Key Insights

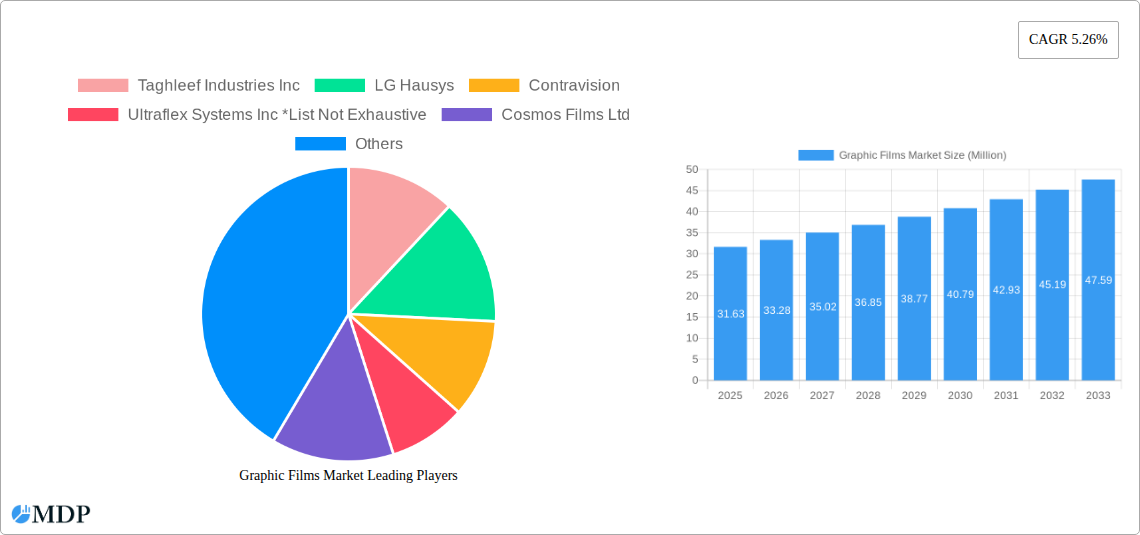

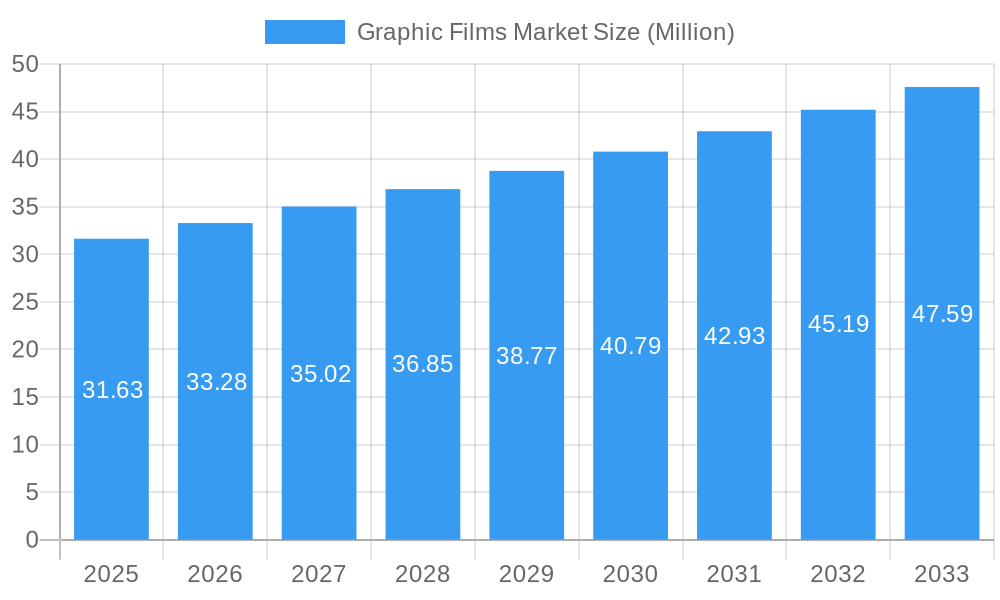

The global Graphic Films Market is poised for significant expansion, projected to reach approximately USD 31.63 million and exhibit a robust Compound Annual Growth Rate (CAGR) of 5.26% throughout the forecast period of 2025-2033. This growth is primarily fueled by escalating demand across diverse end-user industries, notably automotive and promotional/advertisement sectors, where graphic films are indispensable for vehicle wraps, signage, branding, and visual merchandising. The increasing adoption of digital printing technologies and the growing consumer preference for customized and aesthetically appealing products further bolster market expansion. Key drivers include the rising disposable incomes in developing economies, leading to increased spending on decorative and functional film applications, and the inherent durability and versatility of graphic films, offering cost-effective and visually impactful solutions for various commercial and personal uses. The market's trajectory indicates a sustained upward trend driven by innovation in film materials and application techniques.

Graphic Films Market Market Size (In Million)

The market segmentation reveals a strong dominance of Polyethylene (PE) and Polypropylene (PP) within the polymer category, owing to their excellent printability, durability, and cost-effectiveness. These materials are extensively used in a wide array of applications, from vehicle graphics to retail displays. In terms of end-user industries, the automotive sector, with its continuous demand for custom wraps and branding, and the promotional & advertisement segment, driven by the need for eye-catching visual communication, are anticipated to be the leading contributors to market revenue. Emerging trends such as the development of eco-friendly and sustainable graphic film solutions, along with the integration of smart technologies for interactive displays, are expected to shape the market's future landscape. However, challenges such as fluctuating raw material prices and intense competition among manufacturers might pose some restraint to the market's unhindered growth. Nevertheless, the overarching demand for enhanced visual appeal and effective branding across industries ensures a promising outlook for the graphic films market.

Graphic Films Market Company Market Share

Unveiling the Dynamic Graphic Films Market: A Comprehensive Analysis and Forecast (2019-2033)

This in-depth report offers a panoramic view of the global graphic films market, a vital sector powering diverse industries from automotive aesthetics to promotional campaigns. With a comprehensive study period spanning 2019 to 2033, a base and estimated year of 2025, and a detailed forecast period from 2025 to 2033, this analysis provides actionable insights for stakeholders seeking to navigate and capitalize on market opportunities. We delve into key segments like Polypropylene (PP), Polyethylene (PE), Polyvinyl Chloride (PVC), and Other Polymers, alongside crucial End-User Industries including Automotive, Promotional & Advertisement, Institutional, and Other. Discover market dynamics, industry trends, leading segments, product innovations, growth drivers, challenges, emerging opportunities, key players, and pivotal milestones shaping the future of graphic films. This report is your indispensable guide to understanding market concentration, innovation drivers, regulatory landscapes, product substitutes, end-user trends, M&A activities, market penetration, CAGR, technological disruptions, consumer preferences, competitive dynamics, dominant regions and countries, economic policies, infrastructure impacts, product developments, competitive advantages, technological trends, market fit, regulatory factors, supply chain issues, competitive pressures, long-term growth catalysts, strategic partnerships, market expansion strategies, future market potential, and strategic opportunities.

Graphic Films Market Market Dynamics & Concentration

The graphic films market exhibits a moderate to high concentration, with a significant presence of established global players alongside a growing number of regional and specialized manufacturers. Innovation serves as a primary driver, fueled by the continuous demand for enhanced durability, vibrant printability, eco-friendly alternatives, and specialized functionalities such as UV resistance and removability. Regulatory frameworks, particularly concerning environmental impact and material safety, play a crucial role in shaping product development and market access. Product substitutes, such as traditional printing methods or digital displays, pose a challenge, necessitating ongoing advancements in graphic film technology to maintain competitiveness. End-user trends are heavily influenced by the desire for dynamic branding, personalized aesthetics, and sustainable solutions across various sectors. Mergers and acquisitions (M&A) activities are notable, as larger companies seek to expand their product portfolios, geographic reach, and technological capabilities. For instance, the acquisition of smaller, innovative firms by industry giants is a common strategy to consolidate market share and access cutting-edge technologies. Market share distribution remains dynamic, with leading players like 3M Company, Avery Dennison Corporation, and Orafol Europe GMBH holding substantial portions, yet niche players are carving out significant space through specialization. The M&A deal count is expected to see a steady increase as companies aim for strategic growth and competitive advantage in this evolving landscape.

Graphic Films Market Industry Trends & Analysis

The graphic films market is poised for robust growth, driven by an ever-increasing demand for visually appealing and customizable surfaces across a multitude of applications. Market growth is significantly propelled by the booming Promotional & Advertisement sector, where brands leverage high-quality graphic films for eye-catching vehicle wraps, signage, and point-of-sale displays to enhance brand visibility and consumer engagement. The Automotive industry also presents a substantial growth avenue, with a rising trend in vehicle customization and the adoption of protective and aesthetic wraps, contributing to enhanced vehicle lifespan and personalized styling. Furthermore, the Institutional sector, encompassing retail spaces, corporate offices, and public facilities, increasingly utilizes graphic films for interior decoration, wayfinding, and branding, fostering a more engaging and informative environment.

Technological disruptions are at the forefront of shaping the industry. The development of eco-friendly and sustainable graphic films, such as PVC-free alternatives exemplified by Innovia Films' Rayoart launch, is gaining significant traction. This shift is driven by growing environmental consciousness among consumers and stricter environmental regulations globally. Advancements in digital printing technologies have enabled higher resolution, faster printing speeds, and a wider color gamut for graphic films, allowing for more intricate designs and quicker turnaround times. The integration of smart functionalities, such as thermochromic or electrochromic properties, is another emerging trend, offering dynamic visual experiences.

Consumer preferences are increasingly leaning towards personalization and sustainability. The ability to create bespoke designs and the assurance of environmentally responsible products are becoming key purchasing factors. This is pushing manufacturers to offer a wider range of customization options and invest in greener production processes. Competitive dynamics are intense, with key players continuously investing in research and development to introduce innovative products that meet evolving market demands. The CAGR for the graphic films market is projected to be robust, reflecting these strong underlying growth drivers. Market penetration is expected to deepen across existing applications while expanding into new and emerging sectors.

Leading Markets & Segments in Graphic Films Market

The Promotional & Advertisement segment stands as a dominant force within the graphic films market. This leadership is propelled by several key drivers, including the intrinsic need for businesses to capture consumer attention in a crowded marketplace. Economic policies that encourage advertising expenditure and support small and medium-sized enterprises (SMEs) directly correlate with increased demand for graphic films in signage and promotional materials. Infrastructure development, particularly in retail and urban areas, creates more opportunities for visible branding through banners, window graphics, and point-of-sale displays.

Within this segment, the Automotive sub-segment is experiencing remarkable growth. The rise of vehicle wraps, not just for promotional purposes but also for personal customization and protection, has significantly boosted demand for high-performance graphic films. Advancements in automotive styling, coupled with the desire for unique vehicle aesthetics, are key drivers. The increasing adoption of fleet branding by delivery services and logistics companies further solidifies the automotive sector's importance.

Polyvinyl Chloride (PVC) continues to be a dominant polymer in the graphic films market, largely due to its versatility, durability, and cost-effectiveness. Its inherent properties make it ideal for a wide range of applications, from vibrant banners and signage to long-lasting vehicle wraps. However, there is a growing trend towards Other Polymers, particularly Polypropylene (PP) and Polyethylene (PE), driven by environmental concerns and the demand for more sustainable alternatives. Innovia Films' launch of Rayoart PVC-free graphic art films highlights this shift. These emerging materials offer comparable performance with an improved environmental footprint, appealing to eco-conscious consumers and manufacturers.

The Institutional segment is also witnessing steady growth, driven by the increasing focus on interior design, branding, and functionality in commercial spaces. This includes applications like wall graphics, floor graphics, and architectural films, enhancing the aesthetic appeal and user experience of buildings. Economic policies supporting commercial real estate development and the refurbishment of existing structures contribute to this segment's expansion.

Graphic Films Market Product Developments

Product innovation in the graphic films market is primarily centered on enhancing performance, sustainability, and application ease. A prime example is 3M Company's 3M Print Wrap Film IJ280, launched in April 2022. This film is engineered for exceptional print quality and productivity, designed to reduce installation time and rework for converters and installers, signifying a move towards higher efficiency and superior user experience. Concurrently, the development of PVC-free alternatives, like Innovia Films' Rayoart range launched in February 2021, underscores a commitment to sustainability. These BOPP films offer excellent color and print vitality for extended outdoor usage while boasting an improved environmental footprint. These advancements collectively aim to provide superior visual impact, increased durability, and greater ease of application, catering to the evolving demands for both aesthetic appeal and environmental responsibility in various end-user industries.

Key Drivers of Graphic Films Market Growth

The graphic films market is propelled by several powerful growth drivers. Technological advancements in printing and material science are paramount, enabling enhanced durability, superior print fidelity, and innovative functionalities. The growing demand for visual branding and customization across industries like automotive, retail, and corporate sectors fuels the need for high-quality, attention-grabbing graphic films. Sustainability initiatives and a rising environmental consciousness are driving the adoption of eco-friendly and recyclable graphic film solutions. Furthermore, economic growth and increased advertising expenditure globally contribute to a higher demand for promotional and decorative graphic films.

Challenges in the Graphic Films Market Market

Despite its growth trajectory, the graphic films market faces several challenges. Intense competition from established players and new entrants can lead to price pressures and impact profit margins. Fluctuating raw material costs, particularly for polymers like PVC, can affect production expenses and pricing strategies. Stringent regulatory hurdles and environmental compliance standards in certain regions can increase operational complexity and R&D investment. The ongoing development of alternative visual display technologies, such as digital screens, presents a potential substitute that requires continuous innovation to maintain the relevance and cost-effectiveness of graphic films. Supply chain disruptions, as seen in recent global events, can also impact the availability and timely delivery of raw materials and finished products.

Emerging Opportunities in Graphic Films Market

The graphic films market is ripe with emerging opportunities for sustained long-term growth. The increasing demand for sustainable and biodegradable graphic films represents a significant avenue, driven by global environmental concerns and regulatory pushes. Strategic partnerships between film manufacturers and printing technology providers can lead to integrated solutions that enhance performance and streamline workflows. Market expansion into developing economies with growing retail sectors and increasing brand awareness offers substantial untapped potential. The development of specialty graphic films with unique properties, such as anti-microbial surfaces, solar control, or enhanced security features, can open up niche markets and command premium pricing.

Leading Players in the Graphic Films Market Sector

- Taghleef Industries Inc

- LG Hausys

- Contravision

- Ultraflex Systems Inc

- Cosmos Films Ltd

- Schweitzer-Mauduit International Inc

- Orafol Europe GMBH

- Drytac Corporation

- FDC Graphic Films Inc

- 3M Company

- Lintec Corporation

- Avery Dennison Corporation

- Graphic Image Films Ltd

- Spandex AG

- Arlon Graphics LLC

- ACCO Brands Corporation

- Hexis S A

- Ritrama SpA

- Innovia Films

- E I Du Pont De Nemours and Company

Key Milestones in Graphic Films Market Industry

- April 2022: 3M Company announced the launch of 3M Print Wrap Film IJ280, a high-performance vehicle wrap designed for optimal print quality and installation productivity.

- February 2021: Innovia Films launched Rayoart PVC-free graphic art films, offering extended outdoor durability, excellent color performance, and an improved environmental footprint.

Strategic Outlook for Graphic Films Market Market

The strategic outlook for the graphic films market is one of continued innovation and market expansion. Growth accelerators include the ongoing shift towards sustainable material solutions, catering to increasing environmental regulations and consumer demand. Companies that invest in R&D to develop advanced films with superior performance characteristics, such as enhanced durability, UV resistance, and ease of application, will gain a competitive edge. Strategic collaborations and partnerships are crucial for leveraging technological advancements and expanding market reach. Focusing on high-growth end-user industries like automotive customization and the expanding retail sector, coupled with penetration into emerging economies, will be key to capitalizing on future market potential and unlocking significant strategic opportunities.

Graphic Films Market Segmentation

-

1. Polymer

- 1.1. Polypropylene (PP)

- 1.2. Polyethylene (PE)

- 1.3. Polyvinyl Chloride (PVC)

- 1.4. Other Polymers

-

2. End-User Industry

- 2.1. Automotive

- 2.2. Promotional & Advertisement

- 2.3. Institutional

- 2.4. Other En

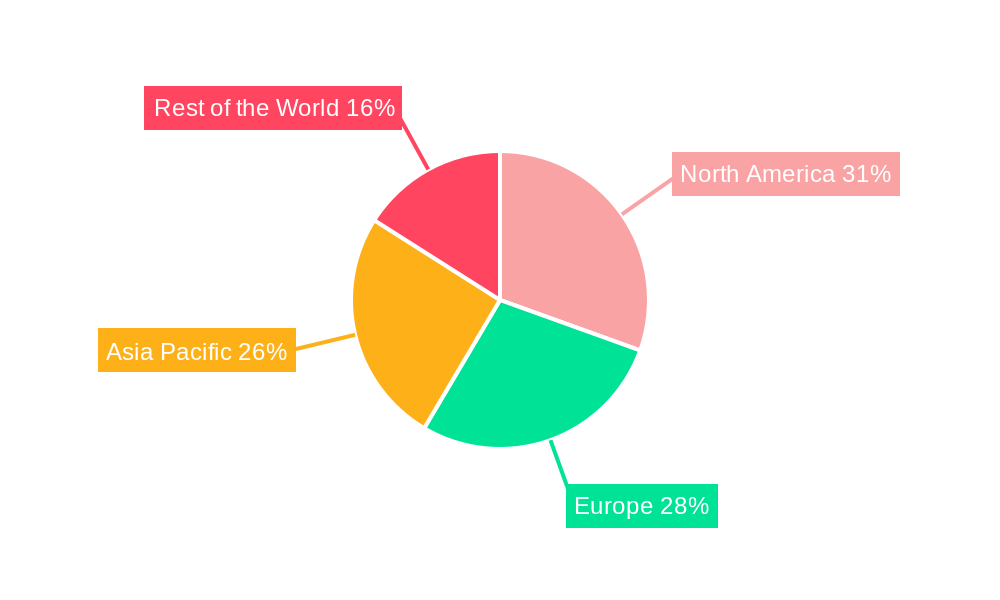

Graphic Films Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Graphic Films Market Regional Market Share

Geographic Coverage of Graphic Films Market

Graphic Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Construction Industry and Improvements in the Standard of Living; Growth in Demand for Wrap Advertisement

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Automotive Sector is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Graphic Films Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Polymer

- 5.1.1. Polypropylene (PP)

- 5.1.2. Polyethylene (PE)

- 5.1.3. Polyvinyl Chloride (PVC)

- 5.1.4. Other Polymers

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Automotive

- 5.2.2. Promotional & Advertisement

- 5.2.3. Institutional

- 5.2.4. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Polymer

- 6. North America Graphic Films Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Polymer

- 6.1.1. Polypropylene (PP)

- 6.1.2. Polyethylene (PE)

- 6.1.3. Polyvinyl Chloride (PVC)

- 6.1.4. Other Polymers

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Automotive

- 6.2.2. Promotional & Advertisement

- 6.2.3. Institutional

- 6.2.4. Other En

- 6.1. Market Analysis, Insights and Forecast - by Polymer

- 7. Europe Graphic Films Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Polymer

- 7.1.1. Polypropylene (PP)

- 7.1.2. Polyethylene (PE)

- 7.1.3. Polyvinyl Chloride (PVC)

- 7.1.4. Other Polymers

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Automotive

- 7.2.2. Promotional & Advertisement

- 7.2.3. Institutional

- 7.2.4. Other En

- 7.1. Market Analysis, Insights and Forecast - by Polymer

- 8. Asia Pacific Graphic Films Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Polymer

- 8.1.1. Polypropylene (PP)

- 8.1.2. Polyethylene (PE)

- 8.1.3. Polyvinyl Chloride (PVC)

- 8.1.4. Other Polymers

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Automotive

- 8.2.2. Promotional & Advertisement

- 8.2.3. Institutional

- 8.2.4. Other En

- 8.1. Market Analysis, Insights and Forecast - by Polymer

- 9. Rest of the World Graphic Films Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Polymer

- 9.1.1. Polypropylene (PP)

- 9.1.2. Polyethylene (PE)

- 9.1.3. Polyvinyl Chloride (PVC)

- 9.1.4. Other Polymers

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Automotive

- 9.2.2. Promotional & Advertisement

- 9.2.3. Institutional

- 9.2.4. Other En

- 9.1. Market Analysis, Insights and Forecast - by Polymer

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Taghleef Industries Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 LG Hausys

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Contravision

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Ultraflex Systems Inc *List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Cosmos Films Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Schweitzer-Mauduit International Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Orafol Europe GMBH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Drytac Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 FDC Graphic Films Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 3M Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Lintec Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Avery Dennison Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Graphic Image Films Ltd

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Spandex AG

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Arlon Graphics LLC (FLEXcon Company Inc )

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 ACCO Brands Corporation

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Hexis S A

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Ritrama SpA

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 Innovia Films (CCL Industries Inc )

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 E I Du Pont De Nemours and Company

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.1 Taghleef Industries Inc

List of Figures

- Figure 1: Global Graphic Films Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Graphic Films Market Revenue (Million), by Polymer 2025 & 2033

- Figure 3: North America Graphic Films Market Revenue Share (%), by Polymer 2025 & 2033

- Figure 4: North America Graphic Films Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 5: North America Graphic Films Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 6: North America Graphic Films Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Graphic Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Graphic Films Market Revenue (Million), by Polymer 2025 & 2033

- Figure 9: Europe Graphic Films Market Revenue Share (%), by Polymer 2025 & 2033

- Figure 10: Europe Graphic Films Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 11: Europe Graphic Films Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 12: Europe Graphic Films Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Graphic Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Graphic Films Market Revenue (Million), by Polymer 2025 & 2033

- Figure 15: Asia Pacific Graphic Films Market Revenue Share (%), by Polymer 2025 & 2033

- Figure 16: Asia Pacific Graphic Films Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 17: Asia Pacific Graphic Films Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 18: Asia Pacific Graphic Films Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Graphic Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Graphic Films Market Revenue (Million), by Polymer 2025 & 2033

- Figure 21: Rest of the World Graphic Films Market Revenue Share (%), by Polymer 2025 & 2033

- Figure 22: Rest of the World Graphic Films Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 23: Rest of the World Graphic Films Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Rest of the World Graphic Films Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Graphic Films Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Graphic Films Market Revenue Million Forecast, by Polymer 2020 & 2033

- Table 2: Global Graphic Films Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 3: Global Graphic Films Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Graphic Films Market Revenue Million Forecast, by Polymer 2020 & 2033

- Table 5: Global Graphic Films Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Global Graphic Films Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Graphic Films Market Revenue Million Forecast, by Polymer 2020 & 2033

- Table 8: Global Graphic Films Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 9: Global Graphic Films Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Graphic Films Market Revenue Million Forecast, by Polymer 2020 & 2033

- Table 11: Global Graphic Films Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 12: Global Graphic Films Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Graphic Films Market Revenue Million Forecast, by Polymer 2020 & 2033

- Table 14: Global Graphic Films Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 15: Global Graphic Films Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Graphic Films Market?

The projected CAGR is approximately 5.26%.

2. Which companies are prominent players in the Graphic Films Market?

Key companies in the market include Taghleef Industries Inc, LG Hausys, Contravision, Ultraflex Systems Inc *List Not Exhaustive, Cosmos Films Ltd, Schweitzer-Mauduit International Inc, Orafol Europe GMBH, Drytac Corporation, FDC Graphic Films Inc, 3M Company, Lintec Corporation, Avery Dennison Corporation, Graphic Image Films Ltd, Spandex AG, Arlon Graphics LLC (FLEXcon Company Inc ), ACCO Brands Corporation, Hexis S A, Ritrama SpA, Innovia Films (CCL Industries Inc ), E I Du Pont De Nemours and Company.

3. What are the main segments of the Graphic Films Market?

The market segments include Polymer, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Construction Industry and Improvements in the Standard of Living; Growth in Demand for Wrap Advertisement.

6. What are the notable trends driving market growth?

Automotive Sector is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

April 2022 - 3M Company has announced the launch of 3M Print Wrap Film IJ280 - a best-in-class vehicle wrap designed for converters and installers who expect exceptional performance, print quality, and productivity. 3M Print Wrap Film IJ280 and the matching 3M Gloss Wrap Overlaminate 8428G were designed to install fast and with less re-work.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Graphic Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Graphic Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Graphic Films Market?

To stay informed about further developments, trends, and reports in the Graphic Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence