Key Insights

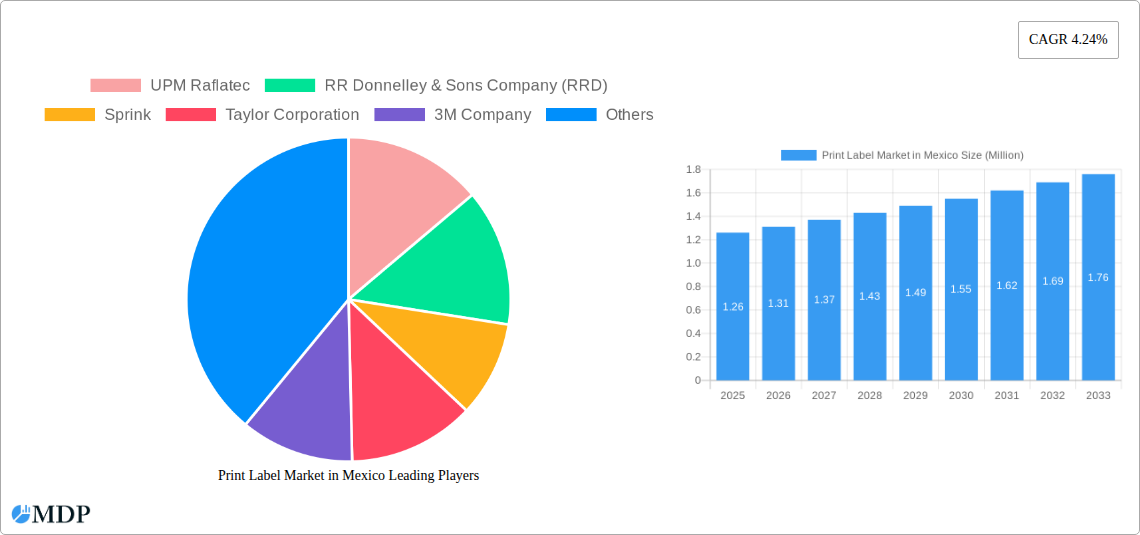

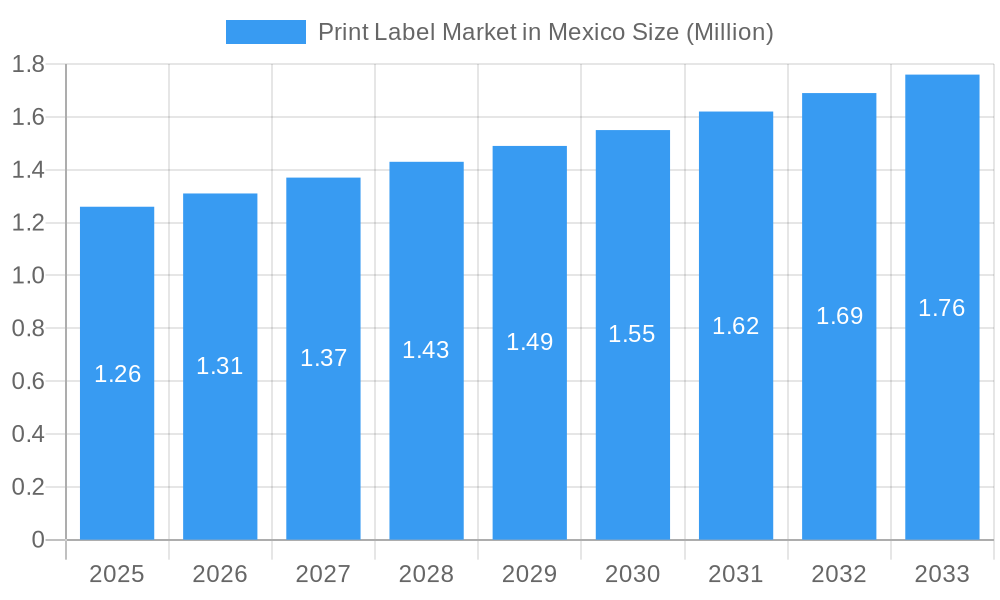

The Mexican print label market is poised for substantial growth, projected to reach $1.26 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 4.24% through 2033. This robust expansion is fueled by a dynamic interplay of factors, including the burgeoning food and beverage sector, which demands sophisticated and attractive labeling for a wide array of products. The healthcare and pharmaceutical industries also present significant opportunities, driven by stringent regulatory requirements for clear, accurate, and tamper-evident labeling. Furthermore, the increasing consumer demand for visually appealing and informative packaging in the cosmetics and household goods segments directly translates to higher consumption of diverse print label types. Advancements in print technologies, particularly the rise of digital printing, are democratizing label production, allowing for greater customization, shorter runs, and faster turnaround times, thereby supporting the market's upward trajectory.

Print Label Market in Mexico Market Size (In Million)

The market's growth is further supported by the increasing adoption of pressure-sensitive labels (PSL) due to their ease of application and versatility across various packaging materials. In-mold labels and shrink sleeve labels are also gaining traction, especially in the beverage and household industries, for their premium look and durability. While the market is generally robust, potential restraints may include fluctuating raw material costs, particularly for paper and adhesives, and the environmental impact associated with certain labeling materials, prompting a greater focus on sustainable and eco-friendly labeling solutions. Leading players are actively investing in innovative technologies and expanding their production capabilities to cater to the evolving needs of end-user industries in Mexico, ensuring a competitive and dynamic market landscape.

Print Label Market in Mexico Company Market Share

Here is the SEO-optimized and engaging report description for the Print Label Market in Mexico, structured as requested, incorporating high-traffic keywords and details without placeholders.

Comprehensive Report: Print Label Market in Mexico - Trends, Dynamics, and Future Outlook (2019-2033)

Dive into the dynamic Print Label Market in Mexico with this in-depth industry report. Explore critical insights into market growth drivers, technological innovations, competitive landscapes, and emerging opportunities within one of Latin America's most vibrant economies. This report provides a strategic roadmap for stakeholders, including label manufacturers, brand owners, packaging suppliers, adhesive producers, and investment firms. Covering the Study Period: 2019–2033, with a Base Year of 2025 and a Forecast Period of 2025–2033, this analysis leverages historical data from 2019–2024 to deliver actionable intelligence. Discover the Mexican label industry's trajectory, focusing on key segments like Pressure Sensitive Labels (PSL), Shrink Sleeve Labels, and the dominant Food and Beverage and Healthcare and Pharmaceutical end-user industries. Understand the impact of digital printing, flexography, and hot melt adhesives on market expansion. This report offers unparalleled market segmentation, detailed competitor analysis featuring giants like Avery Dennison Corporation, CCL Industries Inc, and UPM Raflatec, and a thorough examination of recent industry developments, including major facility expansions and technological investments.

Print Label Market in Mexico Market Dynamics & Concentration

The Print Label Market in Mexico exhibits a moderately concentrated structure, with a few dominant players holding significant market share alongside a vibrant ecosystem of smaller, specialized manufacturers. Innovation is primarily driven by the increasing demand for sustainable labeling solutions, enhanced product traceability, and visually appealing packaging across various end-user industries. Regulatory frameworks, particularly those related to food safety, pharmaceutical packaging, and environmental compliance, play a crucial role in shaping market access and product development. Product substitutes, such as direct printing on packaging or alternative labeling technologies, present a continuous challenge, necessitating ongoing innovation in material science and printing capabilities. End-user trends favor labels that offer improved functionality, such as tamper-evidence, temperature indication, and enhanced shelf appeal, directly impacting market demand. Mergers and acquisitions (M&A) activities are a notable aspect of market dynamics, with companies strategically acquiring competitors or complementary businesses to expand their product portfolios, geographic reach, and technological expertise. The market is witnessing consolidation, with key players aiming to achieve economies of scale and greater market penetration. This strategic consolidation is vital for navigating competitive pressures and capitalizing on growth opportunities.

Print Label Market in Mexico Industry Trends & Analysis

The Print Label Market in Mexico is poised for robust growth, driven by a confluence of escalating consumer demand, significant technological advancements, and expanding industrial applications. The Mexican packaging industry as a whole acts as a strong tailwind, with labels forming an integral component. A key market growth driver is the burgeoning Food and Beverage sector, which consistently requires innovative and compliant labeling for product differentiation and consumer trust. Similarly, the Healthcare and Pharmaceutical industries are witnessing heightened demand for high-quality, secure, and traceable labels, essential for patient safety and regulatory adherence. Cosmetics and Household goods sectors also contribute significantly, emphasizing aesthetic appeal and brand messaging.

Technological disruptions are a major theme, with digital printing rapidly gaining traction. Its ability to facilitate short print runs, offer personalized labeling, and reduce lead times makes it increasingly attractive for various applications, from promotional campaigns to variable data printing. Flexography and Rotogravure printing continue to dominate for high-volume production, especially for established product lines, while Offset printing finds its niche in specific applications requiring high-quality graphics. The adoption of advanced printing technologies is not only improving print quality and efficiency but also enabling the creation of labels with specialized functionalities.

Consumer preferences are evolving, with a growing emphasis on sustainability and eco-friendly packaging. This translates into a demand for labels made from recycled materials, biodegradable substrates, and water-based inks. Brands are increasingly prioritizing label solutions that reduce environmental impact, influencing material choices and manufacturing processes. The Mexican consumer's awareness of sustainability is a growing factor that manufacturers must address.

Competitive dynamics are intense, characterized by both global players and strong local manufacturers. Strategic investments in capacity expansion, technological upgrades, and product innovation are key differentiators. Companies are focusing on offering integrated solutions, including design, printing, and application services, to build stronger customer relationships. The market penetration of advanced labeling technologies is steadily increasing, reflecting the industry's commitment to modernization and efficiency. The overall Compound Annual Growth Rate (CAGR) for the Mexican label market is projected to remain strong, fueled by these multifaceted trends.

Leading Markets & Segments in Print Label Market in Mexico

The Print Label Market in Mexico is characterized by the dominance of specific segments, driven by distinct end-user industry demands and technological adoption patterns.

Dominant Segments by Label Type:

- Pressure Sensitive Labels (PSL): This segment holds a commanding position in the Mexican market. PSLs are favored for their ease of application, versatility across various substrates, and suitability for a wide range of end-user industries, including food, beverage, healthcare, and personal care. Their self-adhesive nature eliminates the need for additional application equipment, making them cost-effective for many manufacturers. The increasing sophistication of adhesive technologies further enhances their appeal, enabling performance on challenging surfaces and in diverse environmental conditions.

- Shrink Sleeve Labels: Experiencing significant growth, shrink sleeve labels are increasingly adopted for their ability to provide 360-degree branding and product decoration, particularly for contoured or uniquely shaped containers. They are highly popular in the beverage, cosmetics, and household goods sectors for their visual impact and tamper-evident features. The demand for visually striking product packaging fuels the expansion of this segment.

Dominant Segments by End-user Industry:

- Food: The Mexican Food industry is the largest consumer of printed labels. The sheer volume of packaged food products, coupled with stringent regulatory requirements for product information, ingredient lists, nutritional facts, and expiration dates, drives consistent demand. The need for brand differentiation and consumer engagement through eye-catching designs further solidifies the food sector's dominance.

- Beverage: Following closely, the beverage sector relies heavily on labels for branding, product identification, and promotional messaging. From soft drinks and juices to alcoholic beverages, labels play a critical role in shelf appeal and consumer choice. The growth of the ready-to-drink market and the demand for premium beverage offerings contribute to the sustained demand for labels in this segment.

- Healthcare and Pharmaceutical: This segment is characterized by a strong emphasis on accuracy, security, and regulatory compliance. Labels for pharmaceuticals require precise printing for dosage information, batch numbers, expiration dates, and warnings. Features like tamper-evident seals and serialization for track-and-trace capabilities are becoming increasingly critical, driving demand for high-specification labels.

- Cosmetics: The cosmetics industry prioritizes labels that enhance brand image and communicate product benefits. High-quality graphics, special finishes, and tactile effects are essential for attracting consumers in this competitive market. Shrink sleeves and pressure-sensitive labels with premium finishes are widely used.

Dominant Segments by Print Technology:

- Flexography: As a well-established and cost-effective technology for high-volume production, flexography remains a dominant print technology for a wide array of label types, particularly for Food and Beverage applications. Its ability to print on various substrates and its versatility make it a workhorse in the Mexican label market.

- Digital Printing: While not yet the largest in volume, digital printing is the fastest-growing technology segment. Its advantages in short runs, personalization, quick turnaround times, and variable data printing make it increasingly valuable for niche applications, promotional campaigns, and the dynamic needs of modern supply chains across all end-user industries.

Key drivers for the dominance of these segments include economic policies supporting manufacturing, robust infrastructure for distribution, evolving consumer purchasing power, and increasing investment by multinational corporations in Mexico.

Print Label Market in Mexico Product Developments

Recent product developments in the Print Label Market in Mexico are heavily influenced by the push for sustainability and enhanced functionality. Innovations include the introduction of compostable and recyclable label materials, alongside advanced adhesives that ensure performance on difficult substrates while facilitating easier removal for recycling. The integration of smart label technologies, such as QR codes and NFC tags, is becoming more prevalent, enabling enhanced consumer engagement and supply chain traceability. Furthermore, manufacturers are developing labels with improved durability and resistance to environmental factors, catering to the specific needs of industries like agriculture and industrial goods. These developments aim to provide brand owners with labeling solutions that are not only visually appealing but also environmentally responsible and technologically advanced, offering a competitive edge in the market.

Key Drivers of Print Label Market in Mexico Growth

The Print Label Market in Mexico is propelled by several key drivers. Technologically, the increasing adoption of digital printing offers faster turnaround times and greater personalization capabilities, catering to evolving market demands. Economically, Mexico's strong manufacturing base, particularly in the Food & Beverage, Healthcare, and Automotive sectors, creates a consistent demand for labels. Growing consumer awareness regarding product safety, authenticity, and sustainability is also a significant driver, pushing for labels with advanced features like tamper-evidence and eco-friendly materials. Regulatory frameworks that mandate specific labeling information for pharmaceuticals and food products also contribute to sustained market growth. Furthermore, the country's strategic position as a manufacturing hub for North America fosters export-oriented growth, requiring high-quality and compliant labeling solutions for a global market.

Challenges in the Print Label Market in Mexico Market

Despite its growth, the Print Label Market in Mexico faces several challenges. Fluctuations in raw material prices, particularly for paper and inks, can impact profit margins and necessitate price adjustments. Intense competition, both from domestic players and international brands, pressures manufacturers to maintain competitive pricing while investing in new technologies and sustainable solutions. Navigating complex and evolving regulatory requirements across different end-user industries can be challenging, requiring continuous adaptation. Furthermore, supply chain disruptions, including logistics and the availability of certain specialized materials, can affect production timelines and costs. The need for significant capital investment in advanced printing technologies and sustainable practices also presents a barrier for smaller market participants, potentially leading to a consolidation trend.

Emerging Opportunities in Print Label Market in Mexico

Emerging opportunities in the Print Label Market in Mexico are primarily centered around sustainability, digitalization, and enhanced functionality. The growing consumer and regulatory demand for eco-friendly packaging presents a significant opportunity for manufacturers offering biodegradable, compostable, and recycled label solutions. The ongoing digital transformation in various industries opens doors for smart labels with integrated RFID, QR codes, and NFC technology, facilitating supply chain visibility, brand authentication, and direct consumer interaction. Strategic partnerships between label converters and material suppliers, as well as technology providers, can accelerate the development and adoption of these innovative solutions. Furthermore, expanding into niche markets within the industrial and agricultural sectors, which require highly durable and specialized labels, offers untapped growth potential. The increasing nearshoring trend in Mexico also presents an opportunity for local label manufacturers to serve the growing demands of international companies relocating their production facilities.

Leading Players in the Print Label Market in Mexico Sector

- UPM Raflatec

- RR Donnelley & Sons Company (RRD)

- Sprink

- Taylor Corporation

- 3M Company

- STICKER'S PACK SA de CV

- CCL Industries Inc

- Clondalkin Group

- Avery Dennison Corporation

- Fuji Seal International Inc

- Multi-Color Mexico Corporation

- Papers and Conversions of Mexico

- Eximpro

- Brady Worldwide Inc

Key Milestones in Print Label Market in Mexico Industry

- October 2023: All4Labels relocated to a larger facility spanning over 12,000 square meters in Mexico, implementing new technologies to enhance its nationwide footprint and adding five new printing lines, emphasizing pressure-sensitive labels and shrink sleeves, set to triple production capacity. Phase two investment of EUR 4 million (USD 4.32 million) includes digital, flexo, and gravure presses, alongside pre-press upgrades, solidifying its presence and fueling market growth.

- June 2022: Henkel opened a hot melt adhesive manufacturing plant in Guadalupe (Nuevo Leon, Mexico), covering almost 30,000 square meters. This plant is dedicated to producing pressure-sensitive and non-pressurized hot melts under the Techno melt brand, including high-performance SUPRA and COOL product portfolios, to increase production and meet growing demand for advanced adhesive solutions, particularly for PSLs.

Strategic Outlook for Print Label Market in Mexico Market

The strategic outlook for the Print Label Market in Mexico is exceptionally positive, driven by a combination of economic resilience, technological adoption, and evolving consumer expectations. Key growth accelerators include the continued expansion of the Food and Beverage and Healthcare sectors, which are fundamental pillars of demand. Investments in digital printing technologies will enable greater agility and customization, meeting the needs of a dynamic marketplace. The increasing global emphasis on sustainability presents a significant opportunity for companies that can offer eco-friendly labeling solutions. Furthermore, Mexico's role as a key manufacturing hub within North America ensures sustained demand for high-quality labels for both domestic consumption and export markets. Strategic focus on value-added services, such as integrated labeling solutions and enhanced supply chain integration, will be crucial for sustained competitive advantage and long-term market leadership.

Print Label Market in Mexico Segmentation

-

1. Print Technology

- 1.1. Offset

- 1.2. Flexography

- 1.3. Rotogravure

- 1.4. Screen

- 1.5. Letterpress

- 1.6. Digital Printing

-

2. Label Type

- 2.1. Wet-glued Labels

- 2.2. Pressure Sensitive Labels (PSL)

- 2.3. Liner less Labels

- 2.4. In-mold Labels

- 2.5. Shrink Sleeve Labels

- 2.6. Multi-part Tracking Label

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Healthcare and Pharmaceutical

- 3.4. Cosmetics

- 3.5. Household

- 3.6. Industrial

- 3.7. Other End-user Industries

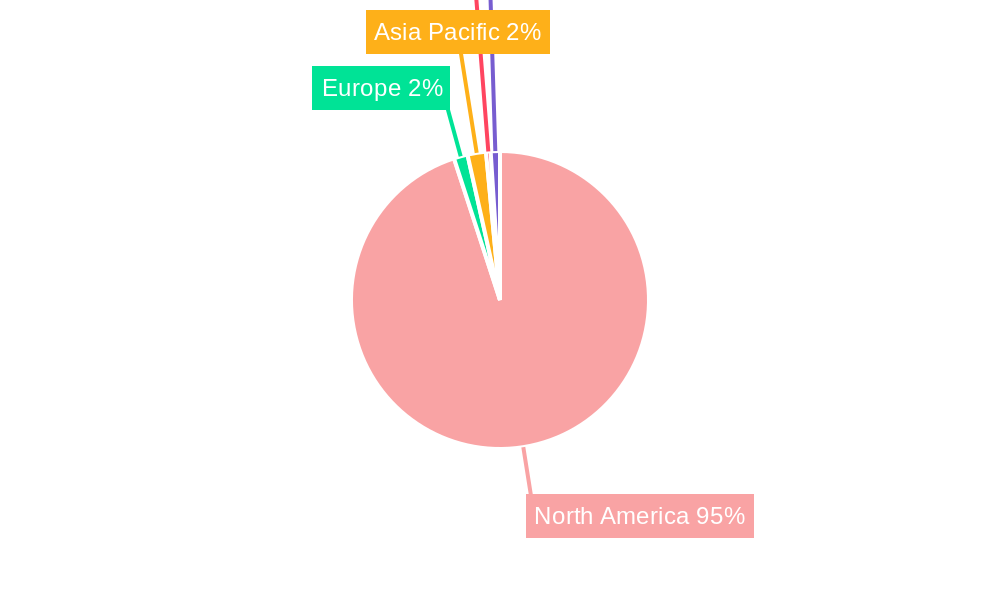

Print Label Market in Mexico Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Print Label Market in Mexico Regional Market Share

Geographic Coverage of Print Label Market in Mexico

Print Label Market in Mexico REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of Digital Print Technology; Technological Advancements Leading to Reduction in Cost and Run Length

- 3.3. Market Restrains

- 3.3.1. Lack of Products with Ability to Withstand Harsh Climatic Conditions

- 3.4. Market Trends

- 3.4.1. Flexographic Printing to Hold the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Print Technology

- 5.1.1. Offset

- 5.1.2. Flexography

- 5.1.3. Rotogravure

- 5.1.4. Screen

- 5.1.5. Letterpress

- 5.1.6. Digital Printing

- 5.2. Market Analysis, Insights and Forecast - by Label Type

- 5.2.1. Wet-glued Labels

- 5.2.2. Pressure Sensitive Labels (PSL)

- 5.2.3. Liner less Labels

- 5.2.4. In-mold Labels

- 5.2.5. Shrink Sleeve Labels

- 5.2.6. Multi-part Tracking Label

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Healthcare and Pharmaceutical

- 5.3.4. Cosmetics

- 5.3.5. Household

- 5.3.6. Industrial

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Print Technology

- 6. North America Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Print Technology

- 6.1.1. Offset

- 6.1.2. Flexography

- 6.1.3. Rotogravure

- 6.1.4. Screen

- 6.1.5. Letterpress

- 6.1.6. Digital Printing

- 6.2. Market Analysis, Insights and Forecast - by Label Type

- 6.2.1. Wet-glued Labels

- 6.2.2. Pressure Sensitive Labels (PSL)

- 6.2.3. Liner less Labels

- 6.2.4. In-mold Labels

- 6.2.5. Shrink Sleeve Labels

- 6.2.6. Multi-part Tracking Label

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Healthcare and Pharmaceutical

- 6.3.4. Cosmetics

- 6.3.5. Household

- 6.3.6. Industrial

- 6.3.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Print Technology

- 7. South America Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Print Technology

- 7.1.1. Offset

- 7.1.2. Flexography

- 7.1.3. Rotogravure

- 7.1.4. Screen

- 7.1.5. Letterpress

- 7.1.6. Digital Printing

- 7.2. Market Analysis, Insights and Forecast - by Label Type

- 7.2.1. Wet-glued Labels

- 7.2.2. Pressure Sensitive Labels (PSL)

- 7.2.3. Liner less Labels

- 7.2.4. In-mold Labels

- 7.2.5. Shrink Sleeve Labels

- 7.2.6. Multi-part Tracking Label

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Healthcare and Pharmaceutical

- 7.3.4. Cosmetics

- 7.3.5. Household

- 7.3.6. Industrial

- 7.3.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Print Technology

- 8. Europe Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Print Technology

- 8.1.1. Offset

- 8.1.2. Flexography

- 8.1.3. Rotogravure

- 8.1.4. Screen

- 8.1.5. Letterpress

- 8.1.6. Digital Printing

- 8.2. Market Analysis, Insights and Forecast - by Label Type

- 8.2.1. Wet-glued Labels

- 8.2.2. Pressure Sensitive Labels (PSL)

- 8.2.3. Liner less Labels

- 8.2.4. In-mold Labels

- 8.2.5. Shrink Sleeve Labels

- 8.2.6. Multi-part Tracking Label

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Healthcare and Pharmaceutical

- 8.3.4. Cosmetics

- 8.3.5. Household

- 8.3.6. Industrial

- 8.3.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Print Technology

- 9. Middle East & Africa Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Print Technology

- 9.1.1. Offset

- 9.1.2. Flexography

- 9.1.3. Rotogravure

- 9.1.4. Screen

- 9.1.5. Letterpress

- 9.1.6. Digital Printing

- 9.2. Market Analysis, Insights and Forecast - by Label Type

- 9.2.1. Wet-glued Labels

- 9.2.2. Pressure Sensitive Labels (PSL)

- 9.2.3. Liner less Labels

- 9.2.4. In-mold Labels

- 9.2.5. Shrink Sleeve Labels

- 9.2.6. Multi-part Tracking Label

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Healthcare and Pharmaceutical

- 9.3.4. Cosmetics

- 9.3.5. Household

- 9.3.6. Industrial

- 9.3.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Print Technology

- 10. Asia Pacific Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Print Technology

- 10.1.1. Offset

- 10.1.2. Flexography

- 10.1.3. Rotogravure

- 10.1.4. Screen

- 10.1.5. Letterpress

- 10.1.6. Digital Printing

- 10.2. Market Analysis, Insights and Forecast - by Label Type

- 10.2.1. Wet-glued Labels

- 10.2.2. Pressure Sensitive Labels (PSL)

- 10.2.3. Liner less Labels

- 10.2.4. In-mold Labels

- 10.2.5. Shrink Sleeve Labels

- 10.2.6. Multi-part Tracking Label

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Healthcare and Pharmaceutical

- 10.3.4. Cosmetics

- 10.3.5. Household

- 10.3.6. Industrial

- 10.3.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Print Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 UPM Raflatec

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 RR Donnelley & Sons Company (RRD)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sprink

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Taylor Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3M Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 STICKER'S PACK SA de CV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CCL Industries Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Clondalkin Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Avery Dennison Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fuji Seal International Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Multi-Color Mexico Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Papers and Conversions of Mexico*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Eximpro

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Brady Worldwide Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 UPM Raflatec

List of Figures

- Figure 1: Global Print Label Market in Mexico Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 3: North America Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 4: North America Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 5: North America Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 6: North America Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 11: South America Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 12: South America Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 13: South America Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 14: South America Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: South America Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 19: Europe Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 20: Europe Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 21: Europe Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 22: Europe Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 27: Middle East & Africa Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 28: Middle East & Africa Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 29: Middle East & Africa Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 30: Middle East & Africa Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 35: Asia Pacific Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 36: Asia Pacific Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 37: Asia Pacific Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 38: Asia Pacific Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 2: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 3: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Print Label Market in Mexico Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 6: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 7: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 13: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 14: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 20: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 21: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 33: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 34: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 43: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 44: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 45: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Print Label Market in Mexico?

The projected CAGR is approximately 4.24%.

2. Which companies are prominent players in the Print Label Market in Mexico?

Key companies in the market include UPM Raflatec, RR Donnelley & Sons Company (RRD), Sprink, Taylor Corporation, 3M Company, STICKER'S PACK SA de CV, CCL Industries Inc, Clondalkin Group, Avery Dennison Corporation, Fuji Seal International Inc, Multi-Color Mexico Corporation, Papers and Conversions of Mexico*List Not Exhaustive, Eximpro, Brady Worldwide Inc.

3. What are the main segments of the Print Label Market in Mexico?

The market segments include Print Technology, Label Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of Digital Print Technology; Technological Advancements Leading to Reduction in Cost and Run Length.

6. What are the notable trends driving market growth?

Flexographic Printing to Hold the Largest Market Share.

7. Are there any restraints impacting market growth?

Lack of Products with Ability to Withstand Harsh Climatic Conditions.

8. Can you provide examples of recent developments in the market?

October 2023 - All4Labels relocated to a larger facility spanning over 12,000 square meters in Mexico. It is implementing various new technologies to enhance its nationwide footprint as part of its expansion strategy. The addition of five new printing lines, emphasizing pressure-sensitive labels and shrink sleeves, is set to triple production capacity at the site. In phase two, the company is investing EUR 4 million (USD 4.32 million) in equipment, encompassing digital, flexo, and gravure presses, along with a comprehensive upgrade of its pre-press capabilities. This strategic expansion, coupled with the integration of advanced technologies, solidifies its presence and plays a pivotal role in fueling the growth of the flourishing label market in Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Print Label Market in Mexico," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Print Label Market in Mexico report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Print Label Market in Mexico?

To stay informed about further developments, trends, and reports in the Print Label Market in Mexico, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence