Key Insights

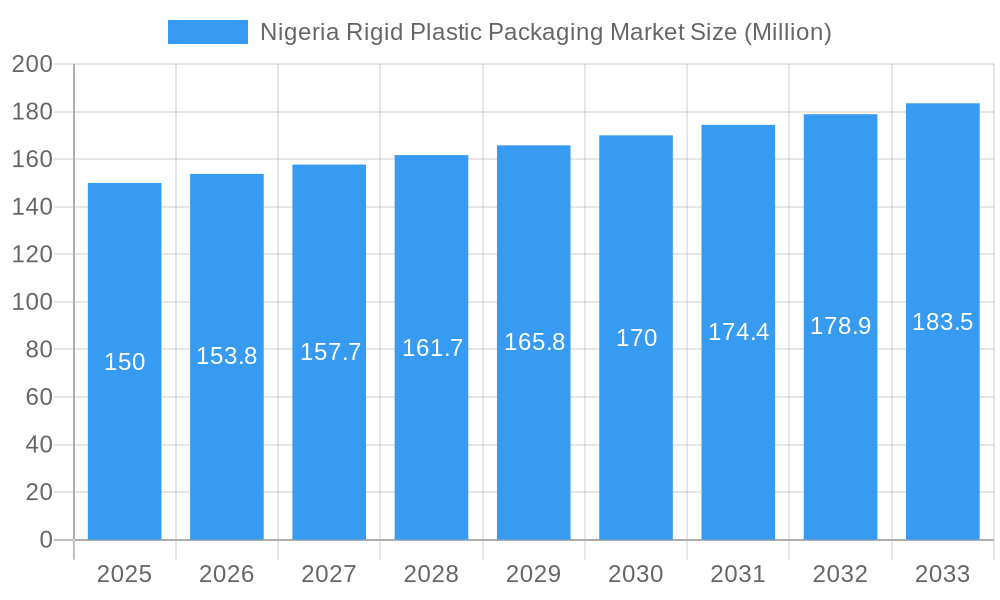

The Nigeria rigid plastic packaging market, valued at $221.07 billion in 2025, is projected to experience significant growth with a Compound Annual Growth Rate (CAGR) of 4.1% through 2033. This expansion is fueled by increasing consumer demand for packaged food and beverages, a robust consumer goods sector, and the widespread adoption of plastic packaging across Nigerian industries. The burgeoning retail and e-commerce sectors further necessitate efficient and cost-effective packaging solutions. Key challenges include volatile raw material costs, environmental concerns surrounding plastic waste, and an intensely competitive market landscape. The market is segmented by packaging type (bottles, containers, films), application (food & beverages, personal care, pharmaceuticals), and distribution channel (direct sales, wholesalers, retailers). Leading companies include Bestaf Holdings and Shan Packaging Limited, who are adapting to evolving waste management regulations.

Nigeria Rigid Plastic Packaging Market Market Size (In Billion)

Future market dynamics will be shaped by strategic partnerships and technological advancements. The increasing demand for sustainable packaging, utilizing recycled materials and exploring biodegradable alternatives, will be critical. Market concentration is observed in major urban centers, with opportunities for growth in developing regions as infrastructure and disposable incomes rise. The long-term outlook for the Nigerian rigid plastic packaging market is positive, provided environmental challenges are effectively managed and economic growth is sustained. Detailed analysis of specific market segments and regional trends is recommended for a comprehensive understanding.

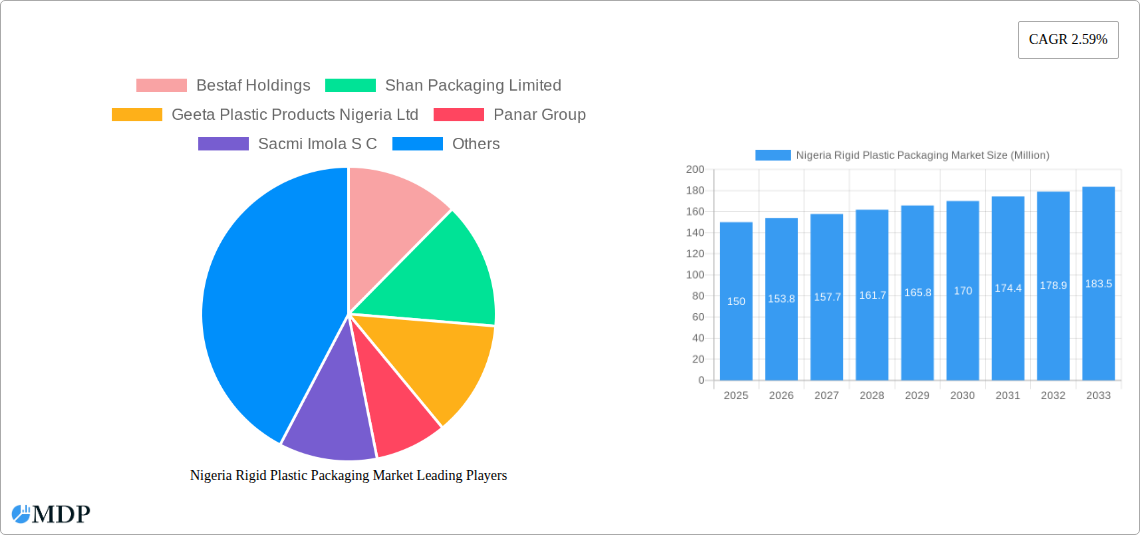

Nigeria Rigid Plastic Packaging Market Company Market Share

Nigeria Rigid Plastic Packaging Market: A Comprehensive Report (2019-2033)

This insightful report offers a detailed analysis of the dynamic Nigeria Rigid Plastic Packaging Market, providing crucial data and forecasts from 2019 to 2033. With a focus on market size, segmentation, competitive landscape, and future trends, this report is essential for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. This report is packed with actionable insights to navigate the complexities of this thriving market.

Nigeria Rigid Plastic Packaging Market Dynamics & Concentration

The Nigerian rigid plastic packaging market is characterized by a moderate level of concentration, with a few major players holding significant market share. The market size in 2025 is estimated at xx Million. However, several smaller, regional players contribute significantly to overall volume. Innovation is a key driver, particularly around sustainable and eco-friendly packaging solutions. Stringent regulatory frameworks concerning plastic waste management are shaping market dynamics, forcing manufacturers to adopt more sustainable practices. The increasing adoption of alternative packaging materials, such as biodegradable plastics and paper-based options, poses a challenge to growth. However, the increasing demand for packaged goods, fueled by population growth and urbanization, continues to drive market expansion. Mergers and acquisitions (M&A) activity has been moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024.

- Market Concentration: Moderate, with a few dominant players and many smaller competitors.

- Innovation Drivers: Sustainability, lightweighting, improved barrier properties.

- Regulatory Frameworks: Increasing focus on waste management and circular economy initiatives.

- Product Substitutes: Biodegradable plastics, paper-based packaging.

- End-User Trends: Growing demand for convenience, sustainability, and brand differentiation.

- M&A Activity: Approximately xx deals between 2019 and 2024. Market share for top players: Bestaf Holdings (xx%), Shan Packaging Limited (xx%), Geeta Plastic Products Nigeria Ltd (xx%).

Nigeria Rigid Plastic Packaging Market Industry Trends & Analysis

The Nigerian rigid plastic packaging market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors, including rising consumer disposable incomes, increased demand for packaged food and beverages, and the expansion of organized retail. Technological advancements in packaging materials, such as the use of lightweighting techniques and improved barrier properties, are further driving market growth. Consumer preferences are shifting towards sustainable and eco-friendly packaging options, leading to increased demand for recycled and biodegradable materials. The competitive landscape is highly fragmented, with both domestic and international players vying for market share. Market penetration of recycled PET (rPET) is currently at xx%, projected to increase to xx% by 2033.

Leading Markets & Segments in Nigeria Rigid Plastic Packaging Market

The largest segment within the Nigerian rigid plastic packaging market is the food and beverage sector, accounting for approximately xx% of total market volume in 2025. This dominance is driven by the high consumption of packaged food and beverages among the Nigerian population. The key drivers for this segment's dominance include:

- High Population Growth: Fuelling increased demand for packaged goods.

- Expanding Retail Sector: Driving demand for attractive and functional packaging.

- Urbanization: Leading to changes in consumer lifestyles and purchasing habits.

- Government Initiatives: Supporting investments in the food processing industry.

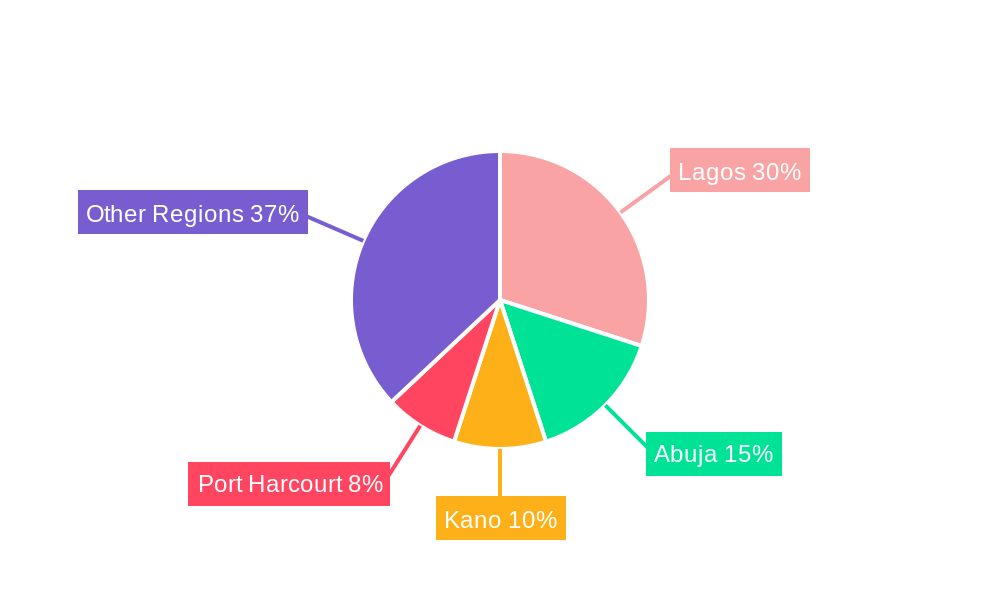

The South-West region of Nigeria is the most dominant in terms of consumption and manufacturing due to its high population density, advanced infrastructure, and established industrial base. Other segments such as pharmaceuticals, cosmetics, and household goods are also experiencing significant growth.

Nigeria Rigid Plastic Packaging Market Product Developments

Recent product innovations focus on lightweighting, improved barrier properties, and sustainable materials. Manufacturers are increasingly adopting recycled PET (rPET) and other recycled materials to meet growing consumer demand for environmentally friendly options. The use of advanced technologies like barrier coatings and multi-layer structures is enhancing the quality and functionality of rigid plastic packaging, while maintaining or lowering cost. These innovations provide competitive advantages by offering improved shelf life, enhanced protection, and sustainable solutions that meet evolving consumer preferences.

Key Drivers of Nigeria Rigid Plastic Packaging Market Growth

Several factors contribute to the robust growth of the Nigerian rigid plastic packaging market. These include:

- Rapid Population Growth: Driving increased demand for packaged goods.

- Rising Disposable Incomes: Boosting consumption of packaged foods and beverages.

- Expansion of the Organized Retail Sector: Promoting the adoption of modern packaging solutions.

- Government Support for the Manufacturing Sector: Encouraging domestic production and investment.

Challenges in the Nigeria Rigid Plastic Packaging Market

The Nigerian rigid plastic packaging market faces several challenges. These include:

- High Costs of Raw Materials: Impacting production costs and profitability.

- Fluctuations in Currency Exchange Rates: Affecting import costs and pricing strategies.

- Inadequate Infrastructure: Hampers efficient transportation and logistics.

- Plastic Waste Management Challenges: Requires sustainable solutions and environmentally conscious practices.

Emerging Opportunities in Nigeria Rigid Plastic Packaging Market

Significant opportunities exist for growth in the Nigerian rigid plastic packaging market. The increasing adoption of sustainable and eco-friendly packaging solutions presents a major opportunity. Strategic partnerships between packaging manufacturers and brands focusing on sustainable packaging can significantly boost market growth. Expansion into underserved regions and market segments with tailored packaging solutions can unlock significant potential. Investment in advanced technologies for efficient production, lighter weight packaging, and innovative designs further creates long-term growth potential.

Leading Players in the Nigeria Rigid Plastic Packaging Market Sector

- Bestaf Holdings

- Shan Packaging Limited

- Geeta Plastic Products Nigeria Ltd

- Panar Group

- Sacmi Imola S C

- Sacvin Nigeria Limited

- Veritas Plastic Limited

- Rida National Plastics Ltd

- Sun Group

Key Milestones in Nigeria Rigid Plastic Packaging Market Industry

- December 2023: Nestlé Nigeria reintroduced Pure Life bottled water with 50% rPET, highlighting a commitment to plastic circularity.

- May 2024: Coca-Cola launched a redesigned, lighter Eva Water bottle in Nigeria, reflecting a broader sustainability strategy.

Strategic Outlook for Nigeria Rigid Plastic Packaging Market

The Nigerian rigid plastic packaging market is poised for sustained growth driven by several factors. Expanding the use of sustainable materials, investing in advanced technologies, and adapting to changing consumer preferences will be crucial for success. Strategic partnerships and collaborations within the industry will allow for greater efficiency and innovation. Focusing on providing value-added services and solutions, and meeting the rising demand for sustainable practices, will be vital to securing a competitive advantage. The market presents significant potential for both domestic and international players willing to embrace sustainability and innovation.

Nigeria Rigid Plastic Packaging Market Segmentation

-

1. Product Type

- 1.1. Bottles and Jars

- 1.2. Trays and Containers

- 1.3. Caps and Closures

- 1.4. Intermediate Bulk Containers (IBCs)

- 1.5. Drums

- 1.6. Pallets

- 1.7. Other Product Types

-

2. Material

-

2.1. Polyethylene (PE)

- 2.1.1. LDPE and LLDPE

- 2.1.2. HDPE

- 2.2. Polyethylene Terephthalate (PET)

- 2.3. Polypropylene (PP)

- 2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 2.5. Polyvinyl chloride (PVC)

- 2.6. Other Rigid Plastic Packaging Materials

-

2.1. Polyethylene (PE)

-

3. End-Use Industries

-

3.1. Food**

- 3.1.1. Candy and Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Food Products

-

3.2. Foodservice**

- 3.2.1. Quick Service Restaurants (QSRs)

- 3.2.2. Full-Service Restaurants (FSRs)

- 3.2.3. Coffee and Snack Outlets

- 3.2.4. Retail Establishments

- 3.2.5. Institutional

- 3.2.6. Hospitality

- 3.2.7. Other Foodservice End-uses

- 3.3. Beverage

- 3.4. Healthcare

- 3.5. Cosmetics and Personal Care

- 3.6. Industrial

- 3.7. Building and Construction

- 3.8. Automotive

- 3.9. Other En

-

3.1. Food**

Nigeria Rigid Plastic Packaging Market Segmentation By Geography

- 1. Niger

Nigeria Rigid Plastic Packaging Market Regional Market Share

Geographic Coverage of Nigeria Rigid Plastic Packaging Market

Nigeria Rigid Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Food and Foodservice Industry in Nigeria; Surging Demand for PE and PET Materials in Rigid Plastic Packaging Production

- 3.3. Market Restrains

- 3.3.1. Growing Food and Foodservice Industry in Nigeria; Surging Demand for PE and PET Materials in Rigid Plastic Packaging Production

- 3.4. Market Trends

- 3.4.1. Polyethylene (PE) Segment Expected to Have the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bottles and Jars

- 5.1.2. Trays and Containers

- 5.1.3. Caps and Closures

- 5.1.4. Intermediate Bulk Containers (IBCs)

- 5.1.5. Drums

- 5.1.6. Pallets

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyethylene (PE)

- 5.2.1.1. LDPE and LLDPE

- 5.2.1.2. HDPE

- 5.2.2. Polyethylene Terephthalate (PET)

- 5.2.3. Polypropylene (PP)

- 5.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 5.2.5. Polyvinyl chloride (PVC)

- 5.2.6. Other Rigid Plastic Packaging Materials

- 5.2.1. Polyethylene (PE)

- 5.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 5.3.1. Food**

- 5.3.1.1. Candy and Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Food Products

- 5.3.2. Foodservice**

- 5.3.2.1. Quick Service Restaurants (QSRs)

- 5.3.2.2. Full-Service Restaurants (FSRs)

- 5.3.2.3. Coffee and Snack Outlets

- 5.3.2.4. Retail Establishments

- 5.3.2.5. Institutional

- 5.3.2.6. Hospitality

- 5.3.2.7. Other Foodservice End-uses

- 5.3.3. Beverage

- 5.3.4. Healthcare

- 5.3.5. Cosmetics and Personal Care

- 5.3.6. Industrial

- 5.3.7. Building and Construction

- 5.3.8. Automotive

- 5.3.9. Other En

- 5.3.1. Food**

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bestaf Holdings

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shan Packaging Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Geeta Plastic Products Nigeria Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Panar Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sacmi Imola S C

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sacvin Nigeria Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Veritas Plastic Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rida National Plastics Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sun Group8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Bestaf Holdings

List of Figures

- Figure 1: Nigeria Rigid Plastic Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Nigeria Rigid Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Nigeria Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Nigeria Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 3: Nigeria Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 4: Nigeria Rigid Plastic Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Nigeria Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Nigeria Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: Nigeria Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 8: Nigeria Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Rigid Plastic Packaging Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Nigeria Rigid Plastic Packaging Market?

Key companies in the market include Bestaf Holdings, Shan Packaging Limited, Geeta Plastic Products Nigeria Ltd, Panar Group, Sacmi Imola S C, Sacvin Nigeria Limited, Veritas Plastic Limited, Rida National Plastics Ltd, Sun Group8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the Nigeria Rigid Plastic Packaging Market?

The market segments include Product Type, Material, End-Use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 221.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Food and Foodservice Industry in Nigeria; Surging Demand for PE and PET Materials in Rigid Plastic Packaging Production.

6. What are the notable trends driving market growth?

Polyethylene (PE) Segment Expected to Have the Largest Market Share.

7. Are there any restraints impacting market growth?

Growing Food and Foodservice Industry in Nigeria; Surging Demand for PE and PET Materials in Rigid Plastic Packaging Production.

8. Can you provide examples of recent developments in the market?

May 2024: Coca-Cola, a United States-based beverage company, unveiled a redesigned Eva Water bottle in Nigeria. The new design, which is lighter and uses less plastic, underscores Coca-Cola's commitment to sustainability. This launch aligns seamlessly with the company's broader sustainability strategy in the Nigerian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Rigid Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Rigid Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Rigid Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Nigeria Rigid Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence