Key Insights

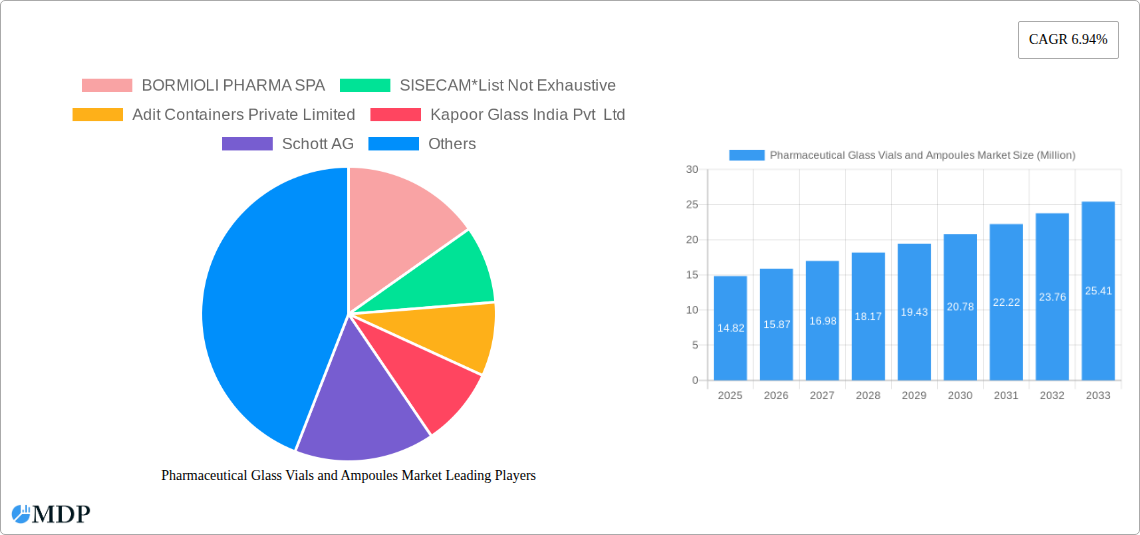

The global Pharmaceutical Glass Vials and Ampoules Market is poised for robust expansion, projecting a significant market size of $14.82 million in 2025, and is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.94% through 2033. This upward trajectory is primarily fueled by the escalating demand for sterile and safe packaging solutions for a wide array of pharmaceutical products, including critical vaccines and biologics. The increasing prevalence of chronic diseases globally necessitates a larger supply of effective medications, directly translating into a higher demand for high-quality glass packaging. Furthermore, advancements in drug delivery systems and the burgeoning biopharmaceutical sector, with its focus on complex therapeutic proteins and monoclonal antibodies, are significant drivers. The emphasis on stringent regulatory compliance and the preference for inert materials like glass, which offer superior protection against contamination and degradation, further bolster market growth. The market is segmented into key applications, with vaccines representing a substantial share, alongside other crucial areas such as insulin and various biopharmaceutical formulations. This sustained demand underscores the critical role of pharmaceutical glass packaging in ensuring drug integrity and patient safety across diverse therapeutic areas.

Pharmaceutical Glass Vials and Ampoules Market Market Size (In Million)

The market dynamics are further shaped by a confluence of prevailing trends and identified restraints. Key trends include a growing preference for Type I borosilicate glass, known for its excellent chemical resistance and thermal stability, making it ideal for sensitive pharmaceuticals. Innovations in vial and ampoule design, such as tamper-evident closures and specialized coatings, are also gaining traction. The increasing focus on sustainable manufacturing practices within the pharmaceutical packaging industry is another significant trend, pushing for more energy-efficient production and recyclable materials. However, challenges such as the volatility in raw material prices, particularly for specialized glass components, and the capital-intensive nature of high-quality glass manufacturing can pose restraints. The emergence of alternative packaging materials, though currently less prevalent for critical applications, also represents a potential long-term challenge. Despite these hurdles, the inherent advantages of glass packaging in preserving drug efficacy and safety, coupled with continued innovation and expanding pharmaceutical production, suggest a promising outlook for the Pharmaceutical Glass Vials and Ampoules Market.

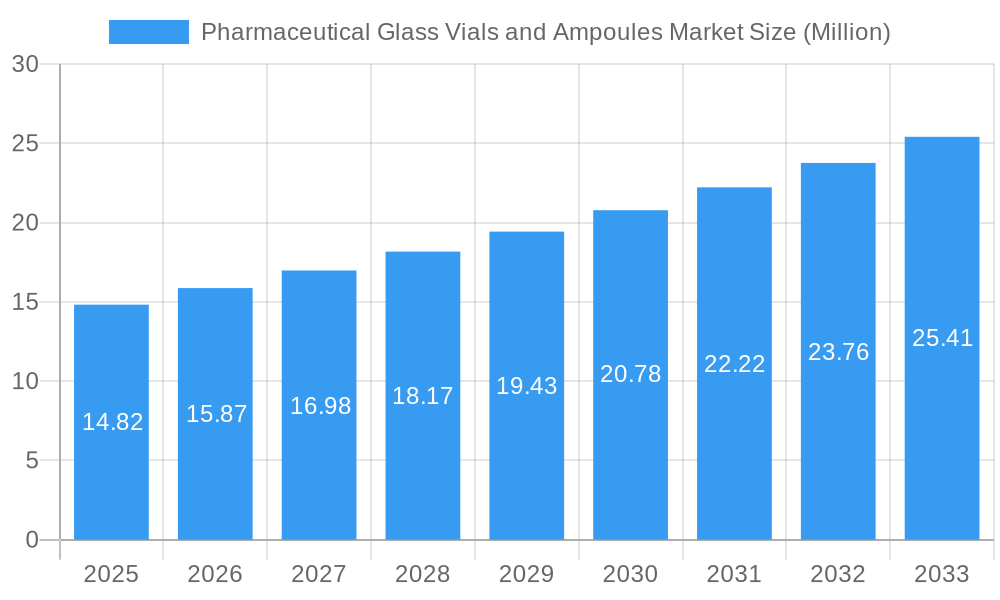

Pharmaceutical Glass Vials and Ampoules Market Company Market Share

This in-depth report provides a comprehensive analysis of the global Pharmaceutical Glass Vials and Ampoules Market, essential for stakeholders in pharmaceutical packaging, drug manufacturing, and healthcare supply chains. Covering the historical period of 2019-2024, the base year of 2025, and an extensive forecast period of 2025-2033, this report offers actionable insights into market dynamics, industry trends, leading segments, product innovations, growth drivers, challenges, and emerging opportunities. With a focus on high-traffic keywords such as "pharmaceutical vials," "glass ampoules," "drug packaging," "biopharma," "vaccine packaging," and "specialty glass," this report is optimized for maximum search visibility and aims to attract a broad spectrum of industry professionals, including manufacturers, suppliers, investors, and regulatory bodies.

The market is segmented by application, with a critical focus on "Vaccines" and "Others" encompassing crucial areas like "Insulin," "Biopharma," and other vital pharmaceutical products. Insights into market concentration, innovation drivers, regulatory landscapes, and M&A activities will equip you with a strategic advantage in this competitive landscape. Understand the intricate interplay of technological advancements, evolving consumer preferences, and the impact of key players like BORMIOLI PHARMA SPA, SISECAM, SCHOTT AG, CORNING INCORPORATED, GERRESHEIMER AG, and Stevanato Group SPA.

Key Report Highlights:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

Pharmaceutical Glass Vials and Ampoules Market Market Dynamics & Concentration

The Pharmaceutical Glass Vials and Ampoules Market exhibits a moderate to high concentration, with a few dominant players holding significant market share, alongside a growing number of specialized manufacturers. Innovation drivers are primarily fueled by the increasing demand for sterile and tamper-evident packaging for sensitive pharmaceutical products, including biologics and vaccines. Stringent regulatory frameworks, such as those from the FDA and EMA, are critical in shaping product development and manufacturing processes, emphasizing material quality, leachables, and extractables. Product substitutes, while present in the form of plastic or other novel packaging materials, are often limited in their ability to match the inertness and barrier properties of high-quality pharmaceutical glass. End-user trends reveal a growing preference for single-dose packaging, pre-filled syringes, and advanced drug delivery systems, all of which rely heavily on precise and reliable glass vial and ampoule solutions. Mergers and acquisitions (M&A) activities are a key aspect of market dynamics, with companies looking to consolidate their market position, expand their product portfolios, or gain access to new technologies and geographical regions. For instance, strategic investments in companies offering optimization services, as seen with Siseecam's interest in ICRON, highlight the industry's focus on operational efficiency and supply chain resilience. The overall M&A deal count has seen a steady increase over the historical period, reflecting consolidation efforts and strategic expansions by leading pharmaceutical packaging providers.

Pharmaceutical Glass Vials and Ampoules Market Industry Trends & Analysis

The Pharmaceutical Glass Vials and Ampoules Market is experiencing robust growth, propelled by a confluence of factors that underscore the indispensable role of high-quality glass packaging in the healthcare industry. The escalating global demand for pharmaceuticals, driven by an aging population, rising incidence of chronic diseases, and advancements in drug discovery, directly translates into increased consumption of pharmaceutical vials and ampoules. The surge in vaccine development and distribution, particularly amplified by recent global health events, has created unprecedented demand for sterile, high-barrier packaging solutions like glass vials. The biopharmaceutical sector's rapid expansion, characterized by the development of complex protein-based therapeutics and personalized medicines, further fuels the need for specialized glass packaging that can maintain drug stability and prevent contamination. Technological disruptions are continuously shaping the industry, with advancements in glass manufacturing techniques leading to improved product quality, enhanced barrier properties, and the development of specialized glass types such as Type I borosilicate glass, renowned for its chemical inertness and thermal shock resistance. Automation in filling and sealing processes also demands precise and uniform vials and ampoules, pushing manufacturers to innovate in terms of dimensional accuracy and surface treatments. Consumer preferences are increasingly leaning towards patient-centric packaging solutions, including pre-filled vials and syringes, which enhance convenience and reduce administration errors. This trend necessitates sophisticated packaging that ensures drug integrity from manufacturing to the point of administration. Competitive dynamics within the market are intense, with companies differentiating themselves through product quality, customization capabilities, regulatory compliance, and supply chain reliability. The market penetration of advanced glass packaging solutions is expected to rise as pharmaceutical companies prioritize drug efficacy and patient safety. The overall market CAGR is projected to remain strong throughout the forecast period, reflecting sustained demand and ongoing innovation.

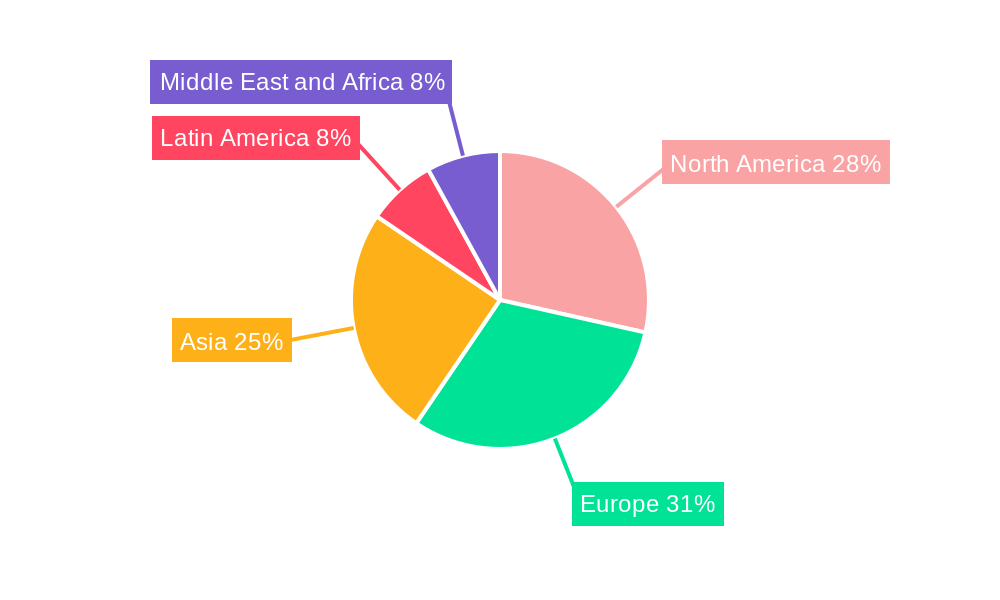

Leading Markets & Segments in Pharmaceutical Glass Vials and Ampoules Market

The Pharmaceutical Glass Vials and Ampoules Market is dominated by several key regions and segments, each contributing significantly to its overall growth trajectory.

Dominant Region: North America, particularly the United States, stands as a leading market for pharmaceutical glass vials and ampoules. This dominance is attributed to several factors:

- High Pharmaceutical R&D Spending: The substantial investment in pharmaceutical research and development, coupled with a robust pipeline of new drug discoveries, directly translates into a higher demand for packaging solutions.

- Advanced Healthcare Infrastructure: The presence of a well-established healthcare system and a large patient base necessitates a consistent supply of pharmaceuticals, requiring vast quantities of vials and ampoules.

- Stringent Regulatory Standards: The rigorous regulatory environment enforced by agencies like the FDA ensures a preference for high-quality, compliant packaging materials, where glass excels.

- Presence of Major Pharmaceutical Companies: The concentration of leading pharmaceutical and biotechnology companies in North America fuels demand for both standard and specialized glass packaging.

- Economic Policies and Incentives: Government initiatives supporting the growth of the pharmaceutical and biopharmaceutical industries further bolster market demand.

Dominant Segment: Vaccines: The "Vaccines" application segment is experiencing unparalleled growth and is a primary driver of the Pharmaceutical Glass Vials and Ampoules Market.

- Global Health Initiatives and Pandemics: Recent global health crises have underscored the critical importance of rapid vaccine development and mass distribution, creating a substantial and sustained demand for sterile vials.

- Routine Immunization Programs: Ongoing global vaccination programs for various infectious diseases contribute to a consistent baseline demand for vials.

- Advancements in Vaccine Technology: The development of new vaccine types, including mRNA and viral vector vaccines, often requires specialized glass packaging to maintain stability and efficacy.

- Cold Chain Logistics: The sensitive nature of many vaccines necessitates packaging that can withstand extreme temperature variations during storage and transportation, a requirement that high-quality glass reliably meets.

Other Significant Segment: Biopharma: The "Others" segment, particularly the "Biopharma" sub-segment, is a crucial growth engine.

- Rise of Biologics: The increasing development and commercialization of biologic drugs, including monoclonal antibodies and recombinant proteins, are driving demand for high-barrier glass packaging.

- Personalized Medicine: The trend towards personalized medicine often involves smaller batch sizes and highly potent, sensitive drugs, requiring precise and sterile packaging solutions.

- Insulin Packaging: The growing prevalence of diabetes globally translates into a continuous and significant demand for insulin vials, a staple within the pharmaceutical glass packaging market.

The interplay of these dominant regions and application segments, supported by favorable economic conditions, advanced manufacturing capabilities, and evolving healthcare needs, solidifies their leading positions within the global Pharmaceutical Glass Vials and Ampoules Market.

Pharmaceutical Glass Vials and Ampoules Market Product Developments

Recent product developments in the Pharmaceutical Glass Vials and Ampoules Market are heavily focused on enhancing drug safety, stability, and patient compliance. Innovations include the development of ultra-low particulate glass, reducing the risk of contamination in sensitive biologics. Advanced surface treatments are being employed to minimize leachables and extractables, ensuring the integrity of potent pharmaceutical compounds. Furthermore, manufacturers are increasingly offering customized solutions, including specialized neck finishes for advanced sealing technologies and pre-filled vial systems to improve drug administration convenience and accuracy. The integration of smart packaging features, though nascent, represents a future frontier. These developments directly address the evolving needs of the biopharmaceutical industry and the demand for high-purity, reliable packaging for a wide range of therapeutic agents.

Key Drivers of Pharmaceutical Glass Vials and Ampoules Market Growth

The Pharmaceutical Glass Vials and Ampoules Market is propelled by several interconnected growth drivers. Firstly, the escalating global demand for pharmaceuticals, driven by an aging population and the rising prevalence of chronic diseases, directly translates into increased consumption of drug packaging. Secondly, the rapid expansion of the biopharmaceutical sector and the burgeoning market for biologics, vaccines, and gene therapies necessitate high-quality, inert glass packaging to maintain product stability and efficacy. Technological advancements in glass manufacturing, leading to improved purity, reduced leachables, and enhanced barrier properties, also play a crucial role. Furthermore, stringent regulatory requirements mandating high standards for drug packaging safety and integrity favor the use of pharmaceutical-grade glass. Finally, the increasing trend towards pre-filled vials and complex drug delivery systems by pharmaceutical companies further boosts the demand for precision-engineered glass vials and ampoules.

Challenges in the Pharmaceutical Glass Vials and Ampoules Market Market

Despite its robust growth, the Pharmaceutical Glass Vials and Ampoules Market faces several challenges. Stringent and evolving regulatory compliance, particularly concerning leachables and extractables, demands continuous investment in quality control and material science. The high initial capital investment required for advanced glass manufacturing facilities can act as a barrier to entry for new players. Fluctuations in raw material prices, especially for borosilicate glass components, can impact manufacturing costs and profit margins. Furthermore, the growing competition from alternative packaging materials, such as high-barrier plastics and novel polymer-based solutions, presents a potential threat, although glass retains its superiority for many sensitive applications. Supply chain disruptions, exacerbated by geopolitical events or unforeseen circumstances, can affect the availability and timely delivery of these critical packaging components, impacting pharmaceutical production schedules.

Emerging Opportunities in Pharmaceutical Glass Vials and Ampoules Market

Emerging opportunities in the Pharmaceutical Glass Vials and Ampoules Market are largely driven by advancements in healthcare and manufacturing. The persistent need for cold-chain-compliant packaging for vaccines and biologics presents a significant opportunity, especially with ongoing global health initiatives. The growing market for personalized medicine and cell and gene therapies requires highly specialized, low-volume, high-purity glass vials, creating a niche for innovative manufacturers. Strategic partnerships between glass manufacturers and pharmaceutical companies can lead to the co-development of customized packaging solutions tailored to specific drug formulations and delivery systems. Furthermore, the increasing focus on sustainability in the pharmaceutical industry is driving demand for recyclable and eco-friendly glass packaging options, presenting an avenue for innovation and market differentiation. Expansion into emerging economies with growing healthcare sectors also offers considerable long-term growth potential.

Leading Players in the Pharmaceutical Glass Vials and Ampoules Market Sector

- BORMIOLI PHARMA SPA

- SISECAM

- Adit Containers Private Limited

- Kapoor Glass India Pvt Ltd

- Schott AG

- NIPRO Corporation

- Stoelzle Oberglas GmbH

- Birgimefar Group

- AAPL Solutions Pvt Ltd

- CORNING INCORPORATED

- Agrado SA

- J Penner Corporation

- BOROSIL

- Stevanato Group SPA

- SGD SA (SGD Pharma)

- Gerresheimer AG

- Accu-Glass LLC

Key Milestones in Pharmaceutical Glass Vials and Ampoules Market Industry

- November 2023: Glassware brand Borosil is looking to reach INR 500 crore in revenue by 2025, driven by a consistent year-on-year growth rate of 16–17%, with a significant contribution from its growth driver segments – pharma packaging, laboratory benchtop equipment, and process sciences. This indicates strong internal growth strategies and market confidence in the pharmaceutical packaging segment.

- October 2023: Siseecam signed a letter of intent to invest in the Turkish technology firm ICRON, which provides operational and strategic decision optimization services. Sisecam is trying to go one step further with the partnership agreement with ICRON. This development highlights the industry's increasing focus on leveraging technology for operational efficiency and supply chain optimization, a critical aspect for glass vial and ampoule manufacturers.

Strategic Outlook for Pharmaceutical Glass Vials and Ampoules Market Market

The strategic outlook for the Pharmaceutical Glass Vials and Ampoules Market is exceptionally positive, driven by the indispensable nature of glass in safeguarding pharmaceutical integrity. Growth accelerators include the sustained demand from the burgeoning biopharmaceutical sector, the continuous need for sterile packaging for vaccines, and the increasing adoption of pre-filled drug delivery systems. Companies are strategically focusing on technological innovation, particularly in developing advanced glass formulations with superior barrier properties and reduced leachables, to meet the demands of complex and sensitive therapeutics. Expansion into emerging markets, where healthcare infrastructure is rapidly developing and pharmaceutical consumption is on the rise, presents significant opportunities. Furthermore, a strategic emphasis on sustainability and the development of recyclable packaging solutions will be crucial for long-term market leadership. Collaborations with pharmaceutical companies to create bespoke packaging solutions will also be a key strategy for capturing market share and fostering innovation.

Pharmaceutical Glass Vials and Ampoules Market Segmentation

-

1. Application

- 1.1. Vaccines

- 1.2. Others (Insulin, Biopharma, Others)

Pharmaceutical Glass Vials and Ampoules Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Australia and New Zealand

- 4. Latin America

- 5. Middle East and Africa

Pharmaceutical Glass Vials and Ampoules Market Regional Market Share

Geographic Coverage of Pharmaceutical Glass Vials and Ampoules Market

Pharmaceutical Glass Vials and Ampoules Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Pharmaceutical Industry in Emerging Economies; Commodity Value of Glass Increased with Recyclability

- 3.3. Market Restrains

- 3.3.1. Increased Relevance of Alternate Sources

- 3.4. Market Trends

- 3.4.1. Vaccines to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Glass Vials and Ampoules Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Vaccines

- 5.1.2. Others (Insulin, Biopharma, Others)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Pharmaceutical Glass Vials and Ampoules Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Vaccines

- 6.1.2. Others (Insulin, Biopharma, Others)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Pharmaceutical Glass Vials and Ampoules Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Vaccines

- 7.1.2. Others (Insulin, Biopharma, Others)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pharmaceutical Glass Vials and Ampoules Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Vaccines

- 8.1.2. Others (Insulin, Biopharma, Others)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Pharmaceutical Glass Vials and Ampoules Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Vaccines

- 9.1.2. Others (Insulin, Biopharma, Others)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Pharmaceutical Glass Vials and Ampoules Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Vaccines

- 10.1.2. Others (Insulin, Biopharma, Others)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 BORMIOLI PHARMA SPA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SISECAM*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Adit Containers Private Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kapoor Glass India Pvt Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Schott AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NIPRO Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Stoelzle Oberglas GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Birgimefar Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AAPL Solutions Pvt Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CORNING INCORPORATED

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Agrado SA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 J Penner Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BOROSIL

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Stevanato Group SPA

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 SGD SA (SGD Pharma)

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Gerresheimer AG

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Accu-Glass LLC

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 BORMIOLI PHARMA SPA

List of Figures

- Figure 1: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Latin America Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Latin America Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Middle East and Africa Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Germany Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: China Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Japan Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: India Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Australia and New Zealand Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Glass Vials and Ampoules Market?

The projected CAGR is approximately 6.94%.

2. Which companies are prominent players in the Pharmaceutical Glass Vials and Ampoules Market?

Key companies in the market include BORMIOLI PHARMA SPA, SISECAM*List Not Exhaustive, Adit Containers Private Limited, Kapoor Glass India Pvt Ltd, Schott AG, NIPRO Corporation, Stoelzle Oberglas GmbH, Birgimefar Group, AAPL Solutions Pvt Ltd, CORNING INCORPORATED, Agrado SA, J Penner Corporation, BOROSIL, Stevanato Group SPA, SGD SA (SGD Pharma), Gerresheimer AG, Accu-Glass LLC.

3. What are the main segments of the Pharmaceutical Glass Vials and Ampoules Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Pharmaceutical Industry in Emerging Economies; Commodity Value of Glass Increased with Recyclability.

6. What are the notable trends driving market growth?

Vaccines to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increased Relevance of Alternate Sources.

8. Can you provide examples of recent developments in the market?

November 2023 - Glassware brand Borosil is looking to reach INR 500 crore in revenue by 2025, driven by a consistent year-on-year growth rate of 16–17%, with a significant contribution from its growth driver segments –pharma packaging, laboratory benchtop equipment, and process sciences.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Glass Vials and Ampoules Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Glass Vials and Ampoules Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Glass Vials and Ampoules Market?

To stay informed about further developments, trends, and reports in the Pharmaceutical Glass Vials and Ampoules Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence