Key Insights

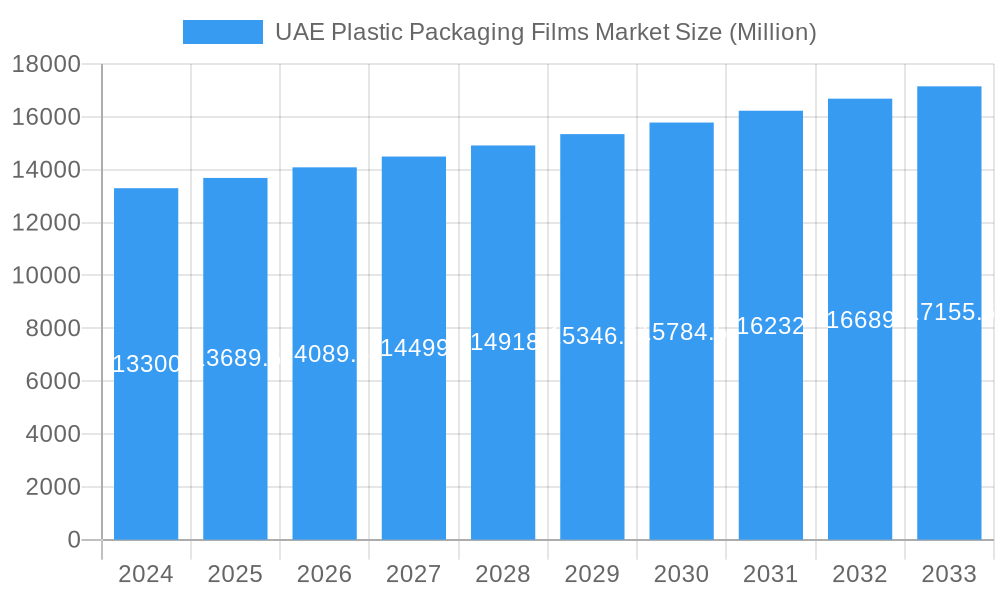

The UAE Plastic Packaging Films Market is poised for steady expansion, currently estimated at USD 13.3 billion in 2024. This growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 2.9% over the forecast period of 2025-2033. The market's robust trajectory is primarily fueled by the burgeoning demand for sophisticated and sustainable packaging solutions across key end-user industries. The food sector, in particular, is a significant driver, with specific segments like confectionery, frozen foods, and fresh produce experiencing elevated consumption of plastic packaging films due to their protective qualities, extended shelf life, and convenience. Similarly, the healthcare industry's increasing reliance on sterile and secure packaging for pharmaceuticals and medical devices contributes to market momentum. The personal care and home care segments also play a vital role, driven by a growing consumer base and the need for attractive and functional packaging.

UAE Plastic Packaging Films Market Market Size (In Billion)

Further impetus for market growth is derived from evolving consumer preferences and technological advancements in film production. The increasing adoption of advanced film types such as Polyethylene Terephthalate Glycol (PETG) and Ethylene Vinyl Alcohol (EVOH) for their superior barrier properties and versatility is a notable trend. While the market benefits from these drivers, it also faces certain restraints. Fluctuations in raw material prices, environmental concerns surrounding plastic waste, and stringent government regulations aimed at promoting sustainable packaging alternatives present challenges. However, the industry's proactive approach in developing bio-based and recyclable plastic films is a promising development that is expected to mitigate these restraints and foster long-term market sustainability. Emerging economies within the Middle East and Africa, alongside established markets in Asia Pacific, are anticipated to witness considerable growth opportunities.

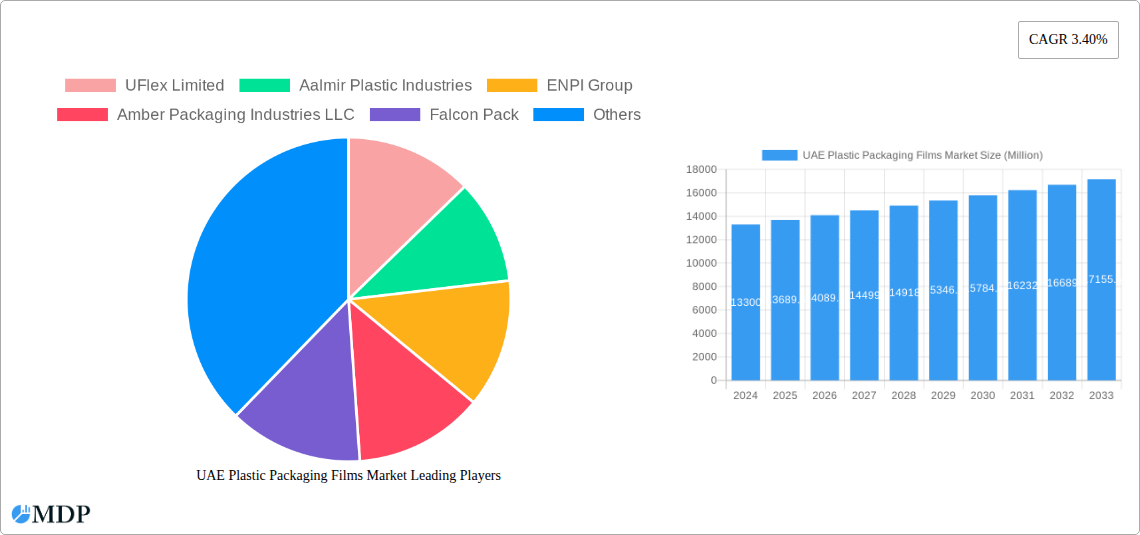

UAE Plastic Packaging Films Market Company Market Share

Unlock critical insights into the UAE plastic packaging films market, a dynamic sector projected to witness substantial growth. This in-depth report offers a granular analysis of market dynamics, key trends, segmentation, product innovations, and leading players. With the base year 2025 and a forecast period extending to 2033, this study provides actionable intelligence for stakeholders navigating the evolving landscape of flexible and rigid packaging solutions in the United Arab Emirates. We delve into the market's trajectory, driven by increasing consumer demand, technological advancements, and a growing emphasis on sustainable packaging solutions. The global plastic packaging market trends are mirrored and amplified within the UAE, particularly in the food packaging films and healthcare packaging segments. This report is an essential resource for understanding market size, competitive intensity, and future opportunities within this burgeoning industry.

UAE Plastic Packaging Films Market Market Dynamics & Concentration

The UAE plastic packaging films market exhibits a moderate to high concentration, with a few key players dominating market share. Innovation drivers are primarily fueled by the demand for enhanced barrier properties, extended shelf-life solutions for food products, and sustainable alternatives. Regulatory frameworks are increasingly pushing for circular economy principles and reduced plastic waste, influencing product development and material choices. Product substitutes, while present, often struggle to match the cost-effectiveness and versatility of plastic films, especially in the food and beverage packaging sector. End-user trends are strongly influenced by a growing, affluent population, a booming tourism industry, and a retail landscape that demands visually appealing and convenient packaging. Mergers and acquisitions (M&A) activities are present, though less frequent, as companies seek to expand their product portfolios and geographical reach. Key market players are strategically investing in R&D to develop high-performance, eco-friendly film solutions to maintain their competitive edge. The Middle East plastic packaging market is a vital component of the global industry, with the UAE at its forefront.

- Market Share: Leading companies hold an estimated 60-70% of the market share.

- Innovation Drivers: Demand for sustainability, advanced barrier properties, lightweighting, and customization.

- Regulatory Frameworks: Growing emphasis on recycling targets, extended producer responsibility, and bans on single-use plastics.

- Product Substitutes: Paper, glass, and metal packaging, though generally less cost-effective for many applications.

- End-User Trends: Convenience, e-commerce growth, health and wellness focus, and demand for premium packaging.

- M&A Activities: Strategic acquisitions to gain market access and technological capabilities.

UAE Plastic Packaging Films Market Industry Trends & Analysis

The UAE plastic packaging films market is experiencing robust growth, propelled by several interconnected industry trends. A significant growth driver is the escalating demand from the food and beverage industry, which requires innovative packaging solutions to preserve freshness, extend shelf life, and enhance consumer appeal for a wide array of products, from candy and confectionery to frozen foods and dairy products. The expanding healthcare sector also contributes to market expansion, demanding high-quality, sterile packaging for pharmaceuticals and medical devices. Furthermore, the surge in e-commerce across the UAE has significantly boosted the need for durable and protective industrial packaging films. Technologically, advancements in film extrusion, multilayer film co-extrusion, and the development of specialized barrier films are revolutionizing the market, offering superior performance and tailored functionalities. The growing consumer awareness regarding environmental sustainability is a pivotal trend, driving the demand for bio-based packaging films and recycled content, such as recycled PET (rPET). This shift is compelling manufacturers to invest in sustainable technologies and product lines. Competitive dynamics are characterized by intense price competition, a focus on product differentiation through advanced features, and strategic alliances aimed at expanding market reach and technological capabilities. The market penetration of advanced film types, like EVOH and PETG, is increasing due to their superior barrier properties and suitability for demanding applications. The plastic packaging in UAE market is also influenced by government initiatives promoting local manufacturing and circular economy principles, fostering a more sustainable and self-reliant packaging ecosystem. The projected Compound Annual Growth Rate (CAGR) for this market is estimated to be between 5.5% and 7.0% over the forecast period.

Leading Markets & Segments in UAE Plastic Packaging Films Market

The UAE plastic packaging films market is segmented by Type and End-user Industry, with distinct segments exhibiting varying growth trajectories.

By Type:

- Polyethylene (PE) films continue to dominate the market due to their versatility, cost-effectiveness, and widespread applications across various industries, particularly in food packaging and industrial packaging. This includes High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), and Linear Low-Density Polyethylene (LLDPE). The extensive use of polyethylene in flexible packaging solutions for everyday consumer goods solidifies its leading position.

- Polypropylene (PP) films are also significant, offering excellent clarity, strength, and heat resistance, making them ideal for food packaging, especially for confectionery and bakery items.

- PETG films are gaining traction due to their excellent clarity, chemical resistance, and recyclability, finding applications in specialized packaging where high performance is critical.

- Bio-Based films represent a rapidly growing segment, driven by increasing environmental consciousness and regulatory push for sustainable alternatives. Their adoption is particularly strong in consumer-facing applications seeking eco-friendly branding.

- PVC films maintain a presence, especially in applications requiring specific properties like transparency and rigidity, though their market share is gradually being influenced by the availability of more sustainable alternatives.

- Polystyrene films, EVOH films, and Other Film Types cater to niche applications requiring specific barrier or performance characteristics.

By End-user Industry:

- Food Packaging is by far the largest and most dynamic segment. Within this, Candy and Confectionery and Frozen Foods represent substantial demand, driven by consumer preferences for convenience and shelf-stable products. Dairy Products and Dry Foods also constitute significant portions, requiring films with excellent moisture and oxygen barrier properties. The growth of the quick-service restaurant (QSR) and food delivery sectors further amplifies demand for efficient and safe food packaging solutions.

- Healthcare is a critical and growing segment, demanding high-purity, sterile, and tamper-evident packaging for pharmaceuticals, medical devices, and diagnostic kits. The stringent regulatory requirements in this sector drive innovation in advanced film technologies.

- Personal Care and Home Care segments require visually appealing and functional packaging for products like cosmetics, toiletries, and cleaning supplies, contributing to consistent market demand.

- Industrial Packaging is a strong contributor, driven by the logistics and shipping needs of various manufacturing sectors, including the demand for protective films, shrink wraps, and stretch films.

- Other End-User Industries encompass diverse applications, reflecting the broad utility of plastic packaging films across the UAE economy.

Key drivers for dominance in these segments include economic policies supporting industrial growth, advancements in manufacturing infrastructure, and the ever-evolving consumer preferences for convenience, safety, and sustainability.

UAE Plastic Packaging Films Market Product Developments

Product developments in the UAE plastic packaging films market are primarily focused on enhancing sustainability, performance, and functionality. Innovations include the development of advanced multilayer films with superior barrier properties against oxygen, moisture, and UV light, crucial for extending the shelf life of perishable goods like frozen foods and dairy products. The rise of bio-based packaging films derived from renewable resources is a significant trend, offering a more environmentally friendly alternative to conventional petroleum-based plastics. Furthermore, advancements in chemical and mechanical recycling are leading to the increased use of post-consumer recycled (PCR) content in packaging films, particularly rPET films, aligning with circular economy initiatives. Companies are also investing in antimicrobial films to improve food safety and reduce spoilage. These innovations are driven by evolving consumer demands for sustainable and high-performance packaging, as well as stricter regulatory landscapes.

Key Drivers of UAE Plastic Packaging Films Market Growth

The growth of the UAE plastic packaging films market is underpinned by several key drivers. The burgeoning food and beverage industry, fueled by a growing population and a robust tourism sector, creates sustained demand for diverse packaging solutions. Technological advancements in film manufacturing, such as enhanced barrier technologies and sophisticated extrusion techniques, enable the creation of higher-performing and more specialized films. The increasing consumer preference for convenience and packaged goods, coupled with the rapid expansion of the e-commerce sector, necessitates robust and protective packaging. Furthermore, a growing global and local emphasis on sustainability is driving the demand for bio-based packaging films and recycled content, creating new market opportunities. Government initiatives promoting local manufacturing and export capabilities also contribute to market expansion.

Challenges in the UAE Plastic Packaging Films Market Market

Despite its growth trajectory, the UAE plastic packaging films market faces several challenges. Increasing regulatory pressures concerning plastic waste management and environmental impact necessitate significant investment in sustainable alternatives and recycling infrastructure. Fluctuations in raw material prices, particularly for petrochemicals, can impact production costs and profitability. Intense competition within the market can lead to price erosion, affecting profit margins. Supply chain disruptions, exacerbated by global events, can affect the availability and cost of raw materials and finished goods. Moreover, overcoming consumer perception and ensuring the widespread adoption of new, sustainable packaging solutions require sustained educational efforts and industry collaboration.

Emerging Opportunities in UAE Plastic Packaging Films Market

Emerging opportunities in the UAE plastic packaging films market are largely centered around sustainability and technological innovation. The growing demand for flexible packaging solutions with enhanced barrier properties for longer shelf life is a significant opportunity, especially within the food packaging segment. The development and commercialization of high-performance bio-based and compostable packaging films present a substantial growth avenue as environmental consciousness rises. Strategic partnerships between raw material suppliers, film manufacturers, and end-users can foster innovation and accelerate the adoption of sustainable materials. Furthermore, investments in advanced recycling technologies, including chemical recycling, offer a promising pathway to create a circular economy for plastic packaging, unlocking new revenue streams and addressing environmental concerns.

Leading Players in the UAE Plastic Packaging Films Market Sector

- UFlex Limited

- Aalmir Plastic Industries

- ENPI Group

- Amber Packaging Industries LLC

- Falcon Pack

- Emirates Printing Press LLC

- Radiant Packaging Industry LLC

- Integrated Plastics Packaging LLC

- Taghleef Industries Group

- Interplast

Key Milestones in UAE Plastic Packaging Films Market Industry

- June 2024: Versalis and Crocco announced a strategic collaboration in the UAE to manufacture food packaging films through chemical recycling techniques, utilizing post-consumer plastic recycling. This collaboration aims to expand production to meet the demands of the burgeoning retail landscape, emphasizing their commitment to sustainability.

- November 2023: Spinneys, a prominent fresh food retailer in the UAE, collaborated with Al Bayader International to launch recycled plastic packaging (rPET). Al Bayader, in partnership with local entities, is instrumental in collecting and transforming plastic waste into rPET, significantly reducing landfill burden. This initiative promotes sustainability and encourages other retailers and brands to adopt similar eco-friendly practices, thereby increasing the demand for recycled plastic packaging films.

Strategic Outlook for UAE Plastic Packaging Films Market Market

The strategic outlook for the UAE plastic packaging films market is one of continued innovation and sustainable growth. Key growth accelerators include the ongoing expansion of the food packaging and healthcare packaging sectors, driven by demographic trends and rising disposable incomes. The increasing integration of Industry 4.0 technologies, such as advanced automation and AI in manufacturing processes, will enhance efficiency and product quality. Strategic partnerships focused on developing and scaling up sustainable packaging solutions, including bio-based films and advanced recycling technologies, will be crucial for long-term success. The UAE's position as a regional hub for trade and commerce will continue to support the export of high-quality plastic packaging films, further driving market expansion. Companies that prioritize R&D, sustainability, and customer-centric solutions will be best positioned to capitalize on the evolving market landscape.

UAE Plastic Packaging Films Market Segmentation

-

1. Type

- 1.1. Polyprop

- 1.2. Polyethy

- 1.3. Polyethy

- 1.4. Polystyrene

- 1.5. Bio-Based

- 1.6. PVC, EVOH, PETG, and Other Film Types

-

2. End-user Industry

-

2.1. Food

- 2.1.1. Candy and Confectionery

- 2.1.2. Frozen Foods

- 2.1.3. Fresh Produce

- 2.1.4. Dairy Products

- 2.1.5. Dry Foods

- 2.1.6. Meat, Poultry, and Seafood

- 2.1.7. Pet Food

- 2.1.8. Other Fo

- 2.2. Healthcare

- 2.3. Personal Care and Home Care

- 2.4. Industrial Packaging

- 2.5. Other En

-

2.1. Food

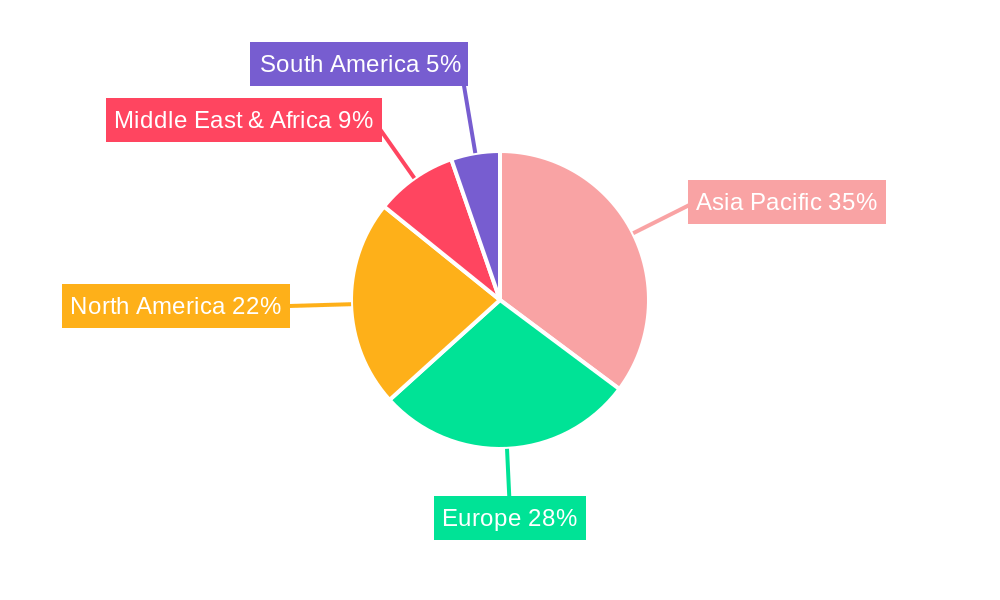

UAE Plastic Packaging Films Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Plastic Packaging Films Market Regional Market Share

Geographic Coverage of UAE Plastic Packaging Films Market

UAE Plastic Packaging Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Tourism Boom Propels UAE Plastic Packaging Films Market; Rising E-Commerce Increase Demand for Plastic Packaging Films in the UAE

- 3.3. Market Restrains

- 3.3.1. Tourism Boom Propels UAE Plastic Packaging Films Market; Rising E-Commerce Increase Demand for Plastic Packaging Films in the UAE

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET) is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Plastic Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Polyprop

- 5.1.2. Polyethy

- 5.1.3. Polyethy

- 5.1.4. Polystyrene

- 5.1.5. Bio-Based

- 5.1.6. PVC, EVOH, PETG, and Other Film Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.1.1. Candy and Confectionery

- 5.2.1.2. Frozen Foods

- 5.2.1.3. Fresh Produce

- 5.2.1.4. Dairy Products

- 5.2.1.5. Dry Foods

- 5.2.1.6. Meat, Poultry, and Seafood

- 5.2.1.7. Pet Food

- 5.2.1.8. Other Fo

- 5.2.2. Healthcare

- 5.2.3. Personal Care and Home Care

- 5.2.4. Industrial Packaging

- 5.2.5. Other En

- 5.2.1. Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UAE Plastic Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Polyprop

- 6.1.2. Polyethy

- 6.1.3. Polyethy

- 6.1.4. Polystyrene

- 6.1.5. Bio-Based

- 6.1.6. PVC, EVOH, PETG, and Other Film Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food

- 6.2.1.1. Candy and Confectionery

- 6.2.1.2. Frozen Foods

- 6.2.1.3. Fresh Produce

- 6.2.1.4. Dairy Products

- 6.2.1.5. Dry Foods

- 6.2.1.6. Meat, Poultry, and Seafood

- 6.2.1.7. Pet Food

- 6.2.1.8. Other Fo

- 6.2.2. Healthcare

- 6.2.3. Personal Care and Home Care

- 6.2.4. Industrial Packaging

- 6.2.5. Other En

- 6.2.1. Food

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UAE Plastic Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Polyprop

- 7.1.2. Polyethy

- 7.1.3. Polyethy

- 7.1.4. Polystyrene

- 7.1.5. Bio-Based

- 7.1.6. PVC, EVOH, PETG, and Other Film Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food

- 7.2.1.1. Candy and Confectionery

- 7.2.1.2. Frozen Foods

- 7.2.1.3. Fresh Produce

- 7.2.1.4. Dairy Products

- 7.2.1.5. Dry Foods

- 7.2.1.6. Meat, Poultry, and Seafood

- 7.2.1.7. Pet Food

- 7.2.1.8. Other Fo

- 7.2.2. Healthcare

- 7.2.3. Personal Care and Home Care

- 7.2.4. Industrial Packaging

- 7.2.5. Other En

- 7.2.1. Food

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UAE Plastic Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Polyprop

- 8.1.2. Polyethy

- 8.1.3. Polyethy

- 8.1.4. Polystyrene

- 8.1.5. Bio-Based

- 8.1.6. PVC, EVOH, PETG, and Other Film Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food

- 8.2.1.1. Candy and Confectionery

- 8.2.1.2. Frozen Foods

- 8.2.1.3. Fresh Produce

- 8.2.1.4. Dairy Products

- 8.2.1.5. Dry Foods

- 8.2.1.6. Meat, Poultry, and Seafood

- 8.2.1.7. Pet Food

- 8.2.1.8. Other Fo

- 8.2.2. Healthcare

- 8.2.3. Personal Care and Home Care

- 8.2.4. Industrial Packaging

- 8.2.5. Other En

- 8.2.1. Food

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UAE Plastic Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Polyprop

- 9.1.2. Polyethy

- 9.1.3. Polyethy

- 9.1.4. Polystyrene

- 9.1.5. Bio-Based

- 9.1.6. PVC, EVOH, PETG, and Other Film Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food

- 9.2.1.1. Candy and Confectionery

- 9.2.1.2. Frozen Foods

- 9.2.1.3. Fresh Produce

- 9.2.1.4. Dairy Products

- 9.2.1.5. Dry Foods

- 9.2.1.6. Meat, Poultry, and Seafood

- 9.2.1.7. Pet Food

- 9.2.1.8. Other Fo

- 9.2.2. Healthcare

- 9.2.3. Personal Care and Home Care

- 9.2.4. Industrial Packaging

- 9.2.5. Other En

- 9.2.1. Food

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UAE Plastic Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Polyprop

- 10.1.2. Polyethy

- 10.1.3. Polyethy

- 10.1.4. Polystyrene

- 10.1.5. Bio-Based

- 10.1.6. PVC, EVOH, PETG, and Other Film Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food

- 10.2.1.1. Candy and Confectionery

- 10.2.1.2. Frozen Foods

- 10.2.1.3. Fresh Produce

- 10.2.1.4. Dairy Products

- 10.2.1.5. Dry Foods

- 10.2.1.6. Meat, Poultry, and Seafood

- 10.2.1.7. Pet Food

- 10.2.1.8. Other Fo

- 10.2.2. Healthcare

- 10.2.3. Personal Care and Home Care

- 10.2.4. Industrial Packaging

- 10.2.5. Other En

- 10.2.1. Food

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 UFlex Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aalmir Plastic Industries

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ENPI Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amber Packaging Industries LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Falcon Pack

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Emirates Printing Press LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Radiant Packaging Industry LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Integrated Plastics Packaging LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Taghleef Industries Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Interplast

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 UFlex Limited

List of Figures

- Figure 1: Global UAE Plastic Packaging Films Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America UAE Plastic Packaging Films Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America UAE Plastic Packaging Films Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America UAE Plastic Packaging Films Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: North America UAE Plastic Packaging Films Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America UAE Plastic Packaging Films Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America UAE Plastic Packaging Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UAE Plastic Packaging Films Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: South America UAE Plastic Packaging Films Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America UAE Plastic Packaging Films Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: South America UAE Plastic Packaging Films Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: South America UAE Plastic Packaging Films Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America UAE Plastic Packaging Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UAE Plastic Packaging Films Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe UAE Plastic Packaging Films Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe UAE Plastic Packaging Films Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Europe UAE Plastic Packaging Films Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe UAE Plastic Packaging Films Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe UAE Plastic Packaging Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UAE Plastic Packaging Films Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: Middle East & Africa UAE Plastic Packaging Films Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa UAE Plastic Packaging Films Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Middle East & Africa UAE Plastic Packaging Films Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Middle East & Africa UAE Plastic Packaging Films Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa UAE Plastic Packaging Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UAE Plastic Packaging Films Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Asia Pacific UAE Plastic Packaging Films Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific UAE Plastic Packaging Films Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Asia Pacific UAE Plastic Packaging Films Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Asia Pacific UAE Plastic Packaging Films Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific UAE Plastic Packaging Films Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Plastic Packaging Films Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global UAE Plastic Packaging Films Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global UAE Plastic Packaging Films Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global UAE Plastic Packaging Films Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global UAE Plastic Packaging Films Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global UAE Plastic Packaging Films Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global UAE Plastic Packaging Films Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global UAE Plastic Packaging Films Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global UAE Plastic Packaging Films Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global UAE Plastic Packaging Films Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global UAE Plastic Packaging Films Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 18: Global UAE Plastic Packaging Films Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global UAE Plastic Packaging Films Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 29: Global UAE Plastic Packaging Films Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 30: Global UAE Plastic Packaging Films Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global UAE Plastic Packaging Films Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 38: Global UAE Plastic Packaging Films Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 39: Global UAE Plastic Packaging Films Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UAE Plastic Packaging Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Plastic Packaging Films Market?

The projected CAGR is approximately 2.9%.

2. Which companies are prominent players in the UAE Plastic Packaging Films Market?

Key companies in the market include UFlex Limited, Aalmir Plastic Industries, ENPI Group, Amber Packaging Industries LLC, Falcon Pack, Emirates Printing Press LLC, Radiant Packaging Industry LLC, Integrated Plastics Packaging LLC, Taghleef Industries Group, Interplast.

3. What are the main segments of the UAE Plastic Packaging Films Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Tourism Boom Propels UAE Plastic Packaging Films Market; Rising E-Commerce Increase Demand for Plastic Packaging Films in the UAE.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET) is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Tourism Boom Propels UAE Plastic Packaging Films Market; Rising E-Commerce Increase Demand for Plastic Packaging Films in the UAE.

8. Can you provide examples of recent developments in the market?

June 2024: Versalis, operating in the United Arab Emirates, and Crocco, a prominent player in flexible packaging, announced a strategic collaboration. Their goal is to manufacture food packaging films through chemical recycling techniques. These films are manufactured, in part, from post-consumer plastic recycling, underscoring their commitment to sustainability. The partners are extensive production to meet the demands of the burgeoning retail landscape.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Plastic Packaging Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Plastic Packaging Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Plastic Packaging Films Market?

To stay informed about further developments, trends, and reports in the UAE Plastic Packaging Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence