Key Insights

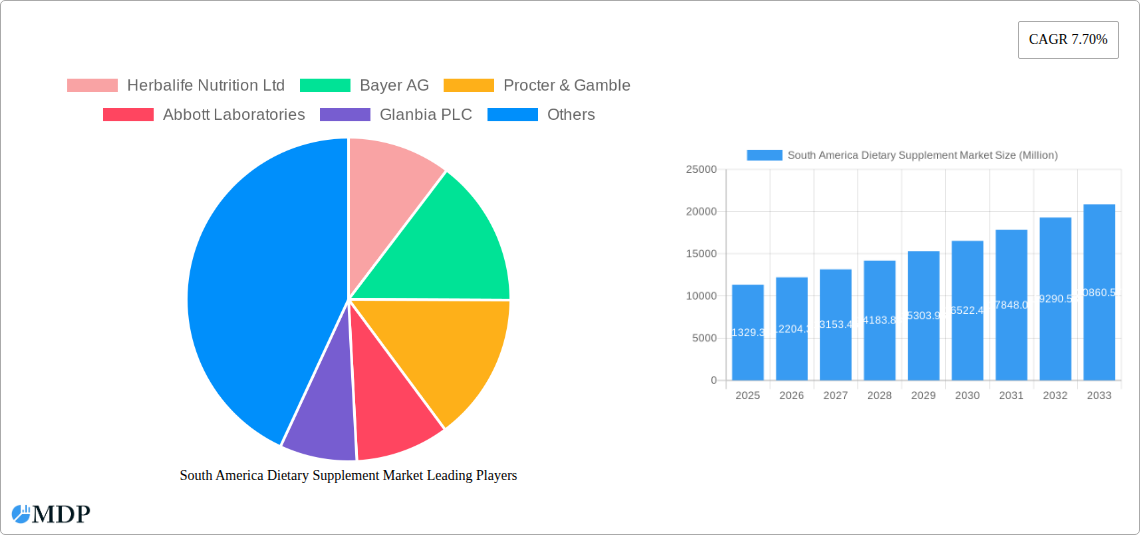

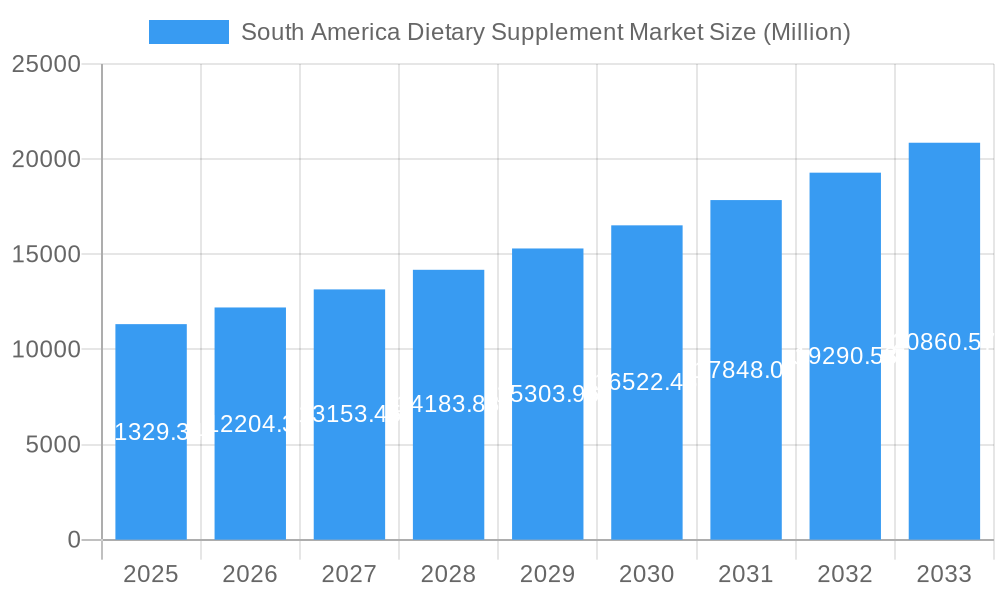

The South America dietary supplement market is poised for significant expansion, currently valued at an estimated USD 11,329.34 million. This robust growth is projected to continue at a Compound Annual Growth Rate (CAGR) of 7.70% from 2025 through 2033. This upward trajectory is primarily fueled by increasing health consciousness among consumers, a growing preference for preventive healthcare solutions, and a rising awareness of the benefits of specific nutrient intake for overall well-being. The demand for dietary supplements is further bolstered by an aging population across the region, who are increasingly seeking products to manage age-related health concerns and maintain vitality. Moreover, the burgeoning e-commerce landscape in South America is democratizing access to a wide array of supplements, making them more accessible and affordable to a broader consumer base. Key market drivers include the rising prevalence of lifestyle-related diseases, such as obesity and cardiovascular conditions, which are prompting individuals to actively seek dietary interventions.

South America Dietary Supplement Market Market Size (In Billion)

The market is segmented across various product types, with Vitamins and Minerals, and Amino Acids and Proteins expected to lead in demand due to their widespread application in general health and fitness. Probiotics are also gaining traction as consumers focus on gut health. Distribution channels are diversifying, with Pharmacies and Drug Stores maintaining a strong presence, complemented by the rapid growth of Online Channels, offering convenience and a wider product selection. Supermarkets and Hypermarkets are also playing a crucial role in making dietary supplements accessible to everyday consumers. Geographically, Brazil and Argentina represent the largest markets within South America, driven by their substantial populations and increasing disposable incomes. The "Rest of South America" also presents considerable growth potential as economies develop and health awareness spreads. However, factors such as stringent regulatory frameworks and the potential for counterfeit products could pose challenges to sustained market expansion. Nonetheless, the overall outlook for the South America dietary supplement market remains highly optimistic, driven by evolving consumer lifestyles and an unwavering commitment to health and wellness.

South America Dietary Supplement Market Company Market Share

South America Dietary Supplement Market: Unlocking Growth in a Dynamic Landscape (2019–2033)

Unlock the immense potential of the South American dietary supplement market with this comprehensive report. Dive deep into the forces shaping this rapidly expanding sector, from evolving consumer health consciousness to innovative product development and robust distribution strategies. This report provides actionable insights for manufacturers, distributors, investors, and policymakers navigating the complex yet lucrative South American dietary supplement industry. We meticulously analyze market dynamics, industry trends, leading segments, product innovations, key drivers, challenges, and emerging opportunities, offering a strategic roadmap for success. Our in-depth analysis covers the period from 2019 to 2033, with a base and estimated year of 2025, and a detailed forecast for 2025–2033, building upon historical data from 2019–2024.

South America Dietary Supplement Market Market Dynamics & Concentration

The South America dietary supplement market is characterized by a growing concentration of key players alongside emerging local businesses, fostering a competitive yet collaborative ecosystem. Innovation drivers are manifold, stemming from increasing consumer awareness of preventative healthcare, the rising prevalence of lifestyle-related diseases, and a growing demand for natural and plant-based ingredients. Regulatory frameworks, while varying across nations, are gradually becoming more standardized, aiming to ensure product safety and efficacy, thereby enhancing consumer trust. Product substitutes, such as functional foods and beverages, present a mild challenge, but the distinct benefits and targeted formulations of dietary supplements continue to drive their appeal. End-user trends are heavily influenced by a desire for enhanced well-being, improved athletic performance, and management of specific health concerns, including immune support and gut health. Mergers and acquisitions (M&A) activities are a notable aspect of market dynamics, with larger international corporations seeking to expand their regional footprint and acquire innovative local brands. The report details M&A deal counts and influential market share analyses to provide a clear picture of the competitive landscape. Key players are strategically acquiring smaller entities to broaden their product portfolios and distribution networks.

South America Dietary Supplement Market Industry Trends & Analysis

The South America dietary supplement market is poised for significant expansion, driven by a confluence of robust economic growth, rising disposable incomes, and a profound shift in consumer attitudes towards health and wellness. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. This growth is further propelled by an increasing health-conscious population actively seeking to proactively manage their well-being and prevent chronic diseases. Technological disruptions are playing a crucial role, with advancements in research and development leading to the creation of novel formulations, personalized supplement recommendations driven by genetic testing and AI, and improved bioavailability of active ingredients. Consumer preferences are evolving rapidly, with a pronounced demand for natural, organic, and ethically sourced ingredients. Transparency in labeling and a preference for scientifically backed claims are becoming paramount. The competitive dynamics are intensifying, with both established global players and agile local companies vying for market share. Market penetration is steadily increasing across all demographics, indicating a broader acceptance and adoption of dietary supplements. The report provides granular analysis of these trends, including market size projections for the base year of 2025, estimated at $5.5 Billion.

Leading Markets & Segments in South America Dietary Supplement Market

Brazil stands as the dominant market within South America for dietary supplements, driven by its large population, increasing health consciousness, and a sophisticated retail infrastructure. Argentina follows as a significant contributor, with a growing demand for specialized supplements and a burgeoning e-commerce presence. The "Rest of South America" segment, encompassing countries like Colombia, Chile, and Peru, presents considerable untapped potential, with expanding economies and increasing awareness of health and wellness products.

Key Dominance Factors and Segment Analysis:

Type Dominance:

- Vitamins and Minerals: This segment continues to hold the largest market share, estimated at 35% of the total market value in 2025, due to their foundational role in overall health and widespread consumer awareness. Growth is fueled by demand for immune support and general well-being.

- Amino Acids and Proteins: Experiencing a robust CAGR of 10.2%, this segment is driven by the growing fitness culture and an increasing number of individuals seeking muscle repair, growth, and improved athletic performance.

- Probiotics: This segment is a high-growth area, with an estimated CAGR of 9.8%, propelled by rising consumer interest in gut health, digestive wellness, and the potential impact on the immune system.

- Others (including Herbal Extracts, Specialty Supplements): This segment, representing 20% of the market, is rapidly evolving with innovation in plant-based and niche health solutions.

Distribution Channel Dominance:

- Pharmacies and Drug Stores: Remain the leading distribution channel, accounting for approximately 45% of the market share in 2025, due to their perceived trustworthiness and the availability of expert advice.

- Online Channels: Exhibiting the fastest growth, with an estimated CAGR of 12.5%, online platforms are becoming increasingly crucial for accessibility, convenience, and competitive pricing, projected to capture 25% of the market by 2025.

- Supermarkets/Hypermarkets: Offer broad reach and are a significant channel for everyday vitamins and minerals, contributing 20% of the market.

- Others (Direct Selling, Health Clinics): Contribute the remaining 10%, catering to specific consumer needs and direct-to-consumer models.

South America Dietary Supplement Market Product Developments

Product development in the South American dietary supplement market is increasingly focused on natural, plant-derived ingredients, enhanced bioavailability, and personalized formulations. Innovations are addressing specific health concerns such as immune support, cognitive function, and gut health, with a rise in probiotics and adaptogens. The competitive advantage lies in scientifically substantiated claims, sustainable sourcing, and convenient delivery formats like gummies and powders. Technological advancements in encapsulation and delivery systems are enhancing efficacy and consumer appeal, ensuring products meet the evolving demands for health, wellness, and sustainability.

Key Drivers of South America Dietary Supplement Market Growth

The South America dietary supplement market is experiencing robust growth fueled by several key drivers. Increasing health consciousness among consumers, driven by a desire for preventative healthcare and management of lifestyle-related diseases, is a primary catalyst. The rising disposable incomes across various South American nations allow for greater expenditure on health and wellness products. Furthermore, a growing aging population and the increasing prevalence of chronic conditions necessitate proactive health management solutions. The influence of digital media and the internet in disseminating health information further educates consumers and drives demand. Finally, supportive government initiatives aimed at promoting public health and well-being contribute to the market's upward trajectory.

Challenges in the South America Dietary Supplement Market Market

Despite its promising growth, the South America dietary supplement market faces several challenges. Stringent and varied regulatory landscapes across different countries can create complexities for market entry and product compliance, leading to increased costs and time-to-market. Supply chain disruptions, particularly for imported raw materials, can impact product availability and pricing. Intense competition from both established global brands and a growing number of local manufacturers exerts downward pressure on profit margins. Additionally, consumer skepticism and the prevalence of misinformation regarding supplement efficacy and safety require continuous educational efforts from industry stakeholders.

Emerging Opportunities in South America Dietary Supplement Market

Emerging opportunities in the South America dietary supplement market are abundant and poised to drive long-term growth. The burgeoning interest in personalized nutrition, driven by genetic testing and advanced diagnostics, presents a significant avenue for customized supplement solutions. The increasing adoption of e-commerce platforms provides wider reach and accessibility for brands, especially in remote areas. Furthermore, the growing demand for plant-based and sustainable products aligns with global trends and offers a competitive edge. Strategic partnerships between supplement manufacturers and healthcare providers, as well as the expansion into emerging economies within the region, represent lucrative pathways for market penetration and revenue generation.

Leading Players in the South America Dietary Supplement Market Sector

- Herbalife Nutrition Ltd

- Bayer AG

- Procter & Gamble

- Abbott Laboratories

- Glanbia PLC

- Amway

- Medcell

- Sanofi S A

List Not Exhaustive

Key Milestones in South America Dietary Supplement Market Industry

- 2020: Increased consumer focus on immunity-boosting supplements due to global health events.

- 2021: Rise in online sales channels for dietary supplements across South America.

- 2022: Growing investment in research and development of plant-based and sustainable supplement ingredients.

- 2023: Expansion of e-commerce logistics and delivery networks to reach more remote regions.

- 2024: Introduction of personalized nutrition services leveraging AI and genetic data.

Strategic Outlook for South America Dietary Supplement Market Market

The strategic outlook for the South America dietary supplement market is exceptionally positive, characterized by sustained growth and evolving consumer demands. Key growth accelerators include the ongoing expansion of online retail channels, offering greater accessibility and convenience to a wider consumer base. The increasing emphasis on preventative healthcare and holistic wellness will continue to drive demand for a diverse range of supplements. Strategic opportunities lie in product innovation focused on natural and organic ingredients, personalized nutrition solutions, and addressing specific health concerns prevalent in the region. Furthermore, strategic collaborations with local distributors and healthcare professionals will be crucial for market penetration and building consumer trust.

South America Dietary Supplement Market Segmentation

-

1. Type

- 1.1. Vitamins and Minerals

- 1.2. Amino Acids and Proteins

- 1.3. Fatty Acids

- 1.4. Probiotics

- 1.5. Others

-

2. Distribution Channel

- 2.1. Pharmacies and Drug Stores

- 2.2. Supermarket/Hypermarket

- 2.3. Online Channels

- 2.4. Others

-

3. Geography

-

3.1. South America

- 3.1.1. Brazil

- 3.1.2. Argentina

- 3.1.3. Rest of South America

-

3.1. South America

South America Dietary Supplement Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Rest of South America

South America Dietary Supplement Market Regional Market Share

Geographic Coverage of South America Dietary Supplement Market

South America Dietary Supplement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularity of Convenient and On the Go Snacking Options; Product Differentiation Playing a Key Role in Market Expansion

- 3.3. Market Restrains

- 3.3.1. Associated Health Risks; Easy Availability of Healthy Substitutes

- 3.4. Market Trends

- 3.4.1. Increased Demand of Vitamin Supplements

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Vitamins and Minerals

- 5.1.2. Amino Acids and Proteins

- 5.1.3. Fatty Acids

- 5.1.4. Probiotics

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Pharmacies and Drug Stores

- 5.2.2. Supermarket/Hypermarket

- 5.2.3. Online Channels

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South America

- 5.3.1.1. Brazil

- 5.3.1.2. Argentina

- 5.3.1.3. Rest of South America

- 5.3.1. South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Herbalife Nutrition Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayer AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Procter & Gamble

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abbott Laboratories

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Glanbia PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amway

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Medcell

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sanofi S A *List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Herbalife Nutrition Ltd

List of Figures

- Figure 1: South America Dietary Supplement Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Dietary Supplement Market Share (%) by Company 2025

List of Tables

- Table 1: South America Dietary Supplement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: South America Dietary Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: South America Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: South America Dietary Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: South America Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: South America Dietary Supplement Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: South America Dietary Supplement Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: South America Dietary Supplement Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: South America Dietary Supplement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: South America Dietary Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 11: South America Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: South America Dietary Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 13: South America Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: South America Dietary Supplement Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: South America Dietary Supplement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: South America Dietary Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Brazil South America Dietary Supplement Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Brazil South America Dietary Supplement Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Argentina South America Dietary Supplement Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina South America Dietary Supplement Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America South America Dietary Supplement Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of South America South America Dietary Supplement Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Dietary Supplement Market?

The projected CAGR is approximately 7.70%.

2. Which companies are prominent players in the South America Dietary Supplement Market?

Key companies in the market include Herbalife Nutrition Ltd, Bayer AG, Procter & Gamble, Abbott Laboratories, Glanbia PLC, Amway, Medcell, Sanofi S A *List Not Exhaustive.

3. What are the main segments of the South America Dietary Supplement Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 11,329.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Popularity of Convenient and On the Go Snacking Options; Product Differentiation Playing a Key Role in Market Expansion.

6. What are the notable trends driving market growth?

Increased Demand of Vitamin Supplements.

7. Are there any restraints impacting market growth?

Associated Health Risks; Easy Availability of Healthy Substitutes.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Dietary Supplement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Dietary Supplement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Dietary Supplement Market?

To stay informed about further developments, trends, and reports in the South America Dietary Supplement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence