Key Insights

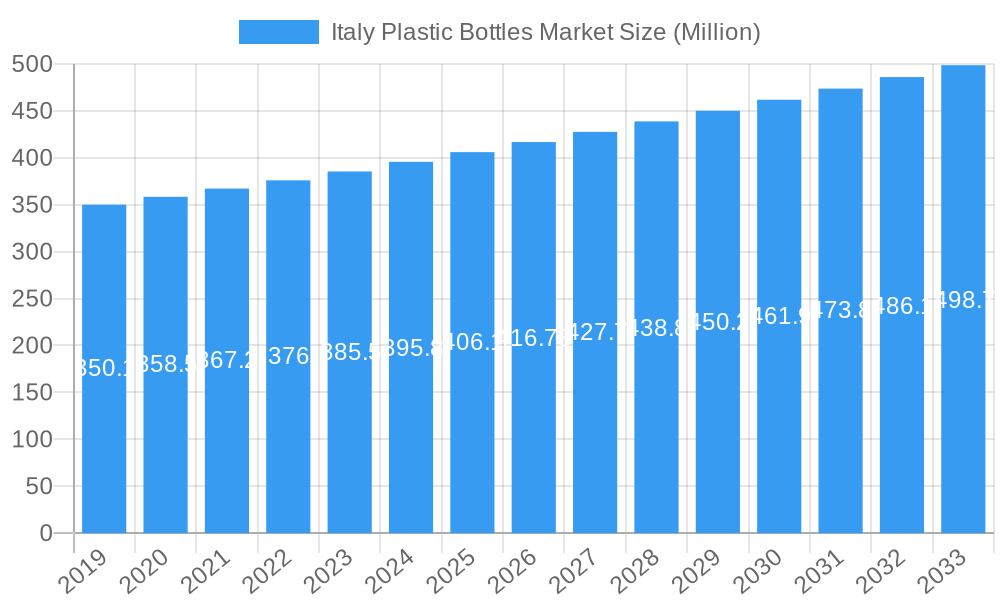

The Italian plastic bottles market is poised for steady growth, projected to reach a market size of approximately 416.78 million Euros by 2025. This expansion is driven by the consistent demand from key end-user industries such as food and beverages, pharmaceuticals, and personal care. Within the beverage sector, bottled water and carbonated soft drinks represent significant segments, contributing substantially to overall consumption. The ongoing preference for convenient and portable packaging solutions, coupled with advancements in plastic material technology offering enhanced durability and recyclability, are key factors fueling this market trajectory. Furthermore, the pharmaceutical industry's increasing reliance on safe and effective plastic packaging for medicines and healthcare products will continue to bolster demand.

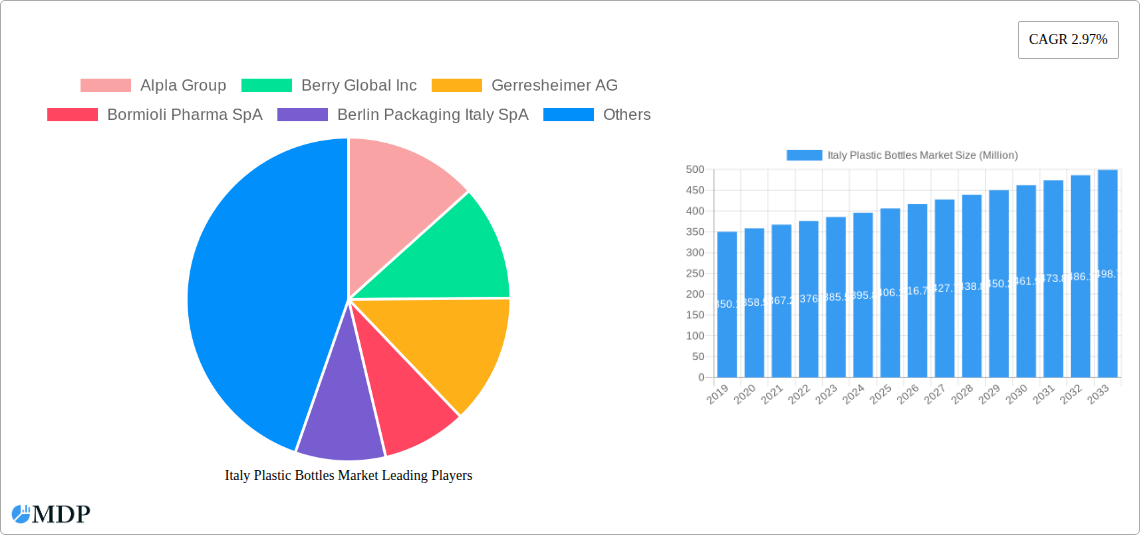

Italy Plastic Bottles Market Market Size (In Million)

While the market demonstrates resilience, certain factors present potential challenges. Evolving regulatory landscapes concerning single-use plastics and a growing consumer inclination towards sustainable alternatives, such as glass or reusable containers, could moderate the growth rate. However, ongoing innovation in recycled plastics and bioplastics, alongside the industry's commitment to circular economy principles, are expected to mitigate these restraints. The competitive landscape is characterized by a mix of established global players and agile local manufacturers, all striving to capture market share through product differentiation, strategic partnerships, and investments in sustainable packaging solutions. The dominance of Polyethylene Terephthalate (PET) as a preferred resin underscores its versatility and widespread adoption across major applications.

Italy Plastic Bottles Market Company Market Share

Unlock unparalleled insights into the dynamic Italy Plastic Bottles Market. This definitive report, encompassing a study period from 2019 to 2033 with a base year of 2025, provides in-depth analysis of market dynamics, industry trends, competitive landscapes, and future opportunities. Essential for stakeholders in the packaging, food & beverage, pharmaceutical, and personal care sectors, this report offers actionable intelligence to navigate the evolving Italian plastic bottle industry.

Italy Plastic Bottles Market Market Dynamics & Concentration

The Italy Plastic Bottles Market exhibits a moderate to high level of concentration, with key players like Alpla Group, Berry Global Inc, and Gerresheimer AG holding significant market shares. Innovation drivers are primarily fueled by the escalating demand for sustainable packaging solutions, including the increased adoption of recycled PET (rPET) and bio-based plastics. Regulatory frameworks, particularly those focused on circular economy principles and waste reduction targets, are playing a crucial role in shaping market strategies and product development. Product substitutes, such as glass and carton packaging, present ongoing competition, though plastic bottles maintain their advantage in terms of cost-effectiveness, durability, and design flexibility. End-user trends are heavily influenced by consumer preferences for convenience, safety, and environmental responsibility, driving the demand for lightweight, resealable, and eco-friendly plastic bottle designs. Merger and acquisition (M&A) activities, while not overtly frequent, are strategic moves by major players to consolidate market presence, acquire advanced technologies, or expand their product portfolios. For instance, the growing emphasis on sustainability has led to M&A targeting companies with advanced recycling capabilities. The market's future trajectory is intrinsically linked to the success of these innovation and sustainability-driven strategies, aiming to balance economic viability with environmental stewardship.

Italy Plastic Bottles Market Industry Trends & Analysis

The Italy Plastic Bottles Market is experiencing robust growth, driven by an interplay of economic, technological, and consumer-centric factors. A key market growth driver is the expanding food and beverage sector, particularly the bottled water and carbonated soft drinks segments, which rely heavily on plastic bottles for their packaging needs. The pharmaceutical industry's consistent demand for safe, sterile, and tamper-evident plastic packaging further bolsters market expansion. Technological disruptions are evident in the advancements in plastic processing machinery, leading to enhanced production efficiency, reduced material waste, and the capability to produce more complex bottle designs. The widespread adoption of polyethylene terephthalate (PET) as the preferred resin due to its clarity, strength, and recyclability is a significant trend. Furthermore, the industry is witnessing a paradigm shift towards sustainability, with a growing preference for recycled PET (rPET) and the exploration of bio-plastics. Consumer preferences are increasingly leaning towards lightweight, convenient, and environmentally responsible packaging. This is pushing manufacturers to innovate with designs that are not only functional but also minimize their ecological footprint. The competitive landscape is characterized by a mix of global giants and agile local players, all vying for market share through product differentiation, strategic pricing, and a strong focus on sustainability initiatives. Market penetration of specialized plastic bottles for niche applications, such as industrial chemicals and household goods, is also on the rise, indicating a diversified market appeal. The projected Compound Annual Growth Rate (CAGR) for the Italy Plastic Bottles Market is approximately 5.2% over the forecast period of 2025–2033, reflecting sustained demand and ongoing innovation.

Leading Markets & Segments in Italy Plastic Bottles Market

The Italy Plastic Bottles Market is segmented by resin type and end-user industry, with significant dominance observed in specific areas.

Resin Segments:

- Polyethylene Terephthalate (PET): This segment holds the largest market share by a substantial margin.

- Dominance Drivers: PET's exceptional clarity, strength-to-weight ratio, excellent barrier properties against gases, and proven recyclability make it the preferred choice for a vast array of applications. Its ability to be easily molded into various shapes and sizes further enhances its appeal for product differentiation. The widespread availability of PET resin and established recycling infrastructure in Italy solidify its leading position.

- Polyethylene (PE): This segment, including HDPE and LDPE, occupies a significant, albeit secondary, position.

- Dominance Drivers: PE's chemical resistance, flexibility, and cost-effectiveness make it ideal for household chemicals, personal care products, and certain industrial applications. Its use in applications requiring squeezability, like certain personal care items, contributes to its market presence.

- Polypropylene (PP): While smaller than PET and PE, PP is crucial for specific applications.

- Dominance Drivers: PP's high melting point, rigidity, and good chemical resistance make it suitable for hot-fill applications and containers requiring heat stability. Its use in caps and closures also adds to its importance.

- Other Resins: This category includes specialized polymers catering to niche requirements.

End-user Industry Segments:

- Beverage: This is the most dominant end-user industry for plastic bottles in Italy.

- Dominance Drivers:

- Bottled Water: Driven by health consciousness and convenience, this sub-segment is a major consumer of PET bottles.

- Carbonated Soft Drinks: The requirement for good gas barrier properties makes PET the ideal choice.

- Alcoholic Beverages: Growing demand for single-serve portions and convenience packaging.

- Juices and Energy Drinks: Increasing consumption and product innovation fuel demand.

- Dominance Drivers:

- Food: A significant and growing segment, encompassing various food products.

- Dominance Drivers: Demand for safe, convenient, and shelf-stable food packaging solutions.

- Personal Care and Toiletries: This segment relies heavily on plastic bottles for a wide range of products.

- Dominance Drivers: Consumer preference for lightweight, durable, and aesthetically pleasing packaging, coupled with the need for product protection.

- Pharmaceuticals: A critical sector demanding high-quality, sterile, and tamper-evident packaging.

- Dominance Drivers: Stringent regulatory requirements for product safety and integrity, alongside the need for user-friendly dispensing.

- Household Chemicals: This segment utilizes plastic bottles for cleaning agents and other household products.

- Dominance Drivers: Cost-effectiveness, chemical resistance, and durability of plastic materials.

- Industrial: Includes packaging for lubricants, solvents, and other industrial fluids.

- Dominance Drivers: Strength, chemical resistance, and drop-test performance of plastic containers.

- Paints and Coatings: Plastic containers offer a lighter and more shatter-resistant alternative to traditional packaging.

- Dominance Drivers: Durability, chemical resistance, and ease of handling.

Italy Plastic Bottles Market Product Developments

Product development in the Italy Plastic Bottles Market is characterized by a strong emphasis on sustainability and enhanced functionality. Innovations are centered around increasing the recycled content in bottles, with a significant push towards certified white rPET for products like UHT milk, as exemplified by Parmalat's recent initiative. The development of 100% recycled PET bottles for seed oils, as introduced by Sagra, highlights a commitment to a fully circular economy for packaging. Furthermore, advancements in lightweighting technologies continue to reduce material consumption without compromising structural integrity. The incorporation of smart features, such as tamper-evident seals and easy-open closures, also contributes to product evolution. These developments are driven by a need to meet stringent environmental regulations, consumer demand for eco-friendly options, and the desire for competitive differentiation in a crowded market.

Key Drivers of Italy Plastic Bottles Market Growth

The Italy Plastic Bottles Market is propelled by several key drivers. The escalating demand from the food and beverage industry, especially for bottled water and soft drinks, remains a primary growth catalyst. Growing consumer awareness regarding health and hygiene is also contributing to the demand for packaged beverages and pharmaceuticals. The persistent drive towards sustainable packaging solutions, including the increased adoption of recycled PET (rPET) and the exploration of bio-plastics, is a significant factor influencing product innovation and market expansion. Stringent government regulations promoting recycling and waste reduction further incentivize the use of recyclable and recycled plastic materials. Technological advancements in manufacturing processes, leading to increased efficiency and cost-effectiveness, also play a crucial role in market growth.

Challenges in the Italy Plastic Bottles Market Market

Despite robust growth, the Italy Plastic Bottles Market faces several challenges. Evolving and increasingly stringent environmental regulations related to plastic waste and single-use plastics can pose compliance hurdles for manufacturers. The fluctuating costs of raw materials, particularly petroleum-based resins, can impact profit margins and pricing strategies. Intense competition from alternative packaging materials such as glass and metal, as well as from other plastic bottle manufacturers, necessitates continuous innovation and cost optimization. Public perception and consumer concerns regarding the environmental impact of plastic waste, despite advancements in recycling, can also influence purchasing decisions and brand reputation. Supply chain disruptions, influenced by global events, can affect the availability and cost of raw materials and finished products.

Emerging Opportunities in Italy Plastic Bottles Market

Emerging opportunities in the Italy Plastic Bottles Market are primarily driven by the growing demand for sustainable and innovative packaging solutions. The expansion of the circular economy model presents a significant opportunity for increased use of recycled PET (rPET) and the development of advanced recycling technologies. Innovations in bio-plastics and biodegradable materials offer potential for new product lines and market penetration. The increasing demand for personalized and premium packaging in sectors like cosmetics and specialty beverages opens avenues for customized bottle designs and functionalities. Strategic partnerships between resin producers, bottle manufacturers, and brand owners can foster collaborative innovation and market development. Furthermore, the growing e-commerce sector presents an opportunity for lightweight and durable plastic bottles designed for online distribution.

Leading Players in the Italy Plastic Bottles Market Sector

- Alpla Group

- Berry Global Inc

- Gerresheimer AG

- Bormioli Pharma SpA

- Berlin Packaging Italy SpA

- Valgroup Italia SRL

- Daunia Plast SpA

- Verve SpA

- Plastopiave SRL

- Vetronaviglio SRL

Key Milestones in Italy Plastic Bottles Market Industry

- February 2024: Parmalat launched its inaugural certified white rPET bottle for UHT milk, incorporating 50% recycled plastic. This initiative, spearheaded by Parmalat's R&D team in partnership with Dentis Recycling Italy, saw an investment of EUR 21 million (USD 23.06 million) and established three new production lines. Notably, two of these lines are situated at Parmalat's flagship facility in Collecchio. At the end of its life cycle, each UHT milk bottle can be recycled and reintegrated into the production system, thereby generating new value for consumers, businesses, and the environment.

- May 2023: Sagra, a brand under the Salov SpA Group, introduced innovative r-PET bottles. These bottles, crafted from 100% recycled plastic, are specifically designed for Sagra's range of seed oils. The new sustainable plastic, derived entirely from recycling other bottles, champions eco-friendliness and upholds traditional bottles' quality, safety, and user-friendliness.

Strategic Outlook for Italy Plastic Bottles Market Market

The strategic outlook for the Italy Plastic Bottles Market is positive, characterized by a strong emphasis on sustainability and innovation. Key growth accelerators will include the continued expansion of the circular economy through increased adoption of rPET and advanced recycling technologies. The market will benefit from ongoing investments in sustainable packaging solutions, driven by both regulatory mandates and evolving consumer preferences. Strategic partnerships and collaborations across the value chain will be crucial for driving innovation in material science and product design. The focus on lightweighting and enhanced functionality will also contribute to market expansion, particularly in the beverage and personal care sectors. The market is poised for sustained growth as players adapt to environmental challenges and leverage technological advancements to meet the increasing demand for efficient, safe, and eco-conscious plastic bottle solutions.

Italy Plastic Bottles Market Segmentation

-

1. Resin

- 1.1. Polyethylene (PE)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Other Re

-

2. End-user Industry

- 2.1. Food

-

2.2. Beverage**

- 2.2.1. Bottled Water

- 2.2.2. Carbonated Soft Drinks

- 2.2.3. Alcoholic Beverages

- 2.2.4. Juices and Energy Drinks

- 2.2.5. Other Beverages

- 2.3. Pharmaceuticals

- 2.4. Personal Care and Toiletries

- 2.5. Industrial

- 2.6. Household Chemicals

- 2.7. Paints and Coatings

- 2.8. Other End-user Industries

Italy Plastic Bottles Market Segmentation By Geography

- 1. Italy

Italy Plastic Bottles Market Regional Market Share

Geographic Coverage of Italy Plastic Bottles Market

Italy Plastic Bottles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Lightweight Packaging Methods; Changing Demographic and Lifestyle Factors

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Lightweight Packaging Methods; Changing Demographic and Lifestyle Factors

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Beverages Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Plastic Bottles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Polyethylene (PE)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Other Re

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage**

- 5.2.2.1. Bottled Water

- 5.2.2.2. Carbonated Soft Drinks

- 5.2.2.3. Alcoholic Beverages

- 5.2.2.4. Juices and Energy Drinks

- 5.2.2.5. Other Beverages

- 5.2.3. Pharmaceuticals

- 5.2.4. Personal Care and Toiletries

- 5.2.5. Industrial

- 5.2.6. Household Chemicals

- 5.2.7. Paints and Coatings

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Alpla Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berry Global Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gerresheimer AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bormioli Pharma SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Berlin Packaging Italy SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Valgroup Italia SRL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Daunia Plast SpA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Verve SpA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Plastopiave SRL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vetronaviglio SRL7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Alpla Group

List of Figures

- Figure 1: Italy Plastic Bottles Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Italy Plastic Bottles Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Plastic Bottles Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 2: Italy Plastic Bottles Market Volume Million Forecast, by Resin 2020 & 2033

- Table 3: Italy Plastic Bottles Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Italy Plastic Bottles Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 5: Italy Plastic Bottles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Italy Plastic Bottles Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Italy Plastic Bottles Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 8: Italy Plastic Bottles Market Volume Million Forecast, by Resin 2020 & 2033

- Table 9: Italy Plastic Bottles Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Italy Plastic Bottles Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Italy Plastic Bottles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Italy Plastic Bottles Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Plastic Bottles Market?

The projected CAGR is approximately 2.97%.

2. Which companies are prominent players in the Italy Plastic Bottles Market?

Key companies in the market include Alpla Group, Berry Global Inc, Gerresheimer AG, Bormioli Pharma SpA, Berlin Packaging Italy SpA, Valgroup Italia SRL, Daunia Plast SpA, Verve SpA, Plastopiave SRL, Vetronaviglio SRL7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the Italy Plastic Bottles Market?

The market segments include Resin, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 416.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Lightweight Packaging Methods; Changing Demographic and Lifestyle Factors.

6. What are the notable trends driving market growth?

Increasing Demand from the Beverages Segment.

7. Are there any restraints impacting market growth?

Increasing Adoption of Lightweight Packaging Methods; Changing Demographic and Lifestyle Factors.

8. Can you provide examples of recent developments in the market?

February 2024: Parmalat, the Italian dairy giant, launched its inaugural certified white rPET bottle for UHT milk, incorporating 50% recycled plastic. This initiative, spearheaded by Parmalat's R&D team in partnership with Dentis Recycling Italy, saw an investment of EUR 21 million (USD 23.06 million) and established three new production lines. Notably, two of these lines are situated at Parmalat's flagship facility in Collecchio. At the end of its life cycle, each UHT milk bottle can be recycled and reintegrated into the production system, thereby generating new value for consumers, businesses, and the environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Plastic Bottles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Plastic Bottles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Plastic Bottles Market?

To stay informed about further developments, trends, and reports in the Italy Plastic Bottles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence