Key Insights

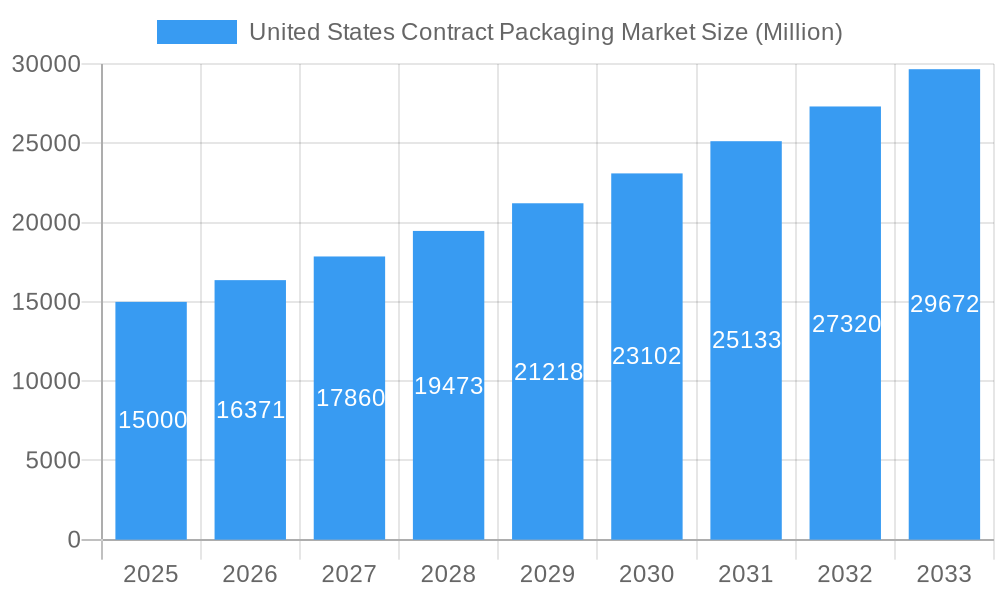

The United States contract packaging market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 9.42%. This growth is propelled by escalating demand for tailored packaging solutions across key sectors including food & beverage, pharmaceuticals, and personal care. Small and medium-sized enterprises (SMEs) are increasingly adopting contract packaging for cost-efficiency and enhanced operational effectiveness, further stimulating market dynamics. Key industry trends emphasize a growing preference for sustainable and eco-friendly packaging materials, the integration of automation to boost speed and precision in packaging processes, and a heightened focus on supply chain optimization and resilience. While navigating regulatory compliance and raw material cost fluctuations presents challenges, the market outlook remains exceptionally positive, offering substantial avenues for innovation and development.

United States Contract Packaging Market Market Size (In Billion)

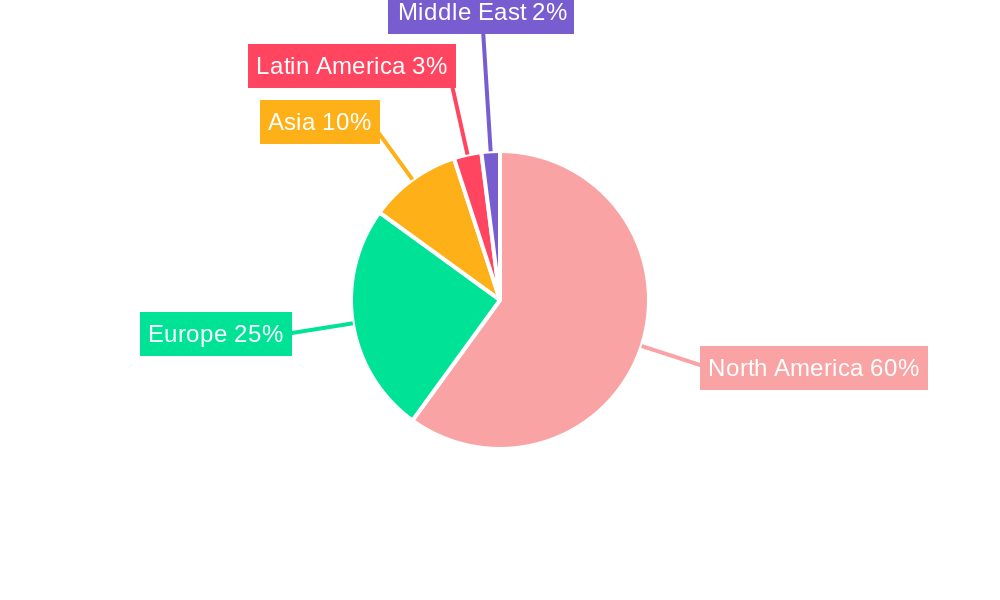

Segmentation analysis indicates that primary packaging commands the largest market share due to its direct consumer interface. Secondary and tertiary packaging follow, contributing to the overall market structure. The food and beverage industry remains a primary growth driver, fueled by robust consumer demand and stringent quality mandates. The pharmaceutical sector also exhibits substantial growth, attributed to critical packaging requirements for drug efficacy and safety. The competitive landscape is characterized by a blend of established industry leaders and agile emerging players, fostering a dynamic environment of continuous innovation and competition. North America, specifically the United States, is projected to maintain market dominance, supported by a strong manufacturing infrastructure and high consumer spending. Future market trajectories will be significantly shaped by technological advancements, evolving consumer preferences, and adaptive regulatory frameworks. The persistent commitment to sustainable and efficient packaging solutions will continue to define the evolution of the US contract packaging market.

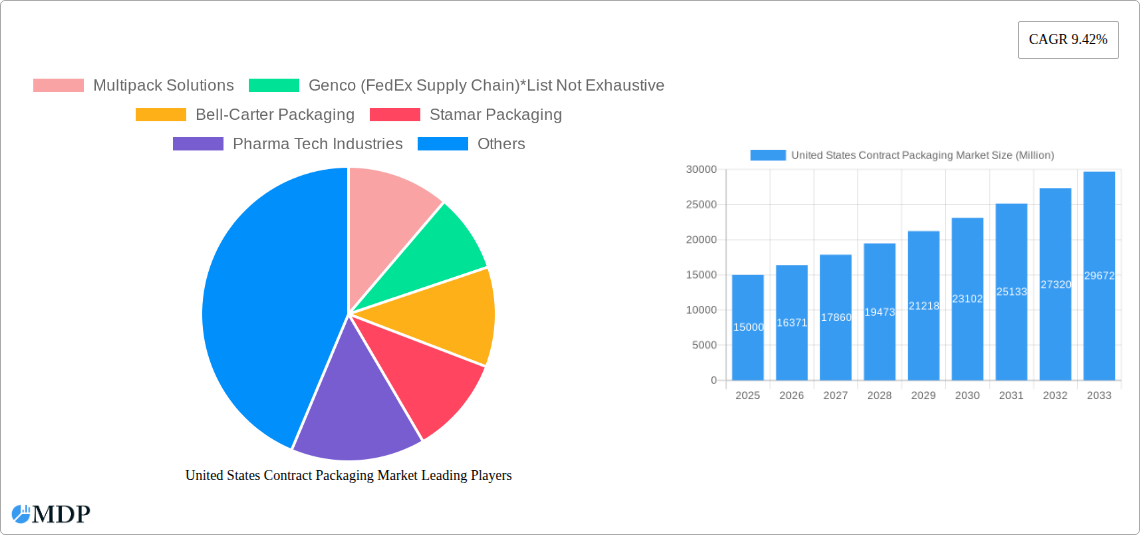

United States Contract Packaging Market Company Market Share

This comprehensive report delivers an in-depth analysis of the United States contract packaging market, providing critical data and forecasts essential for strategic decision-making. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report is an invaluable resource for industry stakeholders, investors, and market strategists. The market size was valued at 98.77 billion in the base year 2025 and is projected to reach a substantial valuation by 2033, demonstrating a strong CAGR of 5.23%.

United States Contract Packaging Market Market Dynamics & Concentration

The US contract packaging market is characterized by a moderately concentrated landscape, with a few large players and numerous smaller, specialized firms. Market concentration is influenced by factors such as economies of scale, technological advancements, and regulatory compliance. Innovation is a key driver, with companies continually investing in automation, sustainable packaging solutions, and advanced packaging technologies to meet evolving consumer demands. Stringent regulatory frameworks, particularly in sectors like pharmaceuticals and food & beverage, significantly impact market dynamics. Product substitutes, such as in-house packaging operations, present a competitive challenge. However, the increasing complexity of packaging and the need for specialized expertise favor the growth of contract packaging.

Key Market Dynamics:

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- M&A Activity: An average of xx M&A deals per year were observed during the historical period (2019-2024).

- Innovation Drivers: Automation, sustainable packaging, and specialized packaging solutions are key innovation areas.

- Regulatory Frameworks: FDA regulations for pharmaceuticals and food safety standards significantly influence market operations.

United States Contract Packaging Market Industry Trends & Analysis

The US contract packaging market demonstrates strong growth momentum, driven by several key factors. The rising demand for customized packaging solutions across various end-user industries, coupled with the increasing adoption of flexible packaging and e-commerce, fuels market expansion. Technological advancements, such as automation and robotics, enhance efficiency and reduce costs, further boosting market growth. Changing consumer preferences toward sustainable and eco-friendly packaging options are also influencing market trends. The competitive landscape is dynamic, with companies focusing on strategic partnerships, acquisitions, and technological innovations to gain a competitive edge. Market penetration of contract packaging services is expected to increase steadily across different end-user sectors.

Leading Markets & Segments in United States Contract Packaging Market

The pharmaceutical and food & beverage sectors are currently the leading end-user industries for contract packaging services in the US, with substantial growth projected for personal care and home care segments. Secondary packaging holds the largest market share by packaging type, owing to its high demand across various industries.

Dominant Segments and Key Drivers:

- By Packaging Type:

- Secondary Packaging: Driven by increased demand for attractive and informative outer packaging.

- Primary Packaging: Growth driven by stringent quality and safety regulations in industries such as pharmaceuticals.

- Tertiary Packaging: Expanding due to efficient logistics and supply chain management needs.

- By End-user Industry:

- Pharmaceutical: Stringent regulatory compliance and the need for specialized packaging drive growth.

- Food & Beverage: Demand for innovative and sustainable packaging solutions is pushing market expansion.

- Home Care and Personal Care: Growing demand for personalized and convenient packaging solutions.

Regional Dominance: The xx region dominates the US market due to factors like xx.

United States Contract Packaging Market Product Developments

Recent product developments focus on sustainable materials, innovative packaging designs, and automated packaging solutions. Companies are increasingly incorporating technology to enhance efficiency and traceability, offering advantages in speed, precision, and reduced waste. These advancements cater to the growing consumer demand for eco-friendly and customized packaging options while improving overall supply chain efficiency.

Key Drivers of United States Contract Packaging Market Growth

The US contract packaging market's growth is driven by several factors, including:

- Rising demand for customized packaging: Consumers demand unique packaging solutions reflecting brand identity and product characteristics.

- Technological advancements: Automation and robotics enhance efficiency and reduce costs.

- E-commerce boom: The growth of online retail fuels demand for protective and efficient packaging.

- Focus on sustainability: The rising demand for eco-friendly packaging materials is a significant driver.

Challenges in the United States Contract Packaging Market Market

Challenges include:

- Fluctuating raw material prices: Increased costs directly impact profitability.

- Stringent regulatory compliance: Meeting industry-specific regulations (e.g., FDA, GMP) is complex and costly.

- Intense competition: The market is fragmented, leading to fierce competition on price and services.

- Supply chain disruptions: Global events can impact the availability of raw materials and packaging components.

Emerging Opportunities in United States Contract Packaging Market

Emerging opportunities include:

- Growth of personalized packaging: Tailored solutions create unique consumer experiences.

- Expansion into niche markets: Specialized packaging solutions for emerging sectors like medical devices and cannabis products.

- Strategic partnerships and acquisitions: Companies expand capabilities through collaborations.

- Focus on circular economy and sustainable packaging: Environmentally friendly solutions become increasingly important.

Leading Players in the United States Contract Packaging Market Sector

- Multipack Solutions

- Genco (FedEx Supply Chain)

- Bell-Carter Packaging

- Stamar Packaging

- Pharma Tech Industries

- Aaron Thomas Company

- Reed-Lane Inc

- UNICEP Packaging

- Jones Packaging Inc

- Sharp Packaging Services

Key Milestones in United States Contract Packaging Market Industry

- February 2022: GenNx360 Capital Partners invests in Nutra-Med Packaging Inc., expanding its presence in the pharmaceutical and health & wellness packaging sectors.

- April 2022: GreenSeed Contract Packaging expands its facility, increasing its warehousing capacity and strengthening its position in the CPG market.

Strategic Outlook for United States Contract Packaging Market Market

The US contract packaging market exhibits substantial growth potential driven by several factors. Continued investment in automation, sustainable packaging solutions, and strategic partnerships will shape the market landscape. Companies focusing on innovation, regulatory compliance, and efficient supply chain management are well-positioned for long-term success. The increasing focus on personalization and sustainability presents considerable opportunities for growth and differentiation.

United States Contract Packaging Market Segmentation

-

1. Packaging Type

- 1.1. Primary

- 1.2. Secondary

- 1.3. Tertiary

-

2. End-user Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Pharmaceutical

- 2.4. Home Care and Personal Care

- 2.5. Automotive

- 2.6. Other End-user Industry

United States Contract Packaging Market Segmentation By Geography

- 1. United States

United States Contract Packaging Market Regional Market Share

Geographic Coverage of United States Contract Packaging Market

United States Contract Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Rapid Technological Advancements; Development in the Retail Chain

- 3.3. Market Restrains

- 3.3.1. In-house Packaging; Increasing Lead Time and Logistics Cost

- 3.4. Market Trends

- 3.4.1. Rapidly Growing Pharmaceutical Industry is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Primary

- 5.1.2. Secondary

- 5.1.3. Tertiary

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Home Care and Personal Care

- 5.2.5. Automotive

- 5.2.6. Other End-user Industry

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Multipack Solutions

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Genco (FedEx Supply Chain)*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bell-Carter Packaging

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stamar Packaging

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pharma Tech Industries

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aaron Thomas Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Reed-Lane Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 UNICEP Packaging

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jones Packaging Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sharp Packaging Services

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Multipack Solutions

List of Figures

- Figure 1: United States Contract Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Contract Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: United States Contract Packaging Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 2: United States Contract Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: United States Contract Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United States Contract Packaging Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 5: United States Contract Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: United States Contract Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Contract Packaging Market?

The projected CAGR is approximately 5.23%.

2. Which companies are prominent players in the United States Contract Packaging Market?

Key companies in the market include Multipack Solutions, Genco (FedEx Supply Chain)*List Not Exhaustive, Bell-Carter Packaging, Stamar Packaging, Pharma Tech Industries, Aaron Thomas Company, Reed-Lane Inc, UNICEP Packaging, Jones Packaging Inc, Sharp Packaging Services.

3. What are the main segments of the United States Contract Packaging Market?

The market segments include Packaging Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 98.77 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Rapid Technological Advancements; Development in the Retail Chain.

6. What are the notable trends driving market growth?

Rapidly Growing Pharmaceutical Industry is Driving the Market.

7. Are there any restraints impacting market growth?

In-house Packaging; Increasing Lead Time and Logistics Cost.

8. Can you provide examples of recent developments in the market?

February 2022 - GenNx360 Capital Partners, a New York-based private equity firm, announced its investment in Nutra-Med Packaging Inc., a New Jersey-based contract packaging organization focused on packaging for the pharmaceutical, health & wellness, and medical devices markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Contract Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Contract Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Contract Packaging Market?

To stay informed about further developments, trends, and reports in the United States Contract Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence