Key Insights

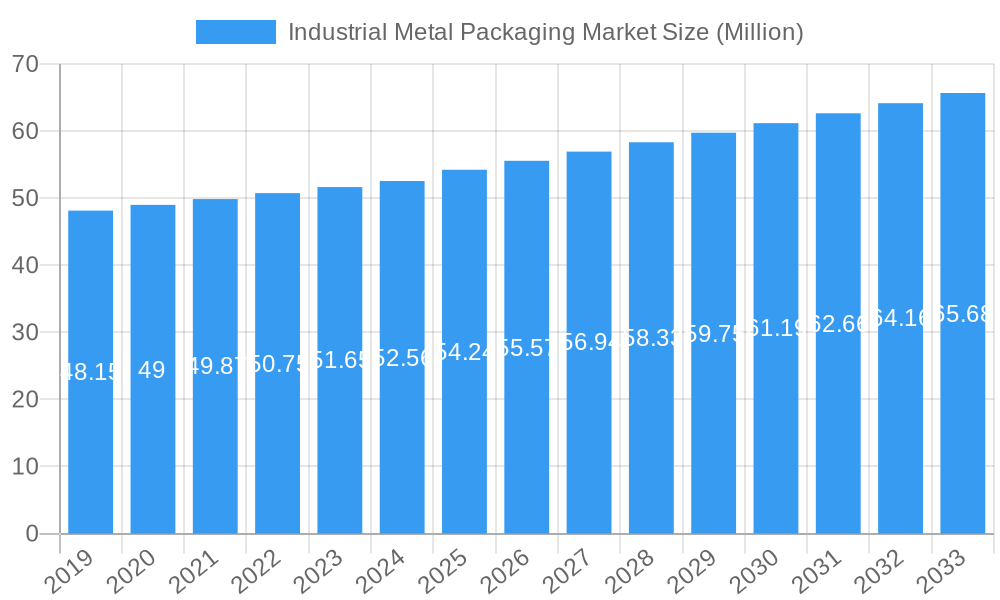

The global Industrial Metal Packaging Market is projected to reach a substantial market size of USD 54.24 million by 2025, demonstrating a steady Compound Annual Growth Rate (CAGR) of 2.49% throughout the forecast period of 2025-2033. This sustained growth is underpinned by the increasing demand for robust and reliable packaging solutions across a diverse range of industries, including food and beverage, chemicals, pharmaceuticals, and oil and petrochemicals. The inherent durability, recyclability, and protective properties of metal packaging, particularly steel and aluminum, make it an indispensable choice for the safe storage and transportation of a wide array of products, from bulk chemicals to sensitive pharmaceuticals. The market's expansion is further fueled by advancements in manufacturing technologies that enhance efficiency and product quality, alongside a growing global emphasis on sustainable packaging alternatives, where metal packaging plays a significant role due to its high recyclability rates.

Industrial Metal Packaging Market Market Size (In Million)

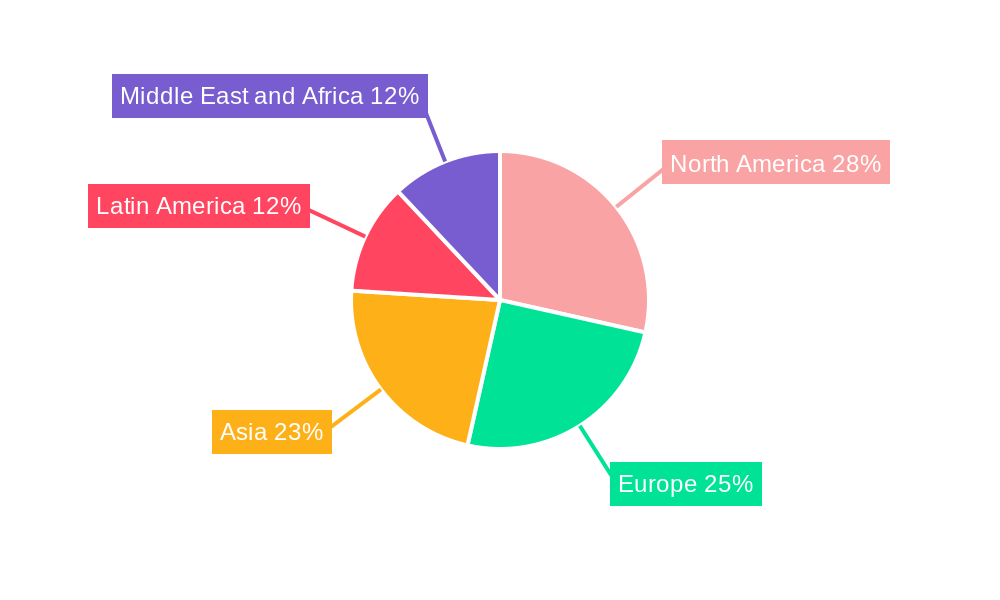

The market is characterized by distinct segmentation based on material type, product type, and end-user industry. Aluminium and steel are the primary material types, each offering unique advantages for specific applications. Key product categories include Intermediate Bulk Containers (IBCs), shipping barrels and drums, and various bulk containers such as pails and kegs, catering to different volume and handling requirements. The end-user industry landscape is broad, with the Food & Beverage sector being a major consumer due to stringent hygiene and preservation needs, followed closely by the Chemicals and Pharmaceuticals industries, which rely on metal packaging for safety and containment. The Oil and Petrochemicals and Building and Construction sectors also contribute significantly to market demand. Geographically, North America and Europe are established markets, while the Asia-Pacific region, driven by rapid industrialization and burgeoning consumer markets in countries like China and India, presents substantial growth opportunities. Emerging trends such as the development of lighter yet stronger metal alloys and innovative coating technologies are poised to further drive market evolution and competitiveness.

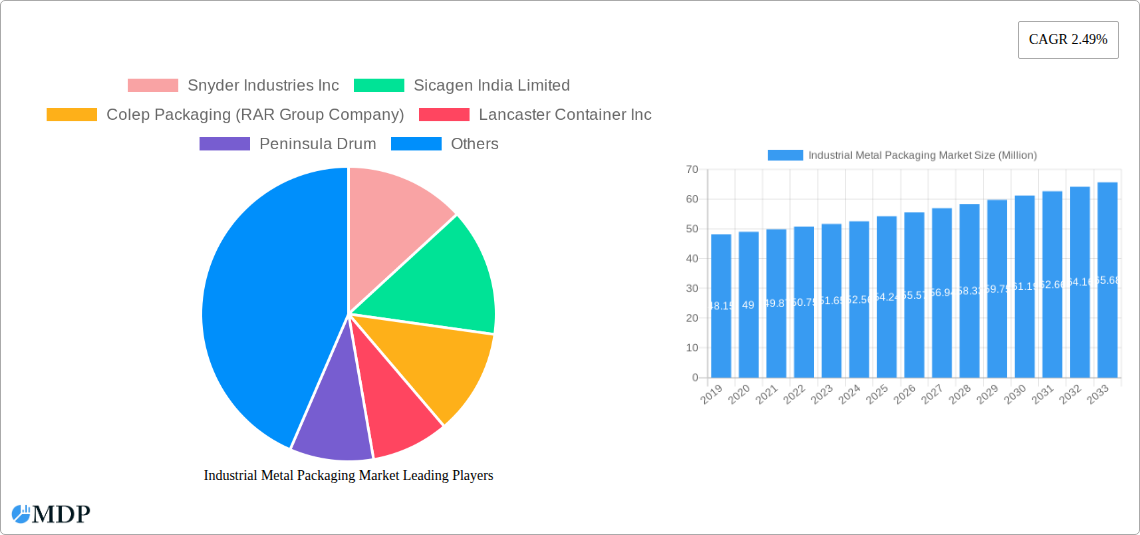

Industrial Metal Packaging Market Company Market Share

Here's the SEO-optimized report description for the Industrial Metal Packaging Market, designed for maximum visibility and stakeholder engagement, with no placeholder values and ready for immediate use.

Industrial Metal Packaging Market Analysis: Trends, Drivers, and Forecast (2019-2033)

Gain critical insights into the Industrial Metal Packaging Market, a vital sector supporting global supply chains across diverse industries. This comprehensive report, covering the study period 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, delves deep into market dynamics, growth drivers, leading segments, and future strategic outlooks. Understand the impact of aluminium and steel packaging, from IBCs and shipping barrels and drums to bulk containers (pails, kegs, etc.), on key end-user industries like Food & Beverage, Chemicals and Pharmaceuticals, Oil and Petrochemicals, Building and Construction, and Automotive. Essential for manufacturers, suppliers, investors, and industry stakeholders seeking to navigate this evolving landscape.

Industrial Metal Packaging Market Market Dynamics & Concentration

The Industrial Metal Packaging Market is characterized by a moderate concentration, with key players strategically focusing on innovation and operational efficiency to secure market share. Innovation drivers are predominantly centered around enhanced durability, safety features, and sustainability initiatives, pushing the boundaries of traditional metal packaging. Regulatory frameworks, particularly concerning hazardous material containment and environmental impact, play a significant role in shaping product development and material choices. The market faces competition from product substitutes such as advanced plastics and composites, necessitating continuous improvement in metal packaging's value proposition. End-user trends highlight a growing demand for specialized packaging solutions tailored to specific industry needs, from high-purity pharmaceutical transport to robust oil and petrochemical containment. Mergers and acquisitions (M&A) activities are a significant feature, with strategic consolidations aimed at expanding product portfolios and geographic reach. For instance, in February 2024, Mauser Packaging Solution acquired Consolidated Container Company LLC, a move designed to complement its existing product portfolio. This consolidation reflects a broader trend of industry players seeking to strengthen their market position and offer integrated solutions. The market share distribution indicates a dynamic competitive environment, with leading companies continuously investing in R&D and strategic alliances to maintain and grow their influence.

Industrial Metal Packaging Market Industry Trends & Analysis

The Industrial Metal Packaging Market is poised for sustained growth, driven by the indispensable role metal containers play in the safe and efficient transport of a wide array of goods across numerous sectors. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period, indicating robust expansion fueled by increasing industrial output and global trade. Technological advancements are continuously enhancing the performance and utility of metal packaging. Innovations in material science have led to lighter yet stronger steel and aluminium alloys, reducing transportation costs and environmental footprint. Advanced coating technologies are improving corrosion resistance and product purity, which is particularly critical for the Chemicals and Pharmaceuticals and Food & Beverage industries. The demand for highly regulated and secure packaging solutions for hazardous materials within the Oil and Petrochemicals sector further bolsters the market for robust metal containers like IBCs and specialized drums. Consumer preferences, while often indirect, influence manufacturers to seek packaging that offers superior protection, extended shelf life, and recyclability. This aligns with the inherent sustainability advantages of metals like steel and aluminium, which possess high recycling rates. The competitive dynamics are characterized by a blend of established global players and regional specialists, each vying for market dominance through product differentiation, cost leadership, and strategic partnerships. Market penetration is significant across mature economies, while emerging markets present substantial growth opportunities due to rapid industrialization and increasing demand for sophisticated logistics solutions. The development of smart packaging solutions, incorporating tracking and monitoring capabilities, is another emerging trend that will shape the future of industrial metal packaging.

Leading Markets & Segments in Industrial Metal Packaging Market

The Industrial Metal Packaging Market exhibits distinct regional and segment leadership, driven by specific industrial demands and economic conditions.

Dominant Regions and Countries

- Asia-Pacific stands as the most dominant region, propelled by rapid industrialization, substantial investments in manufacturing infrastructure, and a burgeoning demand from key end-user industries. Countries like China and India are significant contributors due to their massive manufacturing bases and extensive export activities.

- North America and Europe remain mature yet robust markets, characterized by stringent quality standards, a strong emphasis on safety and environmental regulations, and a high demand for premium packaging solutions, particularly within the Chemicals and Pharmaceuticals and Automotive sectors.

Material Type Dominance

- Steel packaging leads the market due to its exceptional strength, durability, and cost-effectiveness, making it ideal for heavy-duty applications such as bulk chemical transport, oil and petrochemical storage, and construction materials.

- Aluminium packaging is gaining traction, especially in applications where weight reduction is paramount and corrosion resistance is a key concern, such as specialized Food & Beverage packaging and certain chemical intermediates.

Product Type Leadership

- IBCs (Intermediate Bulk Containers) command a significant market share, offering an efficient and safe solution for transporting and storing intermediate quantities of liquids and solids, particularly in the Chemicals and Pharmaceuticals and Oil and Petrochemicals industries. Their reusability and stackability further enhance their appeal.

- Shipping Barrels and Drums continue to be a staple, indispensable for the safe containment and transportation of a vast range of products, from hazardous chemicals to foodstuffs. Their versatility and proven track record ensure continued demand.

- Bulk Containers (Pails, Kegs, etc.) cater to diverse needs, from smaller volume industrial liquids to specialized applications in the food and beverage sector, offering flexibility and ease of handling.

End-User Industry Dominance

- The Chemicals and Pharmaceuticals industry is a primary driver, requiring high-integrity, secure, and often sterile metal packaging to ensure product safety and regulatory compliance. The stringent requirements for transporting hazardous and sensitive materials significantly boost demand for specialized metal containers.

- The Oil and Petrochemicals sector relies heavily on robust metal packaging for the storage and transport of refined products, lubricants, and various chemicals, where durability and resistance to harsh environments are critical.

- The Food & Beverage industry utilizes metal packaging for a wide array of products, from bulk ingredients to finished goods, benefiting from its protective qualities, recyclability, and ability to maintain product freshness.

Industrial Metal Packaging Market Product Developments

Product development in the Industrial Metal Packaging Market is increasingly focused on enhancing sustainability, safety, and efficiency. Innovations include the introduction of lighter-weight yet stronger metal alloys, advanced internal and external coatings for improved corrosion resistance and product compatibility, and ergonomic designs for easier handling and filling. Smart packaging solutions, incorporating RFID tags and sensor technologies for enhanced traceability and condition monitoring during transit, are also emerging. These developments aim to provide competitive advantages by meeting evolving regulatory demands, reducing logistical costs, and catering to the growing environmental consciousness of end-users. The market sees a strong emphasis on recyclable and reusable packaging designs, aligning with circular economy principles.

Key Drivers of Industrial Metal Packaging Market Growth

The Industrial Metal Packaging Market is propelled by several key drivers. The escalating global demand for chemicals, pharmaceuticals, and petrochemicals, driven by population growth and industrial expansion, necessitates secure and reliable containment solutions. Stringent safety regulations and international shipping standards for hazardous materials mandate the use of robust metal packaging, particularly for IBCs and drums. Furthermore, the inherent recyclability and durability of metals like steel and aluminium align with the growing global emphasis on sustainability and circular economy principles. Technological advancements leading to lighter, stronger, and more cost-effective metal packaging solutions also contribute significantly to market growth by enhancing their competitive edge against alternative materials.

Challenges in the Industrial Metal Packaging Market Market

Despite its growth, the Industrial Metal Packaging Market faces several challenges. Fluctuations in raw material prices, particularly for steel and aluminium, can impact production costs and profit margins. Increasing competition from advanced plastic and composite packaging alternatives, which often offer lower initial costs and lighter weight, presents a significant challenge. Evolving environmental regulations regarding waste management and recyclability, while also an opportunity, can necessitate substantial investment in compliant manufacturing processes and product design. Moreover, global supply chain disruptions and logistical complexities can affect the timely delivery of both raw materials and finished products, impacting overall market efficiency.

Emerging Opportunities in Industrial Metal Packaging Market

Emerging opportunities in the Industrial Metal Packaging Market lie in the growing demand for specialized, high-performance packaging solutions. The expansion of e-commerce and the increasing complexity of global supply chains create a need for more robust and trackable packaging. The burgeoning pharmaceutical and biotechnology sectors require aseptic and highly secure metal packaging for sensitive biologics and advanced therapies. Furthermore, the global push towards a circular economy presents a significant opportunity for metal packaging, given its high recyclability rates, to be positioned as a premier sustainable packaging solution. Innovations in smart packaging, integrating digital technologies for enhanced supply chain visibility and product integrity, will also open new avenues for market growth and differentiation.

Leading Players in the Industrial Metal Packaging Market Sector

- Snyder Industries Inc

- Sicagen India Limited

- Colep Packaging (RAR Group Company)

- Lancaster Container Inc

- Peninsula Drum

- Time Mauser Industries Pvt Ltd

- ENVASES OHRINGEN GMBH

- Greif Inc

- Balmer Lawrie & Co Ltd

- THIELMANN PORTINOX SPAIN SA

- SCHAFER Werke GmbH

- American Keg Company (BLEFA BEVERAGE SYSTEMS)

- P Wilkinson Containers Ltd

- Bison IBC Ltd

- Mauser Packaging Solutions

Key Milestones in Industrial Metal Packaging Market Industry

- February 2024: Mauser Packaging Solution acquired Consolidated Container Company LLC. Through this acquisition strategy, the company aims to complement its existing product portfolio.

- December 2023: Novvia Group, a distributor of rigid container and life sciences packaging, acquired JWJ Packaging LLC, a New Jersey-based drums, pails, and other rigid container and shipping products. The acquisition strategy will enable the company to provide additional value to the customers in the region.

Strategic Outlook for Industrial Metal Packaging Market Market

The strategic outlook for the Industrial Metal Packaging Market is highly positive, driven by sustained demand from critical industries and a growing emphasis on sustainability. Companies are likely to focus on expanding their product offerings to include more specialized and eco-friendly solutions, such as lightweight alloys and designs optimized for circularity. Strategic partnerships and acquisitions will continue to be crucial for market players seeking to enhance their technological capabilities, geographic reach, and product portfolios. Investment in advanced manufacturing processes and smart packaging technologies will be key to maintaining a competitive edge. The market is expected to see increased innovation in reusable packaging systems and solutions that facilitate easier logistics and reduced environmental impact, ensuring its continued relevance and growth in the global industrial landscape.

Industrial Metal Packaging Market Segmentation

-

1. Material Type

- 1.1. Aluminium

- 1.2. Steel

-

2. Product Type

- 2.1. IBCs

- 2.2. Shipping Barrels and Drums

- 2.3. Bulk Containers (Pails, Kegs, etc.)

-

3. End-user Industry

- 3.1. Food & Beverage

- 3.2. Chemicals and Pharmaceuticals

- 3.3. Oil and Petrochemicals

- 3.4. Building and Construction

- 3.5. Automotive

Industrial Metal Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Italy

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Thailand

- 3.5. Vietnam

- 3.6. Australia and New Zealand

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Egypt

- 5.4. United Arab Emirates

Industrial Metal Packaging Market Regional Market Share

Geographic Coverage of Industrial Metal Packaging Market

Industrial Metal Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Bulk Container Packaging Solutions for Liquid Transportation; Innovation in Metal Packaging for Storage of Hazardous Materials

- 3.3. Market Restrains

- 3.3.1. Presence of Alternate Packaging Solutions such as Plastic Drums and Others

- 3.4. Market Trends

- 3.4.1. Growing Demand for Bulk Container Packaging Solutions for Liquid Transportation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Metal Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Aluminium

- 5.1.2. Steel

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. IBCs

- 5.2.2. Shipping Barrels and Drums

- 5.2.3. Bulk Containers (Pails, Kegs, etc.)

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food & Beverage

- 5.3.2. Chemicals and Pharmaceuticals

- 5.3.3. Oil and Petrochemicals

- 5.3.4. Building and Construction

- 5.3.5. Automotive

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Industrial Metal Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Aluminium

- 6.1.2. Steel

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. IBCs

- 6.2.2. Shipping Barrels and Drums

- 6.2.3. Bulk Containers (Pails, Kegs, etc.)

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food & Beverage

- 6.3.2. Chemicals and Pharmaceuticals

- 6.3.3. Oil and Petrochemicals

- 6.3.4. Building and Construction

- 6.3.5. Automotive

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Industrial Metal Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Aluminium

- 7.1.2. Steel

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. IBCs

- 7.2.2. Shipping Barrels and Drums

- 7.2.3. Bulk Containers (Pails, Kegs, etc.)

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food & Beverage

- 7.3.2. Chemicals and Pharmaceuticals

- 7.3.3. Oil and Petrochemicals

- 7.3.4. Building and Construction

- 7.3.5. Automotive

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Industrial Metal Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Aluminium

- 8.1.2. Steel

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. IBCs

- 8.2.2. Shipping Barrels and Drums

- 8.2.3. Bulk Containers (Pails, Kegs, etc.)

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food & Beverage

- 8.3.2. Chemicals and Pharmaceuticals

- 8.3.3. Oil and Petrochemicals

- 8.3.4. Building and Construction

- 8.3.5. Automotive

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Latin America Industrial Metal Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Aluminium

- 9.1.2. Steel

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. IBCs

- 9.2.2. Shipping Barrels and Drums

- 9.2.3. Bulk Containers (Pails, Kegs, etc.)

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food & Beverage

- 9.3.2. Chemicals and Pharmaceuticals

- 9.3.3. Oil and Petrochemicals

- 9.3.4. Building and Construction

- 9.3.5. Automotive

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East and Africa Industrial Metal Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Aluminium

- 10.1.2. Steel

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. IBCs

- 10.2.2. Shipping Barrels and Drums

- 10.2.3. Bulk Containers (Pails, Kegs, etc.)

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food & Beverage

- 10.3.2. Chemicals and Pharmaceuticals

- 10.3.3. Oil and Petrochemicals

- 10.3.4. Building and Construction

- 10.3.5. Automotive

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Snyder Industries Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sicagen India Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Colep Packaging (RAR Group Company)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lancaster Container Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Peninsula Drum

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Time Mauser Industries Pvt Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ENVASES OHRINGEN GMBH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Greif Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Balmer Lawrie & Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 THIELMANN PORTINOX SPAIN SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SCHAFER Werke GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 American Keg Company (BLEFA BEVERAGE SYSTEMS)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 P Wilkinson Containers Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Bison IBC Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Mauser Packaging Solutions

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Snyder Industries Inc

List of Figures

- Figure 1: Global Industrial Metal Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Industrial Metal Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 3: North America Industrial Metal Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America Industrial Metal Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Industrial Metal Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Industrial Metal Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Industrial Metal Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Industrial Metal Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Industrial Metal Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Industrial Metal Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 11: Europe Industrial Metal Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: Europe Industrial Metal Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 13: Europe Industrial Metal Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Europe Industrial Metal Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Industrial Metal Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Industrial Metal Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Industrial Metal Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Industrial Metal Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 19: Asia Industrial Metal Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 20: Asia Industrial Metal Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Asia Industrial Metal Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Asia Industrial Metal Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Industrial Metal Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Industrial Metal Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Industrial Metal Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Industrial Metal Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 27: Latin America Industrial Metal Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Latin America Industrial Metal Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 29: Latin America Industrial Metal Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Latin America Industrial Metal Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Latin America Industrial Metal Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Industrial Metal Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Industrial Metal Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Industrial Metal Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 35: Middle East and Africa Industrial Metal Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 36: Middle East and Africa Industrial Metal Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 37: Middle East and Africa Industrial Metal Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Middle East and Africa Industrial Metal Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Industrial Metal Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Industrial Metal Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Industrial Metal Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Metal Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Global Industrial Metal Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Industrial Metal Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Industrial Metal Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Industrial Metal Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: Global Industrial Metal Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Global Industrial Metal Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Industrial Metal Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Industrial Metal Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 12: Global Industrial Metal Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 13: Global Industrial Metal Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Industrial Metal Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Industrial Metal Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 21: Global Industrial Metal Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global Industrial Metal Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Industrial Metal Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Thailand Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Vietnam Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia and New Zealand Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Industrial Metal Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 31: Global Industrial Metal Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Global Industrial Metal Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 33: Global Industrial Metal Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Brazil Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Mexico Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Argentina Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Industrial Metal Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 38: Global Industrial Metal Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 39: Global Industrial Metal Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 40: Global Industrial Metal Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Egypt Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: United Arab Emirates Industrial Metal Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Metal Packaging Market?

The projected CAGR is approximately 2.49%.

2. Which companies are prominent players in the Industrial Metal Packaging Market?

Key companies in the market include Snyder Industries Inc, Sicagen India Limited, Colep Packaging (RAR Group Company), Lancaster Container Inc, Peninsula Drum, Time Mauser Industries Pvt Ltd, ENVASES OHRINGEN GMBH, Greif Inc, Balmer Lawrie & Co Ltd, THIELMANN PORTINOX SPAIN SA, SCHAFER Werke GmbH, American Keg Company (BLEFA BEVERAGE SYSTEMS), P Wilkinson Containers Ltd, Bison IBC Ltd, Mauser Packaging Solutions.

3. What are the main segments of the Industrial Metal Packaging Market?

The market segments include Material Type, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Bulk Container Packaging Solutions for Liquid Transportation; Innovation in Metal Packaging for Storage of Hazardous Materials.

6. What are the notable trends driving market growth?

Growing Demand for Bulk Container Packaging Solutions for Liquid Transportation.

7. Are there any restraints impacting market growth?

Presence of Alternate Packaging Solutions such as Plastic Drums and Others.

8. Can you provide examples of recent developments in the market?

February 2024: Mauser Packaging Solution acquired Consolidated Container Company LLC. Through this acquisition strategy, the company aims to complement its existing product portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Metal Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Metal Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Metal Packaging Market?

To stay informed about further developments, trends, and reports in the Industrial Metal Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence