Key Insights

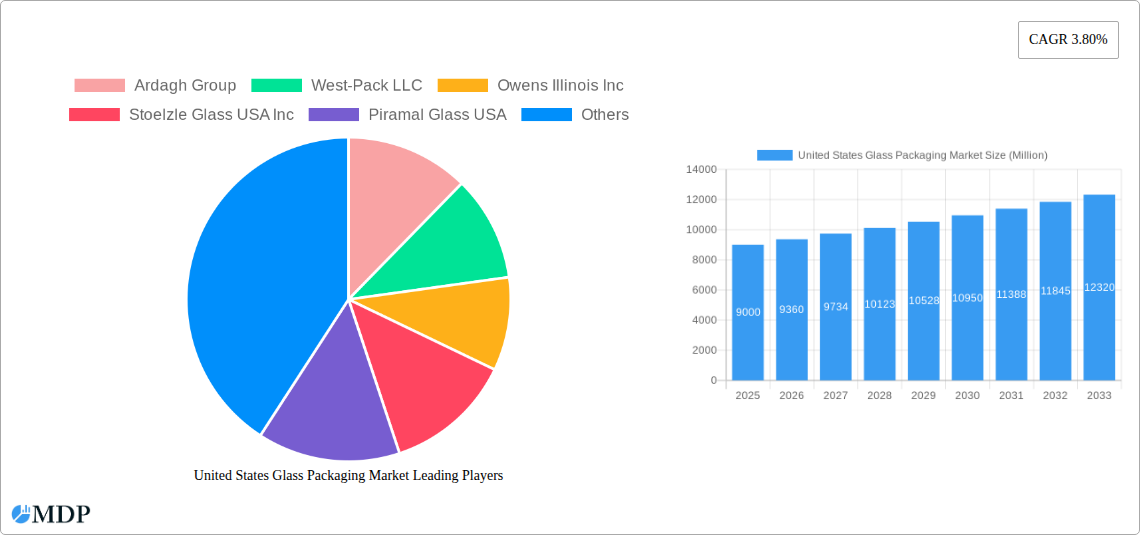

The United States glass packaging market is poised for significant expansion, with a projected market size of $9 billion in 2025. This growth is underpinned by a healthy CAGR of 4% expected throughout the forecast period of 2025-2033. The robust demand for sustainable and premium packaging solutions is a primary driver, as consumers increasingly favor glass for its inertness, recyclability, and aesthetic appeal. Key industries such as food and beverage, personal care, and healthcare are exhibiting strong uptake for glass packaging, driven by consumer preference for product integrity and safety. The shift towards eco-friendly alternatives over plastics, coupled with stringent regulations favoring recyclable materials, further bolsters the market's trajectory. Innovation in glass manufacturing, including lightweighting and enhanced durability, is also contributing to its competitive edge against other packaging materials.

United States Glass Packaging Market Market Size (In Billion)

The market's expansion is further fueled by evolving consumer lifestyles and product branding strategies. The food and beverage sector, in particular, is leveraging glass packaging for its ability to preserve flavor and quality, and to offer a premium unboxing experience. Similarly, the personal care and cosmetics industries are opting for glass to convey luxury and exclusivity. While the market enjoys strong growth, challenges such as higher production costs compared to some alternatives and the logistical complexities of transporting fragile materials exist. However, the inherent benefits of glass, including its superior barrier properties, recyclability, and chemical inertness, are expected to outweigh these restraints, ensuring sustained demand. The continued investment in advanced manufacturing technologies and the exploration of novel designs will be crucial for maintaining this upward momentum in the U.S. glass packaging landscape.

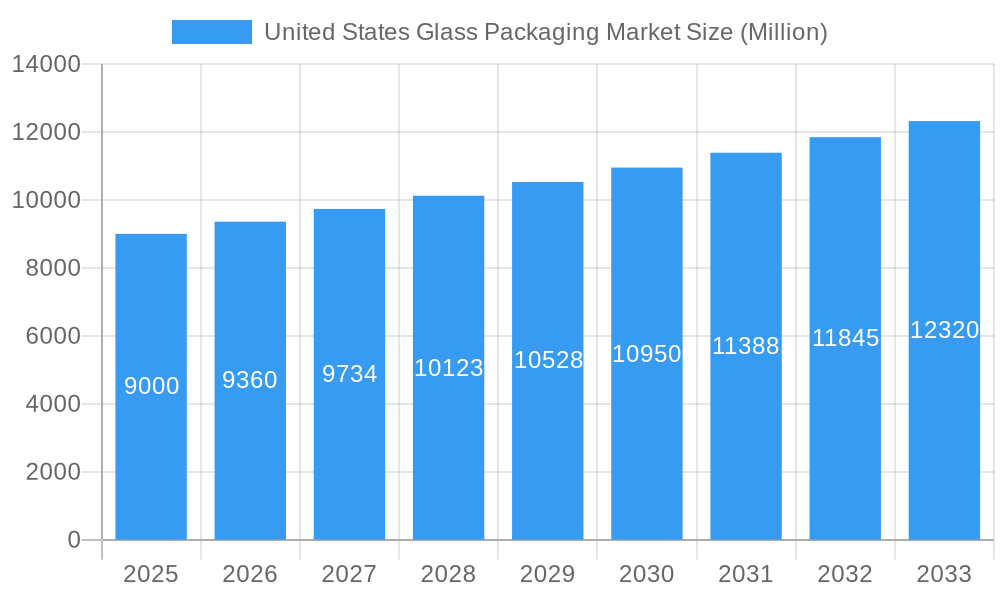

United States Glass Packaging Market Company Market Share

Unlock unparalleled insights into the burgeoning United States glass packaging market with this comprehensive, SEO-optimized report. Covering the extensive study period from 2019 to 2033, with a base year of 2025, this analysis delves into market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, key players, and critical milestones.

This report is an indispensable resource for glass packaging manufacturers, glass bottle suppliers, glass jar producers, vial manufacturers, food and beverage companies, personal care brands, healthcare providers, household care product companies, investors, and industry consultants seeking to understand the intricate landscape of the US glass packaging sector. Featuring high-traffic keywords such as "US glass packaging market," "glass bottles market," "glass jars market," "packaging solutions," "sustainable packaging," "recyclable packaging," "food packaging trends," "beverage packaging," "healthcare packaging," and more, this report guarantees maximum search visibility for critical industry stakeholders.

The United States glass packaging market is projected to reach an estimated USD $XX billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This growth is fueled by a confluence of factors including rising consumer demand for sustainable and premium packaging, increasing adoption of glass packaging in niche and premium product segments, and favorable regulatory initiatives promoting eco-friendly alternatives. Our in-depth analysis provides actionable intelligence to navigate this dynamic market, capitalize on emerging trends, and secure a competitive edge.

United States Glass Packaging Market Market Dynamics & Concentration

The United States glass packaging market is characterized by moderate to high concentration, with a few dominant players holding significant market share. Key innovation drivers include the relentless pursuit of enhanced sustainability, lightweighting of glass containers, and the development of advanced decoration and finishing techniques that appeal to premium branding. Regulatory frameworks, particularly those focused on environmental impact and recycling, play a crucial role in shaping market trends and influencing product development. Product substitutes, such as plastic, metal, and paperboard, present a constant competitive pressure, necessitating continuous innovation in glass manufacturing to maintain market relevance. End-user trends, emphasizing visual appeal, product integrity, and a premium unboxing experience, are increasingly favoring glass. Merger and acquisition (M&A) activities are strategic tools employed by leading companies to expand their product portfolios, geographic reach, and technological capabilities, further consolidating the market. Based on available data, the M&A deal count within the US glass packaging sector averaged approximately X deals annually between 2019 and 2024, indicating ongoing consolidation and strategic expansion efforts. Key players are actively investing in R&D to meet evolving consumer and regulatory demands.

United States Glass Packaging Market Industry Trends & Analysis

The United States glass packaging market is experiencing robust growth, driven by a paradigm shift towards sustainable and eco-friendly packaging solutions. Consumers are increasingly prioritizing products packaged in glass due to its perceived premium quality, inertness, and infinite recyclability. This preference is particularly evident in the beverage sector, where the visual appeal and the perception of purity associated with glass bottles are highly valued. The food industry also continues to rely heavily on glass jars for their ability to preserve freshness and offer an attractive presentation on store shelves. Technological advancements in glass manufacturing, such as the development of thinner and stronger glass, are contributing to lightweighting efforts, thereby reducing transportation costs and environmental impact. Furthermore, advancements in bottle and jar design allow for greater customization and brand differentiation. The market penetration of glass packaging is steadily increasing across various end-user industries, reflecting its enduring appeal. The CAGR of the United States glass packaging market is estimated to be XX% during the forecast period, indicating a sustained upward trajectory. Key market growth drivers include the rising disposable income, the growing demand for premium and artisanal products, and a heightened awareness of environmental issues among consumers. The competitive landscape is dynamic, with established players constantly innovating to meet evolving market demands and new entrants seeking to disrupt the market with novel solutions. The interplay between technological innovations, evolving consumer preferences for sustainable and aesthetically pleasing packaging, and the strategic responses of key industry players is shaping the future trajectory of this vital market. The increasing adoption of recycled content in glass manufacturing also positions the industry favorably in an environmentally conscious era.

Leading Markets & Segments in United States Glass Packaging Market

The United States glass packaging market is segmented by product type and end-user industry, with distinct segments exhibiting varied growth rates and market dominance.

Dominant Product Segments:

- Bottles: This segment consistently holds the largest market share due to its widespread application across the beverage industry (alcoholic and non-alcoholic), food products, and personal care items. The demand for glass bottles is propelled by their ability to maintain product integrity, offer a premium perception, and their infinite recyclability, aligning with growing consumer preferences for sustainable packaging. Economic policies favoring domestic manufacturing and investment in recycling infrastructure further bolster the dominance of this segment. The market penetration of glass bottles is highest within the beverage sector.

- Jars: Following closely behind bottles, glass jars are integral to the food industry, particularly for preserves, sauces, condiments, and baby food. Their robust nature and excellent barrier properties make them ideal for long-term storage and showcasing product quality. Growing consumer interest in health and wellness products, often packaged in glass jars, contributes to steady growth. Infrastructure development supporting food processing and distribution channels directly impacts the demand for glass jars.

- Vials: While smaller in market share compared to bottles and jars, the vials segment is experiencing significant growth, particularly within the healthcare and pharmaceutical industries. The need for sterile, inert, and tamper-evident packaging for medications, vaccines, and diagnostic reagents drives demand. Regulatory mandates for product safety and purity further solidify glass vials' position. Technological advancements in vial design and manufacturing are crucial for meeting stringent industry requirements.

- Others: This category encompasses various specialized glass packaging solutions, including ampoules, cosmetic containers, and industrial packaging. While niche, these segments can offer high-value opportunities driven by specific application needs and premium branding strategies.

Dominant End-User Industries:

- Beverage: This is unequivocally the largest end-user industry for United States glass packaging. The demand for beer, wine, spirits, soft drinks, and premium juices packaged in glass bottles remains exceptionally strong due to consumer preferences for quality, taste preservation, and aesthetic appeal. The industry's commitment to sustainability further enhances the attractiveness of glass.

- Food: As a foundational segment, the food industry's reliance on glass jars and bottles for a wide array of products, from jams and pickles to sauces and ready-to-eat meals, ensures consistent demand. The perceived health benefits and premium image associated with glass packaging drive its adoption in this sector.

- Healthcare: The pharmaceutical and medical industries represent a high-growth segment for glass packaging, primarily for vials, ampoules, and specialized containers. The critical requirement for product integrity, sterility, and chemical inertness makes glass the preferred choice for sensitive medical products.

- Personal Care: The cosmetics and personal care industry increasingly utilizes glass for premium fragrances, skincare, and haircare products, leveraging its aesthetic appeal and perceived luxury.

- Household Care: While not as dominant as other sectors, household care products like cleaning solutions and air fresheners are also increasingly adopting glass packaging for aesthetic and premium branding purposes.

The dominance of these segments is influenced by factors such as consumer purchasing power, regulatory compliance, environmental consciousness, and ongoing innovation in packaging design and material science. The US market exhibits a strong inclination towards premium and sustainable packaging, directly benefiting the glass packaging sector.

United States Glass Packaging Market Product Developments

Product developments in the United States glass packaging market are increasingly focused on enhancing sustainability, functionality, and aesthetic appeal. Innovations include the development of ultra-lightweight glass bottles and jars that maintain structural integrity while reducing material usage and transportation emissions. Advancements in glass coatings and treatments are improving scratch resistance, thermal insulation, and barrier properties, extending product shelf life and enhancing user experience. Furthermore, the adoption of recycled glass content in manufacturing is on the rise, aligning with circular economy principles and consumer demand for eco-friendly options. Digital printing and advanced decoration techniques are enabling intricate designs and personalized branding, allowing manufacturers to cater to the growing demand for premium and customized packaging solutions. These product developments are crucial for maintaining glass's competitive edge against alternative packaging materials and for capturing market share in segments valuing both performance and sustainability.

Key Drivers of United States Glass Packaging Market Growth

The United States glass packaging market's growth is primarily propelled by several key drivers. Firstly, the escalating consumer demand for sustainable and eco-friendly packaging solutions is a significant catalyst. Consumers are increasingly aware of the environmental impact of their purchasing decisions and actively seek products packaged in recyclable materials like glass. Secondly, the premium perception associated with glass packaging, especially in the food, beverage, and personal care sectors, drives its adoption for high-value and artisanal products. Thirdly, stringent regulations promoting the reduction of single-use plastics and encouraging the use of recyclable materials provide a favorable policy environment for glass. Technological advancements in manufacturing, leading to lighter, stronger, and more cost-effective glass packaging, also contribute to its competitiveness. Finally, the growing e-commerce sector, which necessitates robust and protective packaging, further supports the demand for durable glass containers.

Challenges in the United States Glass Packaging Market Market

Despite robust growth, the United States glass packaging market faces several challenges. A primary restraint is the higher cost of glass packaging compared to some plastic alternatives, which can impact price-sensitive consumer segments and product categories. Energy-intensive manufacturing processes also pose an environmental and cost challenge, although advancements in efficiency are being made. Supply chain disruptions, including raw material availability and logistics, can affect production timelines and costs. Furthermore, the weight of glass packaging can lead to higher transportation expenses and associated carbon emissions, presenting a counterpoint to its sustainability benefits. The recycling infrastructure in some regions may not be as robust as desired, leading to concerns about effective end-of-life management. Competitive pressure from innovative and cost-effective alternatives in the flexible packaging and advanced plastic sectors also remains a significant hurdle.

Emerging Opportunities in United States Glass Packaging Market

Emerging opportunities in the United States glass packaging market are abundant, driven by innovation and evolving consumer behavior. The increasing focus on the circular economy presents a significant opportunity for glass manufacturers to further integrate recycled content and develop closed-loop recycling systems, thereby enhancing their environmental credentials. The growth of premium and craft segments within the food and beverage industries, particularly for artisanal spirits, craft beers, and specialty foods, offers a strong avenue for growth, as these products often command higher prices and benefit from the premium perception of glass. The expanding healthcare sector, with its stringent requirements for sterile and safe packaging for pharmaceuticals and biologics, presents a sustained opportunity for glass vials and specialized containers. Furthermore, technological advancements in smart packaging and interactive glass designs, coupled with customized branding solutions, can unlock new avenues for market differentiation and value creation. Strategic partnerships between glass manufacturers and brands seeking sustainable and aesthetically superior packaging will be crucial for capitalizing on these opportunities.

Leading Players in the United States Glass Packaging Market Sector

- Ardagh Group

- West-Pack LLC

- Owens Illinois Inc

- Stoelzle Glass USA Inc

- Piramal Glass USA

- Heinz Glas USA Inc

- Gerresheimer AG

- Vitro SAB de CV

Key Milestones in United States Glass Packaging Market Industry

- April 2022: Ardagh Glass Packaging partnered with Kansas City Bier Company to supply all the brewery's glass beer bottles. Kansas City Bier exclusively packages its beer in 100% and endlessly recyclable glass bottles, and all are manufactured in the United States. This collaboration highlights the growing preference for domestically produced, sustainable glass packaging solutions.

- January 2022: Gerresheimer announced that it is expanding its capacities for glass vials at the Wertheim site and two further sites in the United States and China. The company is investing in production in Wertheim to increase vials capacity by 150 million vials per year. This expansion underscores the increasing demand for glass vials in the healthcare and pharmaceutical sectors and Gerresheimer's strategic commitment to meeting this demand.

Strategic Outlook for United States Glass Packaging Market Market

The strategic outlook for the United States glass packaging market is exceptionally positive, driven by a confluence of sustainability trends, premiumization, and technological advancements. The ongoing shift towards a circular economy and increased environmental consciousness among consumers will continue to favor glass as a preferred packaging material. Manufacturers will likely focus on further enhancing the sustainability profile of their products by increasing the use of recycled content, reducing energy consumption in production, and improving lightweighting techniques. The demand for customized and aesthetically appealing glass packaging in premium segments of the food, beverage, and personal care industries is expected to rise, presenting opportunities for innovation in design and decoration. Strategic investments in advanced manufacturing technologies, such as automation and digital printing, will be crucial for enhancing efficiency and meeting evolving market demands. Furthermore, collaborations and partnerships between glass packaging suppliers and end-user industries will be key to driving innovation, expanding market reach, and solidifying glass's position as a leading sustainable packaging solution. The market is poised for sustained growth, offering significant opportunities for stakeholders committed to innovation and sustainability.

United States Glass Packaging Market Segmentation

-

1. Products

- 1.1. Bottles

- 1.2. Jars

- 1.3. Vials

- 1.4. Others

-

2. End-User Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Personal care

- 2.4. Healthcare

- 2.5. Household care

- 2.6. Other End-user Industries

United States Glass Packaging Market Segmentation By Geography

- 1. United States

United States Glass Packaging Market Regional Market Share

Geographic Coverage of United States Glass Packaging Market

United States Glass Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Eco-friendly Products; Rising Demand from the Food and Beverage Market

- 3.3. Market Restrains

- 3.3.1. ; Recycling Concerns and Dependence on End-user Uptake

- 3.4. Market Trends

- 3.4.1. Rising Demand from the Food and Beverage Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Glass Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. Bottles

- 5.1.2. Jars

- 5.1.3. Vials

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Personal care

- 5.2.4. Healthcare

- 5.2.5. Household care

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ardagh Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 West-Pack LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Owens Illinois Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stoelzle Glass USA Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Piramal Glass USA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Heinz Glas USA Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gerresheimer AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vitro SAB de CV*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Ardagh Group

List of Figures

- Figure 1: United States Glass Packaging Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Glass Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: United States Glass Packaging Market Revenue undefined Forecast, by Products 2020 & 2033

- Table 2: United States Glass Packaging Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 3: United States Glass Packaging Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: United States Glass Packaging Market Revenue undefined Forecast, by Products 2020 & 2033

- Table 5: United States Glass Packaging Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 6: United States Glass Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Glass Packaging Market?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the United States Glass Packaging Market?

Key companies in the market include Ardagh Group, West-Pack LLC, Owens Illinois Inc, Stoelzle Glass USA Inc, Piramal Glass USA, Heinz Glas USA Inc, Gerresheimer AG, Vitro SAB de CV*List Not Exhaustive.

3. What are the main segments of the United States Glass Packaging Market?

The market segments include Products, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Eco-friendly Products; Rising Demand from the Food and Beverage Market.

6. What are the notable trends driving market growth?

Rising Demand from the Food and Beverage Driving the Market.

7. Are there any restraints impacting market growth?

; Recycling Concerns and Dependence on End-user Uptake.

8. Can you provide examples of recent developments in the market?

April 2022: Ardagh Glass Packaging partnered with Kansas City Bier Company to supply all the brewery's glass beer bottles. Kansas City Bier exclusively packages its beer in 100% and endlessly recyclable glass bottles, and all are manufactured in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Glass Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Glass Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Glass Packaging Market?

To stay informed about further developments, trends, and reports in the United States Glass Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence