Key Insights

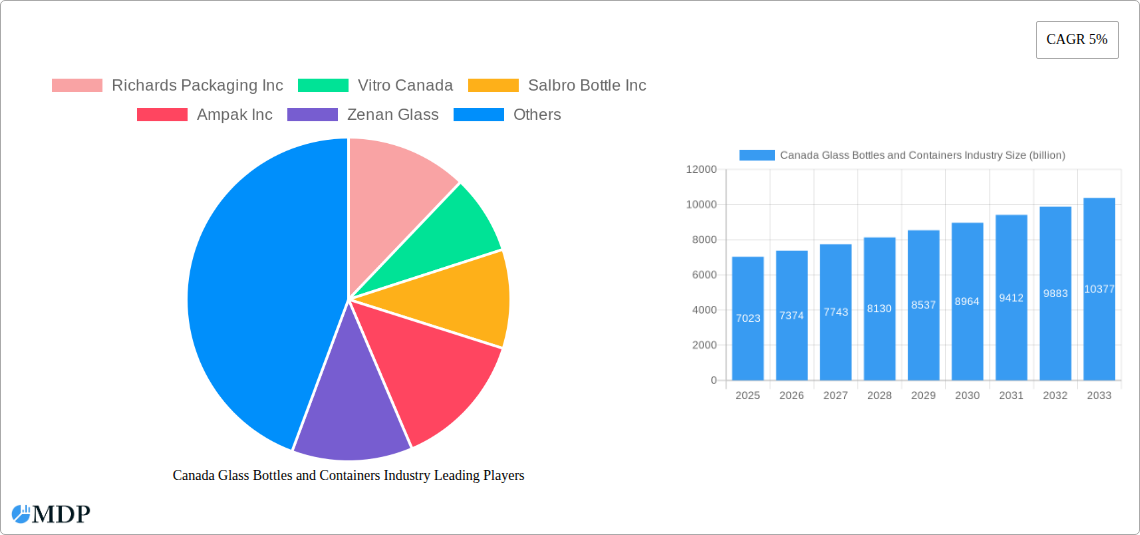

The Canadian Glass Bottles and Containers Industry is poised for steady expansion, with an estimated market size of $7.02 billion in 2025. This growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 5% over the forecast period of 2025-2033. This robust expansion is primarily driven by the increasing demand from key end-user verticals, particularly the food and beverage sectors, which rely heavily on glass packaging for its inert properties, aesthetic appeal, and recyclability. The pharmaceutical industry also continues to be a significant contributor, with glass bottles being the preferred choice for many medications due to their superior barrier properties, ensuring product integrity and shelf life. Furthermore, the rising consumer preference for premium and sustainable packaging solutions is boosting the demand for glass containers across all segments.

Canada Glass Bottles and Containers Industry Market Size (In Billion)

Several trends are shaping the Canadian glass packaging landscape. The focus on sustainability is a major propellant, as consumers and manufacturers alike are increasingly prioritizing eco-friendly materials. Glass's inherent recyclability and its ability to be reused multiple times make it an attractive option in a market conscious of its environmental footprint. Innovations in glass manufacturing, leading to lighter yet stronger containers, are also contributing to cost efficiencies and broader adoption. The cosmetics industry is also embracing glass for its premium feel and perceived quality, enhancing brand perception. While the market enjoys strong drivers, potential restraints include the higher initial cost compared to some plastic alternatives and the logistics associated with the weight of glass packaging. However, the perceived value, safety, and environmental benefits of glass are expected to outweigh these considerations, ensuring continued market vitality.

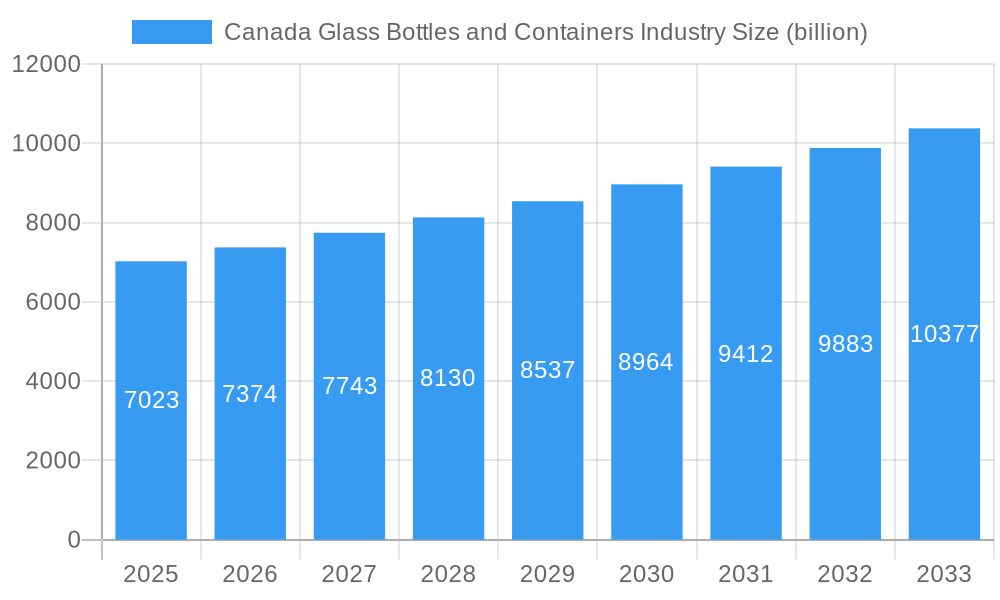

Canada Glass Bottles and Containers Industry Company Market Share

This comprehensive report offers an in-depth analysis of the Canada Glass Bottles and Containers Industry, a vital sector supporting numerous consumer goods and industrial applications. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this study provides actionable insights into market dynamics, key trends, and future growth trajectories. We delve into the intricate details of market concentration, innovation drivers, regulatory landscapes, and the impact of product substitutes. Furthermore, we meticulously examine end-user trends across critical verticals such as Food, Beverage, Pharmaceuticals, Cosmetics, and Other End-User Verticals. This report is an indispensable resource for industry stakeholders, including manufacturers, suppliers, investors, and regulatory bodies, seeking to navigate and capitalize on the evolving Canadian glass packaging market.

Canada Glass Bottles and Containers Industry Market Dynamics & Concentration

The Canada Glass Bottles and Containers Industry exhibits a moderate to high level of market concentration, with several key players dominating production and distribution. Richards Packaging Inc., Vitro Canada, Salbro Bottle Inc., Ampak Inc., Zenan Glass, and Owens-Illinois Inc. represent a significant portion of the market share, each contributing unique capabilities and product portfolios. Innovation drivers are primarily fueled by the demand for sustainable packaging solutions, advancements in glass manufacturing technologies, and the increasing need for specialized containers in the pharmaceutical and cosmetic sectors. Regulatory frameworks, such as environmental protection mandates and food safety standards, play a crucial role in shaping production processes and product development. The presence of viable product substitutes, including plastic and aluminum containers, presents a constant competitive pressure, compelling glass manufacturers to emphasize durability, inertness, and recyclability. End-user trends are leaning towards premiumization, with a growing preference for glass packaging in the beverage and food industries due to its perceived quality and health benefits. Mergers and acquisitions (M&A) activities, though not extensively documented in public records, are expected to continue as companies seek to consolidate market share, enhance operational efficiencies, and expand their geographical reach. For instance, an estimated xx M&A deals are anticipated within the study period, driven by the pursuit of synergistic growth and technological integration.

Canada Glass Bottles and Containers Industry Industry Trends & Analysis

The Canada Glass Bottles and Containers Industry is projected to experience robust growth, driven by several interconnected trends. A significant growth driver is the escalating demand for sustainable and eco-friendly packaging solutions. Consumers are increasingly favoring glass due to its infinite recyclability and its perceived lower environmental impact compared to single-use plastics. This is reflected in a projected Compound Annual Growth Rate (CAGR) of approximately XX% over the forecast period. Technological disruptions in glass manufacturing, such as advancements in lightweighting, improved strength, and decorative printing techniques, are enhancing the appeal and functionality of glass containers. These innovations allow for more cost-effective production and offer greater aesthetic appeal for brands. Consumer preferences are a powerful force, with a noticeable shift towards premiumization across various end-user verticals. In the beverage sector, glass bottles are often associated with higher quality spirits, craft beers, and premium wines. Similarly, the pharmaceutical industry relies on glass for its inertness and barrier properties, ensuring drug stability and safety. The cosmetics industry leverages glass for its aesthetic appeal, conveying a sense of luxury and quality. Competitive dynamics within the industry are characterized by a blend of established large-scale manufacturers and specialized niche players. Companies are investing in research and development to create innovative bottle designs, improve energy efficiency in production, and enhance their supply chain resilience. Market penetration of glass packaging is expected to remain strong, particularly in sectors where its intrinsic qualities—such as inertness, impermeability, and aesthetic appeal—are paramount. The estimated market penetration for glass containers in the premium beverage segment is expected to reach XX% by 2033. Furthermore, the ongoing emphasis on health and wellness is boosting the demand for glass packaging in food and pharmaceutical applications, as glass is considered a safer and more hygienic material for preserving product integrity. The industry is also witnessing a growing trend towards customization, with brands seeking unique bottle shapes and designs to differentiate themselves in a crowded marketplace. This requires manufacturers to be agile and capable of producing a diverse range of custom solutions.

Leading Markets & Segments in Canada Glass Bottles and Containers Industry

Within the Canada Glass Bottles and Containers Industry, the Beverage segment is poised to be the dominant end-user vertical, followed closely by Food. This dominance is propelled by several key drivers.

- Economic Policies: Government initiatives supporting domestic manufacturing and sustainable practices indirectly bolster the glass container sector. Policies that encourage recycling and reduce reliance on imported packaging materials provide a favorable environment for Canadian glass manufacturers.

- Infrastructure: Well-developed logistics and transportation networks across Canada are crucial for the efficient distribution of glass bottles and containers from production facilities to a wide array of end-users, ensuring timely delivery and cost-effectiveness.

- Consumer Preferences: A persistent and growing consumer preference for glass packaging in the beverage industry, particularly for alcoholic beverages like wine, spirits, and craft beers, as well as for premium non-alcoholic drinks, is a primary growth accelerator. This preference stems from glass's perceived quality, inertness, and superior shelf life.

- Health and Safety Regulations: Stringent food and beverage safety regulations in Canada necessitate the use of inert and impermeable packaging materials. Glass excels in this regard, preventing chemical leaching and preserving the taste and quality of contents, making it a preferred choice for sensitive products.

The Food segment also represents a substantial market, driven by the demand for glass jars and containers for a variety of products including jams, sauces, pickles, and ready-to-eat meals. The "farm-to-table" movement and the growing popularity of artisanal and organic food products further enhance the appeal of glass packaging, which is often associated with natural and high-quality food items.

The Pharmaceuticals segment, while smaller in volume compared to food and beverage, is characterized by high-value applications. The inertness and barrier properties of glass are critical for the safe storage and efficacy of medications, vaccines, and other sensitive pharmaceutical products. The increasing stringency of pharmaceutical packaging regulations worldwide reinforces the demand for high-quality glass containers.

The Cosmetics sector utilizes glass for its aesthetic appeal and the perception of luxury and premium quality it imparts to products. Perfumes, skincare, and haircare brands often opt for glass bottles and jars to enhance their brand image and attract discerning consumers.

The Other End-User Verticals, encompassing industrial chemicals, household products, and specialty items, represent a diverse but significant market. While these sectors might not always prioritize aesthetic appeal, the chemical resistance and durability of glass make it a suitable choice for many applications.

The dominance of the Beverage and Food segments is underscored by their substantial market share, estimated to be approximately XX% and XX% respectively within the Canadian market by 2025. The continued growth in these sectors, coupled with the intrinsic advantages of glass packaging, ensures its sustained relevance and market leadership.

Canada Glass Bottles and Containers Industry Product Developments

Product development in the Canada Glass Bottles and Containers Industry is increasingly focused on enhancing sustainability and functionality. Innovations include the development of thinner-walled yet stronger glass bottles, reducing material usage and transportation emissions. Advanced coating technologies are being employed to improve scratch resistance and provide UV protection for contents. Furthermore, the industry is exploring the use of recycled glass content at higher percentages, contributing to a more circular economy. Decorative printing and embossing techniques are also being refined, allowing for greater brand customization and shelf appeal. These developments aim to provide competitive advantages by offering cost savings, improved product preservation, and unique branding opportunities, directly addressing evolving market demands for eco-conscious and visually appealing packaging.

Key Drivers of Canada Glass Bottles and Containers Industry Growth

The Canada Glass Bottles and Containers Industry is propelled by a confluence of compelling growth drivers. A primary catalyst is the escalating global and domestic demand for sustainable packaging solutions, with consumers actively choosing glass for its recyclability and eco-friendly perception. Technological advancements in glass manufacturing, such as improved energy efficiency and the development of lighter-weight yet durable containers, are enhancing cost-effectiveness and market competitiveness. The food and beverage sector's continued growth, particularly in premium and craft segments, significantly boosts demand for glass bottles and jars. Furthermore, stringent regulations in the pharmaceutical industry, mandating inert and safe packaging, ensure a consistent demand for glass. The rising consumer preference for premium products across various categories, where glass packaging often signifies quality and luxury, also plays a crucial role in driving market expansion.

Challenges in the Canada Glass Bottles and Containers Industry Market

The Canada Glass Bottles and Containers Industry faces several significant challenges that can temper growth. Intense competition from alternative packaging materials, such as plastics and aluminum, which often offer lower price points and lighter weight, poses a continuous threat. Fluctuations in the cost of raw materials, particularly sand, soda ash, and limestone, can impact production costs and profit margins. Energy-intensive manufacturing processes contribute to higher operational expenses and environmental concerns. Furthermore, logistical challenges and the inherent fragility of glass can lead to increased transportation costs and breakage rates. Strict regulatory compliance in sectors like pharmaceuticals and food safety, while a driver for glass, also necessitates significant investment in quality control and process adherence.

Emerging Opportunities in Canada Glass Bottles and Containers Industry

The Canada Glass Bottles and Containers Industry is ripe with emerging opportunities. The growing consumer and corporate focus on circular economy principles presents a significant opportunity for increased use of recycled glass (cullet) in manufacturing, driving down costs and environmental impact. Innovations in smart packaging technologies, such as embedded sensors or QR codes for enhanced traceability and consumer engagement, can differentiate glass containers. The expansion of the craft beverage industry (beer, spirits, cider) continues to fuel demand for uniquely designed and high-quality glass bottles. Furthermore, strategic partnerships between glass manufacturers and brands focused on premium or organic products can unlock new market segments and foster collaborative innovation. The increasing demand for personalized and small-batch products across various sectors also opens avenues for flexible production capabilities and custom glass container designs.

Leading Players in the Canada Glass Bottles and Containers Industry Sector

- Richards Packaging Inc.

- Vitro Canada

- Salbro Bottle Inc.

- Ampak Inc.

- Zenan Glass

- Owens-Illinois Inc.

Key Milestones in Canada Glass Bottles and Containers Industry Industry

- 2019-2020: Increased focus on sustainability initiatives and investments in recycled glass processing technologies by major manufacturers.

- 2021: Significant demand surge for pharmaceutical glass vials and ampoules due to global health events.

- 2022: Introduction of new lightweighting technologies by leading players to reduce material usage and transportation costs.

- 2023: Growing adoption of advanced decorative printing techniques for enhanced product branding and shelf appeal.

- 2024: Emerging trends in customized and artisanal glass packaging solutions for the premium beverage and food markets.

- 2025 (Base Year): Solidification of market share for key players and continued emphasis on operational efficiency and technological upgrades.

- 2026-2033 (Forecast Period): Anticipated growth driven by sustainability mandates, technological innovations in glass manufacturing, and evolving consumer preferences for premium and eco-friendly packaging.

Strategic Outlook for Canada Glass Bottles and Containers Industry Market

The strategic outlook for the Canada Glass Bottles and Containers Industry is positive, driven by sustained demand for its inherent qualities and an increasing alignment with global sustainability trends. Growth accelerators include ongoing investment in advanced manufacturing technologies to improve efficiency and reduce environmental footprint, as well as the development of innovative glass formulations for enhanced performance and lighter weight. The industry's ability to cater to the growing premiumization trend in the food, beverage, and cosmetics sectors, coupled with its essential role in the pharmaceutical supply chain, provides a strong foundation for future expansion. Strategic partnerships and a focus on the circular economy, particularly through increased cullet utilization, will be key to unlocking long-term market potential and ensuring competitive advantage in an evolving global marketplace.

Canada Glass Bottles and Containers Industry Segmentation

-

1. End-User Vertical

- 1.1. Food

- 1.2. Beverage

- 1.3. Pharmaceuticals

- 1.4. Cosmetics

- 1.5. Other End-User Verticals

Canada Glass Bottles and Containers Industry Segmentation By Geography

- 1. Canada

Canada Glass Bottles and Containers Industry Regional Market Share

Geographic Coverage of Canada Glass Bottles and Containers Industry

Canada Glass Bottles and Containers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Improved Technology Offering Better Solutions; Higher Disposable Income and Integration in Premium Packaging

- 3.3. Market Restrains

- 3.3.1. Environmental Regulations from Government Bodies over Single-use Plastic Packaging; High Dependence on Raw Material Availability and Pricing

- 3.4. Market Trends

- 3.4.1. Beverage is Expected to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Glass Bottles and Containers Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.1.1. Food

- 5.1.2. Beverage

- 5.1.3. Pharmaceuticals

- 5.1.4. Cosmetics

- 5.1.5. Other End-User Verticals

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by End-User Vertical

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Richards Packaging Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vitro Canada

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Salbro Bottle Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ampak Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zenan Glass

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Owens-Illinois Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Richards Packaging Inc

List of Figures

- Figure 1: Canada Glass Bottles and Containers Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Glass Bottles and Containers Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Glass Bottles and Containers Industry Revenue billion Forecast, by End-User Vertical 2020 & 2033

- Table 2: Canada Glass Bottles and Containers Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Canada Glass Bottles and Containers Industry Revenue billion Forecast, by End-User Vertical 2020 & 2033

- Table 4: Canada Glass Bottles and Containers Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Glass Bottles and Containers Industry?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Canada Glass Bottles and Containers Industry?

Key companies in the market include Richards Packaging Inc, Vitro Canada, Salbro Bottle Inc, Ampak Inc, Zenan Glass, Owens-Illinois Inc.

3. What are the main segments of the Canada Glass Bottles and Containers Industry?

The market segments include End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 70.23 billion as of 2022.

5. What are some drivers contributing to market growth?

; Improved Technology Offering Better Solutions; Higher Disposable Income and Integration in Premium Packaging.

6. What are the notable trends driving market growth?

Beverage is Expected to Hold Major Share.

7. Are there any restraints impacting market growth?

Environmental Regulations from Government Bodies over Single-use Plastic Packaging; High Dependence on Raw Material Availability and Pricing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Glass Bottles and Containers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Glass Bottles and Containers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Glass Bottles and Containers Industry?

To stay informed about further developments, trends, and reports in the Canada Glass Bottles and Containers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence