Key Insights

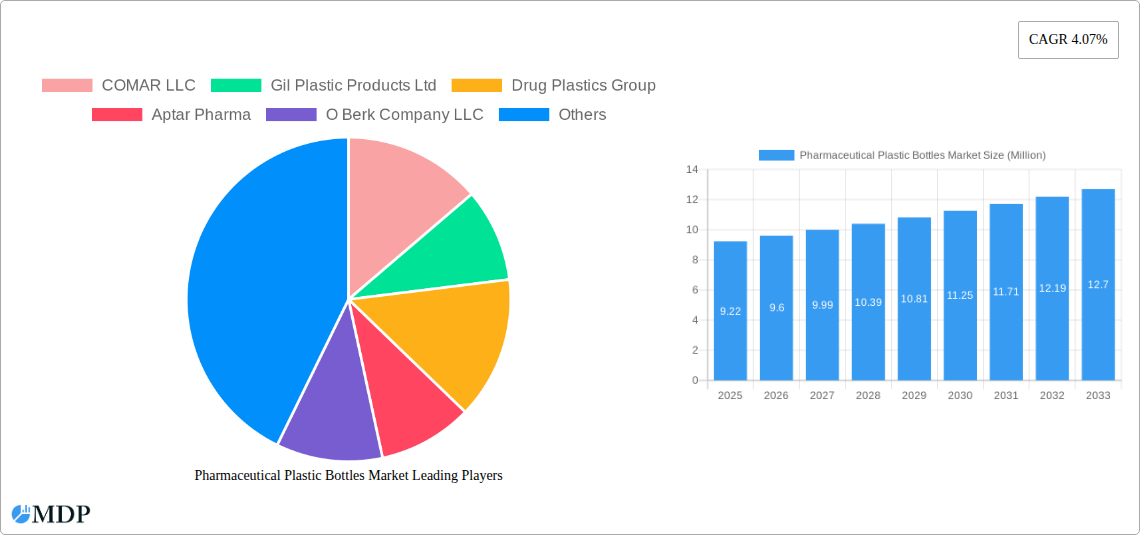

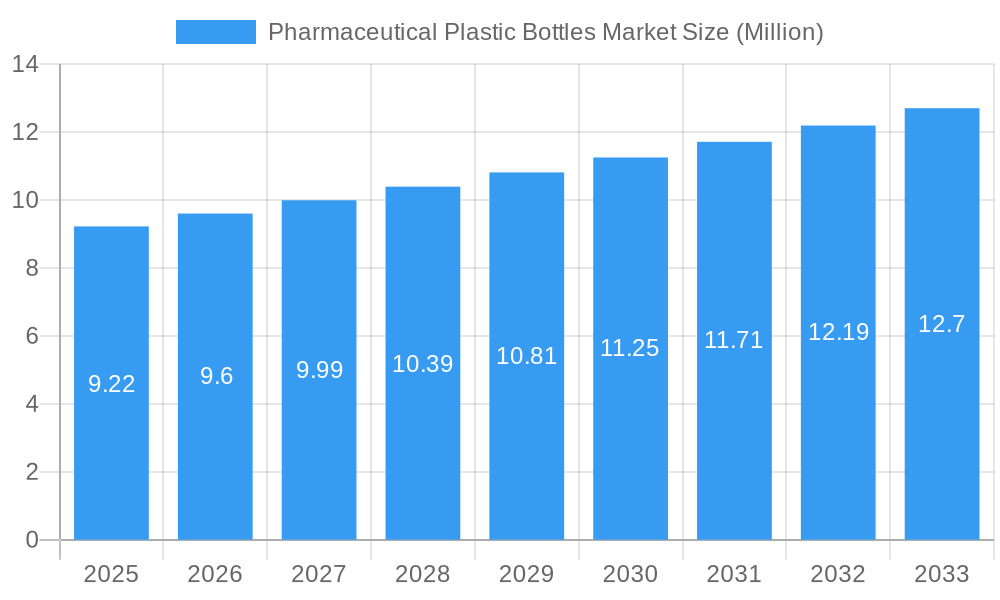

The global Pharmaceutical Plastic Bottles Market is poised for robust growth, projected to reach a substantial value of 9.22 million units by 2025. Driven by an anticipated Compound Annual Growth Rate (CAGR) of 4.07%, this expansion underscores the increasing demand for safe, reliable, and cost-effective packaging solutions within the pharmaceutical industry. The market's dynamism is fueled by several key drivers, including the escalating prevalence of chronic diseases, the growing global population, and the continuous innovation in drug delivery systems. Manufacturers are increasingly opting for plastic bottles due to their lightweight nature, durability, and versatility, which contribute to reduced transportation costs and enhanced product integrity. Furthermore, advancements in material science have led to the development of specialized plastics offering superior chemical resistance and barrier properties, crucial for preserving the efficacy of sensitive pharmaceutical formulations.

Pharmaceutical Plastic Bottles Market Market Size (In Million)

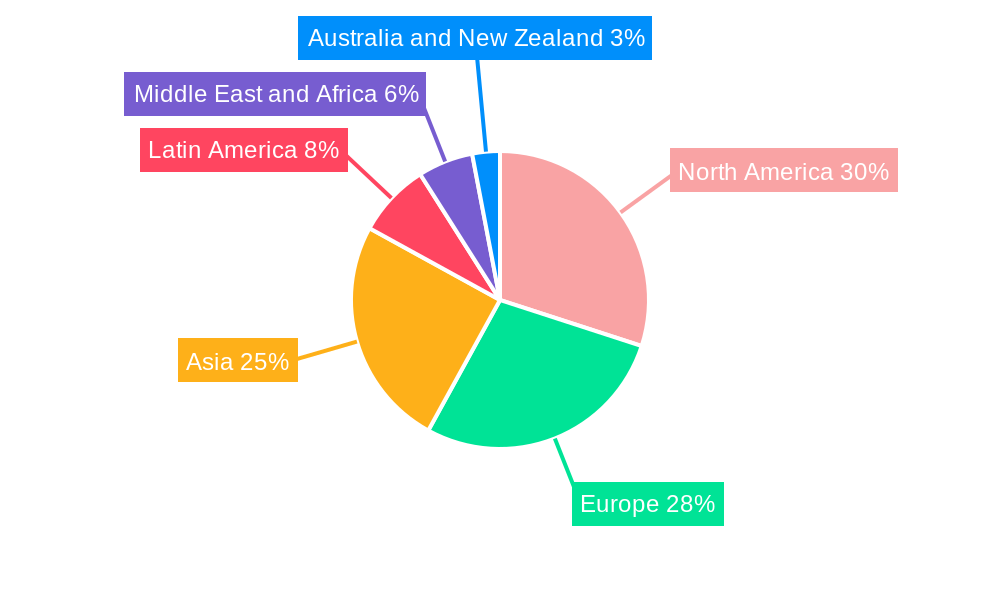

The market is segmented by raw material, with Polyethylene Terephthalate (PET) and Polypropylene (PP) dominating due to their excellent chemical resistance and cost-effectiveness. In terms of type, Liquid Bottles are expected to hold a significant share, driven by the widespread use of liquid medications and oral solutions. The growing sophistication of drug delivery methods also fuels demand for specialized formats like Dropper Bottles and Nasal Spray Bottles. Geographically, North America and Europe currently lead the market, owing to well-established pharmaceutical industries and stringent quality control standards. However, the Asia-Pacific region, particularly China and India, is emerging as a high-growth area, propelled by a burgeoning pharmaceutical manufacturing base, increasing healthcare expenditure, and a large patient pool. Emerging trends include the adoption of sustainable and recyclable plastic materials, as well as the integration of smart packaging technologies for enhanced traceability and patient compliance.

Pharmaceutical Plastic Bottles Market Company Market Share

Unlock crucial insights into the rapidly evolving pharmaceutical plastic bottles market with this comprehensive, SEO-optimized report. Delve into market dynamics, identify key growth drivers, and analyze the competitive landscape shaping the future of pharmaceutical packaging. This in-depth analysis covers market segmentation, regional dominance, product innovations, and strategic outlook, providing actionable intelligence for manufacturers, suppliers, and stakeholders.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

Pharmaceutical Plastic Bottles Market Dynamics & Concentration

The pharmaceutical plastic bottles market is characterized by a moderately consolidated landscape, with key players holding significant market share, estimated at over 60% by leading manufacturers. Innovation remains a primary driver, fueled by the continuous need for advanced, safer, and more sustainable pharma packaging solutions. Stringent regulatory frameworks, such as those from the FDA and EMA, dictate material safety, product integrity, and child-resistance features, heavily influencing product development. The market also faces pressure from product substitutes like glass, though plastic's lightweight, shatter-resistant, and cost-effective nature provides a distinct advantage. End-user trends are leaning towards smaller, single-dose formats for convenience and reduced waste, alongside an increasing demand for specialty pharmaceutical bottles like nasal spray bottles and dropper bottles for precise drug delivery. Mergers and acquisitions (M&A) activity is moderate, with an estimated xx M&A deals in the historical period, primarily aimed at expanding geographical reach or acquiring specific technological capabilities.

- Market Concentration: Moderately consolidated with key players dominating market share.

- Innovation Drivers: Need for enhanced safety, sustainability, and advanced drug delivery systems.

- Regulatory Frameworks: FDA, EMA, and other regional bodies set strict standards for material, design, and functionality.

- Product Substitutes: Competition from glass bottles, though plastic offers superior durability and cost-effectiveness.

- End-User Trends: Growing demand for single-dose packaging and specialized bottle types.

- M&A Activities: Moderate, focused on strategic expansion and technological integration.

Pharmaceutical Plastic Bottles Market Industry Trends & Analysis

The global pharmaceutical plastic bottles market is poised for significant expansion, driven by the escalating demand for pharmaceuticals, increasing healthcare expenditure worldwide, and the growing adoption of plastic containers due to their inherent advantages. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. Technological advancements in plastic bottle manufacturing are playing a pivotal role, enabling the production of lighter, more durable, and aesthetically superior containers that offer enhanced barrier properties to protect sensitive medications. Consumer preferences are increasingly shifting towards user-friendly packaging, including features like tamper-evident seals and easy-to-open caps, particularly for over-the-counter (OTC) drugs and dietary supplements. The competitive dynamics are intensifying, with manufacturers focusing on product differentiation through material innovation, specialized designs, and sustainable manufacturing practices. Furthermore, the growing prevalence of chronic diseases and the aging global population are directly contributing to the rise in pharmaceutical consumption, thereby boosting the demand for reliable and efficient pharmaceutical packaging solutions. The penetration of PET pharmaceutical bottles and PP pharmaceutical bottles is particularly noteworthy due to their chemical resistance and versatility. The market also sees a burgeoning trend towards bio-based plastic bottles for pharmaceuticals, aligning with global sustainability initiatives and corporate environmental commitments.

Leading Markets & Segments in Pharmaceutical Plastic Bottles Market

The pharmaceutical plastic bottles market is segmented by raw material and bottle type, with distinct leaders in each category.

Raw Material Dominance:

- Polyethylene Terephthalate (PET): This segment holds a substantial market share, estimated at over xx% of the total market value in the base year. PET's excellent clarity, barrier properties against gases and moisture, and recyclability make it a preferred choice for a wide range of pharmaceutical liquids and solids. Key drivers for PET dominance include its cost-effectiveness and widespread availability.

- Poly Propylene (PP): PP is another major contributor, accounting for approximately xx% of the market. Its high chemical resistance, heat tolerance, and durability make it ideal for vials, caps, and closures, as well as for specific drug formulations. The growing demand for sterile packaging further bolsters PP's position.

- High-Density Poly Ethylene (HDPE): HDPE, with its robust chemical resistance and rigidity, is extensively used for solid dosage form containers, such as tablets and capsules. Its market share is estimated at xx%.

- Low-Density Poly Ethylene (LDPE): While holding a smaller share (estimated at xx%), LDPE finds application in specific uses like dropper bottles and squeezable containers where flexibility is paramount.

Dominant Bottle Types:

- Liquid Bottles: This segment is the largest revenue generator, estimated at over xx% of the total market in the base year. The increasing prevalence of liquid medications for various therapeutic areas, including pediatrics and geriatrics, fuels this segment's growth.

- Solid Containers: Accounting for approximately xx% of the market, solid containers are essential for packaging tablets, capsules, and powders. Their demand is closely tied to the OTC and prescription drug markets.

- Dropper Bottles: This specialized segment is experiencing robust growth (estimated at xx%), driven by the rise in ophthalmic solutions, oral medications requiring precise dosing, and the increasing use of essential oils and supplements.

- Nasal Spray Bottles: While a niche segment (estimated at xx%), nasal spray bottles are critical for respiratory medications and allergy treatments, with consistent demand.

- Oral Care: Bottles designed for oral hygiene products, mouthwashes, and dental treatments constitute a steady market segment (estimated at xx%).

The Asia Pacific region is emerging as a leading market, driven by rapid industrialization, a growing middle class, increasing healthcare expenditure, and favorable government initiatives supporting domestic manufacturing of pharmaceutical packaging. North America and Europe remain significant markets due to established pharmaceutical industries and high per capita healthcare spending.

Pharmaceutical Plastic Bottles Market Product Developments

Product developments in the pharmaceutical plastic bottles market are focusing on enhancing functionality, safety, and sustainability. Innovations include the introduction of advanced barrier technologies to extend drug shelf life, child-resistant closures for improved safety, and tamper-evident features to ensure product integrity. The development of novel plastic formulations, including those with antimicrobial properties, is also gaining traction. Furthermore, there's a significant push towards lightweighting and using recycled or bio-based materials to meet growing environmental concerns. The market is witnessing a rise in customized solutions tailored to specific drug formulations and delivery mechanisms, such as precision-dosing dropper bottles and inhaler components.

Key Drivers of Pharmaceutical Plastic Bottles Market Growth

Several key factors are propelling the pharmaceutical plastic bottles market forward. The escalating global demand for pharmaceuticals, driven by an aging population and the increasing prevalence of chronic diseases, is a primary growth engine. Advancements in drug delivery systems necessitate specialized and reliable pharma packaging solutions. Moreover, the inherent advantages of plastic, including its lightweight nature, durability, shatter-resistance, and cost-effectiveness compared to alternatives like glass, make it the preferred material for many pharmaceutical applications. Regulatory support for safe and tamper-evident packaging also indirectly fuels the demand for innovative plastic bottle designs.

Challenges in the Pharmaceutical Plastic Bottles Market Market

Despite robust growth, the pharmaceutical plastic bottles market faces several challenges. Stringent regulatory compliances regarding material safety, extractables, and leachables can increase development costs and timelines. Fluctuations in raw material prices, particularly for petroleum-based plastics, can impact profit margins. Growing environmental concerns and the push for sustainability are creating pressure to adopt more eco-friendly materials and manufacturing processes, requiring significant investment in research and development. Intense competition among numerous players can lead to price wars, squeezing margins. Supply chain disruptions, as witnessed during recent global events, can also pose a significant challenge to timely production and delivery.

Emerging Opportunities in Pharmaceutical Plastic Bottles Market

The pharmaceutical plastic bottles market is rife with emerging opportunities. The increasing focus on sustainable packaging presents a significant avenue for growth, with a rising demand for bio-based plastic bottles and advanced recycling solutions. The expansion of biologics and specialized therapies is driving the need for high-barrier, sterile pharmaceutical containers. Furthermore, the growing pharmaceutical markets in emerging economies in Asia Pacific and Latin America offer substantial untapped potential. Strategic partnerships between plastic bottle manufacturers and pharmaceutical companies can lead to the co-development of innovative packaging solutions tailored to specific drug needs. The adoption of smart packaging technologies, such as those incorporating RFID or NFC tags, for track-and-trace capabilities also presents a futuristic opportunity.

Leading Players in the Pharmaceutical Plastic Bottles Market Sector

- COMAR LLC

- Gil Plastic Products Ltd

- Drug Plastics Group

- Aptar Pharma

- O Berk Company LLC

- Alpha Packaging

- Frapak Packaging

- Pro-Pac Packaging Ltd

- Amcor Limited

- Gerresheimer AG

- Berry Group Inc

Key Milestones in Pharmaceutical Plastic Bottles Market Industry

- May 2022: Gerresheimer AG enhanced its manufacturing capabilities in India by opening a new plant at its Kosamba site, dedicated to producing plastic containers and closures to ensure consistent local supply for pharma and healthcare operations.

- November 2021: Santen Pharmaceutical Co. Ltd. announced its plan to launch the first bio-based plastic eye drop bottle in the Europe, Middle East, and Africa (EMEA) region as part of its zero-carbon commitment, signaling a significant step towards sustainable pharmaceutical packaging.

Strategic Outlook for Pharmaceutical Plastic Bottles Market Market

The strategic outlook for the pharmaceutical plastic bottles market is highly positive, driven by sustained demand from the growing global healthcare sector. Key growth accelerators will include continued innovation in sustainable materials and manufacturing processes, catering to an increasing demand for eco-friendly pharma packaging. Manufacturers focusing on developing specialized bottles for advanced drug delivery systems, such as those for biologics and personalized medicine, will likely see significant market penetration. Expansion into emerging markets, coupled with strategic collaborations to leverage technological advancements, will be crucial for long-term success. The market's future trajectory will be shaped by a strong emphasis on regulatory compliance, product safety, and the integration of circular economy principles within the pharmaceutical packaging supply chain.

Pharmaceutical Plastic Bottles Market Segmentation

-

1. Raw Material

- 1.1. Polyethylene Terephthalate (PET)

- 1.2. Poly Propylene (PP)

- 1.3. Low-density Poly Ethylene (LDPE)

- 1.4. High-density Poly Ethylene (HDPE)

-

2. Type

- 2.1. Solid Containers

- 2.2. Dropper Bottles

- 2.3. Nasal Spray Bottles

- 2.4. Liquid Bottles

- 2.5. Oral Care

- 2.6. Other Types

Pharmaceutical Plastic Bottles Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 4. Australia and New Zealand

-

5. Latin America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Mexico

-

6. Middle East and Africa

- 6.1. Saudi Arabia

- 6.2. United Arab Emirates

- 6.3. South Africa

Pharmaceutical Plastic Bottles Market Regional Market Share

Geographic Coverage of Pharmaceutical Plastic Bottles Market

Pharmaceutical Plastic Bottles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Need for Lightweight Pharma Bottles by Consumers; Increasing Spending on Healthcare and Pharmaceutical to Augment the Market Growth

- 3.3. Market Restrains

- 3.3.1. Increasing Raw Material Costs; Environmental Concerns over Usage of Plastics

- 3.4. Market Trends

- 3.4.1. HDPE Segment to Report the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Polyethylene Terephthalate (PET)

- 5.1.2. Poly Propylene (PP)

- 5.1.3. Low-density Poly Ethylene (LDPE)

- 5.1.4. High-density Poly Ethylene (HDPE)

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Solid Containers

- 5.2.2. Dropper Bottles

- 5.2.3. Nasal Spray Bottles

- 5.2.4. Liquid Bottles

- 5.2.5. Oral Care

- 5.2.6. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. North America Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 6.1.1. Polyethylene Terephthalate (PET)

- 6.1.2. Poly Propylene (PP)

- 6.1.3. Low-density Poly Ethylene (LDPE)

- 6.1.4. High-density Poly Ethylene (HDPE)

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Solid Containers

- 6.2.2. Dropper Bottles

- 6.2.3. Nasal Spray Bottles

- 6.2.4. Liquid Bottles

- 6.2.5. Oral Care

- 6.2.6. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 7. Europe Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 7.1.1. Polyethylene Terephthalate (PET)

- 7.1.2. Poly Propylene (PP)

- 7.1.3. Low-density Poly Ethylene (LDPE)

- 7.1.4. High-density Poly Ethylene (HDPE)

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Solid Containers

- 7.2.2. Dropper Bottles

- 7.2.3. Nasal Spray Bottles

- 7.2.4. Liquid Bottles

- 7.2.5. Oral Care

- 7.2.6. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 8. Asia Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 8.1.1. Polyethylene Terephthalate (PET)

- 8.1.2. Poly Propylene (PP)

- 8.1.3. Low-density Poly Ethylene (LDPE)

- 8.1.4. High-density Poly Ethylene (HDPE)

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Solid Containers

- 8.2.2. Dropper Bottles

- 8.2.3. Nasal Spray Bottles

- 8.2.4. Liquid Bottles

- 8.2.5. Oral Care

- 8.2.6. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 9. Australia and New Zealand Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 9.1.1. Polyethylene Terephthalate (PET)

- 9.1.2. Poly Propylene (PP)

- 9.1.3. Low-density Poly Ethylene (LDPE)

- 9.1.4. High-density Poly Ethylene (HDPE)

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Solid Containers

- 9.2.2. Dropper Bottles

- 9.2.3. Nasal Spray Bottles

- 9.2.4. Liquid Bottles

- 9.2.5. Oral Care

- 9.2.6. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 10. Latin America Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 10.1.1. Polyethylene Terephthalate (PET)

- 10.1.2. Poly Propylene (PP)

- 10.1.3. Low-density Poly Ethylene (LDPE)

- 10.1.4. High-density Poly Ethylene (HDPE)

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Solid Containers

- 10.2.2. Dropper Bottles

- 10.2.3. Nasal Spray Bottles

- 10.2.4. Liquid Bottles

- 10.2.5. Oral Care

- 10.2.6. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 11. Middle East and Africa Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Raw Material

- 11.1.1. Polyethylene Terephthalate (PET)

- 11.1.2. Poly Propylene (PP)

- 11.1.3. Low-density Poly Ethylene (LDPE)

- 11.1.4. High-density Poly Ethylene (HDPE)

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Solid Containers

- 11.2.2. Dropper Bottles

- 11.2.3. Nasal Spray Bottles

- 11.2.4. Liquid Bottles

- 11.2.5. Oral Care

- 11.2.6. Other Types

- 11.1. Market Analysis, Insights and Forecast - by Raw Material

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 COMAR LLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Gil Plastic Products Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Drug Plastics Group

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Aptar Pharma

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 O Berk Company LLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Alpha Packaging

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Frapak Packagin

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Pro-Pac Packaging Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Amcor Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Gerresheimer AG

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Berry Group Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 COMAR LLC

List of Figures

- Figure 1: Global Pharmaceutical Plastic Bottles Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Pharmaceutical Plastic Bottles Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 3: North America Pharmaceutical Plastic Bottles Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 4: North America Pharmaceutical Plastic Bottles Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Pharmaceutical Plastic Bottles Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Pharmaceutical Plastic Bottles Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Pharmaceutical Plastic Bottles Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Pharmaceutical Plastic Bottles Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 9: Europe Pharmaceutical Plastic Bottles Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 10: Europe Pharmaceutical Plastic Bottles Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Pharmaceutical Plastic Bottles Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Pharmaceutical Plastic Bottles Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Pharmaceutical Plastic Bottles Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pharmaceutical Plastic Bottles Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 15: Asia Pharmaceutical Plastic Bottles Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 16: Asia Pharmaceutical Plastic Bottles Market Revenue (Million), by Type 2025 & 2033

- Figure 17: Asia Pharmaceutical Plastic Bottles Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Asia Pharmaceutical Plastic Bottles Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pharmaceutical Plastic Bottles Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Pharmaceutical Plastic Bottles Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 21: Australia and New Zealand Pharmaceutical Plastic Bottles Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 22: Australia and New Zealand Pharmaceutical Plastic Bottles Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Australia and New Zealand Pharmaceutical Plastic Bottles Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Australia and New Zealand Pharmaceutical Plastic Bottles Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Pharmaceutical Plastic Bottles Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Pharmaceutical Plastic Bottles Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 27: Latin America Pharmaceutical Plastic Bottles Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 28: Latin America Pharmaceutical Plastic Bottles Market Revenue (Million), by Type 2025 & 2033

- Figure 29: Latin America Pharmaceutical Plastic Bottles Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Latin America Pharmaceutical Plastic Bottles Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Pharmaceutical Plastic Bottles Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Pharmaceutical Plastic Bottles Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 33: Middle East and Africa Pharmaceutical Plastic Bottles Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 34: Middle East and Africa Pharmaceutical Plastic Bottles Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Pharmaceutical Plastic Bottles Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Pharmaceutical Plastic Bottles Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Pharmaceutical Plastic Bottles Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 2: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 5: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 10: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 16: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: India Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 22: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 25: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Mexico Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 31: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Saudi Arabia Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Arab Emirates Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Plastic Bottles Market?

The projected CAGR is approximately 4.07%.

2. Which companies are prominent players in the Pharmaceutical Plastic Bottles Market?

Key companies in the market include COMAR LLC, Gil Plastic Products Ltd, Drug Plastics Group, Aptar Pharma, O Berk Company LLC, Alpha Packaging, Frapak Packagin, Pro-Pac Packaging Ltd, Amcor Limited, Gerresheimer AG, Berry Group Inc.

3. What are the main segments of the Pharmaceutical Plastic Bottles Market?

The market segments include Raw Material, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Need for Lightweight Pharma Bottles by Consumers; Increasing Spending on Healthcare and Pharmaceutical to Augment the Market Growth.

6. What are the notable trends driving market growth?

HDPE Segment to Report the Highest Growth Rate.

7. Are there any restraints impacting market growth?

Increasing Raw Material Costs; Environmental Concerns over Usage of Plastics.

8. Can you provide examples of recent developments in the market?

May 2022 - Gerresheimer AG has enhanced its manufacturing capabilities in India to ensure consistent local supply for pharma and healthcare operations. The company has opened a new plant to produce plastic containers and closures at its Kosamba manufacturing site.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Plastic Bottles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Plastic Bottles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Plastic Bottles Market?

To stay informed about further developments, trends, and reports in the Pharmaceutical Plastic Bottles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence