Key Insights

The global Meat, Poultry, and Seafood Packaging market is projected for significant expansion, expected to reach a market size of USD 15.62 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.2%. This growth is driven by escalating consumer demand for convenient, safe, and long-lasting food options, coupled with population increases and rising disposable incomes. Innovations in sustainable, hygienic, and visually appealing packaging materials and technologies are key influencers. The demand for processed and ready-to-eat meat, poultry, and seafood products fuels the need for specialized packaging. Advanced techniques like modified atmosphere packaging (MAP) and vacuum sealing enhance product freshness and reduce spoilage, further contributing to market growth. The competitive landscape features both established global players and emerging regional companies focused on differentiation and strategic alliances.

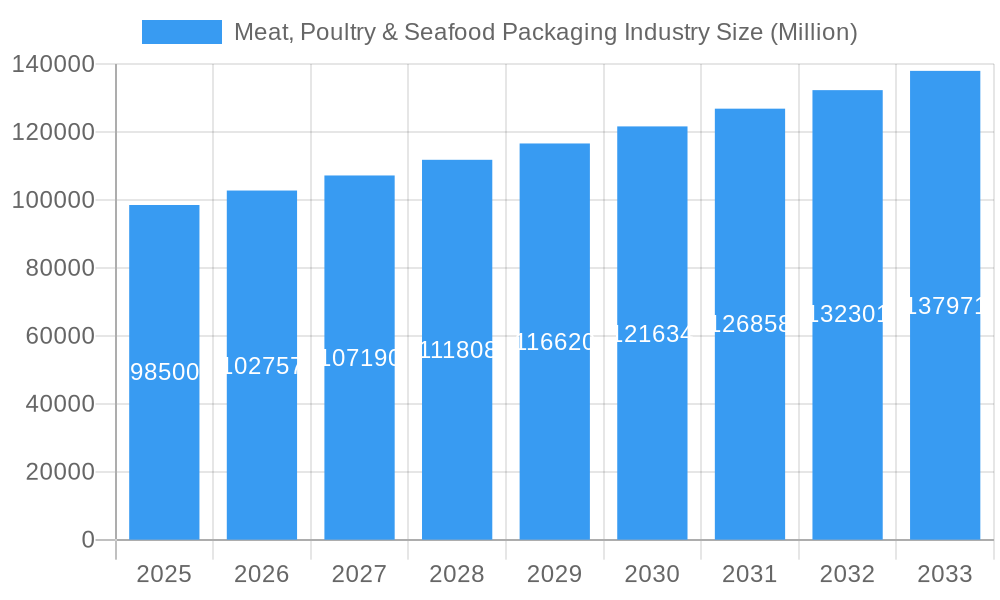

Meat, Poultry & Seafood Packaging Industry Market Size (In Billion)

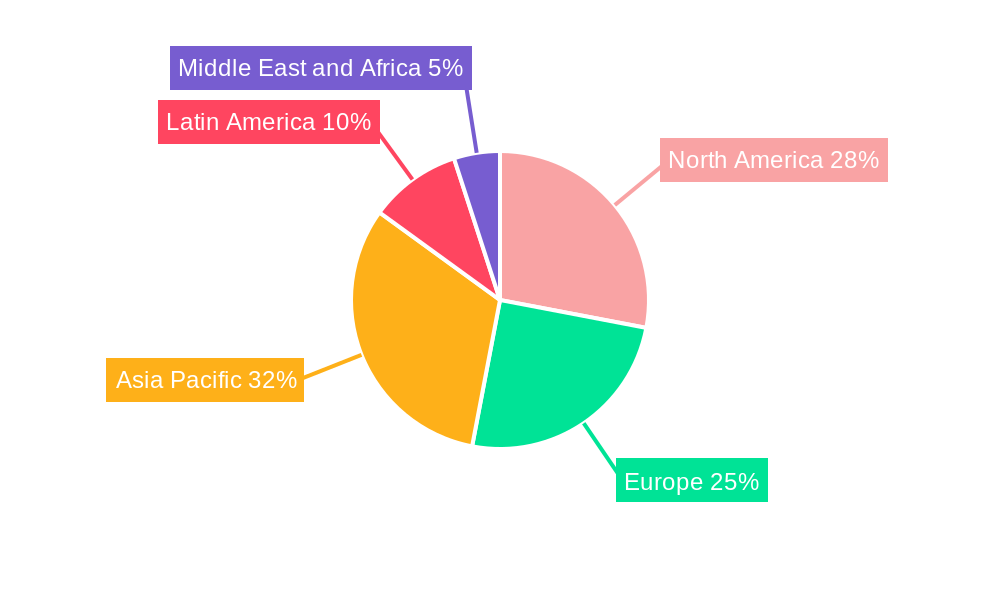

The market is segmented by packaging type, product, material, and application. Rigid packaging, such as containers and cans, commands a significant share due to its protective attributes and premium perception. Flexible packaging, including bags and films, is increasingly adopted for its cost-efficiency, light weight, and suitability for high-volume production. Polypropylene (PP) and Polyester (PET) are dominant material types, offering excellent barrier properties and recyclability. While fresh and frozen products lead applications, processed and ready-to-eat segments show robust growth. North America and Europe are mature markets emphasizing innovation and sustainability. Asia Pacific is the fastest-growing region, propelled by urbanization, changing dietary habits, and a growing middle class. Challenges, including regulatory compliance and the demand for cost-effective sustainable solutions, continue to shape market strategies.

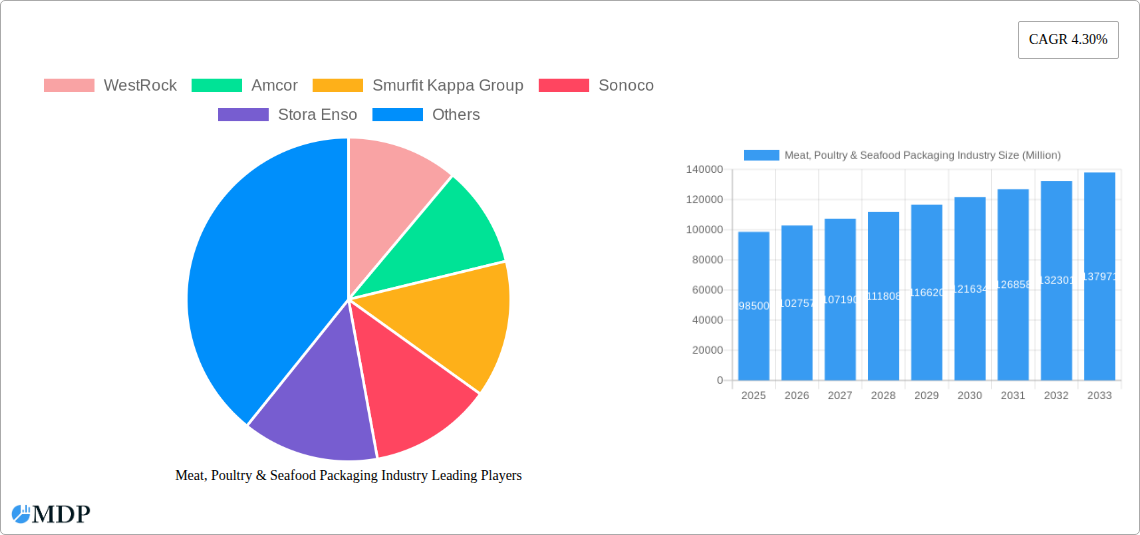

Meat, Poultry & Seafood Packaging Industry Company Market Share

Gain comprehensive insights into the dynamic Meat, Poultry & Seafood Packaging Industry. This report covers historical data from 2019–2024 and forecasts growth through 2033. With a base year of 2025, it provides actionable intelligence for stakeholders navigating market complexities and identifying emerging opportunities.

Meat, Poultry & Seafood Packaging Industry Market Dynamics & Concentration

The global Meat, Poultry & Seafood Packaging market exhibits a moderately concentrated landscape, with leading players holding significant market share. Key innovation drivers include the demand for extended shelf life, enhanced food safety, and the growing consumer preference for convenient and ready-to-eat options. Stringent regulatory frameworks governing food contact materials and recycling initiatives significantly influence product development and material choices. Product substitutes, such as bulk purchasing and alternative preservation methods, pose a minor threat, largely offset by the inherent need for packaging to maintain product integrity and extend freshness. End-user trends are dominated by the rise of e-commerce and direct-to-consumer sales, demanding robust and visually appealing packaging. Mergers and acquisitions (M&A) activity is a notable strategy for market expansion and technological integration.

- Market Share: Leading companies collectively hold over 60% of the market share.

- M&A Deal Counts: An average of 10-15 significant M&A deals are recorded annually in the broader packaging sector relevant to this industry.

- Innovation Drivers: Shelf-life extension technologies, smart packaging solutions, and sustainable material development.

- Regulatory Frameworks: Compliance with FDA, EFSA, and other regional food safety and environmental regulations.

- End-User Trends: Growing demand for sustainable packaging, convenience, and online grocery shopping.

Meat, Poultry & Seafood Packaging Industry Industry Trends & Analysis

The Meat, Poultry & Seafood Packaging market is experiencing robust growth, driven by escalating global protein consumption and evolving consumer lifestyles. The forecast period (2025–2033) anticipates a Compound Annual Growth Rate (CAGR) of approximately 5.5%, reflecting the sustained demand for safe, fresh, and convenient protein products. Technological advancements in materials science and packaging machinery are pivotal. Innovations such as advanced barrier films, modified atmosphere packaging (MAP), and intelligent packaging solutions are enhancing product shelf life, reducing spoilage, and providing consumers with greater transparency. The competitive landscape is characterized by intense rivalry, with companies focusing on product differentiation through sustainability, functionality, and cost-effectiveness. Consumer preferences are increasingly shifting towards eco-friendly packaging, prompting manufacturers to invest heavily in recyclable, biodegradable, and compostable materials. The rise of e-commerce for fresh and frozen foods also necessitates specialized packaging that can withstand rigorous transportation and handling, further stimulating market penetration of advanced packaging solutions. The market penetration of sustainable packaging solutions is projected to reach 50% by 2030.

Leading Markets & Segments in Meat, Poultry & Seafood Packaging Industry

North America and Europe currently dominate the Meat, Poultry & Seafood Packaging market, driven by established protein consumption patterns, advanced retail infrastructure, and a strong emphasis on food safety and quality. Asia-Pacific is the fastest-growing region, fueled by increasing disposable incomes, urbanization, and a burgeoning middle class adopting Western dietary habits.

Packaging Type Dominance:

- Flexible Packaging: Holds the largest market share, estimated at 55%, due to its versatility, cost-effectiveness, and suitability for various product formats like pre-made bags and coated films. Key drivers include its lightweight nature, reduced material usage, and excellent barrier properties for extending shelf life.

- Rigid Packaging: Accounts for approximately 45% of the market, with significant application in containers like aluminium foil containers and plastic containers, offering superior protection and stackability.

Product Type Dominance:

- Containers: (Aluminium Foil Container, Plastic Container, Board Container) constitute the largest segment within rigid packaging, favored for their structural integrity and portion control.

- Pre-made Bags: Lead within flexible packaging, offering convenience and excellent branding opportunities.

- Food Cans: remain a significant segment, particularly for processed and preserved products, offering long shelf life and durability.

- Coated Films: are crucial for modified atmosphere packaging and providing essential barrier properties.

Material Type Dominance:

- Polypropylene (PP): is a leading material due to its excellent thermal resistance, chemical inertness, and affordability.

- Polyester (PET): is widely used for its clarity, strength, and barrier properties, especially in rigid containers and films.

- Aluminium: remains vital for its superior barrier properties and recyclability, particularly in foil containers and food cans.

- Thermoform: materials are essential for creating custom-fit packaging solutions, particularly for fresh meat and poultry.

Application Dominance:

- Fresh and Frozen Products: represent the largest application segment, demanding packaging that maintains temperature, prevents contamination, and extends shelf life.

- Processed Products: also constitute a substantial segment, with packaging often designed for convenience and microwaveability.

- Ready-to-eat Products: are a growing segment, requiring highly convenient, portion-controlled, and visually appealing packaging.

Meat, Poultry & Seafood Packaging Industry Product Developments

Product development in the Meat, Poultry & Seafood Packaging sector is increasingly focused on enhancing sustainability and functionality. Innovations include the introduction of advanced barrier films with improved oxygen and moisture resistance, extending shelf life and reducing food waste. The rise of recyclable mono-material packaging solutions, such as those utilizing advanced polypropylene or polyester, is a key trend. Furthermore, the integration of smart technologies, like active and intelligent packaging, which can monitor freshness or indicate tampering, is gaining traction. These developments aim to meet growing consumer demand for safety, convenience, and environmental responsibility, while also offering a competitive edge through enhanced product protection and reduced environmental impact.

Key Drivers of Meat, Poultry & Seafood Packaging Industry Growth

The growth of the Meat, Poultry & Seafood Packaging industry is propelled by several key factors. Firstly, the escalating global demand for protein-rich diets, particularly in emerging economies, directly translates to increased packaging requirements. Secondly, advancements in food processing and preservation technologies necessitate sophisticated packaging solutions to maintain product quality and safety. Thirdly, the proliferation of e-commerce and online grocery shopping platforms creates a demand for robust, temperature-controlled, and leak-proof packaging. Finally, evolving consumer preferences for convenience, extended shelf life, and sustainable packaging options are significant growth accelerators, pushing innovation in material science and packaging design.

Challenges in the Meat, Poultry & Seafood Packaging Industry Market

Despite robust growth, the Meat, Poultry & Seafood Packaging market faces several challenges. Stringent and evolving regulatory landscapes concerning food safety, recyclability, and waste management can increase compliance costs and necessitate product reformulation. Fluctuations in raw material prices, particularly for plastics and aluminium, can impact profitability and supply chain stability. The increasing demand for sustainable packaging also presents a challenge, as developing cost-effective and high-performance eco-friendly alternatives requires significant investment in research and development. Furthermore, intense competition among packaging manufacturers can lead to price pressures and reduced profit margins, necessitating continuous innovation and operational efficiency.

Emerging Opportunities in Meat, Poultry & Seafood Packaging Industry

The Meat, Poultry & Seafood Packaging industry is ripe with emerging opportunities. The growing consumer awareness and demand for sustainable packaging present a significant avenue for innovation, particularly in the development of biodegradable, compostable, and widely recyclable materials. The expansion of the ready-to-eat meal market, driven by busy lifestyles, creates a demand for convenient, portion-controlled, and microwaveable packaging solutions. Furthermore, advancements in smart packaging technologies, offering features like extended shelf-life monitoring and authentication, represent a burgeoning segment. Strategic partnerships between packaging manufacturers and food producers can lead to tailored solutions that address specific market needs and enhance competitive advantage. The increasing adoption of automation in food processing and packaging lines also offers opportunities for advanced, integrated packaging systems.

Leading Players in the Meat, Poultry & Seafood Packaging Industry Sector

- WestRock

- Amcor

- Smurfit Kappa Group

- Sonoco

- Stora Enso

- Mondi Group

- Can-Pack SA

- Crown Holdings

- Berry Global

- DS Smith

- Sealed Air

Key Milestones in Meat, Poultry & Seafood Packaging Industry Industry

- December 2022: Amcor announced the opening of its new state-of-the-art manufacturing plant in Huizhou, China. With an investment of over USD 100 million, the 590,000 sq ft factory is the largest flexible packaging plant in China by production capacity, substantially enhancing Amcor's capabilities to fulfill rising client demand throughout Asia-Pacific. The facility has China's first automated packaging production line, resulting in double-digit decreases in production cycle time, together with high-speed printing presses, laminators, and bag-making equipment.

- October 2022: Berry Global announced Printpack, leveraging its independent strengths in film manufacturing and conversion to create packaging solutions that support increased customer demand for more sustainable packaging. The companies introduced the Preserve PE PCR recyclable polyethylene (PE) pouch. It is How2Recycle pre-qualified and contains 30% FDA-compliant post-consumer recycled resin (PCR) content with a lower carbon footprint than equivalent products made from virgin plastic while maintaining package performance.

Strategic Outlook for Meat, Poultry & Seafood Packaging Industry Market

The strategic outlook for the Meat, Poultry & Seafood Packaging market is one of sustained innovation and adaptation. Key growth accelerators include the relentless pursuit of sustainable packaging solutions, driven by both consumer demand and regulatory pressures. Investments in advanced materials, such as bio-plastics and high-performance recycled content, will be crucial. Furthermore, the integration of digital technologies, including smart packaging and traceability solutions, will become increasingly important for enhancing food safety and consumer trust. Strategic partnerships and collaborations will play a vital role in developing novel solutions and expanding market reach. The market's future success will be defined by its ability to balance cost-effectiveness with environmental responsibility and provide innovative solutions that meet the evolving needs of protein producers and consumers worldwide.

Meat, Poultry & Seafood Packaging Industry Segmentation

-

1. Packaging Type

- 1.1. Rigid Packaging

- 1.2. Flexible Packaging

-

2. Product Type

-

2.1. Containers

- 2.1.1. Aluminium Foil Container

- 2.1.2. Plastic Container

- 2.1.3. Board Container

- 2.2. Pre-made Bags

- 2.3. Food Cans

- 2.4. Coated Films

- 2.5. Other Product Types

-

2.1. Containers

-

3. Material Type

- 3.1. Polypropylene (PP)

- 3.2. Polystrene (PS)

- 3.3. Polyester (PET)

- 3.4. Thermoform

- 3.5. Aluminium

- 3.6. Other Material Types

-

4. Application

- 4.1. Fresh and Frozen Products

- 4.2. Processed Products

- 4.3. Read-to-eat Products

Meat, Poultry & Seafood Packaging Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Meat, Poultry & Seafood Packaging Industry Regional Market Share

Geographic Coverage of Meat, Poultry & Seafood Packaging Industry

Meat, Poultry & Seafood Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Population May Increase the Demand; Government Regulations for Improved and Better Packaging Materials

- 3.3. Market Restrains

- 3.3.1. Contamination Due to Poor Packaging or Mishandling

- 3.4. Market Trends

- 3.4.1. Flexible Packaging to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Meat, Poultry & Seafood Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Rigid Packaging

- 5.1.2. Flexible Packaging

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Containers

- 5.2.1.1. Aluminium Foil Container

- 5.2.1.2. Plastic Container

- 5.2.1.3. Board Container

- 5.2.2. Pre-made Bags

- 5.2.3. Food Cans

- 5.2.4. Coated Films

- 5.2.5. Other Product Types

- 5.2.1. Containers

- 5.3. Market Analysis, Insights and Forecast - by Material Type

- 5.3.1. Polypropylene (PP)

- 5.3.2. Polystrene (PS)

- 5.3.3. Polyester (PET)

- 5.3.4. Thermoform

- 5.3.5. Aluminium

- 5.3.6. Other Material Types

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Fresh and Frozen Products

- 5.4.2. Processed Products

- 5.4.3. Read-to-eat Products

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. North America Meat, Poultry & Seafood Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6.1.1. Rigid Packaging

- 6.1.2. Flexible Packaging

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Containers

- 6.2.1.1. Aluminium Foil Container

- 6.2.1.2. Plastic Container

- 6.2.1.3. Board Container

- 6.2.2. Pre-made Bags

- 6.2.3. Food Cans

- 6.2.4. Coated Films

- 6.2.5. Other Product Types

- 6.2.1. Containers

- 6.3. Market Analysis, Insights and Forecast - by Material Type

- 6.3.1. Polypropylene (PP)

- 6.3.2. Polystrene (PS)

- 6.3.3. Polyester (PET)

- 6.3.4. Thermoform

- 6.3.5. Aluminium

- 6.3.6. Other Material Types

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Fresh and Frozen Products

- 6.4.2. Processed Products

- 6.4.3. Read-to-eat Products

- 6.1. Market Analysis, Insights and Forecast - by Packaging Type

- 7. Europe Meat, Poultry & Seafood Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Packaging Type

- 7.1.1. Rigid Packaging

- 7.1.2. Flexible Packaging

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Containers

- 7.2.1.1. Aluminium Foil Container

- 7.2.1.2. Plastic Container

- 7.2.1.3. Board Container

- 7.2.2. Pre-made Bags

- 7.2.3. Food Cans

- 7.2.4. Coated Films

- 7.2.5. Other Product Types

- 7.2.1. Containers

- 7.3. Market Analysis, Insights and Forecast - by Material Type

- 7.3.1. Polypropylene (PP)

- 7.3.2. Polystrene (PS)

- 7.3.3. Polyester (PET)

- 7.3.4. Thermoform

- 7.3.5. Aluminium

- 7.3.6. Other Material Types

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Fresh and Frozen Products

- 7.4.2. Processed Products

- 7.4.3. Read-to-eat Products

- 7.1. Market Analysis, Insights and Forecast - by Packaging Type

- 8. Asia Pacific Meat, Poultry & Seafood Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Packaging Type

- 8.1.1. Rigid Packaging

- 8.1.2. Flexible Packaging

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Containers

- 8.2.1.1. Aluminium Foil Container

- 8.2.1.2. Plastic Container

- 8.2.1.3. Board Container

- 8.2.2. Pre-made Bags

- 8.2.3. Food Cans

- 8.2.4. Coated Films

- 8.2.5. Other Product Types

- 8.2.1. Containers

- 8.3. Market Analysis, Insights and Forecast - by Material Type

- 8.3.1. Polypropylene (PP)

- 8.3.2. Polystrene (PS)

- 8.3.3. Polyester (PET)

- 8.3.4. Thermoform

- 8.3.5. Aluminium

- 8.3.6. Other Material Types

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Fresh and Frozen Products

- 8.4.2. Processed Products

- 8.4.3. Read-to-eat Products

- 8.1. Market Analysis, Insights and Forecast - by Packaging Type

- 9. Latin America Meat, Poultry & Seafood Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Packaging Type

- 9.1.1. Rigid Packaging

- 9.1.2. Flexible Packaging

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Containers

- 9.2.1.1. Aluminium Foil Container

- 9.2.1.2. Plastic Container

- 9.2.1.3. Board Container

- 9.2.2. Pre-made Bags

- 9.2.3. Food Cans

- 9.2.4. Coated Films

- 9.2.5. Other Product Types

- 9.2.1. Containers

- 9.3. Market Analysis, Insights and Forecast - by Material Type

- 9.3.1. Polypropylene (PP)

- 9.3.2. Polystrene (PS)

- 9.3.3. Polyester (PET)

- 9.3.4. Thermoform

- 9.3.5. Aluminium

- 9.3.6. Other Material Types

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Fresh and Frozen Products

- 9.4.2. Processed Products

- 9.4.3. Read-to-eat Products

- 9.1. Market Analysis, Insights and Forecast - by Packaging Type

- 10. Middle East and Africa Meat, Poultry & Seafood Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Packaging Type

- 10.1.1. Rigid Packaging

- 10.1.2. Flexible Packaging

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Containers

- 10.2.1.1. Aluminium Foil Container

- 10.2.1.2. Plastic Container

- 10.2.1.3. Board Container

- 10.2.2. Pre-made Bags

- 10.2.3. Food Cans

- 10.2.4. Coated Films

- 10.2.5. Other Product Types

- 10.2.1. Containers

- 10.3. Market Analysis, Insights and Forecast - by Material Type

- 10.3.1. Polypropylene (PP)

- 10.3.2. Polystrene (PS)

- 10.3.3. Polyester (PET)

- 10.3.4. Thermoform

- 10.3.5. Aluminium

- 10.3.6. Other Material Types

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Fresh and Frozen Products

- 10.4.2. Processed Products

- 10.4.3. Read-to-eat Products

- 10.1. Market Analysis, Insights and Forecast - by Packaging Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WestRock

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amcor

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Smurfit Kappa Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sonoco

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Stora Enso

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mondi Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Can-Pack SA*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Crown Holdings

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Berry Global

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DS Smith

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sealed Air

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 WestRock

List of Figures

- Figure 1: Global Meat, Poultry & Seafood Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Packaging Type 2025 & 2033

- Figure 3: North America Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 4: North America Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 5: North America Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 7: North America Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 8: North America Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Application 2025 & 2033

- Figure 9: North America Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Packaging Type 2025 & 2033

- Figure 13: Europe Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 14: Europe Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Europe Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 17: Europe Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 18: Europe Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Application 2025 & 2033

- Figure 19: Europe Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Packaging Type 2025 & 2033

- Figure 23: Asia Pacific Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 24: Asia Pacific Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 25: Asia Pacific Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 26: Asia Pacific Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 27: Asia Pacific Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Asia Pacific Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Asia Pacific Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Packaging Type 2025 & 2033

- Figure 33: Latin America Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 34: Latin America Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 35: Latin America Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Latin America Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 37: Latin America Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 38: Latin America Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Application 2025 & 2033

- Figure 39: Latin America Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Latin America Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Latin America Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Packaging Type 2025 & 2033

- Figure 43: Middle East and Africa Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 44: Middle East and Africa Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 45: Middle East and Africa Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 46: Middle East and Africa Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 47: Middle East and Africa Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 48: Middle East and Africa Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Application 2025 & 2033

- Figure 49: Middle East and Africa Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 50: Middle East and Africa Meat, Poultry & Seafood Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 51: Middle East and Africa Meat, Poultry & Seafood Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 2: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 4: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 7: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 9: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 12: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 14: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 17: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 19: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 22: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 23: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 24: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 25: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 27: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 28: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 29: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Meat, Poultry & Seafood Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Meat, Poultry & Seafood Packaging Industry?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Meat, Poultry & Seafood Packaging Industry?

Key companies in the market include WestRock, Amcor, Smurfit Kappa Group, Sonoco, Stora Enso, Mondi Group, Can-Pack SA*List Not Exhaustive, Crown Holdings, Berry Global, DS Smith, Sealed Air.

3. What are the main segments of the Meat, Poultry & Seafood Packaging Industry?

The market segments include Packaging Type, Product Type, Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.62 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Population May Increase the Demand; Government Regulations for Improved and Better Packaging Materials.

6. What are the notable trends driving market growth?

Flexible Packaging to Witness Growth.

7. Are there any restraints impacting market growth?

Contamination Due to Poor Packaging or Mishandling.

8. Can you provide examples of recent developments in the market?

December 2022 - Amcor announced the opening of its new state-of-the-art manufacturing plant in Huizhou, China. With an investment of over USD 100 million, the 590,000 sq ft factory is the largest flexible packaging plant in China by production capacity, substantially enhancing Amcor's capabilities to fulfill rising client demand throughout Asia-Pacific. The facility has China's first automated packaging production line, resulting in double-digit decreases in production cycle time, together with high-speed printing presses, laminators, and bag-making equipment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Meat, Poultry & Seafood Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Meat, Poultry & Seafood Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Meat, Poultry & Seafood Packaging Industry?

To stay informed about further developments, trends, and reports in the Meat, Poultry & Seafood Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence