Key Insights

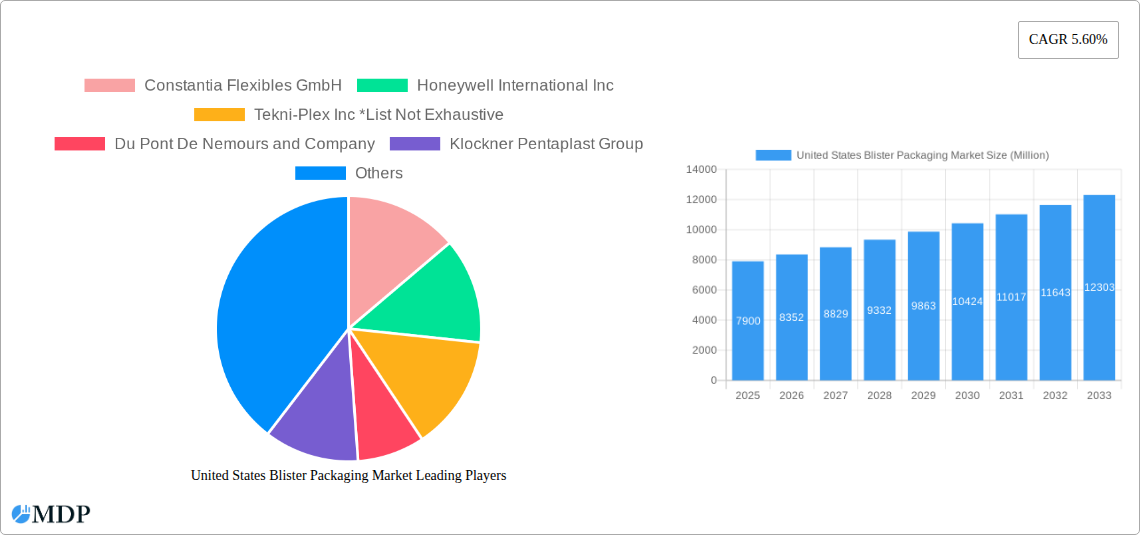

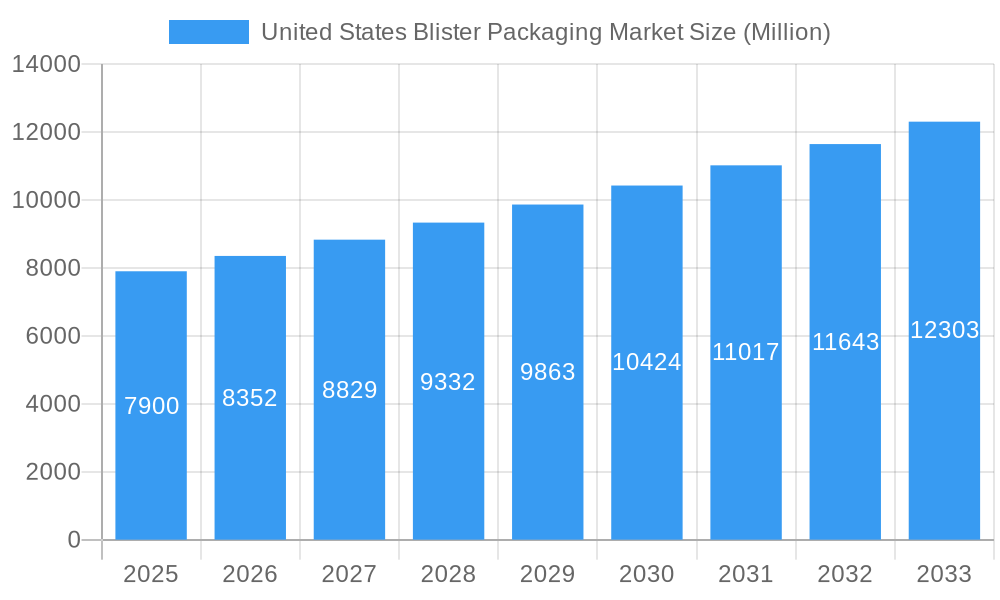

The United States blister packaging market is projected for substantial growth, anticipated to reach a market size of $30.73 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.4% through 2033. This expansion is driven by the increasing demand for protective and convenient packaging solutions across key sectors. Pharmaceutical applications are a major growth catalyst, leveraging blister packs for enhanced product integrity, tamper-evidence, and the growing preference for single-dose and pre-portioned products. The consumer goods sector, including food, beverages, cosmetics, and personal care, is also adopting blister packaging for its product visibility and preservation capabilities. Technological advancements in thermoforming and coldforming are enabling more efficient production of intricate and sustainable designs, minimizing material waste. The market is further supported by a shift towards recyclable and biodegradable materials, alongside regulatory emphasis on product safety and extended shelf life.

United States Blister Packaging Market Market Size (In Billion)

The competitive landscape features prominent global players such as Constantia Flexibles GmbH, Honeywell International Inc., Tekni-Plex Inc., Du Pont De Nemours and Company, Klockner Pentaplast Group, Sonoco Products Company, The Dow Chemical Company, Westrock Company, and Amcor PLC. These entities are pursuing mergers, acquisitions, and product innovation to expand market share. Key innovation areas include enhanced barrier properties for extended shelf life, child-resistant features, and user-friendly designs. Challenges such as raw material cost volatility and environmental concerns are being addressed through investments in eco-friendly materials and advanced recycling technologies. The United States, a major hub for pharmaceuticals and consumer goods, is expected to maintain its position as the leading market for blister packaging throughout the forecast period.

United States Blister Packaging Market Company Market Share

This report provides an in-depth analysis of the United States Blister Packaging Market, focusing on market size, growth trends, and future projections.

United States Blister Packaging Market Market Dynamics & Concentration

The United States Blister Packaging Market is characterized by a dynamic interplay of innovation, evolving regulatory landscapes, and shifting end-user demands. Market concentration is moderate, with key players vying for market share through strategic expansions and technological advancements. Innovation drivers are primarily fueled by the demand for enhanced product protection, tamper-evidence, and increasing pressure for sustainable packaging solutions. Regulatory frameworks, particularly within the pharmaceutical sector, play a significant role in dictating material choices and design specifications, often mandating stringent safety and efficacy standards. Product substitutes, such as pouches and bottles, present a competitive challenge, necessitating continuous innovation in blister packaging to maintain its market dominance. End-user trends are leaning towards convenience, child-resistant features, and improved consumer experience, especially in the pharmaceutical and consumer goods segments. Mergers and acquisitions (M&A) activities are a notable aspect of market dynamics, indicating a strategic consolidation to gain market access, technological capabilities, and economies of scale. For instance, the historical period has seen several M&A deals aimed at expanding product portfolios and geographical reach. The market share distribution is influenced by the specialized needs of diverse end-user industries.

- Key Market Dynamics:

- Increasing demand for pharmaceutical and healthcare packaging solutions.

- Growing adoption of sustainable and recyclable blister packaging materials.

- Impact of government regulations on material selection and product design.

- Competitive pressure from alternative packaging formats.

- Focus on child-resistant and senior-friendly blister packaging.

- M&A Activities: Strategic acquisitions are expected to continue as companies aim to strengthen their market position and expand their service offerings in the US blister packaging sector.

United States Blister Packaging Market Industry Trends & Analysis

The United States Blister Packaging Market is poised for significant growth, driven by a confluence of robust economic factors, technological advancements, and evolving consumer preferences. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 5.8% between 2025 and 2033, reflecting sustained demand across key end-user industries. Technological disruptions are transforming the manufacturing processes, with a greater emphasis on automation, advanced printing techniques, and the development of novel materials that offer enhanced barrier properties and improved sustainability profiles. Consumer preferences are increasingly dictating packaging designs, with a growing demand for user-friendly, aesthetically pleasing, and environmentally conscious options. This trend is particularly evident in the consumer goods sector, where attractive and informative packaging can significantly influence purchasing decisions. The pharmaceutical industry continues to be a dominant force, with blister packaging providing essential protection and tamper-evidence for medications, especially oral solid dosages. The market penetration of advanced blister packaging solutions is expected to deepen as manufacturers invest in research and development to meet the stringent requirements of the healthcare sector and the growing demand for sustainable alternatives. Competitive dynamics are shaped by the continuous introduction of innovative products, strategic partnerships, and the ability of companies to adapt to changing market needs. The integration of digital technologies in packaging, such as serialization for track-and-trace capabilities in pharmaceuticals, is another emerging trend that is enhancing the value proposition of blister packaging. The market’s trajectory is also influenced by the broader economic health of the United States, with increased consumer spending directly correlating to higher demand for packaged goods. The continuous innovation in materials science, leading to the development of bio-based and recycled content for blister packs, is further propelling market growth and aligning with global sustainability initiatives.

Leading Markets & Segments in United States Blister Packaging Market

The United States Blister Packaging Market is a multifaceted landscape, with specific segments demonstrating pronounced dominance and growth potential. Among the Process segments, Thermoforming stands out as the most prevalent method due to its versatility, cost-effectiveness, and ability to create complex shapes for a wide array of products. Its dominance is underpinned by its widespread adoption in the pharmaceutical and consumer goods industries for packaging everything from pills to small electronic devices. Coldforming, while more specialized, holds significant sway in high-barrier pharmaceutical packaging applications where moisture and oxygen protection are paramount, particularly for sensitive drugs.

In terms of Material, Plastic Films reign supreme, driven by their excellent formability, transparency, and cost-efficiency. Materials like PVC, PET, and PP are extensively used across various applications. Paper and Paperboard are gaining traction as a more sustainable option, often used in conjunction with plastic films or for specific consumer goods packaging where rigidity and printability are key. Aluminum remains critical for high-barrier applications, especially in the pharmaceutical sector, providing an impenetrable shield against environmental factors. Other Materials, including specialized polymers and barrier coatings, are emerging as innovation frontiers, catering to niche requirements.

The End-User Industry landscape is prominently led by the Pharmaceutical sector. This dominance stems from the critical need for safe, sterile, and tamper-evident packaging for prescription and over-the-counter medications. The stringent regulatory requirements and the growing global healthcare demand ensure a consistent and expanding market for pharmaceutical-grade blister packaging. The Consumer Goods sector is another major consumer, utilizing blister packs for electronics, toys, personal care items, and small hardware due to their product visibility and security features. The Industrial sector, while a smaller segment, utilizes blister packaging for components, tools, and spare parts where protection and organization are essential.

- Dominant Process:

- Thermoforming: Characterized by high adoption rates in pharmaceuticals and consumer goods due to its flexibility and cost-effectiveness.

- Dominant Material:

- Plastic Films (PVC, PET, PP): Favored for their excellent formability, transparency, and affordability across diverse applications.

- Dominant End-User Industry:

- Pharmaceutical: Driven by strict regulatory requirements, demand for drug safety, and a broad range of oral solid dosage forms.

- Consumer Goods: Benefiting from product visibility, security, and attractive display capabilities.

United States Blister Packaging Market Product Developments

The United States Blister Packaging Market is witnessing a surge in product development, primarily focused on enhancing sustainability and functionality. Innovations include the development of recycle-ready healthcare blister systems, such as Amcor's AmSky, which offers a more sustainable option with an optimized carbon footprint for oral solid medications and nutraceuticals. Another significant advancement is Huhtamaki's mono-material PET blister lid, the Push Tab, which is free from aluminum, providing a more environmentally sustainable alternative to traditional push-through blisters without compromising the stringent safety requirements of pharmaceutical and healthcare packaging. These developments highlight a clear trend towards materials with reduced environmental impact and improved end-of-life recyclability, while maintaining high performance standards demanded by regulated industries.

Key Drivers of United States Blister Packaging Market Growth

The growth of the United States Blister Packaging Market is propelled by several key factors. The expanding pharmaceutical and healthcare industry, with its continuous introduction of new drugs and increasing demand for sterile, tamper-evident packaging, is a primary driver. Growing consumer demand for visually appealing, securely packaged, and convenient products across various sectors, including consumer goods and electronics, also fuels market expansion. Furthermore, increasing regulatory pressure for product safety and integrity, coupled with a rising emphasis on sustainable and recyclable packaging solutions, is pushing manufacturers to innovate and adopt advanced blister packaging technologies. The convenience and product protection offered by blister packs make them indispensable for a wide range of goods.

Challenges in the United States Blister Packaging Market Market

Despite robust growth, the United States Blister Packaging Market faces several challenges. Stringent and evolving regulatory compliance, particularly within the pharmaceutical sector, demands continuous investment in research and development and can lead to increased production costs. Fluctuations in raw material prices, especially for plastics and aluminum, can impact profitability and supply chain stability. The competitive pressure from alternative packaging formats, such as pouches and bottles, necessitates ongoing innovation to maintain market share. Furthermore, the increasing demand for sustainable packaging presents a challenge in developing cost-effective and widely recyclable blister solutions that meet performance requirements, especially concerning barrier properties.

Emerging Opportunities in United States Blister Packaging Market

The United States Blister Packaging Market is ripe with emerging opportunities, primarily driven by technological advancements and a growing focus on sustainability. The development of advanced barrier materials, biodegradable, and compostable blister films presents significant market potential, aligning with increasing consumer and regulatory demand for eco-friendly packaging. Strategic partnerships between packaging manufacturers and pharmaceutical or consumer goods companies can foster innovation and accelerate the adoption of new blister packaging solutions. The expansion of blister packaging into new applications, such as specialty foods and nutraceuticals, where product visibility and protection are crucial, offers further growth avenues. Moreover, the integration of smart packaging technologies, including RFID tags and QR codes for enhanced traceability and consumer engagement, represents a promising frontier for value-added blister packaging.

Leading Players in the United States Blister Packaging Market Sector

- Amcor PLC

- Constantia Flexibles GmbH

- Du Pont De Nemours and Company

- Honeywell International Inc

- Klockner Pentaplast Group

- Sonoco Products Company

- Tekni-Plex Inc

- The Dow Chemical Company

- Westrock Company

Key Milestones in United States Blister Packaging Market Industry

- November 2022: Amcor's AmSky, a recycle-ready healthcare blister system, won the US Plastics Pact Sustainable Packaging Innovation Award, highlighting a significant step towards more sustainable healthcare packaging for oral solid medications and nutraceuticals.

- April 2022: Huhtamaki launched the Push Tab, a first-to-market mono-material PET blister lid free from aluminum, offering a more environmentally sustainable alternative for pharmaceutical and healthcare packaging.

Strategic Outlook for United States Blister Packaging Market Market

The strategic outlook for the United States Blister Packaging Market is highly positive, characterized by a strong focus on innovation, sustainability, and market expansion. Growth will be accelerated by the continuous demand from the pharmaceutical sector for secure and compliant packaging, alongside the burgeoning need for eco-friendly solutions across all end-user industries. Companies that invest in developing advanced materials, such as recyclable and compostable films, and embrace circular economy principles will likely gain a competitive edge. Strategic collaborations and partnerships, particularly in co-developing novel packaging formats and sustainable alternatives, will be crucial. Furthermore, the integration of smart technologies for enhanced product traceability and consumer engagement will unlock new market opportunities and solidify the indispensable role of blister packaging in the US market.

United States Blister Packaging Market Segmentation

-

1. Process

- 1.1. Thermoforming

- 1.2. Coldforming

-

2. Material

- 2.1. Plastic Films

- 2.2. Paper and Paperboard

- 2.3. Aluminum

- 2.4. Other Materials

-

3. End-User Industry

- 3.1. Consumer Goods

- 3.2. Pharmaceutical

- 3.3. Industrial

- 3.4. Other End-User Industries

United States Blister Packaging Market Segmentation By Geography

- 1. United States

United States Blister Packaging Market Regional Market Share

Geographic Coverage of United States Blister Packaging Market

United States Blister Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Geriatric Population and Prevalence of Diseases; Product Innovations Such as Downsizing Coupled with Relatively Low Costs

- 3.3. Market Restrains

- 3.3.1. Advent of New Printing Technologies

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Sector is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Blister Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Thermoforming

- 5.1.2. Coldforming

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Plastic Films

- 5.2.2. Paper and Paperboard

- 5.2.3. Aluminum

- 5.2.4. Other Materials

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Consumer Goods

- 5.3.2. Pharmaceutical

- 5.3.3. Industrial

- 5.3.4. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Constantia Flexibles GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tekni-Plex Inc *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Du Pont De Nemours and Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Klockner Pentaplast Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sonoco Products Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Dow Chemical Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Westrock Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amcor PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Constantia Flexibles GmbH

List of Figures

- Figure 1: United States Blister Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Blister Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: United States Blister Packaging Market Revenue billion Forecast, by Process 2020 & 2033

- Table 2: United States Blister Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 3: United States Blister Packaging Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 4: United States Blister Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Blister Packaging Market Revenue billion Forecast, by Process 2020 & 2033

- Table 6: United States Blister Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: United States Blister Packaging Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 8: United States Blister Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Blister Packaging Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the United States Blister Packaging Market?

Key companies in the market include Constantia Flexibles GmbH, Honeywell International Inc, Tekni-Plex Inc *List Not Exhaustive, Du Pont De Nemours and Company, Klockner Pentaplast Group, Sonoco Products Company, The Dow Chemical Company, Westrock Company, Amcor PLC.

3. What are the main segments of the United States Blister Packaging Market?

The market segments include Process, Material, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.73 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Geriatric Population and Prevalence of Diseases; Product Innovations Such as Downsizing Coupled with Relatively Low Costs.

6. What are the notable trends driving market growth?

Pharmaceutical Sector is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Advent of New Printing Technologies.

8. Can you provide examples of recent developments in the market?

November 2022- Amsky, Amcor's breakthrough recycle-ready healthcare blister system innovation, has won the US Plastics Pact Sustainable Packaging Innovation Award in the Recyclability category. AmSky offers a more sustainable option and an optimized carbon footprint for the most in-demand healthcare packaging type, blister packaging, which is widely used for packaging and protecting oral solid medications and nutraceuticals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Blister Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Blister Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Blister Packaging Market?

To stay informed about further developments, trends, and reports in the United States Blister Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence