Key Insights

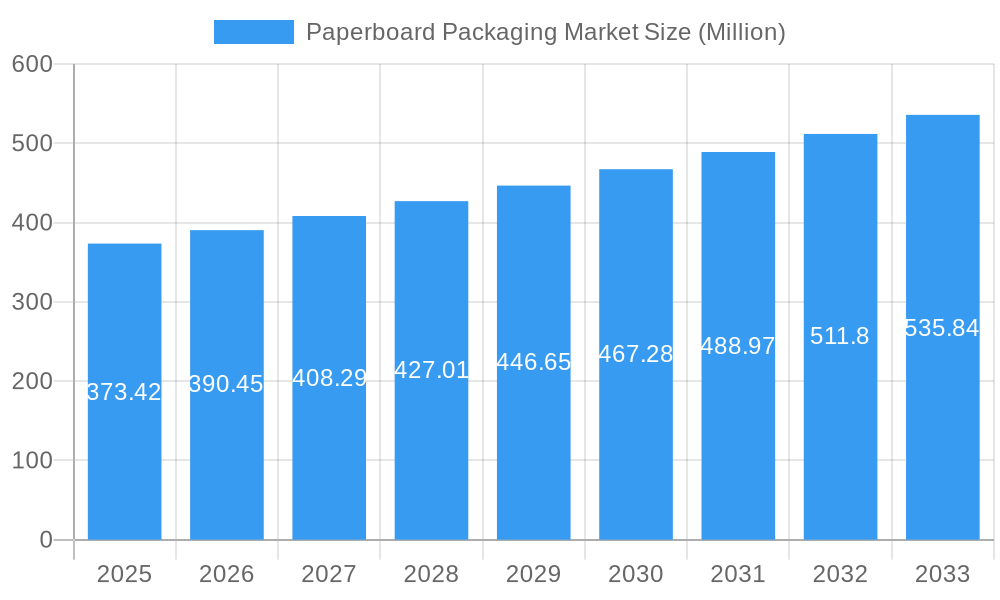

The global Paperboard Packaging Market is poised for robust expansion, projected to reach approximately $373.42 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 4.54% throughout the forecast period of 2025-2033. This growth is underpinned by a confluence of powerful drivers, including the escalating demand for sustainable and eco-friendly packaging solutions, a direct response to growing environmental consciousness among consumers and regulatory bodies. The inherent recyclability and biodegradability of paperboard make it a preferred choice over single-use plastics, a trend that is intensifying across various end-user industries. Furthermore, the burgeoning e-commerce sector continues to fuel the need for efficient and protective shipping solutions, with corrugated boxes playing a pivotal role in safeguarding goods during transit. Innovations in paperboard technology, leading to enhanced strength, moisture resistance, and printability, are also contributing significantly to market expansion, enabling its application in a wider array of products.

Paperboard Packaging Market Market Size (In Million)

The market's trajectory is further shaped by evolving consumer preferences and industry-specific needs. The Food and Beverage sector remains a dominant force, driven by an ever-increasing demand for convenient, shelf-stable, and attractively packaged products. Similarly, the Healthcare industry's reliance on sterile and secure packaging for pharmaceuticals and medical devices presents a substantial growth avenue. While the market enjoys strong growth, certain restraints could influence its pace. Fluctuations in raw material prices, particularly for pulp and paper, can impact manufacturing costs and profitability. Additionally, intense competition from alternative packaging materials and the need for significant investment in advanced manufacturing technologies to meet evolving demands represent ongoing challenges. Nevertheless, the overarching trend towards a circular economy and the inherent advantages of paperboard packaging are expected to propel sustained and healthy market growth.

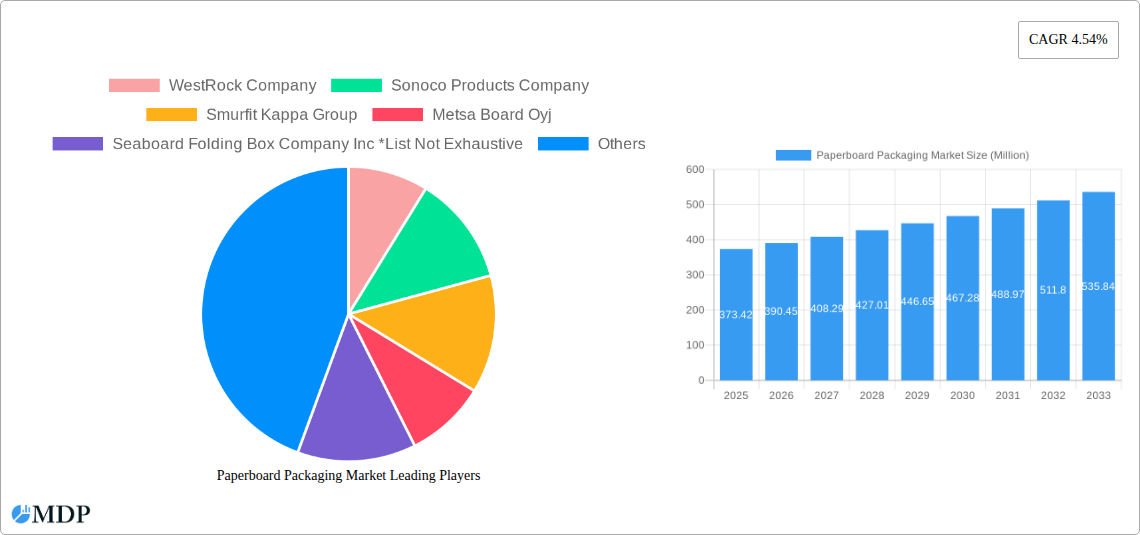

Paperboard Packaging Market Company Market Share

Here's an SEO-optimized and engaging report description for the Paperboard Packaging Market, incorporating all your specified details and adhering to the requested structure and word counts.

Dive deep into the dynamic Paperboard Packaging Market with this indispensable report, meticulously crafted to provide industry stakeholders with actionable insights and a definitive growth trajectory from 2019 to 2033. This comprehensive analysis, with 2025 as the base and estimated year, and a robust forecast period of 2025–2033, examines critical market dynamics, industry trends, leading segments, and strategic opportunities. Leveraging high-traffic keywords such as "paperboard packaging solutions," "corrugated box market," "folding carton industry," and "sustainable packaging trends," this report is engineered to maximize search visibility and attract key players in the global packaging ecosystem. Understand the competitive landscape, technological innovations, and evolving consumer preferences shaping the future of paperboard packaging.

Paperboard Packaging Market Market Dynamics & Concentration

The Paperboard Packaging Market is characterized by a moderate concentration of leading players, with a significant market share held by global giants. Innovation drivers are primarily centered on sustainability, enhanced functionality, and cost-effectiveness. Regulatory frameworks, particularly those promoting circular economy principles and reducing single-use plastics, are increasingly influencing market strategies. Product substitutes, such as flexible packaging and rigid plastics, pose a competitive threat, but the inherent recyclability and biodegradability of paperboard offer a strong counter-argument. End-user trends lean towards eco-friendly solutions, e-commerce ready packaging, and specialized applications in food, beverage, and healthcare. Mergers and acquisitions (M&A) activity remains a key indicator of market consolidation and strategic expansion, with an estimated X M&A deal counts observed in recent periods. Key market share percentages for dominant players are detailed within the report, offering a granular view of the competitive hierarchy.

- Market Concentration: Moderate, with key players holding substantial market share.

- Innovation Drivers: Sustainability, functionality, cost-effectiveness, e-commerce readiness.

- Regulatory Frameworks: Growing emphasis on recyclability, waste reduction, and extended producer responsibility.

- Product Substitutes: Flexible packaging, rigid plastics, metal cans.

- End-User Trends: Demand for eco-friendly, customizable, and protective packaging solutions.

- M&A Activities: Active, focused on market consolidation and vertical integration.

Paperboard Packaging Market Industry Trends & Analysis

The Paperboard Packaging Market is poised for significant expansion, driven by a confluence of robust growth drivers, rapid technological disruptions, evolving consumer preferences, and intense competitive dynamics. The escalating global demand for sustainable and environmentally friendly packaging solutions is a paramount growth catalyst, pushing manufacturers to invest heavily in recyclable and biodegradable paperboard options. The burgeoning e-commerce sector continues to fuel the demand for corrugated boxes and folding cartons that are not only protective but also aesthetically pleasing and optimized for shipping. Technological advancements in paperboard production, such as enhanced barrier properties, improved printability, and innovative designs, are enabling new applications and strengthening paperboard's competitive edge against traditional materials. Consumer preferences are increasingly shifting towards brands that demonstrate a commitment to environmental responsibility, making sustainable paperboard packaging a key differentiator. The competitive landscape is marked by ongoing innovation, strategic partnerships, and a relentless focus on cost optimization and supply chain efficiency. Market penetration for paperboard packaging is expected to continue its upward trajectory, with a projected Compound Annual Growth Rate (CAGR) of approximately XX% over the forecast period. The increasing awareness of the environmental impact of plastic packaging further solidifies paperboard's position as a preferred choice across numerous end-user industries. The report delves into the intricacies of these trends, providing data-driven insights into market penetration rates and the impact of key market influencers.

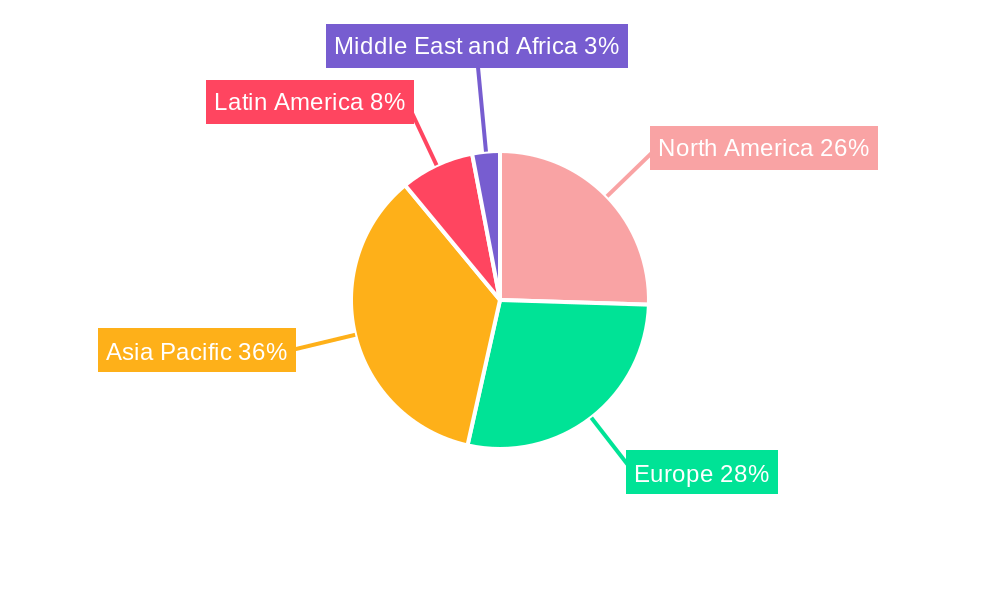

Leading Markets & Segments in Paperboard Packaging Market

North America and Europe currently dominate the Paperboard Packaging Market, driven by strong regulatory support for sustainable packaging, high consumer disposable income, and well-established e-commerce infrastructure. Within these regions, countries like the United States, Germany, and the United Kingdom are key contributors to market growth.

Grade Analysis:

- Cartonboard: This segment is expected to witness substantial growth, fueled by its extensive use in food & beverage, personal care, and pharmaceutical packaging. The demand for visually appealing and shelf-ready packaging solutions further boosts its market penetration.

- Containerboard: The bedrock of e-commerce, containerboard is experiencing robust demand due to the continuous expansion of online retail and the need for durable shipping solutions. This segment is intrinsically linked to global trade and logistics.

- Other Grades: This category encompasses specialized paperboards used in niche applications, and its growth is often tied to specific industry innovations and emerging market needs.

Product Type Analysis:

- Folding Cartons: Leading the product type segment, folding cartons are favored for their versatility, cost-effectiveness, and excellent printability, making them ideal for a wide array of consumer goods.

- Corrugated Boxes: Indispensable for shipping and transit packaging, corrugated boxes are experiencing a surge in demand, directly correlated with the growth of e-commerce and global supply chains.

- Other Types: This includes rigid boxes and specialized paperboard containers, catering to premium product packaging and specific industrial requirements.

End-User Industry Analysis:

- Food: The largest end-user industry, driven by the continuous demand for packaged food products and the need for safe, hygienic, and attractive packaging.

- Beverage: A significant contributor, with paperboard packaging widely used for beverage cartons and multipacks.

- Healthcare: Growing demand for pharmaceutical packaging, medical device containers, and healthcare product packaging due to increased healthcare awareness and spending.

- Personal Care: This sector utilizes folding cartons and other paperboard formats for cosmetics, toiletries, and hygiene products, emphasizing both functionality and aesthetic appeal.

- Household Care: Demand for packaging for detergents, cleaning supplies, and other household essentials.

- Electrical Products: Increasingly utilizing paperboard for packaging of consumer electronics and appliances, often requiring robust protective qualities.

Paperboard Packaging Market Product Developments

Product innovation in the Paperboard Packaging Market is sharply focused on enhancing sustainability, improving barrier properties for extended shelf life, and creating lightweight yet durable solutions. Advances in coating technologies and material science are enabling the development of paperboard packaging that is resistant to moisture, grease, and other environmental factors, expanding its applicability in challenging product categories. The integration of smart packaging features, such as track-and-trace capabilities and tamper-evident seals, is also a growing trend. Furthermore, companies are investing in novel designs that optimize space utilization during shipping and enhance unboxing experiences for consumers. These developments aim to provide a competitive edge by meeting stringent performance requirements and aligning with evolving consumer and regulatory demands for greener packaging alternatives.

Key Drivers of Paperboard Packaging Market Growth

The Paperboard Packaging Market is propelled by a combination of potent drivers. The escalating global emphasis on environmental sustainability and the increasing consumer preference for eco-friendly products are primary growth catalysts, driving the demand for recyclable and biodegradable paperboard. The burgeoning e-commerce sector, with its inherent need for robust and efficient shipping solutions, significantly boosts the demand for corrugated boxes. Technological advancements in paperboard production, including improved printing techniques and barrier coatings, are expanding its application range and competitiveness. Furthermore, favorable government regulations promoting the use of sustainable packaging materials and penalizing single-use plastics are accelerating market adoption. The cost-effectiveness and versatility of paperboard packaging compared to certain plastic alternatives also contribute to its widespread use across various industries.

Challenges in the Paperboard Packaging Market Market

Despite its robust growth, the Paperboard Packaging Market faces several challenges. Fluctuations in raw material prices, particularly pulp and recycled fiber, can impact production costs and profit margins. Intense competition from alternative packaging materials like plastics and flexible films necessitates continuous innovation and cost optimization. Stringent environmental regulations, while driving adoption, also require significant investment in sustainable manufacturing processes and compliance. Supply chain disruptions, geopolitical instability, and logistical complexities can affect the availability and delivery of raw materials and finished products. Furthermore, the need for specialized coatings or treatments to achieve specific barrier properties can sometimes increase the cost and complexity of paperboard packaging, posing a restraint in certain high-performance applications.

Emerging Opportunities in Paperboard Packaging Market

Emerging opportunities in the Paperboard Packaging Market are abundant and strategically positioned for long-term growth. The continued expansion of the global e-commerce landscape presents a sustained demand for innovative and resilient shipping solutions. The increasing consumer awareness and regulatory push for plastic reduction are creating a significant market opening for sustainable paperboard alternatives across numerous product categories. Innovations in bio-based coatings and biodegradable adhesives are unlocking new possibilities for enhanced functionality and environmental performance. Strategic partnerships between paperboard manufacturers and brands focused on circular economy initiatives can lead to the development of closed-loop systems and novel recycling programs. Furthermore, the growing demand for premium and experiential packaging in sectors like luxury goods and gourmet food presents an opportunity for sophisticated paperboard designs and finishes.

Leading Players in the Paperboard Packaging Market Sector

- WestRock Company

- Sonoco Products Company

- Smurfit Kappa Group

- Metsa Board Oyj

- Seaboard Folding Box Company Inc

- Rengo Co Ltd

- Oji Holdings Corporation

- International Paper Company

- DS Smith Plc

- Visy Industries

- Nippon Paper Industries Co Ltd

- Packaging Corporation of America

- Cascades Inc

- Graphic Packaging International

- Mondi Plc

Key Milestones in Paperboard Packaging Market Industry

- September 2022: Smurfit Kappa, a multinational corrugated packaging manufacturer, has agreed to purchase Paperbox, a packaging facility in Brazil. The company's footprint in the nation will be enhanced by this purchase, which will also increase manufacturing capacity, enabling the company to continue developing new business prospects and new client alliances.

- April 2022: DS Smith has created a corrugated cardboard box for shipments of medical devices made through online commerce. The corrugated cardboard box employs a single-material approach instead of glued packaging with a single-use plastic insert. Furthermore, the packaging is created to be readily recyclable and enhance environmental protection along the supply chain.

Strategic Outlook for Paperboard Packaging Market Market

The strategic outlook for the Paperboard Packaging Market is exceptionally promising, driven by a clear trajectory towards sustainability and e-commerce dominance. Growth accelerators include continued investment in advanced recycling technologies, the development of bio-based and compostable paperboard solutions, and the integration of smart packaging features to enhance traceability and consumer engagement. Strategic opportunities lie in expanding into emerging markets with rapidly growing consumer bases and increasing disposable incomes. Furthermore, collaborations focused on developing innovative, lightweight, and highly protective packaging for fragile goods and specialized products will be crucial. Manufacturers will need to prioritize supply chain resilience and operational efficiency to navigate potential disruptions and maintain competitive pricing, ensuring paperboard packaging remains the preferred choice for a sustainable future.

Paperboard Packaging Market Segmentation

-

1. Grade

- 1.1. Cartonboard

- 1.2. Containerboard

- 1.3. Other Grades

-

2. Product Type

- 2.1. Folding Cartons

- 2.2. Corrugated Boxes

- 2.3. Other Types

-

3. End-User Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Healthcare

- 3.4. Personal Care

- 3.5. Household Care

- 3.6. Electrical Products

- 3.7. Other End-User Industries

Paperboard Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Italy

- 2.4. France

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Mexico

- 4.4. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Paperboard Packaging Market Regional Market Share

Geographic Coverage of Paperboard Packaging Market

Paperboard Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong demand from the e-commerce sector; Growing adoption of light weighting materials and scope for printing innovations propelling growth in the electronics & personal care segment

- 3.3. Market Restrains

- 3.3.1. Effects of Deforestation on Paper Packaging; Increasing Operational Costs

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Food and Beverage Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Paperboard Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 5.1.1. Cartonboard

- 5.1.2. Containerboard

- 5.1.3. Other Grades

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Folding Cartons

- 5.2.2. Corrugated Boxes

- 5.2.3. Other Types

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Healthcare

- 5.3.4. Personal Care

- 5.3.5. Household Care

- 5.3.6. Electrical Products

- 5.3.7. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 6. North America Paperboard Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 6.1.1. Cartonboard

- 6.1.2. Containerboard

- 6.1.3. Other Grades

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Folding Cartons

- 6.2.2. Corrugated Boxes

- 6.2.3. Other Types

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Healthcare

- 6.3.4. Personal Care

- 6.3.5. Household Care

- 6.3.6. Electrical Products

- 6.3.7. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 7. Europe Paperboard Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 7.1.1. Cartonboard

- 7.1.2. Containerboard

- 7.1.3. Other Grades

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Folding Cartons

- 7.2.2. Corrugated Boxes

- 7.2.3. Other Types

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Healthcare

- 7.3.4. Personal Care

- 7.3.5. Household Care

- 7.3.6. Electrical Products

- 7.3.7. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 8. Asia Pacific Paperboard Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 8.1.1. Cartonboard

- 8.1.2. Containerboard

- 8.1.3. Other Grades

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Folding Cartons

- 8.2.2. Corrugated Boxes

- 8.2.3. Other Types

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Healthcare

- 8.3.4. Personal Care

- 8.3.5. Household Care

- 8.3.6. Electrical Products

- 8.3.7. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 9. Latin America Paperboard Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 9.1.1. Cartonboard

- 9.1.2. Containerboard

- 9.1.3. Other Grades

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Folding Cartons

- 9.2.2. Corrugated Boxes

- 9.2.3. Other Types

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Healthcare

- 9.3.4. Personal Care

- 9.3.5. Household Care

- 9.3.6. Electrical Products

- 9.3.7. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 10. Middle East and Africa Paperboard Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Grade

- 10.1.1. Cartonboard

- 10.1.2. Containerboard

- 10.1.3. Other Grades

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Folding Cartons

- 10.2.2. Corrugated Boxes

- 10.2.3. Other Types

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Healthcare

- 10.3.4. Personal Care

- 10.3.5. Household Care

- 10.3.6. Electrical Products

- 10.3.7. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by Grade

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WestRock Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sonoco Products Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Smurfit Kappa Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Metsa Board Oyj

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Seaboard Folding Box Company Inc *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rengo Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oji Holdings Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 International Paper Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DS Smith Plc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Visy Industries

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nippon Paper Industries Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Packaging Corporation of America

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Cascades Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Graphic Packaging International

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Mondi Plc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 WestRock Company

List of Figures

- Figure 1: Global Paperboard Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Paperboard Packaging Market Revenue (Million), by Grade 2025 & 2033

- Figure 3: North America Paperboard Packaging Market Revenue Share (%), by Grade 2025 & 2033

- Figure 4: North America Paperboard Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Paperboard Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Paperboard Packaging Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 7: North America Paperboard Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 8: North America Paperboard Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Paperboard Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Paperboard Packaging Market Revenue (Million), by Grade 2025 & 2033

- Figure 11: Europe Paperboard Packaging Market Revenue Share (%), by Grade 2025 & 2033

- Figure 12: Europe Paperboard Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 13: Europe Paperboard Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Europe Paperboard Packaging Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 15: Europe Paperboard Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 16: Europe Paperboard Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Paperboard Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Paperboard Packaging Market Revenue (Million), by Grade 2025 & 2033

- Figure 19: Asia Pacific Paperboard Packaging Market Revenue Share (%), by Grade 2025 & 2033

- Figure 20: Asia Pacific Paperboard Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Asia Pacific Paperboard Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Asia Pacific Paperboard Packaging Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 23: Asia Pacific Paperboard Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Asia Pacific Paperboard Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Paperboard Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Paperboard Packaging Market Revenue (Million), by Grade 2025 & 2033

- Figure 27: Latin America Paperboard Packaging Market Revenue Share (%), by Grade 2025 & 2033

- Figure 28: Latin America Paperboard Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 29: Latin America Paperboard Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Latin America Paperboard Packaging Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 31: Latin America Paperboard Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 32: Latin America Paperboard Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Paperboard Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Paperboard Packaging Market Revenue (Million), by Grade 2025 & 2033

- Figure 35: Middle East and Africa Paperboard Packaging Market Revenue Share (%), by Grade 2025 & 2033

- Figure 36: Middle East and Africa Paperboard Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 37: Middle East and Africa Paperboard Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Middle East and Africa Paperboard Packaging Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 39: Middle East and Africa Paperboard Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 40: Middle East and Africa Paperboard Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Paperboard Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Paperboard Packaging Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 2: Global Paperboard Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Paperboard Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Paperboard Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Paperboard Packaging Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 6: Global Paperboard Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Global Paperboard Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: Global Paperboard Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Paperboard Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Paperboard Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Paperboard Packaging Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 12: Global Paperboard Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 13: Global Paperboard Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 14: Global Paperboard Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Germany Paperboard Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Paperboard Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Italy Paperboard Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Paperboard Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Paperboard Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Paperboard Packaging Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 21: Global Paperboard Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global Paperboard Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 23: Global Paperboard Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Paperboard Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Paperboard Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Paperboard Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Paperboard Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Paperboard Packaging Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 29: Global Paperboard Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Global Paperboard Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 31: Global Paperboard Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Paperboard Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Paperboard Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Paperboard Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Latin America Paperboard Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Paperboard Packaging Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 37: Global Paperboard Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global Paperboard Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 39: Global Paperboard Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Saudi Arabia Paperboard Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: South Africa Paperboard Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East and Africa Paperboard Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Paperboard Packaging Market?

The projected CAGR is approximately 4.54%.

2. Which companies are prominent players in the Paperboard Packaging Market?

Key companies in the market include WestRock Company, Sonoco Products Company, Smurfit Kappa Group, Metsa Board Oyj, Seaboard Folding Box Company Inc *List Not Exhaustive, Rengo Co Ltd, Oji Holdings Corporation, International Paper Company, DS Smith Plc, Visy Industries, Nippon Paper Industries Co Ltd, Packaging Corporation of America, Cascades Inc, Graphic Packaging International, Mondi Plc.

3. What are the main segments of the Paperboard Packaging Market?

The market segments include Grade, Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 373.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Strong demand from the e-commerce sector; Growing adoption of light weighting materials and scope for printing innovations propelling growth in the electronics & personal care segment.

6. What are the notable trends driving market growth?

Increasing Demand from Food and Beverage Segment.

7. Are there any restraints impacting market growth?

Effects of Deforestation on Paper Packaging; Increasing Operational Costs.

8. Can you provide examples of recent developments in the market?

September 2022: Smurfit Kappa, a multinational corrugated packaging manufacturer, has agreed to purchase Paperbox, a packaging facility in Brazil. The company's footprint in the nation will be enhanced by this purchase, which will also increase manufacturing capacity, enabling the company to continue developing new business prospects and new client alliances.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Paperboard Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Paperboard Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Paperboard Packaging Market?

To stay informed about further developments, trends, and reports in the Paperboard Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence