Key Insights

The Middle East and Africa (MEA) plastic closures market is projected for significant expansion, reaching an estimated $85.2 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.52% through 2033. This growth is propelled by escalating demand from key end-user industries, notably beverages and food, which represent substantial consumption. Regional drivers include a growing population, rising disposable incomes, and an increasing preference for packaged goods. The pharmaceutical and healthcare sectors are also experiencing heightened demand for secure plastic closures, attributed to advancements in healthcare infrastructure and growing health consciousness. Cosmetics and toiletries further contribute to market growth, driven by a larger consumer base seeking convenient and appealing packaging solutions. Dominant materials like PET, PP, LDPE, and HDPE are expected to continue their market prevalence due to their versatility, cost-effectiveness, and recyclability.

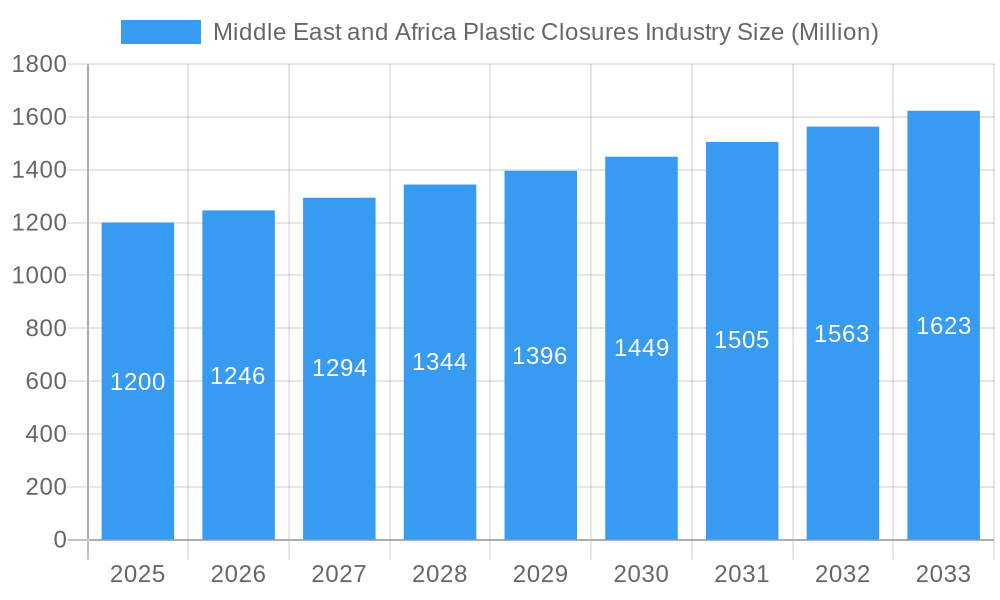

Middle East and Africa Plastic Closures Industry Market Size (In Billion)

Despite positive market sentiment, potential restraints exist. Stringent regulations on plastic waste and a growing shift towards sustainable packaging alternatives, such as bio-based or recycled materials, may pose challenges. However, the industry is actively innovating with sustainable materials and enhancing recycling initiatives. Key MEA players are concentrating on advanced closure technologies, including improved tamper-evidence, child resistance, and user-friendliness, to meet evolving consumer expectations and regulatory mandates. Investments in efficient manufacturing and expanded distribution networks are crucial for market participants to leverage regional growth opportunities. The Middle East, led by Saudi Arabia and the UAE, is anticipated to be a primary market contributor, supported by substantial infrastructure investments and a diverse industrial landscape.

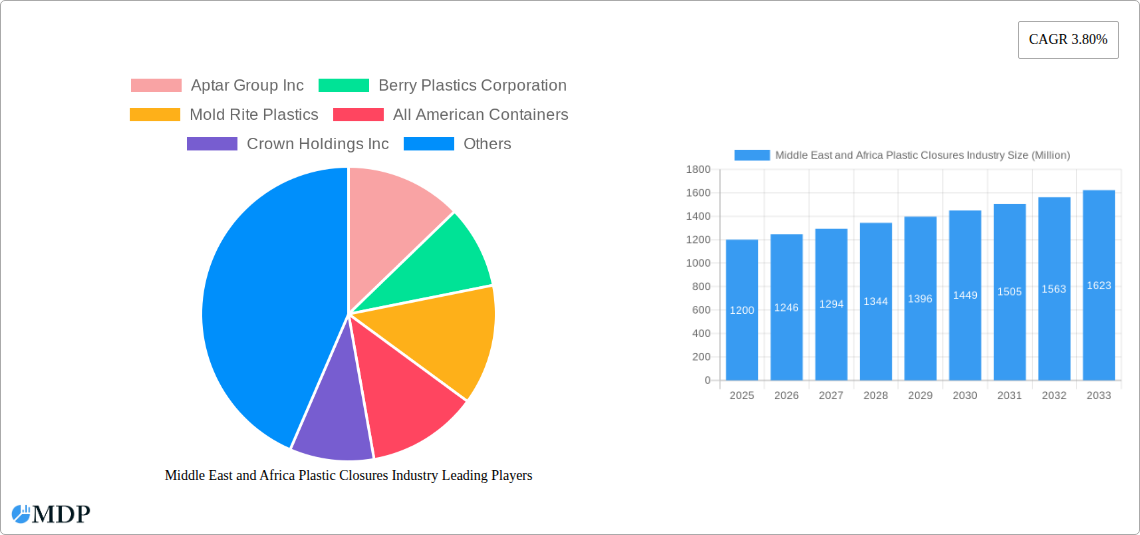

Middle East and Africa Plastic Closures Industry Company Market Share

Middle East and Africa Plastic Closures Market Analysis Report: 2025-2033

This comprehensive report provides in-depth insights into the dynamic Middle East and Africa plastic closures market from 2025 to 2033. Utilizing high-impact keywords such as "plastic closures market," "MEA packaging industry," "PET closures," "PP closures," "beverage packaging," "pharmaceutical packaging," and "cosmetic packaging," this analysis is optimized for maximum search visibility. Explore critical market dynamics, emerging trends, leading segments, product innovations, growth drivers, challenges, and a strategic outlook for this evolving sector. The report also identifies key players and milestones, offering actionable intelligence for strategic decision-making. The estimated market size for plastic closures in the Middle East and Africa is projected to reach $85.2 billion by 2025, with a projected CAGR of 5.52% from 2025 to 2033.

Middle East and Africa Plastic Closures Industry Market Dynamics & Concentration

The Middle East and Africa plastic closures industry is characterized by a moderate market concentration, with a blend of global giants and regional players vying for market share. The market share distribution is roughly estimated, with Aptar Group Inc holding approximately 12% and Berry Plastics Corporation around 10%. M&A activities have been a significant driver, with an estimated xx number of deals recorded during the historical period (2019-2024). Innovation, particularly in sustainable materials and advanced sealing technologies, is a key driver, pushing companies to invest in R&D. Regulatory frameworks, focusing on food safety and environmental impact, are evolving, influencing product design and material choices. Product substitutes, while present in niche applications, have limited impact on the overall market due to the cost-effectiveness and versatility of plastic closures. End-user trends, such as the growing demand for convenience packaging and smaller portion sizes, are reshaping product portfolios.

- Market Concentration: Moderate, with a few key global players and a substantial number of regional manufacturers.

- Innovation Drivers: Sustainability (e.g., recycled content, biodegradable plastics), tamper-evident features, child-resistant closures, and enhanced dispensing mechanisms.

- Regulatory Frameworks: Increasing emphasis on food-grade materials, child safety standards, and waste management regulations.

- Product Substitutes: Limited in core applications due to plastic's cost-effectiveness and performance.

- End-User Trends: Rise of e-commerce, demand for premium and aesthetically pleasing packaging, and growth in health-conscious product consumption.

- M&A Activities: Strategic acquisitions to expand geographical reach, acquire technological capabilities, and consolidate market position. An estimated xx M&A deals occurred between 2019 and 2024.

Middle East and Africa Plastic Closures Industry Industry Trends & Analysis

The Middle East and Africa plastic closures industry is experiencing robust growth driven by a confluence of factors, including expanding populations, increasing disposable incomes, and a burgeoning middle class across key economies. The market penetration of plastic closures in various end-user industries is steadily rising. The Beverage industry remains a dominant segment, fueled by the rising consumption of bottled water, juices, and carbonated soft drinks, with an estimated market share of xx% in 2025. The Food industry follows closely, driven by the demand for packaged convenience foods and pantry staples. The Pharmaceutical and Healthcare sector presents a significant growth avenue, with an increasing need for secure and tamper-evident closures for medicines and healthcare products, contributing an estimated xx% to the market in 2025. The Cosmetics and Toiletries segment is also witnessing expansion, propelled by evolving consumer preferences for personal care products and demand for innovative dispensing solutions.

Technological disruptions are playing a crucial role, with advancements in material science leading to the development of lighter, stronger, and more sustainable plastic closure solutions. The adoption of advanced manufacturing techniques, such as injection molding optimization and automation, is enhancing production efficiency and reducing costs. Consumer preferences are increasingly leaning towards closures that offer convenience, ease of use, and enhanced product integrity. The competitive dynamics are characterized by both price-based competition and a growing emphasis on product differentiation through design, functionality, and sustainability features. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). The estimated market size is projected to reach xx Million by 2025, signifying substantial growth potential.

Leading Markets & Segments in Middle East and Africa Plastic Closures Industry

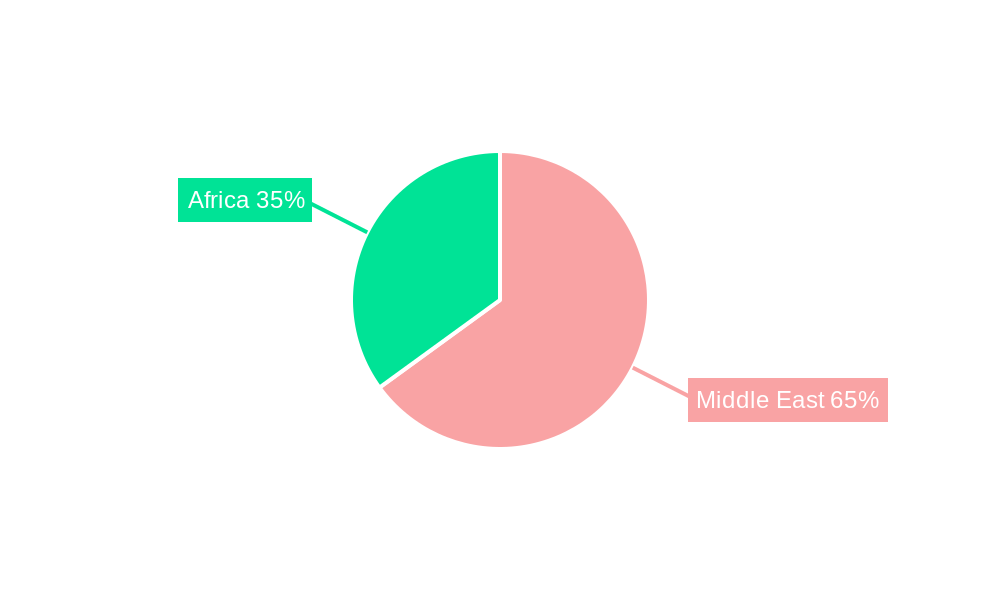

The Middle East and Africa plastic closures industry exhibits distinct regional dominance and segment leadership, with the Middle East region, particularly countries like Saudi Arabia, UAE, and Egypt, emerging as a leading market. This dominance is propelled by robust economic development, significant investments in infrastructure, and a rapidly growing consumer base with increasing purchasing power. The Beverage end-user industry is a primary driver of this regional growth, accounting for an estimated xx% of the plastic closures market in 2025. The sheer volume of bottled water and soft drink consumption, coupled with the expansion of the food and beverage processing sector, underpins this segment's strength.

Within the material segment, PP (Polypropylene) and HDPE (High-Density Polyethylene) closures command a significant market share, estimated at xx% and xx% respectively in 2025, due to their versatility, cost-effectiveness, and suitability for a wide range of applications. However, PET (Polyethylene Terephthalate) closures are gaining traction, especially for beverage bottles, due to their clarity, barrier properties, and recyclability. The Pharmaceutical and Healthcare sector is a key growth segment, with its share projected to reach xx% by 2025. This growth is driven by stringent regulatory requirements for product safety and tamper-evidence, alongside the increasing healthcare expenditure and a rising demand for pharmaceuticals and medical supplies. The Cosmetics and Toiletries segment also contributes significantly, with an estimated market share of xx% in 2025, fueled by the growing popularity of personal care products and the demand for innovative and aesthetically appealing packaging solutions.

- Dominant Region: Middle East (Saudi Arabia, UAE, Egypt) - driven by economic growth, infrastructure development, and consumer demand.

- Dominant End-User Industry: Beverage (xx% market share in 2025) - supported by high consumption of bottled drinks and expansion of food & beverage processing.

- Leading Material Segments: PP (xx% market share in 2025) and HDPE (xx% market share in 2025) - due to their versatility and cost-effectiveness.

- Fastest Growing End-User Industry: Pharmaceutical and Healthcare (xx% projected market share in 2025) - driven by safety regulations and rising healthcare expenditure.

- Key Drivers for Dominance:

- Economic Policies: Favorable investment climates and trade agreements in leading Middle Eastern nations.

- Infrastructure Development: Advanced logistics and manufacturing facilities supporting high production volumes.

- Consumer Demographics: Young and growing populations with increasing disposable incomes and a preference for packaged goods.

- Regulatory Compliance: Adherence to international standards for food safety and product integrity in key sectors like pharmaceuticals.

Middle East and Africa Plastic Closures Industry Product Developments

Product innovation in the Middle East and Africa plastic closures industry is largely focused on enhancing functionality, sustainability, and consumer convenience. Developments include the introduction of lightweight designs to reduce material usage and transportation costs, alongside advanced tamper-evident features that provide superior product security and consumer confidence. Innovations in dispensing mechanisms, such as push-and-turn caps and flip-top closures, are catering to the demand for ease of use in the beverage, cosmetic, and household chemical sectors. Furthermore, there's a significant push towards incorporating recycled content and exploring biodegradable materials to align with growing environmental consciousness and regulatory pressures, offering a competitive advantage in an increasingly eco-aware market.

Key Drivers of Middle East and Africa Plastic Closures Industry Growth

The growth of the Middle East and Africa plastic closures industry is primarily propelled by a confluence of interconnected factors. A rapidly expanding population, coupled with rising urbanization and an increasing middle class, is fueling demand for packaged goods across all end-user sectors. Economic diversification initiatives in several countries are leading to increased investments in manufacturing, particularly in the food and beverage and pharmaceutical sectors, which are major consumers of plastic closures. Technological advancements in closure design and manufacturing are enabling more efficient production and the development of specialized closures with enhanced safety and functionality features. Evolving consumer preferences for convenience, safety, and aesthetic appeal are also significant drivers, compelling manufacturers to innovate.

Challenges in the Middle East and Africa Plastic Closures Industry Market

Despite the promising growth trajectory, the Middle East and Africa plastic closures industry faces several significant challenges. Fluctuations in raw material prices, particularly for polymers derived from crude oil, can impact profit margins and introduce pricing volatility. Navigating diverse and evolving regulatory landscapes across different countries within the region can be complex and costly for manufacturers. Intense competition, both from local and international players, often leads to price pressures, squeezing profit margins. Furthermore, the growing global emphasis on sustainability and the push for reduced plastic consumption pose a long-term challenge, requiring continuous innovation in recyclable and biodegradable materials, which can entail substantial investment.

Emerging Opportunities in Middle East and Africa Plastic Closures Industry

The Middle East and Africa plastic closures industry is ripe with emerging opportunities, driven by several catalysts for long-term growth. The continued expansion of the pharmaceutical and healthcare sector, spurred by increasing healthcare access and an aging population, presents a substantial opportunity for high-value, secure, and tamper-evident closures. The growing demand for premium and specialty beverages, including functional drinks and juices, opens avenues for innovative and aesthetically pleasing closures. Strategic partnerships and collaborations between closure manufacturers and packaging converters can unlock new markets and enhance supply chain efficiencies. Furthermore, the increasing adoption of e-commerce across the region necessitates specialized packaging solutions, including closures that ensure product integrity during transit, presenting a significant untapped market.

Leading Players in the Middle East and Africa Plastic Closures Industry Sector

- Aptar Group Inc

- Berry Plastics Corporation

- Mold Rite Plastics

- All American Containers

- Crown Holdings Inc

- Silgan Plastics

- Bericap

- Alpha Packaging

- Portola Packaging

- Closure Systems International*List Not Exhaustive

- Mocap

- MJS Packaging

Key Milestones in Middle East and Africa Plastic Closures Industry Industry

- 2019: Increased focus on developing tamper-evident closures for the pharmaceutical sector in response to evolving regulations.

- 2020: Rise in demand for child-resistant closures for household chemicals and personal care products, driven by safety awareness.

- 2021: Significant investment in R&D for sustainable and recyclable plastic closure solutions by major industry players.

- 2022: Expansion of production capacities by several regional manufacturers to meet growing demand from the beverage and food industries.

- 2023: Introduction of innovative dispensing closures for the cosmetics and toiletries market, enhancing user experience.

- 2024: Growing trend towards lightweighting of closures to reduce material consumption and carbon footprint.

Strategic Outlook for Middle East and Africa Plastic Closures Industry Market

The strategic outlook for the Middle East and Africa plastic closures market is highly optimistic, driven by sustained demand from a growing consumer base and expanding end-user industries. Key growth accelerators include continued investment in innovative and sustainable closure technologies, such as those made from recycled or bio-based materials, which will cater to increasing environmental consciousness. The pharmaceutical and healthcare sectors, with their stringent requirements for product safety and integrity, will continue to be a major growth engine, encouraging the development of specialized closures. Furthermore, strategic collaborations with beverage and food manufacturers to develop bespoke packaging solutions for new product launches and expanding product lines will be crucial for market penetration. The digitalization of manufacturing processes and supply chains will also enhance efficiency and competitiveness.

Middle East and Africa Plastic Closures Industry Segmentation

-

1. Material

- 1.1. PET

- 1.2. PP

- 1.3. LDPE and HDPE

- 1.4. Other Materials

-

2. End-user Industry

- 2.1. Beverage

- 2.2. Food

- 2.3. Pharmaceutical and Healthcare

- 2.4. Cosmetics and Toiletries

- 2.5. Household Chemicals

- 2.6. Other End-user Industries

Middle East and Africa Plastic Closures Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Plastic Closures Industry Regional Market Share

Geographic Coverage of Middle East and Africa Plastic Closures Industry

Middle East and Africa Plastic Closures Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Demand for Innovative Solutions from End-Users

- 3.3. Market Restrains

- 3.3.1. ; Lightweight And Cost-effective Stand-up Pouch Packaging

- 3.4. Market Trends

- 3.4.1. Pharmaceutical and Healthcare Plays a Significant Role

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Plastic Closures Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. PET

- 5.1.2. PP

- 5.1.3. LDPE and HDPE

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Beverage

- 5.2.2. Food

- 5.2.3. Pharmaceutical and Healthcare

- 5.2.4. Cosmetics and Toiletries

- 5.2.5. Household Chemicals

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aptar Group Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berry Plastics Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mold Rite Plastics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 All American Containers

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Crown Holdings Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Silgan Plastics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bericap

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alpha Packaging

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Portola Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Closure Systems International*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Mocap

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 MJS Packaging

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Aptar Group Inc

List of Figures

- Figure 1: Middle East and Africa Plastic Closures Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Plastic Closures Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Plastic Closures Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Middle East and Africa Plastic Closures Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Middle East and Africa Plastic Closures Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Middle East and Africa Plastic Closures Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 5: Middle East and Africa Plastic Closures Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Middle East and Africa Plastic Closures Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East and Africa Plastic Closures Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East and Africa Plastic Closures Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East and Africa Plastic Closures Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East and Africa Plastic Closures Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East and Africa Plastic Closures Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East and Africa Plastic Closures Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East and Africa Plastic Closures Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East and Africa Plastic Closures Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East and Africa Plastic Closures Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Plastic Closures Industry?

The projected CAGR is approximately 5.52%.

2. Which companies are prominent players in the Middle East and Africa Plastic Closures Industry?

Key companies in the market include Aptar Group Inc, Berry Plastics Corporation, Mold Rite Plastics, All American Containers, Crown Holdings Inc, Silgan Plastics, Bericap, Alpha Packaging, Portola Packaging, Closure Systems International*List Not Exhaustive, Mocap, MJS Packaging.

3. What are the main segments of the Middle East and Africa Plastic Closures Industry?

The market segments include Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 85.2 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increased Demand for Innovative Solutions from End-Users.

6. What are the notable trends driving market growth?

Pharmaceutical and Healthcare Plays a Significant Role.

7. Are there any restraints impacting market growth?

; Lightweight And Cost-effective Stand-up Pouch Packaging.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Plastic Closures Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Plastic Closures Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Plastic Closures Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Plastic Closures Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence