Key Insights

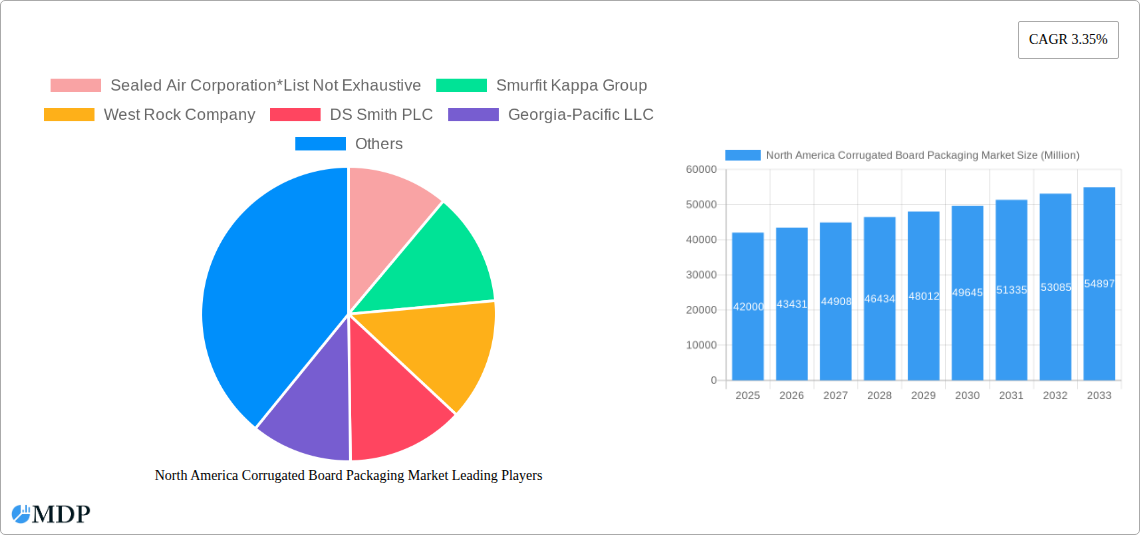

The North American corrugated board packaging market is poised for steady growth, projected to reach a substantial USD 42.00 million in value, exhibiting a Compound Annual Growth Rate (CAGR) of 3.35% from 2025 to 2033. This robust expansion is primarily fueled by the escalating demand for sustainable and efficient packaging solutions across diverse industries, including e-commerce, food and beverage, and consumer goods. The burgeoning online retail sector, in particular, continues to be a significant driver, necessitating reliable and cost-effective primary and secondary packaging for shipped products. Furthermore, growing consumer awareness regarding environmental impact is pushing manufacturers towards recyclable and biodegradable corrugated materials, thereby shaping production and consumption patterns. The increasing adoption of advanced printing technologies and innovative structural designs for corrugated packaging also contributes to its market appeal, offering enhanced branding opportunities and product protection.

North America Corrugated Board Packaging Market Market Size (In Billion)

The market is characterized by a dynamic interplay of drivers and restraints. Key growth drivers include the strong e-commerce penetration, a shift towards sustainable packaging alternatives, and the growing demand for customized packaging solutions. However, potential restraints such as fluctuating raw material costs for paper pulp and increasing competition from alternative packaging materials like plastic films and rigid plastics, could moderate the growth trajectory. Within the North American region, the United States is expected to lead the market due to its large consumer base and developed industrial infrastructure. Canada and Mexico also represent significant markets, with their own unique demands and growth potentials. The market segmentation analysis, encompassing production, consumption, import/export dynamics, and price trends, will provide deeper insights into the specific opportunities and challenges within these segments. Leading companies like Sealed Air Corporation, Smurfit Kappa Group, and West Rock Company are actively investing in innovation and expanding their production capacities to cater to the evolving market needs.

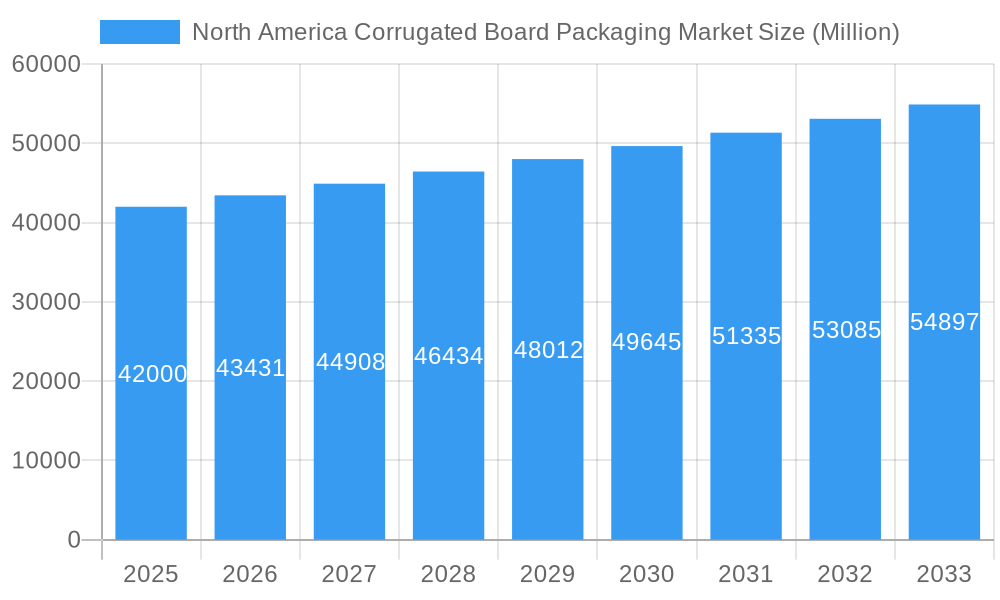

North America Corrugated Board Packaging Market Company Market Share

This comprehensive report offers an in-depth analysis of the North America Corrugated Board Packaging Market, providing critical insights for stakeholders seeking to understand market dynamics, identify growth opportunities, and strategize for future success. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, including a detailed historical analysis from 2019 to 2024. This report is your definitive guide to the corrugated packaging industry in North America, detailing market size, trends, and competitive landscapes.

North America Corrugated Board Packaging Market Market Dynamics & Concentration

The North America Corrugated Board Packaging Market is characterized by a moderate to high level of concentration, with a few dominant players holding a significant portion of the market share. Key companies such as Sealed Air Corporation, Smurfit Kappa Group, West Rock Company, DS Smith PLC, and Georgia-Pacific LLC consistently vie for market leadership through strategic acquisitions and organic growth initiatives. The market's dynamics are shaped by a complex interplay of factors including innovation drivers, evolving regulatory frameworks, the persistent threat of product substitutes, shifting end-user trends, and ongoing merger and acquisition (M&A) activities.

- Market Share: Leading players collectively hold approximately 70-75% of the market share, indicating a consolidated yet competitive environment.

- Innovation Drivers: Sustainability, e-commerce growth, and demand for custom solutions are primary catalysts for innovation.

- Regulatory Frameworks: Stringent environmental regulations and packaging standards are influencing material choices and production processes.

- Product Substitutes: While corrugated board remains a dominant material, alternatives like plastic films and rigid plastics pose some competitive pressure, particularly in niche applications.

- End-User Trends: The exponential growth of e-commerce necessitates robust, protective, and easily recyclable packaging solutions. The food & beverage, healthcare, and electronics sectors are major consumers.

- M&A Activities: The historical period saw an average of 5-7 significant M&A deals annually, with major players acquiring smaller companies to expand their geographical reach or technological capabilities.

North America Corrugated Board Packaging Market Industry Trends & Analysis

The North America Corrugated Board Packaging Market is poised for substantial growth, driven by a confluence of robust market growth drivers, transformative technological disruptions, evolving consumer preferences, and intense competitive dynamics. The increasing adoption of sustainable packaging solutions, fueled by environmental consciousness and regulatory mandates, is a paramount trend. This includes a surge in demand for recycled and recyclable corrugated materials, biodegradable coatings, and lightweight designs that reduce transportation costs and carbon footprints. The e-commerce boom continues to be a significant growth engine, demanding efficient, durable, and aesthetically pleasing packaging for direct-to-consumer shipments. Innovations in printing technologies, such as high-definition digital printing, are enabling enhanced branding and customization, allowing manufacturers to offer unique packaging solutions that cater to specific product lines and marketing campaigns.

Technological advancements in the production process are also playing a crucial role. Automated machinery, advanced software for design optimization, and the implementation of Industry 4.0 principles are leading to improved efficiency, reduced waste, and higher quality output. The integration of smart packaging solutions, incorporating QR codes for supply chain tracking or augmented reality features for enhanced consumer engagement, represents a nascent but rapidly developing trend. Consumer preferences are increasingly leaning towards convenience, functionality, and sustainability. This translates to a demand for easy-to-open, resealable, and perfectly sized packaging that minimizes waste. The competitive landscape is characterized by fierce rivalry among established players and agile new entrants, leading to continuous innovation and price competition. The market penetration of specialized corrugated solutions for specific industries, such as protective packaging for electronics or temperature-controlled solutions for pharmaceuticals, is also on the rise. Overall, the North America Corrugated Board Packaging Market is an dynamic sector that rewards adaptability, innovation, and a deep understanding of evolving consumer and industry needs, with a projected Compound Annual Growth Rate (CAGR) of approximately 5.5% over the forecast period.

Leading Markets & Segments in North America Corrugated Board Packaging Market

The North America Corrugated Board Packaging Market exhibits distinct leadership across various segments, influenced by economic policies, infrastructure development, and specific end-user demands. From a Production Analysis: perspective, the United States dominates the North American market due to its large manufacturing base, significant industrial output, and extensive supply chain networks. Key drivers for this dominance include substantial investments in paper and pulp production facilities and advanced manufacturing technologies. Canada and Mexico also contribute significantly, with Mexico experiencing rapid growth due to its burgeoning manufacturing sector and strategic trade relationships.

Analyzing Consumption Analysis: , the Food & Beverage sector consistently represents the largest consumer of corrugated board packaging in North America. This is attributed to the high volume of packaged food and beverages produced and distributed, requiring robust and protective secondary and tertiary packaging. The E-commerce sector is another major and rapidly expanding consumer, driven by the ongoing shift towards online retail and the need for reliable shipping solutions. The Retail sector, encompassing both brick-and-mortar stores and online platforms, also heavily relies on corrugated packaging for product display and transportation.

In terms of Import Market Analysis (Value & Volume): , the United States is a net importer of certain specialized corrugated products and raw materials, though it is a significant exporter overall. Canada and Mexico's import volumes are driven by their domestic industrial needs and the availability of specific raw materials. The Export Market Analysis (Value & Volume): reveals the United States as a dominant exporter, leveraging its advanced production capabilities and economies of scale to supply corrugated packaging to global markets. Key export drivers include the cost-effectiveness of US-produced corrugated board and its adherence to international packaging standards.

The Price Trend Analysis: indicates a general upward trend driven by fluctuating raw material costs (such as pulp and energy), transportation expenses, and increasing demand. However, the competitive nature of the market and the availability of alternative packaging materials can exert downward pressure on prices in certain segments. Factors like sustainable sourcing initiatives and the development of lighter-weight board can also influence pricing strategies. Economic policies, such as trade agreements and tariffs, can significantly impact import and export dynamics and, consequently, market prices. The development of robust infrastructure, including transportation networks and port facilities, is crucial for efficient raw material sourcing and finished product distribution, further influencing regional market dominance and overall cost structures.

North America Corrugated Board Packaging Market Product Developments

Recent product developments in the North America corrugated board packaging market emphasize sustainability, enhanced functionality, and digital integration. Innovations include the introduction of lighter-weight yet stronger corrugated boards made from recycled content, reducing both material usage and shipping emissions. Advancements in barrier coatings are enabling corrugated packaging to safely contain liquids and protect sensitive goods from moisture and oxygen, expanding its application in previously limited sectors. Furthermore, the integration of digital printing technologies allows for highly customizable designs, on-demand production, and the incorporation of unique branding elements, providing a competitive advantage for end-users. The development of smart packaging features, such as embedded RFID tags or QR codes, is also gaining traction, offering enhanced supply chain traceability and consumer engagement opportunities.

Key Drivers of North America Corrugated Board Packaging Market Growth

Several key drivers are propelling the growth of the North America corrugated board packaging market. The relentless expansion of the e-commerce sector, with its ever-increasing demand for reliable and cost-effective shipping solutions, is a primary catalyst. Growing consumer and regulatory pressure for sustainable packaging alternatives is driving innovation in recycled and recyclable materials, as well as biodegradable options. Technological advancements in manufacturing processes, including automation and digital printing, are enhancing efficiency and enabling greater customization, meeting specific end-user needs. Furthermore, the food and beverage industry's continuous demand for protective and safe packaging, coupled with the healthcare sector's requirements for sterile and secure packaging, provides a consistent and substantial market.

Challenges in the North America Corrugated Board Packaging Market Market

Despite robust growth, the North America corrugated board packaging market faces several challenges. Fluctuations in the cost of raw materials, particularly pulp, and rising energy prices can significantly impact production costs and profit margins. Stringent environmental regulations, while driving sustainability, can also increase compliance costs for manufacturers. The availability of alternative packaging materials, such as plastics and composite materials, presents ongoing competitive pressure in certain applications. Additionally, disruptions in global supply chains, as witnessed in recent years, can lead to material shortages and increased logistics expenses, affecting production timelines and overall market stability. Intense competition among numerous players also leads to price pressures.

Emerging Opportunities in North America Corrugated Board Packaging Market

Emerging opportunities in the North America corrugated board packaging market are primarily centered around innovation and sustainability. The increasing demand for advanced protective packaging solutions for sensitive electronics and pharmaceuticals presents a significant growth avenue. The development of smart packaging technologies, offering enhanced traceability and consumer interaction, is an untapped potential market. Furthermore, the circular economy movement is creating opportunities for innovative recycling and upcycling solutions for corrugated waste. Strategic partnerships between packaging manufacturers and e-commerce giants to develop optimized shipping solutions, as well as expansion into emerging niche markets like sustainable packaging for direct-to-consumer food delivery, represent further catalysts for long-term growth.

Leading Players in the North America Corrugated Board Packaging Market Sector

- Sealed Air Corporation

- Smurfit Kappa Group

- West Rock Company

- DS Smith PLC

- Georgia-Pacific LLC

- Mondi PLC

- Oji Holdings Corporation

- International Paper Company

- Nippon Paper Industries Co Ltd

- Packaging Corporation of America

- Cascades Inc

Key Milestones in North America Corrugated Board Packaging Market Industry

- 2021: Major companies announce significant investments in expanding recycled fiber capacity to meet growing sustainability demands.

- 2022: Introduction of advanced digital printing technologies enables enhanced customization and shorter lead times for corrugated packaging.

- 2023: Several M&A activities occur as larger players consolidate to enhance market share and operational efficiencies.

- 2024: Increased focus on lightweighting solutions to reduce transportation costs and environmental impact.

- 2025 (Projected): Growing adoption of smart packaging features, including QR codes for enhanced supply chain visibility.

Strategic Outlook for North America Corrugated Board Packaging Market Market

The strategic outlook for the North America corrugated board packaging market is highly promising, with continued growth anticipated. Key accelerators will include the ongoing digital transformation of manufacturing, leading to greater efficiency and customization capabilities. The persistent demand from the booming e-commerce sector, coupled with a strong commitment to sustainability, will drive innovation in eco-friendly and high-performance packaging solutions. Strategic opportunities lie in developing advanced protective packaging for high-value goods and expanding the application of smart packaging to enhance consumer engagement. Companies that prioritize research and development, invest in sustainable practices, and adapt to evolving consumer preferences will be well-positioned for sustained success in this dynamic market.

North America Corrugated Board Packaging Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

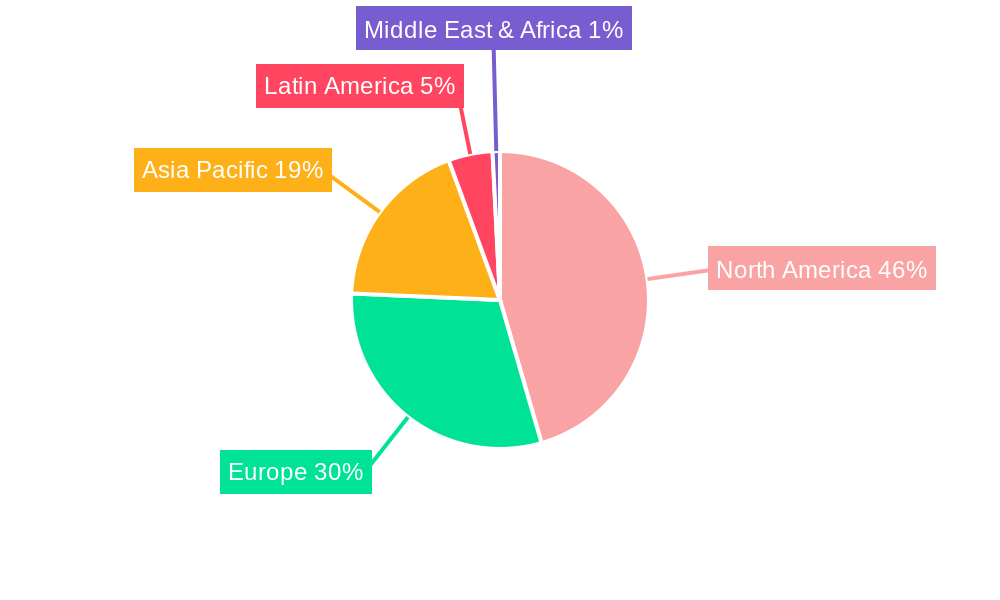

North America Corrugated Board Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Corrugated Board Packaging Market Regional Market Share

Geographic Coverage of North America Corrugated Board Packaging Market

North America Corrugated Board Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Demand from the E-commerce Sector; Growing Adoption of Light Weighting Materials and Scope for Printing Innovations

- 3.3. Market Restrains

- 3.3.1. Strict Environmental Regulation Regarding Deforestation

- 3.4. Market Trends

- 3.4.1. Strong Demand from the E-commerce Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Corrugated Board Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sealed Air Corporation*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Smurfit Kappa Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 West Rock Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DS Smith PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Georgia-Pacific LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mondi PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oji Holdings Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 International Paper Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nippon Paper Industries Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Packaging Corporation of America

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cascades Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Sealed Air Corporation*List Not Exhaustive

List of Figures

- Figure 1: North America Corrugated Board Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Corrugated Board Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: North America Corrugated Board Packaging Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Corrugated Board Packaging Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Corrugated Board Packaging Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Corrugated Board Packaging Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Corrugated Board Packaging Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Corrugated Board Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: North America Corrugated Board Packaging Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Corrugated Board Packaging Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Corrugated Board Packaging Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Corrugated Board Packaging Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Corrugated Board Packaging Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Corrugated Board Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States North America Corrugated Board Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Corrugated Board Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Corrugated Board Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Corrugated Board Packaging Market?

The projected CAGR is approximately 3.35%.

2. Which companies are prominent players in the North America Corrugated Board Packaging Market?

Key companies in the market include Sealed Air Corporation*List Not Exhaustive, Smurfit Kappa Group, West Rock Company, DS Smith PLC, Georgia-Pacific LLC, Mondi PLC, Oji Holdings Corporation, International Paper Company, Nippon Paper Industries Co Ltd, Packaging Corporation of America, Cascades Inc.

3. What are the main segments of the North America Corrugated Board Packaging Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.00 Million as of 2022.

5. What are some drivers contributing to market growth?

Strong Demand from the E-commerce Sector; Growing Adoption of Light Weighting Materials and Scope for Printing Innovations.

6. What are the notable trends driving market growth?

Strong Demand from the E-commerce Sector.

7. Are there any restraints impacting market growth?

Strict Environmental Regulation Regarding Deforestation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Corrugated Board Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Corrugated Board Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Corrugated Board Packaging Market?

To stay informed about further developments, trends, and reports in the North America Corrugated Board Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence