Key Insights

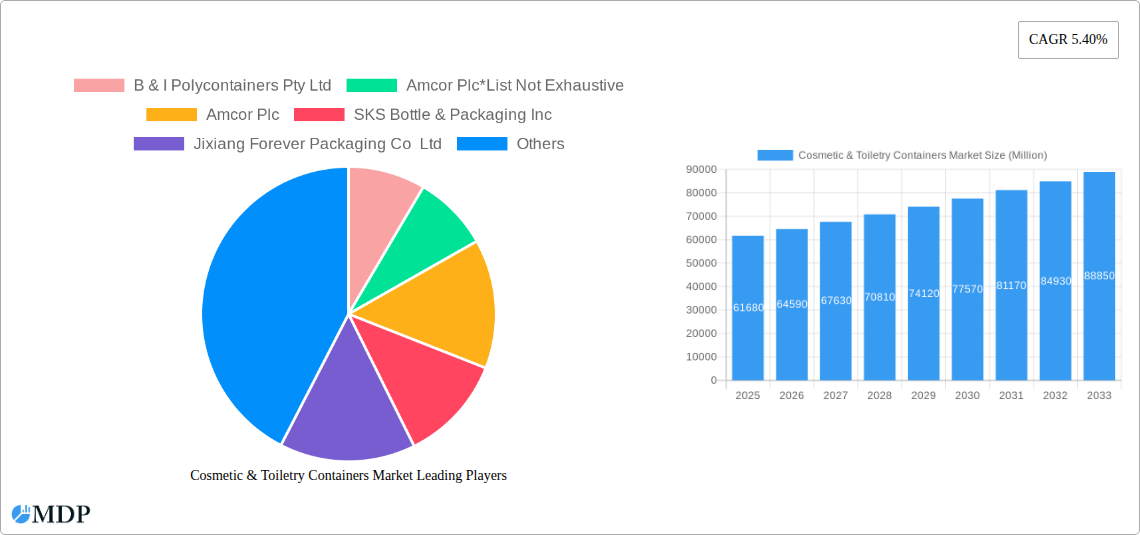

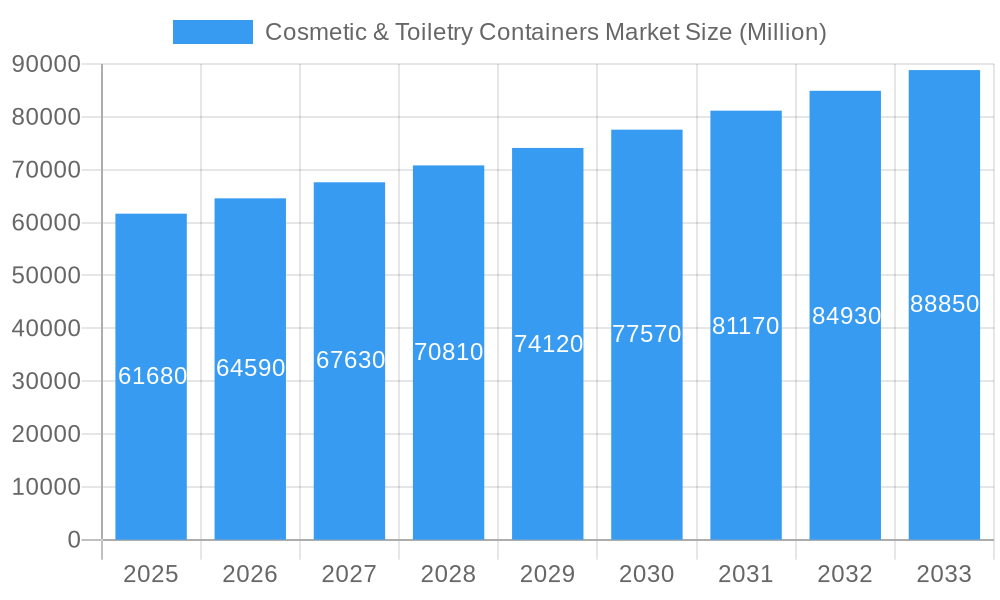

The global Cosmetic & Toiletry Containers Market is poised for substantial growth, projected to reach USD 61.68 billion in 2025, and expand at a Compound Annual Growth Rate (CAGR) of 4.7% through 2033. This robust expansion is fueled by a confluence of powerful market drivers, including the burgeoning global demand for beauty and personal care products, driven by increasing disposable incomes, a growing focus on personal grooming, and the relentless innovation in cosmetic formulations. The market is experiencing a significant shift towards sustainable packaging solutions, with a rising preference for eco-friendly materials like recycled plastics and glass. Furthermore, the premiumization trend within the beauty sector is pushing demand for aesthetically appealing and high-quality containers that enhance brand perception. Emerging markets, particularly in the Asia Pacific, are emerging as key growth engines due to a rapidly expanding middle class and a rising adoption of Western beauty standards.

Cosmetic & Toiletry Containers Market Market Size (In Billion)

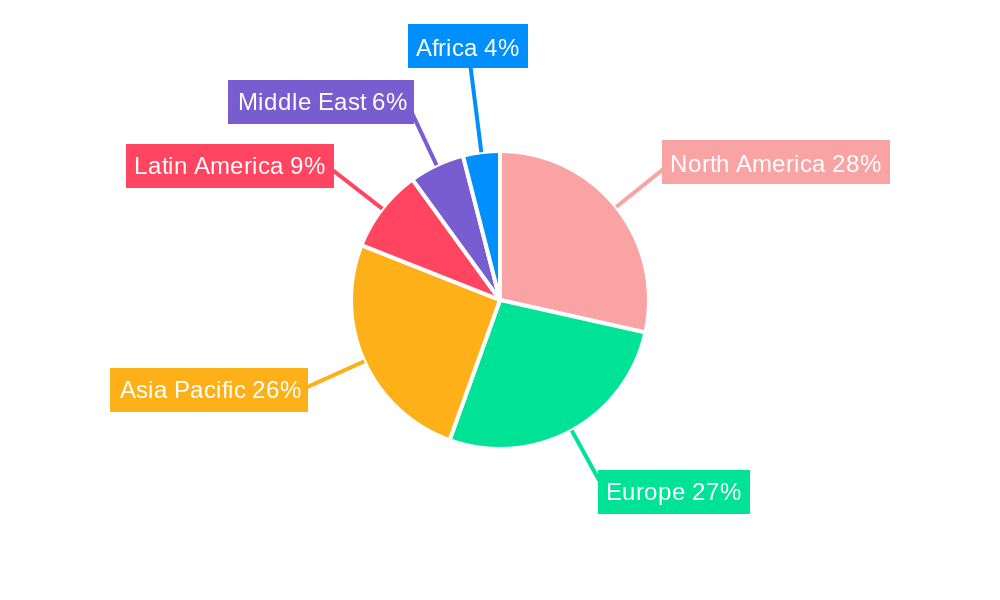

The market is segmented into various material types, with Plastic and Glass holding dominant positions due to their versatility, cost-effectiveness, and aesthetic appeal. However, there's a discernible trend towards exploring innovative and sustainable "Other Types" of materials, driven by regulatory pressures and consumer consciousness. Key players in the market are actively engaged in research and development to offer differentiated packaging solutions, focusing on functionalities like airless pumps, multi-layer structures for product protection, and child-resistant features. Geographically, North America and Europe currently represent significant markets, but the Asia Pacific region is anticipated to witness the fastest growth. Restraints, such as the volatility of raw material prices and stringent environmental regulations, are being addressed through strategic supply chain management and the adoption of circular economy principles.

Cosmetic & Toiletry Containers Market Company Market Share

Here's an SEO-optimized and engaging report description for the Cosmetic & Toiletry Containers Market:

Report Title: Cosmetic & Toiletry Containers Market Size, Share, Growth, Trends & Forecast 2024-2033

This comprehensive report delves into the dynamic Cosmetic & Toiletry Containers Market, providing in-depth analysis of market size, share, growth drivers, industry trends, and future projections. With a study period spanning from 2019 to 2033, this report offers invaluable insights for stakeholders seeking to capitalize on opportunities in this rapidly evolving sector. The base year for analysis is 2025, with estimations for the estimated year also in 2025, and a detailed forecast period from 2025 to 2033, building upon the historical period of 2019–2024.

The global Cosmetic & Toiletry Containers Market is projected to reach a valuation of USD XX billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This growth is fueled by burgeoning consumer demand for premium beauty and personal care products, increasing emphasis on sustainable packaging solutions, and continuous innovation in container designs and materials. This report meticulously dissects the market landscape, segmenting it by container type, including Plastic, Glass, Metal, and Other Types, to offer granular insights into specific market dynamics.

We explore critical market dynamics, including the competitive landscape, technological advancements, evolving consumer preferences, and the impact of stringent regulatory frameworks. The report also highlights key industry developments and strategic initiatives undertaken by leading players.

Cosmetic & Toiletry Containers Market Dynamics & Concentration

The Cosmetic & Toiletry Containers Market is characterized by a moderate to high concentration, with key players actively engaged in strategic initiatives to maintain and expand their market share. Innovation drivers are paramount, focusing on sustainable materials like recycled plastics and bioplastics, as well as advancements in smart packaging and personalization. Regulatory frameworks, particularly concerning environmental impact and consumer safety, are shaping product development and material choices. Product substitutes, such as sachets and refillable options, are gaining traction, influencing traditional packaging demand. End-user trends are leaning towards premiumization, on-the-go solutions, and eco-conscious consumption. Mergers and acquisitions (M&A) activities are strategically employed to enhance capabilities, expand geographical reach, and consolidate market presence. For instance, recent M&A deal counts indicate a proactive approach to market consolidation. Key companies like Amcor Plc and RPC Group Plc are consistently investing in R&D and strategic partnerships to address these dynamics effectively. The market share distribution among top players reflects a blend of established giants and emerging innovators, all vying for dominance through differentiated product offerings and sustainable practices. The increasing demand for luxury cosmetic packaging further drives innovation in design and material, contributing to market concentration around companies with advanced manufacturing capabilities.

Cosmetic & Toiletry Containers Market Industry Trends & Analysis

The Cosmetic & Toiletry Containers Market is experiencing significant growth driven by a confluence of factors that underscore evolving consumer demands and technological advancements. A primary growth driver is the escalating global demand for beauty, personal care, and hygiene products, which directly translates into a higher need for associated packaging solutions. Consumers are increasingly prioritizing aesthetic appeal, functionality, and convenience, pushing manufacturers to develop innovative container designs that enhance user experience and product appeal. Furthermore, the growing consumer consciousness regarding environmental sustainability is a transformative trend. This has led to a surge in demand for eco-friendly packaging options, including recyclable, biodegradable, and refillable containers. Companies are actively investing in research and development to incorporate post-consumer recycled (PCR) content, plant-based materials, and lightweight designs to minimize environmental footprints. Technological disruptions, such as advancements in material science and manufacturing processes, are enabling the creation of novel packaging formats, improved barrier properties, and enhanced product preservation. For example, advancements in injection molding and blow molding technologies allow for intricate designs and cost-effective production of plastic containers. The digital revolution is also impacting the industry, with the rise of e-commerce necessitating robust and protective packaging solutions that can withstand the rigors of shipping while maintaining brand integrity. Market penetration of specialized packaging, such as airless pumps for sensitive formulations and smart packaging with integrated tracking or authentication features, is steadily increasing. Competitive dynamics are intense, with manufacturers differentiating themselves through sustainable practices, innovative designs, and cost-efficiency. Strategic partnerships and collaborations are becoming more prevalent as companies aim to leverage each other's expertise in material science, design, and distribution to capture a larger market share. The overall market penetration for sustainable cosmetic and toiletry containers is on an upward trajectory, signaling a long-term shift in industry priorities. The CAGR of the market is being significantly influenced by the adoption rates of these new technologies and sustainable solutions across different geographies.

Leading Markets & Segments in Cosmetic & Toiletry Containers Market

The Plastic segment is projected to maintain its dominance within the Cosmetic & Toiletry Containers Market throughout the forecast period. This segment's leadership is attributed to its inherent versatility, cost-effectiveness, and the wide array of design possibilities it offers. Plastic containers, including PET, HDPE, and PP, are lightweight, durable, and highly adaptable for various product types, ranging from skincare lotions and shampoos to makeup compacts and perfume bottles. Economic policies that support manufacturing and the availability of raw materials for plastic production in key regions further bolster its market position. Infrastructure development, particularly in emerging economies, facilitates the efficient production and distribution of plastic packaging, making it a preferred choice for both manufacturers and consumers.

- Dominance of Plastic Segment:

- Material Versatility: Plastic's ability to be molded into diverse shapes, sizes, and finishes allows for extensive customization, catering to the aesthetic demands of the cosmetic industry.

- Cost-Effectiveness: Compared to glass and metal, plastic offers a more economical solution for mass production, which is crucial for high-volume consumer goods.

- Durability and Lightweight Properties: Plastic containers are less prone to breakage than glass and are significantly lighter, reducing transportation costs and environmental impact during shipping.

- Barrier Properties: Advanced plastic formulations provide excellent barrier protection against oxygen, moisture, and light, preserving product efficacy and shelf life.

The Asia Pacific region is anticipated to be the leading market for cosmetic and toiletry containers, driven by its rapidly growing population, increasing disposable incomes, and the burgeoning beauty and personal care industry. Countries like China, India, and Southeast Asian nations are witnessing a surge in consumer spending on cosmetics and toiletries, thereby fueling the demand for packaging solutions. Government initiatives promoting manufacturing and foreign investment, coupled with a strong domestic demand for both luxury and mass-market products, further solidify Asia Pacific's leading position. The region's robust manufacturing capabilities also contribute to its competitive edge in producing a wide range of container types.

Cosmetic & Toiletry Containers Market Product Developments

Product developments in the Cosmetic & Toiletry Containers Market are heavily influenced by sustainability and consumer experience. Innovations are focused on creating lighter yet durable plastic containers using PCR content and advanced barrier technologies. The introduction of refillable and reusable packaging systems is a significant trend, addressing environmental concerns and appealing to eco-conscious consumers. Smart packaging solutions, incorporating features like authentication and usage tracking, are also emerging, offering enhanced product security and consumer engagement. Furthermore, advancements in decoration techniques, such as sophisticated printing and embossing, allow brands to create premium and unique packaging aesthetics that differentiate them in a competitive market.

Key Drivers of Cosmetic & Toiletry Containers Market Growth

The growth of the Cosmetic & Toiletry Containers Market is propelled by several key drivers. Firstly, the escalating global demand for beauty, personal care, and wellness products, driven by increasing disposable incomes and evolving lifestyle choices, directly fuels the need for packaging. Secondly, the rising consumer consciousness towards sustainability is a significant catalyst, pushing manufacturers to adopt eco-friendly materials like recycled plastics, bioplastics, and glass, alongside promoting refillable and reusable packaging solutions. Technological advancements in material science and manufacturing processes are enabling the creation of innovative, functional, and aesthetically pleasing containers. Regulatory initiatives focused on reducing plastic waste and promoting circular economy principles are also encouraging the adoption of sustainable packaging alternatives.

Challenges in the Cosmetic & Toiletry Containers Market Market

Despite its robust growth, the Cosmetic & Toiletry Containers Market faces several challenges. Increasing scrutiny over plastic waste and environmental regulations can lead to higher compliance costs and the need for significant investment in alternative materials and recycling infrastructure. Supply chain disruptions, particularly concerning the availability and cost of raw materials, can impact production efficiency and pricing. Intense competition among manufacturers, coupled with pressure from private label brands, can lead to price erosion. Furthermore, the complexity of global regulatory landscapes across different regions adds a layer of difficulty for companies seeking to expand internationally. The shift towards sustainable options also requires substantial R&D investment and can present challenges in achieving the same performance and aesthetic qualities as traditional materials.

Emerging Opportunities in Cosmetic & Toiletry Containers Market

Emerging opportunities in the Cosmetic & Toiletry Containers Market are primarily centered around the growing demand for sustainable and innovative packaging solutions. The expanding market for natural and organic cosmetics, which often require specialized packaging to maintain product integrity, presents a significant opportunity. Strategic partnerships between packaging manufacturers and cosmetic brands to co-develop bespoke, eco-friendly solutions are on the rise. Technological breakthroughs in biodegradable materials and advanced recycling technologies offer promising avenues for future growth. The growing e-commerce channel also creates opportunities for designing secure, tamper-evident, and visually appealing shipping-ready packaging. Furthermore, the trend towards personalization and customization in beauty products opens doors for unique and on-demand packaging solutions.

Leading Players in the Cosmetic & Toiletry Containers Market Sector

- B & I Polycontainers Pty Ltd

- Amcor Plc

- SKS Bottle & Packaging Inc

- Jixiang Forever Packaging Co Ltd

- APC Packaging

- Albea S A

- RPC Group Plc

- FusionPKG

- Silgan Holdings

- Gerresheimer Holdings GmbH

- Libo Cosmetics Co Ltd

Key Milestones in Cosmetic & Toiletry Containers Market Industry

- 2019: Increased adoption of PCR content in plastic cosmetic bottles, driven by growing environmental awareness.

- 2020: Launch of innovative refillable packaging systems by several major cosmetic brands, signaling a shift towards a circular economy.

- 2021: Advancements in bioplastic technology leading to more viable and sustainable alternatives for traditional plastics.

- 2022: Heightened focus on supply chain resilience and diversification of raw material sourcing due to global events.

- 2023: Expansion of smart packaging solutions, incorporating features like QR codes for authenticity and ingredient information.

- 2024: Growing investment in advanced recycling technologies for plastic cosmetic containers.

Strategic Outlook for Cosmetic & Toiletry Containers Market Market

The strategic outlook for the Cosmetic & Toiletry Containers Market is highly positive, driven by a clear shift towards sustainability, innovation, and consumer-centric designs. Growth accelerators include continued investment in R&D for eco-friendly materials and circular economy solutions, such as advanced recycling and refillable systems. Strategic collaborations between packaging suppliers and cosmetic brands will be crucial for co-creating unique and sustainable packaging that aligns with evolving consumer preferences and brand identities. The increasing adoption of digital technologies in manufacturing and supply chain management will enhance efficiency and traceability. Furthermore, the expansion into emerging markets, coupled with a focus on premium and specialized packaging for niche beauty segments, presents significant future market potential.

Cosmetic & Toiletry Containers Market Segmentation

-

1. Type

- 1.1. Plastic

- 1.2. Glass

- 1.3. Metal

- 1.4. Other Types

Cosmetic & Toiletry Containers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East

Cosmetic & Toiletry Containers Market Regional Market Share

Geographic Coverage of Cosmetic & Toiletry Containers Market

Cosmetic & Toiletry Containers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Popularity in The Beauty Market Along With Changing Scenario of Beauty Retail Distribution; Increasing Online Penetration to Enhance Greater Visibility of International Brands Across the World

- 3.3. Market Restrains

- 3.3.1. ; Fluctuation in the Prices of Raw Material

- 3.4. Market Trends

- 3.4.1. Plastic Container Holds the Significant Share in The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cosmetic & Toiletry Containers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Plastic

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Cosmetic & Toiletry Containers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Plastic

- 6.1.2. Glass

- 6.1.3. Metal

- 6.1.4. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Cosmetic & Toiletry Containers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Plastic

- 7.1.2. Glass

- 7.1.3. Metal

- 7.1.4. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Cosmetic & Toiletry Containers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Plastic

- 8.1.2. Glass

- 8.1.3. Metal

- 8.1.4. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Cosmetic & Toiletry Containers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Plastic

- 9.1.2. Glass

- 9.1.3. Metal

- 9.1.4. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Cosmetic & Toiletry Containers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Plastic

- 10.1.2. Glass

- 10.1.3. Metal

- 10.1.4. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 B & I Polycontainers Pty Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amcor Plc*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amcor Plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SKS Bottle & Packaging Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jixiang Forever Packaging Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 APC Packaging

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Albea S A

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 RPC Group Plc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 FusionPKG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Silgan Holdings

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Gerresheimer Holdings GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Libo Cosmetics Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 B & I Polycontainers Pty Ltd

List of Figures

- Figure 1: Global Cosmetic & Toiletry Containers Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Cosmetic & Toiletry Containers Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Cosmetic & Toiletry Containers Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Cosmetic & Toiletry Containers Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Cosmetic & Toiletry Containers Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Cosmetic & Toiletry Containers Market Revenue (undefined), by Type 2025 & 2033

- Figure 7: Europe Cosmetic & Toiletry Containers Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Cosmetic & Toiletry Containers Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Cosmetic & Toiletry Containers Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Cosmetic & Toiletry Containers Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Asia Pacific Cosmetic & Toiletry Containers Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Cosmetic & Toiletry Containers Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Cosmetic & Toiletry Containers Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Cosmetic & Toiletry Containers Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Latin America Cosmetic & Toiletry Containers Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Latin America Cosmetic & Toiletry Containers Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Latin America Cosmetic & Toiletry Containers Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Cosmetic & Toiletry Containers Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: Middle East Cosmetic & Toiletry Containers Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Middle East Cosmetic & Toiletry Containers Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East Cosmetic & Toiletry Containers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cosmetic & Toiletry Containers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Cosmetic & Toiletry Containers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Cosmetic & Toiletry Containers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global Cosmetic & Toiletry Containers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States Cosmetic & Toiletry Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada Cosmetic & Toiletry Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Global Cosmetic & Toiletry Containers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Cosmetic & Toiletry Containers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Cosmetic & Toiletry Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Germany Cosmetic & Toiletry Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: France Cosmetic & Toiletry Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Cosmetic & Toiletry Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global Cosmetic & Toiletry Containers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Cosmetic & Toiletry Containers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: China Cosmetic & Toiletry Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Japan Cosmetic & Toiletry Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: India Cosmetic & Toiletry Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Asia Pacific Cosmetic & Toiletry Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Cosmetic & Toiletry Containers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Global Cosmetic & Toiletry Containers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Cosmetic & Toiletry Containers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global Cosmetic & Toiletry Containers Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cosmetic & Toiletry Containers Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Cosmetic & Toiletry Containers Market?

Key companies in the market include B & I Polycontainers Pty Ltd, Amcor Plc*List Not Exhaustive, Amcor Plc, SKS Bottle & Packaging Inc, Jixiang Forever Packaging Co Ltd, APC Packaging, Albea S A, RPC Group Plc, FusionPKG, Silgan Holdings, Gerresheimer Holdings GmbH, Libo Cosmetics Co Ltd.

3. What are the main segments of the Cosmetic & Toiletry Containers Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing Popularity in The Beauty Market Along With Changing Scenario of Beauty Retail Distribution; Increasing Online Penetration to Enhance Greater Visibility of International Brands Across the World.

6. What are the notable trends driving market growth?

Plastic Container Holds the Significant Share in The Market.

7. Are there any restraints impacting market growth?

; Fluctuation in the Prices of Raw Material.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cosmetic & Toiletry Containers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cosmetic & Toiletry Containers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cosmetic & Toiletry Containers Market?

To stay informed about further developments, trends, and reports in the Cosmetic & Toiletry Containers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence