Key Insights

The Thailand Flexible Plastic Packaging Market is projected for significant expansion, anticipated to reach $2.56 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 10.57%. This growth is primarily propelled by the expanding food and beverage sector, driven by increasing consumer demand for convenience, extended shelf life, and visually appealing packaging. Rising disposable incomes and evolving lifestyles in Thailand are boosting the consumption of processed foods, ready-to-eat meals, and premium beverages, all of which necessitate effective flexible plastic packaging for preservation and presentation. The medical and pharmaceutical industries, with their critical requirements for sterile and secure packaging, also present substantial growth opportunities. Demand from the personal care and household care segments remains steady, influenced by product innovation and a preference for user-friendly and portable packaging formats.

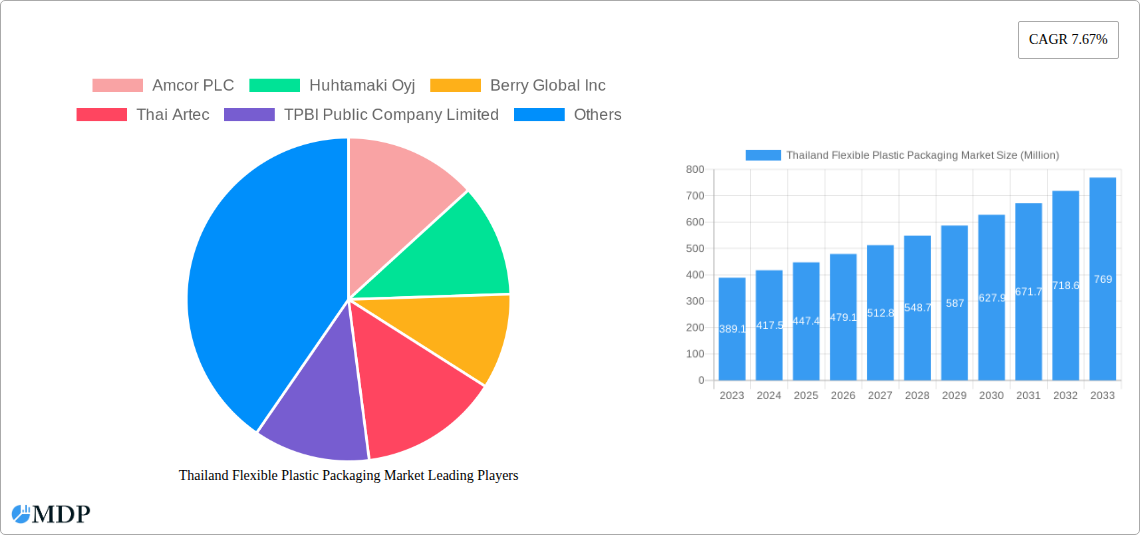

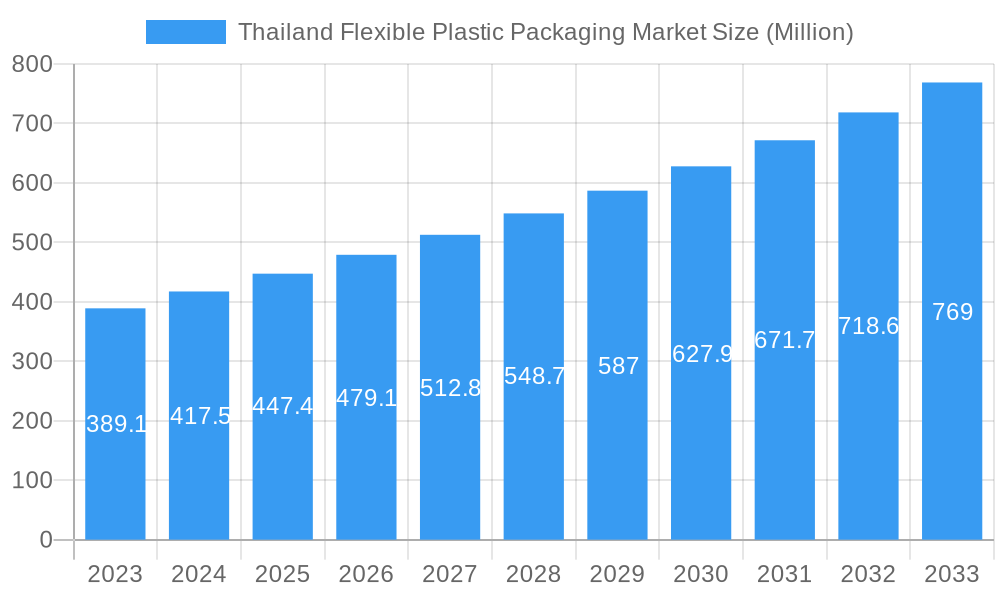

Thailand Flexible Plastic Packaging Market Market Size (In Billion)

Key factors fueling this market's upward trend include technological advancements in packaging materials, enhancing barrier properties, printability, and sustainability. The adoption of advanced manufacturing processes and automation in Thailand's packaging sector is also improving efficiency and product quality. However, the market faces challenges such as fluctuating raw material prices, particularly for petroleum-based plastics, and growing environmental concerns regarding plastic waste. Regulatory pressures and the drive towards sustainable and recyclable packaging solutions present both obstacles and avenues for innovation. The market is characterized by intense competition among major global and local players, focusing on product differentiation, strategic alliances, and the development of eco-friendly alternatives. The prevalence of Polyethene (PE) and Bi-oriented Polypropylene (BOPP) as leading materials, alongside strong demand for pouches, films, and wraps, are key trends shaping the market's future.

Thailand Flexible Plastic Packaging Market Company Market Share

Gain critical insights into the Thailand Flexible Plastic Packaging Market through this comprehensive report. Spanning the study period from 2019 to 2033, with a base year of 2025, this analysis details market drivers, segmentation, competitive dynamics, and future outlooks. Explore key trends in Thailand's flexible packaging industry, understand the growth catalysts for plastic packaging in Thailand, and identify opportunities within the food and medical packaging markets in Thailand. This report is essential for flexible plastic packaging manufacturers, material suppliers, and end-user industries aiming to strategize for this evolving market.

Thailand Flexible Plastic Packaging Market Market Dynamics & Concentration

The Thailand Flexible Plastic Packaging Market is characterized by a moderate level of concentration, with a few dominant global players alongside significant local manufacturers. Innovation remains a key driver, fueled by the increasing demand for sustainable and functional packaging solutions. Regulatory frameworks are evolving, with a growing emphasis on environmental responsibility and waste management, impacting material choices and product designs. Product substitutes, such as rigid packaging and alternative sustainable materials, pose a continuous challenge, necessitating ongoing innovation and cost-effectiveness from flexible plastic packaging providers. End-user trends are strongly influenced by consumer preferences for convenience, shelf-life extension, and aesthetic appeal, particularly in the food and beverage sectors. Mergers and acquisitions (M&A) activity, while not at an extreme level, contributes to market consolidation and the expansion of capabilities. The market share of leading players is distributed, with Amcor PLC and Berry Global Inc. holding substantial portions due to their global reach and diverse product portfolios. Thai companies like SCG Packaging Public Company Limited and TPBI Public Company Limited are also significant players, leveraging their local market understanding and production capacities. M&A deal counts in the region have seen a steady, albeit moderate, increase as companies seek to gain market share and integrate advanced technologies.

Thailand Flexible Plastic Packaging Market Industry Trends & Analysis

The Thailand Flexible Plastic Packaging Market is poised for significant growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period of 2025–2033. This robust expansion is driven by a confluence of factors, including Thailand's burgeoning economy, a growing middle class with increasing disposable incomes, and a rapidly expanding food and beverage industry. The demand for convenient, safe, and aesthetically pleasing packaging solutions is escalating, with consumers seeking products that offer extended shelf life and ease of use. Technological advancements in printing, lamination, and barrier properties are enabling manufacturers to develop innovative packaging that meets these evolving consumer needs. For instance, the integration of high-barrier films is crucial for preserving the freshness and quality of food products, a key growth driver. Furthermore, the rise of e-commerce in Thailand has amplified the need for durable and protective flexible packaging for shipping and handling a wide array of goods. The market penetration of advanced flexible packaging solutions is steadily increasing across various end-user industries, from personal care to pharmaceuticals. The competitive dynamics are characterized by a blend of global giants and agile local players, each vying for market share through product differentiation, strategic partnerships, and investments in sustainable practices. The increasing focus on circular economy principles and waste reduction is also shaping industry trends, pushing manufacturers towards recyclable and biodegradable packaging options. This shift is not only driven by regulatory pressure but also by a growing consumer awareness and demand for eco-friendly products. The robust growth in the Thailand plastic packaging market is further supported by government initiatives aimed at promoting industrial development and attracting foreign investment, creating a favorable environment for market expansion and innovation.

Leading Markets & Segments in Thailand Flexible Plastic Packaging Market

The Thailand Flexible Plastic Packaging Market exhibits distinct dominance across various segments, driven by specific end-user demands and material properties.

Dominant End-User Industry: Food

- The food industry remains the largest consumer of flexible plastic packaging in Thailand, accounting for an estimated 65% of the market share in 2025. This dominance is propelled by several sub-segments:

- Candy & Confectionery: High demand for attractive, moisture-resistant packaging to maintain product quality and appeal.

- Frozen Foods: Essential for preserving food integrity and extending shelf life under freezing conditions.

- Fresh Produce: Growing use of modified atmosphere packaging (MAP) to extend the freshness of fruits and vegetables.

- Dairy Products: Requirement for barrier properties to prevent spoilage and maintain taste.

- Dry Foods: Need for moisture and oxygen barrier to prevent staleness and extend shelf life.

- Meat, Poultry, And Seafood: Critical for hygiene, preservation, and extended shelf life through specialized barrier films.

- Pet Food: Increasing demand for resealable pouches and high-barrier films to maintain freshness.

- Key Drivers: Economic policies promoting food processing and export, rising consumer spending on processed and convenience foods, and the expansion of modern retail channels are key economic drivers. Infrastructure development, including cold chain logistics, is crucial for the growth of frozen and chilled food packaging.

- The food industry remains the largest consumer of flexible plastic packaging in Thailand, accounting for an estimated 65% of the market share in 2025. This dominance is propelled by several sub-segments:

Dominant Material Type: Polyethene (PE)

- Polyethene (PE), particularly Low-Density Polyethene (LDPE) and High-Density Polyethene (HDPE), is the most widely used material in Thailand's flexible plastic packaging market, representing an estimated 45% of the material segment.

- Key Drivers: Its versatility, cost-effectiveness, excellent moisture barrier properties, and good sealability make it ideal for a broad range of applications, from carrier bags and liners to food wrappers. The established recycling infrastructure for PE also contributes to its widespread adoption.

Dominant Product Type: Films and Wraps

- Films and wraps, encompassing a wide array of flexible packaging formats, command a significant market share, estimated at 40% of the product type segment.

- Key Drivers: These include shrink films, stretch films, cling films, and various types of overwraps used extensively in the food, beverage, and personal care industries for product protection, containment, and branding. Their adaptability to different product shapes and sizes makes them highly sought after.

Emerging Segments: While food dominates, the Beverage, Medical and Pharmaceutical, and Personal Care and Household Care sectors are exhibiting strong growth trajectories, driven by increasing demand for specialized barrier properties, sterilization capabilities, and child-resistant features. The "Other Product Types" segment, including blister packs and liners, is also gaining traction due to specialized industrial and medical applications.

Thailand Flexible Plastic Packaging Market Product Developments

Product innovation in Thailand's flexible plastic packaging market is primarily focused on enhancing sustainability, functionality, and shelf-life extension. Manufacturers are actively developing multi-layer films with improved barrier properties using advanced polymers like EVOH for demanding applications in the food and medical sectors. The push for recyclability is driving the development of mono-material solutions, replacing traditional multi-material laminates. For instance, advancements in PE and PP-based structures are enabling the creation of packaging that can be more effectively sorted and recycled within existing infrastructure. Furthermore, the integration of smart packaging features, such as active and intelligent packaging, is on the rise, offering enhanced product protection and consumer convenience. These developments aim to address growing environmental concerns and meet the evolving demands of sophisticated consumers and industries. The competitive advantage lies in offering solutions that are not only cost-effective but also contribute to reduced waste and a smaller environmental footprint.

Key Drivers of Thailand Flexible Plastic Packaging Market Growth

Several key drivers are propelling the growth of the Thailand Flexible Plastic Packaging Market. Economically, Thailand's expanding middle class and rising disposable incomes are fueling increased consumption of packaged goods, particularly in the food and beverage sectors. Technologically, advancements in extrusion, printing, and lamination technologies enable the creation of high-performance flexible packaging with superior barrier properties, extended shelf life, and enhanced aesthetic appeal. Regulatory factors, while posing challenges, also act as drivers for innovation, with government initiatives promoting recycling and sustainable packaging encouraging the development of eco-friendly solutions. The growing e-commerce sector necessitates robust and protective flexible packaging for shipping, further boosting demand. Finally, a strong focus on convenience by consumers, leading to a preference for single-serve and resealable packaging, is a significant market accelerator.

Challenges in the Thailand Flexible Plastic Packaging Market Market

The Thailand Flexible Plastic Packaging Market faces several challenges that can impede its growth. A primary concern is the growing public and regulatory pressure regarding plastic waste and environmental pollution, leading to stricter regulations on single-use plastics and a demand for sustainable alternatives, which can increase production costs. Supply chain disruptions, including volatility in raw material prices (e.g., crude oil derivatives for plastics) and logistical complexities, can impact profitability and delivery timelines. Intense competition among domestic and international players, coupled with the threat of product substitutes like paper-based packaging and rigid containers, necessitates continuous innovation and cost optimization. Furthermore, the lack of widespread advanced recycling infrastructure in some regions can limit the adoption of truly circular economy solutions, posing a hurdle for manufacturers aiming for enhanced sustainability.

Emerging Opportunities in Thailand Flexible Plastic Packaging Market

Emerging opportunities within the Thailand Flexible Plastic Packaging Market are ripe for exploitation. The burgeoning demand for sustainable and eco-friendly packaging presents a significant avenue for growth, with opportunities in biodegradable, compostable, and highly recyclable flexible packaging solutions. Technological breakthroughs in advanced recycling processes, such as chemical recycling, offer the potential to transform plastic waste into high-value raw materials, creating a circular economy loop. Strategic partnerships between packaging manufacturers, material suppliers, and end-user industries are crucial for co-developing innovative solutions and expanding market reach. Market expansion into under-penetrated sectors like specialized medical packaging and premium personal care products also offers substantial potential. The increasing adoption of e-commerce in Thailand further fuels the need for specialized, durable, and tamper-evident flexible packaging solutions for online retail.

Leading Players in the Thailand Flexible Plastic Packaging Market Sector

- Amcor PLC

- Huhtamaki Oyj

- Berry Global Inc

- Thai Artec

- TPBI Public Company Limited

- Sealed Air Corporation

- Mondi Plc

- SCG Packaging Public Company Limited

Key Milestones in Thailand Flexible Plastic Packaging Market Industry

- June 2024: SCG Packaging Public Company Limited (SCGP) collaborated in the “Sanofi Planet Care Upcycling Program” to transform recycled plastic pellets into new packaging. Sanofi, SCGC, and Cirplas spearheaded Thailand's "Reviving Used Insulin Pens" initiative. It marked the country's debut in employing Advanced Recycling technology to convert pens into plastic pellets, promoting a "Check, Remove, Dispose" behavior. This plan is expected to repurpose plastic pellets into diverse packaging solutions, enhancing their value, fostering resource circulation, and championing resource reusability.

- May 2024: Mondi’s WalletPack is a PP based solution which is designed for recyclability. This packaging is purposefully developed with recycling in mind, aligning with our customer’s goals, and NPA's missions as an approved producer responsibility organisation dedicated to advancing circular and traceable material recycling. WalletPack can be effectively sorted by Site Zero, Europe’s largest and most advanced plastic recycling facility located in Sweden and is thereby contributing to a circular economy. It replaces the previous solution, which was an unrecyclable multi-material pack that consisted of PET-PE and PA-PE laminates.

Strategic Outlook for Thailand Flexible Plastic Packaging Market Market

The strategic outlook for the Thailand Flexible Plastic Packaging Market is characterized by a strong emphasis on sustainability, innovation, and market diversification. Growth accelerators include the continued demand for convenient and extended-shelf-life packaging, especially in the food and beverage sectors, coupled with the increasing adoption of e-commerce. Manufacturers are expected to invest heavily in research and development to offer a wider range of recyclable, biodegradable, and compostable packaging solutions, aligning with global environmental trends and stringent regulatory requirements. Strategic partnerships and collaborations will be crucial for leveraging advanced recycling technologies and expanding market reach. Furthermore, focusing on high-growth segments like medical and pharmaceutical packaging, where specialized barrier properties and stringent quality control are paramount, presents a significant opportunity for market leaders to enhance their product portfolios and secure long-term growth prospects.

Thailand Flexible Plastic Packaging Market Segmentation

-

1. Material Type

- 1.1. Polyethene (PE)

- 1.2. Bi-oriented Polypropylene (BOPP)

- 1.3. Cast Polypropylene (CPP)

- 1.4. Polyvinyl Chloride (PVC)

- 1.5. Ethylene Vinyl Alcohol (EVOH)

- 1.6. Other Ma

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types (Blister Packs, Liners, etc)

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

Thailand Flexible Plastic Packaging Market Segmentation By Geography

- 1. Thailand

Thailand Flexible Plastic Packaging Market Regional Market Share

Geographic Coverage of Thailand Flexible Plastic Packaging Market

Thailand Flexible Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Convenient Packaging

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Convenient Packaging

- 3.4. Market Trends

- 3.4.1. The Demand for Convenient Packaging is Rising

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Flexible Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Polyethene (PE)

- 5.1.2. Bi-oriented Polypropylene (BOPP)

- 5.1.3. Cast Polypropylene (CPP)

- 5.1.4. Polyvinyl Chloride (PVC)

- 5.1.5. Ethylene Vinyl Alcohol (EVOH)

- 5.1.6. Other Ma

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types (Blister Packs, Liners, etc)

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Huhtamaki Oyj

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Berry Global Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thai Artec

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TPBI Public Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sealed Air Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mondi Plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SCG Packaging Public Company Limited*List Not Exhaustive 7 2 Heat Map Analysi

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Amcor PLC

List of Figures

- Figure 1: Thailand Flexible Plastic Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Thailand Flexible Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Flexible Plastic Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Thailand Flexible Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Thailand Flexible Plastic Packaging Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 4: Thailand Flexible Plastic Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Thailand Flexible Plastic Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Thailand Flexible Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Thailand Flexible Plastic Packaging Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 8: Thailand Flexible Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Flexible Plastic Packaging Market?

The projected CAGR is approximately 10.57%.

2. Which companies are prominent players in the Thailand Flexible Plastic Packaging Market?

Key companies in the market include Amcor PLC, Huhtamaki Oyj, Berry Global Inc, Thai Artec, TPBI Public Company Limited, Sealed Air Corporation, Mondi Plc, SCG Packaging Public Company Limited*List Not Exhaustive 7 2 Heat Map Analysi.

3. What are the main segments of the Thailand Flexible Plastic Packaging Market?

The market segments include Material Type, Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.56 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Convenient Packaging.

6. What are the notable trends driving market growth?

The Demand for Convenient Packaging is Rising.

7. Are there any restraints impacting market growth?

Rising Demand for Convenient Packaging.

8. Can you provide examples of recent developments in the market?

June 2024: SCG Packaging Public Company Limited (SCGP) collaborated in the “Sanofi Planet Care Upcycling Program” to transform recycled plastic pellets into new packaging. Sanofi, SCGC, and Cirplas spearheaded Thailand's "Reviving Used Insulin Pens" initiative. It marked the country's debut in employing Advanced Recycling technology to convert pens into plastic pellets, promoting a "Check, Remove, Dispose" behavior. This plan is expected to repurpose plastic pellets into diverse packaging solutions, enhancing their value, fostering resource circulation, and championing resource reusability.May 2024: May 2024 - Mondi’s WalletPack is a PP based solution which is designed for recyclability. This packaging is purposefully developed with recycling in mind, aligning with our customer’s goals, and NPA's missions as an approved producer responsibility organisation dedicated to advancing circular and traceable material recycling. WalletPack can be effectively sorted by Site Zero, Europe’s largest and most advanced plastic recycling facility located in Sweden and is thereby contributing to a circular economy. It replaces the previous solution, which was an unrecyclable multi-material pack that consisted of PET-PE and PA-PE laminates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Flexible Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Flexible Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Flexible Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Thailand Flexible Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence