Key Insights

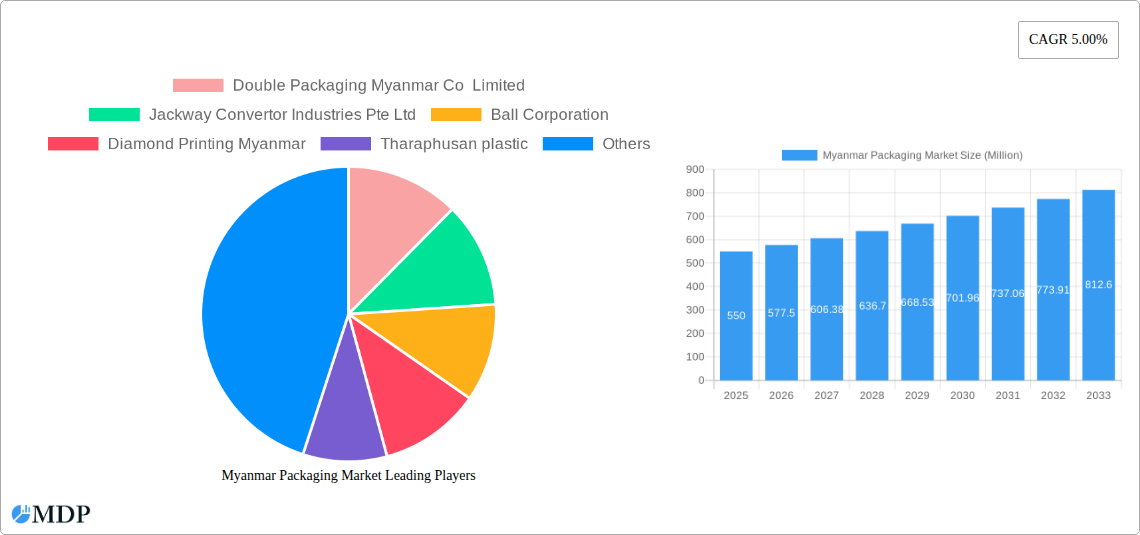

The Myanmar Packaging Market is projected for significant expansion, expected to reach a market size of 725 million by 2028, with a Compound Annual Growth Rate (CAGR) of 8%. This growth is primarily driven by robust demand from the expanding food and beverage sector, a cornerstone of Myanmar's economy. Increasing adoption of processed foods, a growing middle class, and evolving consumer preferences for convenience and preserved goods directly fuel the demand for diverse packaging solutions. Furthermore, the pharmaceutical and healthcare industries are experiencing accelerated growth due to an expanding population and increased healthcare expenditure, necessitating higher quality and more specialized packaging for product safety and efficacy. The cosmetics and toiletries sector also presents a notable growth avenue, influenced by rising disposable incomes and greater awareness of personal care products.

Myanmar Packaging Market Market Size (In Million)

The market's dynamics are shaped by material innovations and evolving product types. Plastic packaging, particularly bottles, containers, pouches, and bags, continues to dominate due to its versatility, cost-effectiveness, and durability. However, a discernible trend towards sustainable options is emerging, with paper and paperboard packaging gaining traction among eco-conscious consumers and brands aiming to reduce their environmental footprint. Metal cans also hold a significant share, especially within the beverage industry. Key restraints include fluctuating raw material prices, impacting production costs, and potential supply chain disruptions, though efforts are underway to enhance local manufacturing capabilities. Despite these challenges, the outlook for the Myanmar Packaging Market remains positive, driven by sustained industrial development and changing consumer lifestyles.

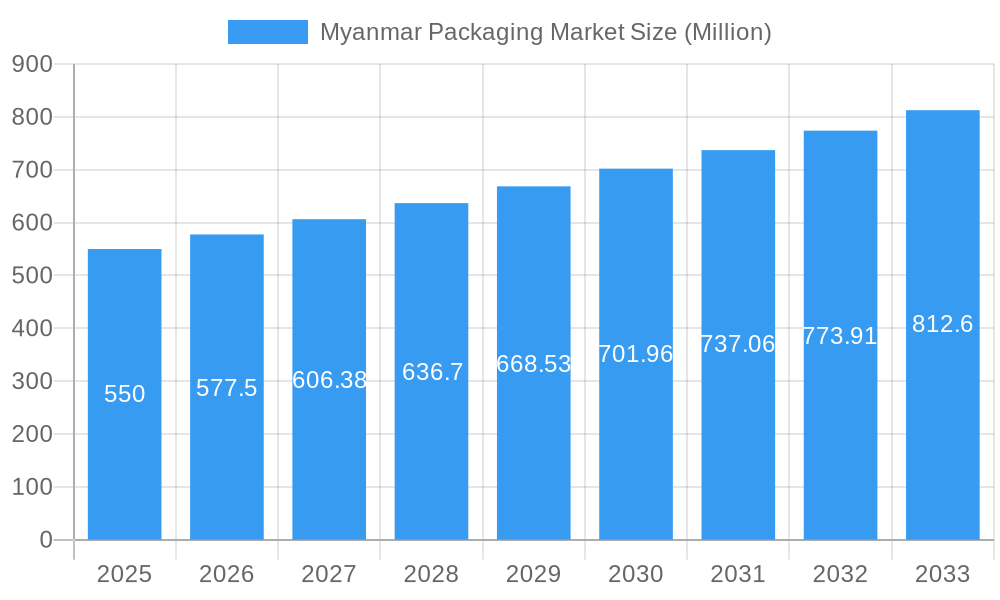

Myanmar Packaging Market Company Market Share

This comprehensive report offers a detailed analysis of the Myanmar packaging market from 2023 to 2033, with a base year of 2023. We provide crucial insights into market dynamics, industry trends, leading segments, product innovations, growth drivers, challenges, emerging opportunities, and strategic outlook. Focusing on high-traffic keywords such as "Myanmar packaging market," "plastic packaging Myanmar," "paper packaging Myanmar," "food packaging Myanmar," and "beverage packaging Myanmar," this report is designed to maximize search visibility and attract key industry stakeholders, including manufacturers, suppliers, investors, and end-users.

Myanmar Packaging Market Market Dynamics & Concentration

The Myanmar packaging market is characterized by a moderate level of concentration, with key players vying for market share across diverse segments. Innovation is increasingly driven by a growing demand for sustainable packaging solutions, with companies exploring biodegradable and recyclable materials. Regulatory frameworks are evolving, with a focus on environmental protection and food safety standards, influencing packaging design and material choices. Product substitutes, particularly in flexible packaging, pose a competitive challenge to traditional rigid formats. End-user trends are shifting towards convenience and premiumization, impacting packaging formats and functionalities. Merger and acquisition activities are nascent but expected to increase as larger domestic and international players seek to consolidate their presence. Current market share estimations indicate that plastic packaging holds a dominant position, estimated at around 65%, followed by paper and paperboard at approximately 25%. M&A deal counts have been limited, with less than 5 significant transactions recorded in the historical period (2019-2024), signaling an early stage of market consolidation.

Myanmar Packaging Market Industry Trends & Analysis

The Myanmar packaging market is poised for significant growth, driven by a burgeoning economy, a young and growing population, and increasing disposable incomes. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. Technological disruptions are playing a pivotal role, with advancements in printing, material science, and automated packaging machinery enhancing efficiency and product appeal. Consumer preferences are increasingly leaning towards aesthetically pleasing, user-friendly, and sustainable packaging. The beverage sector, a major consumer of packaging, is witnessing a rise in demand for single-serve and multipack options, particularly for bottled water and ready-to-drink beverages. The food industry is also a strong driver, with a growing demand for processed and packaged foods requiring robust and safe packaging solutions. Market penetration for advanced packaging technologies is still in its early stages, offering substantial room for expansion. The rise of e-commerce is also influencing packaging design, with a greater emphasis on durability and tamper-evidence for shipping.

Leading Markets & Segments in Myanmar Packaging Market

The Plastic segment is the dominant force in the Myanmar packaging market, holding an estimated market share of over 65%. This dominance is fueled by its versatility, cost-effectiveness, and suitability for a wide range of products. Within the plastic segment, Plastic Bottles & Containers represent a significant portion, driven by the beverage and household chemical industries. The Pouches & Bags sub-segment is also experiencing robust growth, particularly for food products and smaller consumer goods, driven by their flexibility and lower material costs.

The Paper & Paperboard segment commands a substantial market share of approximately 25%, driven by its eco-friendly appeal and use in the food, beverage, and pharmaceutical industries for applications like cartons, boxes, and paper bags.

The Beverage end-user industry is the largest consumer of packaging in Myanmar, accounting for an estimated 35% of the total market. This is attributed to the strong demand for bottled water, soft drinks, and alcoholic beverages. The Food industry follows closely, representing around 30% of the market, driven by the increasing consumption of processed foods, snacks, and ready-to-eat meals. The Pharmaceutical and Healthcare sector, while smaller, is a high-value segment with stringent packaging requirements for drug safety and shelf life.

Key Drivers for Dominance:

- Economic Policies: Government initiatives promoting industrial development and foreign investment are boosting manufacturing and consumption, thereby increasing packaging demand.

- Infrastructure Development: Improved logistics and supply chain networks facilitate wider distribution of packaged goods across the country.

- Growing Middle Class: Increased purchasing power leads to higher consumption of packaged convenience foods, beverages, and personal care products.

- Urbanization: Concentration of populations in urban centers drives demand for packaged goods in retail outlets.

- Sustainability Awareness: While still nascent, a growing awareness of environmental issues is fostering demand for recyclable and biodegradable packaging options.

Myanmar Packaging Market Product Developments

Product developments in the Myanmar packaging market are increasingly focused on enhancing functionality, aesthetics, and sustainability. Innovations in plastic packaging include the development of lightweight yet durable materials for bottles and containers, and advanced barrier films for pouches and bags to extend product shelf life. Paperboard innovations are centered on enhanced printability and structural integrity for premium packaging. Companies are also investing in child-resistant and tamper-evident closures for pharmaceutical and cosmetic products, while flexible packaging solutions are gaining traction due to their versatility and cost-effectiveness. The competitive advantage lies in offering customized solutions that meet specific end-user needs for product protection, brand visibility, and consumer convenience.

Key Drivers of Myanmar Packaging Market Growth

The Myanmar packaging market's growth is primarily propelled by several key factors. Economic growth and rising disposable incomes are fueling consumer spending on packaged goods across various categories. The expanding beverage and food processing industries, driven by domestic demand and potential export markets, directly translate into higher packaging requirements. Technological advancements in packaging machinery and materials are leading to more efficient production and innovative product offerings. Furthermore, government initiatives promoting industrialization and foreign direct investment are creating a more favorable business environment, stimulating investment in the packaging sector. The increasing urbanization and the growth of the retail sector also play a significant role in driving demand for packaged products.

Challenges in the Myanmar Packaging Market Market

Despite its growth potential, the Myanmar packaging market faces several significant challenges. Limited access to advanced packaging technologies and raw materials can hinder innovation and increase production costs. Inconsistent supply chain infrastructure and logistical complexities can lead to delays and higher operational expenses. Regulatory hurdles and evolving compliance requirements related to environmental standards and product safety can pose challenges for new entrants and established players alike. Intense price competition, particularly in commodity packaging segments, can pressure profit margins. Furthermore, a lack of skilled labor in specialized packaging operations can impact efficiency and quality. The informal sector also presents a competitive challenge in certain segments.

Emerging Opportunities in Myanmar Packaging Market

Emerging opportunities in the Myanmar packaging market are driven by several catalysts for long-term growth. The growing demand for sustainable and eco-friendly packaging solutions presents a significant opportunity for companies offering biodegradable, compostable, or recyclable alternatives. The expansion of the pharmaceutical and healthcare sector, with its increasing need for specialized, sterile, and tamper-evident packaging, is a lucrative avenue. E-commerce growth is creating a demand for robust, efficient, and attractive shipping and product packaging. Strategic partnerships and collaborations between local and international players can facilitate technology transfer and market penetration. Furthermore, investments in modernizing manufacturing facilities and improving supply chain efficiencies will unlock greater potential for market expansion and increased competitiveness.

Leading Players in the Myanmar Packaging Market Sector

- Double Packaging Myanmar Co Limited

- Jackway Convertor Industries Pte Ltd

- Ball Corporation

- Diamond Printing Myanmar

- Tharaphusan plastic

- Can-One Berhad

- Daibochi Myanmar

- May Kha San Family Co Ltd

- Oji Myanmar Packaging Co Ltd

Key Milestones in Myanmar Packaging Market Industry

- 2019: Increased investment in flexible packaging solutions for the growing snack food market.

- 2020: Introduction of new food-grade plastic container standards by the Ministry of Commerce.

- 2021: Launch of several local initiatives focused on promoting plastic recycling and waste management.

- 2022: Growing adoption of paper-based packaging for beverages and consumer goods due to environmental concerns.

- 2023: Expansion of production capacity for metal cans by key beverage manufacturers.

- 2024: Increased focus on child-resistant and tamper-evident packaging solutions within the pharmaceutical sector.

Strategic Outlook for Myanmar Packaging Market Market

The strategic outlook for the Myanmar packaging market is highly optimistic, driven by strong underlying economic and demographic trends. Key growth accelerators include the continued expansion of the consumer goods sector, particularly in food and beverages, and the increasing adoption of advanced and sustainable packaging technologies. Companies that can offer innovative, cost-effective, and environmentally responsible packaging solutions will be best positioned for success. Strategic opportunities lie in leveraging the growing middle class's demand for premium and convenience-oriented packaging, expanding into underdeveloped regions, and investing in R&D for material innovation. Furthermore, building robust local supply chains and fostering strategic partnerships will be crucial for sustained market leadership and capturing future growth potential.

Myanmar Packaging Market Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Paper & Paperboard

- 1.3. Metal

- 1.4. Glass

-

2. Product Type

- 2.1. Plastic Bottles & Containers

- 2.2. Pouches & Bags

- 2.3. Metal Cans

- 2.4. Glass Bottles & Containers

- 2.5. Other Product Types

-

3. End-user Industry

- 3.1. Beverage

- 3.2. Food

- 3.3. Pharmaceutical and Healthcare

- 3.4. Cosmetics and Toiletries

- 3.5. Household Chemicals

- 3.6. Other End-user Industries

Myanmar Packaging Market Segmentation By Geography

- 1. Myanmar

Myanmar Packaging Market Regional Market Share

Geographic Coverage of Myanmar Packaging Market

Myanmar Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growth in Demand of End user Industries; Low Import and Export Duty

- 3.3. Market Restrains

- 3.3.1. Stringent Government Rules and Regulations

- 3.4. Market Trends

- 3.4.1. Growing Demand in Food and Beverage Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Myanmar Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Paper & Paperboard

- 5.1.3. Metal

- 5.1.4. Glass

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Plastic Bottles & Containers

- 5.2.2. Pouches & Bags

- 5.2.3. Metal Cans

- 5.2.4. Glass Bottles & Containers

- 5.2.5. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Beverage

- 5.3.2. Food

- 5.3.3. Pharmaceutical and Healthcare

- 5.3.4. Cosmetics and Toiletries

- 5.3.5. Household Chemicals

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Myanmar

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Double Packaging Myanmar Co Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jackway Convertor Industries Pte Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ball Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Diamond Printing Myanmar

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tharaphusan plastic

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Can-One Berhad**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Daibochi Myanmar

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 May Kha San Family Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oji Myanmar Packaging Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Double Packaging Myanmar Co Limited

List of Figures

- Figure 1: Myanmar Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Myanmar Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Myanmar Packaging Market Revenue million Forecast, by Material 2020 & 2033

- Table 2: Myanmar Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Myanmar Packaging Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Myanmar Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Myanmar Packaging Market Revenue million Forecast, by Material 2020 & 2033

- Table 6: Myanmar Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Myanmar Packaging Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 8: Myanmar Packaging Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Myanmar Packaging Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Myanmar Packaging Market?

Key companies in the market include Double Packaging Myanmar Co Limited, Jackway Convertor Industries Pte Ltd, Ball Corporation, Diamond Printing Myanmar, Tharaphusan plastic, Can-One Berhad**List Not Exhaustive, Daibochi Myanmar, May Kha San Family Co Ltd, Oji Myanmar Packaging Co Ltd.

3. What are the main segments of the Myanmar Packaging Market?

The market segments include Material, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 725 million as of 2022.

5. What are some drivers contributing to market growth?

; Growth in Demand of End user Industries; Low Import and Export Duty.

6. What are the notable trends driving market growth?

Growing Demand in Food and Beverage Industry.

7. Are there any restraints impacting market growth?

Stringent Government Rules and Regulations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Myanmar Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Myanmar Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Myanmar Packaging Market?

To stay informed about further developments, trends, and reports in the Myanmar Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence