmetics. With a focus on actionable data, this report is essential for label manufacturers, converters, suppliers, and industry stakeholders seeking to navigate and capitalize on the evolving landscape of US label printing.

US Print Label Market Market Dynamics & Concentration

The US print label market exhibits a moderately concentrated landscape, with key players like Avery Dennison Corporation, Multi Color Corporation, and Fort Dearborn holding significant market share, estimated to be around 55-60% of the total market value. Innovation remains a primary driver, fueled by advancements in digital printing technologies, sustainable materials, and enhanced functionalities such as smart labels and anti-counterfeiting features. Regulatory frameworks, particularly concerning food safety, pharmaceutical packaging, and environmental compliance, significantly influence product development and market entry strategies. Product substitutes, while present in some niche applications, are largely outweighed by the superior functionality and cost-effectiveness of printed labels, especially pressure-sensitive and shrink sleeve formats. End-user trends are heavily swayed by consumer demand for convenience, product traceability, and brand aesthetics, leading to increased demand for eye-catching and informative labeling solutions across all sectors. Mergers and acquisitions (M&A) are a notable aspect of market dynamics, with approximately 5-8 significant M&A deals reported annually over the historical period, aimed at expanding market reach, acquiring new technologies, and consolidating market position. For instance, the acquisition of JDC Solutions by Avery Dennison in March 2021 highlights the ongoing consolidation and strategic growth pursuits within the sector.

US Print Label Market Industry Trends & Analysis

The US print label market is poised for robust growth, driven by several interconnected trends and technological advancements throughout the study period (2019-2033). The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at approximately 4.5% to 5.5%, indicating a steady and healthy expansion. Market penetration for advanced labeling solutions is rapidly increasing, particularly in high-growth sectors like healthcare and personal care, where product differentiation and regulatory compliance are paramount. The escalating demand for enhanced product visibility and brand storytelling on retail shelves is a primary growth accelerator. Consumers are increasingly influenced by packaging, making premium and innovative label designs crucial for brand success. This has led to a significant uptake in digital printing technologies, offering greater flexibility, faster turnaround times, and cost-effectiveness for shorter print runs and variable data printing. Furthermore, the growing emphasis on sustainability is reshaping the industry, with a rising preference for eco-friendly materials, reduced waste in production processes, and recyclable label solutions. The rise of e-commerce has also created new demands for durable and informative shipping labels, as well as promotional labels for direct-to-consumer products. Technological disruptions, such as the integration of RFID and NFC technologies into labels for supply chain management and consumer engagement, are creating new avenues for value creation and competitive advantage. The competitive landscape is characterized by both large, established players and a growing number of specialized converters focusing on niche markets and innovative solutions. Companies are investing heavily in R&D to develop smart labels, functional coatings, and advanced printing techniques to meet evolving market demands and maintain a competitive edge. The increasing adoption of automation and advanced analytics in label production further contributes to operational efficiency and market responsiveness.

Leading Markets & Segments in US Print Label Market

The US print label market is dominated by several key segments, each contributing significantly to overall market value and growth. Within Print Process, Flexography remains a dominant technology, accounting for an estimated 40-45% of the market share due to its versatility, speed, and cost-effectiveness for long-run production of labels for the food and beverage industries. However, Inkjet and Electrophotography are experiencing the fastest growth rates, projected to grow at a CAGR of over 7% during the forecast period, driven by their ability to handle variable data printing, short runs, and their suitability for personalized marketing campaigns in sectors like healthcare and cosmetics.

In terms of Label Format, Pressure-sensitive Labels are the undisputed market leader, commanding approximately 60-65% of the market. This dominance is attributed to their ease of application, versatility across numerous substrates, and widespread use in almost every end-user industry, particularly Food, Beverage, Healthcare, and Household. Shrink and Stretch Sleeves are the second largest segment, holding around 15-20% market share, experiencing strong growth due to their ability to provide 360-degree branding and tamper-evident features, making them popular in the beverage and cosmetic industries. Linerless Labels are emerging as a significant niche, driven by sustainability initiatives and reduced waste.

Across End-user Industry, the Food and Beverage sector continues to be the largest consumer of printed labels, representing an estimated 35-40% of the total market. This is due to the sheer volume of products, stringent labeling requirements for ingredient information and nutritional facts, and the critical role of labels in brand appeal. The Healthcare industry is another high-value segment, estimated at 20-25% of the market, driven by the need for precise product identification, regulatory compliance for pharmaceuticals, medical devices, and vials, and the growing demand for tamper-evident and child-resistant labeling. The Cosmetics and Personal Care sector follows, accounting for approximately 15-20% of the market, where aesthetic appeal, brand differentiation, and promotional labeling are paramount. The Industrial and Logistics sectors are also significant contributors, requiring durable labels for product identification, shipping, and tracking.

US Print Label Market Product Developments

Product development in the US print label market is characterized by a strong focus on enhancing functionality, sustainability, and brand appeal. Innovations in materials science are leading to the creation of advanced pressure-sensitive adhesives with superior performance on challenging substrates and in extreme conditions. The integration of digital printing technologies is enabling faster and more cost-effective production of labels with variable data, personalized messaging, and intricate designs, catering to the growing demand for customization. Smart labels incorporating RFID, NFC, and QR codes are gaining traction, offering enhanced traceability, supply chain visibility, and interactive consumer experiences. Furthermore, there's a significant push towards eco-friendly solutions, including biodegradable substrates, water-based inks, and recyclable liner materials, aligning with increasing environmental consciousness. These developments are crucial for maintaining competitive advantages and meeting the evolving needs of diverse end-user industries.

Key Drivers of US Print Label Market Growth

Several key factors are propelling the growth of the US print label market. The burgeoning e-commerce sector is a significant driver, increasing the demand for shipping and fulfillment labels. Growing consumer awareness and regulatory mandates for product information, ingredient disclosure, and safety warnings are boosting the need for accurate and compliant labeling, particularly in the food, beverage, and healthcare industries. Advancements in digital printing technologies are enabling greater personalization, shorter run lengths, and on-demand printing, making labels more accessible and cost-effective for businesses of all sizes. The rising emphasis on brand differentiation and premium packaging in the cosmetics, personal care, and food industries also fuels the demand for innovative and visually appealing label designs. Furthermore, increasing investment in supply chain optimization and traceability solutions is driving the adoption of smart labels with integrated tracking capabilities.

Challenges in the US Print Label Market Market

Despite its growth trajectory, the US print label market faces several challenges. Volatility in raw material prices, particularly for paper, films, and inks, can impact manufacturing costs and profit margins. Stringent regulatory requirements across various end-user industries, especially for food and pharmaceuticals, necessitate continuous compliance investments and can lead to extended product development cycles. The intense competition within the market, characterized by numerous players and price pressures, can hinder profitability and necessitate aggressive differentiation strategies. Supply chain disruptions, exacerbated by global events, can lead to delays in raw material sourcing and finished product delivery. Furthermore, the increasing demand for sustainable solutions requires significant investment in new technologies and materials, which may pose a financial burden for smaller manufacturers.

Emerging Opportunities in US Print Label Market

The US print label market is ripe with emerging opportunities driven by technological innovation and evolving consumer demands. The continued growth of the healthcare sector presents a significant opportunity for specialized pharmaceutical and medical device labels, including those with enhanced tamper-evidence and anti-counterfeiting features. The expanding market for sustainable packaging is creating demand for eco-friendly label solutions, such as compostable and recycled materials, and advancements in water-based inks. The integration of smart technologies like RFID and NFC into labels for enhanced supply chain visibility, product authentication, and consumer engagement opens up new revenue streams and value-added services. The increasing trend towards personalization and mass customization in consumer goods offers opportunities for digital printing solutions that can deliver unique and variable label designs. Strategic partnerships between label manufacturers, technology providers, and end-user brands can accelerate the development and adoption of these innovative solutions.

Leading Players in the US Print Label Market Sector

- Fort Dearborn

- R R Donnelley & Sons Company

- Westrock Company

- Cenveo Corporation

- Mondi Group

- Multi Color Corporation

- Avery Dennison Corporation

- Taylor Corporation

- Ahlstrom-munksjö Oyj

- Brady Corporation

Key Milestones in US Print Label Market Industry

- March 2021: Avery Dennison Corporation acquired JDC Solutions, Inc., a privately-held manufacturer of pressure-sensitive specialty tapes in Mount Juliet, Tennessee, at USD 24 million. JDC's manufacturing operations, workforce, and product portfolio became part of Avery Dennison's Performance Tapes North America business. This acquisition aimed to bolster Avery Dennison's specialty tape offerings and expand its market reach in North America.

- February 2021: R.R. Donnelley & Sons Company announced expanded operations in Sacramento, creating Pacific Standard Print (PSP), a dynamic center of excellence for commercial print in Northern California. This expansion included enhanced digital and sheetfed capabilities and mail-out and print fulfillment services within a 136,000 square foot facility, notably incorporating 40-inch sheetfed offset presses, signifying a strategic investment in advanced printing infrastructure to cater to evolving customer needs.

Strategic Outlook for US Print Label Market Market

The strategic outlook for the US print label market is characterized by a strong emphasis on innovation, sustainability, and digital transformation. Companies are expected to continue investing in advanced printing technologies, particularly digital solutions, to meet the growing demand for customization, shorter lead times, and variable data printing. The push towards environmentally friendly label materials and manufacturing processes will remain a critical focus, presenting opportunities for businesses that can offer sustainable alternatives. Strategic partnerships and collaborations will play a vital role in developing and commercializing new technologies, such as smart labels with integrated functionalities. Furthermore, market consolidation through mergers and acquisitions is likely to continue as companies seek to expand their product portfolios, geographical reach, and operational efficiencies to remain competitive in this dynamic sector. The ability to adapt to evolving regulatory landscapes and cater to niche market demands will be crucial for sustained success.

US Print Label Market Segmentation

-

1. Print Process

- 1.1. Offset Lithography

- 1.2. Gravure

- 1.3. Flexography

- 1.4. Screen

- 1.5. Letterpress

- 1.6. Electrophotography

- 1.7. Inkjet

-

2. Label Format

- 2.1. Wet-glue Labels

- 2.2. Pressure-sensitive Labels

- 2.3. Linerless Labels

- 2.4. Multi-part Tracking Labels

- 2.5. In-mold Labels

- 2.6. Shrink and Stretch Sleeves

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Healthcare

- 3.4. Cosmetics

- 3.5. Household

- 3.6. Industri

- 3.7. Logistics

- 3.8. Other End-user Industries

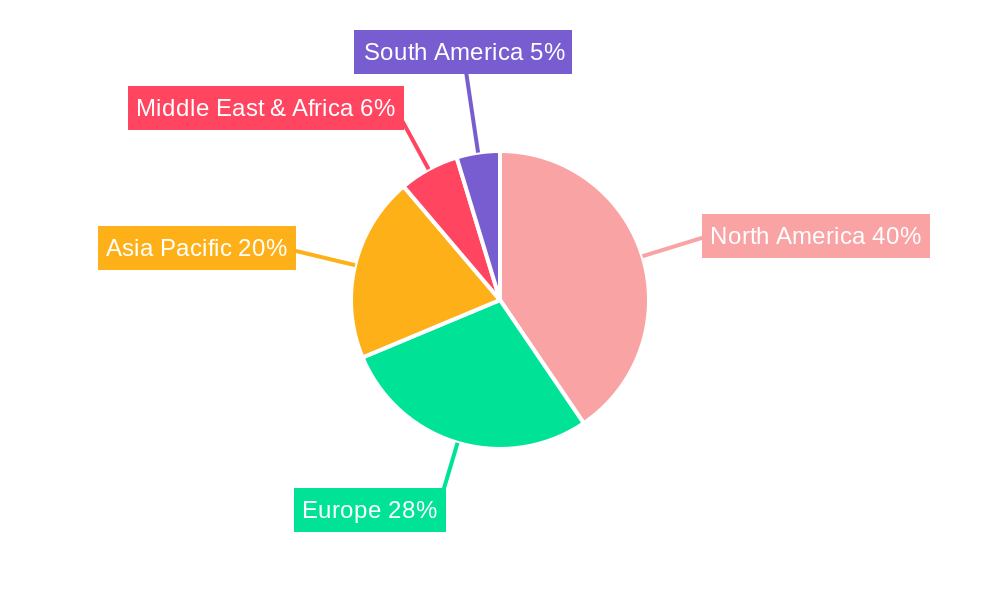

US Print Label Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Print Label Market Regional Market Share

Geographic Coverage of US Print Label Market

US Print Label Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Labels Manufactured with Digital Print Technologies; High Adoption From Healthcare and Cosmetics Segment

- 3.3. Market Restrains

- 3.3.1. Lack of Products with Ability to Withstand Harsh Climatic Conditions

- 3.4. Market Trends

- 3.4.1. Pressure-sensitive Labels Accounts for the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Print Label Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Print Process

- 5.1.1. Offset Lithography

- 5.1.2. Gravure

- 5.1.3. Flexography

- 5.1.4. Screen

- 5.1.5. Letterpress

- 5.1.6. Electrophotography

- 5.1.7. Inkjet

- 5.2. Market Analysis, Insights and Forecast - by Label Format

- 5.2.1. Wet-glue Labels

- 5.2.2. Pressure-sensitive Labels

- 5.2.3. Linerless Labels

- 5.2.4. Multi-part Tracking Labels

- 5.2.5. In-mold Labels

- 5.2.6. Shrink and Stretch Sleeves

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Healthcare

- 5.3.4. Cosmetics

- 5.3.5. Household

- 5.3.6. Industri

- 5.3.7. Logistics

- 5.3.8. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Print Process

- 6. North America US Print Label Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Print Process

- 6.1.1. Offset Lithography

- 6.1.2. Gravure

- 6.1.3. Flexography

- 6.1.4. Screen

- 6.1.5. Letterpress

- 6.1.6. Electrophotography

- 6.1.7. Inkjet

- 6.2. Market Analysis, Insights and Forecast - by Label Format

- 6.2.1. Wet-glue Labels

- 6.2.2. Pressure-sensitive Labels

- 6.2.3. Linerless Labels

- 6.2.4. Multi-part Tracking Labels

- 6.2.5. In-mold Labels

- 6.2.6. Shrink and Stretch Sleeves

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Healthcare

- 6.3.4. Cosmetics

- 6.3.5. Household

- 6.3.6. Industri

- 6.3.7. Logistics

- 6.3.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Print Process

- 7. South America US Print Label Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Print Process

- 7.1.1. Offset Lithography

- 7.1.2. Gravure

- 7.1.3. Flexography

- 7.1.4. Screen

- 7.1.5. Letterpress

- 7.1.6. Electrophotography

- 7.1.7. Inkjet

- 7.2. Market Analysis, Insights and Forecast - by Label Format

- 7.2.1. Wet-glue Labels

- 7.2.2. Pressure-sensitive Labels

- 7.2.3. Linerless Labels

- 7.2.4. Multi-part Tracking Labels

- 7.2.5. In-mold Labels

- 7.2.6. Shrink and Stretch Sleeves

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Healthcare

- 7.3.4. Cosmetics

- 7.3.5. Household

- 7.3.6. Industri

- 7.3.7. Logistics

- 7.3.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Print Process

- 8. Europe US Print Label Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Print Process

- 8.1.1. Offset Lithography

- 8.1.2. Gravure

- 8.1.3. Flexography

- 8.1.4. Screen

- 8.1.5. Letterpress

- 8.1.6. Electrophotography

- 8.1.7. Inkjet

- 8.2. Market Analysis, Insights and Forecast - by Label Format

- 8.2.1. Wet-glue Labels

- 8.2.2. Pressure-sensitive Labels

- 8.2.3. Linerless Labels

- 8.2.4. Multi-part Tracking Labels

- 8.2.5. In-mold Labels

- 8.2.6. Shrink and Stretch Sleeves

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Healthcare

- 8.3.4. Cosmetics

- 8.3.5. Household

- 8.3.6. Industri

- 8.3.7. Logistics

- 8.3.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Print Process

- 9. Middle East & Africa US Print Label Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Print Process

- 9.1.1. Offset Lithography

- 9.1.2. Gravure

- 9.1.3. Flexography

- 9.1.4. Screen

- 9.1.5. Letterpress

- 9.1.6. Electrophotography

- 9.1.7. Inkjet

- 9.2. Market Analysis, Insights and Forecast - by Label Format

- 9.2.1. Wet-glue Labels

- 9.2.2. Pressure-sensitive Labels

- 9.2.3. Linerless Labels

- 9.2.4. Multi-part Tracking Labels

- 9.2.5. In-mold Labels

- 9.2.6. Shrink and Stretch Sleeves

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Healthcare

- 9.3.4. Cosmetics

- 9.3.5. Household

- 9.3.6. Industri

- 9.3.7. Logistics

- 9.3.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Print Process

- 10. Asia Pacific US Print Label Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Print Process

- 10.1.1. Offset Lithography

- 10.1.2. Gravure

- 10.1.3. Flexography

- 10.1.4. Screen

- 10.1.5. Letterpress

- 10.1.6. Electrophotography

- 10.1.7. Inkjet

- 10.2. Market Analysis, Insights and Forecast - by Label Format

- 10.2.1. Wet-glue Labels

- 10.2.2. Pressure-sensitive Labels

- 10.2.3. Linerless Labels

- 10.2.4. Multi-part Tracking Labels

- 10.2.5. In-mold Labels

- 10.2.6. Shrink and Stretch Sleeves

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Healthcare

- 10.3.4. Cosmetics

- 10.3.5. Household

- 10.3.6. Industri

- 10.3.7. Logistics

- 10.3.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Print Process

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Fort Dearborn

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 R R Donnelley & Sons Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Westrock Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cenveo Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mondi Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Multi Color Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Avery Dennison Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Taylor Corporation*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ahlstrom-munksjö Oyj

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Brady Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Fort Dearborn

List of Figures

- Figure 1: Global US Print Label Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Print Label Market Revenue (Million), by Print Process 2025 & 2033

- Figure 3: North America US Print Label Market Revenue Share (%), by Print Process 2025 & 2033

- Figure 4: North America US Print Label Market Revenue (Million), by Label Format 2025 & 2033

- Figure 5: North America US Print Label Market Revenue Share (%), by Label Format 2025 & 2033

- Figure 6: North America US Print Label Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America US Print Label Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America US Print Label Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America US Print Label Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Print Label Market Revenue (Million), by Print Process 2025 & 2033

- Figure 11: South America US Print Label Market Revenue Share (%), by Print Process 2025 & 2033

- Figure 12: South America US Print Label Market Revenue (Million), by Label Format 2025 & 2033

- Figure 13: South America US Print Label Market Revenue Share (%), by Label Format 2025 & 2033

- Figure 14: South America US Print Label Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: South America US Print Label Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America US Print Label Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America US Print Label Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Print Label Market Revenue (Million), by Print Process 2025 & 2033

- Figure 19: Europe US Print Label Market Revenue Share (%), by Print Process 2025 & 2033

- Figure 20: Europe US Print Label Market Revenue (Million), by Label Format 2025 & 2033

- Figure 21: Europe US Print Label Market Revenue Share (%), by Label Format 2025 & 2033

- Figure 22: Europe US Print Label Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe US Print Label Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe US Print Label Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe US Print Label Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Print Label Market Revenue (Million), by Print Process 2025 & 2033

- Figure 27: Middle East & Africa US Print Label Market Revenue Share (%), by Print Process 2025 & 2033

- Figure 28: Middle East & Africa US Print Label Market Revenue (Million), by Label Format 2025 & 2033

- Figure 29: Middle East & Africa US Print Label Market Revenue Share (%), by Label Format 2025 & 2033

- Figure 30: Middle East & Africa US Print Label Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa US Print Label Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa US Print Label Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Print Label Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Print Label Market Revenue (Million), by Print Process 2025 & 2033

- Figure 35: Asia Pacific US Print Label Market Revenue Share (%), by Print Process 2025 & 2033

- Figure 36: Asia Pacific US Print Label Market Revenue (Million), by Label Format 2025 & 2033

- Figure 37: Asia Pacific US Print Label Market Revenue Share (%), by Label Format 2025 & 2033

- Figure 38: Asia Pacific US Print Label Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific US Print Label Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific US Print Label Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific US Print Label Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Print Label Market Revenue Million Forecast, by Print Process 2020 & 2033

- Table 2: Global US Print Label Market Revenue Million Forecast, by Label Format 2020 & 2033

- Table 3: Global US Print Label Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global US Print Label Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global US Print Label Market Revenue Million Forecast, by Print Process 2020 & 2033

- Table 6: Global US Print Label Market Revenue Million Forecast, by Label Format 2020 & 2033

- Table 7: Global US Print Label Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global US Print Label Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global US Print Label Market Revenue Million Forecast, by Print Process 2020 & 2033

- Table 13: Global US Print Label Market Revenue Million Forecast, by Label Format 2020 & 2033

- Table 14: Global US Print Label Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global US Print Label Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global US Print Label Market Revenue Million Forecast, by Print Process 2020 & 2033

- Table 20: Global US Print Label Market Revenue Million Forecast, by Label Format 2020 & 2033

- Table 21: Global US Print Label Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global US Print Label Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global US Print Label Market Revenue Million Forecast, by Print Process 2020 & 2033

- Table 33: Global US Print Label Market Revenue Million Forecast, by Label Format 2020 & 2033

- Table 34: Global US Print Label Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 35: Global US Print Label Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global US Print Label Market Revenue Million Forecast, by Print Process 2020 & 2033

- Table 43: Global US Print Label Market Revenue Million Forecast, by Label Format 2020 & 2033

- Table 44: Global US Print Label Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 45: Global US Print Label Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Print Label Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Print Label Market?

The projected CAGR is approximately 3.19%.

2. Which companies are prominent players in the US Print Label Market?

Key companies in the market include Fort Dearborn, R R Donnelley & Sons Company, Westrock Company, Cenveo Corporation, Mondi Group, Multi Color Corporation, Avery Dennison Corporation, Taylor Corporation*List Not Exhaustive, Ahlstrom-munksjö Oyj, Brady Corporation.

3. What are the main segments of the US Print Label Market?

The market segments include Print Process, Label Format, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Labels Manufactured with Digital Print Technologies; High Adoption From Healthcare and Cosmetics Segment.

6. What are the notable trends driving market growth?

Pressure-sensitive Labels Accounts for the Largest Market Share.

7. Are there any restraints impacting market growth?

Lack of Products with Ability to Withstand Harsh Climatic Conditions.

8. Can you provide examples of recent developments in the market?

March 2021 - Avery Dennison Corporation acquired JDC Solutions, Inc., a privately-held manufacturer of pressure-sensitive specialty tapes in Mount Juliet, Tennessee, at USD 24 million. JDC's manufacturing operations, workforce, and product portfolio will become part of Avery Dennison's Performance Tapes North America business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Print Label Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Print Label Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Print Label Market?

To stay informed about further developments, trends, and reports in the US Print Label Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence