Key Insights

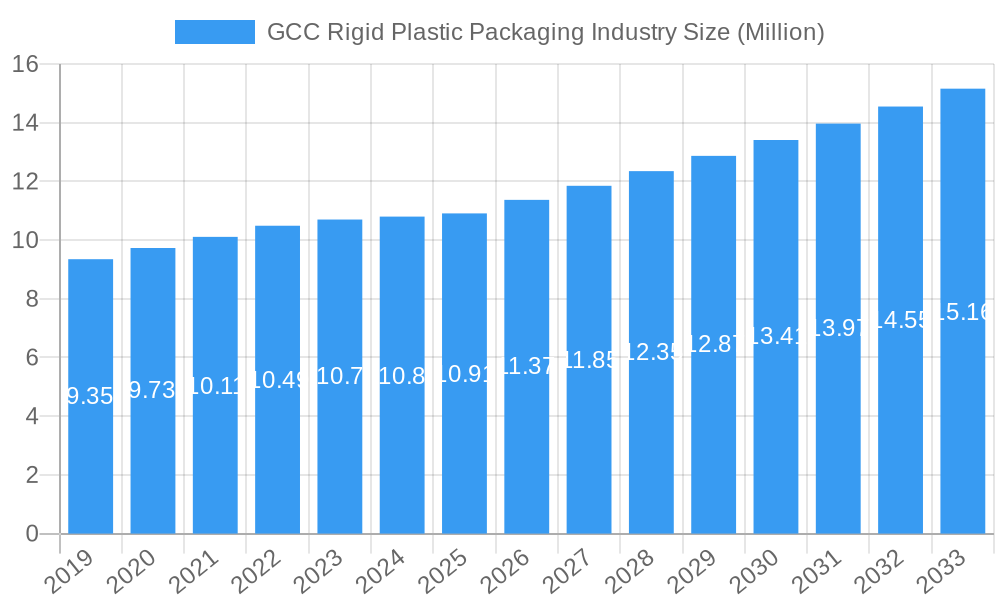

The GCC Rigid Plastic Packaging market is projected for substantial growth, estimated to reach $396.27 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.6% through 2033. This expansion is driven by increasing demand across key sectors including food and beverages, healthcare, and cosmetics. Rigid plastic packaging's inherent convenience and durability make it essential for product protection, from consumer goods to medical supplies. Growing consumer preference for packaged items and the rapid rise of e-commerce further boost the need for efficient packaging solutions. Investments in industrial infrastructure and rising disposable incomes within the GCC region also significantly contribute to this positive market trend.

GCC Rigid Plastic Packaging Industry Market Size (In Billion)

Key growth catalysts for the GCC rigid plastic packaging market include the expanding food and beverage industry, requiring advanced packaging for dairy, fresh produce, and confectionery. The healthcare sector's stringent demands for sterile and protective pharmaceutical and medical device packaging also represent a significant growth driver. Emerging trends favor sustainable and recyclable plastic materials, influencing product development and consumer preferences. While robust demand exists, potential challenges such as raw material price volatility and environmental regulations concerning plastic waste management necessitate strategic industry approaches. Despite these considerations, the GCC rigid plastic packaging market exhibits a highly positive outlook due to its versatility, cost-effectiveness, and vital role in contemporary commerce and consumption.

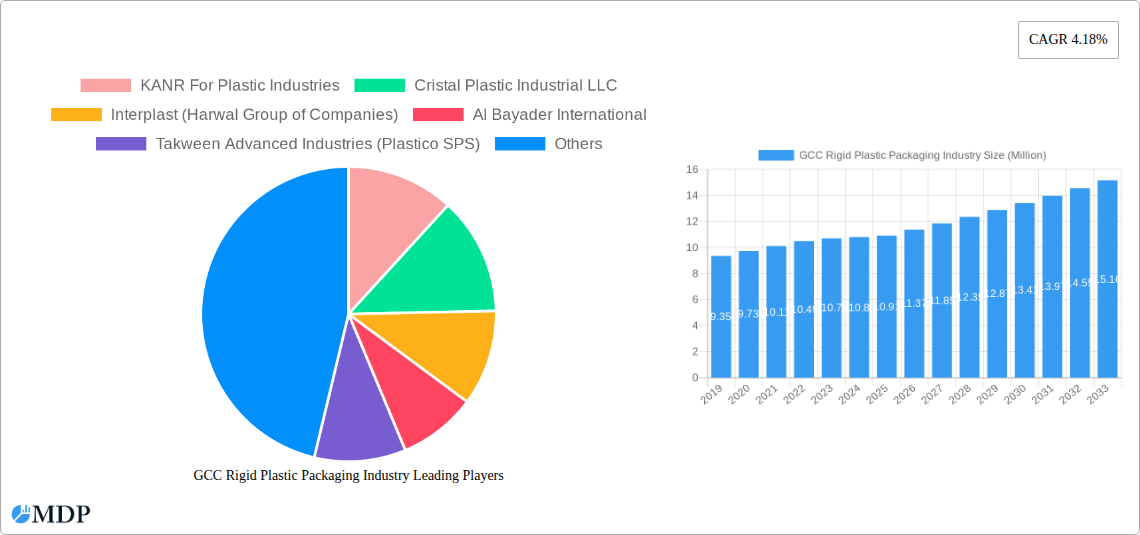

GCC Rigid Plastic Packaging Industry Company Market Share

This report provides a comprehensive analysis of the GCC Rigid Plastic Packaging Industry, including in-depth market insights and strategic forecasts for 2019–2033. With a base year of 2025, this study offers a detailed understanding of market drivers, segmentation, competitive dynamics, and future growth potential. Optimized for search visibility with relevant keywords, this report serves industry stakeholders including manufacturers, suppliers, investors, and policymakers.

GCC Rigid Plastic Packaging Industry Market Dynamics & Concentration

The GCC Rigid Plastic Packaging Industry is characterized by a moderate to high concentration, with several key players dominating significant market shares. Innovation is a primary driver, fueled by the increasing demand for sustainable packaging solutions and advanced product functionalities. Regulatory frameworks are evolving, with a growing emphasis on environmental protection and recyclability, impacting material choices and production processes. Product substitutes, such as flexible packaging and alternative materials like paper and glass, present ongoing competitive pressures. End-user trends are heavily influenced by consumer preferences for convenience, safety, and sustainability, particularly within the food, beverage, and healthcare sectors. Merger and acquisition (M&A) activities are anticipated to continue as companies seek to expand their market reach, acquire new technologies, and consolidate their positions. The number of M&A deals is projected to increase by approximately 15% over the forecast period, indicating a trend towards industry consolidation and strategic alliances. Market share for key players is estimated to range from 5% to 12%, reflecting a competitive yet consolidated landscape.

GCC Rigid Plastic Packaging Industry Industry Trends & Analysis

The GCC Rigid Plastic Packaging Industry is poised for robust growth, driven by a confluence of favorable economic conditions, evolving consumer demands, and significant technological advancements. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025-2033). This growth is underpinned by the region's burgeoning population, increasing disposable incomes, and a robust expansion in key end-user industries. The food and beverage sector, in particular, continues to be a major consumer of rigid plastic packaging, owing to its ability to preserve product freshness, enhance shelf appeal, and offer convenience. The escalating demand for packaged goods, coupled with the growth of the foodservice industry, is a significant growth driver. Technological disruptions, such as the development of advanced barrier materials, lightweighting techniques, and innovative designs, are enhancing the performance and sustainability of rigid plastic packaging. Furthermore, the increasing adoption of automation and smart packaging solutions is improving operational efficiency and supply chain management. Consumer preferences are increasingly leaning towards sustainable and eco-friendly packaging options, pushing manufacturers to invest in recycled content and biodegradable alternatives. The competitive dynamics within the industry are intensifying, with a focus on product differentiation, cost optimization, and building strong customer relationships. Market penetration of advanced packaging solutions is expected to grow by an estimated 20% over the next decade, reflecting the industry's receptiveness to innovation.

Leading Markets & Segments in GCC Rigid Plastic Packaging Industry

The GCC Rigid Plastic Packaging Industry exhibits distinct leadership across various segments, driven by specific regional demands and end-user requirements.

- Dominant Resin Type: Polyethylene (PE), particularly High-Density Polyethylene (HDPE) and Low-Density Polyethylene (LDPE), leads the market due to its versatility, cost-effectiveness, and excellent barrier properties. It is extensively used across various product types and end-user industries. Polypropylene (PP) also holds a significant share, especially in applications requiring heat resistance and rigidity.

- Leading Product Types:

- Bottles and Jars: This segment is the largest contributor, driven by the extensive use in beverage, food, personal care, and pharmaceutical applications. The demand for convenient and safe storage solutions fuels its dominance.

- Trays and Containers: Essential for the food industry, particularly for fresh produce, dairy, and frozen foods, this segment witnesses continuous growth due to its ability to protect and display products effectively.

- Caps and Closures: Crucial for product integrity and safety, this segment is a steady performer, driven by the demand across all packaged goods.

- Dominant End-user Industries:

- Food: This is the largest end-user industry, encompassing a wide array of sub-segments.

- Dairy Products: Demand for milk, yogurt, and cheese packaging drives significant consumption of rigid plastics.

- Beverage: Bottled water, juices, and carbonated soft drinks represent a massive market for rigid plastic bottles.

- Fresh Produce: Trays and containers made of PET and PP are crucial for preserving and marketing fruits and vegetables.

- Beverage: The growing beverage market, especially for water and juices, is a primary consumer of rigid plastic bottles and containers.

- Healthcare: The stringent requirements for sterile and safe packaging in the pharmaceutical and medical device sectors contribute to the steady demand for specialized rigid plastic packaging.

- Food: This is the largest end-user industry, encompassing a wide array of sub-segments.

Economic policies promoting industrial diversification and infrastructure development within GCC countries are key drivers for the growth of these segments. For instance, investments in food processing and manufacturing facilities directly translate into increased demand for suitable rigid plastic packaging solutions.

GCC Rigid Plastic Packaging Industry Product Developments

Product innovation in the GCC Rigid Plastic Packaging Industry is increasingly focused on sustainability and enhanced functionality. Manufacturers are actively developing lightweight yet durable packaging solutions that reduce material usage and carbon footprint. The integration of advanced barrier technologies within PET and PE packaging is extending shelf life for food and beverage products. Furthermore, the development of easily reclosable caps and tamper-evident features enhances consumer convenience and product security. Companies are also investing in designs that facilitate recyclability and incorporate higher percentages of post-consumer recycled (PCR) content, aligning with global sustainability trends and meeting evolving regulatory demands. These developments aim to provide competitive advantages by offering solutions that are both environmentally responsible and meet stringent performance criteria.

Key Drivers of GCC Rigid Plastic Packaging Industry Growth

The GCC Rigid Plastic Packaging Industry is propelled by several pivotal growth drivers. The expanding population and increasing urbanization across the GCC nations are fueling a higher demand for packaged goods across food, beverage, and healthcare sectors. Economic diversification initiatives and robust investments in manufacturing infrastructure by governments are creating a fertile ground for the industry. Technological advancements in material science and processing techniques are leading to the development of more efficient, sustainable, and high-performance packaging solutions. Furthermore, a growing consumer awareness and demand for convenience and product safety are directly influencing the adoption of rigid plastic packaging. Evolving regulatory frameworks that encourage the use of recyclable materials and promote a circular economy are also acting as a significant catalyst.

Challenges in the GCC Rigid Plastic Packaging Industry Market

Despite the positive growth outlook, the GCC Rigid Plastic Packaging Industry faces several challenges. Stringent environmental regulations regarding plastic waste management and disposal can pose compliance hurdles for manufacturers. Fluctuations in raw material prices, particularly for petroleum-based resins, can impact profit margins and necessitate strategic sourcing. Intense competition from alternative packaging materials, such as paper and glass, requires continuous innovation and cost optimization. Supply chain disruptions, exacerbated by global events, can affect the availability and cost of essential raw materials. Furthermore, negative public perception surrounding plastic pollution necessitates a proactive approach towards sustainability initiatives and increased investment in recycling infrastructure.

Emerging Opportunities in GCC Rigid Plastic Packaging Industry

Emerging opportunities within the GCC Rigid Plastic Packaging Industry are primarily centered around sustainability and technological innovation. The increasing global and regional focus on a circular economy presents significant opportunities for companies investing in recycled plastics and advanced recycling technologies. The growing demand for premium and convenience food products fuels the need for specialized rigid packaging solutions with enhanced barrier properties and shelf appeal. Strategic partnerships between packaging manufacturers, raw material suppliers, and end-users can foster collaborative innovation and drive market growth. Furthermore, the expansion of e-commerce logistics creates new avenues for durable and protective rigid packaging solutions. Embracing digitalization and smart packaging technologies offers opportunities for enhanced supply chain visibility and consumer engagement.

Leading Players in the GCC Rigid Plastic Packaging Industry Sector

- KANR For Plastic Industries

- Cristal Plastic Industrial LLC

- lnterplast (Harwal Group of Companies)

- Al Bayader International

- Takween Advanced Industries (Plastico SPS)

- Zamil Plastic Industries Co

- Al Rashid Boxes and Plastic Co Ltd

- Saudi Arabian Packaging Industry WLL (SAPIN)

- Saudi Plastic Factory Company

- Al Jabri Plastic

- Precision Plastic Products Co (LLC)

- Nuplas Industries

- National Plastic Factory LLC

- AL-Ghandoura Plastic Co (GhanPlast)

- Packaging Products Company (PPC)

Key Milestones in GCC Rigid Plastic Packaging Industry Industry

- April 2024: SABIC, a prominent player in the global chemical industry and a member of GPCA, announced Saudi Arabia's inaugural circular packaging initiative. This initiative is a pivotal part of SABIC's TRUCIRCLE program, designed to propel the adoption of a circular plastic economy.

- November 2023: PepsiCo is pioneering using 100% recycled plastic bottles for its Pepsi, Diet Pepsi, and Pepsi Zero brands in the United Arab Emirates. This move marks a significant milestone, making PepsiCo the first in the country to introduce locally produced, fully recycled packaging in the carbonated soft drinks (CSDs) segment.

Strategic Outlook for GCC Rigid Plastic Packaging Industry Market

The strategic outlook for the GCC Rigid Plastic Packaging Industry remains optimistic, driven by sustained demand from core end-user sectors and a strong push towards sustainability. Key growth accelerators include continued investment in advanced manufacturing technologies, enabling the production of lightweight, recyclable, and high-performance packaging. The industry will likely witness an increased adoption of bio-based and recycled resins, aligning with global environmental mandates and consumer preferences. Strategic alliances and potential M&A activities will shape the competitive landscape, fostering innovation and market consolidation. Furthermore, the development of smart packaging solutions, offering enhanced traceability and consumer interaction, represents a significant future growth avenue. The industry is poised to capitalize on the region's ongoing economic development and evolving consumer lifestyles.

GCC Rigid Plastic Packaging Industry Segmentation

-

1. Resin Type

-

1.1. Polyethylene (PE)

- 1.1.1. Low-dens

- 1.1.2. High Density Polyethylene (HDPE)

- 1.2. Polyethylene terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 1.5. Polyvinyl chloride (PVC)

- 1.6. Other Resin Types

-

1.1. Polyethylene (PE)

-

2. Product Type

- 2.1. Bottles and Jars

- 2.2. Trays and Containers

- 2.3. Caps and Closures

- 2.4. Intermediate Bulk Containers (IBCs)

- 2.5. Drums

- 2.6. Pallets

- 2.7. Other Product Types

-

3. End-user Industry

-

3.1. Food**

- 3.1.1. Candy and Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Food Products

-

3.2. Foodservice**

- 3.2.1. Quick Service Restaurants (QSRs)

- 3.2.2. Full-Service Restaurants (FSRs)

- 3.2.3. Coffee and Snack Outlets

- 3.2.4. Retail Establishments

- 3.2.5. Institutional

- 3.2.6. Hospitality

- 3.2.7. Others Food Service Sectors

- 3.3. Beverage

- 3.4. Healthcare

- 3.5. Cosmetics and Personal Care

- 3.6. Industrial

- 3.7. Building and Construction

- 3.8. Automotive

- 3.9. Other End-user Industries

-

3.1. Food**

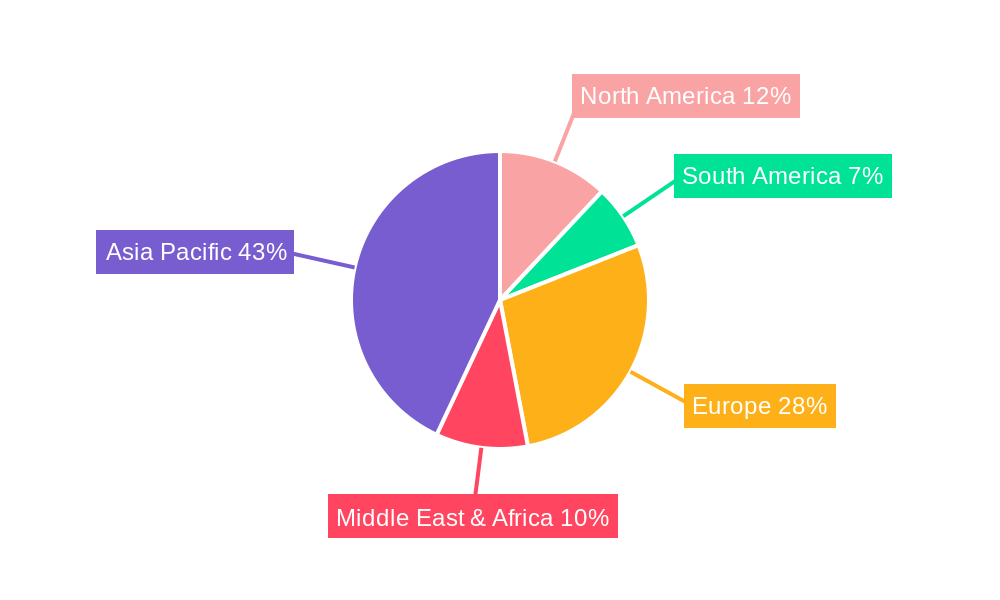

GCC Rigid Plastic Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC Rigid Plastic Packaging Industry Regional Market Share

Geographic Coverage of GCC Rigid Plastic Packaging Industry

GCC Rigid Plastic Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Recyclable Rigid Plastic Packaging is Expected to Increase with New Regulations; Increasing Demand for Rigid Plastic Packaging to Increase Shelf Life of the Products

- 3.3. Market Restrains

- 3.3.1. Environmental Concerns Over Safe Disposal and Price Volatility of the Raw Materials

- 3.4. Market Trends

- 3.4.1. Food Segment to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Rigid Plastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Polyethylene (PE)

- 5.1.1.1. Low-dens

- 5.1.1.2. High Density Polyethylene (HDPE)

- 5.1.2. Polyethylene terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 5.1.5. Polyvinyl chloride (PVC)

- 5.1.6. Other Resin Types

- 5.1.1. Polyethylene (PE)

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles and Jars

- 5.2.2. Trays and Containers

- 5.2.3. Caps and Closures

- 5.2.4. Intermediate Bulk Containers (IBCs)

- 5.2.5. Drums

- 5.2.6. Pallets

- 5.2.7. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food**

- 5.3.1.1. Candy and Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Food Products

- 5.3.2. Foodservice**

- 5.3.2.1. Quick Service Restaurants (QSRs)

- 5.3.2.2. Full-Service Restaurants (FSRs)

- 5.3.2.3. Coffee and Snack Outlets

- 5.3.2.4. Retail Establishments

- 5.3.2.5. Institutional

- 5.3.2.6. Hospitality

- 5.3.2.7. Others Food Service Sectors

- 5.3.3. Beverage

- 5.3.4. Healthcare

- 5.3.5. Cosmetics and Personal Care

- 5.3.6. Industrial

- 5.3.7. Building and Construction

- 5.3.8. Automotive

- 5.3.9. Other End-user Industries

- 5.3.1. Food**

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. North America GCC Rigid Plastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Polyethylene (PE)

- 6.1.1.1. Low-dens

- 6.1.1.2. High Density Polyethylene (HDPE)

- 6.1.2. Polyethylene terephthalate (PET)

- 6.1.3. Polypropylene (PP)

- 6.1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 6.1.5. Polyvinyl chloride (PVC)

- 6.1.6. Other Resin Types

- 6.1.1. Polyethylene (PE)

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Bottles and Jars

- 6.2.2. Trays and Containers

- 6.2.3. Caps and Closures

- 6.2.4. Intermediate Bulk Containers (IBCs)

- 6.2.5. Drums

- 6.2.6. Pallets

- 6.2.7. Other Product Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food**

- 6.3.1.1. Candy and Confectionery

- 6.3.1.2. Frozen Foods

- 6.3.1.3. Fresh Produce

- 6.3.1.4. Dairy Products

- 6.3.1.5. Dry Foods

- 6.3.1.6. Meat, Poultry, And Seafood

- 6.3.1.7. Pet Food

- 6.3.1.8. Other Food Products

- 6.3.2. Foodservice**

- 6.3.2.1. Quick Service Restaurants (QSRs)

- 6.3.2.2. Full-Service Restaurants (FSRs)

- 6.3.2.3. Coffee and Snack Outlets

- 6.3.2.4. Retail Establishments

- 6.3.2.5. Institutional

- 6.3.2.6. Hospitality

- 6.3.2.7. Others Food Service Sectors

- 6.3.3. Beverage

- 6.3.4. Healthcare

- 6.3.5. Cosmetics and Personal Care

- 6.3.6. Industrial

- 6.3.7. Building and Construction

- 6.3.8. Automotive

- 6.3.9. Other End-user Industries

- 6.3.1. Food**

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. South America GCC Rigid Plastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Polyethylene (PE)

- 7.1.1.1. Low-dens

- 7.1.1.2. High Density Polyethylene (HDPE)

- 7.1.2. Polyethylene terephthalate (PET)

- 7.1.3. Polypropylene (PP)

- 7.1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 7.1.5. Polyvinyl chloride (PVC)

- 7.1.6. Other Resin Types

- 7.1.1. Polyethylene (PE)

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Bottles and Jars

- 7.2.2. Trays and Containers

- 7.2.3. Caps and Closures

- 7.2.4. Intermediate Bulk Containers (IBCs)

- 7.2.5. Drums

- 7.2.6. Pallets

- 7.2.7. Other Product Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food**

- 7.3.1.1. Candy and Confectionery

- 7.3.1.2. Frozen Foods

- 7.3.1.3. Fresh Produce

- 7.3.1.4. Dairy Products

- 7.3.1.5. Dry Foods

- 7.3.1.6. Meat, Poultry, And Seafood

- 7.3.1.7. Pet Food

- 7.3.1.8. Other Food Products

- 7.3.2. Foodservice**

- 7.3.2.1. Quick Service Restaurants (QSRs)

- 7.3.2.2. Full-Service Restaurants (FSRs)

- 7.3.2.3. Coffee and Snack Outlets

- 7.3.2.4. Retail Establishments

- 7.3.2.5. Institutional

- 7.3.2.6. Hospitality

- 7.3.2.7. Others Food Service Sectors

- 7.3.3. Beverage

- 7.3.4. Healthcare

- 7.3.5. Cosmetics and Personal Care

- 7.3.6. Industrial

- 7.3.7. Building and Construction

- 7.3.8. Automotive

- 7.3.9. Other End-user Industries

- 7.3.1. Food**

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Europe GCC Rigid Plastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Polyethylene (PE)

- 8.1.1.1. Low-dens

- 8.1.1.2. High Density Polyethylene (HDPE)

- 8.1.2. Polyethylene terephthalate (PET)

- 8.1.3. Polypropylene (PP)

- 8.1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 8.1.5. Polyvinyl chloride (PVC)

- 8.1.6. Other Resin Types

- 8.1.1. Polyethylene (PE)

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Bottles and Jars

- 8.2.2. Trays and Containers

- 8.2.3. Caps and Closures

- 8.2.4. Intermediate Bulk Containers (IBCs)

- 8.2.5. Drums

- 8.2.6. Pallets

- 8.2.7. Other Product Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food**

- 8.3.1.1. Candy and Confectionery

- 8.3.1.2. Frozen Foods

- 8.3.1.3. Fresh Produce

- 8.3.1.4. Dairy Products

- 8.3.1.5. Dry Foods

- 8.3.1.6. Meat, Poultry, And Seafood

- 8.3.1.7. Pet Food

- 8.3.1.8. Other Food Products

- 8.3.2. Foodservice**

- 8.3.2.1. Quick Service Restaurants (QSRs)

- 8.3.2.2. Full-Service Restaurants (FSRs)

- 8.3.2.3. Coffee and Snack Outlets

- 8.3.2.4. Retail Establishments

- 8.3.2.5. Institutional

- 8.3.2.6. Hospitality

- 8.3.2.7. Others Food Service Sectors

- 8.3.3. Beverage

- 8.3.4. Healthcare

- 8.3.5. Cosmetics and Personal Care

- 8.3.6. Industrial

- 8.3.7. Building and Construction

- 8.3.8. Automotive

- 8.3.9. Other End-user Industries

- 8.3.1. Food**

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. Middle East & Africa GCC Rigid Plastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Polyethylene (PE)

- 9.1.1.1. Low-dens

- 9.1.1.2. High Density Polyethylene (HDPE)

- 9.1.2. Polyethylene terephthalate (PET)

- 9.1.3. Polypropylene (PP)

- 9.1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 9.1.5. Polyvinyl chloride (PVC)

- 9.1.6. Other Resin Types

- 9.1.1. Polyethylene (PE)

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Bottles and Jars

- 9.2.2. Trays and Containers

- 9.2.3. Caps and Closures

- 9.2.4. Intermediate Bulk Containers (IBCs)

- 9.2.5. Drums

- 9.2.6. Pallets

- 9.2.7. Other Product Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food**

- 9.3.1.1. Candy and Confectionery

- 9.3.1.2. Frozen Foods

- 9.3.1.3. Fresh Produce

- 9.3.1.4. Dairy Products

- 9.3.1.5. Dry Foods

- 9.3.1.6. Meat, Poultry, And Seafood

- 9.3.1.7. Pet Food

- 9.3.1.8. Other Food Products

- 9.3.2. Foodservice**

- 9.3.2.1. Quick Service Restaurants (QSRs)

- 9.3.2.2. Full-Service Restaurants (FSRs)

- 9.3.2.3. Coffee and Snack Outlets

- 9.3.2.4. Retail Establishments

- 9.3.2.5. Institutional

- 9.3.2.6. Hospitality

- 9.3.2.7. Others Food Service Sectors

- 9.3.3. Beverage

- 9.3.4. Healthcare

- 9.3.5. Cosmetics and Personal Care

- 9.3.6. Industrial

- 9.3.7. Building and Construction

- 9.3.8. Automotive

- 9.3.9. Other End-user Industries

- 9.3.1. Food**

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Asia Pacific GCC Rigid Plastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 10.1.1. Polyethylene (PE)

- 10.1.1.1. Low-dens

- 10.1.1.2. High Density Polyethylene (HDPE)

- 10.1.2. Polyethylene terephthalate (PET)

- 10.1.3. Polypropylene (PP)

- 10.1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 10.1.5. Polyvinyl chloride (PVC)

- 10.1.6. Other Resin Types

- 10.1.1. Polyethylene (PE)

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Bottles and Jars

- 10.2.2. Trays and Containers

- 10.2.3. Caps and Closures

- 10.2.4. Intermediate Bulk Containers (IBCs)

- 10.2.5. Drums

- 10.2.6. Pallets

- 10.2.7. Other Product Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food**

- 10.3.1.1. Candy and Confectionery

- 10.3.1.2. Frozen Foods

- 10.3.1.3. Fresh Produce

- 10.3.1.4. Dairy Products

- 10.3.1.5. Dry Foods

- 10.3.1.6. Meat, Poultry, And Seafood

- 10.3.1.7. Pet Food

- 10.3.1.8. Other Food Products

- 10.3.2. Foodservice**

- 10.3.2.1. Quick Service Restaurants (QSRs)

- 10.3.2.2. Full-Service Restaurants (FSRs)

- 10.3.2.3. Coffee and Snack Outlets

- 10.3.2.4. Retail Establishments

- 10.3.2.5. Institutional

- 10.3.2.6. Hospitality

- 10.3.2.7. Others Food Service Sectors

- 10.3.3. Beverage

- 10.3.4. Healthcare

- 10.3.5. Cosmetics and Personal Care

- 10.3.6. Industrial

- 10.3.7. Building and Construction

- 10.3.8. Automotive

- 10.3.9. Other End-user Industries

- 10.3.1. Food**

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 KANR For Plastic Industries

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cristal Plastic Industrial LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 lnterplast (Harwal Group of Companies)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Al Bayader International

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Takween Advanced Industries (Plastico SPS)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Zamil Plastic Industries Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Al Rashid Boxes and Plastic Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Saudi Arabian Packaging Industry WLL (SAPIN)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Saudi Plastic Factory Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Al Jabri Plastic

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Precision Plastic Products Co (LLC)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nuplas Industries

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 National Plastic Factory LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 AL-Ghandoura Plastic Co (GhanPlast)

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Packaging Products Company (PPC)

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 KANR For Plastic Industries

List of Figures

- Figure 1: Global GCC Rigid Plastic Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America GCC Rigid Plastic Packaging Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 3: North America GCC Rigid Plastic Packaging Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 4: North America GCC Rigid Plastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 5: North America GCC Rigid Plastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America GCC Rigid Plastic Packaging Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 7: North America GCC Rigid Plastic Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America GCC Rigid Plastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America GCC Rigid Plastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America GCC Rigid Plastic Packaging Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 11: South America GCC Rigid Plastic Packaging Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 12: South America GCC Rigid Plastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 13: South America GCC Rigid Plastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: South America GCC Rigid Plastic Packaging Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: South America GCC Rigid Plastic Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America GCC Rigid Plastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: South America GCC Rigid Plastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe GCC Rigid Plastic Packaging Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 19: Europe GCC Rigid Plastic Packaging Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 20: Europe GCC Rigid Plastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Europe GCC Rigid Plastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe GCC Rigid Plastic Packaging Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Europe GCC Rigid Plastic Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe GCC Rigid Plastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe GCC Rigid Plastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa GCC Rigid Plastic Packaging Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 27: Middle East & Africa GCC Rigid Plastic Packaging Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 28: Middle East & Africa GCC Rigid Plastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 29: Middle East & Africa GCC Rigid Plastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Middle East & Africa GCC Rigid Plastic Packaging Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa GCC Rigid Plastic Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa GCC Rigid Plastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa GCC Rigid Plastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific GCC Rigid Plastic Packaging Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 35: Asia Pacific GCC Rigid Plastic Packaging Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 36: Asia Pacific GCC Rigid Plastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 37: Asia Pacific GCC Rigid Plastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific GCC Rigid Plastic Packaging Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific GCC Rigid Plastic Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific GCC Rigid Plastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific GCC Rigid Plastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 2: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 6: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 13: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 20: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 21: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 22: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 33: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 34: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 35: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 43: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 44: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 45: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Rigid Plastic Packaging Industry?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the GCC Rigid Plastic Packaging Industry?

Key companies in the market include KANR For Plastic Industries, Cristal Plastic Industrial LLC, lnterplast (Harwal Group of Companies), Al Bayader International, Takween Advanced Industries (Plastico SPS), Zamil Plastic Industries Co, Al Rashid Boxes and Plastic Co Ltd, Saudi Arabian Packaging Industry WLL (SAPIN), Saudi Plastic Factory Company, Al Jabri Plastic, Precision Plastic Products Co (LLC), Nuplas Industries, National Plastic Factory LLC, AL-Ghandoura Plastic Co (GhanPlast), Packaging Products Company (PPC).

3. What are the main segments of the GCC Rigid Plastic Packaging Industry?

The market segments include Resin Type, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 396.27 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand for Recyclable Rigid Plastic Packaging is Expected to Increase with New Regulations; Increasing Demand for Rigid Plastic Packaging to Increase Shelf Life of the Products.

6. What are the notable trends driving market growth?

Food Segment to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Environmental Concerns Over Safe Disposal and Price Volatility of the Raw Materials.

8. Can you provide examples of recent developments in the market?

April 2024: SABIC, a prominent player in the global chemical industry and a member of GPCA announced Saudi Arabia's inaugural circular packaging initiative. This initiative is a pivotal part of SABIC's TRUCIRCLE program, designed to propel the adoption of a circular plastic economy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Rigid Plastic Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Rigid Plastic Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Rigid Plastic Packaging Industry?

To stay informed about further developments, trends, and reports in the GCC Rigid Plastic Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence