Key Insights

The Vietnam glass container market is projected to experience robust growth, reaching an estimated $14.07 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 10.36% forecast through 2033. This expansion is significantly driven by the thriving food and beverage sectors, the primary end-users. Increasing demand for packaged goods, coupled with rising disposable incomes and a growing middle class in Vietnam, fuels the need for high-quality, aesthetically appealing glass packaging. The cosmetics and pharmaceutical industries also contribute to market growth, leveraging glass containers for their premium image and hygiene advantages. Key industry players such as HuphuMeglass, Oi-Bjc Vietnam Glass Co, Go Vap Glass, and Sanmiguel Corporation are investing in production capacity enhancements and advanced manufacturing technologies to meet this escalating demand.

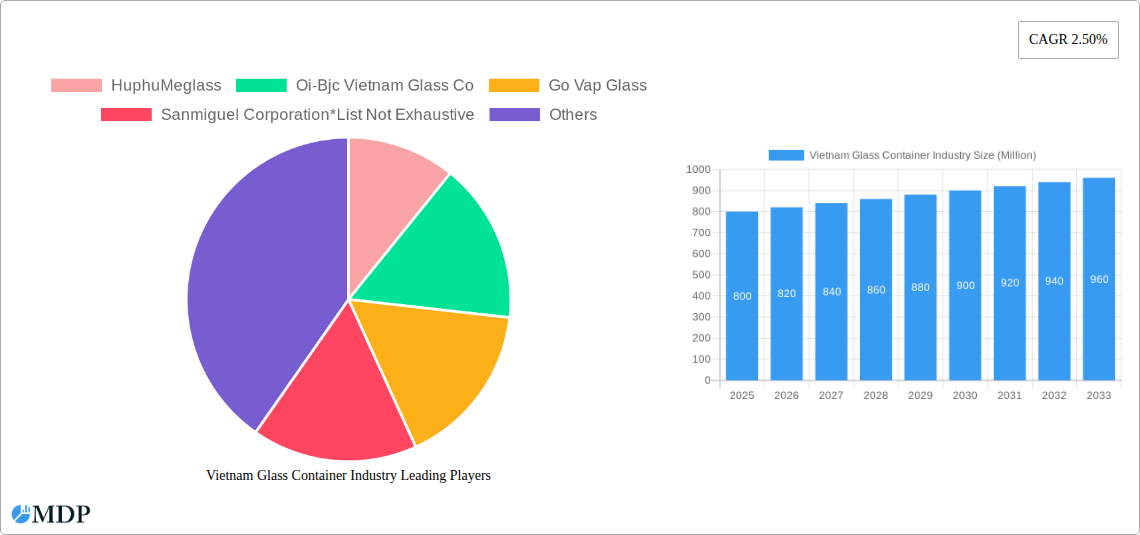

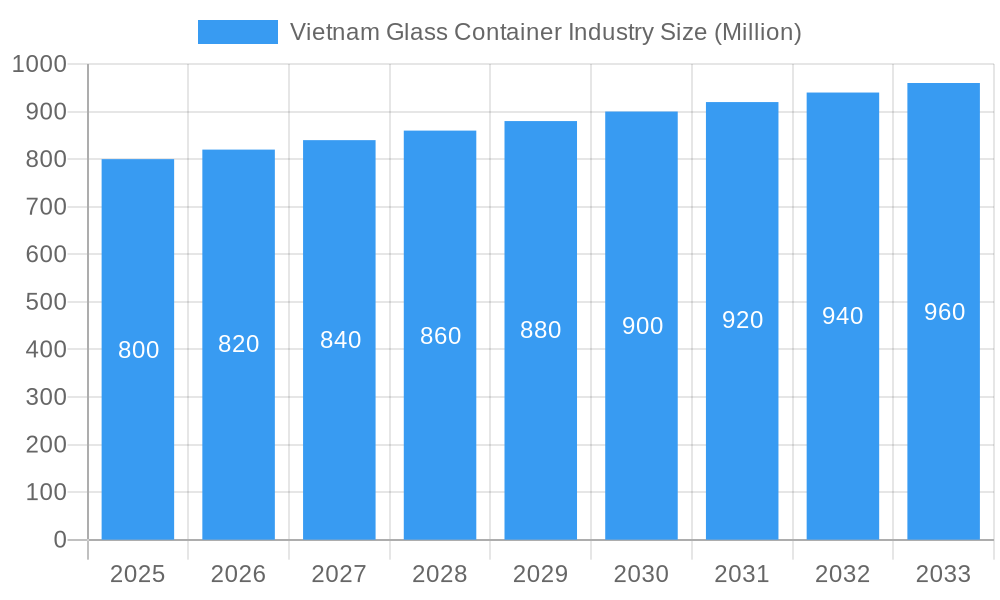

Vietnam Glass Container Industry Market Size (In Billion)

Challenges for the industry include fluctuating raw material costs, particularly for soda ash and sand, impacting profit margins. Intense domestic competition and the rise of alternative packaging materials like plastic and aluminum also pose hurdles. Nevertheless, the outlook remains positive, supported by innovations in lightweighting and durability in glass manufacturing, and a growing consumer preference for sustainable and recyclable packaging. Government initiatives to boost the manufacturing sector and promote export-oriented industries further support the market's continued growth. The market is segmented by end-use industry, including beverages (alcoholic and non-alcoholic), food, cosmetics, and pharmaceuticals, with beverages and food representing the largest segments.

Vietnam Glass Container Industry Company Market Share

This report provides a comprehensive analysis of the Vietnam glass container market for the study period of 2019–2033, using 2025 as the base year. It combines historical data (2019–2024) with forecasted insights (2025–2033) to deliver actionable intelligence. The analysis covers market concentration, industry trends, leading segments, product developments, growth drivers, challenges, opportunities, key players, historical milestones, and a strategic outlook, examining the influence of economic policies, technological advancements, and evolving consumer preferences.

Vietnam Glass Container Industry Market Dynamics & Concentration

The Vietnam glass container market, while experiencing robust growth, exhibits a moderate level of market concentration. Key players like HuphuMeglass, Oi-Bjc Vietnam Glass Co, Go Vap Glass, and Sanmiguel Corporation are significant contributors, though the market also includes a host of smaller, regional manufacturers. Market share distribution is dynamic, with major players holding an estimated 55-65% of the total market share in the base year of 2025. Innovation drivers are primarily fueled by increasing demand for sustainable packaging solutions and advancements in manufacturing technologies that enhance efficiency and product quality. Regulatory frameworks, particularly concerning environmental standards and product safety, are evolving, impacting production processes and material sourcing. The availability of viable product substitutes, such as plastic and metal packaging, presents a continuous competitive challenge. End-user trends, especially within the burgeoning beverage and food sectors, are significantly shaping product design and volume requirements. Merger and acquisition (M&A) activities have been relatively subdued in recent years, with an estimated 2-4 significant M&A deals recorded between 2021 and 2024, indicating a market focused on organic growth and operational efficiency rather than aggressive consolidation.

Vietnam Glass Container Industry Industry Trends & Analysis

The Vietnam glass container industry is poised for significant expansion, driven by a confluence of factors. The compound annual growth rate (CAGR) is projected to be approximately 6.5% during the forecast period (2025–2033). This growth is primarily fueled by the escalating demand from the beverage sector, encompassing both alcoholic and non-alcoholic drinks, as consumer preferences shift towards premium and aesthetically pleasing packaging. The food industry also remains a substantial consumer, with a growing demand for preserved goods and specialty food items requiring durable and safe packaging. Technological disruptions are playing a pivotal role, with advancements in glass manufacturing processes leading to lighter, stronger, and more energy-efficient containers. Innovations in decorative printing and specialized coatings are further enhancing product appeal. Consumer preferences are increasingly leaning towards sustainable and recyclable materials, positioning glass containers as an environmentally responsible choice. The competitive dynamics within the market are characterized by a blend of local and international players, all vying for market share through product differentiation, cost optimization, and strategic partnerships. Market penetration of glass containers in emerging segments like premium cosmetics and niche pharmaceuticals is steadily increasing, indicating a diversification of demand beyond traditional uses. The economic recovery and rising disposable incomes across Vietnam are further bolstering demand for packaged goods, directly impacting the glass container industry.

Leading Markets & Segments in Vietnam Glass Container Industry

The Beverage sector unequivocally dominates the Vietnam glass container industry, accounting for an estimated 60-70% of the total market demand in 2025. Within this broad segment, Beer and Cider represents the largest sub-segment, driven by robust domestic consumption and growing export markets. The Wine and Spirits category also presents significant potential, fueled by an expanding middle class and an increasing appetite for premium alcoholic beverages. Non-Alcoholic beverages, particularly Carbonated Soft Drinks and Water, are consistently strong performers, with the convenience and perceived health benefits of bottled water driving substantial volume.

- Key Drivers for Beverage Segment Dominance:

- Rising Disposable Incomes: Increased consumer spending power directly translates to higher demand for packaged beverages.

- Urbanization: Growing urban populations lead to greater consumption of convenience beverages.

- Tourism Growth: A flourishing tourism sector boosts demand for bottled drinks.

- Brewing and Distilling Industry Expansion: Significant investments in new breweries and distilleries necessitate a consistent supply of glass bottles.

- Consumer Preference for Glass: Perceived as healthier, more premium, and environmentally friendly than plastic alternatives for certain beverage types.

The Food segment is the second-largest consumer of glass containers, driven by demand for jams, sauces, pickles, and preserved fruits. Cosmetics and Pharmaceuticals represent growing niche markets, where the inert nature and aesthetic appeal of glass are highly valued.

- Dominance Analysis: The sheer volume and consistent demand from the beverage industry, coupled with the inherent suitability of glass for preserving freshness and taste, solidify its leading position. Economic policies supporting industrial growth and consumer goods production further bolster this segment. Infrastructure development, including efficient logistics networks, plays a crucial role in ensuring timely delivery of glass containers to a geographically diverse beverage manufacturing base.

Vietnam Glass Container Industry Product Developments

Product innovation in the Vietnam glass container industry is focused on enhancing functionality, sustainability, and aesthetic appeal. Developments include lighter-weight bottles that reduce transportation costs and environmental impact, as well as thicker-walled containers for premium spirits and wines. Advanced coatings are being utilized to improve barrier properties and UV protection, extending shelf life. The application of sophisticated printing and labeling techniques allows for sophisticated branding and product differentiation. Competitive advantages are derived from offering customized solutions, quick turnaround times for new product launches, and a commitment to utilizing recycled glass content.

Key Drivers of Vietnam Glass Container Industry Growth

Several key factors are propelling the growth of the Vietnam glass container industry. The expanding domestic consumption of beverages and food products, driven by a growing population and rising disposable incomes, is a primary driver. Technological advancements in manufacturing, leading to improved efficiency and product quality, are also significant. Favorable government policies aimed at boosting manufacturing and export activities, alongside increasing consumer awareness and preference for sustainable and recyclable packaging, are creating a conducive environment for growth. The rise of premiumization in consumer goods further fuels demand for higher-quality glass packaging.

Challenges in the Vietnam Glass Container Industry Market

Despite the promising growth trajectory, the Vietnam glass container market faces several challenges. Fluctuating raw material costs, particularly for soda ash and sand, can impact profitability. Stringent environmental regulations and the increasing cost of energy for high-temperature production processes present significant operational hurdles. Intense competition from alternative packaging materials like plastic and aluminum, which often offer lower price points, poses a constant threat. Supply chain disruptions, exacerbated by global events, can lead to delays and increased logistics costs. Quantifiably, rising energy costs could increase production expenses by an estimated 8-12% in the coming years.

Emerging Opportunities in Vietnam Glass Container Industry

Catalysts driving long-term growth in the Vietnam glass container industry are abundant. The increasing demand for eco-friendly packaging presents a significant opportunity for glass, given its recyclability and inert nature. Technological breakthroughs in cold-end coatings and lightweighting are making glass containers more competitive. Strategic partnerships between glass manufacturers and beverage and food companies to co-develop innovative packaging solutions can unlock new market segments. Furthermore, the expansion of e-commerce and direct-to-consumer (DTC) models opens avenues for specialized glass packaging designed for safe and attractive delivery.

Leading Players in the Vietnam Glass Container Industry Sector

- HuphuMeglass

- Oi-Bjc Vietnam Glass Co

- Go Vap Glass

- Sanmiguel Corporation

Key Milestones in Vietnam Glass Container Industry Industry

- 2019: Significant investment in new furnace technology by a leading player to increase production capacity by an estimated 15%.

- 2020: Introduction of advanced decorative printing capabilities, allowing for higher quality branding on glass containers.

- 2021: Increased focus on lightweighting technologies to reduce material usage and transportation costs, with several companies reporting a 5-7% reduction in bottle weight.

- 2022: Implementation of enhanced quality control measures to meet stringent international standards for food and beverage packaging.

- 2023: Growing adoption of recycled glass content in manufacturing, with some companies achieving up to 40% recycled material usage.

- 2024: Launch of specialized glass container designs tailored for the growing craft beer and premium spirits market.

Strategic Outlook for Vietnam Glass Container Industry Market

The strategic outlook for the Vietnam glass container market remains highly positive. Growth accelerators include the continued expansion of end-user industries, particularly beverages and food, and the increasing consumer preference for sustainable packaging solutions. Opportunities lie in further technological innovation to enhance efficiency and reduce environmental impact, alongside exploring niche markets like cosmetics and pharmaceuticals with premium offerings. Companies that focus on agility, cost-effectiveness, and building strong relationships with key customers will be well-positioned to capitalize on the substantial future market potential in Vietnam.

Vietnam Glass Container Industry Segmentation

-

1. End-user Industry

-

1.1. Beverage

-

1.1.1. Alcoholic

- 1.1.1.1. Beer and Cider

- 1.1.1.2. Wine and Spirits

- 1.1.1.3. Other Alcoholic Beverages

-

1.1.2. Non-Alcoholic

- 1.1.2.1. Carbonated Soft Drinks

- 1.1.2.2. Milk

- 1.1.2.3. Water an

-

1.1.1. Alcoholic

- 1.2. Food

- 1.3. Cosmetics

- 1.4. Pharmaceuticals

- 1.5. Other End-user Industries

-

1.1. Beverage

Vietnam Glass Container Industry Segmentation By Geography

- 1. Vietnam

Vietnam Glass Container Industry Regional Market Share

Geographic Coverage of Vietnam Glass Container Industry

Vietnam Glass Container Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.3599999999999% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Enviornmental Awareness among the Population; The Increasing Beverage Consumption in the Country

- 3.3. Market Restrains

- 3.3.1. 4.; Fluctuating Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Beverage Segment to Bolster Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Glass Container Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Beverage

- 5.1.1.1. Alcoholic

- 5.1.1.1.1. Beer and Cider

- 5.1.1.1.2. Wine and Spirits

- 5.1.1.1.3. Other Alcoholic Beverages

- 5.1.1.2. Non-Alcoholic

- 5.1.1.2.1. Carbonated Soft Drinks

- 5.1.1.2.2. Milk

- 5.1.1.2.3. Water an

- 5.1.1.1. Alcoholic

- 5.1.2. Food

- 5.1.3. Cosmetics

- 5.1.4. Pharmaceuticals

- 5.1.5. Other End-user Industries

- 5.1.1. Beverage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 HuphuMeglass

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Oi-Bjc Vietnam Glass Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Go Vap Glass

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sanmiguel Corporation*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.1 HuphuMeglass

List of Figures

- Figure 1: Vietnam Glass Container Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Vietnam Glass Container Industry Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Glass Container Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: Vietnam Glass Container Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Vietnam Glass Container Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Vietnam Glass Container Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Glass Container Industry?

The projected CAGR is approximately 10.3599999999999%.

2. Which companies are prominent players in the Vietnam Glass Container Industry?

Key companies in the market include HuphuMeglass, Oi-Bjc Vietnam Glass Co, Go Vap Glass, Sanmiguel Corporation*List Not Exhaustive.

3. What are the main segments of the Vietnam Glass Container Industry?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Enviornmental Awareness among the Population; The Increasing Beverage Consumption in the Country.

6. What are the notable trends driving market growth?

Beverage Segment to Bolster Growth.

7. Are there any restraints impacting market growth?

4.; Fluctuating Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Glass Container Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Glass Container Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Glass Container Industry?

To stay informed about further developments, trends, and reports in the Vietnam Glass Container Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence