Key Insights

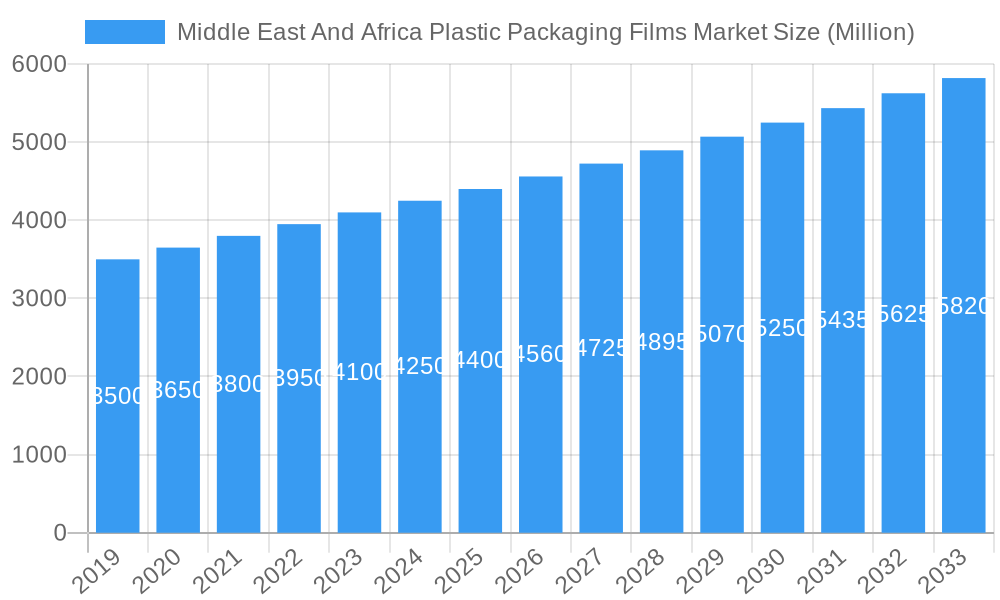

The Middle East and Africa plastic packaging films market is projected for significant expansion, expected to reach $635.2 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.4% through 2033. This growth is driven by increasing demand for packaged food and beverages, a growing middle class, and a greater focus on hygiene and product preservation. Expanding industrial sectors, the cost-effectiveness and versatility of plastic packaging, and investments in advanced manufacturing technologies are also key contributors. Essential drivers include the need for effective food preservation, the growth of e-commerce, and the expanding personal care and healthcare industries.

Middle East And Africa Plastic Packaging Films Market Market Size (In Million)

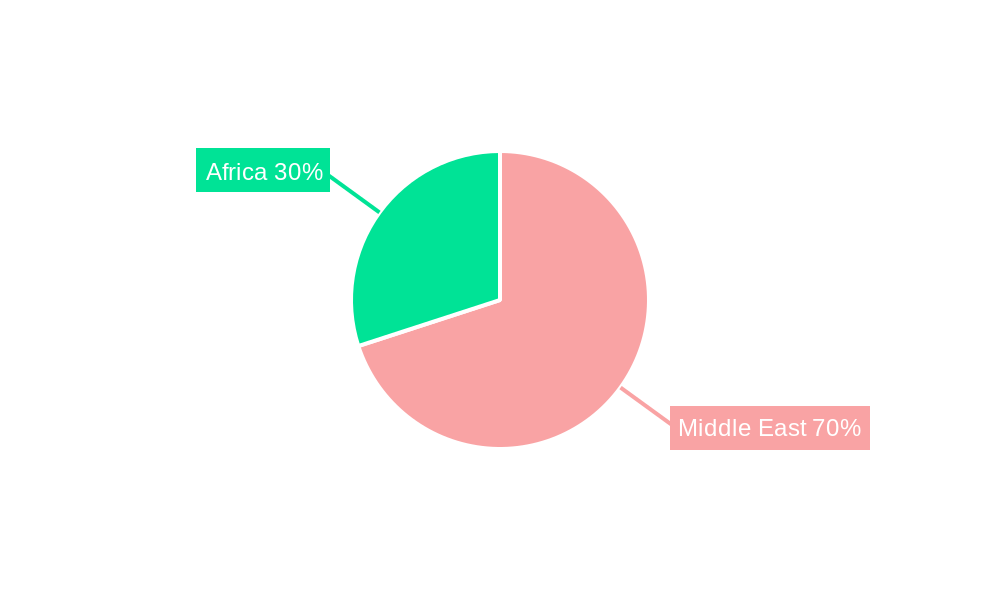

Polyethylene (PE) and Polypropylene (PP) films are the market leaders due to their affordability and versatility. However, demand for specialized films like Polyethylene Vinyl Acetate (PVOH), Ethylene Vinyl Alcohol (EVOH), and Polyethylene Terephthalate Glycol (PETG) is rising for enhanced barrier properties in food and healthcare applications. The market is also witnessing a trend towards bio-based plastic films driven by sustainability concerns. While fluctuating raw material prices and evolving plastic waste management regulations pose challenges, innovation in recyclable and biodegradable alternatives is addressing these issues. Leading companies are investing in R&D to meet these evolving demands, fostering a dynamic market. The Middle East region is anticipated to be a primary growth engine.

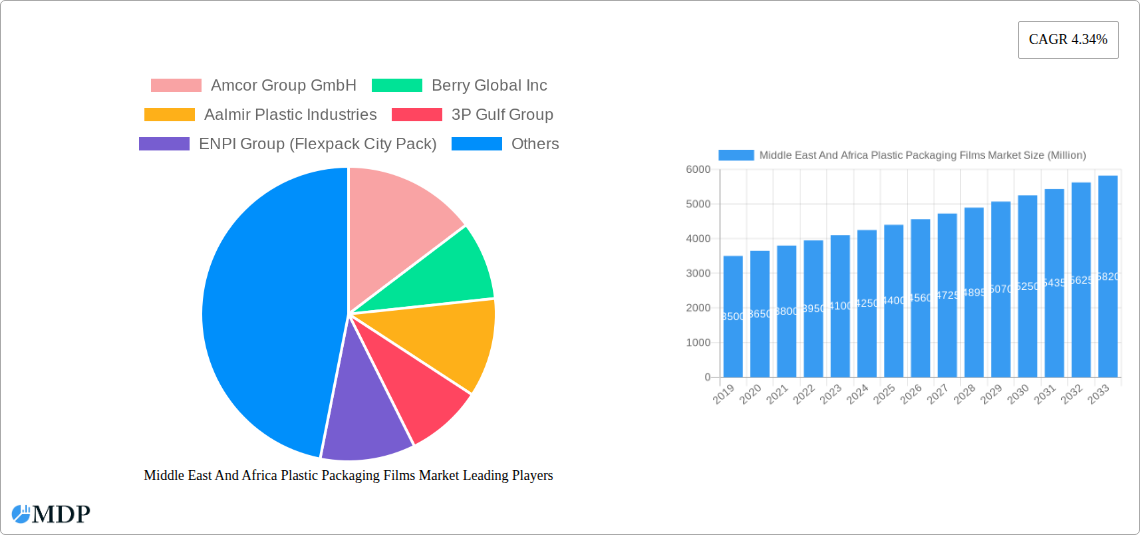

Middle East And Africa Plastic Packaging Films Market Company Market Share

Middle East & Africa Plastic Packaging Films Market: Growth, Trends, and Future Outlook (2019-2033)

This comprehensive report delves into the dynamic Middle East and Africa plastic packaging films market, offering an in-depth analysis of its growth trajectory, key drivers, emerging opportunities, and competitive landscape. With a study period spanning from 2019 to 2033, and a base and estimated year of 2025, this report provides invaluable insights for stakeholders seeking to understand and capitalize on this rapidly evolving sector. Covering a wide array of film types, including Polypropylene, Polyethylene, Polystyrene, Bio-Based, PVC, EVOH, PETG, and Other Film Types, and dissecting end-user industries such as Food (Candy & Confectionery, Frozen Foods, Fresh Produce, Dairy Products, Dry Foods, Meat, Poultry, And Seafood, Pet Food, Other Fo), Healthcare, Personal Care & Home Care, Industrial Packaging, and Other, this report is your definitive guide to the MEA plastic packaging films market.

Middle East And Africa Plastic Packaging Films Market Market Dynamics & Concentration

The Middle East and Africa plastic packaging films market is characterized by a moderate concentration, with a few key players holding significant market share, yet offering ample space for innovation and emerging businesses. The market's dynamism is fueled by a growing demand for convenient and protective packaging solutions across diverse end-user industries, particularly the burgeoning food and beverage sector. Innovation drivers are largely centered around sustainability, with increased investment in research and development for biodegradable and recyclable plastic films. Regulatory frameworks are evolving, with governments in several MEA nations implementing stricter environmental policies and Extended Producer Responsibility (EPR) schemes, which are prompting manufacturers to adopt more eco-friendly practices and materials. Product substitutes, while present in the form of glass, metal, and paper packaging, are increasingly being challenged by the cost-effectiveness and versatility of plastic films. End-user trends highlight a significant shift towards on-the-go consumption and e-commerce, escalating the demand for robust and lightweight packaging. Mergers and acquisitions (M&A) activities, though not yet at a fever pitch, are on the rise as larger corporations seek to consolidate their market presence and expand their product portfolios. For instance, the acquisition of smaller regional players by established international companies is a recurring theme, aimed at gaining access to local distribution networks and understanding specific market nuances. The M&A deal count is projected to see a steady increase over the forecast period as market consolidation accelerates, driven by the pursuit of economies of scale and enhanced competitive positioning.

Middle East And Africa Plastic Packaging Films Market Industry Trends & Analysis

The Middle East and Africa plastic packaging films market is poised for robust expansion, driven by a confluence of accelerating economic growth, increasing population, and evolving consumer lifestyles across the region. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period of 2025-2033, reaching an estimated market size of over US$ 15,000 Million by 2033. This growth is underpinned by the escalating demand from the food and beverage industry, which accounts for the largest share of the market, driven by the need for extended shelf-life, product preservation, and attractive packaging. The growing adoption of convenience foods and ready-to-eat meals, especially in urban centers, directly translates to a higher demand for sophisticated plastic packaging films. Furthermore, the expanding healthcare sector, spurred by an increasing focus on public health and the introduction of advanced medical treatments, is another significant contributor, requiring specialized packaging for pharmaceuticals and medical devices that offer protection against contamination and ensure sterility. The personal care and home care segments are also exhibiting substantial growth, fueled by rising disposable incomes and a growing awareness of hygiene and wellness. Technologically, advancements in film extrusion, co-extrusion, and printing technologies are enabling the production of thinner, stronger, and more functional plastic films with enhanced barrier properties, catering to specific product requirements and minimizing material usage. The push towards sustainability is also a major trend, with a growing emphasis on developing and utilizing recycled content, bio-based polymers, and recyclable film structures. This is partly driven by consumer preference for environmentally conscious brands and partly by increasingly stringent environmental regulations. Competitive dynamics are intensifying, with both local and international players vying for market share through product innovation, strategic partnerships, and capacity expansions. The market penetration of advanced packaging solutions is expected to deepen, as manufacturers invest in sophisticated machinery and R&D to meet the sophisticated demands of diverse end-users. The industrial packaging segment, while smaller, is also demonstrating steady growth, driven by the expansion of manufacturing and logistics operations across the MEA region.

Leading Markets & Segments in Middle East And Africa Plastic Packaging Films Market

The Middle East and Africa plastic packaging films market exhibits significant regional and segmental dominance, with specific areas and product categories spearheading growth. Within the region, the GCC (Gulf Cooperation Council) countries, including Saudi Arabia, the UAE, and Qatar, stand out as the leading markets due to their robust economies, high disposable incomes, and developed retail infrastructure. These nations are at the forefront of adopting advanced packaging technologies and prioritizing high-quality, safe, and sustainable packaging solutions.

- Dominant End-User Industry: The Food segment unequivocally leads the market, driven by a rapidly growing population, increasing urbanization, and a burgeoning middle class with a penchant for convenience and a wider variety of packaged goods. Within the food sector, Fresh Produce, Dairy Products, and Meat, Poultry, and Seafood are experiencing particularly strong demand for advanced plastic films that offer extended shelf-life, prevent spoilage, and maintain product freshness.

- Key Drivers for Food Segment Dominance:

- Growing demand for packaged convenience foods.

- Increasing focus on food safety and hygiene standards.

- Expansion of modern retail formats and e-commerce platforms.

- Demand for aesthetically pleasing and informative packaging.

- Key Drivers for Food Segment Dominance:

- Dominant Film Type: Polyethylene (PE), encompassing both High-Density Polyethylene (HDPE) and Low-Density Polyethylene (LDPE), is the dominant film type in the MEA plastic packaging films market. Its versatility, cost-effectiveness, excellent barrier properties against moisture, and good sealability make it an ideal choice for a vast array of applications.

- Key Drivers for Polyethylene Dominance:

- Cost-effectiveness and widespread availability.

- Excellent moisture barrier properties crucial for food preservation.

- High flexibility and puncture resistance.

- Versatility for various packaging formats (films, bags, pouches).

- Established recycling infrastructure in some key markets.

- Key Drivers for Polyethylene Dominance:

Other segments, such as Healthcare and Personal Care & Home Care, are also significant growth areas. The healthcare sector's demand is fueled by stricter regulations and the need for sterile, tamper-evident packaging for pharmaceuticals and medical devices. The personal care and home care industries benefit from increasing consumer spending on hygiene products, cosmetics, and cleaning supplies, all of which rely heavily on plastic packaging films for product protection and presentation. While Bio-Based and EVOH films are emerging segments driven by sustainability trends and specific high-barrier requirements, their market share is currently smaller compared to traditional polymers like Polyethylene. The dominance analysis indicates that the MEA market is largely driven by essential consumer goods, with a strong emphasis on functional and cost-effective packaging solutions.

Middle East And Africa Plastic Packaging Films Market Product Developments

Product development in the Middle East and Africa plastic packaging films market is increasingly focused on enhancing sustainability and functionality. Manufacturers are investing in advanced multi-layer film technologies that incorporate recycled content and offer improved barrier properties, extending product shelf-life and reducing food waste. Innovations include the development of lighter-weight films that maintain strength, thereby reducing material consumption and transportation costs. There's also a growing trend towards the development of specialized films with antimicrobial or anti-fogging properties, catering to niche applications in the food and healthcare sectors. These advancements aim to provide a competitive edge by meeting evolving regulatory demands and catering to the growing consumer preference for eco-friendly and high-performance packaging solutions.

Key Drivers of Middle East And Africa Plastic Packaging Films Market Growth

The growth of the Middle East and Africa plastic packaging films market is propelled by several key factors. Firstly, the rapidly expanding population and urbanization across the region translate to a higher demand for packaged goods. Secondly, escalating disposable incomes and changing consumer lifestyles are increasing the consumption of processed foods, healthcare products, and personal care items, all of which rely on effective plastic packaging. Thirdly, technological advancements in film manufacturing are enabling the production of more sophisticated, lighter, and stronger films, offering enhanced product protection and shelf-life extension. Finally, growing environmental consciousness and governmental initiatives promoting sustainability are driving the adoption of recyclable and bio-based plastic films, opening new avenues for innovation and market penetration.

Challenges in the Middle East And Africa Plastic Packaging Films Market Market

Despite its promising growth, the Middle East and Africa plastic packaging films market faces several challenges. Stringent and varying regulatory landscapes across different countries can create compliance hurdles for manufacturers. The increasing global focus on plastic waste reduction and single-use plastic bans pose a significant threat, necessitating substantial investment in alternative materials and recycling infrastructure. Supply chain disruptions, geopolitical instabilities, and fluctuating raw material prices can impact production costs and market stability. Furthermore, the competition from alternative packaging materials, coupled with growing consumer skepticism towards plastics, requires continuous innovation and effective communication regarding the benefits and recyclability of plastic films.

Emerging Opportunities in Middle East And Africa Plastic Packaging Films Market

The Middle East and Africa plastic packaging films market is ripe with emerging opportunities. The increasing demand for sustainable packaging solutions presents a significant avenue for growth, particularly for companies investing in recyclable, compostable, and bio-based film alternatives. The expansion of e-commerce necessitates robust and lightweight packaging, creating opportunities for specialized films designed for online retail. Furthermore, the growing healthcare and pharmaceutical industries, especially in emerging economies within Africa, require advanced barrier films for sterile and tamper-evident packaging. Strategic partnerships between local manufacturers and international technology providers can foster innovation and knowledge transfer, accelerating market development.

Leading Players in the Middle East And Africa Plastic Packaging Films Market Sector

- Amcor Group GmbH

- Berry Global Inc

- Aalmir Plastic Industries

- 3P Gulf Group

- ENPI Group (Flexpack City Pack)

- Amber Packaging Industries LLC

- Falcon Pack

- Arabian Plastic Industrial Company Limited (APICO)

- Takween Advanced Industries

- Emirates Printing Press (LLC)

- Radiant Packaging Industry LLC

- Interplast (Harwal Group of Companies)

- Integrated Plastics Packaging LLC

- Madayn Plastic Company

- Al Amoudi Plastic Factor

Key Milestones in Middle East And Africa Plastic Packaging Films Market Industry

- April 2024: SABIC, in collaboration with its partners, introduced bread packaging crafted from recycled post-consumer plastic. FONTE launched bread bags for its Oat Arabic Bread, fashioned from SABIC's certified circular polyethylene (PE). These bags are manufactured by Napco National, a Saudi-based manufacturer specializing in flexible film and packaging, highlighting a significant step towards circularity in food packaging.

- November 2023: Amcor Group GmbH, a company based in the Middle East that develops and produces responsible packaging solutions, announced a Memorandum of Understanding (MOU) with leading sustainable polyethylene producer NOVA Chemicals Corporation for the purchase of mechanically recycled polyethylene resin (rPE) for use in flexible packaging films. Increasing the use of rPE in flexible packaging applications is an important element of Amcor's commitment to support packaging circularity.

Strategic Outlook for Middle East And Africa Plastic Packaging Films Market Market

The strategic outlook for the Middle East and Africa plastic packaging films market is characterized by a strong emphasis on sustainability, innovation, and market expansion. Companies are expected to focus on developing advanced, eco-friendly packaging solutions that meet both performance requirements and environmental regulations. Investment in research and development for biodegradable and recyclable films will be crucial. Strategic partnerships and collaborations will play a vital role in enhancing technological capabilities and expanding market reach. Furthermore, companies that can effectively address the growing demand for specialized packaging in sectors like healthcare and e-commerce, while navigating the complexities of regional regulations, are poised for significant growth and long-term success in this dynamic market.

Middle East And Africa Plastic Packaging Films Market Segmentation

-

1. Type

- 1.1. Polyprop

- 1.2. Polyethy

- 1.3. Polyethy

- 1.4. Polystyrene

- 1.5. Bio-Based

- 1.6. PVC, EVOH, PETG, and Other Film Types

-

2. End-User Industry

-

2.1. Food

- 2.1.1. Candy & Confectionery

- 2.1.2. Frozen Foods

- 2.1.3. Fresh Produce

- 2.1.4. Dairy Products

- 2.1.5. Dry Foods

- 2.1.6. Meat, Poultry, And Seafood

- 2.1.7. Pet Food

- 2.1.8. Other Fo

- 2.2. Healthcare

- 2.3. Personal Care & Home Care

- 2.4. Industrial Packaging

- 2.5. Other En

-

2.1. Food

Middle East And Africa Plastic Packaging Films Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East And Africa Plastic Packaging Films Market Regional Market Share

Geographic Coverage of Middle East And Africa Plastic Packaging Films Market

Middle East And Africa Plastic Packaging Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Growth of HoReCa and Food Industry in Middle Eastern Nations; MEA's Healthcare Emphasis Drives Demand for Medical-Grade Plastic Films

- 3.3. Market Restrains

- 3.3.1. Rapid Growth of HoReCa and Food Industry in Middle Eastern Nations; MEA's Healthcare Emphasis Drives Demand for Medical-Grade Plastic Films

- 3.4. Market Trends

- 3.4.1. Polyethylene (PE) is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East And Africa Plastic Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Polyprop

- 5.1.2. Polyethy

- 5.1.3. Polyethy

- 5.1.4. Polystyrene

- 5.1.5. Bio-Based

- 5.1.6. PVC, EVOH, PETG, and Other Film Types

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Food

- 5.2.1.1. Candy & Confectionery

- 5.2.1.2. Frozen Foods

- 5.2.1.3. Fresh Produce

- 5.2.1.4. Dairy Products

- 5.2.1.5. Dry Foods

- 5.2.1.6. Meat, Poultry, And Seafood

- 5.2.1.7. Pet Food

- 5.2.1.8. Other Fo

- 5.2.2. Healthcare

- 5.2.3. Personal Care & Home Care

- 5.2.4. Industrial Packaging

- 5.2.5. Other En

- 5.2.1. Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor Group GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berry Global Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aalmir Plastic Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 3P Gulf Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ENPI Group (Flexpack City Pack)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amber Packaging Industries LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Falcon Pack

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arabian Plastic Industrial Company Limited (APICO)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Takween Advanced Industries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Emirates Printing Press (LLC)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Radiant Packaging Industry LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Interplast (Harwal Group of Companies)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Integrated Plastics Packaging LLC

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Madayn Plastic Company

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Al Amoudi Plastic Factor

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Amcor Group GmbH

List of Figures

- Figure 1: Middle East And Africa Plastic Packaging Films Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East And Africa Plastic Packaging Films Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East And Africa Plastic Packaging Films Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Middle East And Africa Plastic Packaging Films Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 3: Middle East And Africa Plastic Packaging Films Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Middle East And Africa Plastic Packaging Films Market Revenue million Forecast, by Type 2020 & 2033

- Table 5: Middle East And Africa Plastic Packaging Films Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 6: Middle East And Africa Plastic Packaging Films Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East And Africa Plastic Packaging Films Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East And Africa Plastic Packaging Films Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East And Africa Plastic Packaging Films Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East And Africa Plastic Packaging Films Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East And Africa Plastic Packaging Films Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East And Africa Plastic Packaging Films Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East And Africa Plastic Packaging Films Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East And Africa Plastic Packaging Films Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East And Africa Plastic Packaging Films Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East And Africa Plastic Packaging Films Market?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the Middle East And Africa Plastic Packaging Films Market?

Key companies in the market include Amcor Group GmbH, Berry Global Inc, Aalmir Plastic Industries, 3P Gulf Group, ENPI Group (Flexpack City Pack), Amber Packaging Industries LLC, Falcon Pack, Arabian Plastic Industrial Company Limited (APICO), Takween Advanced Industries, Emirates Printing Press (LLC), Radiant Packaging Industry LLC, Interplast (Harwal Group of Companies), Integrated Plastics Packaging LLC, Madayn Plastic Company, Al Amoudi Plastic Factor.

3. What are the main segments of the Middle East And Africa Plastic Packaging Films Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 635.2 million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Growth of HoReCa and Food Industry in Middle Eastern Nations; MEA's Healthcare Emphasis Drives Demand for Medical-Grade Plastic Films.

6. What are the notable trends driving market growth?

Polyethylene (PE) is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Rapid Growth of HoReCa and Food Industry in Middle Eastern Nations; MEA's Healthcare Emphasis Drives Demand for Medical-Grade Plastic Films.

8. Can you provide examples of recent developments in the market?

April 2024: SABIC, in collaboration with its partners, introduced bread packaging crafted from recycled post-consumer plastic. FONTE launched bread bags for its Oat Arabic Bread, fashioned from SABIC's certified circular polyethylene (PE). These bags are manufactured by Napco National, a Saudi-based manufacturer specializing in flexible film and packaging.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East And Africa Plastic Packaging Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East And Africa Plastic Packaging Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East And Africa Plastic Packaging Films Market?

To stay informed about further developments, trends, and reports in the Middle East And Africa Plastic Packaging Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence