Key Insights

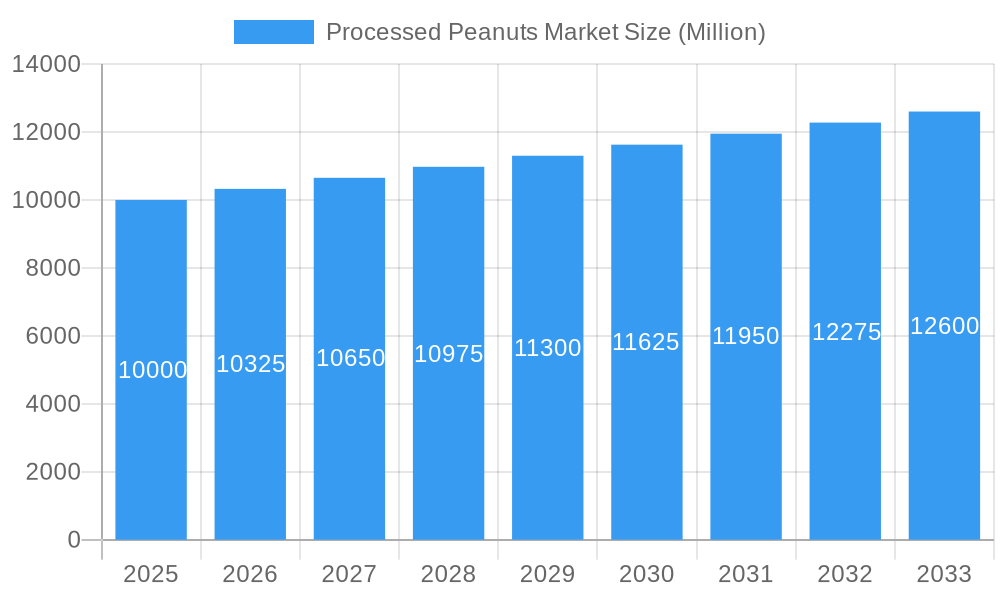

The global processed peanuts market is projected for significant expansion, anticipated to reach a market size of $115.47 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.8% through 2033. This growth is propelled by rising consumer demand for convenient, ready-to-eat snacks and heightened awareness of peanuts' nutritional value. Peanuts' adaptability to diverse flavors, from savory to sweet, enhances their broad appeal. Key growth drivers include the increasing integration of processed peanut products into confectionery, bakery items, and savory dishes, alongside expanding retail channels such as supermarkets, hypermarkets, and online food delivery services, which improve market accessibility.

Processed Peanuts Market Market Size (In Billion)

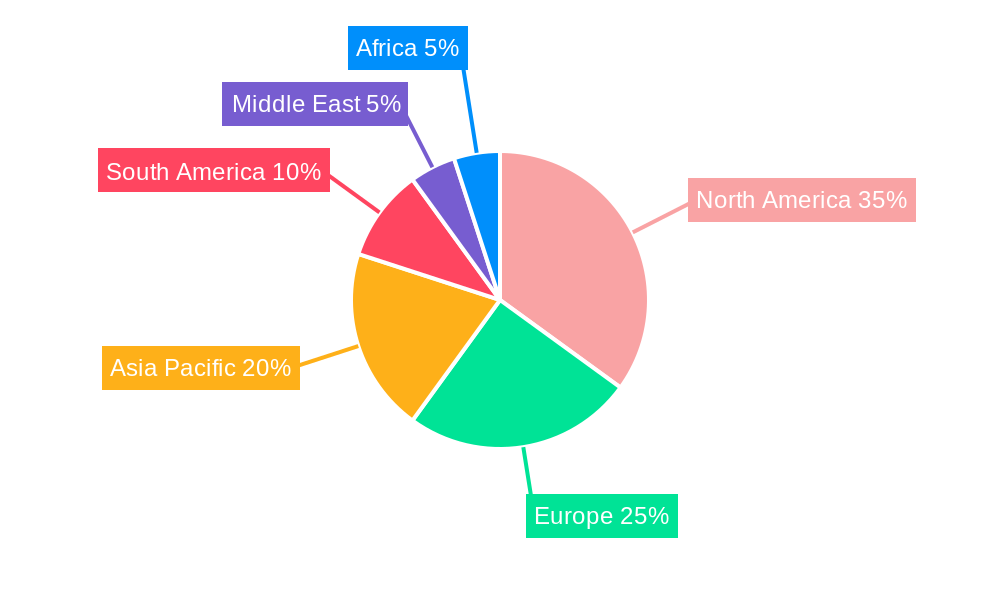

Despite positive trends, the market faces challenges including raw peanut price volatility due to weather and agricultural yields, and the necessity for stringent allergen management and product development strategies for peanut allergies. Innovation in product formulations and the development of allergen-free options are mitigating these concerns. The market is segmented by product type into 'Plain' and 'Flavored' varieties, with 'Flavored' further categorized into 'Salted', 'Sweet Flavored', and 'Spicy Flavored'. Distribution is led by 'Supermarkets/Hypermarkets' and 'Online Stores', aligning with modern consumer shopping habits. Geographically, North America is expected to dominate market share, with Asia Pacific showing robust growth driven by a rising middle class and increasing disposable incomes.

Processed Peanuts Market Company Market Share

This report offers a comprehensive analysis of the Processed Peanuts Market, providing insights and projections from 2019 to 2033. It examines market drivers, emerging trends, competitive dynamics, and strategic opportunities within the global processed peanuts industry. With a focus on flavored peanuts, roasted peanuts, snack nuts, and nut-based snacks, this research is vital for stakeholders aiming to understand and leverage opportunities in this expanding market.

Processed Peanuts Market Dynamics & Concentration

The processed peanuts market exhibits a moderate to high concentration, with a mix of large multinational corporations and regional players vying for market share. Innovation remains a key driver, with companies continually introducing new flavors, textures, and healthier options to cater to evolving consumer preferences. Regulatory frameworks, particularly concerning food safety and labeling, play a significant role in shaping market entry and product development. The availability of a wide range of product substitutes, including other nuts, seeds, and savory snacks, necessitates continuous product differentiation and value proposition enhancement. End-user trends are leaning towards healthier snacking options, with an increasing demand for roasted, lightly seasoned, and protein-rich peanut products. Mergers and acquisitions (M&A) activities are also observed as companies seek to expand their product portfolios, geographical reach, and market presence. For instance, a projected xx number of M&A deals are anticipated within the study period to consolidate market power and drive synergistic growth.

Processed Peanuts Market Industry Trends & Analysis

The global processed peanuts market is poised for robust growth, fueled by an escalating demand for convenient and flavorful snack options. Peanut snacks are experiencing a surge in popularity due to their perceived health benefits, including high protein content and nutritional value, making them a preferred choice for health-conscious consumers. This trend is further amplified by the increasing adoption of on-the-go lifestyles, driving the demand for individually packaged and easily consumable peanut products. The market is witnessing significant technological advancements in processing techniques, such as advanced roasting methods that enhance flavor and texture while preserving nutritional integrity. Innovations in flavored peanuts, encompassing a wide spectrum from classic salted to exotic spicy and sweet varieties, are attracting a broader consumer base and catering to diverse taste preferences. The penetration of processed peanuts into emerging economies is also on the rise, driven by increasing disposable incomes and evolving dietary habits. The projected Compound Annual Growth Rate (CAGR) for the processed peanuts market is estimated to be xx% during the forecast period, indicating a substantial upward trajectory. Competitive dynamics are characterized by intense product development, strategic marketing campaigns, and a focus on supply chain efficiency to ensure consistent product availability and quality.

Leading Markets & Segments in Processed Peanuts Market

North America currently dominates the processed peanuts market, driven by a well-established snacking culture and high consumer spending on convenience foods. The United States, in particular, represents a significant market due to the widespread popularity of various peanut-based products, including roasted peanuts and snack nuts.

Type Segment Dominance: The Flavored segment is anticipated to lead the market, with Salted and Spicy Flavored varieties showcasing particularly strong growth. This dominance is attributed to:

- Consumer Preference for Variety: Consumers are increasingly seeking novel taste experiences, pushing manufacturers to develop a wider array of savory and spicy flavor profiles.

- Product Innovation: Extensive research and development in flavor encapsulation and seasoning technologies enable the creation of appealing and consistent flavors.

- Adaptability to Cuisines: Spicy flavors, in particular, align with global culinary trends, further boosting their appeal.

Distribution Channel Dominance: Supermarkets/Hypermarkets currently hold the largest market share, owing to their extensive reach and ability to stock a wide variety of processed peanut products. However, Online Stores are exhibiting rapid growth, driven by:

- Convenience and Accessibility: E-commerce platforms offer consumers the ease of purchasing their preferred snacks from home.

- Wider Product Selection: Online retailers often provide a more extensive selection of specialized and niche processed peanut products than brick-and-mortar stores.

- Targeted Marketing: Digital marketing strategies effectively reach specific consumer segments interested in healthy and gourmet peanut snacks.

Processed Peanuts Market Product Developments

The processed peanuts market is abuzz with product innovation, focusing on enhanced flavor profiles, healthier formulations, and novel snacking experiences. Companies are developing innovative flavored peanuts like sweet & spicy combinations and gourmet savory options. Advancements in processing techniques are leading to the creation of healthier alternatives, such as dry-roasted and thinly-dipped peanuts, appealing to health-conscious consumers. These developments aim to expand applications beyond traditional snacking, with potential in bakery inclusions and savory meal components, offering competitive advantages through unique taste, texture, and perceived health benefits.

Key Drivers of Processed Peanuts Market Growth

The processed peanuts market is propelled by several key drivers. Technological advancements in processing and flavoring techniques enable the creation of diverse and appealing peanut products. The economic factor of rising disposable incomes, particularly in emerging economies, leads to increased consumer spending on convenience foods and premium snacks. Furthermore, positive health perceptions associated with peanuts, such as their protein and nutrient content, contribute significantly to their demand as a healthy snack option. The growing trend of convenience snacking further fuels the market, with consumers seeking portable and ready-to-eat peanut products for their busy lifestyles.

Challenges in the Processed Peanuts Market Market

Despite robust growth, the processed peanuts market faces several challenges. Regulatory hurdles, including stringent food safety standards and labeling requirements, can impact product development and market entry. Supply chain volatility, influenced by climate conditions affecting peanut harvests and fluctuating raw material prices, poses a risk to production costs and availability. Intense competitive pressures from both established brands and new entrants necessitate continuous innovation and aggressive marketing strategies to maintain market share. Furthermore, potential health concerns related to allergies and the perception of peanuts as a high-calorie food can also act as restraints for certain consumer segments.

Emerging Opportunities in Processed Peanuts Market

The processed peanuts market is ripe with emerging opportunities. Technological breakthroughs in sustainable farming practices and advanced processing methods can lead to cost efficiencies and improved product quality. Strategic partnerships between peanut processors and food manufacturers or beverage companies can unlock new product categories and distribution channels. Market expansion into untapped geographical regions with growing middle classes and increasing demand for protein-rich snacks presents significant long-term growth potential. The development of value-added products, such as peanut butter powders and specialized protein-infused peanut snacks, can cater to niche markets and drive further market penetration.

Leading Players in the Processed Peanuts Market Sector

- Hampton Farms

- Haldiram's India Pvt Ltd

- Frito-Lay North America Inc (PepsiCo)

- Snak Club

- Hormel Foods LLC

- John B Sanfilippo & Son Inc

- The Peanut Shop of Williamsburg

- Jabsons Foods

- Whitley's Peanut Factory

- Margaret Holmes

Key Milestones in Processed Peanuts Market Industry

- June 2022: Planters, a Hormel Foods Corp. brand, launched sweet & spicy dry roasted peanuts, now available in convenience stores and grocery stores, introducing a novel flavor combination and convenient packaging options.

- June 2022: Humdinger partnered with Budweiser to launch three new American-based flavored peanuts in the UK, including Smokey Texan BBQ, Buffalo Chicken Wings, and Flame Grilled Ribs, aiming to create a unique snack and beverage pairing experience.

- October 2020: SkinnyDipped announced the launch of a line of thinly-dipped peanuts in milk chocolate and PB & J flavors, offering nostalgic and healthier snack options with reduced sugar content.

Strategic Outlook for Processed Peanuts Market Market

The strategic outlook for the processed peanuts market is highly optimistic, driven by ongoing consumer demand for convenient, healthy, and flavorful snacks. Companies are expected to focus on expanding their product portfolios with innovative flavor profiles and healthier formulations, such as reduced-salt and added-nutrient varieties. Investment in advanced processing technologies will be crucial for maintaining product quality and optimizing production costs. Furthermore, strategic market expansion, particularly in emerging economies and through direct-to-consumer channels, will be a key growth accelerator. Collaborations and partnerships will play a vital role in creating unique product offerings and reaching wider consumer bases, ensuring sustained growth and competitive advantage in the global processed peanuts market.

Processed Peanuts Market Segmentation

-

1. Type

- 1.1. Plain

-

1.2. Flavored

- 1.2.1. Salted

- 1.2.2. Sweet Flavored

- 1.2.3. Spicy Flavored

- 1.2.4. Others

-

2. Distibution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Processed Peanuts Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Processed Peanuts Market Regional Market Share

Geographic Coverage of Processed Peanuts Market

Processed Peanuts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health Benefits Promoting Apple Cider Vinegar Demand; Unfiltered Apple Cider Vinegar Being Popular

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Other Vinegar Types

- 3.4. Market Trends

- 3.4.1. Rising Demand For Convenient And Healthy Snacking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Processed Peanuts Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Plain

- 5.1.2. Flavored

- 5.1.2.1. Salted

- 5.1.2.2. Sweet Flavored

- 5.1.2.3. Spicy Flavored

- 5.1.2.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Processed Peanuts Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Plain

- 6.1.2. Flavored

- 6.1.2.1. Salted

- 6.1.2.2. Sweet Flavored

- 6.1.2.3. Spicy Flavored

- 6.1.2.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Processed Peanuts Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Plain

- 7.1.2. Flavored

- 7.1.2.1. Salted

- 7.1.2.2. Sweet Flavored

- 7.1.2.3. Spicy Flavored

- 7.1.2.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Processed Peanuts Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Plain

- 8.1.2. Flavored

- 8.1.2.1. Salted

- 8.1.2.2. Sweet Flavored

- 8.1.2.3. Spicy Flavored

- 8.1.2.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Processed Peanuts Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Plain

- 9.1.2. Flavored

- 9.1.2.1. Salted

- 9.1.2.2. Sweet Flavored

- 9.1.2.3. Spicy Flavored

- 9.1.2.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Processed Peanuts Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Plain

- 10.1.2. Flavored

- 10.1.2.1. Salted

- 10.1.2.2. Sweet Flavored

- 10.1.2.3. Spicy Flavored

- 10.1.2.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Saudi Arabia Processed Peanuts Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Plain

- 11.1.2. Flavored

- 11.1.2.1. Salted

- 11.1.2.2. Sweet Flavored

- 11.1.2.3. Spicy Flavored

- 11.1.2.4. Others

- 11.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 11.2.1. Supermarkets/Hypermarkets

- 11.2.2. Convenience Stores

- 11.2.3. Online Stores

- 11.2.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Hampton Farms

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Haldiram's India Pvt Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Frito-Lay North America Inc (PepsiCo)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Snak Club

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Hormel Foods LLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 John B Sanfilippo & Son Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 The Peanut Shop of Williamsburg

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Jabsons Foods*List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Whitley's Peanut Factory

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Margaret Holmes

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Hampton Farms

List of Figures

- Figure 1: Global Processed Peanuts Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Processed Peanuts Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Processed Peanuts Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Processed Peanuts Market Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 5: North America Processed Peanuts Market Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 6: North America Processed Peanuts Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Processed Peanuts Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Processed Peanuts Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Processed Peanuts Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Processed Peanuts Market Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 11: Europe Processed Peanuts Market Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 12: Europe Processed Peanuts Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Processed Peanuts Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Processed Peanuts Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Processed Peanuts Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Processed Peanuts Market Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 17: Asia Pacific Processed Peanuts Market Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 18: Asia Pacific Processed Peanuts Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Processed Peanuts Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Processed Peanuts Market Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Processed Peanuts Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Processed Peanuts Market Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 23: South America Processed Peanuts Market Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 24: South America Processed Peanuts Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Processed Peanuts Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Processed Peanuts Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East Processed Peanuts Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Processed Peanuts Market Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 29: Middle East Processed Peanuts Market Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 30: Middle East Processed Peanuts Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Processed Peanuts Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Saudi Arabia Processed Peanuts Market Revenue (billion), by Type 2025 & 2033

- Figure 33: Saudi Arabia Processed Peanuts Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Saudi Arabia Processed Peanuts Market Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 35: Saudi Arabia Processed Peanuts Market Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 36: Saudi Arabia Processed Peanuts Market Revenue (billion), by Country 2025 & 2033

- Figure 37: Saudi Arabia Processed Peanuts Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Processed Peanuts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Processed Peanuts Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 3: Global Processed Peanuts Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Processed Peanuts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Processed Peanuts Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 6: Global Processed Peanuts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Processed Peanuts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Processed Peanuts Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 13: Global Processed Peanuts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Spain Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Russia Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Processed Peanuts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Processed Peanuts Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 23: Global Processed Peanuts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Processed Peanuts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Global Processed Peanuts Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 31: Global Processed Peanuts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Processed Peanuts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 36: Global Processed Peanuts Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 37: Global Processed Peanuts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: Global Processed Peanuts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 39: Global Processed Peanuts Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 40: Global Processed Peanuts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: South Africa Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Processed Peanuts Market?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Processed Peanuts Market?

Key companies in the market include Hampton Farms, Haldiram's India Pvt Ltd, Frito-Lay North America Inc (PepsiCo), Snak Club, Hormel Foods LLC, John B Sanfilippo & Son Inc, The Peanut Shop of Williamsburg, Jabsons Foods*List Not Exhaustive, Whitley's Peanut Factory, Margaret Holmes.

3. What are the main segments of the Processed Peanuts Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 115.47 billion as of 2022.

5. What are some drivers contributing to market growth?

Health Benefits Promoting Apple Cider Vinegar Demand; Unfiltered Apple Cider Vinegar Being Popular.

6. What are the notable trends driving market growth?

Rising Demand For Convenient And Healthy Snacking.

7. Are there any restraints impacting market growth?

Rising Demand for Other Vinegar Types.

8. Can you provide examples of recent developments in the market?

In June 2022, Planters, a Hormel Foods Corp. brand, launched sweet & spicy dry roasted peanuts that are now available at convenience stores. The company claims that this snack is dry roasted with honey and dried red chili peppers, then seasoned with salt. They are currently available in a 1.75-ounce on-the-go package in convenience stores and 16-ounce bottles at grocery stores

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Processed Peanuts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Processed Peanuts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Processed Peanuts Market?

To stay informed about further developments, trends, and reports in the Processed Peanuts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence