Key Insights

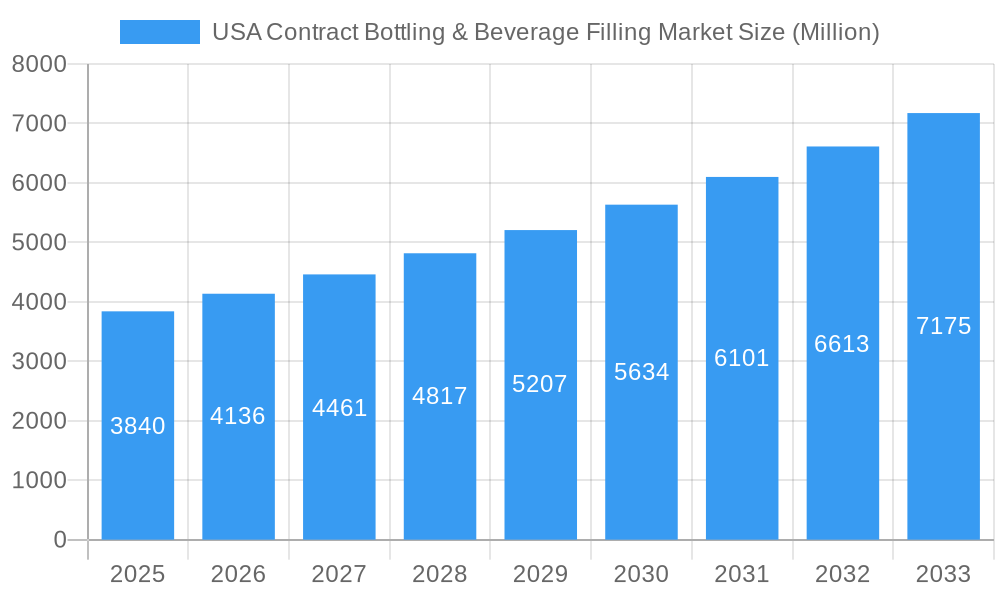

The USA contract bottling and beverage filling market, valued at $3.84 billion in 2025, is projected to experience robust growth, driven by increasing demand for convenience, rising disposable incomes, and the flourishing food and beverage industry. The market's Compound Annual Growth Rate (CAGR) of 7.67% from 2025 to 2033 indicates significant expansion opportunities for contract bottlers. Key growth drivers include the rising popularity of bottled water and ready-to-drink beverages, the outsourcing trend among beverage producers seeking cost optimization and scalability, and the increasing need for specialized filling solutions for diverse beverage types. The market is segmented by beverage type, with bottled water, carbonated drinks, and fruit-based beverages holding significant market share. Leading players like Robinsons Breweries, Southeast Bottling & Beverages, and Niagara Bottling LLC are capitalizing on these trends, while emerging companies and smaller regional players also contribute to the competitive landscape. Growth is expected across all US regions, with the Northeast and Southeast potentially showing stronger growth due to higher population density and established beverage industries. However, potential restraints could include fluctuating raw material prices, stringent regulations concerning food safety and packaging, and increased competition from in-house bottling facilities among larger beverage manufacturers.

USA Contract Bottling & Beverage Filling Market Market Size (In Billion)

The forecast period of 2025-2033 suggests continued expansion, propelled by innovative packaging solutions, sustainable practices (e.g., reduced plastic usage), and the increasing demand for functional and healthy beverages. Contract bottlers are likely to invest further in automation and advanced technologies to improve efficiency and meet the diverse needs of their clients. The market’s fragmentation presents both opportunities and challenges. While it enables access for smaller players, it also necessitates differentiation through specialization, service quality, and competitive pricing strategies. Geographical expansion and strategic partnerships will likely be key to long-term success in this dynamic market. The continued growth trajectory necessitates close monitoring of consumer preferences, technological advancements, and regulatory changes to maintain a competitive edge.

USA Contract Bottling & Beverage Filling Market Company Market Share

USA Contract Bottling & Beverage Filling Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the USA Contract Bottling & Beverage Filling Market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, trends, leading players, and future opportunities. The report leverages extensive data analysis and forecasts to provide a clear picture of this dynamic sector, allowing informed decision-making and strategic advantage.

USA Contract Bottling & Beverage Filling Market Market Dynamics & Concentration

The USA contract bottling and beverage filling market presents a dynamic and evolving landscape. While a core group of established, large-scale contract bottlers commands a substantial portion of the market share, the sector is further characterized by a vibrant ecosystem of smaller, specialized firms catering to niche beverage categories. This dual structure fosters a competitive environment where economies of scale, cutting-edge technological integration, and the agility to adapt to the rapidly changing demands of beverage manufacturers are paramount for success. Innovations in packaging, particularly advancements in lightweighting and the adoption of sustainable materials, are not only driving market expansion but also fundamentally reshaping competitive strategies. Furthermore, the rigorous regulatory environment, primarily governed by FDA guidelines on food safety and accurate labeling, imposes strict operational standards and necessitates perpetual adherence and investment in compliance. The market also contends with the persistent challenge of product substitution, especially within the commoditized bottled water segment, as consumer preferences increasingly lean towards alternative beverage formats. Consequently, the escalating popularity of functional beverages, personalized drink options, and ready-to-drink (RTD) formats significantly influences the demand for specialized contract bottling and filling services.

Mergers and acquisitions (M&A) remain a pivotal force in shaping the concentration dynamics of this market. Recent years have witnessed a discernible trend towards consolidation, with several high-profile transactions underscoring this movement. While granular market share data for individual companies is proprietary, industry analysis suggests that the top 5 key market players collectively hold approximately [Insert estimated xx%] of the overall market share. It is important to note that this concentration can vary considerably across different beverage sub-segments. Over the historical period spanning 2019 to 2024, an estimated [Insert estimated xx] significant M&A deals have been recorded. This robust M&A activity underscores a highly dynamic market characterized by strategic consolidation and ambitious expansion endeavors by key industry participants.

USA Contract Bottling & Beverage Filling Market Industry Trends & Analysis

The USA contract bottling and beverage filling market is currently experiencing a period of robust and sustained growth. This expansion is primarily propelled by several interconnected factors. A significant driver is the escalating consumer demand for convenient, ready-to-drink (RTD) beverage options, which compels established beverage manufacturers to increasingly outsource their bottling and filling operations to specialized contract providers. This outsourcing trend is further amplified by evolving consumer palates and preferences for a wider array of beverage types, encompassing innovative functional drinks, artisanal craft beers, and premium bottled water varieties. Concurrently, rapid technological advancements in bottling and filling equipment, including the widespread adoption of highly automated systems and sophisticated efficiency-enhancing technologies, are not only boosting productivity but also contributing to significant cost reductions, thereby stimulating further market expansion. Moreover, a growing societal and corporate imperative towards sustainability and the adoption of eco-friendly packaging solutions is actively reshaping the industry. This is manifesting in substantial investments by companies in developing and utilizing lighter-weight materials and highly recyclable packaging options.

The competitive arena within this market is characterized by the co-existence of large, national contract bottlers and a multitude of smaller, agile regional companies, many of whom have carved out successful niches within specialized beverage segments. The overall market compound annual growth rate (CAGR) is projected to be approximately [Insert estimated xx%] during the forecast period, spanning from 2025 to 2033, indicating a strong and positive growth trajectory. Market penetration is notably high in the carbonated soft drinks and fruit-based beverage segments. However, the bottled water segment, despite its maturity, demonstrates significant untapped growth potential. The escalating consumer preference for sustainable and environmentally conscious packaging solutions is acting as a powerful catalyst for ongoing innovation and is significantly enhancing the overall market appeal. Based on current projections, the market size is estimated to be approximately [Insert estimated xx] Million USD in 2025, with a further forecast of reaching [Insert estimated xx] Million USD by 2033.

Leading Markets & Segments in USA Contract Bottling & Beverage Filling Market

While precise regional data is proprietary, the report suggests the strongest growth is observed in regions with robust beverage manufacturing industries and favorable economic conditions. Within beverage types, carbonated drinks and fruit-based beverages hold the largest market share due to high demand and established infrastructure.

- Key Drivers for Carbonated Drinks & Fruit-based Beverages:

- High consumer demand for flavored and carbonated beverages.

- Well-established distribution channels.

- Existing infrastructure supports large-scale bottling operations.

- Bottled Water Segment Growth:

- Increasing health consciousness and demand for healthier alternatives.

- Growing popularity of premium and functional water varieties.

- Expansion into various packaging formats.

- Beer Segment:

- Expanding craft beer market with high demand for customized bottling solutions.

- Rising popularity of ready-to-drink (RTD) alcoholic beverages.

- Increased focus on eco-friendly packaging solutions.

- The Others (Sports Drinks) segment displays moderate growth, influenced by fitness trends and health-conscious consumer choices.

The dominance of certain segments and regions is analyzed in detail in the full report, considering factors like consumer preferences, manufacturing costs, and regulatory landscapes.

USA Contract Bottling & Beverage Filling Market Product Developments

Recent product developments within the USA contract bottling and beverage filling market are largely focused on enhancing operational speed, maximizing efficiency, and championing sustainability initiatives. Key trends include the implementation of high-speed automated filling lines, the integration of advanced quality control systems, and the widespread adoption of lighter-weight, recyclable, and increasingly biodegradable packaging materials. These innovations empower beverage manufacturers to optimize their production costs, significantly reduce their environmental footprint, and effectively cater to the ever-evolving demands of discerning consumers for innovative, convenient, and environmentally responsible packaging solutions. The market is also witnessing a pronounced shift towards greater flexibility in packaging formats, enabling contract bottlers to adeptly serve the burgeoning demand for personalized and customized beverage offerings tailored to specific consumer segments.

Key Drivers of USA Contract Bottling & Beverage Filling Market Growth

Several key factors fuel market expansion. The burgeoning demand for convenient, ready-to-drink beverages is a primary driver. Technological advancements in bottling and filling equipment, enabling higher production efficiency and reduced costs, also contribute. Furthermore, the rising consumer preference for sustainable and eco-friendly packaging solutions is pushing the industry towards innovative, environmentally conscious practices. Government regulations promoting sustainable packaging and waste reduction further propel the adoption of eco-friendly materials and technologies.

Challenges in the USA Contract Bottling & Beverage Filling Market Market

The contract bottling and beverage filling industry in the USA is not without its significant challenges. A primary concern revolves around the inherent volatility of raw material costs, particularly for essential commodities like aluminum and plastics, which can directly impact profit margins. Furthermore, persistent supply chain disruptions, stemming from various global and domestic factors, can lead to production delays and consequently escalate operational expenses. The industry also operates under a stringent and ever-evolving regulatory compliance framework, necessitating substantial and continuous investments in robust quality control systems and comprehensive safety measures to ensure adherence. The highly competitive nature of the contract bottler landscape intensifies pricing pressures, compelling companies to engage in relentless innovation and operational optimization to maintain profitability. The collective estimated impact of these multifaceted challenges on overall market growth is projected to be approximately [Insert estimated xx%] during the forecast period.

Emerging Opportunities in the USA Contract Bottling & Beverage Filling Market

Significant growth opportunities exist through strategic partnerships with beverage manufacturers to develop customized bottling solutions. Expansion into niche beverage segments, such as functional beverages and personalized drinks, presents substantial potential. Investing in advanced automation and robotics offers enhanced efficiency and productivity, while embracing sustainable packaging solutions aligns with growing consumer demands and environmental regulations. Exploration of new materials and packaging technologies will open up opportunities for further market expansion.

Leading Players in the USA Contract Bottling & Beverage Filling Market Sector

- Robinsons Breweries (Frederic Robinson Limited)

- Southeast Bottling & Beverages

- Niagara Bottling LLC

- Brooklyn Bottling Group

- G3 Enterprises Inc

- CSD Co-Packers Inc

- Western Innovations Inc

Key Milestones in USA Contract Bottling & Beverage Filling Market Industry

- October 2021: MSI Express acquires Power Packaging, expanding its capabilities into aseptic beverage filling and broadening its market reach.

- January 2022: Encore Consumer Capital acquires Lion Beverages, boosting the latter's capacity and market access.

- April 2022: G3 Enterprises introduces a dedicated aluminum can supply, addressing the shortage affecting craft brewers and other beverage companies. This move showcases proactive responses to market challenges and underscores the importance of secure supply chains.

Strategic Outlook for USA Contract Bottling & Beverage Filling Market Market

The USA contract bottling and beverage filling market presents a landscape replete with substantial future potential, intrinsically linked to the consistent and projected growth of the broader beverage industry. Strategic opportunities for market participants are abundant and lie predominantly in embracing technological advancements, spearheading the development and implementation of sustainable packaging solutions, and strategically expanding into emerging and underserved niche beverage segments. Companies that proactively prioritize innovation, relentlessly pursue operational efficiency, and maintain a highly responsive approach to customer needs are best positioned to capture significant market share and drive sustainable, long-term growth. The market is projected to experience a significant expansion over the forecast period, with an anticipated market size reaching [Insert estimated xx] Million USD by 2033.

USA Contract Bottling & Beverage Filling Market Segmentation

-

1. Beverage Type

- 1.1. Beer

- 1.2. Carbonated Drinks and Fruit-based Beverages

- 1.3. Bottled Water

- 1.4. Other Beverage Types (Sport Drinks)

USA Contract Bottling & Beverage Filling Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Contract Bottling & Beverage Filling Market Regional Market Share

Geographic Coverage of USA Contract Bottling & Beverage Filling Market

USA Contract Bottling & Beverage Filling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. CapEx Benefits offered by contract bottlers for small-scale beverage manufacturers; Rise in demand from new-age drinks and craft beer segment; Gradual change in the business model of Contact packagers towards a consultative approach involving design & placement

- 3.3. Market Restrains

- 3.3.1. Strong Competition from the Paints Segment; Recent Changes in Macro-environment Expected to Impact Customer Spending

- 3.4. Market Trends

- 3.4.1. Beer is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Beverage Type

- 5.1.1. Beer

- 5.1.2. Carbonated Drinks and Fruit-based Beverages

- 5.1.3. Bottled Water

- 5.1.4. Other Beverage Types (Sport Drinks)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Beverage Type

- 6. North America USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Beverage Type

- 6.1.1. Beer

- 6.1.2. Carbonated Drinks and Fruit-based Beverages

- 6.1.3. Bottled Water

- 6.1.4. Other Beverage Types (Sport Drinks)

- 6.1. Market Analysis, Insights and Forecast - by Beverage Type

- 7. South America USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Beverage Type

- 7.1.1. Beer

- 7.1.2. Carbonated Drinks and Fruit-based Beverages

- 7.1.3. Bottled Water

- 7.1.4. Other Beverage Types (Sport Drinks)

- 7.1. Market Analysis, Insights and Forecast - by Beverage Type

- 8. Europe USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Beverage Type

- 8.1.1. Beer

- 8.1.2. Carbonated Drinks and Fruit-based Beverages

- 8.1.3. Bottled Water

- 8.1.4. Other Beverage Types (Sport Drinks)

- 8.1. Market Analysis, Insights and Forecast - by Beverage Type

- 9. Middle East & Africa USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Beverage Type

- 9.1.1. Beer

- 9.1.2. Carbonated Drinks and Fruit-based Beverages

- 9.1.3. Bottled Water

- 9.1.4. Other Beverage Types (Sport Drinks)

- 9.1. Market Analysis, Insights and Forecast - by Beverage Type

- 10. Asia Pacific USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Beverage Type

- 10.1.1. Beer

- 10.1.2. Carbonated Drinks and Fruit-based Beverages

- 10.1.3. Bottled Water

- 10.1.4. Other Beverage Types (Sport Drinks)

- 10.1. Market Analysis, Insights and Forecast - by Beverage Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Robinsons Breweries (Frederic Robinson Limited)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Southeast Bottling & Beverages

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Niagara Bottling LLC*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Brooklyn Bottling Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 G3 Enterprises Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CSD Co-Packers Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Western Innovations Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Robinsons Breweries (Frederic Robinson Limited)

List of Figures

- Figure 1: Global USA Contract Bottling & Beverage Filling Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 3: North America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 4: North America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 7: South America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 8: South America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 9: South America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 11: Europe USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 12: Europe USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 15: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 16: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 19: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 20: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 2: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 4: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 9: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 14: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 25: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 33: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Contract Bottling & Beverage Filling Market?

The projected CAGR is approximately 7.67%.

2. Which companies are prominent players in the USA Contract Bottling & Beverage Filling Market?

Key companies in the market include Robinsons Breweries (Frederic Robinson Limited), Southeast Bottling & Beverages, Niagara Bottling LLC*List Not Exhaustive, Brooklyn Bottling Group, G3 Enterprises Inc, CSD Co-Packers Inc, Western Innovations Inc.

3. What are the main segments of the USA Contract Bottling & Beverage Filling Market?

The market segments include Beverage Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.84 Million as of 2022.

5. What are some drivers contributing to market growth?

CapEx Benefits offered by contract bottlers for small-scale beverage manufacturers; Rise in demand from new-age drinks and craft beer segment; Gradual change in the business model of Contact packagers towards a consultative approach involving design & placement.

6. What are the notable trends driving market growth?

Beer is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Strong Competition from the Paints Segment; Recent Changes in Macro-environment Expected to Impact Customer Spending.

8. Can you provide examples of recent developments in the market?

April 2022 - G3 Enterprises introduces a new; dedicated aluminum can supply to craft brewers, RTD cocktail producers, and beverage companies. The recent aluminum can shortage has questioned this pastime, particularly for small beer companies, forced to pay more for aluminum cans if they can find them.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Contract Bottling & Beverage Filling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Contract Bottling & Beverage Filling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Contract Bottling & Beverage Filling Market?

To stay informed about further developments, trends, and reports in the USA Contract Bottling & Beverage Filling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence