Key Insights

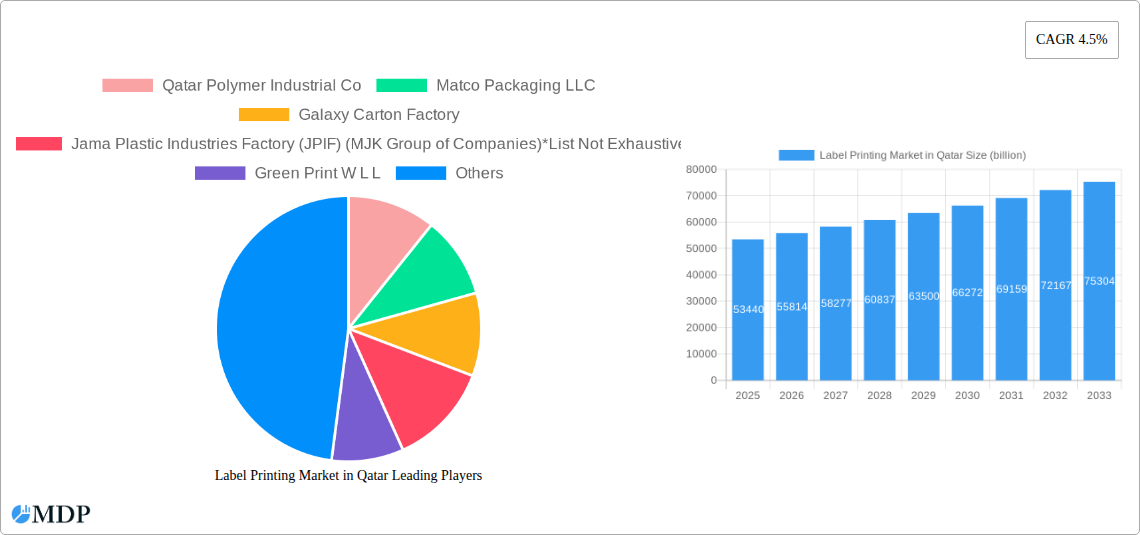

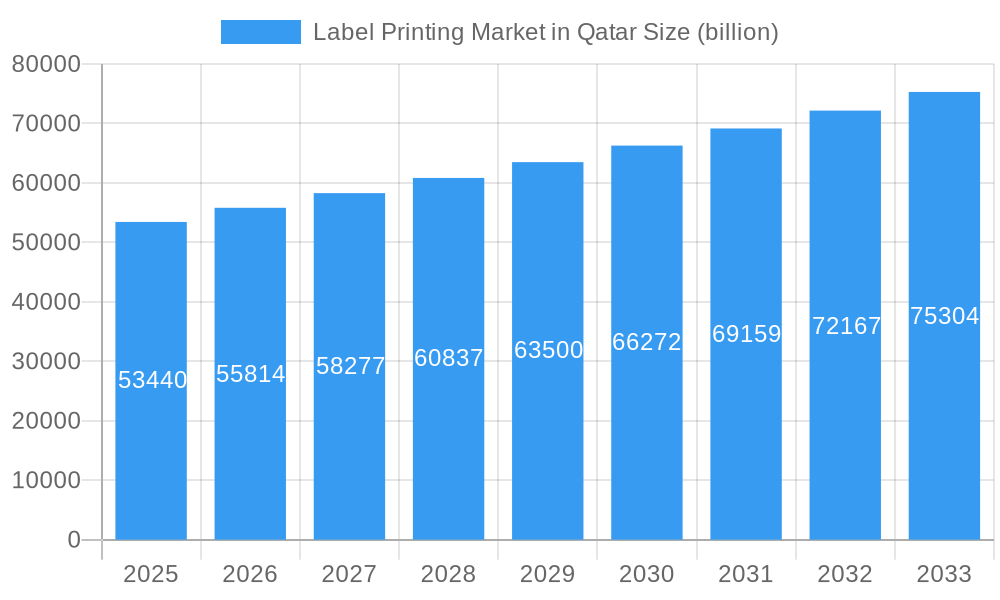

The Qatar Printing Market is poised for significant expansion, projected to reach USD 53.44 billion in 2025 with a robust CAGR of 4.5% during the forecast period of 2025-2033. This growth is primarily driven by the escalating demand for high-quality printing across various end-user verticals, including commercial printing, labels and packaging, and publications. The burgeoning e-commerce sector in Qatar, coupled with a growing emphasis on sophisticated product packaging, is fueling the demand for advanced printing solutions, particularly digital printing which offers customization and faster turnaround times. Furthermore, government initiatives aimed at diversifying the economy and fostering local manufacturing are creating a conducive environment for the printing industry's advancement. However, the market also faces challenges such as rising raw material costs and intense competition from established regional and international players. Navigating these dynamics effectively will be crucial for sustained growth.

Label Printing Market in Qatar Market Size (In Billion)

Within the broader printing market, the Qatar Packaging Market, a significant segment, is expected to witness substantial growth, driven by the Food & Beverage and Personal Care & Household Care industries. The increasing consumer preference for aesthetically appealing and informative packaging is pushing manufacturers to adopt innovative materials and printing techniques. Plastic and paper & paperboard remain dominant materials, with a growing interest in sustainable packaging solutions. The "Commercial Print" segment also plays a crucial role, encompassing marketing collateral, corporate stationery, and other business-related printing needs. Companies like Qatar Polymer Industrial Co, Matco Packaging LLC, and Galaxy Carton Factory are key players contributing to the market's dynamism through their product portfolios and technological advancements. The evolution of printing processes, with digital lithography and flexography gaining prominence for their efficiency and quality, will continue to shape the market landscape in the coming years.

Label Printing Market in Qatar Company Market Share

Report Description: Label Printing Market in Qatar - Growth, Trends, and Opportunities (2019-2033)

Unlock the immense potential of Qatar's thriving label printing sector with this comprehensive, SEO-optimized market research report. Delve into the intricate dynamics, key trends, and future trajectory of the label printing market in Qatar. This in-depth analysis, spanning the historical period of 2019-2024, the base year of 2025, and an extensive forecast period from 2025 to 2033, provides actionable insights for stakeholders seeking to capitalize on this rapidly evolving industry. Discover key growth drivers, emerging opportunities, and the competitive landscape, featuring analysis of the Qatar printing market segments like Print Process (Offset lithography, Flexography, Digital, Other Analog Printing Processes) and End-User Vertical (Books & Magazines, Newspapers, Commercial Print, Labels & Packaging, Other End-User Verticals), alongside the Qatar packaging market including Material (Plastic, Paper & Paperboard, Glass, Metal) and End-User Industry (Food, Beverage, Pharmaceuticals, Personal Care & Household Care, Other End-User Industries). Gain a competitive edge by understanding the market's concentration, innovation drivers, regulatory frameworks, and the influence of product substitutes. This report is your definitive guide to navigating the label printing market in Qatar, projecting significant growth and offering strategic pathways for success.

Label Printing Market in Qatar Market Dynamics & Concentration

The label printing market in Qatar is characterized by a moderately concentrated landscape, with key players vying for market share through innovation and strategic expansion. The primary drivers of market concentration include the capital-intensive nature of advanced printing technologies and the established relationships between major printing houses and large-scale end-user industries. Innovation is a significant force, fueled by the increasing demand for visually appealing, functional, and sustainable labeling solutions. Investments in advanced digital printing technologies, smart labeling solutions, and eco-friendly inks are at the forefront of this innovation wave. Regulatory frameworks, particularly concerning food safety, pharmaceutical product labeling, and environmental standards, play a crucial role in shaping market practices and product development. These regulations often necessitate higher quality and specialized printing capabilities. Product substitutes, such as direct printing on packaging or alternative marking methods, present a minor but present challenge, though the versatility and cost-effectiveness of labels generally maintain their dominance. End-user trends lean towards premiumization, customization, and the need for compliance with international standards. Mergers and acquisitions (M&A) activities, while not yet at a fever pitch, are expected to increase as companies seek to consolidate their market position, acquire new technologies, or expand their service offerings. The label printing market in Qatar is projected to witness a CAGR of approximately xx.xx% between 2025 and 2033, with a market value expected to reach billions by the end of the forecast period. Key M&A deals are anticipated in the coming years, focusing on consolidating smaller players and integrating innovative technologies.

Label Printing Market in Qatar Industry Trends & Analysis

The label printing market in Qatar is experiencing robust growth, propelled by a confluence of economic development, burgeoning consumer demand, and technological advancements. The label printing market size in Qatar is estimated to reach over $X billion by 2033. A significant growth driver is the expansion of key end-user industries such as food and beverage, pharmaceuticals, and personal care, all of which rely heavily on high-quality and compliant labeling for product differentiation, information dissemination, and brand integrity. The increasing disposable income in Qatar and the growing sophistication of consumer preferences are fueling demand for premium and aesthetically pleasing labels, driving innovation in design and material usage.

Technological disruptions are reshaping the label printing market in Qatar at an unprecedented pace. The widespread adoption of digital printing technologies is a cornerstone trend, offering benefits like faster turnaround times, cost-effectiveness for short runs, and the ability to produce personalized or variable data labels. This shift is significantly impacting traditional printing methods. Furthermore, the integration of smart technologies into labels, such as RFID tags and QR codes, is gaining traction, enabling enhanced supply chain management, product authentication, and interactive consumer experiences. The label printing market penetration of these advanced technologies is projected to rise significantly in the coming years.

Consumer preferences are increasingly dictating market trends. There is a growing demand for sustainable and eco-friendly labeling solutions, including recyclable materials, biodegradable inks, and reduced packaging waste. This has prompted label printers to invest in greener production processes and materials. Moreover, consumers are seeking clear, concise, and easily readable information on product labels, emphasizing the importance of design and typography.

Competitive dynamics within the label printing market in Qatar are intensifying. Local players are enhancing their capabilities to meet international standards, while global manufacturers are also exploring opportunities in the region. Strategic partnerships and collaborations are becoming more prevalent as companies aim to leverage each other's expertise and market reach. The market is characterized by a blend of established printing houses and agile, technology-driven startups, creating a dynamic and competitive environment. The label printing market growth in Qatar is further bolstered by government initiatives aimed at diversifying the economy and supporting manufacturing sectors, including the packaging and printing industries. The overall label printing market value in Qatar is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately xx.xx% during the forecast period, indicating a healthy and sustainable expansion.

Leading Markets & Segments in Label Printing Market in Qatar

The label printing market in Qatar exhibits strong performance across multiple segments, reflecting the nation's diverse industrial landscape and consumer demands. Within the broader Qatar printing market, the Labels & Packaging end-user vertical is a dominant force, experiencing significant growth due to the expansion of the food, beverage, and pharmaceutical sectors. The Print Process segment is witnessing a pronounced shift towards Digital printing, driven by its flexibility, cost-effectiveness for short runs, and ability to deliver variable data printing, crucial for product personalization and compliance. However, Flexography remains a vital process for high-volume packaging applications, especially for flexible packaging and films. Offset lithography continues to hold its ground for commercial print and high-quality graphic applications, while Other Analog Printing Processes cater to niche requirements.

In the Qatar packaging market, the Plastic material segment leads in label substrate usage, owing to its versatility, durability, and cost-effectiveness across various applications, especially in food and beverage packaging. Paper & Paperboard is also a significant material, particularly for secondary packaging and consumer goods, driven by increasing sustainability initiatives and a preference for recyclable options.

The End-User Industry segment demonstrates substantial demand from the Food sector, which requires extensive labeling for branding, nutritional information, and regulatory compliance. The Beverage industry follows closely, with a high volume of products requiring eye-catching and informative labels. The Pharmaceuticals sector represents a critical segment, demanding highly accurate, secure, and often tamper-evident labeling for patient safety and regulatory adherence. The Personal Care & Household Care industries also contribute significantly to label demand, with a focus on aesthetic appeal and brand differentiation.

Key drivers underpinning the dominance of these segments include:

- Economic diversification initiatives: Qatar's Vision 2030 promotes the growth of non-oil sectors, including manufacturing, food processing, and healthcare, directly boosting demand for labels and packaging.

- Infrastructure development: Investments in logistics and supply chain infrastructure facilitate the efficient distribution of packaged goods, increasing the overall need for labeling.

- Growing consumer base and disposable income: An expanding population and rising purchasing power lead to increased consumption of packaged goods, thereby driving label demand.

- Stringent regulatory requirements: Compliance with international standards for food safety, pharmaceuticals, and product information necessitates high-quality, accurate labeling.

- Technological advancements in printing: The adoption of digital and specialized printing technologies allows for more efficient, customized, and cost-effective label production, catering to diverse industry needs.

- Focus on brand differentiation and marketing: Companies increasingly rely on innovative and attractive labels to capture consumer attention and enhance brand recognition in a competitive market.

The Labels & Packaging segment is projected to maintain its leadership, with Digital printing and Plastic materials expected to see the fastest growth within their respective categories. The Food and Beverage industries will continue to be the largest end-user industries for labels in Qatar, with the Pharmaceuticals segment offering significant growth potential due to its stringent requirements and high-value products.

Label Printing Market in Qatar Product Developments

Product development in the label printing market in Qatar is primarily focused on enhancing functionality, sustainability, and visual appeal. Innovations include the increasing use of advanced materials such as high-security films, tamper-evident substrates, and eco-friendly recycled or biodegradable paper stocks. Digital printing advancements are enabling greater personalization, variable data printing (VDP) for promotional campaigns, and on-demand production, offering a competitive advantage. The integration of smart technologies like QR codes, NFC tags, and RFID chips into labels is gaining traction, providing supply chain visibility, authentication capabilities, and interactive consumer experiences. These developments cater to the evolving needs of industries like food & beverage, pharmaceuticals, and personal care, where product safety, traceability, and brand engagement are paramount.

Key Drivers of Label Printing Market in Qatar Growth

The label printing market in Qatar is propelled by several key drivers that are shaping its expansion and evolution.

- Robust Growth in End-User Industries: The expanding food & beverage, pharmaceutical, and personal care sectors in Qatar are significant demand generators for labels, driven by population growth and increased consumption.

- Technological Advancements in Printing: The adoption of digital printing technologies offers increased efficiency, customization capabilities, and cost-effectiveness for shorter print runs, making it an attractive option for businesses.

- Increasing Demand for Sustainable Labeling: Growing environmental awareness and regulatory pressures are pushing for the use of eco-friendly materials and production processes, creating opportunities for innovative sustainable label solutions.

- Government Support and Economic Diversification: Qatar's focus on diversifying its economy and supporting manufacturing sectors, including packaging and printing, provides a conducive environment for market growth.

- Evolving Consumer Preferences: A demand for premium, aesthetically pleasing, and informative labels to enhance brand appeal and consumer engagement is driving innovation in design and printing techniques.

Challenges in the Label Printing Market in Qatar Market

The label printing market in Qatar faces several challenges that could impact its growth trajectory.

- Intensifying Competition: The presence of both local and international players leads to price pressures and the need for continuous innovation to maintain market share.

- Supply Chain Volatility: Global disruptions in the supply of raw materials, such as paper and ink, can lead to increased costs and production delays, impacting profitability.

- Skilled Labor Shortage: The demand for skilled professionals in advanced printing technologies and graphic design can pose a challenge in finding and retaining qualified talent.

- High Initial Investment in Technology: The adoption of state-of-the-art digital printing equipment and software requires significant capital outlay, which can be a barrier for smaller businesses.

- Strict Regulatory Compliance: Adhering to evolving regulations for product labeling, particularly in the pharmaceutical and food sectors, demands constant updates in printing processes and materials, incurring additional costs.

Emerging Opportunities in Label Printing Market in Qatar

Several emerging opportunities are poised to catalyze long-term growth within the label printing market in Qatar. The increasing adoption of smart packaging solutions, integrating RFID and NFC technologies for enhanced traceability and consumer interaction, presents a significant avenue for innovation and premium service offerings. The growing emphasis on sustainability is driving demand for biodegradable, compostable, and recycled label materials, creating a niche for eco-conscious label providers. Strategic partnerships and collaborations between label manufacturers, material suppliers, and end-user industries can foster co-creation of customized solutions and unlock new market segments. Furthermore, the expansion of e-commerce in Qatar necessitates innovative packaging and labeling solutions that ensure product integrity during transit and enhance the unboxing experience. Investments in advanced digital printing technologies will enable greater personalization and on-demand production, catering to the increasing need for customized marketing campaigns.

Leading Players in the Label Printing Market in Qatar Sector

- Qatar Polymer Industrial Co

- Matco Packaging LLC

- Galaxy Carton Factory

- Jama Plastic Industries Factory (JPIF) (MJK Group of Companies)

- Green Print W L L

- Arabian Packaging Industries

- Qatar National Printing Press (QNPP)

- New Printing Co (Ghanem Al Thani Holding Group)

- AST Group of Companies

- Aspire Printing

- Breezpack (Anesco Trading & Services WLL)

Key Milestones in Label Printing Market in Qatar Industry

- 2019-2021: Increased adoption of digital printing technologies by key players to enhance efficiency and cater to shorter print runs.

- 2020: Growing awareness and initial adoption of sustainable printing practices and materials in response to global environmental trends.

- 2021: Emergence of smart labeling solutions, with QR codes becoming more prevalent for product information and marketing.

- 2022: Increased focus on pharmaceutical labeling due to heightened demand for product safety and regulatory compliance.

- 2023: Strategic investments in advanced printing machinery by leading companies to expand capacity and service offerings.

- 2024: Growing interest in personalized and variable data printing for promotional campaigns and niche product segments.

Strategic Outlook for Label Printing Market in Qatar Market

The label printing market in Qatar is poised for sustained growth, driven by a proactive approach to technological integration and market diversification. Key growth accelerators include the continued embrace of digital printing for its flexibility and cost-effectiveness, especially for the expanding small and medium-sized enterprise (SME) sector. The increasing demand for sustainable and eco-friendly labeling solutions presents a significant opportunity for differentiation and market capture. Strategic partnerships aimed at developing innovative packaging and labeling solutions for the burgeoning e-commerce sector and specialized industries like healthcare will be crucial. Furthermore, investments in smart labeling technologies will enhance supply chain efficiency and consumer engagement, offering premium services. The market's strategic outlook is positive, emphasizing innovation, sustainability, and customer-centric solutions to capitalize on Qatar's economic development and evolving consumer demands.

Label Printing Market in Qatar Segmentation

-

1. QATAR PRINTING MARKET

-

1.1. Print Process

- 1.1.1. Offset lithography

- 1.1.2. Flexography

- 1.1.3. Digital

- 1.1.4. Other Analog Printing Processes

-

1.2. End-User Vertical

- 1.2.1. Books & Magazines

- 1.2.2. Newspapers

- 1.2.3. Commercial Print

- 1.2.4. Labels & Packaging

- 1.2.5. Other End-User Verticals

-

1.1. Print Process

-

2. QATAR PACKAGING MARKET

-

2.1. Material

- 2.1.1. Plastic

- 2.1.2. Paper & Paperboard

- 2.1.3. Glass

- 2.1.4. Metal

-

2.2. End-User Industry

- 2.2.1. Food

- 2.2.2. Beverage

- 2.2.3. Pharmaceuticals

- 2.2.4. Personal Care & Household Care

- 2.2.5. Other End-User Industries

-

2.1. Material

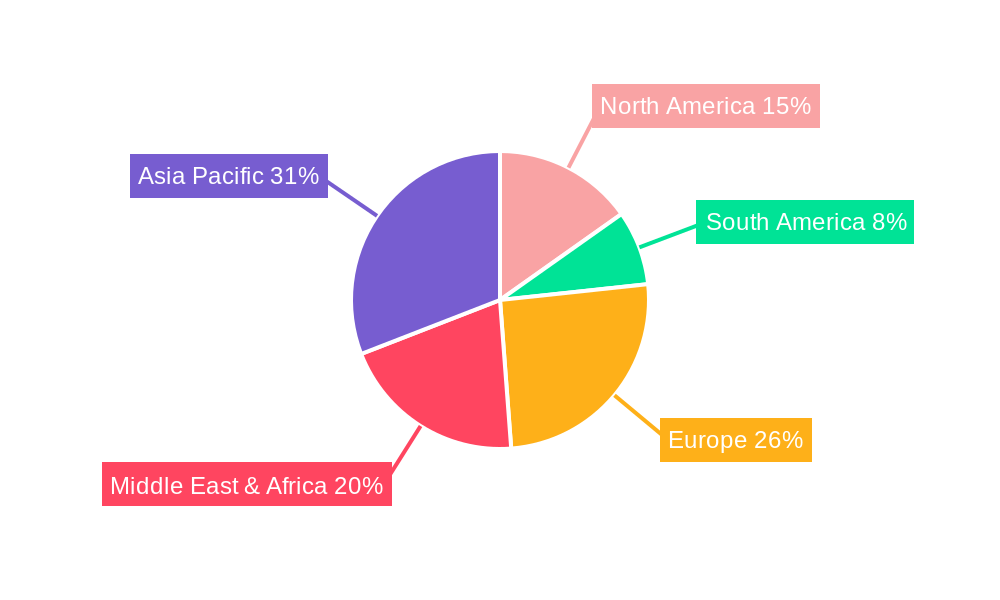

Label Printing Market in Qatar Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Label Printing Market in Qatar Regional Market Share

Geographic Coverage of Label Printing Market in Qatar

Label Printing Market in Qatar REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Recyclability Rates of Metal Packaging; High Recyclability of Metal Cans

- 3.3. Market Restrains

- 3.3.1. Increasing Operational Costs

- 3.4. Market Trends

- 3.4.1. Digital Printing to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Label Printing Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 5.1.1. Print Process

- 5.1.1.1. Offset lithography

- 5.1.1.2. Flexography

- 5.1.1.3. Digital

- 5.1.1.4. Other Analog Printing Processes

- 5.1.2. End-User Vertical

- 5.1.2.1. Books & Magazines

- 5.1.2.2. Newspapers

- 5.1.2.3. Commercial Print

- 5.1.2.4. Labels & Packaging

- 5.1.2.5. Other End-User Verticals

- 5.1.1. Print Process

- 5.2. Market Analysis, Insights and Forecast - by QATAR PACKAGING MARKET

- 5.2.1. Material

- 5.2.1.1. Plastic

- 5.2.1.2. Paper & Paperboard

- 5.2.1.3. Glass

- 5.2.1.4. Metal

- 5.2.2. End-User Industry

- 5.2.2.1. Food

- 5.2.2.2. Beverage

- 5.2.2.3. Pharmaceuticals

- 5.2.2.4. Personal Care & Household Care

- 5.2.2.5. Other End-User Industries

- 5.2.1. Material

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 6. North America Label Printing Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 6.1.1. Print Process

- 6.1.1.1. Offset lithography

- 6.1.1.2. Flexography

- 6.1.1.3. Digital

- 6.1.1.4. Other Analog Printing Processes

- 6.1.2. End-User Vertical

- 6.1.2.1. Books & Magazines

- 6.1.2.2. Newspapers

- 6.1.2.3. Commercial Print

- 6.1.2.4. Labels & Packaging

- 6.1.2.5. Other End-User Verticals

- 6.1.1. Print Process

- 6.2. Market Analysis, Insights and Forecast - by QATAR PACKAGING MARKET

- 6.2.1. Material

- 6.2.1.1. Plastic

- 6.2.1.2. Paper & Paperboard

- 6.2.1.3. Glass

- 6.2.1.4. Metal

- 6.2.2. End-User Industry

- 6.2.2.1. Food

- 6.2.2.2. Beverage

- 6.2.2.3. Pharmaceuticals

- 6.2.2.4. Personal Care & Household Care

- 6.2.2.5. Other End-User Industries

- 6.2.1. Material

- 6.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 7. South America Label Printing Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 7.1.1. Print Process

- 7.1.1.1. Offset lithography

- 7.1.1.2. Flexography

- 7.1.1.3. Digital

- 7.1.1.4. Other Analog Printing Processes

- 7.1.2. End-User Vertical

- 7.1.2.1. Books & Magazines

- 7.1.2.2. Newspapers

- 7.1.2.3. Commercial Print

- 7.1.2.4. Labels & Packaging

- 7.1.2.5. Other End-User Verticals

- 7.1.1. Print Process

- 7.2. Market Analysis, Insights and Forecast - by QATAR PACKAGING MARKET

- 7.2.1. Material

- 7.2.1.1. Plastic

- 7.2.1.2. Paper & Paperboard

- 7.2.1.3. Glass

- 7.2.1.4. Metal

- 7.2.2. End-User Industry

- 7.2.2.1. Food

- 7.2.2.2. Beverage

- 7.2.2.3. Pharmaceuticals

- 7.2.2.4. Personal Care & Household Care

- 7.2.2.5. Other End-User Industries

- 7.2.1. Material

- 7.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 8. Europe Label Printing Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 8.1.1. Print Process

- 8.1.1.1. Offset lithography

- 8.1.1.2. Flexography

- 8.1.1.3. Digital

- 8.1.1.4. Other Analog Printing Processes

- 8.1.2. End-User Vertical

- 8.1.2.1. Books & Magazines

- 8.1.2.2. Newspapers

- 8.1.2.3. Commercial Print

- 8.1.2.4. Labels & Packaging

- 8.1.2.5. Other End-User Verticals

- 8.1.1. Print Process

- 8.2. Market Analysis, Insights and Forecast - by QATAR PACKAGING MARKET

- 8.2.1. Material

- 8.2.1.1. Plastic

- 8.2.1.2. Paper & Paperboard

- 8.2.1.3. Glass

- 8.2.1.4. Metal

- 8.2.2. End-User Industry

- 8.2.2.1. Food

- 8.2.2.2. Beverage

- 8.2.2.3. Pharmaceuticals

- 8.2.2.4. Personal Care & Household Care

- 8.2.2.5. Other End-User Industries

- 8.2.1. Material

- 8.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 9. Middle East & Africa Label Printing Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 9.1.1. Print Process

- 9.1.1.1. Offset lithography

- 9.1.1.2. Flexography

- 9.1.1.3. Digital

- 9.1.1.4. Other Analog Printing Processes

- 9.1.2. End-User Vertical

- 9.1.2.1. Books & Magazines

- 9.1.2.2. Newspapers

- 9.1.2.3. Commercial Print

- 9.1.2.4. Labels & Packaging

- 9.1.2.5. Other End-User Verticals

- 9.1.1. Print Process

- 9.2. Market Analysis, Insights and Forecast - by QATAR PACKAGING MARKET

- 9.2.1. Material

- 9.2.1.1. Plastic

- 9.2.1.2. Paper & Paperboard

- 9.2.1.3. Glass

- 9.2.1.4. Metal

- 9.2.2. End-User Industry

- 9.2.2.1. Food

- 9.2.2.2. Beverage

- 9.2.2.3. Pharmaceuticals

- 9.2.2.4. Personal Care & Household Care

- 9.2.2.5. Other End-User Industries

- 9.2.1. Material

- 9.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 10. Asia Pacific Label Printing Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 10.1.1. Print Process

- 10.1.1.1. Offset lithography

- 10.1.1.2. Flexography

- 10.1.1.3. Digital

- 10.1.1.4. Other Analog Printing Processes

- 10.1.2. End-User Vertical

- 10.1.2.1. Books & Magazines

- 10.1.2.2. Newspapers

- 10.1.2.3. Commercial Print

- 10.1.2.4. Labels & Packaging

- 10.1.2.5. Other End-User Verticals

- 10.1.1. Print Process

- 10.2. Market Analysis, Insights and Forecast - by QATAR PACKAGING MARKET

- 10.2.1. Material

- 10.2.1.1. Plastic

- 10.2.1.2. Paper & Paperboard

- 10.2.1.3. Glass

- 10.2.1.4. Metal

- 10.2.2. End-User Industry

- 10.2.2.1. Food

- 10.2.2.2. Beverage

- 10.2.2.3. Pharmaceuticals

- 10.2.2.4. Personal Care & Household Care

- 10.2.2.5. Other End-User Industries

- 10.2.1. Material

- 10.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Qatar Polymer Industrial Co

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Matco Packaging LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Galaxy Carton Factory

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jama Plastic Industries Factory (JPIF) (MJK Group of Companies)*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Green Print W L L

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Arabian Packaging Industries

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qatar National Printing Press (QNPP)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 New Printing Co (Ghanem Al Thani Holding Group)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AST Group of Companies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Aspire Printing

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Breezpack (Anesco Trading & Services WLL)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Qatar Polymer Industrial Co

List of Figures

- Figure 1: Global Label Printing Market in Qatar Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Label Printing Market in Qatar Revenue (billion), by QATAR PRINTING MARKET 2025 & 2033

- Figure 3: North America Label Printing Market in Qatar Revenue Share (%), by QATAR PRINTING MARKET 2025 & 2033

- Figure 4: North America Label Printing Market in Qatar Revenue (billion), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 5: North America Label Printing Market in Qatar Revenue Share (%), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 6: North America Label Printing Market in Qatar Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Label Printing Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Label Printing Market in Qatar Revenue (billion), by QATAR PRINTING MARKET 2025 & 2033

- Figure 9: South America Label Printing Market in Qatar Revenue Share (%), by QATAR PRINTING MARKET 2025 & 2033

- Figure 10: South America Label Printing Market in Qatar Revenue (billion), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 11: South America Label Printing Market in Qatar Revenue Share (%), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 12: South America Label Printing Market in Qatar Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Label Printing Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Label Printing Market in Qatar Revenue (billion), by QATAR PRINTING MARKET 2025 & 2033

- Figure 15: Europe Label Printing Market in Qatar Revenue Share (%), by QATAR PRINTING MARKET 2025 & 2033

- Figure 16: Europe Label Printing Market in Qatar Revenue (billion), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 17: Europe Label Printing Market in Qatar Revenue Share (%), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 18: Europe Label Printing Market in Qatar Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Label Printing Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Label Printing Market in Qatar Revenue (billion), by QATAR PRINTING MARKET 2025 & 2033

- Figure 21: Middle East & Africa Label Printing Market in Qatar Revenue Share (%), by QATAR PRINTING MARKET 2025 & 2033

- Figure 22: Middle East & Africa Label Printing Market in Qatar Revenue (billion), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 23: Middle East & Africa Label Printing Market in Qatar Revenue Share (%), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 24: Middle East & Africa Label Printing Market in Qatar Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Label Printing Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Label Printing Market in Qatar Revenue (billion), by QATAR PRINTING MARKET 2025 & 2033

- Figure 27: Asia Pacific Label Printing Market in Qatar Revenue Share (%), by QATAR PRINTING MARKET 2025 & 2033

- Figure 28: Asia Pacific Label Printing Market in Qatar Revenue (billion), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 29: Asia Pacific Label Printing Market in Qatar Revenue Share (%), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 30: Asia Pacific Label Printing Market in Qatar Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Label Printing Market in Qatar Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PRINTING MARKET 2020 & 2033

- Table 2: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PACKAGING MARKET 2020 & 2033

- Table 3: Global Label Printing Market in Qatar Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PRINTING MARKET 2020 & 2033

- Table 5: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PACKAGING MARKET 2020 & 2033

- Table 6: Global Label Printing Market in Qatar Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PRINTING MARKET 2020 & 2033

- Table 11: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PACKAGING MARKET 2020 & 2033

- Table 12: Global Label Printing Market in Qatar Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PRINTING MARKET 2020 & 2033

- Table 17: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PACKAGING MARKET 2020 & 2033

- Table 18: Global Label Printing Market in Qatar Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PRINTING MARKET 2020 & 2033

- Table 29: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PACKAGING MARKET 2020 & 2033

- Table 30: Global Label Printing Market in Qatar Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PRINTING MARKET 2020 & 2033

- Table 38: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PACKAGING MARKET 2020 & 2033

- Table 39: Global Label Printing Market in Qatar Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Label Printing Market in Qatar?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Label Printing Market in Qatar?

Key companies in the market include Qatar Polymer Industrial Co, Matco Packaging LLC, Galaxy Carton Factory, Jama Plastic Industries Factory (JPIF) (MJK Group of Companies)*List Not Exhaustive, Green Print W L L, Arabian Packaging Industries, Qatar National Printing Press (QNPP), New Printing Co (Ghanem Al Thani Holding Group), AST Group of Companies, Aspire Printing, Breezpack (Anesco Trading & Services WLL).

3. What are the main segments of the Label Printing Market in Qatar?

The market segments include QATAR PRINTING MARKET, QATAR PACKAGING MARKET.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.44 billion as of 2022.

5. What are some drivers contributing to market growth?

High Recyclability Rates of Metal Packaging; High Recyclability of Metal Cans.

6. What are the notable trends driving market growth?

Digital Printing to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Increasing Operational Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Label Printing Market in Qatar," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Label Printing Market in Qatar report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Label Printing Market in Qatar?

To stay informed about further developments, trends, and reports in the Label Printing Market in Qatar, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence